Mga Batayang Estadistika

| Nilai Portofolio | $ 287,405,158 |

| Posisi Saat Ini | 116 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

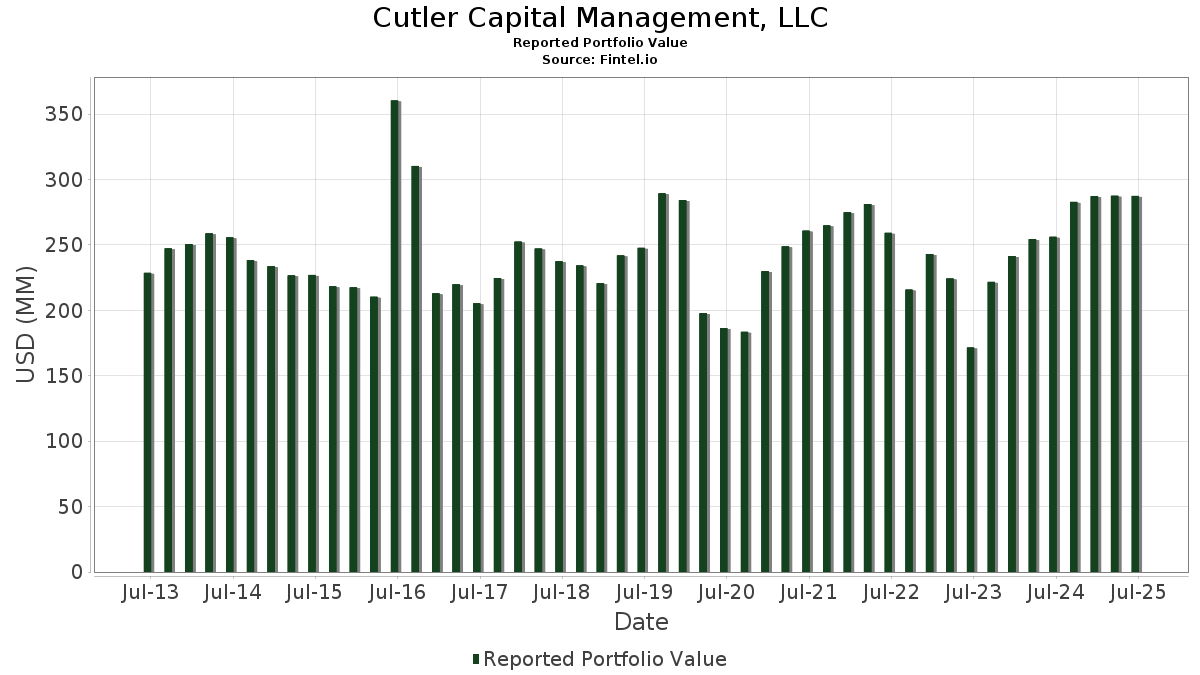

Cutler Capital Management, LLC telah mengungkapkan total kepemilikan 116 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 287,405,158 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Cutler Capital Management, LLC adalah Agnico Eagle Mines Limited (US:AEM) , MetLife, Inc. (US:MET) , CTO Realty Growth, Inc. (US:CTO) , Timberland Bancorp, Inc. (US:TSBK) , and Exchange Bank (Santa Rosa, CA) (US:EXSR) . Posisi baru Cutler Capital Management, LLC meliputi: Jazz Pharmaceuticals plc (US:JAZZ) , Innoviva, Inc. (US:US45781MAD39) , CONV. NOTE (US:US531229AQ58) , CONVERTIBLE ZERO (US:US345370CZ16) , and Etsy Inc (US:US29786AAL08) . Industri unggulan Cutler Capital Management, LLC adalah "Rubber And Miscellaneous Plastics Products" (sic 30) , "Oil And Gas Extraction" (sic 13) , and "Home Furniture, Furnishings, And Equipment Stores" (sic 57) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.64 | 11.08 | 3.8558 | 2.5670 | |

| 0.02 | 2.33 | 0.8098 | 0.8098 | |

| 0.02 | 1.57 | 0.5478 | 0.5478 | |

| 0.13 | 15.67 | 5.4510 | 0.3615 | |

| 0.17 | 4.99 | 1.7360 | 0.2769 | |

| 0.01 | 0.74 | 0.2567 | 0.2567 | |

| 1.57 | 0.5467 | 0.2181 | ||

| 0.16 | 7.89 | 2.7462 | 0.1977 | |

| 0.31 | 6.31 | 2.1947 | 0.1703 | |

| 0.11 | 3.97 | 1.3800 | 0.1681 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.17 | 2.25 | 0.7827 | -0.6049 | |

| 0.02 | 0.32 | 0.1102 | -0.2536 | |

| 0.47 | 3.28 | 1.1404 | -0.2506 | |

| 0.39 | 7.49 | 2.6050 | -0.2377 | |

| 0.39 | 7.14 | 2.4830 | -0.2099 | |

| 0.20 | 3.95 | 1.3738 | -0.2097 | |

| 0.06 | 4.59 | 1.5984 | -0.2040 | |

| 0.16 | 4.09 | 1.4234 | -0.1948 | |

| 0.11 | 2.27 | 0.7884 | -0.1591 | |

| 0.05 | 1.42 | 0.4956 | -0.1590 |

Pengajuan 13D/G

Ini adalah daftar pengajuan 13D dan 13G yang dibuat dalam setahun terakhir (jika ada). Klik ikon tautan untuk melihat riwayat transaksi lengkap. Baris berwarna hijau menunjukkan posisi baru. Baris berwarna merah menunjukkan posisi yang sudah ditutup.

| Tanggal File | Formulir | Keamanan | Sebelumnya Saham |

Saat ini Saham |

ΔPersentase Saham | % Kepemilikan |

% ΔKepemilikan | |

|---|---|---|---|---|---|---|---|---|

| 2025-02-13 | SBFG / SB Financial Group, Inc. | 400,284 | 392,556 | -1.93 | 6.00 | 1.35 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-13 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AEM / Agnico Eagle Mines Limited | 0.13 | -2.40 | 15.67 | 7.07 | 5.4510 | 0.3615 | |||

| MET / MetLife, Inc. | 0.16 | -0.72 | 13.27 | -0.56 | 4.6164 | -0.0244 | |||

| CTO / CTO Realty Growth, Inc. | 0.64 | 234.59 | 11.08 | 199.08 | 3.8558 | 2.5670 | |||

| TSBK / Timberland Bancorp, Inc. | 0.30 | -0.14 | 9.31 | 3.34 | 3.2393 | 0.1058 | |||

| EXSR / Exchange Bank (Santa Rosa, CA) | 0.08 | 0.00 | 8.02 | -3.21 | 2.7918 | -0.0916 | |||

| FBIZ / First Business Financial Services, Inc. | 0.16 | 0.26 | 7.89 | 7.71 | 2.7462 | 0.1977 | |||

| SHEL / Shell plc - Depositary Receipt (Common Stock) | 0.11 | -0.36 | 7.79 | -4.26 | 2.7109 | -0.1197 | |||

| SBFG / SB Financial Group, Inc. | 0.39 | -0.15 | 7.49 | -8.41 | 2.6050 | -0.2377 | |||

| ET / Energy Transfer LP - Limited Partnership | 0.39 | -5.49 | 7.14 | -7.83 | 2.4830 | -0.2099 | |||

| PPL CAPITAL / NOTE 2.875% 3/1 (69352PAS2) | 6.84 | 0.0000 | |||||||

| BG / Bunge Global SA | 0.08 | -0.97 | 6.42 | 4.04 | 2.2336 | 0.0872 | |||

| FENY / Fidelity Covington Trust - Fidelity MSCI Energy Index ETF | 0.27 | 2.66 | 6.34 | -5.78 | 2.2071 | -0.1346 | |||

| PKBK / Parke Bancorp, Inc. | 0.31 | 0.23 | 6.31 | 8.37 | 2.1947 | 0.1703 | |||

| PFE / Pfizer Inc. | 0.25 | 0.20 | 6.08 | -4.16 | 2.1161 | -0.0909 | |||

| JAZZ / Jazz Pharmaceuticals plc | 5.78 | -3.31 | 2.0126 | -0.0681 | |||||

| KIM.PRN / Kimco Realty Corporation - Preferred Stock | 0.09 | -0.50 | 5.48 | 0.13 | 1.9056 | 0.0034 | |||

| VICI / VICI Properties Inc. | 0.17 | 0.55 | 5.42 | 0.48 | 1.8844 | 0.0097 | |||

| BMBN / Benchmark Bankshares, Inc. | 0.17 | 1.90 | 4.99 | 18.93 | 1.7360 | 0.2769 | |||

| LFGP / Ledyard Financial Group, Inc. | 0.33 | 0.00 | 4.68 | -7.42 | 1.6283 | -0.1299 | |||

| MRK / Merck & Co., Inc. | 0.06 | 0.52 | 4.59 | -11.35 | 1.5984 | -0.2040 | |||

| US45781MAD39 / Innoviva, Inc. | 4.33 | 2.27 | 1.5063 | 0.0338 | |||||

| VTRS / Viatris Inc. | 0.46 | -0.22 | 4.14 | 2.30 | 1.4414 | 0.0330 | |||

| WY / Weyerhaeuser Company | 0.16 | 0.22 | 4.09 | -12.08 | 1.4234 | -0.1948 | |||

| BORT / Bank of Botetourt | 0.11 | 7.85 | 3.97 | 13.83 | 1.3800 | 0.1681 | |||

| FXNC / First National Corporation | 0.20 | 0.00 | 3.95 | -13.27 | 1.3738 | -0.2097 | |||

| VZ / Verizon Communications Inc. | 0.09 | 0.52 | 3.83 | -4.10 | 1.3338 | -0.0567 | |||

| PTBS / Potomac Bancshares, Inc. | 0.22 | 4.36 | 3.83 | 12.17 | 1.3311 | 0.1449 | |||

| FLG.PRU / New York Community Capital Trust V - Preferred Security | 0.10 | -0.51 | 3.76 | 2.62 | 1.3089 | 0.0341 | |||

| CPKF / Chesapeake Financial Shares, Inc. | 0.17 | 0.00 | 3.61 | 8.91 | 1.2550 | 0.1027 | |||

| ALRS / Alerus Financial Corporation | 0.16 | -1.87 | 3.38 | 15.03 | 1.1746 | 0.1539 | |||

| APLE / Apple Hospitality REIT, Inc. | 0.28 | 1.03 | 3.31 | -8.69 | 1.1522 | -0.1090 | |||

| GMRE / Global Medical REIT Inc. | 0.47 | 3.48 | 3.28 | -18.05 | 1.1404 | -0.2506 | |||

| CWBC / Community West Bancshares | 0.16 | 0.00 | 3.16 | 5.58 | 1.1001 | 0.0584 | |||

| US531229AQ58 / CONV. NOTE | 3.14 | 7.80 | 1.0913 | 0.0792 | |||||

| CSBB / CSB Bancorp, Inc. | 0.07 | 0.00 | 3.00 | -1.15 | 1.0443 | -0.0116 | |||

| ACI / Albertsons Companies, Inc. | 0.13 | 2.22 | 2.90 | 0.00 | 1.0080 | 0.0002 | |||

| FMBM / F & M Bank Corp. | 0.14 | 0.00 | 2.87 | 8.78 | 0.9997 | 0.0808 | |||

| GUESS INC / NOTE 3.750% 4/1 (401617AF2) | 2.85 | 0.0000 | |||||||

| SFL / SFL Corporation Ltd. | 0.34 | -0.44 | 2.82 | 1.15 | 0.9819 | 0.0114 | |||

| AIG / American International Group, Inc. | 0.03 | 0.00 | 2.81 | -1.54 | 0.9768 | -0.0151 | |||

| LIBERTY MEDIA / NOTE 3.750% 3/1 (531229AP7) | 2.64 | 0.0000 | |||||||

| MFGI / Merchants Financial Group, Inc. | 0.09 | 0.00 | 2.35 | 3.07 | 0.8183 | 0.0247 | |||

| HCI / HCI Group, Inc. | 0.02 | 2.33 | 0.8098 | 0.8098 | |||||

| LXP / LXP Industrial Trust | 0.28 | 1.42 | 2.28 | -3.18 | 0.7936 | -0.0256 | |||

| DUKE ENERGY / NOTE 4.125% 4/1 (26441CBY0) | 2.27 | 0.0000 | |||||||

| ENR / Energizer Holdings, Inc. | 0.11 | 23.45 | 2.27 | -16.82 | 0.7884 | -0.1591 | |||

| CNH / CNH Industrial N.V. | 0.17 | -46.57 | 2.25 | -43.62 | 0.7827 | -0.6049 | |||

| US345370CZ16 / CONVERTIBLE ZERO | 2.25 | -2.30 | 0.7821 | -0.0181 | |||||

| ABCB / Ameris Bancorp | 0.03 | 2.07 | 2.23 | 14.72 | 0.7757 | 0.0997 | |||

| MOAT / VanEck ETF Trust - VanEck Morningstar Wide Moat ETF | 0.02 | 1.41 | 2.16 | 8.10 | 0.7526 | 0.0565 | |||

| EPR.PRC / EPR Properties - Preferred Stock | 0.08 | -0.91 | 2.05 | 7.54 | 0.7147 | 0.0504 | |||

| T / AT&T Inc. | 0.07 | 0.00 | 1.89 | 2.38 | 0.6580 | 0.0152 | |||

| FCCO / First Community Corporation | 0.08 | 0.00 | 1.87 | 8.12 | 0.6489 | 0.0487 | |||

| FSBH / FSBH Corp. | 0.21 | 0.00 | 1.80 | 20.23 | 0.6247 | 0.1054 | |||

| US29786AAL08 / Etsy Inc | 1.74 | -0.12 | 0.6039 | -0.0005 | |||||

| ES / Eversource Energy | 0.02 | 1.57 | 0.5478 | 0.5478 | |||||

| US009066AB74 / CONVERTIBLE ZERO | 1.57 | 66.42 | 0.5467 | 0.2181 | |||||

| TSN / Tyson Foods, Inc. | 0.03 | 3.81 | 1.52 | -9.01 | 0.5304 | -0.0522 | |||

| PROGRESS SOFTWARE / NOTE 3.500% 3/0 (743312AD2) | 1.49 | 0.0000 | |||||||

| SOBS / Solvay Bank Corp. | 0.05 | -22.36 | 1.42 | -24.30 | 0.4956 | -0.1590 | |||

| PFIS / Peoples Financial Services Corp. | 0.03 | 0.00 | 1.38 | 11.03 | 0.4801 | 0.0478 | |||

| US501812AB77 / LCI INDUSTRIES CONV 1.125% 05/15/2026 | 1.34 | -3.67 | 0.4653 | -0.0178 | |||||

| GDX / VanEck ETF Trust - VanEck Gold Miners ETF | 0.02 | -8.60 | 1.27 | 3.50 | 0.4429 | 0.0152 | |||

| FISI / Financial Institutions, Inc. | 0.05 | 1.91 | 1.23 | 4.86 | 0.4282 | 0.0200 | |||

| AMPHASTAR PHARMA / NOTE 2.000% 3/1 (03209RAB9) | 1.12 | 0.0000 | |||||||

| BANC / Banc of California, Inc. | 0.08 | 0.00 | 1.09 | -1.00 | 0.3801 | -0.0037 | |||

| US85571BBA26 / STARWOOD PROPERTY TRUST INC | 1.01 | -1.94 | 0.3512 | -0.0068 | |||||

| ALLIANT ENERGY / NOTE 3.875% 3/1 (018802AC2) | 0.99 | 0.0000 | |||||||

| WIW / Western Asset Inflation-Linked Opportunities & Income Fund | 0.10 | 11.94 | 0.89 | 11.68 | 0.3093 | 0.0321 | |||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.00 | -22.66 | 0.87 | -14.48 | 0.3021 | -0.0512 | |||

| MSFT / Microsoft Corporation | 0.00 | -6.11 | 0.83 | 24.36 | 0.2897 | 0.0569 | |||

| SLB / Schlumberger Limited | 0.02 | 44.53 | 0.82 | 16.76 | 0.2863 | 0.0414 | |||

| VGM / Invesco Trust for Investment Grade Municipals | 0.09 | 0.00 | 0.82 | -4.67 | 0.2844 | -0.0140 | |||

| VISHAY INTERT / NOTE 2.250% 9/1 (928298AR9) | 0.77 | 0.0000 | |||||||

| SPLG / SPDR Series Trust - SPDR Portfolio S&P 500 ETF | 0.01 | 0.74 | 0.2567 | 0.2567 | |||||

| IFF / International Flavors & Fragrances Inc. | 0.01 | -5.76 | 0.72 | -10.78 | 0.2508 | -0.0299 | |||

| GTLS.PRB / Chart Industries, Inc. - Preferred Stock | 0.01 | 0.00 | 0.71 | 10.37 | 0.2482 | 0.0232 | |||

| CZBT / Citizens Bancorp of Virginia, Inc. | 0.02 | 0.00 | 0.67 | 21.01 | 0.2325 | 0.0402 | |||

| ORCL / Oracle Corporation | 0.00 | 0.00 | 0.66 | 56.32 | 0.2282 | 0.0823 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 0.00 | 0.65 | -8.76 | 0.2248 | -0.0216 | |||

| HWC / Hancock Whitney Corporation | 0.01 | 0.00 | 0.63 | 9.46 | 0.2177 | 0.0188 | |||

| MTB / M&T Bank Corporation | 0.00 | 0.00 | 0.62 | 8.45 | 0.2146 | 0.0169 | |||

| BANC.PRF / Banc of California, Inc. - Preferred Stock | 0.03 | 7.97 | 0.60 | 4.33 | 0.2101 | 0.0087 | |||

| SSB / SouthState Corporation | 0.01 | 0.00 | 0.52 | -0.76 | 0.1821 | -0.0015 | |||

| IUSV / iShares Trust - iShares Core S&P U.S. Value ETF | 0.00 | 0.00 | 0.43 | 2.61 | 0.1504 | 0.0038 | |||

| CLVT / Clarivate Plc | 0.09 | -12.30 | 0.39 | -3.95 | 0.1354 | -0.0057 | |||

| QABA / First Trust Exchange-Traded Fund - First Trust NASDAQ ABA Community Bank Index Fund | 0.01 | -11.82 | 0.38 | -8.47 | 0.1315 | -0.0123 | |||

| KR / The Kroger Co. | 0.01 | 0.00 | 0.37 | 6.02 | 0.1288 | 0.0073 | |||

| ABBV / AbbVie Inc. | 0.00 | -10.00 | 0.35 | -20.32 | 0.1232 | -0.0313 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | -9.31 | 0.34 | 7.17 | 0.1198 | 0.0081 | |||

| EBMT / Eagle Bancorp Montana, Inc. | 0.02 | -69.55 | 0.32 | -69.76 | 0.1102 | -0.2536 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | -24.10 | 0.31 | -16.17 | 0.1083 | -0.0210 | |||

| SBCF / Seacoast Banking Corporation of Florida | 0.01 | 0.00 | 0.30 | 7.55 | 0.1040 | 0.0072 | |||

| US70509VAA89 / Pebblebrook Hotel Trust | 0.28 | 1.07 | 0.0986 | 0.0011 | |||||

| AMZN / Amazon.com, Inc. | 0.00 | 0.00 | 0.25 | 14.95 | 0.0859 | 0.0114 | |||

| FBTC / Fidelity Wise Origin Bitcoin Fund | 0.00 | 0.24 | 0.0836 | 0.0836 | |||||

| US30212PBE43 / CONVERTIBLE ZERO | 0.24 | -1.24 | 0.0829 | -0.0011 | |||||

| GOOGL / Alphabet Inc. | 0.00 | 0.00 | 0.22 | 13.68 | 0.0754 | 0.0093 | |||

| JCI / Johnson Controls International plc | 0.00 | 0.00 | 0.19 | 31.97 | 0.0677 | 0.0164 | |||

| AGI / Alamos Gold Inc. | 0.01 | 17.15 | 0.18 | 16.77 | 0.0631 | 0.0089 | |||

| IBM / International Business Machines Corporation | 0.00 | 0.00 | 0.18 | 19.21 | 0.0627 | 0.0098 | |||

| SKE / Skeena Resources Limited | 0.01 | 0.17 | 0.0582 | 0.0582 | |||||

| ALB.PRA / Albemarle Corporation - Preferred Stock | 0.01 | 0.00 | 0.16 | -9.89 | 0.0572 | -0.0063 | |||

| FRAF / Franklin Financial Services Corporation | 0.00 | 0.00 | 0.15 | -1.94 | 0.0530 | -0.0012 | |||

| SCHF / Schwab Strategic Trust - Schwab International Equity ETF | 0.01 | 0.00 | 0.13 | 11.86 | 0.0461 | 0.0049 | |||

| XOM / Exxon Mobil Corporation | 0.00 | 0.00 | 0.13 | -8.97 | 0.0459 | -0.0047 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.00 | 0.13 | 0.0449 | 0.0449 | |||||

| DUK / Duke Energy Corporation | 0.00 | -1.72 | 0.13 | -4.48 | 0.0446 | -0.0023 | |||

| MOTG / VanEck ETF Trust - VanEck Morningstar Global Wide Moat ETF | 0.00 | 0.12 | 0.0432 | 0.0432 | |||||

| US393657AM33 / GBX 2 7/8 04/15/28 | 0.12 | -3.88 | 0.0432 | -0.0018 | |||||

| GLD / SPDR Gold Trust | 0.00 | 0.12 | 0.0419 | 0.0419 | |||||

| QQQ / Invesco QQQ Trust, Series 1 | 0.00 | -18.18 | 0.12 | -3.25 | 0.0415 | -0.0015 | |||

| IWS / iShares Trust - iShares Russell Mid-Cap Value ETF | 0.00 | 0.00 | 0.12 | 5.41 | 0.0407 | 0.0019 | |||

| US40637HAD17 / CONV. NOTE | 0.11 | -6.03 | 0.0380 | -0.0024 | |||||

| SHY / iShares Trust - iShares 1-3 Year Treasury Bond ETF | 0.00 | 0.00 | 0.11 | 0.00 | 0.0371 | 0.0001 | |||

| RSP / Invesco Exchange-Traded Fund Trust - Invesco S&P 500 Equal Weight ETF | 0.00 | 0.10 | 0.0354 | 0.0354 | |||||

| IEI / iShares Trust - iShares 3-7 Year Treasury Bond ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| WMT / Walmart Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| LOW / Lowe's Companies, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SO / The Southern Company | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MNSB / MainStreet Bancshares, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| COST / Costco Wholesale Corporation | 0.00 | -100.00 | 0.00 | 0.0000 |