Mga Batayang Estadistika

| Nilai Portofolio | $ 202,397 |

| Posisi Saat Ini | 134 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

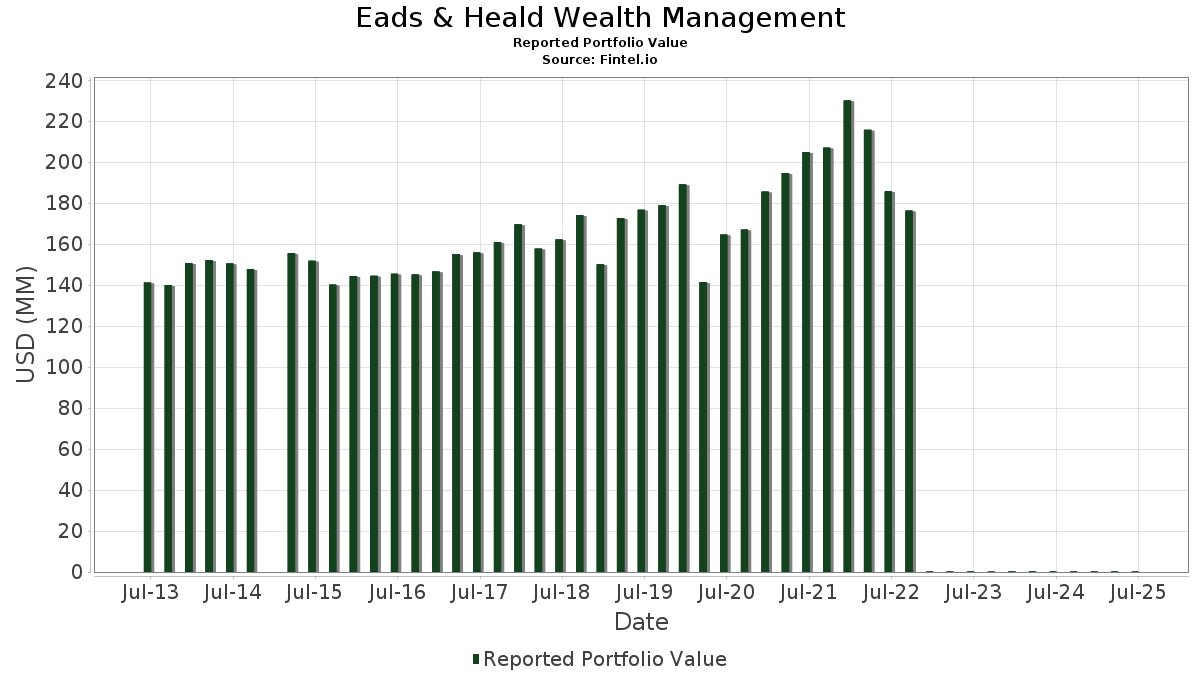

Eads & Heald Wealth Management telah mengungkapkan total kepemilikan 134 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 202,397 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Eads & Heald Wealth Management adalah NVIDIA Corporation (US:NVDA) , Oracle Corporation (US:ORCL) , Costco Wholesale Corporation (US:COST) , Walmart Inc. (US:WMT) , and JPMorgan Chase & Co. (US:JPM) . Posisi baru Eads & Heald Wealth Management meliputi: Hubbell Incorporated (US:HUBB) , Elevance Health, Inc. (US:ELV) , Bank of America Corporation (US:BAC) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.05 | 0.01 | 3.5332 | 0.8278 | |

| 0.02 | 0.00 | 1.9482 | 0.5802 | |

| 0.00 | 0.00 | 0.5346 | 0.5346 | |

| 0.01 | 0.00 | 1.4442 | 0.4654 | |

| 0.04 | 0.00 | 1.7154 | 0.3805 | |

| 0.02 | 0.00 | 1.1606 | 0.2996 | |

| 0.01 | 0.00 | 1.5262 | 0.2939 | |

| 0.00 | 0.00 | 1.7149 | 0.2642 | |

| 0.01 | 0.00 | 0.7643 | 0.2620 | |

| 0.00 | 0.00 | 0.6107 | 0.2475 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.00 | 0.5618 | -0.7071 | |

| 0.01 | 0.00 | 1.2377 | -0.4294 | |

| 0.00 | 0.00 | 0.8755 | -0.2527 | |

| 0.02 | 0.00 | 1.1127 | -0.2111 | |

| 0.01 | 0.00 | 0.6749 | -0.2038 | |

| 0.01 | 0.00 | 1.4832 | -0.2011 | |

| 0.01 | 0.00 | 0.4298 | -0.1736 | |

| 0.01 | 0.00 | 1.0647 | -0.1706 | |

| 0.03 | 0.00 | 1.3251 | -0.1683 | |

| 0.03 | 0.00 | 1.3404 | -0.1601 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-22 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NVDA / NVIDIA Corporation | 0.05 | -7.90 | 0.01 | 40.00 | 3.5332 | 0.8278 | |||

| ORCL / Oracle Corporation | 0.02 | -6.35 | 0.00 | 50.00 | 1.9482 | 0.5802 | |||

| COST / Costco Wholesale Corporation | 0.00 | -4.45 | 0.00 | 0.00 | 1.8167 | -0.0505 | |||

| WMT / Walmart Inc. | 0.04 | -5.98 | 0.00 | 0.00 | 1.8054 | 0.0326 | |||

| JPM / JPMorgan Chase & Co. | 0.01 | -6.01 | 0.00 | 0.00 | 1.7925 | 0.1330 | |||

| APH / Amphenol Corporation | 0.04 | -12.25 | 0.00 | 50.00 | 1.7154 | 0.3805 | |||

| NFLX / Netflix, Inc. | 0.00 | -15.38 | 0.00 | 50.00 | 1.7149 | 0.2642 | |||

| AMZN / Amazon.com, Inc. | 0.02 | -3.94 | 0.00 | 0.00 | 1.6591 | 0.1195 | |||

| SYK / Stryker Corporation | 0.01 | -2.95 | 0.00 | 0.00 | 1.5682 | 0.0052 | |||

| MSFT / Microsoft Corporation | 0.01 | -3.91 | 0.00 | 50.00 | 1.5262 | 0.2939 | |||

| AXP / American Express Company | 0.01 | -6.23 | 0.00 | 50.00 | 1.5208 | 0.1148 | |||

| V / Visa Inc. | 0.01 | -4.06 | 0.00 | 0.00 | 1.4936 | -0.0861 | |||

| AAPL / Apple Inc. | 0.01 | -1.98 | 0.00 | 0.00 | 1.4832 | -0.2011 | |||

| AVGO / Broadcom Inc. | 0.01 | -7.88 | 0.00 | 100.00 | 1.4442 | 0.4654 | |||

| COR / Cencora, Inc. | 0.01 | -5.91 | 0.00 | 0.00 | 1.4229 | -0.0191 | |||

| GWW / W.W. Grainger, Inc. | 0.00 | -2.53 | 0.00 | 0.00 | 1.4071 | -0.0024 | |||

| BKNG / Booking Holdings Inc. | 0.00 | -3.96 | 0.00 | 0.00 | 1.3864 | 0.2054 | |||

| EMR / Emerson Electric Co. | 0.02 | 2.01 | 0.00 | 0.00 | 1.3513 | 0.2313 | |||

| AFL / Aflac Incorporated | 0.03 | -3.18 | 0.00 | 0.00 | 1.3404 | -0.1601 | |||

| ORLY / O'Reilly Automotive, Inc. | 0.03 | 1,350.29 | 0.00 | 0.00 | 1.3251 | -0.1683 | |||

| ADI / Analog Devices, Inc. | 0.01 | -2.27 | 0.00 | 0.00 | 1.2564 | 0.1364 | |||

| FI / Fiserv, Inc. | 0.01 | -2.21 | 0.00 | -33.33 | 1.2377 | -0.4294 | |||

| 0HJI / Automatic Data Processing, Inc. | 0.01 | -2.10 | 0.00 | 0.00 | 1.1764 | -0.0478 | |||

| ITW / Illinois Tool Works Inc. | 0.01 | -1.41 | 0.00 | 0.00 | 1.1739 | -0.0543 | |||

| LRCX / Lam Research Corporation | 0.02 | 3.49 | 0.00 | 100.00 | 1.1606 | 0.2996 | |||

| 0Q18 / Caterpillar Inc. | 0.01 | -2.82 | 0.00 | 0.00 | 1.1571 | 0.1174 | |||

| CSL / Carlisle Companies Incorporated | 0.01 | -1.65 | 0.00 | 0.00 | 1.1196 | 0.0524 | |||

| INTU / Intuit Inc. | 0.00 | -0.07 | 0.00 | 100.00 | 1.1171 | 0.2211 | |||

| GJR / Strats Trust For Procter & Gambel Security - Preferred Security | 0.01 | 0.81 | 0.00 | 0.00 | 1.1156 | -0.1014 | |||

| CHD / Church & Dwight Co., Inc. | 0.02 | -1.03 | 0.00 | 0.00 | 1.1127 | -0.2111 | |||

| SHW / The Sherwin-Williams Company | 0.01 | -1.27 | 0.00 | 0.00 | 1.0657 | -0.0629 | |||

| AMGN / Amgen Inc. | 0.01 | -1.14 | 0.00 | 0.00 | 1.0647 | -0.1706 | |||

| MCD / McDonald's Corporation | 0.01 | -1.24 | 0.00 | 0.00 | 1.0465 | -0.1183 | |||

| CSCO / Cisco Systems, Inc. | 0.03 | -1.79 | 0.00 | 100.00 | 1.0460 | 0.0722 | |||

| FAST / Fastenal Company | 0.05 | 91.17 | 0.00 | 0.00 | 1.0400 | 0.0074 | |||

| EXPD / Expeditors International of Washington, Inc. | 0.02 | -1.76 | 0.00 | 0.00 | 1.0356 | -0.1053 | |||

| APD / Air Products and Chemicals, Inc. | 0.01 | 1.27 | 0.00 | 0.00 | 1.0321 | -0.0635 | |||

| GOOG / Alphabet Inc. | 0.01 | -2.79 | 0.00 | 100.00 | 1.0148 | 0.0726 | |||

| ECL / Ecolab Inc. | 0.01 | 0.52 | 0.00 | 100.00 | 1.0030 | 0.0379 | |||

| CTAS / Cintas Corporation | 0.01 | -5.57 | 0.00 | 0.00 | 0.9560 | -0.0040 | |||

| CVX / Chevron Corporation | 0.01 | 6.68 | 0.00 | -50.00 | 0.9471 | -0.1196 | |||

| ABBV / AbbVie Inc. | 0.01 | -0.62 | 0.00 | -50.00 | 0.9452 | -0.1586 | |||

| CL / Colgate-Palmolive Company | 0.02 | 0.43 | 0.00 | 0.00 | 0.9274 | -0.0509 | |||

| PEP / PepsiCo, Inc. | 0.01 | 8.26 | 0.00 | 0.00 | 0.9101 | -0.0713 | |||

| ABT / Abbott Laboratories | 0.01 | -1.54 | 0.00 | 0.00 | 0.8997 | -0.0166 | |||

| TSCO / Tractor Supply Company | 0.03 | -6.87 | 0.00 | -50.00 | 0.8854 | -0.1351 | |||

| XOM / Exxon Mobil Corporation | 0.02 | -1.35 | 0.00 | 0.00 | 0.8775 | -0.1313 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | -2.06 | 0.00 | -50.00 | 0.8755 | -0.2527 | |||

| SNA / Snap-on Incorporated | 0.01 | 2.37 | 0.00 | 0.00 | 0.8691 | -0.0762 | |||

| NOC / Northrop Grumman Corporation | 0.00 | -2.61 | 0.00 | 0.00 | 0.8098 | -0.0654 | |||

| SBUX / Starbucks Corporation | 0.02 | -2.85 | 0.00 | 0.00 | 0.8068 | -0.1075 | |||

| AMD / Advanced Micro Devices, Inc. | 0.01 | 13.23 | 0.00 | 0.7643 | 0.2620 | ||||

| VMC / Vulcan Materials Company | 0.01 | -3.96 | 0.00 | 0.00 | 0.7624 | 0.0324 | |||

| META / Meta Platforms, Inc. | 0.00 | -5.72 | 0.00 | 0.00 | 0.7574 | 0.1123 | |||

| JNJ / Johnson & Johnson | 0.01 | -0.36 | 0.00 | 0.00 | 0.7525 | -0.0907 | |||

| DOV / Dover Corporation | 0.01 | -3.51 | 0.00 | 0.00 | 0.7396 | -0.0162 | |||

| FDS / FactSet Research Systems Inc. | 0.00 | -0.80 | 0.00 | 0.00 | 0.7372 | -0.0395 | |||

| HD / The Home Depot, Inc. | 0.00 | 7.83 | 0.00 | 0.00 | 0.7085 | 0.0334 | |||

| IDXX / IDEXX Laboratories, Inc. | 0.00 | 10.76 | 0.00 | 0.00 | 0.7011 | 0.1916 | |||

| CTSH / Cognizant Technology Solutions Corporation | 0.02 | 1.37 | 0.00 | 0.00 | 0.6996 | 0.0042 | |||

| HON / Honeywell International Inc. | 0.01 | -2.69 | 0.00 | 0.00 | 0.6937 | 0.0273 | |||

| MAR / Marriott International, Inc. | 0.01 | -9.10 | 0.00 | 0.00 | 0.6887 | 0.0096 | |||

| DHI / D.R. Horton, Inc. | 0.01 | -22.15 | 0.00 | 0.00 | 0.6749 | -0.2038 | |||

| ROP / Roper Technologies, Inc. | 0.00 | -1.04 | 0.00 | 0.00 | 0.6660 | -0.0532 | |||

| NEE / NextEra Energy, Inc. | 0.02 | -0.59 | 0.00 | 0.00 | 0.6631 | -0.0369 | |||

| AVY / Avery Dennison Corporation | 0.01 | -0.89 | 0.00 | 0.00 | 0.6631 | -0.0349 | |||

| DIS / The Walt Disney Company | 0.01 | 5.28 | 0.00 | 0.00 | 0.6547 | 0.1457 | |||

| DHR / Danaher Corporation | 0.01 | -11.71 | 0.00 | 0.00 | 0.6507 | -0.1351 | |||

| TXN / Texas Instruments Incorporated | 0.01 | -4.42 | 0.00 | 0.00 | 0.6482 | 0.0448 | |||

| EW / Edwards Lifesciences Corporation | 0.02 | -4.36 | 0.00 | 0.00 | 0.6329 | 0.0020 | |||

| LOW / Lowe's Companies, Inc. | 0.01 | -7.93 | 0.00 | 0.00 | 0.6300 | -0.1096 | |||

| GOOG / Alphabet Inc. | 0.01 | -1.07 | 0.00 | 0.00 | 0.6250 | 0.0531 | |||

| GS / The Goldman Sachs Group, Inc. | 0.00 | 0.40 | 0.00 | 0.6166 | 0.1290 | ||||

| ACN / Accenture plc | 0.00 | 80.49 | 0.00 | 0.6107 | 0.2475 | ||||

| CBRE / CBRE Group, Inc. | 0.01 | -4.58 | 0.00 | 0.00 | 0.5894 | -0.0033 | |||

| RTX / RTX Corporation | 0.01 | -2.23 | 0.00 | 0.00 | 0.5687 | 0.0262 | |||

| ADBE / Adobe Inc. | 0.00 | -19.72 | 0.00 | 0.00 | 0.5642 | -0.1520 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | -23.56 | 0.00 | -50.00 | 0.5618 | -0.7071 | |||

| ADSK / Autodesk, Inc. | 0.00 | -10.90 | 0.00 | 0.00 | 0.5499 | 0.0130 | |||

| BALL / Ball Corporation | 0.02 | -4.68 | 0.00 | 0.00 | 0.5494 | -0.0007 | |||

| HUBB / Hubbell Incorporated | 0.00 | 0.00 | 0.5346 | 0.5346 | |||||

| CHKP / Check Point Software Technologies Ltd. | 0.00 | -6.30 | 0.00 | 0.00 | 0.4961 | -0.0647 | |||

| BMY / Bristol-Myers Squibb Company | 0.02 | 12.94 | 0.00 | 0.00 | 0.4956 | -0.0987 | |||

| MS / Morgan Stanley | 0.01 | -4.85 | 0.00 | 0.4674 | 0.0494 | ||||

| EOG / EOG Resources, Inc. | 0.01 | -4.22 | 0.00 | -100.00 | 0.4625 | -0.0694 | |||

| LMT / Lockheed Martin Corporation | 0.00 | 0.00 | 0.00 | 0.4531 | 0.0040 | ||||

| CRM / Salesforce, Inc. | 0.00 | 7.46 | 0.00 | 0.4501 | 0.0260 | ||||

| ANSS / ANSYS, Inc. | 0.00 | -4.24 | 0.00 | 0.4471 | 0.0144 | ||||

| DCI / Donaldson Company, Inc. | 0.01 | 25.93 | 0.00 | 0.4308 | 0.0905 | ||||

| 0I0J / The Clorox Company | 0.01 | -10.21 | 0.00 | -100.00 | 0.4298 | -0.1736 | |||

| KMB / Kimberly-Clark Corporation | 0.01 | 11.15 | 0.00 | 0.4279 | -0.0085 | ||||

| GL / Globe Life Inc. | 0.01 | 3.28 | 0.00 | 0.4160 | -0.0229 | ||||

| DE / Deere & Company | 0.00 | -6.58 | 0.00 | 0.4106 | -0.0064 | ||||

| FCX / Freeport-McMoRan Inc. | 0.02 | -5.31 | 0.00 | 0.4066 | 0.0211 | ||||

| CI / The Cigna Group | 0.00 | 3.26 | 0.00 | 0.4032 | 0.0034 | ||||

| PCAR / PACCAR Inc | 0.01 | -3.84 | 0.00 | 0.4002 | -0.0382 | ||||

| CVS / CVS Health Corporation | 0.01 | 4.93 | 0.00 | 0.3972 | 0.0148 | ||||

| SJM / The J. M. Smucker Company | 0.01 | -1.98 | 0.00 | 0.3943 | -0.1045 | ||||

| BDX / Becton, Dickinson and Company | 0.00 | -1.76 | 0.00 | -100.00 | 0.3933 | -0.1538 | |||

| LLY / Eli Lilly and Company | 0.00 | -5.50 | 0.00 | 0.3898 | -0.0597 | ||||

| GPC / Genuine Parts Company | 0.01 | -10.08 | 0.00 | 0.3720 | -0.0460 | ||||

| MTD / Mettler-Toledo International Inc. | 0.00 | -21.33 | 0.00 | 0.3231 | -0.1015 | ||||

| VLO / Valero Energy Corporation | 0.00 | 3.34 | 0.00 | 0.3221 | 0.0072 | ||||

| IBM / International Business Machines Corporation | 0.00 | -15.62 | 0.00 | 0.3147 | -0.0088 | ||||

| AVT / Avnet, Inc. | 0.01 | 9.91 | 0.00 | 0.3147 | 0.0481 | ||||

| VZ / Verizon Communications Inc. | 0.01 | -1.43 | 0.00 | 0.3009 | -0.0283 | ||||

| ADM / Archer-Daniels-Midland Company | 0.01 | 0.76 | 0.00 | 0.2994 | 0.0216 | ||||

| NKE / NIKE, Inc. | 0.01 | -18.20 | 0.00 | 0.2989 | -0.0368 | ||||

| MDLZ / Mondelez International, Inc. | 0.01 | 0.00 | 0.00 | 0.2836 | -0.0095 | ||||

| GIS / General Mills, Inc. | 0.01 | 8.54 | 0.00 | 0.2816 | -0.0262 | ||||

| ITT / ITT Inc. | 0.00 | -7.07 | 0.00 | 0.2703 | 0.0244 | ||||

| MMC / Marsh & McLennan Companies, Inc. | 0.00 | -3.05 | 0.00 | 0.2574 | -0.0474 | ||||

| STZ / Constellation Brands, Inc. | 0.00 | -17.90 | 0.00 | 0.2549 | -0.1052 | ||||

| MA / Mastercard Incorporated | 0.00 | -3.50 | 0.00 | 0.2451 | -0.0094 | ||||

| TFC / Truist Financial Corporation | 0.01 | -27.39 | 0.00 | 0.2416 | -0.0855 | ||||

| FITB / Fifth Third Bancorp | 0.01 | 18.88 | 0.00 | 0.2209 | 0.0390 | ||||

| WAT / Waters Corporation | 0.00 | 3.97 | 0.00 | 0.2209 | -0.0098 | ||||

| COP / ConocoPhillips | 0.00 | -17.11 | 0.00 | 0.1952 | -0.0883 | ||||

| HP / Helmerich & Payne, Inc. | 0.02 | 0.00 | 0.1863 | 0.1863 | |||||

| MRK / Merck & Co., Inc. | 0.00 | 14.11 | 0.00 | 0.1774 | -0.0040 | ||||

| PHM / PulteGroup, Inc. | 0.00 | -3.96 | 0.00 | 0.1710 | -0.0073 | ||||

| ELV / Elevance Health, Inc. | 0.00 | 0.00 | 0.1616 | 0.1616 | |||||

| C / Citigroup Inc. | 0.00 | -4.83 | 0.00 | 0.1492 | 0.0151 | ||||

| T / AT&T Inc. | 0.01 | -10.63 | 0.00 | 0.1398 | -0.0176 | ||||

| DGX / Quest Diagnostics Incorporated | 0.00 | 0.00 | 0.00 | 0.1388 | 0.0047 | ||||

| GGG / Graco Inc. | 0.00 | 0.00 | 0.00 | 0.1354 | 0.0003 | ||||

| CHE / Chemed Corporation | 0.00 | -0.88 | 0.00 | 0.1349 | -0.0419 | ||||

| SHEL / Shell plc - Depositary Receipt (Common Stock) | 0.00 | -2.70 | 0.00 | 0.1319 | -0.0128 | ||||

| WMB / The Williams Companies, Inc. | 0.00 | -20.39 | 0.00 | 0.1235 | -0.0284 | ||||

| LNC / Lincoln National Corporation | 0.01 | -3.88 | 0.00 | 0.1206 | -0.0135 | ||||

| RIO / Rio Tinto Group - Depositary Receipt (Common Stock) | 0.00 | -3.24 | 0.00 | 0.1161 | -0.0109 | ||||

| TOL / Toll Brothers, Inc. | 0.00 | 0.00 | 0.1117 | 0.1117 | |||||

| BAC / Bank of America Corporation | 0.00 | 0.00 | 0.1102 | 0.1102 | |||||

| DUK / Duke Energy Corporation | 0.00 | -7.48 | 0.00 | 0.1038 | -0.0156 | ||||

| AA / Alcoa Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BP / BP p.l.c. - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CRL / Charles River Laboratories International, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GILD / Gilead Sciences, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PFE / Pfizer Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PM / Philip Morris International Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PRU / Prudential Financial, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MKC / McCormick & Company, Incorporated | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| DLTR / Dollar Tree, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |