Mga Batayang Estadistika

| Nilai Portofolio | $ 344,568,618 |

| Posisi Saat Ini | 97 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

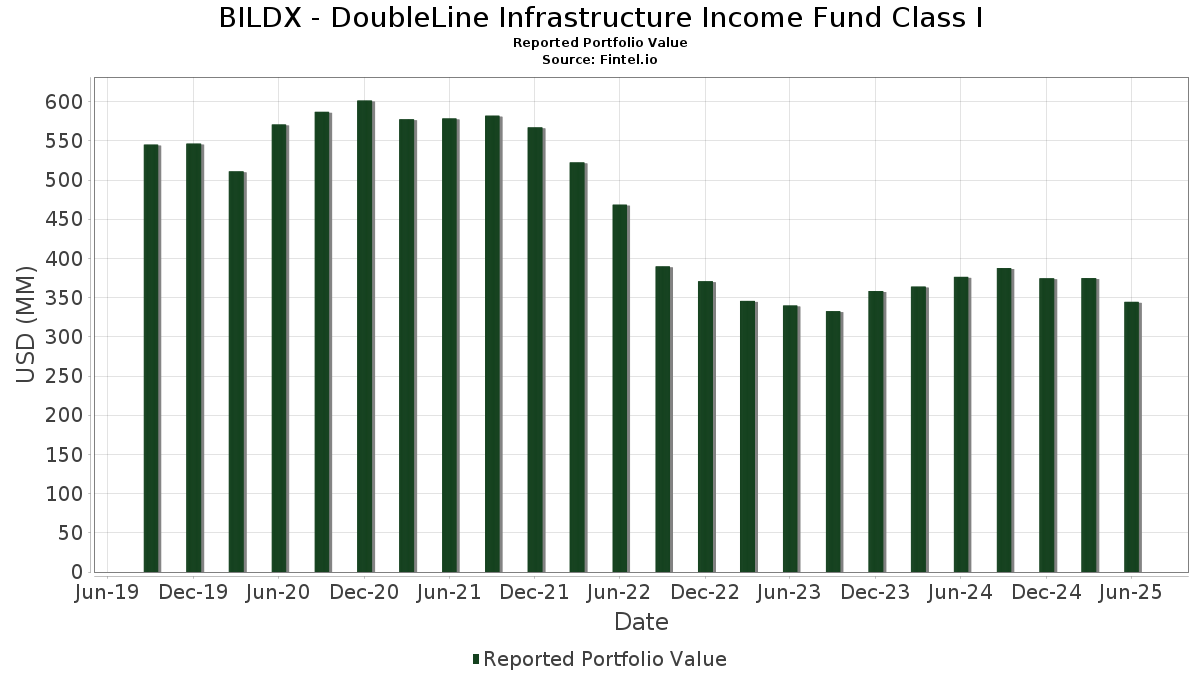

BILDX - DoubleLine Infrastructure Income Fund Class I telah mengungkapkan total kepemilikan 97 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 344,568,618 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama BILDX - DoubleLine Infrastructure Income Fund Class I adalah Southern Co. (The) (US:US842587DS35) , AT&T Inc (US:US00206RBH49) , EVERSOURCE ENERGY (US:US30040WAU27) , Energy Transfer LP (US:US29273VAQ32) , and Crown Castle Inc (US:US22822VBC46) . Posisi baru BILDX - DoubleLine Infrastructure Income Fund Class I meliputi: Southern Co. (The) (US:US842587DS35) , AT&T Inc (US:US00206RBH49) , EVERSOURCE ENERGY (US:US30040WAU27) , Energy Transfer LP (US:US29273VAQ32) , and Crown Castle Inc (US:US22822VBC46) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 9.53 | 2.7925 | 2.7925 | ||

| 7.59 | 2.2232 | 2.2232 | ||

| 6.49 | 1.9028 | 1.9028 | ||

| 6.04 | 1.7700 | 1.7700 | ||

| 6.00 | 1.7595 | 1.7595 | ||

| 5.23 | 1.5338 | 1.5338 | ||

| 5.09 | 1.4924 | 1.4924 | ||

| 5.09 | 1.4911 | 1.4911 | ||

| 5.08 | 1.4881 | 1.4881 | ||

| 5.04 | 1.4761 | 1.4761 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 1.01 | 0.2962 | -0.3439 | ||

| 1.53 | 0.4490 | -0.1226 | ||

| 0.21 | 0.0623 | -0.0535 | ||

| 4.47 | 1.3104 | -0.0448 | ||

| 1.08 | 0.3166 | -0.0408 | ||

| 0.63 | 0.1855 | -0.0238 | ||

| 0.52 | 0.1534 | -0.0237 | ||

| 0.09 | 0.0271 | -0.0233 | ||

| 0.80 | 0.2335 | -0.0072 | ||

| 0.77 | 0.2250 | -0.0066 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-22 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US842587DS35 / Southern Co. (The) | 9.53 | 2.7925 | 2.7925 | ||||||

| US00206RBH49 / AT&T Inc | 9.29 | 0.25 | 2.7215 | 0.1653 | |||||

| GreenSky Home Improvement Issuer Trust 2025-1 / ABS-O (US39571NAG16) | 9.11 | 0.96 | 2.6711 | 0.1800 | |||||

| US30040WAU27 / EVERSOURCE ENERGY | 8.51 | 1.23 | 2.4943 | 0.1739 | |||||

| US29273VAQ32 / Energy Transfer LP | 8.31 | 1.43 | 2.4346 | 0.1745 | |||||

| AASET 2024-1 / ABS-O (US00255JAC45) | 8.25 | -3.91 | 2.4183 | 0.0483 | |||||

| US22822VBC46 / Crown Castle Inc | 7.97 | 1.90 | 2.3361 | 0.1774 | |||||

| US55336VBV18 / MPLX LP | 7.89 | 1.02 | 2.3130 | 0.1572 | |||||

| US465685AS47 / ITC Holdings Corp | 7.59 | 0.53 | 2.2243 | 0.1407 | |||||

| US30161NBK63 / Exelon Corp | 7.59 | 2.2232 | 2.2232 | ||||||

| Luminace Abs-2024 Issuer LLC / ABS-O (US55026NAA19) | 6.71 | 0.07 | 1.9677 | 0.1162 | |||||

| US23802WAL54 / COLO_23-1 | 6.49 | 1.9028 | 1.9028 | ||||||

| US76134KAC80 / Retained Vantage Data Centers Issuer LLC | 6.25 | 0.56 | 1.8314 | 0.1164 | |||||

| A1EE34 / Ameren Corporation - Depositary Receipt (Common Stock) | 6.04 | 1.7700 | 1.7700 | ||||||

| HASI / HA Sustainable Infrastructure Capital, Inc. | 6.00 | 1.7595 | 1.7595 | ||||||

| US89366LAE48 / Transelec SA | 5.81 | 0.31 | 1.7039 | 0.1043 | |||||

| APAAU / APT Pipelines Ltd | 5.48 | 0.35 | 1.6049 | 0.0990 | |||||

| Diversified Abs X LLC / ABS-O (US255126AA23) | 5.36 | -2.24 | 1.5713 | 0.0578 | |||||

| US26444HAQ48 / DUKE ENERGY FLORIDA LLC SR SEC 1ST LIEN 5.875% 11-15-33 | 5.33 | 0.98 | 1.5627 | 0.1055 | |||||

| US96950FAF18 / Williams Partners Lp 6.3% Senior Notes 04/15/40 | 5.31 | 0.72 | 1.5569 | 0.1013 | |||||

| Stack Infrastructure Issuer LLC / ABS-O (US85236KAP75) | 5.23 | 1.5338 | 1.5338 | ||||||

| US49456BAH42 / Kinder Morgan Inc/DE | 5.19 | 0.68 | 1.5220 | 0.0984 | |||||

| Switch ABS Issuer LLC / ABS-O (US871044AJ27) | 5.19 | -0.27 | 1.5204 | 0.0848 | |||||

| US92328MAE30 / Venture Global Calcasieu Pass LLC | 5.16 | 1.61 | 1.5123 | 0.1110 | |||||

| US816851BR98 / Sempra Energy | 5.11 | 1.29 | 1.4965 | 0.1053 | |||||

| Willis Engine Structured Trust VIII / ABS-O (US97063RAA86) | 5.09 | 1.4924 | 1.4924 | ||||||

| Pluto 2 (GIP Sharon Finco) / DBT (N/A) | 5.09 | 1.4911 | 1.4911 | ||||||

| QTS Issuer ABS I LLC / ABS-O (US74690DAB73) | 5.08 | 1.4881 | 1.4881 | ||||||

| US958667AA50 / WESTERN MIDSTREAM OPERAT SR UNSECURED 02/50 5.25 | 5.05 | -1.31 | 1.4805 | 0.0681 | |||||

| AASET MT-1 Ltd / ABS-O (US00039NAB01) | 5.04 | 1.4761 | 1.4761 | ||||||

| SSI ABS-2025-1 Issuer LLC / ABS-O (US78475CAA36) | 5.02 | 1.4704 | 1.4704 | ||||||

| US44148JAC36 / Hotwire Funding LLC | 4.88 | 1.08 | 1.4298 | 0.0976 | |||||

| US92243JAA07 / VAULT DI ISSUER LLC VAULT 2021-1A A2 | 4.84 | 0.58 | 1.4177 | 0.0905 | |||||

| Enterprise Products Operating LLC / DBT (US29379VCH42) | 4.83 | -0.64 | 1.4151 | 0.0740 | |||||

| US12189LBK61 / Burlington Northern Santa Fe LLC | 4.74 | -0.57 | 1.3884 | 0.0738 | |||||

| US33939HAB50 / Flex Intermediate Holdco LLC | 4.54 | -0.07 | 1.3317 | 0.0766 | |||||

| Mosaic Solar Loan Trust 2025-1 / ABS-O (US61945HAA05) | 4.47 | -8.96 | 1.3104 | -0.0448 | |||||

| Purewest Abs Issuer LLC / ABS-CBDO (US74628AAA25) | 4.44 | -1.64 | 1.3012 | 0.0557 | |||||

| T-Mobile USA Inc / DBT (US87264ADG76) | 4.27 | -0.33 | 1.2512 | 0.0692 | |||||

| United States Treasury Note/Bond / DBT (US91282CKX82) | 4.08 | 0.64 | 1.1943 | 0.0769 | |||||

| Switch ABS Issuer LLC / ABS-O (US871044AC73) | 4.05 | 0.77 | 1.1865 | 0.0778 | |||||

| US92854VAA35 / Vivint Colar Financing V LLC | 3.91 | -1.96 | 1.1462 | 0.0453 | |||||

| US62947AAF03 / NP SPE X LP | 3.81 | -0.16 | 1.1157 | 0.0632 | |||||

| ALTDE 2025-1 Trust / ABS-O (US00166NAB55) | 3.68 | -3.69 | 1.0773 | 0.0240 | |||||

| US682680BN20 / ONEOK Inc | 3.64 | -0.66 | 1.0669 | 0.0555 | |||||

| Wireless PropCo Funding LLC / ABS-O (US97655EAG89) | 3.63 | 1.0639 | 1.0639 | ||||||

| LNG / Cheniere Energy, Inc. | 3.59 | 1.24 | 1.0510 | 0.0735 | |||||

| Cloud Capital Holdco LP / ABS-O (US102104AC05) | 3.52 | -0.45 | 1.0320 | 0.0557 | |||||

| Foundry JV Holdco LLC / DBT (US350930AK91) | 3.14 | 1.00 | 0.9209 | 0.0623 | |||||

| US75903HAA05 / Regional 2021-1 Ltd | 2.88 | -4.45 | 0.8428 | 0.0122 | |||||

| MGMXX / JPMorgan Trust II - JPMorgan U.S. Government Money Market Fund IM | 2.83 | 1,382.52 | 2.83 | 1,390.00 | 0.8296 | 0.7770 | |||

| US61747C7074 / Morgan Stanley Institutional Liquidity Funds Government Portfolio, Institutional Class | 2.83 | 1,382.52 | 2.83 | 1,390.00 | 0.8296 | 0.7770 | |||

| US31846V2117 / FIRST AM GOV OBLIG-U | 2.83 | 1,382.52 | 2.83 | 1,390.00 | 0.8296 | 0.7770 | |||

| US46651NAA28 / JOL Air Ltd., Series 2019-1, Class A | 2.71 | -2.97 | 0.7943 | 0.0235 | |||||

| US532522AA74 / LIMA METRO LINE 2 144A LIFE SR SEC SF 5.875% 07-05-34 | 2.62 | -1.58 | 0.7687 | 0.0332 | |||||

| FERMCA / Fermaca Enterprises S de RL de CV | 2.30 | -1.79 | 0.6743 | 0.0279 | |||||

| TLWND / GAIA Aviation Ltd | 2.29 | -2.51 | 0.6704 | 0.0229 | |||||

| US89656CAA18 / Trinity Rail Leasing 2010 LLC | 2.22 | -3.82 | 0.6493 | 0.0135 | |||||

| US382371AB83 / GoodLeap Sustainable Home Solutions Trust 2021-3 | 2.21 | -1.12 | 0.6487 | 0.0310 | |||||

| US19521UAC71 / Cologix Data Centers US Issuer LLC | 2.16 | 0.75 | 0.6337 | 0.0415 | |||||

| US25265LAC46 / DIAMOND INFRASTRUCTURE FUNDING DNFRA 2021 1A B 144A | 2.13 | 0.00 | 0.6237 | 0.0363 | |||||

| Foundry JV Holdco LLC / DBT (US350930AC75) | 2.11 | 1.25 | 0.6172 | 0.0430 | |||||

| US09606BAE48 / Blue Stream Issuer LLC | 2.07 | 0.19 | 0.6054 | 0.0364 | |||||

| US61946TAB17 / Mosaic Solar Loan Trust 2021-3 | 2.06 | -2.93 | 0.6028 | 0.0180 | |||||

| Compass Datacenters Issuer II LLC / ABS-O (US20469CAC91) | 2.05 | 0.6016 | 0.6016 | ||||||

| US23802WAE12 / DATABANK ISSUER 4.43% | 2.03 | 0.54 | 0.5962 | 0.0378 | |||||

| US350930AA10 / Foundry JV Holdco LLC | 2.03 | 1.40 | 0.5961 | 0.0424 | |||||

| US09228YAC66 / Blackbird Capital Aircraft Lease Securitization, Ltd. 2016-1 | 2.03 | -5.54 | 0.5946 | 0.0018 | |||||

| US90354PAA57 / USQ RAIL II LLC 2.21% | 2.03 | 0.15 | 0.5938 | 0.0356 | |||||

| US23284BAA26 / CyrusOne Data Centers Issuer I LLC | 1.95 | 0.31 | 0.5725 | 0.0349 | |||||

| 8DCB / Emirates Semb Corp Water & Power Co PJSC | 1.88 | 0.91 | 0.5513 | 0.0366 | |||||

| CONGLO / Energia Eolica SA | 1.86 | -0.64 | 0.5452 | 0.0285 | |||||

| US44040HAA05 / Horizon Aircraft Finance II Ltd | 1.53 | -26.07 | 0.4490 | -0.1226 | |||||

| CyrusOne Data Centers Issuer I LLC / ABS-O (US23284BAH78) | 1.43 | 0.49 | 0.4194 | 0.0262 | |||||

| US61945LAB99 / Mosaic Solar Loan Trust 2019-2 | 1.43 | -3.84 | 0.4187 | 0.0087 | |||||

| US61946QAB77 / Mosaic Solar Loan Trust, Series 2022-1A, Class B | 1.40 | -5.93 | 0.4090 | -0.0003 | |||||

| US23284BAC81 / CyrusOne Data Centers Issuer I | 1.29 | -2.36 | 0.3767 | 0.0136 | |||||

| USP39198AA76 / Fermaca Enterprises S. de R.L. de C.V. | 1.25 | -1.73 | 0.3673 | 0.0152 | |||||

| US61946FAA30 / MOSAIC SOLAR LOAN TRUST 2018-1 MSAIC 2018-1A A | 1.13 | -2.66 | 0.3324 | 0.0108 | |||||

| US86745JAA51 / Sunnova Helios II Issuer LLC, Series 2018-1A, Class A | 1.11 | 0.63 | 0.3255 | 0.0209 | |||||

| US94353WAA36 / WAVE 2017-1 Trust | 1.08 | -16.54 | 0.3166 | -0.0408 | |||||

| US886065AB76 / Thunderbolt II Aircraft Lease Ltd | 1.01 | -56.45 | 0.2962 | -0.3439 | |||||

| US62946AAC80 / NP SPE II LLC | 0.99 | 0.10 | 0.2887 | 0.0171 | |||||

| US86746CAA99 / SNVA 2020 AA A 144A | 0.82 | -4.08 | 0.2415 | 0.0045 | |||||

| US86744TAB26 / Helios Issuer LLC, Series 2021-B, Class B | 0.80 | -8.72 | 0.2335 | -0.0072 | |||||

| US49255PAA12 / Kestrel Aircraft Funding Ltd | 0.77 | -8.58 | 0.2250 | -0.0066 | |||||

| US40417QAC96 / HERO Funding Trust, Series 2016-4A, Class A2 | 0.67 | 0.45 | 0.1966 | 0.0121 | |||||

| US886065AA93 / THUNDERBOLT AIRCRAFT LEASE 2018-A A 4.147% 07/15/2038 144A | 0.63 | -16.49 | 0.1855 | -0.0238 | |||||

| US85572RAA77 / Start Ltd/Bermuda | 0.62 | -3.75 | 0.1806 | 0.0039 | |||||

| US30605YAB74 / Falcon Aerospace Ltd. | 0.52 | -18.41 | 0.1534 | -0.0237 | |||||

| US42770XAC11 / HERO Funding Trust | 0.27 | -0.37 | 0.0790 | 0.0045 | |||||

| USP52715AB80 / Interoceanica IV Finance Ltd | 0.21 | -49.40 | 0.0623 | -0.0535 | |||||

| USG54897AA45 / Lima Metro Line 2 Finance Ltd | 0.14 | -1.40 | 0.0414 | 0.0018 | |||||

| INTERF / INTEROCEANICA IV FINANCE SR SECURED 144A 11/25 0.00000 | 0.09 | -49.45 | 0.0271 | -0.0233 | |||||

| US82321UAA16 / Shenton Aircraft Investment I Ltd | 0.09 | -3.33 | 0.0256 | 0.0006 | |||||

| US62946AAA25 / NP SPE II LLC | 0.03 | -18.18 | 0.0082 | -0.0011 | |||||

| US42770UAA16 / HERO Funding Trust, Series 2015-2A, Class A | 0.01 | 0.00 | 0.0027 | 0.0002 |