Mga Batayang Estadistika

| Nilai Portofolio | $ 83,630,744 |

| Posisi Saat Ini | 44 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

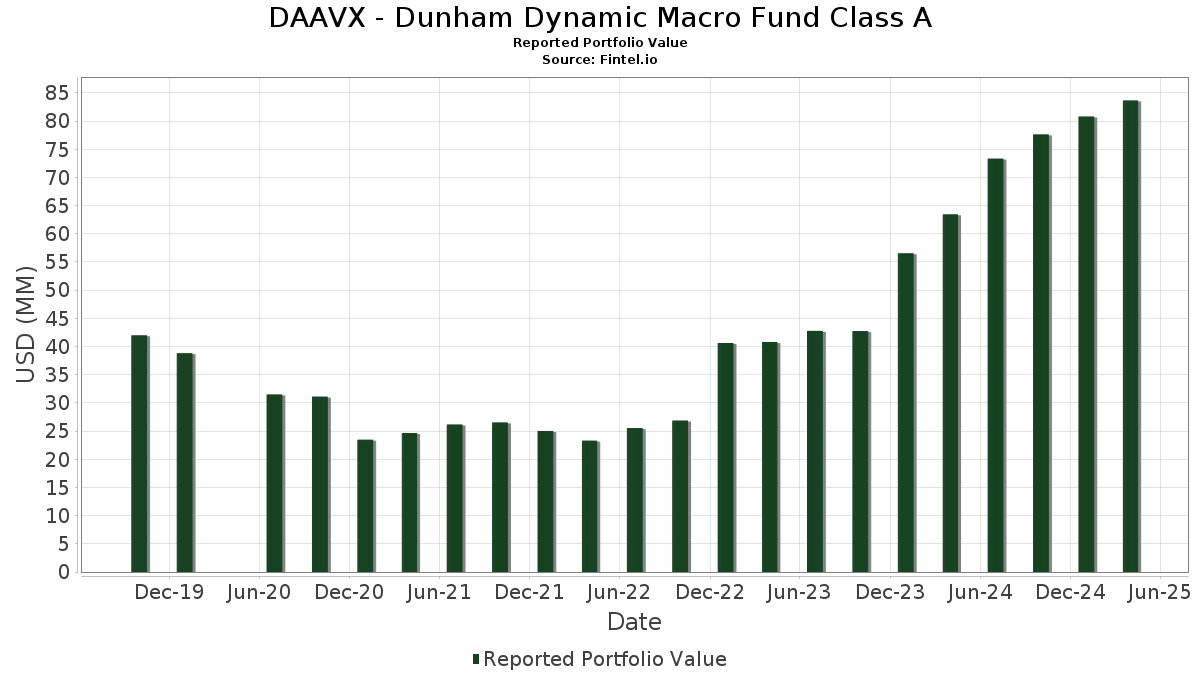

DAAVX - Dunham Dynamic Macro Fund Class A telah mengungkapkan total kepemilikan 44 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 83,630,744 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama DAAVX - Dunham Dynamic Macro Fund Class A adalah Morgan Stanley Institutional Liquidity Funds Government Portfolio, Institutional Class (US:US61747C7074) , SPDR S&P 500 ETF (US:SPY) , Invesco Exchange-Traded Fund Trust II - Invesco NASDAQ 100 ETF (US:QQQM) , Franklin Templeton ETF Trust - Franklin FTSE Japan ETF (US:FLJP) , and United States Treasury Note/Bond (US:US912828K742) . Posisi baru DAAVX - Dunham Dynamic Macro Fund Class A meliputi: Morgan Stanley Institutional Liquidity Funds Government Portfolio, Institutional Class (US:US61747C7074) , United States Treasury Note/Bond (US:US912828K742) , United States Treasury Note/Bond (US:US912828ZT04) , United States Treasury Note/Bond (US:US912828XB14) , and United States Treasury Note/Bond (US:US91282CEU18) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 14.40 | 16.9900 | 4.9653 | ||

| 2.99 | 3.5324 | 3.5324 | ||

| 0.11 | 2.76 | 3.2510 | 3.2192 | |

| 1.46 | 1.7214 | 1.7214 | ||

| 2.48 | 2.9275 | 1.1252 | ||

| 2.45 | 2.8921 | 1.1222 | ||

| 2.95 | 3.4813 | 1.1139 | ||

| 3.48 | 4.1003 | 1.0992 | ||

| 3.19 | 3.7612 | 0.7629 | ||

| 3.00 | 3.5354 | 0.5159 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.03 | 5.99 | 7.0688 | -1.5262 | |

| 0.01 | 6.77 | 7.9798 | -1.3685 | |

| -0.28 | -0.3271 | -0.3271 | ||

| -0.22 | -0.2603 | -0.2603 | ||

| 2.49 | 2.9415 | -0.0778 | ||

| 1.50 | 1.7676 | -0.0494 | ||

| 1.94 | 2.2921 | -0.0436 | ||

| 1.49 | 1.7520 | -0.0358 | ||

| 1.92 | 2.2662 | -0.0347 | ||

| 1.92 | 2.2704 | -0.0344 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-06-26 untuk periode pelaporan 2025-04-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US61747C7074 / Morgan Stanley Institutional Liquidity Funds Government Portfolio, Institutional Class | 14.40 | 45.57 | 16.9900 | 4.9653 | |||||

| SPY / SPDR S&P 500 ETF | 0.01 | -4.56 | 6.77 | -12.06 | 7.9798 | -1.3685 | |||

| QQQM / Invesco Exchange-Traded Fund Trust II - Invesco NASDAQ 100 ETF | 0.03 | -6.99 | 5.99 | -15.27 | 7.0688 | -1.5262 | |||

| FLJP / Franklin Templeton ETF Trust - Franklin FTSE Japan ETF | 0.15 | 3.80 | 4.68 | 8.97 | 5.5186 | 0.3010 | |||

| US912828K742 / United States Treasury Note/Bond | 3.48 | 40.79 | 4.1003 | 1.0992 | |||||

| FEZ / SPDR Index Shares Funds - SPDR EURO STOXX 50 ETF | 0.06 | -4.06 | 3.46 | 3.56 | 4.0803 | 0.0206 | |||

| FLGB / Franklin Templeton ETF Trust - Franklin FTSE United Kingdom ETF | 0.11 | -3.68 | 3.28 | 2.12 | 3.8646 | -0.0337 | |||

| US912828ZT04 / United States Treasury Note/Bond | 3.19 | 29.23 | 3.7612 | 0.7629 | |||||

| US912828XB14 / United States Treasury Note/Bond | 3.00 | 20.65 | 3.5354 | 0.5159 | |||||

| US91282CEU18 / United States Treasury Note/Bond | 2.99 | 3.5324 | 3.5324 | ||||||

| US912828Y792 / United States Treasury Note/Bond | 2.99 | 20.39 | 3.5255 | 0.5084 | |||||

| US91282CAM38 / United States Treasury Note/Bond | 2.95 | 51.49 | 3.4813 | 1.1139 | |||||

| COMT / iShares U.S. ETF Trust - iShares GSCI Commodity Dynamic Roll Strategy ETF | 0.11 | 11,280.00 | 2.76 | 10,500.00 | 3.2510 | 3.2192 | |||

| US912828XZ81 / U.S. Treasury Notes 2.75%, due 06/30/2025 | 2.49 | 0.36 | 2.9415 | -0.0778 | |||||

| US9128285N64 / United States Treasury Note/Bond | 2.48 | 67.30 | 2.9275 | 1.1252 | |||||

| US91282CAT80 / United States Treasury Note/Bond | 2.45 | 68.34 | 2.8921 | 1.1222 | |||||

| US91282CBQ33 / United States Treasury Note/Bond | 1.94 | 1.09 | 2.2921 | -0.0436 | |||||

| US91282CDG33 / United States Treasury Note/Bond | 1.92 | 1.48 | 2.2704 | -0.0344 | |||||

| US91282CDQ15 / United States Treasury Note/Bond | 1.92 | 1.59 | 2.2669 | -0.0317 | |||||

| US91282CCZ23 / United States Treasury Note/Bond | 1.92 | 1.48 | 2.2662 | -0.0347 | |||||

| US91282CGE57 / United States Treasury Note/Bond | 1.50 | 0.20 | 1.7676 | -0.0494 | |||||

| US459058JE46 / INTERNATIONAL BK RECON and DEVEL 0.375% 07/28/2025 | 1.49 | 0.95 | 1.7520 | -0.0358 | |||||

| US045167DU47 / Asian Development Bank | 1.47 | 1.38 | 1.7376 | -0.0285 | |||||

| US045167FC21 / Asian Development Bank | 1.46 | 1.7214 | 1.7214 | ||||||

| US91282CCW91 / UNITED STATES TREASURY NOTE 0.75000000 | 1.44 | 1.41 | 1.7003 | -0.0267 | |||||

| US9128286L99 / United States Treasury Note/Bond | 0.99 | 0.82 | 1.1618 | -0.0262 | |||||

| Euro-BTP Future Jun25 / DIR (DE000F1B2NF9) | 0.15 | 0.1726 | 0.1726 | ||||||

| TOPIX INDX FUTR Jun25 / DE (N/A) | 0.12 | 0.1474 | 0.1474 | ||||||

| US 10YR NOTE (CBT)Jun25 / DIR (N/A) | 0.12 | 0.1467 | 0.1467 | ||||||

| LONG GILT FUTURE Jun25 / DIR (GB00MDWGKH25) | 0.12 | 0.1374 | 0.1374 | ||||||

| Euro-OAT Future Jun25 / DIR (DE000F1B2NL7) | 0.05 | 0.0600 | 0.0600 | ||||||

| EURO-BUND FUTURE Jun25 / DIR (DE000F1B2NG7) | 0.04 | 0.0434 | 0.0434 | ||||||

| CURRENCY CONTRACT - EUR / DFE (N/A) | 0.02 | 0.0268 | 0.0268 | ||||||

| CURRENCY CONTRACT - GBP / DFE (N/A) | 0.02 | 0.0238 | 0.0238 | ||||||

| S&P500 EMINI FUT Jun25 / DE (N/A) | 0.02 | 0.0232 | 0.0232 | ||||||

| Euro-BONO Sp Gov Jun25 / DIR (DE000F1B2NB8) | 0.02 | 0.0209 | 0.0209 | ||||||

| CURRENCY CONTRACT - JPY / DFE (N/A) | 0.02 | 0.0196 | 0.0196 | ||||||

| EURO STOXX 50 Jun25 / DE (DE000C6ZNNN9) | 0.01 | 0.0163 | 0.0163 | ||||||

| FTSE 100 IDX FUT Jun25 / DE (GB00M251VK77) | 0.01 | 0.0105 | 0.0105 | ||||||

| CURRENCY CONTRACT - USD / DFE (N/A) | 0.00 | 0.0013 | 0.0013 | ||||||

| CURRENCY CONTRACT - USD / DFE (N/A) | 0.00 | 0.0013 | 0.0013 | ||||||

| MOUNT VERNON LIQUID ASSETS PORTFOLIO / STIV (N/A) | 0.00 | 0.00 | 0.0000 | 0.0000 | |||||

| NASDAQ 100 E-MINI Jun25 / DE (N/A) | -0.01 | -0.0075 | -0.0075 | ||||||

| CURRENCY CONTRACT - USD / DFE (N/A) | -0.22 | -0.2603 | -0.2603 | ||||||

| CURRENCY CONTRACT - USD / DFE (N/A) | -0.28 | -0.3271 | -0.3271 |