Mga Batayang Estadistika

| Nilai Portofolio | $ 27,422,588 |

| Posisi Saat Ini | 118 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

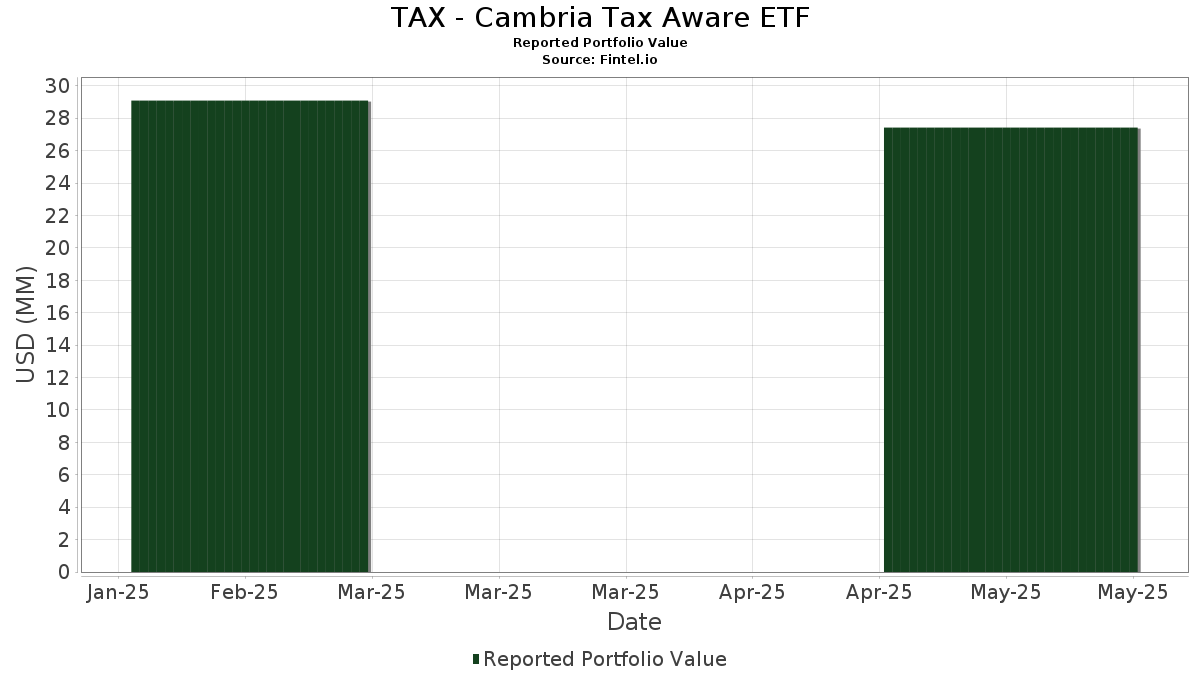

TAX - Cambria Tax Aware ETF telah mengungkapkan total kepemilikan 118 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 27,422,588 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama TAX - Cambria Tax Aware ETF adalah Vanguard Index Funds - Vanguard Total Stock Market ETF (US:VTI) , iShares Trust - iShares Core S&P 500 ETF (US:IVV) , Invesco Exchange-Traded Fund Trust - Invesco S&P 500 Equal Weight ETF (US:RSP) , Advanced Micro Devices, Inc. (US:AMD) , and Calamos ETF Trust - Calamos S&P 500 Structured Alt Protection ETF - December (US:CPSD) . Posisi baru TAX - Cambria Tax Aware ETF meliputi: Constellation Energy Corporation (US:CEG) , Mattel, Inc. (MX:MAT) , Woodward, Inc. (US:WWD) , AerCap Holdings N.V. (US:AER) , and TechnipFMC plc (US:FTI) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.32 | 1.1800 | 1.1800 | |

| 0.02 | 0.30 | 1.1100 | 1.1100 | |

| 0.00 | 0.29 | 1.0500 | 1.0500 | |

| 0.00 | 0.28 | 1.0200 | 1.0200 | |

| 0.00 | 0.28 | 1.0200 | 1.0200 | |

| 0.01 | 0.28 | 1.0100 | 1.0100 | |

| 0.00 | 0.28 | 1.0100 | 1.0100 | |

| 0.00 | 0.27 | 0.9700 | 0.9700 | |

| 0.01 | 0.27 | 0.9700 | 0.9700 | |

| 0.00 | 0.26 | 0.9600 | 0.9600 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.22 | 0.8100 | -6.8000 | ||

| 0.00 | 0.00 | -1.5600 | ||

| 0.00 | 0.00 | -1.0000 | ||

| 0.00 | 0.20 | 0.7200 | -0.2900 | |

| 0.00 | 0.20 | 0.7400 | -0.2600 | |

| 0.01 | 0.25 | 0.9100 | -0.2100 | |

| 0.01 | 0.22 | 0.8200 | -0.2000 | |

| 0.00 | 0.00 | -0.2000 | ||

| 0.00 | 0.00 | -0.1900 | ||

| 0.00 | 0.00 | -0.1900 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-30 untuk periode pelaporan 2025-05-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.01 | -5.03 | 3.45 | -6.02 | 12.5900 | -0.0400 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.00 | -4.85 | 0.77 | -5.55 | 2.7900 | 0.0000 | |||

| RSP / Invesco Exchange-Traded Fund Trust - Invesco S&P 500 Equal Weight ETF | 0.00 | -5.03 | 0.76 | -7.10 | 2.7700 | -0.0400 | |||

| AMD / Advanced Micro Devices, Inc. | 0.01 | -5.00 | 0.58 | 5.26 | 2.1200 | 0.2200 | |||

| CPSD / Calamos ETF Trust - Calamos S&P 500 Structured Alt Protection ETF - December | 0.02 | -5.02 | 0.55 | -4.82 | 2.0200 | 0.0200 | |||

| BOXX / EA Series Trust - Alpha Architect 1-3 Month Box ETF | 0.00 | -4.92 | 0.52 | -3.88 | 1.9000 | 0.0400 | |||

| STRL / Sterling Infrastructure, Inc. | 0.00 | -4.93 | 0.46 | 40.74 | 1.6600 | 0.5400 | |||

| URBN / Urban Outfitters, Inc. | 0.01 | -5.00 | 0.37 | 14.02 | 1.3400 | 0.2300 | |||

| FIX / Comfort Systems USA, Inc. | 0.00 | -4.64 | 0.35 | 25.62 | 1.2900 | 0.3200 | |||

| THC / Tenet Healthcare Corporation | 0.00 | -4.96 | 0.35 | 26.91 | 1.2700 | 0.3200 | |||

| EME / EMCOR Group, Inc. | 0.00 | -4.92 | 0.33 | 9.73 | 1.2000 | 0.1700 | |||

| PAYC / Paycom Software, Inc. | 0.00 | -4.98 | 0.33 | 12.41 | 1.1900 | 0.1900 | |||

| CEG / Constellation Energy Corporation | 0.00 | 0.32 | 1.1800 | 1.1800 | |||||

| EXEL / Exelixis, Inc. | 0.01 | -5.03 | 0.32 | 5.92 | 1.1700 | 0.1200 | |||

| LBRDA / Liberty Broadband Corporation | 0.00 | -4.95 | 0.32 | 8.11 | 1.1700 | 0.1500 | |||

| OLLI / Ollie's Bargain Outlet Holdings, Inc. | 0.00 | -4.88 | 0.31 | 2.30 | 1.1400 | 0.0900 | |||

| USFD / US Foods Holding Corp. | 0.00 | -4.92 | 0.31 | 4.71 | 1.1400 | 0.1200 | |||

| ACM / AECOM | 0.00 | -4.85 | 0.31 | 4.38 | 1.1300 | 0.1100 | |||

| LOPE / Grand Canyon Education, Inc. | 0.00 | -4.77 | 0.31 | 4.76 | 1.1200 | 0.1100 | |||

| WAB / Westinghouse Air Brake Technologies Corporation | 0.00 | -4.90 | 0.31 | 3.73 | 1.1200 | 0.1100 | |||

| MAT / Mattel, Inc. | 0.02 | 0.30 | 1.1100 | 1.1100 | |||||

| PFGC / Performance Food Group Company | 0.00 | -4.91 | 0.30 | 0.00 | 1.1000 | 0.0600 | |||

| FLEX / Flex Ltd. | 0.01 | -4.97 | 0.30 | 6.01 | 1.1000 | 0.1300 | |||

| DOCU / DocuSign, Inc. | 0.00 | -4.91 | 0.30 | 1.02 | 1.0900 | 0.0800 | |||

| ITT / ITT Inc. | 0.00 | -4.97 | 0.29 | 1.03 | 1.0700 | 0.0700 | |||

| JBL / Jabil Inc. | 0.00 | -4.89 | 0.29 | 3.17 | 1.0700 | 0.0900 | |||

| WWD / Woodward, Inc. | 0.00 | 0.29 | 1.0500 | 1.0500 | |||||

| MKL / Markel Group Inc. | 0.00 | -3.90 | 0.29 | -3.37 | 1.0500 | 0.0300 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | -4.12 | 0.28 | -6.02 | 1.0300 | 0.0000 | |||

| DIS / The Walt Disney Company | 0.00 | -5.03 | 0.28 | -5.70 | 1.0300 | 0.0000 | |||

| ZWS / Zurn Elkay Water Solutions Corporation | 0.01 | -4.99 | 0.28 | -3.11 | 1.0200 | 0.0200 | |||

| Fabrinet / EC (N/A) | 0.00 | 0.28 | 1.0200 | 1.0200 | |||||

| TWLO / Twilio Inc. | 0.00 | -4.82 | 0.28 | -6.38 | 1.0200 | -0.0100 | |||

| AER / AerCap Holdings N.V. | 0.00 | 0.28 | 1.0200 | 1.0200 | |||||

| NWS / News Corporation | 0.01 | -5.02 | 0.28 | -3.81 | 1.0200 | 0.0200 | |||

| TDY / Teledyne Technologies Incorporated | 0.00 | -4.13 | 0.28 | -7.36 | 1.0100 | -0.0200 | |||

| RRC / Range Resources Corporation | 0.01 | -5.00 | 0.28 | -2.46 | 1.0100 | 0.0300 | |||

| AN / AutoNation, Inc. | 0.00 | -4.92 | 0.28 | -4.15 | 1.0100 | 0.0200 | |||

| KNF / Knife River Corporation | 0.00 | -5.03 | 0.28 | -6.42 | 1.0100 | -0.0100 | |||

| FTI / TechnipFMC plc | 0.01 | 0.28 | 1.0100 | 1.0100 | |||||

| COOP / Mr. Cooper Group Inc. | 0.00 | 0.28 | 1.0100 | 1.0100 | |||||

| SKX / Skechers U.S.A., Inc. | 0.00 | -5.01 | 0.28 | -3.17 | 1.0000 | 0.0200 | |||

| J / Jacobs Solutions Inc. | 0.00 | -4.98 | 0.27 | -6.16 | 1.0000 | -0.0100 | |||

| GL / Globe Life Inc. | 0.00 | -4.87 | 0.27 | -9.06 | 0.9900 | -0.0400 | |||

| GTES / Gates Industrial Corporation plc | 0.01 | -5.03 | 0.27 | -6.87 | 0.9900 | -0.0100 | |||

| FFIV / F5, Inc. | 0.00 | -4.84 | 0.27 | -7.24 | 0.9800 | -0.0200 | |||

| CCL / Carnival Corporation & plc | 0.01 | -5.03 | 0.27 | -7.90 | 0.9800 | -0.0200 | |||

| EXPE / Expedia Group, Inc. | 0.00 | 0.27 | 0.9700 | 0.9700 | |||||

| NWSA / News Corporation | 0.01 | 0.27 | 0.9700 | 0.9700 | |||||

| CHTR / Charter Communications, Inc. | 0.00 | 0.26 | 0.9600 | 0.9600 | |||||

| AME / AMETEK, Inc. | 0.00 | -5.03 | 0.26 | -10.24 | 0.9600 | -0.0500 | |||

| WCC / WESCO International, Inc. | 0.00 | -4.75 | 0.26 | -11.49 | 0.9600 | -0.0600 | |||

| PYPL / PayPal Holdings, Inc. | 0.00 | -4.90 | 0.26 | -6.12 | 0.9600 | 0.0000 | |||

| CART / Maplebear Inc. | 0.01 | -5.04 | 0.26 | 5.74 | 0.9400 | 0.1000 | |||

| MCK / McKesson Corporation | 0.00 | 0.26 | 0.9400 | 0.9400 | |||||

| FCNCA / First Citizens BancShares, Inc. | 0.00 | -4.14 | 0.26 | -13.51 | 0.9400 | -0.0800 | |||

| COR / Cencora, Inc. | 0.00 | 0.26 | 0.9300 | 0.9300 | |||||

| VMI / Valmont Industries, Inc. | 0.00 | -4.32 | 0.25 | -12.76 | 0.9200 | -0.0800 | |||

| GPI / Group 1 Automotive, Inc. | 0.00 | -4.78 | 0.25 | -12.15 | 0.9200 | -0.0700 | |||

| LAD / Lithia Motors, Inc. | 0.00 | -5.01 | 0.25 | -12.50 | 0.9200 | -0.0700 | |||

| PPC / Pilgrim's Pride Corporation | 0.01 | -5.01 | 0.25 | -14.33 | 0.9200 | -0.0900 | |||

| AIT / Applied Industrial Technologies, Inc. | 0.00 | -4.64 | 0.25 | -13.75 | 0.9200 | -0.0800 | |||

| ACIW / ACI Worldwide, Inc. | 0.01 | -4.94 | 0.25 | -23.55 | 0.9100 | -0.2100 | |||

| UTHR / United Therapeutics Corporation | 0.00 | -4.46 | 0.25 | -4.65 | 0.9000 | 0.0100 | |||

| JAZZ / Jazz Pharmaceuticals plc | 0.00 | 0.24 | 0.8700 | 0.8700 | |||||

| JLL / Jones Lang LaSalle Incorporated | 0.00 | -4.94 | 0.23 | -22.22 | 0.8400 | -0.1800 | |||

| AFL / Aflac Incorporated | 0.00 | -4.86 | 0.23 | -10.12 | 0.8400 | -0.0400 | |||

| ABG / Asbury Automotive Group, Inc. | 0.00 | -4.58 | 0.23 | -19.22 | 0.8300 | -0.1400 | |||

| EPAM / EPAM Systems, Inc. | 0.00 | -4.85 | 0.23 | -19.64 | 0.8200 | -0.1400 | |||

| BILL / BILL Holdings, Inc. | 0.01 | -5.00 | 0.22 | -24.92 | 0.8200 | -0.2000 | |||

| FGXXX / First American Funds Inc - First American Government Obligations Fund Class X | 0.22 | -89.96 | 0.8100 | -6.8000 | |||||

| GMED / Globus Medical, Inc. | 0.00 | -4.98 | 0.20 | -30.00 | 0.7400 | -0.2600 | |||

| ALK / Alaska Air Group, Inc. | 0.00 | -5.02 | 0.20 | -33.11 | 0.7200 | -0.2900 | |||

| AMZN / Amazon.com, Inc. | 0.00 | -4.47 | 0.16 | -8.19 | 0.5800 | -0.0100 | |||

| LLY / Eli Lilly and Company | 0.00 | -3.12 | 0.14 | -22.16 | 0.5000 | -0.1100 | |||

| ITOT / iShares Trust - iShares Core S&P Total U.S. Stock Market ETF | 0.00 | -4.82 | 0.14 | -5.52 | 0.5000 | 0.0000 | |||

| IVE / iShares Trust - iShares S&P 500 Value ETF | 0.00 | -4.49 | 0.12 | -8.40 | 0.4400 | -0.0100 | |||

| ADBE / Adobe Inc. | 0.00 | -4.24 | 0.11 | -9.68 | 0.4100 | -0.0200 | |||

| HIMS / Hims & Hers Health, Inc. | 0.00 | -4.76 | 0.11 | 20.00 | 0.4000 | 0.0900 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | -4.33 | 0.11 | -27.40 | 0.3900 | -0.1100 | |||

| GILD / Gilead Sciences, Inc. | 0.00 | -4.44 | 0.10 | -8.33 | 0.3600 | -0.0100 | |||

| FCN / FTI Consulting, Inc. | 0.00 | -4.82 | 0.10 | -5.83 | 0.3500 | 0.0000 | |||

| EFA / iShares Trust - iShares MSCI EAFE ETF | 0.00 | -4.80 | 0.08 | 3.70 | 0.3100 | 0.0300 | |||

| PTLC / Pacer Funds Trust - Pacer Trendpilot US Large Cap ETF | 0.00 | -4.87 | 0.08 | -15.05 | 0.2900 | -0.0300 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | -2.64 | 0.07 | -38.32 | 0.2400 | -0.1300 | |||

| GOOGL / Alphabet Inc. | 0.00 | -4.63 | 0.06 | -4.55 | 0.2300 | 0.0000 | |||

| BLK / BlackRock, Inc. | 0.00 | 0.00 | 0.06 | 0.00 | 0.2300 | 0.0100 | |||

| SPYC / Simplify Exchange Traded Funds - Simplify US Equity PLUS Convexity ETF | 0.00 | -5.03 | 0.06 | 0.00 | 0.2100 | 0.0100 | |||

| MOAT / VanEck ETF Trust - VanEck Morningstar Wide Moat ETF | 0.00 | -4.55 | 0.06 | -6.67 | 0.2100 | 0.0000 | |||

| MTH / Meritage Homes Corporation | 0.00 | -4.54 | 0.06 | -16.42 | 0.2100 | -0.0200 | |||

| BLDR / Builders FirstSource, Inc. | 0.00 | -3.89 | 0.05 | -26.56 | 0.1700 | -0.0500 | |||

| WM / Waste Management, Inc. | 0.00 | -3.31 | 0.04 | 0.00 | 0.1500 | 0.0100 | |||

| META / Meta Platforms, Inc. | 0.00 | 0.00 | 0.04 | -5.00 | 0.1400 | 0.0000 | |||

| SLB / Schlumberger Limited | 0.00 | -4.54 | 0.04 | -24.49 | 0.1400 | -0.0300 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.00 | -3.16 | 0.04 | 2.94 | 0.1300 | 0.0100 | |||

| TDG / TransDigm Group Incorporated | 0.00 | 0.00 | 0.03 | 7.41 | 0.1100 | 0.0200 | |||

| PLTR / Palantir Technologies Inc. | 0.00 | -2.71 | 0.03 | 55.56 | 0.1000 | 0.0400 | |||

| STLD / Steel Dynamics, Inc. | 0.00 | -2.71 | 0.03 | -10.34 | 0.1000 | 0.0000 | |||

| TCEHY / Tencent Holdings Limited - Depositary Receipt (Common Stock) | 0.00 | -5.03 | 0.02 | -4.55 | 0.0800 | 0.0000 | |||

| VMC / Vulcan Materials Company | 0.00 | 0.00 | 0.02 | 5.56 | 0.0700 | 0.0100 | |||

| SMH / VanEck ETF Trust - VanEck Semiconductor ETF | 0.00 | 0.00 | 0.02 | 5.56 | 0.0700 | 0.0100 | |||

| VEEV / Veeva Systems Inc. | 0.00 | 0.00 | 0.02 | 20.00 | 0.0700 | 0.0200 | |||

| SYK / Stryker Corporation | 0.00 | 0.00 | 0.02 | 0.00 | 0.0600 | 0.0000 | |||

| FICO / Fair Isaac Corporation | 0.00 | 0.00 | 0.02 | -6.25 | 0.0600 | 0.0000 | |||

| BA / The Boeing Company | 0.00 | 0.00 | 0.01 | 20.00 | 0.0500 | 0.0100 | |||

| LPLA / LPL Financial Holdings Inc. | 0.00 | 0.00 | 0.01 | 0.00 | 0.0500 | 0.0100 | |||

| DUK / Duke Energy Corporation | 0.00 | 0.00 | 0.01 | 0.00 | 0.0400 | 0.0000 | |||

| GE / General Electric Company | 0.00 | 0.00 | 0.01 | 28.57 | 0.0300 | 0.0000 | |||

| D / Dominion Energy, Inc. | 0.00 | -3.68 | 0.01 | -11.11 | 0.0300 | 0.0000 | |||

| ADSK / Autodesk, Inc. | 0.00 | 0.00 | 0.01 | 16.67 | 0.0300 | 0.0100 | |||

| GNRC / Generac Holdings Inc. | 0.00 | 0.00 | 0.01 | -14.29 | 0.0200 | -0.0100 | |||

| MELI / MercadoLibre, Inc. | 0.00 | 0.00 | 0.01 | 25.00 | 0.0200 | 0.0100 | |||

| RBC / RBC Bearings Incorporated | 0.00 | 0.00 | 0.01 | 0.00 | 0.0200 | 0.0000 | |||

| BCPC / Balchem Corporation | 0.00 | 0.00 | 0.00 | -25.00 | 0.0100 | 0.0000 | |||

| AMTM / Amentum Holdings, Inc. | 0.00 | 0.00 | 0.0100 | 0.0100 | |||||

| IT / Gartner, Inc. | 0.00 | 0.00 | 0.00 | 0.00 | 0.0100 | 0.0000 | |||

| ICLR / ICON Public Limited Company | 0.00 | 0.00 | 0.00 | -50.00 | 0.0100 | 0.0000 | |||

| ALSN / Allison Transmission Holdings, Inc. | 0.00 | 0.00 | 0.00 | 0.0000 | 0.0000 | ||||

| PNC / The PNC Financial Services Group, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0900 | ||||

| TGT / Target Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.0200 | ||||

| FSS / Federal Signal Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.0100 | ||||

| JNJ / Johnson & Johnson | 0.00 | -100.00 | 0.00 | -100.00 | -0.0600 | ||||

| MS / Morgan Stanley | 0.00 | -100.00 | 0.00 | -100.00 | -0.2000 | ||||

| TXN / Texas Instruments Incorporated | 0.00 | -100.00 | 0.00 | -100.00 | -0.0700 | ||||

| AMGN / Amgen Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.1000 | ||||

| REGN / Regeneron Pharmaceuticals, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0400 | ||||

| JD / JD.com, Inc. - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | -100.00 | -0.1000 | ||||

| GS / The Goldman Sachs Group, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.5600 | ||||

| BUD / Anheuser-Busch InBev SA/NV - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | -100.00 | -0.1900 | ||||

| WSO / Watsco, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0100 | ||||

| CALM / Cal-Maine Foods, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0900 | ||||

| PAGP / Plains GP Holdings, L.P. - Limited Partnership | 0.00 | -100.00 | 0.00 | -100.00 | -0.0700 | ||||

| UNM / Unum Group | 0.00 | -100.00 | 0.00 | -100.00 | -0.0800 | ||||

| RTO / Rentokil Initial plc - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | -100.00 | -0.0500 | ||||

| AZPN / Aspen Technology, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.0000 | ||||

| SBUX / Starbucks Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.0400 | ||||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 0.00 | -100.00 | 0.00 | -100.00 | -0.1900 |