Mga Batayang Estadistika

| Nilai Portofolio | $ 93,124,580 |

| Posisi Saat Ini | 67 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

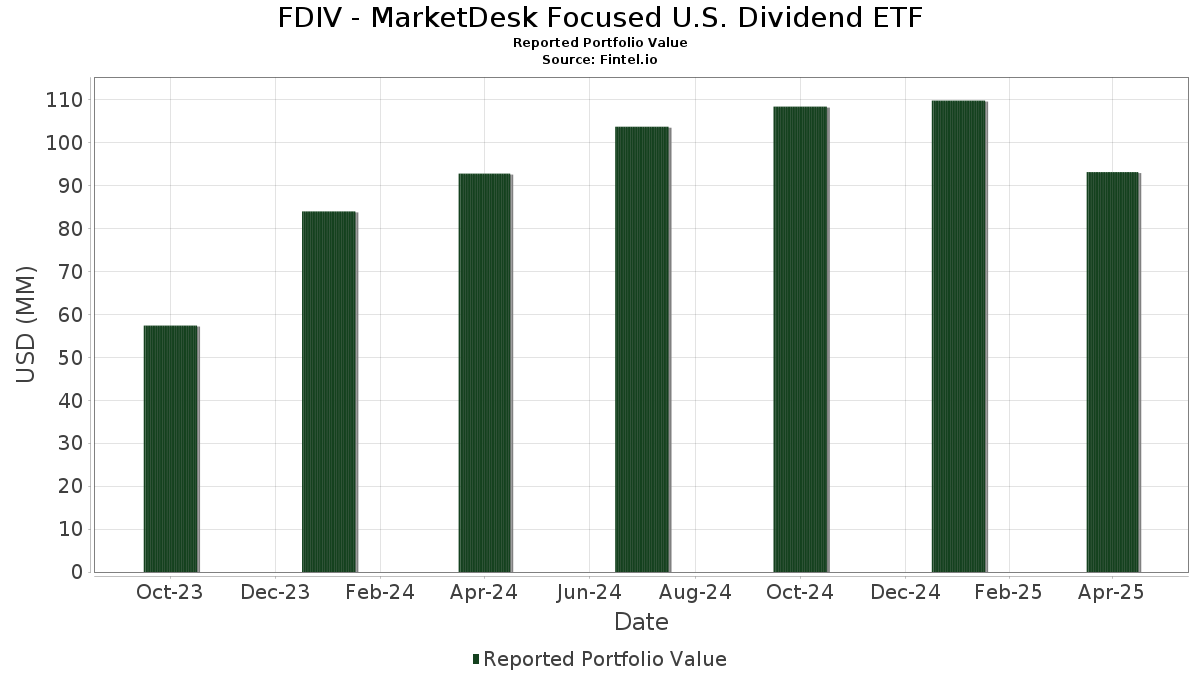

FDIV - MarketDesk Focused U.S. Dividend ETF telah mengungkapkan total kepemilikan 67 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 93,124,580 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama FDIV - MarketDesk Focused U.S. Dividend ETF adalah Lockheed Martin Corporation (US:LMT) , PPG Industries, Inc. (US:PPG) , Brown-Forman Corp. - Class B (US:BFB) , A. O. Smith Corporation (US:AOS) , and The Home Depot, Inc. (US:HD) . Posisi baru FDIV - MarketDesk Focused U.S. Dividend ETF meliputi: The Home Depot, Inc. (US:HD) , The Clorox Company (US:CLX) , Accenture plc (US:ACN) , CSX Corporation (US:CSX) , and DICK'S Sporting Goods, Inc. (US:DKS) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.01 | 1.99 | 2.1400 | 2.1400 | |

| 0.01 | 1.96 | 2.1000 | 2.1000 | |

| 0.01 | 1.92 | 2.0600 | 2.0600 | |

| 0.07 | 1.89 | 2.0200 | 2.0200 | |

| 0.01 | 1.77 | 1.9000 | 1.9000 | |

| 0.01 | 1.98 | 2.1200 | 1.1200 | |

| 0.01 | 1.03 | 1.1000 | 1.1000 | |

| 0.03 | 1.95 | 2.0900 | 1.0900 | |

| 0.01 | 1.01 | 1.0800 | 1.0800 | |

| 0.03 | 1.93 | 2.0700 | 1.0700 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.00 | -2.0500 | ||

| 0.00 | 0.00 | -2.0200 | ||

| 0.00 | 0.00 | -1.9900 | ||

| 0.00 | 0.00 | -1.9700 | ||

| 0.00 | 0.00 | -1.9100 | ||

| 0.01 | 0.83 | 0.8900 | -1.0800 | |

| 0.01 | 0.82 | 0.8800 | -1.0700 | |

| 0.00 | 0.00 | -1.0300 | ||

| 0.00 | 0.00 | -1.0300 | ||

| 0.00 | 0.00 | -1.0100 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-06-27 untuk periode pelaporan 2025-04-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| LMT / Lockheed Martin Corporation | 0.00 | -8.60 | 2.15 | -5.67 | 2.3000 | 0.2300 | |||

| PPG / PPG Industries, Inc. | 0.02 | 3.70 | 2.04 | -2.16 | 2.1800 | 0.2900 | |||

| BFB / Brown-Forman Corp. - Class B | 0.06 | -14.68 | 2.03 | -9.92 | 2.1700 | 0.1200 | |||

| AOS / A. O. Smith Corporation | 0.03 | -7.27 | 2.02 | -6.52 | 2.1700 | 0.2000 | |||

| HD / The Home Depot, Inc. | 0.01 | 1.99 | 2.1400 | 2.1400 | |||||

| AFG / American Financial Group, Inc. | 0.02 | -2.97 | 1.98 | -10.03 | 2.1300 | 0.1200 | |||

| ADP / Automatic Data Processing, Inc. | 0.01 | 82.18 | 1.98 | 80.73 | 2.1200 | 1.1200 | |||

| LW / Lamb Weston Holdings, Inc. | 0.04 | 1.82 | 1.97 | -10.29 | 2.1100 | 0.1100 | |||

| CLX / The Clorox Company | 0.01 | 1.96 | 2.1000 | 2.1000 | |||||

| GPC / Genuine Parts Company | 0.02 | -12.24 | 1.96 | -11.28 | 2.1000 | 0.0900 | |||

| ESNT / Essent Group Ltd. | 0.03 | 80.77 | 1.95 | 76.82 | 2.0900 | 1.0900 | |||

| MRK / Merck & Co., Inc. | 0.02 | 1.13 | 1.94 | -12.80 | 2.0800 | 0.0500 | |||

| SYY / Sysco Corporation | 0.03 | -12.19 | 1.93 | -14.02 | 2.0700 | 0.0200 | |||

| SWKS / Skyworks Solutions, Inc. | 0.03 | 142.47 | 1.93 | 75.64 | 2.0700 | 1.0700 | |||

| AVY / Avery Dennison Corporation | 0.01 | -1.65 | 1.93 | -9.40 | 2.0700 | 0.1300 | |||

| ACN / Accenture plc | 0.01 | 1.92 | 2.0600 | 2.0600 | |||||

| GIS / General Mills, Inc. | 0.03 | -9.33 | 1.90 | -14.47 | 2.0400 | 0.0200 | |||

| CSX / CSX Corporation | 0.07 | 1.89 | 2.0200 | 2.0200 | |||||

| TROW / T. Rowe Price Group, Inc. | 0.02 | 9.56 | 1.88 | -17.00 | 2.0100 | -0.0500 | |||

| FLO / Flowers Foods, Inc. | 0.11 | -6.69 | 1.87 | -16.05 | 2.0100 | -0.0200 | |||

| CBT / Cabot Corporation | 0.02 | -5.98 | 1.87 | -14.59 | 2.0000 | 0.0100 | |||

| CMCSA / Comcast Corporation | 0.05 | -9.21 | 1.83 | -7.75 | 1.9700 | 0.1600 | |||

| LANC / Lancaster Colony Corporation | 0.01 | 72.27 | 1.83 | 66.18 | 1.9700 | 0.9700 | |||

| TTC / The Toro Company | 0.03 | 2.68 | 1.83 | -15.81 | 1.9600 | -0.0200 | |||

| PEP / PepsiCo, Inc. | 0.01 | -8.97 | 1.81 | -18.12 | 1.9400 | -0.0800 | |||

| TGT / Target Corporation | 0.02 | 18.77 | 1.80 | -16.70 | 1.9300 | -0.0400 | |||

| BBY / Best Buy Co., Inc. | 0.03 | 3.41 | 1.77 | -19.69 | 1.9000 | -0.1100 | |||

| DKS / DICK'S Sporting Goods, Inc. | 0.01 | 1.77 | 1.9000 | 1.9000 | |||||

| OSK / Oshkosh Corporation | 0.02 | 78.26 | 1.72 | 28.33 | 1.8400 | 0.6200 | |||

| UPS / United Parcel Service, Inc. | 0.02 | 9.53 | 1.72 | -8.62 | 1.8400 | 0.1300 | |||

| VOYA / Voya Financial, Inc. | 0.03 | -6.29 | 1.70 | -21.88 | 1.8300 | -0.1500 | |||

| NKE / NIKE, Inc. | 0.03 | 105.70 | 1.69 | 50.94 | 1.8100 | 0.7900 | |||

| RHI / Robert Half Inc. | 0.04 | 126.19 | 1.61 | 54.70 | 1.7300 | 0.7800 | |||

| NSP / Insperity, Inc. | 0.02 | 58.70 | 1.44 | 37.60 | 1.5500 | 0.6000 | |||

| FAST / Fastenal Company | 0.01 | -13.48 | 1.04 | -4.31 | 1.1200 | 0.1300 | |||

| Bunge Global SA / EC (N/A) | 0.01 | 1.03 | 1.1000 | 1.1000 | |||||

| STZ / Constellation Brands, Inc. | 0.01 | -10.12 | 1.02 | -6.74 | 1.1000 | 0.1000 | |||

| GD / General Dynamics Corporation | 0.00 | -14.57 | 1.02 | -9.50 | 1.0900 | 0.0600 | |||

| MDLZ / Mondelez International, Inc. | 0.01 | -61.51 | 1.02 | -54.78 | 1.0900 | -0.9600 | |||

| 0HQU / CF Industries Holdings, Inc. | 0.01 | 1.01 | 1.0800 | 1.0800 | |||||

| ABT / Abbott Laboratories | 0.01 | 1.00 | 1.0700 | 1.0700 | |||||

| CL / Colgate-Palmolive Company | 0.01 | 0.99 | 1.0700 | 1.0700 | |||||

| HSY / The Hershey Company | 0.01 | -59.91 | 0.99 | -55.09 | 1.0700 | -0.9400 | |||

| HO7 / Hormel Foods Corporation | 0.03 | 0.99 | 1.0600 | 1.0600 | |||||

| NTAP / NetApp, Inc. | 0.01 | 0.98 | 1.0500 | 1.0500 | |||||

| JNJ / Johnson & Johnson | 0.01 | -58.27 | 0.96 | -57.16 | 1.0300 | -1.0000 | |||

| ITW / Illinois Tool Works Inc. | 0.00 | -7.13 | 0.96 | -14.04 | 1.0200 | 0.0100 | |||

| NEE / NextEra Energy, Inc. | 0.01 | 0.95 | 1.0200 | 1.0200 | |||||

| SNA / Snap-on Incorporated | 0.00 | -4.05 | 0.94 | -15.26 | 1.0100 | 0.0000 | |||

| QCOM / QUALCOMM Incorporated | 0.01 | 0.94 | 1.0100 | 1.0100 | |||||

| ROK / Rockwell Automation, Inc. | 0.00 | 0.92 | 0.9900 | 0.9900 | |||||

| KFY / Korn Ferry | 0.01 | 0.91 | 0.9700 | 0.9700 | |||||

| GNTX / Gentex Corporation | 0.04 | 0.90 | 0.9600 | 0.9600 | |||||

| THO / THOR Industries, Inc. | 0.01 | 0.90 | 0.9600 | 0.9600 | |||||

| SLVM / Sylvamo Corporation | 0.01 | 7.07 | 0.89 | -20.32 | 0.9600 | -0.0600 | |||

| TXN / Texas Instruments Incorporated | 0.01 | -9.57 | 0.89 | -21.62 | 0.9600 | -0.0800 | |||

| FDX / FedEx Corporation | 0.00 | 2.32 | 0.86 | -18.76 | 0.9200 | -0.0500 | |||

| LCII / LCI Industries | 0.01 | 1.57 | 0.84 | -25.36 | 0.9000 | -0.1200 | |||

| NXST / Nexstar Media Group, Inc. | 0.01 | -60.78 | 0.83 | -61.68 | 0.8900 | -1.0800 | |||

| LYB / LyondellBasell Industries N.V. | 0.01 | -50.15 | 0.82 | -61.69 | 0.8800 | -1.0700 | |||

| CVX / Chevron Corporation | 0.01 | -16.10 | 0.81 | -23.47 | 0.8700 | -0.1000 | |||

| CHRD / Chord Energy Corporation | 0.01 | -7.38 | 0.80 | -25.63 | 0.8500 | -0.1200 | |||

| NOG / Northern Oil and Gas, Inc. | 0.03 | 8.97 | 0.78 | -26.38 | 0.8400 | -0.1300 | |||

| CRC / California Resources Corporation | 0.02 | 4.54 | 0.78 | -26.69 | 0.8400 | -0.1300 | |||

| CIVI / Civitas Resources, Inc. | 0.03 | 30.54 | 0.77 | -29.98 | 0.8200 | -0.1800 | |||

| MTDR / Matador Resources Company | 0.02 | 0.76 | 0.8100 | 0.8100 | |||||

| FGXXX / First American Funds Inc - First American Government Obligations Fund Class X | 0.19 | -17.80 | 0.2100 | -0.0100 | |||||

| OVV / Ovintiv Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.9700 | ||||

| BC / Brunswick Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -1.0000 | ||||

| KMB / Kimberly-Clark Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -2.0200 | ||||

| HII / Huntington Ingalls Industries, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.0300 | ||||

| DG / Dollar General Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -1.9900 | ||||

| LKQ / LKQ Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -1.0000 | ||||

| PAYX / Paychex, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.0100 | ||||

| THG / The Hanover Insurance Group, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.9900 | ||||

| ADM / Archer-Daniels-Midland Company | 0.00 | -100.00 | 0.00 | -100.00 | -1.0100 | ||||

| KLIC / Kulicke and Soffa Industries, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.0300 | ||||

| ASH / Ashland Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.9100 | ||||

| AMGN / Amgen Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -2.0500 | ||||

| HIG / The Hartford Insurance Group, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.9900 | ||||

| AES / The AES Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -1.0000 | ||||

| MCHP / Microchip Technology Incorporated | 0.00 | -100.00 | 0.00 | -100.00 | -1.9700 |