Mga Batayang Estadistika

| Nilai Portofolio | $ 4,948,919,716 |

| Posisi Saat Ini | 667 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

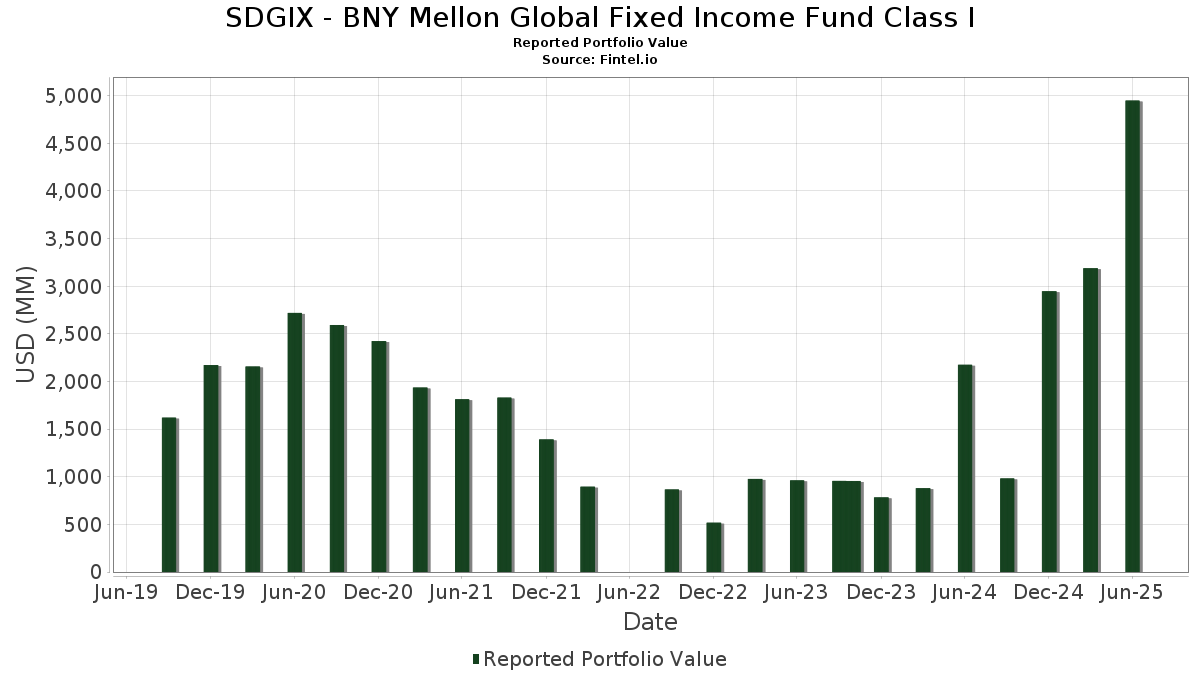

SDGIX - BNY Mellon Global Fixed Income Fund Class I telah mengungkapkan total kepemilikan 667 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 4,948,919,716 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama SDGIX - BNY Mellon Global Fixed Income Fund Class I adalah United States Treasury Note/Bond (US:US91282CGQ87) , United Kingdom Gilt (GB:GB00BM8Z2V59) , BTPS (IT:IT0005518128) , New Zealand Government Bond (NZ:NZGOVDT534C4) , and United States Treasury Note/Bond (US:US91282CHZ77) . Posisi baru SDGIX - BNY Mellon Global Fixed Income Fund Class I meliputi: United States Treasury Note/Bond (US:US91282CGQ87) , United Kingdom Gilt (GB:GB00BM8Z2V59) , BTPS (IT:IT0005518128) , New Zealand Government Bond (NZ:NZGOVDT534C4) , and United States Treasury Note/Bond (US:US91282CHZ77) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 169.29 | 5.0086 | 3.0052 | ||

| 100.24 | 2.9657 | 2.9657 | ||

| 100.24 | 2.9657 | 2.9657 | ||

| 68.24 | 2.0189 | 2.0189 | ||

| 61.76 | 1.8271 | 1.8271 | ||

| 61.76 | 1.8271 | 1.8271 | ||

| 50.98 | 1.5083 | 1.5083 | ||

| 50.98 | 1.5083 | 1.5083 | ||

| 50.66 | 1.4987 | 1.4987 | ||

| 50.66 | 1.4987 | 1.4987 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 44.99 | 1.3309 | -4.3565 | ||

| 44.99 | 1.3309 | -4.3565 | ||

| 52.35 | 1.5489 | -2.6086 | ||

| 52.35 | 1.5489 | -2.6086 | ||

| 0.98 | 0.0289 | -2.0109 | ||

| -27.76 | -0.8214 | -0.8214 | ||

| -27.76 | -0.8214 | -0.8214 | ||

| -16.17 | -0.4783 | -0.4783 | ||

| -16.17 | -0.4783 | -0.4783 | ||

| 155.06 | 4.5876 | -0.3962 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-26 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US91282CGQ87 / United States Treasury Note/Bond | 169.29 | 168.07 | 5.0086 | 3.0052 | |||||

| United States Treasury Note/Bond / DBT (US91282CMD01) | 155.06 | -1.30 | 4.5876 | -0.3962 | |||||

| United States Treasury Note/Bond / DBT (US91282CMD01) | 155.06 | -1.30 | 4.5876 | -0.3962 | |||||

| United States Treasury Note/Bond / DBT (US91282CNE74) | 100.24 | 2.9657 | 2.9657 | ||||||

| United States Treasury Note/Bond / DBT (US91282CNE74) | 100.24 | 2.9657 | 2.9657 | ||||||

| GB00BM8Z2V59 / United Kingdom Gilt | 70.92 | 6.21 | 2.0981 | -0.0200 | |||||

| China Government Bond / DBT (CND10008WR28) | 68.24 | 2.0189 | 2.0189 | ||||||

| IT0005518128 / BTPS | 65.90 | 11.53 | 1.9496 | 0.0752 | |||||

| United States Treasury Note/Bond / DBT (US91282CMU26) | 61.76 | 1.8271 | 1.8271 | ||||||

| United States Treasury Note/Bond / DBT (US91282CMU26) | 61.76 | 1.8271 | 1.8271 | ||||||

| United States Treasury Note/Bond / DBT (US91282CLJ89) | 59.45 | 0.84 | 1.7590 | -0.1114 | |||||

| United States Treasury Note/Bond / DBT (US91282CLJ89) | 59.45 | 0.84 | 1.7590 | -0.1114 | |||||

| NZGOVDT534C4 / New Zealand Government Bond | 57.43 | 7.80 | 1.6990 | 0.0090 | |||||

| US91282CHZ77 / United States Treasury Note/Bond | 56.30 | 0.66 | 1.6657 | -0.1087 | |||||

| 5831 / Shizuoka Financial Group,Inc. | 56.15 | -2.82 | 1.6611 | -0.1717 | |||||

| 5831 / Shizuoka Financial Group,Inc. | 56.15 | -2.82 | 1.6611 | -0.1717 | |||||

| 5831 / Shizuoka Financial Group,Inc. | 55.88 | -5.80 | 1.6533 | -0.2287 | |||||

| 5831 / Shizuoka Financial Group,Inc. | 55.88 | -5.80 | 1.6533 | -0.2287 | |||||

| BRSTNCNTF212 / Brazil Notas do Tesouro Nacional Serie F | 53.56 | 13.71 | 1.5846 | 0.0903 | |||||

| United States Treasury Note/Bond / DBT (US91282CMP31) | 52.35 | -60.05 | 1.5489 | -2.6086 | |||||

| United States Treasury Note/Bond / DBT (US91282CMP31) | 52.35 | -60.05 | 1.5489 | -2.6086 | |||||

| United States Treasury Note/Bond / DBT (US91282CMM00) | 50.98 | 1.5083 | 1.5083 | ||||||

| United States Treasury Note/Bond / DBT (US91282CMM00) | 50.98 | 1.5083 | 1.5083 | ||||||

| Italy Buoni Poliennali Del Tesoro / DBT (IT0005611741) | 50.66 | 1.4987 | 1.4987 | ||||||

| Italy Buoni Poliennali Del Tesoro / DBT (IT0005611741) | 50.66 | 1.4987 | 1.4987 | ||||||

| United States Treasury Note/Bond / DBT (US91282CJZ59) | 46.69 | 0.33 | 1.3814 | -0.0949 | |||||

| United States Treasury Note/Bond / DBT (US91282CJZ59) | 46.69 | 0.33 | 1.3814 | -0.0949 | |||||

| China Government Bond / DBT (CND10008RFM0) | 46.32 | 1.3705 | 1.3705 | ||||||

| China Government Bond / DBT (CND10008RFM0) | 46.32 | 1.3705 | 1.3705 | ||||||

| United States Treasury Note/Bond / DBT (US91282CLW90) | 44.99 | -74.91 | 1.3309 | -4.3565 | |||||

| United States Treasury Note/Bond / DBT (US91282CLW90) | 44.99 | -74.91 | 1.3309 | -4.3565 | |||||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 39.89 | 14.32 | 1.1803 | 0.0732 | |||||

| BRSTNCNTF1P8 / Brazil Notas do Tesouro Nacional Serie F | 39.89 | 14.32 | 1.1803 | 0.0732 | |||||

| United States Treasury Note/Bond / DBT (US912810UJ50) | 38.21 | 1.1304 | 1.1304 | ||||||

| United States Treasury Note/Bond / DBT (US912810UJ50) | 38.21 | 1.1304 | 1.1304 | ||||||

| DREYFUS INSTITUTIONAL PREFERRED GOVERNMENT PLUS MONEY MARKET FUND / STIV (000000000) | 36.93 | 36.93 | 1.0925 | 1.0925 | |||||

| DREYFUS INSTITUTIONAL PREFERRED GOVERNMENT PLUS MONEY MARKET FUND / STIV (000000000) | 36.93 | 36.93 | 1.0925 | 1.0925 | |||||

| NZGOVDT433C9 / New Zealand Government Bond | 33.50 | 8.13 | 0.9913 | 0.0083 | |||||

| GB00BMV7TC88 / United Kingdom Gilt | 32.74 | 6.39 | 0.9686 | -0.0077 | |||||

| GB00BMV7TC88 / United Kingdom Gilt | 32.74 | 6.39 | 0.9686 | -0.0077 | |||||

| NZGOVDT532C8 / NEW ZEALAND GVT | 31.89 | 8.61 | 0.9433 | 0.0120 | |||||

| ES0000012K20 / SPAIN GOVT EUR 144A LIFE/REG S 0.7% 04-30-32 | 28.51 | 10.94 | 0.8436 | 0.0282 | |||||

| US3140XKTX85 / FN FS4165 | 27.87 | -2.28 | 0.8246 | -0.0802 | |||||

| GB00BMV7TC88 / United Kingdom Gilt | 27.61 | 8.28 | 0.8168 | 0.0080 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 27.58 | -2.65 | 0.8160 | -0.0828 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 27.58 | -2.65 | 0.8160 | -0.0828 | |||||

| AU3SG0002710 / TREASURY CORP OF VICTORIA | 26.53 | 7.97 | 0.7848 | 0.0054 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 25.15 | -1.77 | 0.7440 | -0.0681 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 25.15 | -1.77 | 0.7440 | -0.0681 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 24.64 | -2.36 | 0.7291 | -0.0716 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 24.64 | -2.36 | 0.7291 | -0.0716 | |||||

| COL17CT03862 / Colombia TES | 24.51 | 1.51 | 0.7252 | -0.0408 | |||||

| US3133KQVG80 / Freddie Mac | 23.76 | -1.83 | 0.7030 | -0.0648 | |||||

| DREYFUS INSTITUTIONAL PREFERRED GOVERNMENT PLUS MONEY MARKET FUND / STIV (000000000) | 23.43 | 23.43 | 0.6932 | 0.6932 | |||||

| DREYFUS INSTITUTIONAL PREFERRED GOVERNMENT PLUS MONEY MARKET FUND / STIV (000000000) | 23.43 | 23.43 | 0.6932 | 0.6932 | |||||

| GB00BMV7TC88 / United Kingdom Gilt | 21.28 | 7.86 | 0.6296 | 0.0037 | |||||

| GB00BMV7TC88 / United Kingdom Gilt | 21.28 | 7.86 | 0.6296 | 0.0037 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 20.80 | -1.12 | 0.6153 | -0.0519 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 20.80 | -1.12 | 0.6153 | -0.0519 | |||||

| ADANIENSOL / Adani Energy Solutions Limited | 20.29 | 45.83 | 0.6004 | 0.1589 | |||||

| ADANIENSOL / Adani Energy Solutions Limited | 20.29 | 45.83 | 0.6004 | 0.1589 | |||||

| United States Treasury Note/Bond / DBT (US91282CKC46) | 19.68 | 0.76 | 0.5821 | -0.0373 | |||||

| United States Treasury Note/Bond / DBT (US91282CKC46) | 19.68 | 0.76 | 0.5821 | -0.0373 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 18.91 | -2.78 | 0.5595 | -0.0576 | |||||

| CH0344958688 / Swiss Confederation Government Bond | 18.55 | 12.79 | 0.5487 | 0.0271 | |||||

| GB00BMF9LG83 / UK TSY GILT | 18.54 | 7.24 | 0.5484 | 0.0001 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 18.10 | -2.90 | 0.5354 | -0.0558 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 18.10 | -2.90 | 0.5354 | -0.0558 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 17.67 | -0.71 | 0.5228 | -0.0418 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 17.67 | -0.71 | 0.5228 | -0.0418 | |||||

| US3140QMT536 / FNCL UMBS 2.5 CB2371 12-01-51 | 16.59 | -2.67 | 0.4909 | -0.0499 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 16.38 | -0.01 | 0.4847 | -0.0351 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 16.38 | -0.01 | 0.4847 | -0.0351 | |||||

| GB00BMV7TC88 / United Kingdom Gilt | 16.08 | 7.65 | 0.4756 | 0.0018 | |||||

| GB00BMV7TC88 / United Kingdom Gilt | 16.08 | 7.65 | 0.4756 | 0.0018 | |||||

| KR103502GCC8 / Korea Treasury Bond | 15.92 | 8.36 | 0.4711 | 0.0049 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 15.83 | -2.31 | 0.4682 | -0.0457 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 15.83 | -2.31 | 0.4682 | -0.0457 | |||||

| Duke Energy Carolinas LLC / DBT (US26442CBM55) | 15.70 | 1.20 | 0.4645 | -0.0277 | |||||

| Duke Energy Carolinas LLC / DBT (US26442CBM55) | 15.70 | 1.20 | 0.4645 | -0.0277 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 15.50 | -3.10 | 0.4587 | -0.0489 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 15.50 | -3.10 | 0.4587 | -0.0489 | |||||

| NL0015031501 / Netherlands Government Bond | 15.39 | 10.41 | 0.4554 | 0.0131 | |||||

| NL0015031501 / Netherlands Government Bond | 15.39 | 10.41 | 0.4554 | 0.0131 | |||||

| AU000XCLWAG2 / Australia Government Bond | 15.32 | 7.50 | 0.4532 | 0.0012 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 14.59 | -1.62 | 0.4318 | -0.0388 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 14.59 | -1.62 | 0.4318 | -0.0388 | |||||

| OF20 / French Republic Government Bond OAT | 14.45 | 10.37 | 0.4276 | 0.0122 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 14.33 | -2.39 | 0.4240 | -0.0418 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 14.33 | -2.39 | 0.4240 | -0.0418 | |||||

| US3140QQQY49 / Fannie Mae Pool | 13.99 | -2.07 | 0.4139 | -0.0393 | |||||

| United States Treasury Note/Bond / DBT (US912810UG12) | 13.90 | 0.4112 | 0.4112 | ||||||

| United States Treasury Note/Bond / DBT (US912810UG12) | 13.90 | 0.4112 | 0.4112 | ||||||

| US3132DVLF03 / FHLG 30YR 2.5% 10/01/2050#SD7526 | 13.63 | -2.71 | 0.4031 | -0.0412 | |||||

| US31418EF214 / Fannie Mae Pool | 13.51 | -2.59 | 0.3996 | -0.0403 | |||||

| I1CE34 / Intercontinental Exchange, Inc. - Depositary Receipt (Common Stock) | 13.16 | 0.3895 | 0.3895 | ||||||

| I1CE34 / Intercontinental Exchange, Inc. - Depositary Receipt (Common Stock) | 13.16 | 0.3895 | 0.3895 | ||||||

| CA135087Q491 / CANADIAN GOVERNMENT 3.250000% 09/01/2028 | 13.14 | 4.94 | 0.3886 | -0.0085 | |||||

| EU000A3KM903 / EUROPEAN UNION SR UNSECURED REGS 06/36 0.2 | 12.56 | 11.51 | 0.3715 | 0.0143 | |||||

| XS2550206333 / Northumbrian Water Finance PLC | 12.34 | 8.26 | 0.3650 | 0.0035 | |||||

| AT0000A2QRW0 / REP OF AUSTRIA | 11.66 | 10.26 | 0.3450 | 0.0095 | |||||

| AT0000A2QRW0 / REP OF AUSTRIA | 11.66 | 10.26 | 0.3450 | 0.0095 | |||||

| ABN / ABN AMRO Bank N.V. - Depositary Receipt (Common Stock) | 11.42 | 1.57 | 0.3378 | -0.0188 | |||||

| ABN / ABN AMRO Bank N.V. - Depositary Receipt (Common Stock) | 11.42 | 1.57 | 0.3378 | -0.0188 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 11.31 | -2.33 | 0.3347 | -0.0328 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 11.31 | -2.33 | 0.3347 | -0.0328 | |||||

| FR001400KHW7 / Kering SA | 11.24 | 35.34 | 0.3324 | 0.0466 | |||||

| Amprion GmbH / DBT (DE000A383BP6) | 11.21 | 132.66 | 0.3315 | 0.1787 | |||||

| Amprion GmbH / DBT (DE000A383BP6) | 11.21 | 132.66 | 0.3315 | 0.1787 | |||||

| CA135087M680 / Canadian Government Bond | 10.99 | -1.42 | 0.3250 | -0.0285 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 10.88 | -2.26 | 0.3219 | -0.0312 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 10.88 | -2.26 | 0.3219 | -0.0312 | |||||

| AU3SG0002082 / New South Wales Treasury Corp | 10.83 | 8.31 | 0.3204 | 0.0032 | |||||

| MYBMT1800039 / Malaysia Government Bond | 10.59 | 7.09 | 0.3134 | -0.0004 | |||||

| XS2264968665 / Ivory Coast Government International Bond | 10.58 | 11.45 | 0.3130 | 0.0119 | |||||

| XS2264968665 / Ivory Coast Government International Bond | 10.58 | 11.45 | 0.3130 | 0.0119 | |||||

| XS1772374770 / Deutsche Bahn Finance GMBH | 10.56 | 9.55 | 0.3125 | 0.0066 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 10.55 | -2.33 | 0.3121 | -0.0305 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 10.55 | -2.33 | 0.3121 | -0.0305 | |||||

| Canadian Government Bond / DBT (CA135087S216) | 9.69 | 3.27 | 0.2868 | -0.0110 | |||||

| Canadian Government Bond / DBT (CA135087S216) | 9.69 | 3.27 | 0.2868 | -0.0110 | |||||

| MX0MGO0001D6 / Mexican Bonos Desarr Fixed Rate, Series M | 9.28 | 41.04 | 0.2745 | 0.0228 | |||||

| XS2484327999 / DEUTSCHE BAHN FIN GMBH /EUR/ REGD REG S EMTN 1.87500000 | 9.22 | 10.87 | 0.2727 | 0.0090 | |||||

| Sequoia Logistics 2025-1 DAC / ABS-MBS (XS2967783031) | 9.19 | 8.63 | 0.2720 | 0.0035 | |||||

| US 5YR NOTE (CBT) / DIR (000000000) | 9.11 | 0.2696 | 0.2696 | ||||||

| US 5YR NOTE (CBT) / DIR (000000000) | 9.11 | 0.2696 | 0.2696 | ||||||

| Aareal Bank AG / DBT (DE000AAR0439) | 9.06 | 9.38 | 0.2680 | 0.0053 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 8.92 | -2.14 | 0.2639 | -0.0252 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 8.92 | -2.14 | 0.2639 | -0.0252 | |||||

| Athora Holding Ltd / DBT (XS2831758474) | 8.80 | 0.2604 | 0.2604 | ||||||

| Athora Holding Ltd / DBT (XS2831758474) | 8.80 | 0.2604 | 0.2604 | ||||||

| XS2643673952 / NASDAQ INC EUR SR UNSEC 4.5% 02-15-32 | 8.78 | 9.99 | 0.2599 | 0.0065 | |||||

| AMI / Aurelia Metals Limited | 8.78 | 9.90 | 0.2599 | 0.0063 | |||||

| Ford Auto Securitization Trust II Series 2022-A Asset-Backed Notes / ABS-O (CA345214AE07) | 8.56 | 5.12 | 0.2532 | -0.0051 | |||||

| Ford Auto Securitization Trust II Series 2022-A Asset-Backed Notes / ABS-O (CA345214AE07) | 8.56 | 5.12 | 0.2532 | -0.0051 | |||||

| EU000A3K4DY4 / European Union | 8.50 | 9.96 | 0.2516 | 0.0062 | |||||

| KR103502G8C0 / KOREA TREASURY BOND BONDS 12/28 2.375 | 8.37 | 9.55 | 0.2477 | 0.0053 | |||||

| US61747YFE05 / Morgan Stanley | 8.34 | 0.2469 | 0.2469 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 8.28 | 0.2449 | 0.2449 | ||||||

| W1MB34 / The Williams Companies, Inc. - Depositary Receipt (Common Stock) | 8.09 | -9.19 | 0.2393 | -0.0433 | |||||

| W1MB34 / The Williams Companies, Inc. - Depositary Receipt (Common Stock) | 8.09 | -9.19 | 0.2393 | -0.0433 | |||||

| Octagon 61 Ltd / ABS-CBDO (US675947AL91) | 7.93 | 0.2346 | 0.2346 | ||||||

| Octagon 61 Ltd / ABS-CBDO (US675947AL91) | 7.93 | 0.2346 | 0.2346 | ||||||

| GOOGL / Alphabet Inc. - Depositary Receipt (Common Stock) | 7.92 | 0.2344 | 0.2344 | ||||||

| CA68333ZBA45 / Province of Ontario Canada | 7.90 | 1.66 | 0.2337 | -0.0128 | |||||

| RLGH Finance Bermuda Ltd / DBT (XS2845154124) | 7.82 | -0.09 | 0.2314 | -0.0169 | |||||

| RLGH Finance Bermuda Ltd / DBT (XS2845154124) | 7.82 | -0.09 | 0.2314 | -0.0169 | |||||

| JT International Financial Services BV / DBT (XS3040320908) | 7.64 | 0.2259 | 0.2259 | ||||||

| JT International Financial Services BV / DBT (XS3040320908) | 7.64 | 0.2259 | 0.2259 | ||||||

| XS2106054443 / AA BOND CO LTD SR SECURED REGS 07/50 5.5 | 7.45 | 6.82 | 0.2205 | -0.0008 | |||||

| TotalEnergies Capital International SA / DBT (XS3015113882) | 7.37 | 0.2182 | 0.2182 | ||||||

| TotalEnergies Capital International SA / DBT (XS3015113882) | 7.37 | 0.2182 | 0.2182 | ||||||

| Rentokil Terminix Funding LLC / DBT (US760130AA26) | 7.30 | 0.2161 | 0.2161 | ||||||

| Rentokil Terminix Funding LLC / DBT (US760130AA26) | 7.30 | 0.2161 | 0.2161 | ||||||

| US89612LAA44 / Tricon American Homes Trust, Series 2019-SFR1, Class A | 7.30 | 0.12 | 0.2158 | -0.0153 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 7.29 | -2.97 | 0.2156 | -0.0226 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 7.29 | -2.97 | 0.2156 | -0.0226 | |||||

| TIF Funding III LLC / ABS-O (US88655AAA88) | 7.27 | -1.20 | 0.2152 | -0.0183 | |||||

| TIF Funding III LLC / ABS-O (US88655AAA88) | 7.27 | -1.20 | 0.2152 | -0.0183 | |||||

| BE0000358672 / BELGIUM KINGDOM EUR 144A LIFE/REG S 3.3% 06-22-54 | 7.16 | 9.41 | 0.2118 | 0.0043 | |||||

| IDG000014101 / Indonesia Treasury Bond | 7.11 | 4.88 | 0.2105 | -0.0047 | |||||

| US92890HAD44 / WEA Finance LLC / Westfield UK & Europe Finance PLC | 7.05 | -1.41 | 0.2087 | -0.0183 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 6.87 | -51.60 | 0.2034 | -0.2472 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 6.87 | -1.28 | 0.2032 | -0.0175 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 6.87 | -1.28 | 0.2032 | -0.0175 | |||||

| KR103502GC99 / Korea Treasury Bond | 6.84 | 76.50 | 0.2024 | 0.0794 | |||||

| G1MI34 / General Mills, Inc. - Depositary Receipt (Common Stock) | 6.77 | 0.2003 | 0.2003 | ||||||

| G1MI34 / General Mills, Inc. - Depositary Receipt (Common Stock) | 6.77 | 0.2003 | 0.2003 | ||||||

| US78403DAP50 / SBA Tower Trust | 6.75 | 0.84 | 0.1997 | -0.0126 | |||||

| MUFG / Mitsubishi UFJ Financial Group, Inc. - Depositary Receipt (Common Stock) | 6.65 | 0.1966 | 0.1966 | ||||||

| GOOGL / Alphabet Inc. - Depositary Receipt (Common Stock) | 6.64 | 0.1965 | 0.1965 | ||||||

| GOOGL / Alphabet Inc. - Depositary Receipt (Common Stock) | 6.64 | 0.1965 | 0.1965 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 6.62 | -2.07 | 0.1959 | -0.0186 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 6.62 | -2.07 | 0.1959 | -0.0186 | |||||

| BNP / BNP Paribas SA | 6.57 | 0.1943 | 0.1943 | ||||||

| BNP / BNP Paribas SA | 6.57 | 0.1943 | 0.1943 | ||||||

| 4020 / Saudi Real Estate Company | 6.51 | 1.48 | 0.1927 | -0.0109 | |||||

| 4020 / Saudi Real Estate Company | 6.51 | 1.48 | 0.1927 | -0.0109 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 6.44 | -3.33 | 0.1905 | -0.0208 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 6.44 | -3.33 | 0.1905 | -0.0208 | |||||

| US31418ED805 / Fannie Mae Pool | 6.40 | -2.65 | 0.1894 | -0.0192 | |||||

| KR103502GD31 / Korea Treasury Bond | 6.33 | 6.18 | 0.1872 | -0.0018 | |||||

| Experian Finance PLC / DBT (XS2896485930) | 6.29 | 0.1862 | 0.1862 | ||||||

| Experian Finance PLC / DBT (XS2896485930) | 6.29 | 0.1862 | 0.1862 | ||||||

| AU3SG0002728 / NEW SOUTH WALES TREASURY CORP | 6.28 | 7.84 | 0.1859 | 0.0011 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 6.25 | 1.12 | 0.1848 | -0.0112 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 6.25 | 1.12 | 0.1848 | -0.0112 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 6.19 | 96.10 | 0.1831 | 0.0830 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 6.19 | 96.10 | 0.1831 | 0.0830 | |||||

| JP1201841P46 / JAPAN (20 YEAR ISSUE) /JPY/ REGD SER 184 1.10000000 | 6.19 | 2.55 | 0.1830 | -0.0083 | |||||

| AU3CB0296580 / Queensland Treasury Corp | 6.17 | 7.55 | 0.1824 | 0.0005 | |||||

| XS2189786226 / RAIFFEISEN BANK INTERNATIONAL AG 2.875000% 06/18/2032 | 6.15 | 9.65 | 0.1819 | 0.0040 | |||||

| XS2102380776 / DEUTSCH BAHN FIN | 6.15 | 11.00 | 0.1819 | 0.0062 | |||||

| XS2102380776 / DEUTSCH BAHN FIN | 6.15 | 11.00 | 0.1819 | 0.0062 | |||||

| 4020 / Saudi Real Estate Company | 6.08 | 10.04 | 0.1800 | 0.0046 | |||||

| US23284BAE48 / CyrusOne Data Centers Issuer I | 6.07 | 1.23 | 0.1796 | -0.0106 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 5.94 | 0.1757 | 0.1757 | ||||||

| XS1960589155 / HEATHROW FNDG | 5.91 | 0.1748 | 0.1748 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 5.88 | -2.26 | 0.1740 | -0.0169 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 5.88 | -2.26 | 0.1740 | -0.0169 | |||||

| US716973AG71 / Pfizer Investment Enterprises Pte Ltd | 5.78 | -0.58 | 0.1711 | -0.0134 | |||||

| Regatta XXV Funding Ltd / ABS-CBDO (US758978AL48) | 5.78 | 0.1710 | 0.1710 | ||||||

| Regatta XXV Funding Ltd / ABS-CBDO (US758978AL48) | 5.78 | 0.1710 | 0.1710 | ||||||

| US758978AA82 / Regatta XXV Funding Ltd., Series 2023-1A, Class A | 5.78 | -0.07 | 0.1709 | -0.0125 | |||||

| US87267CAA62 / TRP 2021 LLC | 5.76 | -1.25 | 0.1704 | -0.0146 | |||||

| US92212KAE64 / Vantage Data Centers Issuer LLC | 5.74 | -0.71 | 0.1699 | -0.0136 | |||||

| JP1400151N57 / JAPAN (40 YEAR ISSUE) /JPY/ REGD SER 15 1.00000000 | 5.72 | -6.45 | 0.1691 | -0.0247 | |||||

| US3140QPCQ87 / UMBS | 5.69 | -3.46 | 0.1683 | -0.0186 | |||||

| US89683LAA89 / TRP 2021 LLC | 5.67 | -0.56 | 0.1676 | -0.0131 | |||||

| US95000U3H45 / Wells Fargo & Co | 5.66 | 0.1676 | 0.1676 | ||||||

| TD.PFA / The Toronto-Dominion Bank - Preferred Security | 5.62 | 0.1662 | 0.1662 | ||||||

| TD.PFA / The Toronto-Dominion Bank - Preferred Security | 5.62 | 0.1662 | 0.1662 | ||||||

| US46091RAA14 / ASSET BACKED SECURITY | 5.60 | -0.23 | 0.1657 | -0.0124 | |||||

| US76134KAA25 / Retained Vantage Data Centers Issuer LLC | 5.59 | -0.05 | 0.1654 | -0.0121 | |||||

| IRS IFS GBP / DIR (000000000) | 5.56 | 0.1644 | 0.1644 | ||||||

| IRS IFS GBP / DIR (000000000) | 5.56 | 0.1644 | 0.1644 | ||||||

| US78403DAX84 / SBA Tower Trust | 5.54 | 3.17 | 0.1638 | -0.0065 | |||||

| BALLYROCK CLO 24 LTD / ABS-CBDO (US05875AAJ79) | 5.42 | 0.1605 | 0.1605 | ||||||

| BALLYROCK CLO 24 LTD / ABS-CBDO (US05875AAJ79) | 5.42 | 0.1605 | 0.1605 | ||||||

| Ballyrock CLO 24 Ltd / ABS-CBDO (US05875AAA60) | 5.42 | -0.07 | 0.1604 | -0.0117 | |||||

| Ballyrock CLO 24 Ltd / ABS-CBDO (US05875AAA60) | 5.42 | -0.07 | 0.1604 | -0.0117 | |||||

| US92928QAH11 / WEA Finance LLC | 5.36 | 0.69 | 0.1587 | -0.0103 | |||||

| China Government Bond / DBT (CND1000716X4) | 5.31 | 5.13 | 0.1572 | -0.0031 | |||||

| E / Eni S.p.A. - Depositary Receipt (Common Stock) | 5.29 | -44.09 | 0.1564 | -0.1436 | |||||

| E / Eni S.p.A. - Depositary Receipt (Common Stock) | 5.29 | -44.09 | 0.1564 | -0.1436 | |||||

| US3140QEYX44 / Fannie Mae Pool | 5.22 | -3.33 | 0.1545 | -0.0169 | |||||

| US25755TAN00 / Domino's Pizza Master Issuer LLC | 5.11 | 1.05 | 0.1513 | -0.0092 | |||||

| AU0000079402 / Queensland Treasury Corp | 5.10 | 8.29 | 0.1508 | 0.0015 | |||||

| SE0014555991 / Sweden Treasury Bill | 5.08 | 10.19 | 0.1504 | 0.0040 | |||||

| XS2676395408 / Sartorius Finance BV | 5.04 | 75.38 | 0.1492 | 0.0580 | |||||

| US84574TP340 / SOUTHWESTERN PUBLIC SERVICE CO. | 5.02 | 0.1484 | 0.1484 | ||||||

| US84574TP340 / SOUTHWESTERN PUBLIC SERVICE CO. | 5.02 | 0.1484 | 0.1484 | ||||||

| AU3CB0284172 / Queensland Treasury Corp | 5.02 | 8.36 | 0.1484 | 0.0015 | |||||

| COLT 2023-4 Mortgage Loan Trust / ABS-MBS (US12598WAA09) | 5.02 | -8.95 | 0.1484 | -0.0264 | |||||

| COLT 2023-4 Mortgage Loan Trust / ABS-MBS (US12598WAA09) | 5.02 | -8.95 | 0.1484 | -0.0264 | |||||

| US3132DVMB89 / FNCL UMBS 2.5 SD7554 04-01-52 | 5.01 | -2.78 | 0.1482 | -0.0152 | |||||

| MUFG / Mitsubishi UFJ Financial Group, Inc. - Depositary Receipt (Common Stock) | 4.97 | 0.1470 | 0.1470 | ||||||

| MUFG / Mitsubishi UFJ Financial Group, Inc. - Depositary Receipt (Common Stock) | 4.97 | 0.1470 | 0.1470 | ||||||

| XS2451376219 / Deutsche Bahn Finance GMBH | 4.94 | 10.30 | 0.1460 | 0.0041 | |||||

| C1RR34 / Carrier Global Corporation - Depositary Receipt (Common Stock) | 4.88 | -39.30 | 0.1444 | -0.1107 | |||||

| C1RR34 / Carrier Global Corporation - Depositary Receipt (Common Stock) | 4.88 | -39.30 | 0.1444 | -0.1107 | |||||

| Ginnie Mae II Pool / ABS-MBS (US3622AAQ728) | 4.87 | -3.45 | 0.1442 | -0.0159 | |||||

| Ginnie Mae II Pool / ABS-MBS (US3622AAQ728) | 4.87 | -3.45 | 0.1442 | -0.0159 | |||||

| SAN / Banco Santander, S.A. - Depositary Receipt (Common Stock) | 4.86 | 0.1437 | 0.1437 | ||||||

| SAN / Banco Santander, S.A. - Depositary Receipt (Common Stock) | 4.86 | 0.1437 | 0.1437 | ||||||

| SG3261987691 / Singapore Government Bond | 4.80 | 8.94 | 0.1420 | 0.0022 | |||||

| XS2331271242 / Deutsche Bahn Finance GMBH | 4.76 | 73.71 | 0.1409 | 0.0539 | |||||

| XS2432293756 / Enel Finance International NV | 4.72 | 11.53 | 0.1396 | 0.0054 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 4.69 | -0.51 | 0.1388 | -0.0108 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 4.69 | -0.51 | 0.1388 | -0.0108 | |||||

| P3 Group Sarl / DBT (XS2901491261) | 4.69 | 73.46 | 0.1387 | 0.0530 | |||||

| P3 Group Sarl / DBT (XS2901491261) | 4.69 | 73.46 | 0.1387 | 0.0530 | |||||

| RI / Pernod Ricard SA | 4.68 | 0.1384 | 0.1384 | ||||||

| RI / Pernod Ricard SA | 4.68 | 0.1384 | 0.1384 | ||||||

| XS2434702853 / AUTOSTRADE PER LITALIA SPA 2.25% 01/25/2032 REGS | 4.65 | -32.61 | 0.1376 | -0.0813 | |||||

| XS2434702853 / AUTOSTRADE PER LITALIA SPA 2.25% 01/25/2032 REGS | 4.65 | -32.61 | 0.1376 | -0.0813 | |||||

| E / Eni S.p.A. - Depositary Receipt (Common Stock) | 4.65 | 43.57 | 0.1375 | 0.0348 | |||||

| E / Eni S.p.A. - Depositary Receipt (Common Stock) | 4.65 | 43.57 | 0.1375 | 0.0348 | |||||

| DE000A30VPM1 / AMPRION GMBH /EUR/ REGD REG S 3.97100000 | 4.62 | 39.15 | 0.1368 | 0.0314 | |||||

| AU3SG0002553 / NEW S WALES TREA | 4.61 | 8.45 | 0.1364 | 0.0015 | |||||

| MG / Magna International Inc. | 4.59 | 0.1358 | 0.1358 | ||||||

| IE00BMD03L28 / Ireland Government Bond | 4.54 | 9.82 | 0.1343 | 0.0032 | |||||

| IE00BMD03L28 / Ireland Government Bond | 4.54 | 9.82 | 0.1343 | 0.0032 | |||||

| Ginnie Mae II Pool / ABS-MBS (US3622ADKZ02) | 4.49 | -3.83 | 0.1329 | -0.0153 | |||||

| Ginnie Mae II Pool / ABS-MBS (US3622ADKZ02) | 4.49 | -3.83 | 0.1329 | -0.0153 | |||||

| FI4000550249 / Republic of Finland | 4.47 | 10.23 | 0.1323 | 0.0036 | |||||

| AU3SG0002579 / TREASURY CORP VICTORIA /AUD/ REGD 2.00000000 | 4.43 | 8.66 | 0.1310 | 0.0017 | |||||

| GR0128017747 / Hellenic Republic Government Bond | 4.37 | 11.52 | 0.1291 | 0.0050 | |||||

| XS2357951164 / Deutsche Bahn Finance GMBH | 4.33 | 0.1281 | 0.1281 | ||||||

| US30161NBL47 / EXELON CORPORATION | 4.31 | -0.16 | 0.1275 | -0.0095 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 4.30 | 0.1273 | 0.1273 | ||||||

| Czech Republic Government Bond / DBT (CZ0001007256) | 4.30 | 0.1271 | 0.1271 | ||||||

| Czech Republic Government Bond / DBT (CZ0001007256) | 4.30 | 0.1271 | 0.1271 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 4.24 | -2.73 | 0.1253 | -0.0128 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 4.24 | -2.73 | 0.1253 | -0.0128 | |||||

| US260543DH36 / Dow Chemical Co/The | 4.15 | -1.47 | 0.1227 | -0.0108 | |||||

| FR0014009LQ8 / BNP Paribas SA | 4.12 | -50.82 | 0.1218 | -0.2167 | |||||

| US64830JAA88 / New Residential Mortgage Loan Trust 2022-NQM1 | 4.01 | -5.29 | 0.1186 | -0.0157 | |||||

| US01627AAD00 / ALIGNED DATA CENTERS ISSUER LLC SER 2023-1A CL A2 REGD 144A P/P 6.00000000 | 3.95 | 0.00 | 0.1169 | -0.0085 | |||||

| DTEA / Deutsche Telekom AG - Depositary Receipt (Common Stock) | 3.94 | 0.1166 | 0.1166 | ||||||

| DTEA / Deutsche Telekom AG - Depositary Receipt (Common Stock) | 3.94 | 0.1166 | 0.1166 | ||||||

| Avis Budget Rental Car Funding AESOP LLC / ABS-O (US05377RKQ64) | 3.88 | 0.1148 | 0.1148 | ||||||

| Avis Budget Rental Car Funding AESOP LLC / ABS-O (US05377RKQ64) | 3.88 | 0.1148 | 0.1148 | ||||||

| US980888AF86 / WOOLWORTHS GROUP LTD COMPANY GUAR 144A 04/21 4.55 | 3.84 | 0.1136 | 0.1136 | ||||||

| US980888AF86 / WOOLWORTHS GROUP LTD COMPANY GUAR 144A 04/21 4.55 | 3.84 | 0.1136 | 0.1136 | ||||||

| Rio Tinto Finance USA PLC / DBT (US76720AAT34) | 3.83 | 1.30 | 0.1132 | -0.0066 | |||||

| Rio Tinto Finance USA PLC / DBT (US76720AAT34) | 3.83 | 1.30 | 0.1132 | -0.0066 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 3.80 | -1.81 | 0.1125 | -0.0104 | |||||

| US05377RGY45 / Avis Budget Rental Car Funding AESOP LLC | 3.75 | 0.43 | 0.1108 | -0.0075 | |||||

| XS1963555617 / PepsiCo Inc | 3.73 | 0.1105 | 0.1105 | ||||||

| US89788MAM47 / Truist Financial Corp | 3.65 | 1.90 | 0.1080 | -0.0056 | |||||

| US19828TAB26 / Columbia Pipelines Operating Co LLC | 3.61 | 1.63 | 0.1069 | -0.0059 | |||||

| Diageo Finance PLC / DBT (XS2833391498) | 3.51 | 0.1038 | 0.1038 | ||||||

| Diageo Finance PLC / DBT (XS2833391498) | 3.51 | 0.1038 | 0.1038 | ||||||

| DSV Finance BV / DBT (XS2932829356) | 3.51 | 0.1037 | 0.1037 | ||||||

| Motability Operations Group PLC / DBT (XS2742660660) | 3.49 | 0.1034 | 0.1034 | ||||||

| Motability Operations Group PLC / DBT (XS2742660660) | 3.49 | 0.1034 | 0.1034 | ||||||

| JP1300691M16 / Japan Government Thirty Year Bond | 3.47 | -1.48 | 0.1026 | -0.0091 | |||||

| XS2300293003 / Cellnex Finance Co SA | 3.46 | 0.1023 | 0.1023 | ||||||

| US302491AX31 / FMC CORP 5.65% 05/18/2033 | 3.45 | 0.1021 | 0.1021 | ||||||

| Enel Finance International NV / DBT (XS2751666699) | 3.45 | 0.1020 | 0.1020 | ||||||

| Enel Finance International NV / DBT (XS2751666699) | 3.45 | 0.1020 | 0.1020 | ||||||

| MIL / Bank Millennium S.A. | 3.42 | 0.1011 | 0.1011 | ||||||

| MIL / Bank Millennium S.A. | 3.42 | 0.1011 | 0.1011 | ||||||

| US260543BC66 / Dow Chemical Co 8.850% Debentures 09/15/21 | 3.37 | 0.0996 | 0.0996 | ||||||

| US260543BC66 / Dow Chemical Co 8.850% Debentures 09/15/21 | 3.37 | 0.0996 | 0.0996 | ||||||

| PL0000115291 / Republic of Poland Government Bond | 3.36 | 9.54 | 0.0995 | 0.0021 | |||||

| Kommunalkredit Austria AG / DBT (AT0000A3KDQ3) | 3.35 | 0.0990 | 0.0990 | ||||||

| Kommunalkredit Austria AG / DBT (AT0000A3KDQ3) | 3.35 | 0.0990 | 0.0990 | ||||||

| 30064K105 / Exacttarget, Inc. | 3.34 | 0.0988 | 0.0988 | ||||||

| Store Capital LLC / DBT (US862123AA45) | 3.31 | 0.0981 | 0.0981 | ||||||

| Store Capital LLC / DBT (US862123AA45) | 3.31 | 0.0981 | 0.0981 | ||||||

| UU / UNITED UTILITIES GROUP PLC | 3.22 | -26.10 | 0.0952 | -0.0430 | |||||

| AU3SG0002702 / NEW S WALES TREA | 3.19 | 7.67 | 0.0942 | 0.0004 | |||||

| Yorkshire Water Finance PLC / DBT (XS0439817577) | 3.18 | 7.69 | 0.0940 | 0.0004 | |||||

| Yorkshire Water Finance PLC / DBT (XS0439817577) | 3.18 | 7.69 | 0.0940 | 0.0004 | |||||

| US00002DAA72 / A&D Mortgage Trust 2023-NQM2 | 3.13 | -8.45 | 0.0927 | -0.0159 | |||||

| US 10YR ULTRA / DIR (000000000) | 3.09 | 0.0913 | 0.0913 | ||||||

| A1RE34 / Alexandria Real Estate Equities, Inc. - Depositary Receipt (Common Stock) | 3.05 | 0.56 | 0.0901 | -0.0060 | |||||

| A1RE34 / Alexandria Real Estate Equities, Inc. - Depositary Receipt (Common Stock) | 3.05 | 0.56 | 0.0901 | -0.0060 | |||||

| 254011037 / Telia Company AB (publ) - Preferred Security | 3.04 | 0.0898 | 0.0898 | ||||||

| 254011037 / Telia Company AB (publ) - Preferred Security | 3.04 | 0.0898 | 0.0898 | ||||||

| US37046US851 / General Motors Financial Co Inc | 3.03 | 2.29 | 0.0897 | -0.0043 | |||||

| US37046US851 / General Motors Financial Co Inc | 3.03 | 2.29 | 0.0897 | -0.0043 | |||||

| XS2381853436 / NATL GRID PLC | 3.01 | 11.70 | 0.0890 | 0.0036 | |||||

| US05377RHM97 / Avis Budget Rental Car Funding AESOP LLC | 2.96 | 0.17 | 0.0877 | -0.0062 | |||||

| US37045XEP78 / General Motors Financial Co Inc | 2.94 | 2.47 | 0.0871 | -0.0040 | |||||

| US37046US851 / General Motors Financial Co Inc | 2.94 | 1.66 | 0.0870 | -0.0048 | |||||

| US37046US851 / General Motors Financial Co Inc | 2.94 | 1.66 | 0.0870 | -0.0048 | |||||

| IRS IFS EUR / DIR (000000000) | 2.92 | 0.0865 | 0.0865 | ||||||

| IRS IFS EUR / DIR (000000000) | 2.92 | 0.0865 | 0.0865 | ||||||

| Becton Dickinson Euro Finance Sarl / DBT (XS2838924848) | 2.87 | 0.0848 | 0.0848 | ||||||

| Becton Dickinson Euro Finance Sarl / DBT (XS2838924848) | 2.87 | 0.0848 | 0.0848 | ||||||

| FR00140063V5 / ELECTRICITE DE FRANCE RT SCRIP 12/31/49 | 2.82 | 0.0835 | 0.0835 | ||||||

| FR00140063V5 / ELECTRICITE DE FRANCE RT SCRIP 12/31/49 | 2.82 | 0.0835 | 0.0835 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 2.77 | -2.01 | 0.0821 | -0.0077 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 2.77 | -2.01 | 0.0821 | -0.0077 | |||||

| DK0009922320 / Denmark Government Bond | 2.71 | 8.95 | 0.0803 | 0.0013 | |||||

| XS2264968665 / Ivory Coast Government International Bond | 2.71 | 1.58 | 0.0801 | -0.0045 | |||||

| XS2264968665 / Ivory Coast Government International Bond | 2.71 | 1.58 | 0.0801 | -0.0045 | |||||

| USU94303AF86 / WEA Finance LLC | 2.69 | 0.67 | 0.0796 | -0.0052 | |||||

| AutoNation Finance Trust 2025-1 / ABS-O (US05330QAC69) | 2.68 | 0.0792 | 0.0792 | ||||||

| AutoNation Finance Trust 2025-1 / ABS-O (US05330QAC69) | 2.68 | 0.0792 | 0.0792 | ||||||

| XCLWAS / Australia Government Bond | 2.64 | 8.16 | 0.0781 | 0.0007 | |||||

| Novo Nordisk Finance Netherlands BV / DBT (XS2820460751) | 2.61 | 0.0771 | 0.0771 | ||||||

| Novo Nordisk Finance Netherlands BV / DBT (XS2820460751) | 2.61 | 0.0771 | 0.0771 | ||||||

| Constellation Energy Generation LLC / DBT (US210385AF78) | 2.55 | -23.70 | 0.0754 | -0.0306 | |||||

| Constellation Energy Generation LLC / DBT (US210385AF78) | 2.55 | -23.70 | 0.0754 | -0.0306 | |||||

| F1AN34 / Diamondback Energy, Inc. - Depositary Receipt (Common Stock) | 2.49 | -1.58 | 0.0737 | -0.0066 | |||||

| F1AN34 / Diamondback Energy, Inc. - Depositary Receipt (Common Stock) | 2.49 | -1.58 | 0.0737 | -0.0066 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 2.45 | -2.24 | 0.0724 | -0.0070 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 2.45 | -2.24 | 0.0724 | -0.0070 | |||||

| XS2591848192 / UNILEVER FINANCE /EUR/ REGD REG S 3.50000000 | 2.42 | 0.0716 | 0.0716 | ||||||

| US715638CE05 / REPUBLIC OF PERU SR UNSECURED REGS 02/29 5.94 | 2.40 | 6.80 | 0.0711 | -0.0003 | |||||

| US715638CE05 / REPUBLIC OF PERU SR UNSECURED REGS 02/29 5.94 | 2.40 | 6.80 | 0.0711 | -0.0003 | |||||

| US37046US851 / General Motors Financial Co Inc | 2.37 | 10.54 | 0.0702 | 0.0021 | |||||

| US37046US851 / General Motors Financial Co Inc | 2.37 | 10.54 | 0.0702 | 0.0021 | |||||

| W1BD34 / Warner Bros. Discovery, Inc. - Depositary Receipt (Common Stock) | 2.35 | 0.0694 | 0.0694 | ||||||

| US92928QAE89 / WEA Finance LLC | 2.29 | 0.93 | 0.0676 | -0.0042 | |||||

| RI / Pernod Ricard SA | 2.24 | 0.0663 | 0.0663 | ||||||

| RI / Pernod Ricard SA | 2.24 | 0.0663 | 0.0663 | ||||||

| XS2607194086 / Severn Trent Utilities Finance PLC | 2.22 | 8.98 | 0.0657 | 0.0011 | |||||

| US61747YFJ91 / Morgan Stanley | 2.17 | 1.07 | 0.0643 | -0.0039 | |||||

| US293601AE08 / ENT AUTO RECEIVABLES TRUST ENT 2023 1A A3 144A | 2.13 | -0.42 | 0.0630 | -0.0048 | |||||

| Suez SACA / DBT (FR001400LZO4) | 2.12 | 10.30 | 0.0627 | 0.0017 | |||||

| Suez SACA / DBT (FR001400LZO4) | 2.12 | 10.30 | 0.0627 | 0.0017 | |||||

| XS2360876465 / Tower Bridge Funding plc, Series 2021-2, Class A | 2.12 | -6.04 | 0.0626 | -0.0088 | |||||

| US12598UAA43 / COLT 2023-2 Mortgage Loan Trust | 2.04 | -6.67 | 0.0604 | -0.0090 | |||||

| USD/JPY FORWARD / DFE (000000000) | 2.01 | 0.0595 | 0.0595 | ||||||

| USD/JPY FORWARD / DFE (000000000) | 2.01 | 0.0595 | 0.0595 | ||||||

| ACA / Crédit Agricole S.A. | 2.01 | 0.0594 | 0.0594 | ||||||

| ACA / Crédit Agricole S.A. | 2.01 | 0.0594 | 0.0594 | ||||||

| A1ES34 / The AES Corporation - Depositary Receipt (Common Stock) | 1.98 | 0.46 | 0.0585 | -0.0039 | |||||

| A1ES34 / The AES Corporation - Depositary Receipt (Common Stock) | 1.98 | 0.46 | 0.0585 | -0.0039 | |||||

| US61945WAA71 / Mosaic Solar Loan Trust 2023-2 | 1.97 | -2.24 | 0.0582 | -0.0056 | |||||

| US924934AA00 / Verus Securitization Trust, Series 2023-5, Class A1 | 1.90 | -13.58 | 0.0563 | -0.0136 | |||||

| US92539TAA16 / Verus Securitization Trust, Series 2023-4, Class A1 | 1.75 | -11.49 | 0.0518 | -0.0109 | |||||

| IRS IFS GBP / DIR (000000000) | 1.74 | 0.0514 | 0.0514 | ||||||

| IRS IFS GBP / DIR (000000000) | 1.74 | 0.0514 | 0.0514 | ||||||

| MetroNet Infrastructure Issuer LLC / ABS-O (US59170JAG31) | 1.68 | -0.12 | 0.0497 | -0.0037 | |||||

| MetroNet Infrastructure Issuer LLC / ABS-O (US59170JAG31) | 1.68 | -0.12 | 0.0497 | -0.0037 | |||||

| MRK / Merck KGaA | 1.66 | 10.01 | 0.0491 | 0.0012 | |||||

| MRK / Merck KGaA | 1.66 | 10.01 | 0.0491 | 0.0012 | |||||

| T1TW34 / Take-Two Interactive Software, Inc. - Depositary Receipt (Common Stock) | 1.65 | 0.0488 | 0.0488 | ||||||

| T1TW34 / Take-Two Interactive Software, Inc. - Depositary Receipt (Common Stock) | 1.65 | 0.0488 | 0.0488 | ||||||

| EUR/USD FORWARD / DFE (000000000) | 1.52 | 0.0450 | 0.0450 | ||||||

| US85022WAP95 / SpringCastle America Funding LLC | 1.51 | -7.43 | 0.0446 | -0.0071 | |||||

| US46647PDY97 / JPMorgan Chase & Co | 1.49 | 1.22 | 0.0441 | -0.0026 | |||||

| US85236KAF93 / Stack Infrastructure Issuer LLC | 1.44 | -0.28 | 0.0425 | -0.0032 | |||||

| US63111XAL55 / Nasdaq Inc | 1.39 | 0.36 | 0.0411 | -0.0028 | |||||

| USD/GBP FORWARD / DFE (000000000) | 1.32 | 0.0391 | 0.0391 | ||||||

| FR001400FDC8 / ELECTRICITE DE FRANCE SA /EUR/ REGD REG S EMTN 4.62500000 | 1.29 | 9.81 | 0.0381 | 0.0009 | |||||

| U.S. TREASURY BOND / DIR (000000000) | 1.26 | 0.0374 | 0.0374 | ||||||

| U.S. TREASURY BOND / DIR (000000000) | 1.26 | 0.0374 | 0.0374 | ||||||

| EUR/USD FORWARD / DFE (000000000) | 1.25 | 0.0369 | 0.0369 | ||||||

| XS2264968665 / Ivory Coast Government International Bond | 1.21 | 10.93 | 0.0357 | 0.0012 | |||||

| XS2264968665 / Ivory Coast Government International Bond | 1.21 | 10.93 | 0.0357 | 0.0012 | |||||

| USU5009LAZ32 / Kraft Heinz Foods Co | 1.16 | -81.32 | 0.0343 | -0.1622 | |||||

| USU5009LAZ32 / Kraft Heinz Foods Co | 1.16 | -81.32 | 0.0343 | -0.1622 | |||||

| XS2375844656 / Becton Dickinson Euro Finance Sarl | 1.11 | 0.0329 | 0.0329 | ||||||

| XS2279559889 / GEMGARTO GMG 2021 1A A 144A | 1.11 | -6.47 | 0.0329 | -0.0048 | |||||

| US23284BAC81 / CyrusOne Data Centers Issuer I | 1.11 | -2.81 | 0.0328 | -0.0034 | |||||

| USD/CHF FORWARD / DFE (000000000) | 1.08 | 0.0320 | 0.0320 | ||||||

| USD/CHF FORWARD / DFE (000000000) | 1.08 | 0.0320 | 0.0320 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.04 | -3.96 | 0.0309 | -0.0036 | |||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 1.04 | 0.0309 | 0.0309 | ||||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 1.04 | 0.0309 | 0.0309 | ||||||

| USD/EUR FORWARD / DFE (000000000) | 1.03 | 0.0305 | 0.0305 | ||||||

| HCA Inc / DBT (US404121AK12) | 1.01 | -51.04 | 0.0299 | -0.0356 | |||||

| HCA Inc / DBT (US404121AK12) | 1.01 | -51.04 | 0.0299 | -0.0356 | |||||

| United States Treasury Note/Bond / DBT (US91282CLF67) | 0.98 | -98.48 | 0.0289 | -2.0109 | |||||

| US654579AE17 / Nippon Life Insurance Co | 0.89 | 0.0263 | 0.0263 | ||||||

| US654579AE17 / Nippon Life Insurance Co | 0.89 | 0.0263 | 0.0263 | ||||||

| US3140QPH591 / Fannie Mae Pool | 0.81 | -2.66 | 0.0239 | -0.0024 | |||||

| FCT / Fincantieri S.p.A. | 0.77 | 1.05 | 0.0228 | -0.0014 | |||||

| FCT / Fincantieri S.p.A. | 0.77 | 1.05 | 0.0228 | -0.0014 | |||||

| US86746BAA17 / Helios Issuer LLC, Series 2023-GRID1, Class 1A | 0.76 | -1.56 | 0.0224 | -0.0020 | |||||

| AUD/USD FORWARD / DFE (000000000) | 0.70 | 0.0207 | 0.0207 | ||||||

| AUD/USD FORWARD / DFE (000000000) | 0.70 | 0.0207 | 0.0207 | ||||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 0.68 | 1.48 | 0.0203 | -0.0011 | |||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 0.68 | 1.48 | 0.0203 | -0.0011 | |||||

| NOK/USD FORWARD / DFE (000000000) | 0.64 | 0.0191 | 0.0191 | ||||||

| NOK/USD FORWARD / DFE (000000000) | 0.64 | 0.0191 | 0.0191 | ||||||

| US14686KAD90 / Carvana Auto Receivables Trust 2021-N2 | 0.59 | -13.95 | 0.0174 | -0.0042 | |||||

| USD/SEK FORWARD / DFE (000000000) | 0.49 | 0.0144 | 0.0144 | ||||||

| USD/SEK FORWARD / DFE (000000000) | 0.49 | 0.0144 | 0.0144 | ||||||

| CDS VIRGIN MEDIA FINANCE PLC / DCR (000000000) | 0.45 | 0.0134 | 0.0134 | ||||||

| CDS VIRGIN MEDIA FINANCE PLC / DCR (000000000) | 0.45 | 0.0134 | 0.0134 | ||||||

| USD/EUR FORWARD / DFE (000000000) | 0.40 | 0.0119 | 0.0119 | ||||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 0.35 | 0.0104 | 0.0104 | ||||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 0.35 | 0.0104 | 0.0104 | ||||||

| USD/CAD FORWARD / DFE (000000000) | 0.33 | 0.0097 | 0.0097 | ||||||

| USD/CAD FORWARD / DFE (000000000) | 0.33 | 0.0097 | 0.0097 | ||||||

| LONG GILT / DIR (000000000) | 0.31 | 0.0091 | 0.0091 | ||||||

| LONG GILT / DIR (000000000) | 0.31 | 0.0091 | 0.0091 | ||||||

| EURO-OAT / DIR (000000000) | 0.30 | 0.0090 | 0.0090 | ||||||

| EURO-OAT / DIR (000000000) | 0.30 | 0.0090 | 0.0090 | ||||||

| JPY/USD FORWARD / DFE (000000000) | 0.30 | 0.0088 | 0.0088 | ||||||

| US92928QAD07 / WEA Finance LLC | 0.30 | -3.91 | 0.0087 | -0.0010 | |||||

| EURO-BUXL 30Y BND / DIR (000000000) | 0.29 | 0.0086 | 0.0086 | ||||||

| USD/AUD FORWARD / DFE (000000000) | 0.29 | 0.0086 | 0.0086 | ||||||

| USD/CHF FORWARD / DFE (000000000) | 0.27 | 0.0081 | 0.0081 | ||||||

| USD/CHF FORWARD / DFE (000000000) | 0.27 | 0.0081 | 0.0081 | ||||||

| USD/NOK FORWARD / DFE (000000000) | 0.27 | 0.0080 | 0.0080 | ||||||

| USD/NOK FORWARD / DFE (000000000) | 0.27 | 0.0080 | 0.0080 | ||||||

| USD/AUD FORWARD / DFE (000000000) | 0.25 | 0.0075 | 0.0075 | ||||||

| USD/GBP FORWARD / DFE (000000000) | 0.24 | 0.0071 | 0.0071 | ||||||

| US 10YR NOTE (CBT) / DIR (000000000) | 0.20 | 0.0060 | 0.0060 | ||||||

| US 10YR NOTE (CBT) / DIR (000000000) | 0.20 | 0.0060 | 0.0060 | ||||||

| USD/KRW FORWARD / DFE (000000000) | 0.17 | 0.0050 | 0.0050 | ||||||

| USD/KRW FORWARD / DFE (000000000) | 0.17 | 0.0050 | 0.0050 | ||||||

| CAN 10YR BOND / DIR (000000000) | 0.17 | 0.0050 | 0.0050 | ||||||

| CAN 10YR BOND / DIR (000000000) | 0.17 | 0.0050 | 0.0050 | ||||||

| USD/AUD FORWARD / DFE (000000000) | 0.16 | 0.0049 | 0.0049 | ||||||

| USD/CAD FORWARD / DFE (000000000) | 0.16 | 0.0048 | 0.0048 | ||||||

| USD/CAD FORWARD / DFE (000000000) | 0.16 | 0.0048 | 0.0048 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | 0.16 | 0.0047 | 0.0047 | ||||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 0.13 | 0.0040 | 0.0040 | ||||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 0.12 | 0.0037 | 0.0037 | ||||||

| EURO-BUND / DIR (000000000) | 0.11 | 0.0034 | 0.0034 | ||||||

| EURO-BUND / DIR (000000000) | 0.11 | 0.0034 | 0.0034 | ||||||

| USD/AUD FORWARD / DFE (000000000) | 0.11 | 0.0033 | 0.0033 | ||||||

| EURO-BTP / DIR (000000000) | 0.11 | 0.0033 | 0.0033 | ||||||

| EURO-BTP / DIR (000000000) | 0.11 | 0.0033 | 0.0033 | ||||||

| CDS ZIGGO BOND CO BV / DCR (000000000) | 0.11 | 0.0032 | 0.0032 | ||||||

| CDS ZIGGO BOND CO BV / DCR (000000000) | 0.11 | 0.0032 | 0.0032 | ||||||

| USD/NZD FORWARD / DFE (000000000) | 0.09 | 0.0028 | 0.0028 | ||||||

| USD/NZD FORWARD / DFE (000000000) | 0.09 | 0.0028 | 0.0028 | ||||||

| USD/CHF FORWARD / DFE (000000000) | 0.09 | 0.0027 | 0.0027 | ||||||

| USD/CHF FORWARD / DFE (000000000) | 0.09 | 0.0027 | 0.0027 | ||||||

| USD/CAD FORWARD / DFE (000000000) | 0.08 | 0.0024 | 0.0024 | ||||||

| USD/CAD FORWARD / DFE (000000000) | 0.08 | 0.0024 | 0.0024 | ||||||

| CAD/USD FORWARD / DFE (000000000) | 0.08 | 0.0023 | 0.0023 | ||||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 0.08 | 0.0023 | 0.0023 | ||||||

| CHF/USD FORWARD / DFE (000000000) | 0.07 | 0.0022 | 0.0022 | ||||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 0.07 | 0.0021 | 0.0021 | ||||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 0.07 | 0.0021 | 0.0021 | ||||||

| USD/HUF FORWARD / DFE (000000000) | 0.07 | 0.0019 | 0.0019 | ||||||

| USD/HUF FORWARD / DFE (000000000) | 0.07 | 0.0019 | 0.0019 | ||||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 0.05 | 0.0015 | 0.0015 | ||||||

| CNH/USD FORWARD / DFE (000000000) | 0.04 | 0.0011 | 0.0011 | ||||||

| CNH/USD FORWARD / DFE (000000000) | 0.04 | 0.0011 | 0.0011 | ||||||

| CAD/USD FORWARD / DFE (000000000) | 0.03 | 0.0010 | 0.0010 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | 0.03 | 0.0008 | 0.0008 | ||||||

| AUST 3YR BOND / DIR (000000000) | 0.02 | 0.0006 | 0.0006 | ||||||

| AUST 3YR BOND / DIR (000000000) | 0.02 | 0.0006 | 0.0006 | ||||||

| JPY/USD FORWARD / DFE (000000000) | 0.02 | 0.0006 | 0.0006 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | 0.01 | 0.0004 | 0.0004 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | 0.01 | 0.0004 | 0.0004 | ||||||

| NOK/USD FORWARD / DFE (000000000) | 0.01 | 0.0003 | 0.0003 | ||||||

| NOK/USD FORWARD / DFE (000000000) | 0.01 | 0.0003 | 0.0003 | ||||||

| USD/EUR FORWARD / DFE (000000000) | 0.01 | 0.0003 | 0.0003 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | 0.01 | 0.0003 | 0.0003 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | 0.01 | 0.0003 | 0.0003 | ||||||

| USD/GBP FORWARD / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | ||||||

| USD/GBP FORWARD / DFE (000000000) | 0.00 | 0.0001 | 0.0001 | ||||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 0.00 | 0.0001 | 0.0001 | ||||||

| HU0000404744 / Hungary Government Bond | 0.00 | 0.00 | 0.0000 | 0.0000 | |||||

| CNH/USD FORWARD / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| CNH/USD FORWARD / DFE (000000000) | 0.00 | 0.0000 | 0.0000 | ||||||

| GBP/USD FORWARD / DFE (000000000) | -0.01 | -0.0002 | -0.0002 | ||||||

| GBP/USD FORWARD / DFE (000000000) | -0.01 | -0.0002 | -0.0002 | ||||||

| JPY/USD FORWARD / DFE (000000000) | -0.01 | -0.0002 | -0.0002 | ||||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | -0.01 | -0.0002 | -0.0002 | ||||||

| GBP/USD FORWARD / DFE (000000000) | -0.01 | -0.0003 | -0.0003 | ||||||

| USD/GBP FORWARD / DFE (000000000) | -0.01 | -0.0003 | -0.0003 | ||||||

| USD/CAD FORWARD / DFE (000000000) | -0.01 | -0.0003 | -0.0003 | ||||||

| USD/CAD FORWARD / DFE (000000000) | -0.01 | -0.0003 | -0.0003 | ||||||

| EUR/CHF FORWARD / DFE (000000000) | -0.01 | -0.0004 | -0.0004 | ||||||

| CAD/USD FORWARD / DFE (000000000) | -0.01 | -0.0004 | -0.0004 | ||||||

| USD/SEK FORWARD / DFE (000000000) | -0.02 | -0.0004 | -0.0004 | ||||||

| USD/SEK FORWARD / DFE (000000000) | -0.02 | -0.0004 | -0.0004 | ||||||

| CNH/USD FORWARD / DFE (000000000) | -0.02 | -0.0004 | -0.0004 | ||||||

| CNH/USD FORWARD / DFE (000000000) | -0.02 | -0.0004 | -0.0004 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -0.02 | -0.0005 | -0.0005 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -0.02 | -0.0005 | -0.0005 | ||||||

| SEK/EUR FORWARD / DFE (000000000) | -0.02 | -0.0006 | -0.0006 | ||||||

| SEK/EUR FORWARD / DFE (000000000) | -0.02 | -0.0006 | -0.0006 | ||||||

| CDS MEDIOBANCA BANCA DI CREDITO FINANZIARIO SPA / DCR (000000000) | -0.02 | -0.0006 | -0.0006 | ||||||

| GBP/USD FORWARD / DFE (000000000) | -0.02 | -0.0007 | -0.0007 | ||||||

| I1CE34 / Intercontinental Exchange, Inc. - Depositary Receipt (Common Stock) | -0.03 | -0.0007 | -0.0007 | ||||||

| I1CE34 / Intercontinental Exchange, Inc. - Depositary Receipt (Common Stock) | -0.03 | -0.0007 | -0.0007 | ||||||

| USD/COP FORWARD / DFE (000000000) | -0.03 | -0.0007 | -0.0007 | ||||||

| USD/COP FORWARD / DFE (000000000) | -0.03 | -0.0007 | -0.0007 | ||||||

| BNP / BNP Paribas SA | -0.03 | -0.0008 | -0.0008 | ||||||

| BNP / BNP Paribas SA | -0.03 | -0.0008 | -0.0008 | ||||||

| JPY/USD FORWARD / DFE (000000000) | -0.03 | -0.0010 | -0.0010 | ||||||

| JPY/USD FORWARD / DFE (000000000) | -0.03 | -0.0010 | -0.0010 | ||||||

| CDS ELECTROLUX AB / DCR (000000000) | -0.03 | -0.0010 | -0.0010 | ||||||

| CDS ELECTROLUX AB / DCR (000000000) | -0.03 | -0.0010 | -0.0010 | ||||||

| BNP / BNP Paribas SA | -0.04 | -0.0011 | -0.0011 | ||||||

| BNP / BNP Paribas SA | -0.04 | -0.0011 | -0.0011 | ||||||

| CNH/USD FORWARD / DFE (000000000) | -0.04 | -0.0011 | -0.0011 | ||||||

| CNH/USD FORWARD / DFE (000000000) | -0.04 | -0.0011 | -0.0011 | ||||||

| USD/KRW FORWARD / DFE (000000000) | -0.04 | -0.0011 | -0.0011 | ||||||

| USD/KRW FORWARD / DFE (000000000) | -0.04 | -0.0011 | -0.0011 | ||||||

| USD/AUD FORWARD / DFE (000000000) | -0.04 | -0.0011 | -0.0011 | ||||||

| USD/AUD FORWARD / DFE (000000000) | -0.04 | -0.0011 | -0.0011 | ||||||

| USD/MYR FORWARD / DFE (000000000) | -0.04 | -0.0013 | -0.0013 | ||||||

| USD/MYR FORWARD / DFE (000000000) | -0.04 | -0.0013 | -0.0013 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -0.04 | -0.0013 | -0.0013 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -0.04 | -0.0013 | -0.0013 | ||||||

| CDS ELECTROLUX AB / DCR (000000000) | -0.05 | -0.0014 | -0.0014 | ||||||

| CDS ELECTROLUX AB / DCR (000000000) | -0.05 | -0.0014 | -0.0014 | ||||||

| DGZ / DB Gold Short ETN | -0.05 | -0.0014 | -0.0014 | ||||||

| JPY/USD FORWARD / DFE (000000000) | -0.05 | -0.0014 | -0.0014 | ||||||

| PEN/USD FORWARD / DFE (000000000) | -0.05 | -0.0015 | -0.0015 | ||||||

| PEN/USD FORWARD / DFE (000000000) | -0.05 | -0.0015 | -0.0015 | ||||||

| BNP / BNP Paribas SA | -0.05 | -0.0015 | -0.0015 | ||||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | -0.05 | -0.0016 | -0.0016 | ||||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | -0.06 | -0.0017 | -0.0017 | ||||||

| USD/NZD FORWARD / DFE (000000000) | -0.06 | -0.0018 | -0.0018 | ||||||

| USD/NZD FORWARD / DFE (000000000) | -0.06 | -0.0018 | -0.0018 | ||||||

| DGZ / DB Gold Short ETN | -0.06 | -0.0019 | -0.0019 | ||||||

| DGZ / DB Gold Short ETN | -0.06 | -0.0019 | -0.0019 | ||||||

| BNP / BNP Paribas SA | -0.06 | -0.0019 | -0.0019 | ||||||

| BNP / BNP Paribas SA | -0.06 | -0.0019 | -0.0019 | ||||||

| BNP / BNP Paribas SA | -0.07 | -0.0020 | -0.0020 | ||||||

| BNP / BNP Paribas SA | -0.07 | -0.0020 | -0.0020 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.07 | -0.0020 | -0.0020 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.07 | -0.0020 | -0.0020 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -0.07 | -0.0021 | -0.0021 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -0.07 | -0.0021 | -0.0021 | ||||||

| USD/DKK FORWARD / DFE (000000000) | -0.08 | -0.0023 | -0.0023 | ||||||

| USD/DKK FORWARD / DFE (000000000) | -0.08 | -0.0023 | -0.0023 | ||||||

| USD/AUD FORWARD / DFE (000000000) | -0.08 | -0.0025 | -0.0025 | ||||||

| BNP / BNP Paribas SA | -0.08 | -0.0025 | -0.0025 | ||||||

| BNP / BNP Paribas SA | -0.08 | -0.0025 | -0.0025 | ||||||

| USD/PLN FORWARD / DFE (000000000) | -0.11 | -0.0032 | -0.0032 | ||||||

| USD/PLN FORWARD / DFE (000000000) | -0.11 | -0.0032 | -0.0032 | ||||||

| CZK/USD FORWARD / DFE (000000000) | -0.11 | -0.0033 | -0.0033 | ||||||

| CZK/USD FORWARD / DFE (000000000) | -0.11 | -0.0033 | -0.0033 | ||||||

| USD/MXN FORWARD / DFE (000000000) | -0.12 | -0.0034 | -0.0034 | ||||||

| USD/MXN FORWARD / DFE (000000000) | -0.12 | -0.0034 | -0.0034 | ||||||

| USD/CHF FORWARD / DFE (000000000) | -0.12 | -0.0037 | -0.0037 | ||||||

| USD/CHF FORWARD / DFE (000000000) | -0.12 | -0.0037 | -0.0037 | ||||||

| AUD/USD FORWARD / DFE (000000000) | -0.12 | -0.0037 | -0.0037 | ||||||

| CHF/USD FORWARD / DFE (000000000) | -0.13 | -0.0039 | -0.0039 | ||||||

| EURO-BOBL / DIR (000000000) | -0.13 | -0.0040 | -0.0040 | ||||||

| EURO-BOBL / DIR (000000000) | -0.13 | -0.0040 | -0.0040 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.14 | -0.0042 | -0.0042 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.14 | -0.0042 | -0.0042 | ||||||

| BRL/USD FORWARD / DFE (000000000) | -0.14 | -0.0043 | -0.0043 | ||||||

| CAD/USD FORWARD / DFE (000000000) | -0.14 | -0.0043 | -0.0043 | ||||||

| USD/BRL FORWARD / DFE (000000000) | -0.15 | -0.0043 | -0.0043 | ||||||

| CAD/USD FORWARD / DFE (000000000) | -0.15 | -0.0045 | -0.0045 | ||||||

| CAD/USD FORWARD / DFE (000000000) | -0.15 | -0.0045 | -0.0045 | ||||||

| NZD/USD FORWARD / DFE (000000000) | -0.16 | -0.0047 | -0.0047 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -0.16 | -0.0048 | -0.0048 | ||||||

| KRW/USD FORWARD / DFE (000000000) | -0.17 | -0.0050 | -0.0050 | ||||||

| KRW/USD FORWARD / DFE (000000000) | -0.17 | -0.0050 | -0.0050 | ||||||

| NZD/USD FORWARD / DFE (000000000) | -0.17 | -0.0051 | -0.0051 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -0.17 | -0.0051 | -0.0051 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -0.18 | -0.0052 | -0.0052 | ||||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | -0.19 | -0.0056 | -0.0056 | ||||||

| USD/CHF FORWARD / DFE (000000000) | -0.23 | -0.0067 | -0.0067 | ||||||

| USD/CHF FORWARD / DFE (000000000) | -0.23 | -0.0067 | -0.0067 | ||||||

| IRS IFS USD / DIR (000000000) | -0.25 | -0.0075 | -0.0075 | ||||||

| IRS IFS USD / DIR (000000000) | -0.25 | -0.0075 | -0.0075 | ||||||

| JAPAN 10Y BOND(OSE) / DIR (000000000) | -0.26 | -0.0076 | -0.0076 | ||||||

| JAPAN 10Y BOND(OSE) / DIR (000000000) | -0.26 | -0.0076 | -0.0076 | ||||||

| IRS IFS USD / DIR (000000000) | -0.26 | -0.0076 | -0.0076 | ||||||

| IRS IFS USD / DIR (000000000) | -0.26 | -0.0076 | -0.0076 | ||||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | -0.26 | -0.0076 | -0.0076 | ||||||

| JPY/USD FORWARD / DFE (000000000) | -0.26 | -0.0078 | -0.0078 | ||||||

| USD/SEK FORWARD / DFE (000000000) | -0.31 | -0.0092 | -0.0092 | ||||||

| USD/SEK FORWARD / DFE (000000000) | -0.31 | -0.0092 | -0.0092 | ||||||

| CHF/USD FORWARD / DFE (000000000) | -0.31 | -0.0092 | -0.0092 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -0.33 | -0.0098 | -0.0098 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -0.33 | -0.0098 | -0.0098 | ||||||

| NZD/USD FORWARD / DFE (000000000) | -0.33 | -0.0099 | -0.0099 | ||||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | -0.35 | -0.0102 | -0.0102 | ||||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | -0.35 | -0.0102 | -0.0102 | ||||||

| USD/KRW FORWARD / DFE (000000000) | -0.35 | -0.0103 | -0.0103 | ||||||

| USD/KRW FORWARD / DFE (000000000) | -0.35 | -0.0103 | -0.0103 | ||||||

| EURO-SCHATZ / DIR (000000000) | -0.40 | -0.0118 | -0.0118 | ||||||

| EURO-SCHATZ / DIR (000000000) | -0.40 | -0.0118 | -0.0118 | ||||||

| EUR/USD FORWARD / DFE (000000000) | -0.41 | -0.0121 | -0.0121 | ||||||

| EUR/USD FORWARD / DFE (000000000) | -0.44 | -0.0129 | -0.0129 | ||||||

| CHF/USD FORWARD / DFE (000000000) | -0.46 | -0.0137 | -0.0137 | ||||||

| CHF/USD FORWARD / DFE (000000000) | -0.46 | -0.0137 | -0.0137 | ||||||

| SEK/USD FORWARD / DFE (000000000) | -0.49 | -0.0145 | -0.0145 | ||||||

| SEK/USD FORWARD / DFE (000000000) | -0.49 | -0.0145 | -0.0145 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -0.51 | -0.0150 | -0.0150 | ||||||

| DE000C4SA6R6 / EURO STOXX 50 Index | -0.51 | -0.0150 | -0.0150 | ||||||

| AUST 10Y BOND / DIR (000000000) | -0.51 | -0.0151 | -0.0151 | ||||||

| AUST 10Y BOND / DIR (000000000) | -0.51 | -0.0151 | -0.0151 | ||||||

| US 2YR NOTE (CBT) / DIR (000000000) | -0.59 | -0.0174 | -0.0174 | ||||||

| USD/GBP FORWARD / DFE (000000000) | -0.60 | -0.0178 | -0.0178 | ||||||

| CAD/USD FORWARD / DFE (000000000) | -0.64 | -0.0189 | -0.0189 | ||||||

| AUD/USD FORWARD / DFE (000000000) | -0.66 | -0.0194 | -0.0194 | ||||||

| USD/CNH FORWARD / DFE (000000000) | -0.66 | -0.0194 | -0.0194 | ||||||

| USD/CNH FORWARD / DFE (000000000) | -0.66 | -0.0194 | -0.0194 | ||||||

| USD/NZD FORWARD / DFE (000000000) | -0.71 | -0.0211 | -0.0211 | ||||||

| USD/NZD FORWARD / DFE (000000000) | -0.71 | -0.0211 | -0.0211 | ||||||

| CHF/USD FORWARD / DFE (000000000) | -0.76 | -0.0225 | -0.0225 | ||||||

| EUR/USD FORWARD / DFE (000000000) | -0.79 | -0.0232 | -0.0232 | ||||||

| SEK/USD FORWARD / DFE (000000000) | -0.85 | -0.0250 | -0.0250 | ||||||

| SEK/USD FORWARD / DFE (000000000) | -0.85 | -0.0250 | -0.0250 | ||||||

| CDS TRANSDIGM INC / DCR (000000000) | -0.92 | -0.0272 | -0.0272 | ||||||

| CDS TRANSDIGM INC / DCR (000000000) | -0.92 | -0.0272 | -0.0272 | ||||||

| COP/USD FORWARD / DFE (000000000) | -0.92 | -0.0272 | -0.0272 | ||||||

| COP/USD FORWARD / DFE (000000000) | -0.92 | -0.0272 | -0.0272 | ||||||

| I1CE34 / Intercontinental Exchange, Inc. - Depositary Receipt (Common Stock) | -1.07 | -0.0316 | -0.0316 | ||||||

| I1CE34 / Intercontinental Exchange, Inc. - Depositary Receipt (Common Stock) | -1.07 | -0.0316 | -0.0316 | ||||||

| USD/CHF FORWARD / DFE (000000000) | -1.09 | -0.0323 | -0.0323 | ||||||

| USD/CHF FORWARD / DFE (000000000) | -1.09 | -0.0323 | -0.0323 | ||||||

| USD/EUR FORWARD / DFE (000000000) | -1.10 | -0.0325 | -0.0325 | ||||||

| USD/EUR FORWARD / DFE (000000000) | -1.10 | -0.0325 | -0.0325 | ||||||

| USD/GBP FORWARD / DFE (000000000) | -1.11 | -0.0327 | -0.0327 | ||||||

| USD/GBP FORWARD / DFE (000000000) | -1.11 | -0.0327 | -0.0327 | ||||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | -1.22 | -0.0359 | -0.0359 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -1.27 | -0.0376 | -0.0376 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -1.27 | -0.0376 | -0.0376 | ||||||

| TRS IBOXIG INDEX / DIR (000000000) | -1.34 | -0.0395 | -0.0395 | ||||||

| TRS IBOXIG INDEX / DIR (000000000) | -1.34 | -0.0395 | -0.0395 | ||||||

| NZD/USD FORWARD / DFE (000000000) | -1.42 | -0.0420 | -0.0420 | ||||||

| NZD/USD FORWARD / DFE (000000000) | -1.42 | -0.0420 | -0.0420 | ||||||

| EUR/USD FORWARD / DFE (000000000) | -1.88 | -0.0558 | -0.0558 | ||||||

| USD/GBP FORWARD / DFE (000000000) | -1.90 | -0.0563 | -0.0563 | ||||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | -2.79 | -0.0825 | -0.0825 | ||||||

| BRL/USD FORWARD / DFE (000000000) | -5.16 | -0.1528 | -0.1528 | ||||||

| US ULTRA BOND CBT / DIR (000000000) | -8.67 | -0.2565 | -0.2565 | ||||||

| EUR/USD FORWARD / DFE (000000000) | -16.17 | -0.4783 | -0.4783 | ||||||

| EUR/USD FORWARD / DFE (000000000) | -16.17 | -0.4783 | -0.4783 | ||||||

| I1CE34 / Intercontinental Exchange, Inc. - Depositary Receipt (Common Stock) | -27.76 | -0.8214 | -0.8214 | ||||||

| I1CE34 / Intercontinental Exchange, Inc. - Depositary Receipt (Common Stock) | -27.76 | -0.8214 | -0.8214 |