Mga Batayang Estadistika

| Nilai Portofolio | $ 90,460,343 |

| Posisi Saat Ini | 49 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

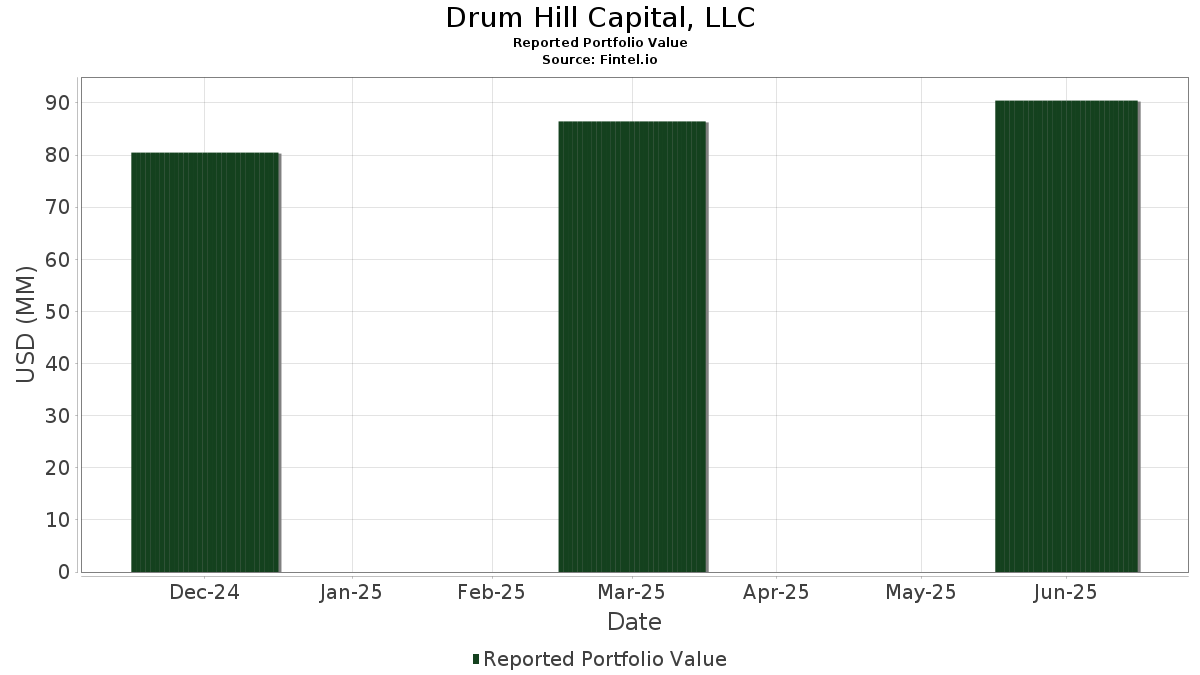

Drum Hill Capital, LLC telah mengungkapkan total kepemilikan 49 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 90,460,343 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Drum Hill Capital, LLC adalah Vanguard Scottsdale Funds - Vanguard Short-Term Treasury ETF (US:VGSH) , Telefonaktiebolaget LM Ericsson (publ) - Depositary Receipt (Common Stock) (US:ERIC) , Simplify Exchange Traded Funds - Simplify Interest Rate Hedge ETF (US:PFIX) , Newmont Corporation (US:NEM) , and Verizon Communications Inc. (US:VZ) . Posisi baru Drum Hill Capital, LLC meliputi: GMS Inc. (US:GMS) , GE Vernova Inc. (US:GEV) , Cisco Systems, Inc. (US:CSCO) , SPDR S&P 500 ETF (US:SPY) , and .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.05 | 2.13 | 2.3594 | 0.6538 | |

| 0.08 | 4.64 | 5.1305 | 0.6342 | |

| 0.00 | 2.29 | 2.5365 | 0.5337 | |

| 0.12 | 4.10 | 4.5336 | 0.4243 | |

| 0.00 | 0.36 | 0.4030 | 0.4030 | |

| 0.05 | 2.23 | 2.4666 | 0.3740 | |

| 0.11 | 5.83 | 6.4441 | 0.2901 | |

| 0.00 | 0.23 | 0.2555 | 0.2555 | |

| 0.00 | 0.23 | 0.2509 | 0.2509 | |

| 0.06 | 3.02 | 3.3425 | 0.2467 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.01 | 3.69 | 4.0747 | -0.6423 | |

| 0.17 | 4.39 | 4.8538 | -0.5443 | |

| 0.10 | 4.53 | 5.0085 | -0.5378 | |

| 0.06 | 3.71 | 4.0989 | -0.5027 | |

| 0.06 | 4.10 | 4.5354 | -0.4882 | |

| 0.31 | 2.24 | 2.4803 | -0.4250 | |

| 0.13 | 1.65 | 1.8261 | -0.3880 | |

| 0.23 | 13.51 | 14.9312 | -0.3604 | |

| 0.05 | 1.46 | 1.6176 | -0.2654 | |

| 0.02 | 0.95 | 1.0520 | -0.2353 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-15 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| VGSH / Vanguard Scottsdale Funds - Vanguard Short-Term Treasury ETF | 0.23 | 2.00 | 13.51 | 2.16 | 14.9312 | -0.3604 | |||

| ERIC / Telefonaktiebolaget LM Ericsson (publ) - Depositary Receipt (Common Stock) | 0.71 | -1.71 | 6.05 | 7.41 | 6.6839 | 0.1734 | |||

| PFIX / Simplify Exchange Traded Funds - Simplify Interest Rate Hedge ETF | 0.11 | 0.47 | 5.83 | 9.57 | 6.4441 | 0.2901 | |||

| NEM / Newmont Corporation | 0.08 | -1.07 | 4.64 | 19.40 | 5.1305 | 0.6342 | |||

| VZ / Verizon Communications Inc. | 0.10 | -0.96 | 4.53 | -5.53 | 5.0085 | -0.5378 | |||

| EQNR / Equinor ASA - Depositary Receipt (Common Stock) | 0.17 | -1.03 | 4.39 | -5.94 | 4.8538 | -0.5443 | |||

| SHEL / Shell plc - Depositary Receipt (Common Stock) | 0.06 | -1.69 | 4.10 | -5.55 | 4.5354 | -0.4882 | |||

| BWA / BorgWarner Inc. | 0.12 | -1.23 | 4.10 | 15.42 | 4.5336 | 0.4243 | |||

| TTE / TotalEnergies SE - Depositary Receipt (Common Stock) | 0.06 | -1.80 | 3.71 | -6.81 | 4.0989 | -0.5027 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.01 | -0.91 | 3.69 | -9.61 | 4.0747 | -0.6423 | |||

| GDX / VanEck ETF Trust - VanEck Gold Miners ETF | 0.06 | -0.26 | 3.02 | 12.97 | 3.3425 | 0.2467 | |||

| TEF / Telefónica, S.A. - Depositary Receipt (Common Stock) | 0.48 | -2.52 | 2.51 | 9.42 | 2.7750 | 0.1212 | |||

| QCOM / QUALCOMM Incorporated | 0.02 | -0.44 | 2.39 | 3.23 | 2.6472 | -0.0358 | |||

| MSFT / Microsoft Corporation | 0.00 | 0.00 | 2.29 | 32.52 | 2.5365 | 0.5337 | |||

| VET / Vermilion Energy Inc. | 0.31 | -0.62 | 2.24 | -10.71 | 2.4803 | -0.4250 | |||

| TEX / Terex Corporation | 0.05 | -0.21 | 2.23 | 23.33 | 2.4666 | 0.3740 | |||

| CLFD / Clearfield, Inc. | 0.05 | -0.91 | 2.13 | 44.78 | 2.3594 | 0.6538 | |||

| NXPI / NXP Semiconductors N.V. | 0.01 | -0.22 | 2.00 | 14.71 | 2.2074 | 0.1941 | |||

| PBR / Petróleo Brasileiro S.A. - Petrobras - Depositary Receipt (Common Stock) | 0.13 | -1.09 | 1.65 | -13.74 | 1.8261 | -0.3880 | |||

| SWKS / Skyworks Solutions, Inc. | 0.02 | -0.62 | 1.57 | 14.61 | 1.7351 | 0.1509 | |||

| ALB.PRA / Albemarle Corporation - Preferred Stock | 0.05 | -0.18 | 1.46 | -10.14 | 1.6176 | -0.2654 | |||

| IBM / International Business Machines Corporation | 0.00 | 0.00 | 1.25 | 18.52 | 1.3800 | 0.1621 | |||

| XOM / Exxon Mobil Corporation | 0.01 | 0.00 | 1.18 | -9.40 | 1.3006 | -0.2006 | |||

| ALB / Albemarle Corporation | 0.02 | -1.75 | 0.95 | -14.56 | 1.0520 | -0.2353 | |||

| AAPL / Apple Inc. | 0.00 | 0.00 | 0.84 | -7.62 | 0.9242 | -0.1227 | |||

| IEUS / iShares Trust - iShares MSCI Europe Small-Cap ETF | 0.01 | -7.35 | 0.77 | 8.58 | 0.8535 | 0.0304 | |||

| UNP / Union Pacific Corporation | 0.00 | 0.00 | 0.68 | -2.58 | 0.7529 | -0.0559 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | 0.00 | 0.66 | 18.10 | 0.7294 | 0.0837 | |||

| GWW / W.W. Grainger, Inc. | 0.00 | 0.00 | 0.65 | 5.35 | 0.7187 | 0.0047 | |||

| GE / General Electric Company | 0.00 | 0.00 | 0.44 | 28.86 | 0.4888 | 0.0911 | |||

| PM / Philip Morris International Inc. | 0.00 | 0.00 | 0.43 | 14.52 | 0.4719 | 0.0416 | |||

| STRL / Sterling Infrastructure, Inc. | 0.00 | 0.36 | 0.4030 | 0.4030 | |||||

| IJH / iShares Trust - iShares Core S&P Mid-Cap ETF | 0.01 | 0.00 | 0.33 | 6.39 | 0.3685 | 0.0058 | |||

| CL / Colgate-Palmolive Company | 0.00 | 0.00 | 0.31 | -2.84 | 0.3405 | -0.0267 | |||

| CAT / Caterpillar Inc. | 0.00 | 0.00 | 0.29 | 18.15 | 0.3240 | 0.0360 | |||

| IJR / iShares Trust - iShares Core S&P Small-Cap ETF | 0.00 | 0.00 | 0.27 | 4.67 | 0.2978 | -0.0003 | |||

| CBU / Community Financial System, Inc. | 0.00 | 0.00 | 0.27 | 0.00 | 0.2966 | -0.0137 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | 0.00 | 0.27 | -18.65 | 0.2949 | -0.0838 | |||

| PEP / PepsiCo, Inc. | 0.00 | 0.00 | 0.27 | -11.96 | 0.2934 | -0.0552 | |||

| TXN / Texas Instruments Incorporated | 0.00 | 0.00 | 0.25 | 15.81 | 0.2754 | 0.0260 | |||

| GMS / GMS Inc. | 0.00 | 0.23 | 0.2555 | 0.2555 | |||||

| GEV / GE Vernova Inc. | 0.00 | 0.23 | 0.2509 | 0.2509 | |||||

| PFE / Pfizer Inc. | 0.01 | 0.00 | 0.22 | -4.33 | 0.2451 | -0.0230 | |||

| KO / The Coca-Cola Company | 0.00 | 0.00 | 0.22 | -0.90 | 0.2444 | -0.0144 | |||

| CSCO / Cisco Systems, Inc. | 0.00 | 0.22 | 0.2401 | 0.2401 | |||||

| ABBV / AbbVie Inc. | 0.00 | 0.00 | 0.21 | -11.44 | 0.2313 | -0.0418 | |||

| MO / Altria Group, Inc. | 0.00 | 0.00 | 0.21 | -2.37 | 0.2282 | -0.0162 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | 0.21 | 0.2281 | 0.2281 | |||||

| LNTH / Lantheus Holdings, Inc. | 0.00 | 0.00 | 0.20 | -16.32 | 0.2217 | -0.0548 | |||

| ROP / Roper Technologies, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MMM / 3M Company | 0.00 | -100.00 | 0.00 | 0.0000 |