Mga Batayang Estadistika

| Nilai Portofolio | $ 246,811,444 |

| Posisi Saat Ini | 89 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

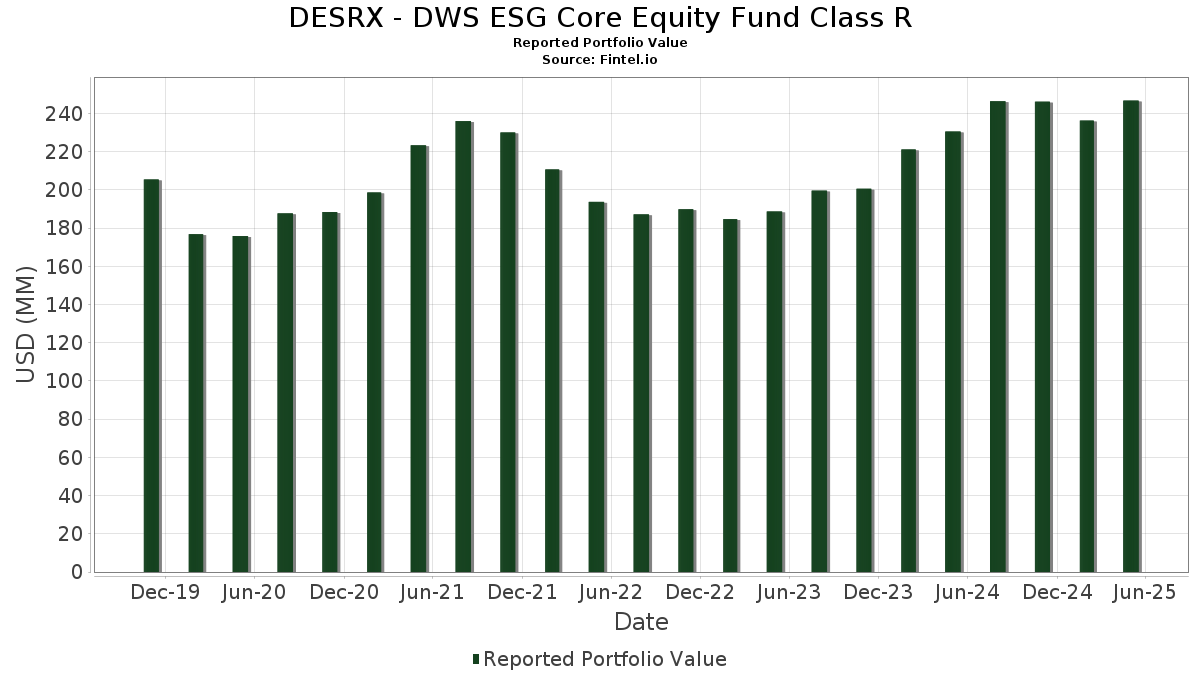

DESRX - DWS ESG Core Equity Fund Class R telah mengungkapkan total kepemilikan 89 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 246,811,444 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama DESRX - DWS ESG Core Equity Fund Class R adalah Microsoft Corporation (US:MSFT) , Apple Inc. (US:AAPL) , Alphabet Inc. (US:GOOGL) , DWS Central Cash Management Government Fund (US:US25160K3068) , and NVIDIA Corporation (US:NVDA) . Posisi baru DESRX - DWS ESG Core Equity Fund Class R meliputi: Veeva Systems Inc. (US:VEEV) , Cboe Global Markets, Inc. (US:CBOE) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 14.70 | 14.70 | 5.9656 | 5.6397 | |

| 0.00 | 1.35 | 0.5464 | 0.5464 | |

| 0.05 | 22.75 | 9.2334 | 0.5164 | |

| 0.01 | 1.18 | 0.4776 | 0.4776 | |

| 0.02 | 6.11 | 2.4815 | 0.3762 | |

| 0.02 | 3.51 | 1.4266 | 0.3006 | |

| 0.02 | 3.85 | 1.5649 | 0.2966 | |

| 0.01 | 4.34 | 1.7599 | 0.1427 | |

| 0.01 | 1.85 | 0.7523 | 0.1276 | |

| 0.02 | 0.94 | 0.3819 | 0.0691 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.09 | 18.86 | 7.6549 | -2.0897 | |

| 0.56 | 0.56 | 0.2253 | -1.3738 | |

| 0.02 | 2.35 | 0.9527 | -0.5842 | |

| 0.02 | 1.06 | 0.4322 | -0.4381 | |

| 0.01 | 1.60 | 0.6485 | -0.3265 | |

| 0.09 | 15.30 | 6.2112 | -0.2996 | |

| 0.10 | 12.89 | 5.2310 | -0.2526 | |

| 0.08 | 0.20 | 0.0811 | -0.2472 | |

| 0.01 | 1.20 | 0.4891 | -0.2279 | |

| 0.02 | 3.11 | 1.2630 | -0.2233 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-24 untuk periode pelaporan 2025-05-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.05 | -3.43 | 22.75 | 11.99 | 9.2334 | 0.5164 | |||

| AAPL / Apple Inc. | 0.09 | 0.00 | 18.86 | -16.95 | 7.6549 | -2.0897 | |||

| GOOGL / Alphabet Inc. | 0.09 | 0.00 | 15.30 | 0.86 | 6.2112 | -0.2996 | |||

| US25160K3068 / DWS Central Cash Management Government Fund | 14.70 | 1,835.04 | 14.70 | 1,836.10 | 5.9656 | 5.6397 | |||

| NVDA / NVIDIA Corporation | 0.10 | -6.77 | 12.89 | 0.85 | 5.2310 | -0.2526 | |||

| GE / General Electric Company | 0.02 | 4.89 | 6.11 | 24.61 | 2.4815 | 0.3762 | |||

| CI / The Cigna Group | 0.02 | 4.89 | 5.54 | 7.54 | 2.2481 | 0.0379 | |||

| BAC / Bank of America Corporation | 0.13 | 4.89 | 5.52 | 0.40 | 2.2406 | -0.1187 | |||

| AMGN / Amgen Inc. | 0.02 | 4.89 | 4.53 | -1.89 | 1.8380 | -0.1424 | |||

| TSLA / Tesla, Inc. | 0.01 | -2.71 | 4.34 | 15.05 | 1.7599 | 0.1427 | |||

| AXP / American Express Company | 0.01 | 4.88 | 4.32 | 2.49 | 1.7533 | -0.0555 | |||

| GS / The Goldman Sachs Group, Inc. | 0.01 | 4.89 | 4.07 | 1.22 | 1.6531 | -0.0738 | |||

| HWM / Howmet Aerospace Inc. | 0.02 | 4.89 | 3.85 | 30.42 | 1.5649 | 0.2966 | |||

| CRM / Salesforce, Inc. | 0.01 | 4.89 | 3.71 | -6.54 | 1.5079 | -0.1981 | |||

| C / Citigroup Inc. | 0.05 | 4.89 | 3.64 | -1.19 | 1.4784 | -0.1034 | |||

| AMZN / Amazon.com, Inc. | 0.02 | 38.69 | 3.51 | 33.97 | 1.4266 | 0.3006 | |||

| AWK / American Water Works Company, Inc. | 0.02 | 4.89 | 3.43 | 10.30 | 1.3917 | 0.0576 | |||

| JPM / JPMorgan Chase & Co. | 0.01 | 4.89 | 3.19 | 4.62 | 1.2968 | -0.0135 | |||

| PEP / PepsiCo, Inc. | 0.02 | 4.89 | 3.11 | -10.16 | 1.2630 | -0.2233 | |||

| DIS / The Walt Disney Company | 0.03 | 4.89 | 3.07 | 4.21 | 1.2468 | -0.0184 | |||

| IRM / Iron Mountain Incorporated | 0.03 | 4.89 | 2.96 | 11.14 | 1.2036 | 0.0585 | |||

| VRSK / Verisk Analytics, Inc. | 0.01 | 4.89 | 2.95 | 11.00 | 1.1961 | 0.0566 | |||

| CSCO / Cisco Systems, Inc. | 0.05 | 4.89 | 2.93 | 3.13 | 1.1892 | -0.0298 | |||

| RSG / Republic Services, Inc. | 0.01 | -14.89 | 2.81 | -7.61 | 1.1394 | -0.1644 | |||

| PHM / PulteGroup, Inc. | 0.03 | 4.89 | 2.59 | -0.46 | 1.0501 | -0.0650 | |||

| H / Hyatt Hotels Corporation | 0.02 | 4.89 | 2.44 | -1.73 | 0.9893 | -0.0752 | |||

| TW / Tradeweb Markets Inc. | 0.02 | 4.89 | 2.43 | 11.91 | 0.9880 | 0.0547 | |||

| KKR / KKR & Co. Inc. | 0.02 | -26.84 | 2.35 | -34.47 | 0.9527 | -0.5842 | |||

| HLT / Hilton Worldwide Holdings Inc. | 0.01 | 4.89 | 2.32 | -1.65 | 0.9413 | -0.0706 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.01 | 4.90 | 2.29 | -3.33 | 0.9305 | -0.0874 | |||

| LOW / Lowe's Companies, Inc. | 0.01 | 4.89 | 2.18 | -4.80 | 0.8861 | -0.0977 | |||

| MU / Micron Technology, Inc. | 0.02 | 4.89 | 2.18 | 5.83 | 0.8852 | 0.0008 | |||

| TJX / The TJX Companies, Inc. | 0.02 | 4.89 | 2.08 | 6.68 | 0.8424 | 0.0076 | |||

| DD / DuPont de Nemours, Inc. | 0.03 | 4.89 | 2.06 | -14.34 | 0.8345 | -0.1951 | |||

| HIG / The Hartford Insurance Group, Inc. | 0.02 | 4.88 | 2.01 | 15.10 | 0.8171 | 0.0668 | |||

| MSCI / MSCI Inc. | 0.00 | 4.88 | 2.01 | 0.20 | 0.8170 | -0.0452 | |||

| AMP / Ameriprise Financial, Inc. | 0.00 | 4.90 | 1.94 | -0.56 | 0.7880 | -0.0500 | |||

| WCC / WESCO International, Inc. | 0.01 | 4.89 | 1.86 | -2.42 | 0.7545 | -0.0630 | |||

| AVGO / Broadcom Inc. | 0.01 | 4.89 | 1.85 | 27.35 | 0.7523 | 0.1276 | |||

| FTI / TechnipFMC plc | 0.06 | 4.89 | 1.76 | 10.96 | 0.7157 | 0.0339 | |||

| AMD / Advanced Micro Devices, Inc. | 0.02 | 4.89 | 1.71 | 16.32 | 0.6949 | 0.0632 | |||

| BALL / Ball Corporation | 0.03 | 4.89 | 1.71 | 6.68 | 0.6940 | 0.0061 | |||

| DLR / Digital Realty Trust, Inc. | 0.01 | 4.89 | 1.69 | 15.09 | 0.6873 | 0.0559 | |||

| ORCL / Oracle Corporation | 0.01 | 4.88 | 1.68 | 4.54 | 0.6826 | -0.0077 | |||

| OC / Owens Corning | 0.01 | 4.88 | 1.63 | -8.80 | 0.6610 | -0.1052 | |||

| HCA / HCA Healthcare, Inc. | 0.00 | -31.09 | 1.62 | -14.22 | 0.6568 | -0.1525 | |||

| SLB / Schlumberger Limited | 0.05 | 4.89 | 1.60 | -16.78 | 0.6485 | -0.1755 | |||

| ABBV / AbbVie Inc. | 0.01 | -21.03 | 1.60 | -29.68 | 0.6485 | -0.3265 | |||

| PYPL / PayPal Holdings, Inc. | 0.02 | 4.89 | 1.53 | 3.73 | 0.6210 | -0.0118 | |||

| LNG / Cheniere Energy, Inc. | 0.01 | 4.89 | 1.48 | 8.80 | 0.6026 | 0.0168 | |||

| BBY / Best Buy Co., Inc. | 0.02 | 4.89 | 1.46 | -22.71 | 0.5919 | -0.2174 | |||

| PFGC / Performance Food Group Company | 0.02 | 4.89 | 1.45 | 10.30 | 0.5873 | 0.0246 | |||

| TPR / Tapestry, Inc. | 0.02 | 4.89 | 1.45 | -3.54 | 0.5871 | -0.0564 | |||

| COST / Costco Wholesale Corporation | 0.00 | 4.92 | 1.42 | 4.03 | 0.5764 | -0.0091 | |||

| ATO / Atmos Energy Corporation | 0.01 | 4.89 | 1.42 | 6.69 | 0.5763 | 0.0050 | |||

| CINF / Cincinnati Financial Corporation | 0.01 | 4.89 | 1.41 | 7.06 | 0.5730 | 0.0070 | |||

| VEEV / Veeva Systems Inc. | 0.00 | 1.35 | 0.5464 | 0.5464 | |||||

| MRK / Merck & Co., Inc. | 0.02 | 4.88 | 1.30 | -12.65 | 0.5271 | -0.1108 | |||

| MA / Mastercard Incorporated | 0.00 | 4.87 | 1.30 | 6.57 | 0.5270 | 0.0042 | |||

| META / Meta Platforms, Inc. | 0.00 | -69.87 | 1.24 | 19.85 | 0.5026 | -0.0527 | |||

| HUM / Humana Inc. | 0.01 | 4.89 | 1.22 | -9.60 | 0.4971 | -0.0841 | |||

| MTCH / Match Group, Inc. | 0.04 | 4.89 | 1.22 | -0.97 | 0.4963 | -0.0335 | |||

| TGT / Target Corporation | 0.01 | 4.89 | 1.22 | -20.68 | 0.4956 | -0.1646 | |||

| LRCX / Lam Research Corporation | 0.01 | -31.49 | 1.20 | -27.90 | 0.4891 | -0.2279 | |||

| UPS / United Parcel Service, Inc. | 0.01 | 4.89 | 1.20 | -14.07 | 0.4860 | -0.1118 | |||

| CBOE / Cboe Global Markets, Inc. | 0.01 | 1.18 | 0.4776 | 0.4776 | |||||

| WMT / Walmart Inc. | 0.01 | 85.78 | 1.13 | 17.76 | 0.4577 | -0.0191 | |||

| DE / Deere & Company | 0.00 | 4.91 | 1.13 | 10.51 | 0.4569 | 0.0196 | |||

| BMY / Bristol-Myers Squibb Company | 0.02 | 4.89 | 1.10 | -15.10 | 0.4453 | -0.1090 | |||

| ZM / Zoom Communications Inc. | 0.01 | 4.89 | 1.09 | 15.65 | 0.4412 | 0.0378 | |||

| CNC / Centene Corporation | 0.02 | -45.90 | 1.06 | -47.51 | 0.4322 | -0.4381 | |||

| LEA / Lear Corporation | 0.01 | 4.88 | 1.06 | 0.95 | 0.4296 | -0.0205 | |||

| BKR / Baker Hughes Company | 0.03 | 4.89 | 1.04 | -12.85 | 0.4241 | -0.0904 | |||

| KDP / Keurig Dr Pepper Inc. | 0.03 | 4.89 | 1.00 | 5.39 | 0.4053 | -0.0014 | |||

| REGN / Regeneron Pharmaceuticals, Inc. | 0.00 | 4.89 | 1.00 | -26.40 | 0.4052 | -0.1769 | |||

| TAP / Molson Coors Beverage Company | 0.02 | 4.89 | 0.97 | -8.29 | 0.3951 | -0.0604 | |||

| NEM / Newmont Corporation | 0.02 | 4.89 | 0.94 | 29.12 | 0.3819 | 0.0691 | |||

| HOLX / Hologic, Inc. | 0.01 | 0.00 | 0.86 | -1.94 | 0.3485 | -0.0272 | |||

| EL / The Estée Lauder Companies Inc. | 0.01 | 4.89 | 0.83 | -2.35 | 0.3380 | -0.0280 | |||

| BIIB / Biogen Inc. | 0.01 | 4.89 | 0.80 | -3.15 | 0.3247 | -0.0296 | |||

| SWKS / Skyworks Solutions, Inc. | 0.01 | 4.88 | 0.76 | 8.57 | 0.3087 | 0.0082 | |||

| BC / Brunswick Corporation | 0.01 | 4.89 | 0.64 | -12.74 | 0.2615 | -0.0554 | |||

| RNG / RingCentral, Inc. | 0.02 | 4.89 | 0.56 | -4.43 | 0.2280 | -0.0242 | |||

| US1475396701 / DWS Gov&Agency Sec Portfolio DWS Gov Cash Inst Shs | 0.56 | -85.10 | 0.56 | -85.10 | 0.2253 | -1.3738 | |||

| MPW / Medical Properties Trust, Inc. | 0.07 | 4.89 | 0.32 | -18.73 | 0.1303 | -0.0393 | |||

| NFE / New Fortress Energy Inc. | 0.08 | 4.89 | 0.20 | -73.99 | 0.0811 | -0.2472 | |||

| CHPT / ChargePoint Holdings, Inc. | 0.06 | 4.89 | 0.04 | 8.57 | 0.0158 | 0.0006 | |||

| S+P500 EMINI OPTN JUN25P 5300 / DE (000000000) | 0.01 | 0.0025 | 0.0025 | ||||||

| S+P500 EMINI OPTN JUN25P 5100 / DE (000000000) | 0.00 | 0.0014 | 0.0014 |