Mga Batayang Estadistika

| Nilai Portofolio | $ 44,208,348 |

| Posisi Saat Ini | 277 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

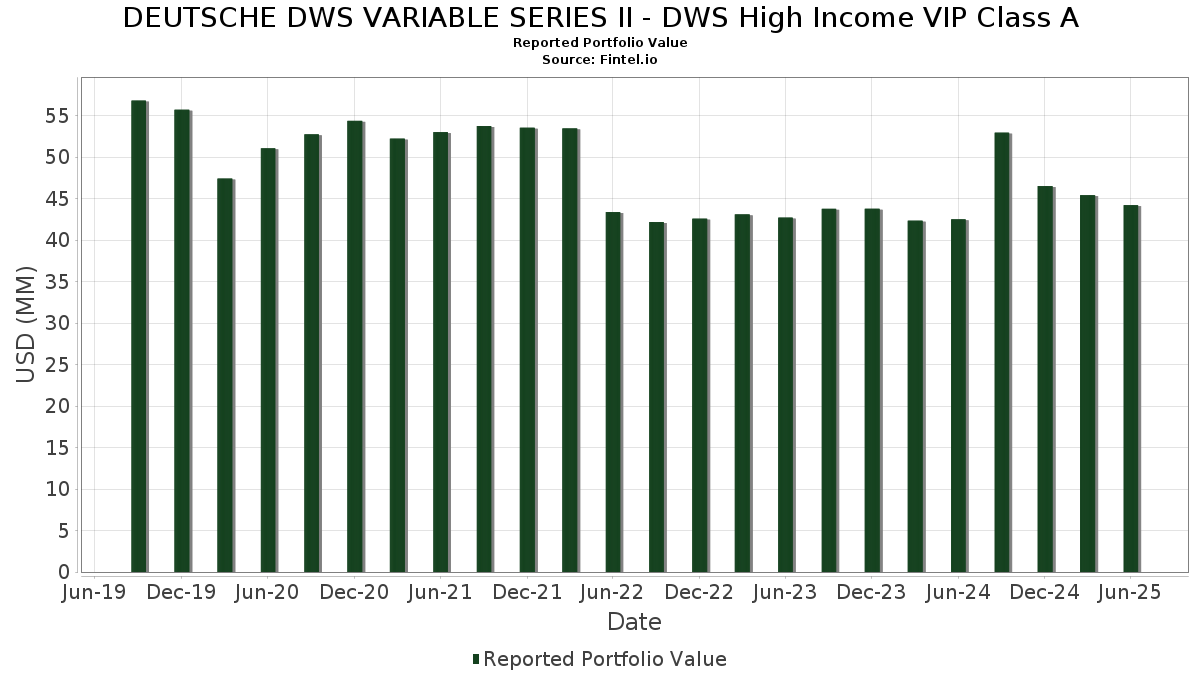

DEUTSCHE DWS VARIABLE SERIES II - DWS High Income VIP Class A telah mengungkapkan total kepemilikan 277 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 44,208,348 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama DEUTSCHE DWS VARIABLE SERIES II - DWS High Income VIP Class A adalah DWS Gov&Agency Sec Portfolio DWS Gov Cash Inst Shs (US:US1475396701) , SPDR Series Trust - SPDR Portfolio High Yield Bond ETF (US:SPHY) , DWS Central Cash Management Government Fund (US:US25160K3068) , Ashland LLC (US:US04433LAA08) , and CCO Holdings LLC / CCO Holdings Capital Corp 5.375% 06/01/2029 144A (US:US1248EPCB75) . Posisi baru DEUTSCHE DWS VARIABLE SERIES II - DWS High Income VIP Class A meliputi: Ashland LLC (US:US04433LAA08) , CCO Holdings LLC / CCO Holdings Capital Corp 5.375% 06/01/2029 144A (US:US1248EPCB75) , CSC HOLDINGS LLC COMPANY GUAR 144A 12/30 4.125 (US:US126307BB25) , Element Solutions Inc (US:US28618MAA45) , and Wyndham Hotels & Resorts Inc (US:US98311AAB17) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.06 | 1.31 | 3.0563 | 1.4060 | |

| 0.44 | 1.0290 | 1.0290 | ||

| 0.44 | 1.0204 | 1.0204 | ||

| 0.31 | 0.7342 | 0.5937 | ||

| 0.25 | 0.5851 | 0.5851 | ||

| 0.51 | 1.1860 | 0.5057 | ||

| 0.20 | 0.4765 | 0.4765 | ||

| 0.20 | 0.4627 | 0.4627 | ||

| 0.20 | 0.4582 | 0.4582 | ||

| 0.28 | 0.6548 | 0.4212 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 1.53 | 1.53 | 3.5822 | -2.6727 | |

| 0.25 | 0.5775 | -0.7249 | ||

| 0.19 | 0.4440 | -0.3753 | ||

| 0.12 | 0.2905 | -0.3716 | ||

| 0.14 | 0.3306 | -0.3006 | ||

| 0.02 | 0.0523 | -0.2817 | ||

| 0.14 | 0.3248 | -0.2809 | ||

| 0.12 | 0.2787 | -0.2774 | ||

| 0.23 | 0.5407 | -0.2537 | ||

| 0.40 | 0.9301 | -0.2398 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-22 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US1475396701 / DWS Gov&Agency Sec Portfolio DWS Gov Cash Inst Shs | 1.53 | -42.39 | 1.53 | -42.40 | 3.5822 | -2.6727 | |||

| SPHY / SPDR Series Trust - SPDR Portfolio High Yield Bond ETF | 0.06 | 83.33 | 1.31 | 86.47 | 3.0563 | 1.4060 | |||

| US25160K3068 / DWS Central Cash Management Government Fund | 1.10 | 3.13 | 1.10 | 3.18 | 2.5779 | 0.0632 | |||

| US04433LAA08 / Ashland LLC | 0.62 | 3.69 | 1.4459 | 0.0432 | |||||

| US1248EPCB75 / CCO Holdings LLC / CCO Holdings Capital Corp 5.375% 06/01/2029 144A | 0.57 | 2.90 | 1.3260 | 0.0305 | |||||

| US126307BB25 / CSC HOLDINGS LLC COMPANY GUAR 144A 12/30 4.125 | 0.51 | 75.43 | 1.1860 | 0.5057 | |||||

| US28618MAA45 / Element Solutions Inc | 0.47 | 3.10 | 1.0869 | 0.0253 | |||||

| US98311AAB17 / Wyndham Hotels & Resorts Inc | 0.45 | 2.25 | 1.0621 | 0.0190 | |||||

| US65341BAG14 / NextEra Energy Partners LP | 0.44 | 0.23 | 1.0368 | -0.0046 | |||||

| HRI / Herc Holdings Inc. | 0.44 | 1.0290 | 1.0290 | ||||||

| XS2066744231 / Carnival PLC | 0.44 | 1.0204 | 1.0204 | ||||||

| Lightning Power LLC / DBT (US53229KAA79) | 0.43 | 2.12 | 1.0124 | 0.0161 | |||||

| US431571AE83 / HILLENBRAND INC 3.75% 03/01/2031 | 0.41 | 2.01 | 0.9515 | 0.0143 | |||||

| Stena International SA / DBT (US85858EAD58) | 0.40 | 0.50 | 0.9368 | -0.0023 | |||||

| US163851AF58 / Chemours Co/The | 0.40 | -20.08 | 0.9301 | -0.2398 | |||||

| US67059TAH86 / NuStar Logistics LP | 0.38 | 2.41 | 0.8952 | 0.0166 | |||||

| US615394AM52 / Moog Inc | 0.37 | 1.09 | 0.8662 | 0.0064 | |||||

| LBTYB / Liberty Global Ltd. | 0.34 | 3.99 | 0.7923 | 0.0248 | |||||

| US159864AG27 / Charles River Laboratories International Inc | 0.31 | 432.20 | 0.7342 | 0.5937 | |||||

| Aethon United BR LP / Aethon United Finance Corp / DBT (US00810GAD60) | 0.31 | 3.00 | 0.7225 | 0.0177 | |||||

| US18912UAA07 / Cloud Software Group Inc | 0.30 | 40.19 | 0.7018 | 0.1982 | |||||

| US897051AC29 / Tronox Inc | 0.28 | 182.83 | 0.6548 | 0.4212 | |||||

| US103304BV23 / BOYD GAMING CORP 4.75% 06/15/2031 144A | 0.28 | 50.82 | 0.6467 | 0.2156 | |||||

| US92857WBQ24 / Vodafone Group PLC | 0.28 | 1.47 | 0.6455 | 0.0045 | |||||

| US72815LAA52 / Playtika Holding Corp | 0.26 | 173.96 | 0.6145 | 0.3870 | |||||

| Capstone Copper Corp / DBT (US14071LAA61) | 0.26 | 94.78 | 0.6096 | 0.2938 | |||||

| US25470XBF15 / DISH DBS Corp. | 0.26 | 2.82 | 0.5962 | 0.0119 | |||||

| US428102AE79 / Hess Midstream Operations LP | 0.25 | 2.01 | 0.5949 | 0.0093 | |||||

| Ascent Resources Utica Holdings LLC / ARU Finance Corp / DBT (US04364VBA08) | 0.25 | 0.5851 | 0.5851 | ||||||

| Windsor Holdings III LLC 2025 USD Term Loan B / LON (US97360BAH87) | 0.25 | -55.42 | 0.5775 | -0.7249 | |||||

| AVNT / Avient Corporation | 0.24 | 2.09 | 0.5703 | 0.0072 | |||||

| US914906AY80 / Univision Communications, Inc. | 0.24 | 24.62 | 0.5686 | 0.1092 | |||||

| 601168 / Western Mining Co.,Ltd. | 0.24 | 3.85 | 0.5685 | 0.0166 | |||||

| KGS / Kodiak Gas Services, Inc. | 0.24 | 1.67 | 0.5676 | 0.0049 | |||||

| US92840MAC64 / Vistra Corp | 0.24 | -0.41 | 0.5671 | -0.0037 | |||||

| US46284VAJ08 / Iron Mountain Inc | 0.24 | 2.99 | 0.5642 | 0.0124 | |||||

| US25461LAA08 / DIRECTV Holdings LLC/DIRECTV Financing Co., Inc. | 0.24 | -10.15 | 0.5585 | -0.0674 | |||||

| US670001AE60 / Novelis Corp | 0.23 | 74.63 | 0.5481 | 0.2317 | |||||

| US15089QAY08 / Celanese US Holdings LLC | 0.23 | -24.35 | 0.5453 | -0.1788 | |||||

| XS1138360166 / Walgreens Boots Alliance Inc | 0.23 | -31.66 | 0.5407 | -0.2537 | |||||

| Panther Escrow Issuer LLC / DBT (US69867RAA59) | 0.23 | 1.79 | 0.5336 | 0.0070 | |||||

| US92332YAD31 / Venture Global LNG Inc | 0.23 | 37.80 | 0.5295 | 0.1429 | |||||

| US28504KAA51 / Electricite de France SA | 0.23 | -12.11 | 0.5267 | -0.0594 | |||||

| NGD / New Gold Inc. | 0.22 | 105.50 | 0.5246 | 0.2684 | |||||

| US450913AF55 / IAMGOLD Corp | 0.22 | 58.16 | 0.5210 | 0.1884 | |||||

| XS2332889778 / Rakuten Group, Inc. | 0.22 | 9.36 | 0.5191 | 0.0417 | |||||

| US86765LAZ04 / Sunoco LP/Sunoco Finance Corp. | 0.22 | 2.79 | 0.5163 | 0.0111 | |||||

| EZPW / EZCORP, Inc. | 0.22 | 15.10 | 0.5161 | 0.0633 | |||||

| US37185LAP76 / Genesis Energy LP / Genesis Energy Finance Corp | 0.22 | 1.39 | 0.5127 | 0.0035 | |||||

| Cablevision Lightpath LLC 2025 Repriced Term Loan / LON (US12687HAD98) | 0.22 | 0.47 | 0.5021 | -0.0022 | |||||

| US681639AA87 / Olympus Water US Holding Corp | 0.21 | 2.90 | 0.4996 | 0.0112 | |||||

| US87901JAJ43 / TEGNA Inc | 0.21 | 2.40 | 0.4992 | 0.0104 | |||||

| L1MN34 / Lumen Technologies, Inc. - Depositary Receipt (Common Stock) | 0.21 | 241.94 | 0.4963 | 0.3492 | |||||

| XS2066744231 / Carnival PLC | 0.21 | 1.92 | 0.4962 | 0.0073 | |||||

| US98310WAS70 / Wyndham Destinations Inc | 0.21 | 0.47 | 0.4957 | -0.0012 | |||||

| US001940AC98 / ATS Automation Tooling Systems Inc | 0.21 | 2.94 | 0.4912 | 0.0112 | |||||

| US013822AC54 / Alcoa Nederland Holding BV | 0.21 | 1.95 | 0.4901 | 0.0065 | |||||

| FM / First Quantum Minerals Ltd. | 0.21 | 1.49 | 0.4790 | 0.0030 | |||||

| Albion Financing 1 SARL / Aggreko Holdings Inc / DBT (US01330AAA43) | 0.20 | 0.4765 | 0.4765 | ||||||

| US81172QAA22 / Seadrill Finance Ltd. | 0.20 | 2.01 | 0.4756 | 0.0062 | |||||

| US449691AC82 / Iliad Holding SASU | 0.20 | 0.50 | 0.4755 | 0.0000 | |||||

| 1261229 BC Ltd / DBT (US68288AAA51) | 0.20 | 1.52 | 0.4711 | 0.0042 | |||||

| US25470MAG42 / DISH Network Corp | 0.20 | -1.95 | 0.4693 | -0.0130 | |||||

| US78397UAA88 / SCIL IV LLC / SCIL USA Holdings LLC | 0.20 | 1.02 | 0.4639 | 0.0019 | |||||

| US70339PAA75 / Pattern Energy Operations LP / Pattern Energy Operations Inc | 0.20 | 4.21 | 0.4637 | 0.0158 | |||||

| Excelerate Energy LP / DBT (US30069UAA60) | 0.20 | 0.4627 | 0.4627 | ||||||

| US12116LAA70 / Burford Capital Global Finance LLC | 0.20 | 0.00 | 0.4626 | -0.0042 | |||||

| TNETBB / Telenet Finance Luxembourg Notes Sarl | 0.20 | 1.55 | 0.4621 | 0.0064 | |||||

| US59833DAB64 / Midwest Gaming Borrower LLC | 0.20 | 2.60 | 0.4611 | 0.0092 | |||||

| US75102WAA62 / Rakuten Group Inc | 0.20 | 0.4582 | 0.4582 | ||||||

| US92770QAA58 / Virgin Media Vendor Financing Notes IV DAC | 0.20 | 3.17 | 0.4572 | 0.0132 | |||||

| US91740PAF53 / USA Compression Partners LP / USA Compression Finance Corp | 0.20 | 105.26 | 0.4562 | 0.2333 | |||||

| US88163VAD10 / Teva Pharmaceutical Finance Co LLC | 0.20 | 3.17 | 0.4561 | 0.0113 | |||||

| US44332PAG63 / HUB International Ltd | 0.20 | 3.72 | 0.4554 | 0.0123 | |||||

| US146869AM47 / Carvana Co. | 0.19 | 86.54 | 0.4538 | 0.2083 | |||||

| XCCC / BondBloxx ETF Trust - BondBloxx CCC Rated USD High Yield Corporate Bond ETF | 0.01 | 0.00 | 0.19 | 2.65 | 0.4532 | 0.0088 | |||

| TKO / Taseko Mines Limited | 0.19 | 2.66 | 0.4522 | 0.0085 | |||||

| McGraw-Hill Education Inc / DBT (US58064LAA26) | 0.19 | 220.00 | 0.4506 | 0.3089 | |||||

| Moss Creek Resources Holdings Inc / DBT (US61965RAC97) | 0.19 | 190.91 | 0.4496 | 0.2939 | |||||

| US536797AF03 / Lithia Motors Inc. | 0.19 | -45.40 | 0.4440 | -0.3753 | |||||

| US98955DAA81 / Ziggo BV | 0.19 | 1.64 | 0.4362 | 0.0058 | |||||

| BRTSG8EN8 / Staples, Inc., Term Loan | 0.19 | 20.13 | 0.4331 | 0.0702 | |||||

| US680665AK27 / Olin Corp | 0.18 | 2.81 | 0.4281 | 0.0079 | |||||

| 53219LAH2 / LifePoint Health, Inc. Bond | 0.18 | 5.81 | 0.4254 | 0.0210 | |||||

| US118230AJ01 / Buckeye Partners Lp 4.875% Senior Notes 02/01/21 | 0.18 | 2.31 | 0.4144 | 0.0076 | |||||

| US88033GAV23 / Tenet Healthcare Corp 6 7/8% Notes 11/15/2031 | 0.18 | 5.36 | 0.4142 | 0.0174 | |||||

| US85571BAU98 / Starwood Property Trust Inc | 0.18 | 1.15 | 0.4131 | 0.0035 | |||||

| SM / SM Energy Company | 0.18 | 0.57 | 0.4118 | -0.0008 | |||||

| Ardonagh Finco Ltd / DBT (XS2765406371) | 0.18 | -17.84 | 0.4098 | -0.0893 | |||||

| Blue Racer Midstream LLC / Blue Racer Finance Corp / DBT (US095796AK46) | 0.17 | 2.35 | 0.4082 | 0.0073 | |||||

| US775631AD66 / Roller Bearing Co of America Inc | 0.17 | 3.57 | 0.4070 | 0.0101 | |||||

| US527298BR35 / Level 3 Financing Inc | 0.17 | 106.10 | 0.3961 | 0.2025 | |||||

| Ascent Resources Utica Holdings LLC / ARU Finance Corp / DBT (US04364VAX10) | 0.17 | 1.82 | 0.3945 | 0.0064 | |||||

| US02156LAC54 / Altice France SA/France | 0.17 | 5.66 | 0.3930 | 0.0177 | |||||

| NGL.PRC / NGL Energy Partners LP - Preferred Stock | 0.17 | 38.33 | 0.3892 | 0.1054 | |||||

| XAL0178UAM89 / Altice Financing S.A., Senior Secured First Lien Term Loan | 0.16 | -1.80 | 0.3851 | -0.0095 | |||||

| Velocity Vehicle Group LLC / DBT (US92262TAA43) | 0.16 | 60.78 | 0.3849 | 0.1440 | |||||

| US380355AH08 / goeasy Ltd | 0.16 | 0.3829 | 0.3829 | ||||||

| Rivers Enterprise Borrower LLC / Rivers Enterprise Finance Corp / DBT (US76883NAA90) | 0.16 | 1.90 | 0.3764 | 0.0046 | |||||

| Venture Global Plaquemines LNG LLC / DBT (US922966AB20) | 0.16 | 0.3665 | 0.3665 | ||||||

| Viking Baked Goods Acquisition Corp / DBT (US92676AAA51) | 0.16 | 143.75 | 0.3660 | 0.2137 | |||||

| SATS / EchoStar Corporation | 0.16 | 4.70 | 0.3646 | 0.0130 | |||||

| Windstream Services LLC / Windstream Escrow Finance Corp / DBT (US97381AAA07) | 0.15 | 83.33 | 0.3619 | 0.1634 | |||||

| US98877DAD75 / ZF North America Capital Inc | 0.15 | 2.04 | 0.3513 | 0.0053 | |||||

| US17888HAB96 / Civitas Resources Inc | 0.15 | 0.3495 | 0.3495 | ||||||

| US57665RAG11 / Match Group Inc | 0.15 | 1.36 | 0.3483 | 0.0029 | |||||

| US33767DAB10 / FirstCash Inc | 0.15 | 2.80 | 0.3439 | 0.0074 | |||||

| SATS / EchoStar Corporation | 0.14 | -2.04 | 0.3367 | -0.0088 | |||||

| CAR / AVIS BUDGET FINANCE PLC /EUR/ REGD REG S 4.75000000 | 0.14 | 0.3350 | 0.3350 | ||||||

| Kraken Oil & Gas Partners LLC / DBT (US50076PAA66) | 0.14 | 72.29 | 0.3349 | 0.1377 | |||||

| US030727AA98 / AmeriTex HoldCo Intermediate LLC | 0.14 | 3.62 | 0.3344 | 0.0089 | |||||

| US05453GAC96 / AXALTA COATING SYSTEMS LLC 3.375% 02/15/2029 144A | 0.14 | 3.65 | 0.3317 | 0.0095 | |||||

| S2TW34 / Starwood Property Trust, Inc. - Depositary Receipt (Common Stock) | 0.14 | -47.39 | 0.3306 | -0.3006 | |||||

| Crescent Energy Finance LLC / DBT (US45344LAD55) | 0.14 | 0.3306 | 0.3306 | ||||||

| MPT Operating Partnership LP / MPT Finance Corp / DBT (US55342UAQ76) | 0.14 | 2.92 | 0.3299 | 0.0069 | |||||

| US78433BAA61 / CORP. NOTE | 0.14 | 2.92 | 0.3298 | 0.0059 | |||||

| Acrisure LLC / Acrisure Finance Inc / DBT (US004961AA64) | 0.14 | 0.3291 | 0.3291 | ||||||

| US389376AZ77 / Gray Television Inc | 0.14 | 52.75 | 0.3254 | 0.1101 | |||||

| US00404AAN90 / Acadia Healthcare Co Inc | 0.14 | -45.91 | 0.3248 | -0.2809 | |||||

| US63861CAC38 / Nationstar Mortgage Holdings Inc | 0.14 | 0.3247 | 0.3247 | ||||||

| US071734AQ04 / Bausch Health Cos Inc | 0.14 | 81.58 | 0.3236 | 0.1446 | |||||

| US89386MAA62 / Transocean Titan Financing Ltd | 0.14 | 65.06 | 0.3219 | 0.1265 | |||||

| US96950GAE26 / Williams Scotsman International Inc | 0.14 | 48.91 | 0.3213 | 0.1050 | |||||

| US91327BAA89 / UNITI GROUP LP / UNITI GROUP FINANCE INC / CSL CAPITAL LLC 6.5% 02/15/2029 144A | 0.14 | 90.14 | 0.3159 | 0.1472 | |||||

| BBALN / BBA US HOLDINGS INC COMPANY GUAR 144A 03/28 4 | 0.14 | -0.74 | 0.3158 | -0.0046 | |||||

| US118230AJ01 / Buckeye Partners Lp 4.875% Senior Notes 02/01/21 | 0.13 | 1.52 | 0.3145 | 0.0041 | |||||

| US01883LAB99 / Alliant Holdings Intermediate LLC / Alliant Holdings Co-Issuer | 0.13 | 1.54 | 0.3094 | 0.0034 | |||||

| N1CL34 / Norwegian Cruise Line Holdings Ltd. - Depositary Receipt (Common Stock) | 0.13 | 3.15 | 0.3077 | 0.0084 | |||||

| US57665RAN61 / Match Group Inc | 0.13 | 1.55 | 0.3076 | 0.0033 | |||||

| US451102BZ91 / CORP. NOTE | 0.13 | 1.56 | 0.3054 | 0.0039 | |||||

| US40390DAC92 / HLF Financing Sarl LLC / Herbalife International Inc | 0.13 | 113.11 | 0.3043 | 0.1594 | |||||

| Voyager Parent LLC / DBT (US92921EAA01) | 0.13 | 0.3037 | 0.3037 | ||||||

| US77313LAB99 / Rocket Mortgage LLC / Rocket Mortgage Co-Issuer Inc | 0.13 | 0.3029 | 0.3029 | ||||||

| RITM.PRD / Rithm Capital Corp. - Preferred Stock | 0.13 | 0.3027 | 0.3027 | ||||||

| W1HR34 / Whirlpool Corporation - Depositary Receipt (Common Stock) | 0.13 | 0.3022 | 0.3022 | ||||||

| US65480CAC91 / NISSAN MOTOR ACCEPTANCE SR UNSECURED 144A 09/26 1.85 | 0.13 | 0.00 | 0.3006 | -0.0004 | |||||

| US20914UAF30 / Consolidated Energy Finance SA | 0.13 | -0.78 | 0.3002 | -0.0028 | |||||

| Venture Global LNG Inc / DBT (US92332YAE14) | 0.13 | 2.40 | 0.2998 | 0.0059 | |||||

| US01883LAD55 / Alliant Holdings Intermediate LLC / Alliant Holdings Co-Issuer | 0.13 | 2.40 | 0.2992 | 0.0041 | |||||

| US579063AB46 / Condor Merger Sub Inc | 0.13 | -15.89 | 0.2977 | -0.0483 | |||||

| US128786AA80 / Calderys Financing LLC | 0.13 | 0.79 | 0.2970 | 0.0002 | |||||

| AMCX / AMC Networks Inc. | 0.13 | 0.2957 | 0.2957 | ||||||

| US640695AA01 / Neptune Bidco US Inc | 0.13 | 38.46 | 0.2955 | 0.0816 | |||||

| US483007AL48 / KAISER ALUMINUM CORP 4.5% 06/01/2031 144A | 0.13 | -36.68 | 0.2949 | -0.1728 | |||||

| US57667JAA07 / Match Group Holdings II LLC | 0.13 | 62.34 | 0.2925 | 0.1103 | |||||

| US737446AP91 / Post Holdings Inc | 0.12 | -55.87 | 0.2905 | -0.3716 | |||||

| Kimmeridge Texas Gas LLC / DBT (US49446BAA26) | 0.12 | 19.23 | 0.2900 | 0.0435 | |||||

| XS2724532333 / AMS-OSRAM AG /EUR/ REGD REG S 10.50000000 | 0.12 | 13.89 | 0.2879 | 0.0320 | |||||

| Ardonagh Finco Ltd / DBT (XS2765489484) | 0.12 | 0.2826 | 0.2826 | ||||||

| US50168QAE52 / LABL Inc | 0.12 | 140.00 | 0.2806 | 0.1614 | |||||

| US629377CS98 / NRG Energy Inc | 0.12 | -49.58 | 0.2787 | -0.2774 | |||||

| CoreWeave Inc / DBT (US21873SAB43) | 0.12 | 0.2721 | 0.2721 | ||||||

| US073685AD12 / Beacon Roofing Supply Inc 4.875% 11/01/2025 144a Bond | 0.12 | 0.2718 | 0.2718 | ||||||

| Howard Midstream Energy Partners LLC / DBT (US442722AC80) | 0.12 | 2.68 | 0.2701 | 0.0054 | |||||

| US57763RAB33 / Mauser Packaging Solutions Holding Co | 0.11 | 0.00 | 0.2681 | 0.0002 | |||||

| US92332YAC57 / Venture Global LNG Inc | 0.11 | 1.79 | 0.2671 | 0.0026 | |||||

| KeHE Distributors LLC / KeHE Finance Corp / NextWave Distribution Inc / DBT (US487526AC91) | 0.11 | 46.75 | 0.2660 | 0.0848 | |||||

| FTAIM / FTAI Aviation Ltd. - Preferred Stock | 0.11 | 1.80 | 0.2659 | 0.0034 | |||||

| SUN / Sunoco LP - Limited Partnership | 0.11 | 0.89 | 0.2659 | 0.0025 | |||||

| US417558AA18 / Harvest Midstream I LP | 0.11 | 0.00 | 0.2612 | 0.0003 | |||||

| US34960PAD33 / Fortress Transportation and Infrastructure Investors LLC | 0.11 | 1.87 | 0.2554 | 0.0022 | |||||

| Garrett Motion Holdings Inc / Garrett LX I Sarl / DBT (US366504AA61) | 0.11 | 57.97 | 0.2552 | 0.0927 | |||||

| Stonepeak Nile Parent LLC / DBT (US861932AA97) | 0.11 | 4.81 | 0.2549 | 0.0083 | |||||

| XS2272845798 / VZ Vendor Financing II BV | 0.11 | 0.2496 | 0.2496 | ||||||

| EVKG / Ever-Glory International Group, Inc. | 0.11 | 0.00 | 0.2496 | -0.0011 | |||||

| US05765WAA18 / TIBCO Software Inc | 0.11 | -43.62 | 0.2485 | -0.1933 | |||||

| XS2310511717 / Ardagh Metal Packaging Finance USA LLC | 0.11 | 16.67 | 0.2463 | 0.0338 | |||||

| US205768AS39 / Comstock Resources Inc | 0.11 | 2.94 | 0.2457 | 0.0045 | |||||

| Global Partners LP / GLP Finance Corp / DBT (US37954FAK03) | 0.11 | 2.94 | 0.2455 | 0.0041 | |||||

| Summit Midstream Holdings LLC / DBT (US86614JAA34) | 0.10 | 0.00 | 0.2436 | -0.0009 | |||||

| EquipmentShare.com Inc / DBT (US29450YAC30) | 0.10 | 4.08 | 0.2397 | 0.0079 | |||||

| Alliant Holdings Intermediate LLC / Alliant Holdings Co-Issuer / DBT (US01883LAG86) | 0.10 | 3.09 | 0.2354 | 0.0072 | |||||

| US1248EPCE15 / CCO Holdings LLC / CCO Holdings Capital Corp | 0.10 | 5.26 | 0.2337 | 0.0092 | |||||

| XS2053846262 / Altice France SA/France | 0.10 | 13.95 | 0.2305 | 0.0282 | |||||

| US90385KAJ07 / BANK LOAN NOTE | 0.10 | 2.08 | 0.2301 | 0.0038 | |||||

| US12543DBG43 / CHS/Community Health Systems Inc | 0.10 | -26.32 | 0.2300 | -0.0840 | |||||

| US12543DBK54 / CHS/CMNTY HEALTH SYSTEMS INC 4.75% 02/15/2031 144A | 0.10 | 8.89 | 0.2295 | 0.0160 | |||||

| WESCO Distribution Inc / DBT (US95081QAS30) | 0.10 | 3.23 | 0.2244 | 0.0049 | |||||

| Champ Acquisition Corp / DBT (US15807XAA81) | 0.10 | 0.2233 | 0.2233 | ||||||

| US85205TAN00 / Spirit AeroSystems Inc | 0.10 | -1.04 | 0.2230 | -0.0026 | |||||

| Champion Iron Canada Inc / DBT (US15853BAA98) | 0.10 | 0.2225 | 0.2225 | ||||||

| US29082KAA34 / Embecta Corp | 0.09 | 62.07 | 0.2215 | 0.0849 | |||||

| US62886EAY41 / NCR CORPORATION NEW 5% 10/01/2028 144A | 0.09 | 3.30 | 0.2196 | 0.0049 | |||||

| CMP / Compass Minerals International, Inc. | 0.09 | 0.2171 | 0.2171 | ||||||

| US55342UAH77 / Mpt Operating Partnership Lp / Mpt Finance Corp 5.00% 10/15/2027 Bond | 0.09 | 2.22 | 0.2157 | 0.0034 | |||||

| US02406PBB58 / AMERICAN AXLE & MFG INC REGD 5.00000000 | 0.09 | -9.00 | 0.2137 | -0.0174 | |||||

| US00253XAA90 / American Airlines Inc/AAdvantage Loyalty IP Ltd | 0.09 | -20.18 | 0.2135 | -0.0549 | |||||

| Wayfair LLC / DBT (US94419NAB38) | 0.09 | 0.2114 | 0.2114 | ||||||

| OLN / Olin Corporation | 0.09 | 1.12 | 0.2114 | 0.0015 | |||||

| US893830BX61 / Transocean Inc | 0.09 | -1.10 | 0.2113 | -0.0034 | |||||

| Freedom Mortgage Holdings LLC / DBT (US35641AAC27) | 0.09 | 3.49 | 0.2100 | 0.0058 | |||||

| US92552VAN01 / ViaSat Inc | 0.09 | 106.98 | 0.2096 | 0.1072 | |||||

| US63938CAK45 / Navient Corp | 0.09 | 1.14 | 0.2093 | 0.0024 | |||||

| US442722AB08 / Howard Midstream Energy Partners LLC | 0.09 | 1.14 | 0.2084 | 0.0002 | |||||

| US039524AB93 / ARCHES BUYER INC 6.125% 12/01/2028 144A | 0.09 | 480.00 | 0.2040 | 0.1745 | |||||

| US35640YAK38 / Freedom Mortgage Corp | 0.09 | 1.18 | 0.2009 | -0.0010 | |||||

| US87901JAH86 / TEGNA Inc | 0.09 | 0.2007 | 0.2007 | ||||||

| Avis Budget Car Rental LLC / Avis Budget Finance Inc / DBT (US053773BK25) | 0.09 | 0.2003 | 0.2003 | ||||||

| US49461MAA80 / Kinetik Holdings LP | 0.09 | 1.19 | 0.2001 | 0.0026 | |||||

| Prime Healthcare Services Inc / DBT (US74165HAC25) | 0.08 | 0.1970 | 0.1970 | ||||||

| Warnermedia Holdings Inc / DBT (US55903VBY83) | 0.08 | 0.1957 | 0.1957 | ||||||

| CCO / Clear Channel Outdoor Holdings, Inc. | 0.08 | 0.1928 | 0.1928 | ||||||

| US86765LAT44 / Sunoco LP / Sunoco Finance Corp | 0.08 | 70.83 | 0.1927 | 0.0759 | |||||

| US77314EAA64 / Rocket Software Inc | 0.08 | 121.62 | 0.1926 | 0.1040 | |||||

| Global Partners LP / GLP Finance Corp / DBT (US37954FAL85) | 0.08 | 0.1918 | 0.1918 | ||||||

| Talos Production Inc / DBT (US87485LAE48) | 0.08 | 305.00 | 0.1907 | 0.1436 | |||||

| US20903XAF06 / Consolidated Communications Inc | 0.08 | 5.19 | 0.1901 | 0.0089 | |||||

| US20451RAB87 / Compass Group Diversified Holdings LLC | 0.08 | 0.1886 | 0.1886 | ||||||

| US12543DBM11 / CHS/Community Health Systems Inc | 0.08 | 6.76 | 0.1863 | 0.0119 | |||||

| BCPE Flavor Debt Merger Sub LLC and BCPE Flavor Issuer Inc / DBT (US072933AA25) | 0.08 | 0.1863 | 0.1863 | ||||||

| US12543DBJ81 / CHS/CMNTY HEALTH SYSTEMS INC 6.875% 04/15/2029 144A | 0.08 | 17.91 | 0.1862 | 0.0213 | |||||

| US880349AU90 / Tenneco Inc | 0.08 | -21.00 | 0.1847 | -0.0505 | |||||

| US415864AM90 / Harsco Corp 5.75% 07/31/2027 144A | 0.08 | -34.45 | 0.1844 | -0.0960 | |||||

| US118230AU55 / Buckeye Partners LP | 0.08 | 2.63 | 0.1840 | 0.0037 | |||||

| US91911XAW48 / Bausch Health Americas Inc | 0.08 | 0.00 | 0.1779 | -0.0006 | |||||

| US87422VAK44 / Talen Energy Supply, LLC | 0.08 | 1.35 | 0.1752 | 0.0008 | |||||

| GPOR / Gulfport Energy Corporation | 0.07 | 1.37 | 0.1747 | 0.0009 | |||||

| US30251GBC06 / FMG Resources August 2006 Pty Ltd | 0.07 | 2.78 | 0.1745 | 0.0049 | |||||

| US513075BW03 / Lamar Media Corp | 0.07 | 10.45 | 0.1744 | 0.0156 | |||||

| US159864AJ65 / Charles River Laboratories International Inc | 0.07 | 135.48 | 0.1712 | 0.0976 | |||||

| S2TW34 / Starwood Property Trust, Inc. - Depositary Receipt (Common Stock) | 0.07 | 4.29 | 0.1711 | 0.0059 | |||||

| US20338HAB96 / Commscope Technologies Llc 5.00% 03/15/2027 144a Bond | 0.07 | 8.96 | 0.1706 | 0.0126 | |||||

| Freedom Mortgage Holdings LLC / DBT (US35641AAA60) | 0.07 | 1.41 | 0.1698 | 0.0028 | |||||

| US281020AX52 / Edison International | 0.07 | -1.37 | 0.1691 | -0.0027 | |||||

| FCFS / FirstCash Holdings, Inc. | 0.07 | 2.86 | 0.1691 | 0.0027 | |||||

| US82873MAA18 / Simmons Foods Inc/Simmons Prepared Foods Inc/Simmons Pet Food Inc/Simmons Feed | 0.07 | 1.45 | 0.1653 | 0.0020 | |||||

| US98919VAA35 / Front Range BidCo Inc | 0.07 | -30.00 | 0.1642 | -0.0711 | |||||

| US92328MAC73 / Venture Global Calcasieu Pass LLC | 0.07 | -51.41 | 0.1633 | -0.1702 | |||||

| US893790AA34 / Transocean Aquila Ltd | 0.07 | -1.43 | 0.1630 | -0.0024 | |||||

| TransMontaigne Partners LLC / DBT (US89377AAA34) | 0.07 | 3.03 | 0.1603 | 0.0041 | |||||

| ACHC / Acadia Healthcare Company, Inc. | 0.07 | 3.08 | 0.1588 | 0.0039 | |||||

| Genesis Energy LP / Genesis Energy Finance Corp / DBT (US37185LAR33) | 0.07 | 3.08 | 0.1587 | 0.0048 | |||||

| US17888HAB96 / Civitas Resources Inc | 0.07 | -1.52 | 0.1534 | -0.0033 | |||||

| US603051AC70 / Mineral Resources Ltd | 0.07 | 0.1525 | 0.1525 | ||||||

| US629377CR16 / NRG ENERGY INC 3.625% 02/15/2031 144A | 0.06 | -50.00 | 0.1504 | -0.1512 | |||||

| US88104LAE39 / TERRAFORM POWER OPERATIN | 0.06 | 3.23 | 0.1502 | 0.0025 | |||||

| US55916AAA25 / Magic Mergeco Inc | 0.06 | 0.1493 | 0.1493 | ||||||

| US89616RAC34 / Trident TPI Holdings Inc | 0.06 | -1.56 | 0.1486 | -0.0025 | |||||

| US77289KAA34 / Rockcliff Energy II LLC | 0.06 | 121.43 | 0.1471 | 0.0825 | |||||

| US49461MAB63 / Kinetik Holdings LP | 0.06 | 1.64 | 0.1457 | 0.0001 | |||||

| US603051AE37 / Mineral Resources Ltd | 0.06 | -60.39 | 0.1434 | -0.2207 | |||||

| MINAU / Mineral Resources Ltd | 0.06 | 0.1400 | 0.1400 | ||||||

| US203372AX50 / CommScope Inc | 0.06 | -60.27 | 0.1368 | -0.2078 | |||||

| US18453HAC07 / Clear Channel Outdoor Holdings Inc | 0.06 | -53.33 | 0.1324 | -0.1503 | |||||

| Specialty Building Products Holdings LLC / SBP Finance Corp / DBT (US84749AAC18) | 0.06 | -30.38 | 0.1285 | -0.0581 | |||||

| US513075BW03 / Lamar Media Corp | 0.05 | 0.1283 | 0.1283 | ||||||

| US89469AAD63 / TreeHouse Foods Inc | 0.05 | -8.47 | 0.1277 | -0.0101 | |||||

| Icahn Enterprises LP / Icahn Enterprises Finance Corp / DBT (US451102CF29) | 0.05 | 0.1247 | 0.1247 | ||||||

| Harvest Midstream I LP / DBT (US417558AB90) | 0.05 | 0.1233 | 0.1233 | ||||||

| US45174HBG11 / iHeartCommunications Inc | 0.05 | 26.83 | 0.1221 | 0.0250 | |||||

| Encino Acquisition Partners Holdings LLC / DBT (US29254BAB36) | 0.05 | 4.26 | 0.1160 | 0.0037 | |||||

| US29450YAA73 / EquipmentShare.com, Inc. | 0.05 | 2.17 | 0.1110 | 0.0015 | |||||

| Fiesta Purchaser Inc / DBT (US31659AAB26) | 0.04 | 2.33 | 0.1035 | 0.0021 | |||||

| Uniti Group LP / Uniti Group Finance 2019 Inc / CSL Capital LLC / DBT (US91327TAC53) | 0.04 | 0.1014 | 0.1014 | ||||||

| US53219LAU35 / LIFEPOINT HEALTH INC COMPANY GUAR 144A 01/29 5.375 | 0.04 | 5.13 | 0.0979 | 0.0052 | |||||

| US707569AV14 / Penn National Gaming Inc | 0.04 | 5.13 | 0.0974 | 0.0035 | |||||

| US13323NAA00 / Camelot Return Merger Sub Inc | 0.04 | 10.81 | 0.0969 | 0.0098 | |||||

| Venture Global LNG Inc / DBT (US92332YAF88) | 0.04 | -51.22 | 0.0953 | -0.0986 | |||||

| US516806AJ59 / Vital Energy Inc | 0.04 | -54.02 | 0.0951 | -0.1061 | |||||

| US17888HAC79 / Civitas Resources Inc | 0.04 | -2.44 | 0.0948 | -0.0021 | |||||

| US914908BD90 / Univision Communications Inc. 2022 First Lien Term Loan B | 0.04 | 2.56 | 0.0935 | 0.0017 | |||||

| US185899AL57 / Cleveland-Cliffs Inc | 0.04 | -2.50 | 0.0919 | -0.0021 | |||||

| Directv Financing LLC / DBT (US25461LAB80) | 0.04 | 2.63 | 0.0916 | 0.0019 | |||||

| SSP / The E.W. Scripps Company | 0.04 | 0.0907 | 0.0907 | ||||||

| US931427AS74 / Walgreens Boots Alliance Inc | 0.04 | 5.56 | 0.0892 | 0.0025 | |||||

| Crescent Energy Finance LLC / DBT (US45344LAG86) | 0.04 | 0.0888 | 0.0888 | ||||||

| NGL.PRC / NGL Energy Partners LP - Preferred Stock | 0.04 | -56.25 | 0.0820 | -0.1063 | |||||

| US071734AM99 / Bausch Health Cos Inc | 0.04 | -14.63 | 0.0817 | -0.0163 | |||||

| US81105DAA37 / SCRIPPS ESCROW II INC SR SECURED 144A 01/29 3.875 | 0.03 | 36.00 | 0.0813 | 0.0333 | |||||

| US462914AA05 / Iris Escrow Issuer Corp | 0.03 | 3.23 | 0.0749 | 0.0016 | |||||

| TransDigm Inc / DBT (US893647BU00) | 0.03 | 0.00 | 0.0719 | 0.0007 | |||||

| US428040DA42 / Hertz Corp/The | 0.02 | -84.83 | 0.0523 | -0.2817 | |||||

| US444454AF95 / HUGHES SATELLITE SYSTEMS CORPORATION 6.625% 08/01/2026 | 0.02 | -53.33 | 0.0499 | -0.0567 | |||||

| BRTSG8EN8 / Staples, Inc., Term Loan | 0.02 | 0.00 | 0.0386 | -0.0011 | |||||

| US4270981164 / HERCULES TR II WTS EXP 31MAR29 | 0.00 | 0.00 | 0.00 | -40.00 | 0.0086 | -0.0038 | |||

| QUAD / Quad/Graphics, Inc. | 0.00 | 0.00 | 0.00 | 0.00 | 0.0038 | 0.0001 | |||

| PURCHASED USD / SOLD EUR / DFE (000000000) | -0.01 | -0.0147 | -0.0147 |