Mga Batayang Estadistika

| Nilai Portofolio | $ 58,958,633 |

| Posisi Saat Ini | 58 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

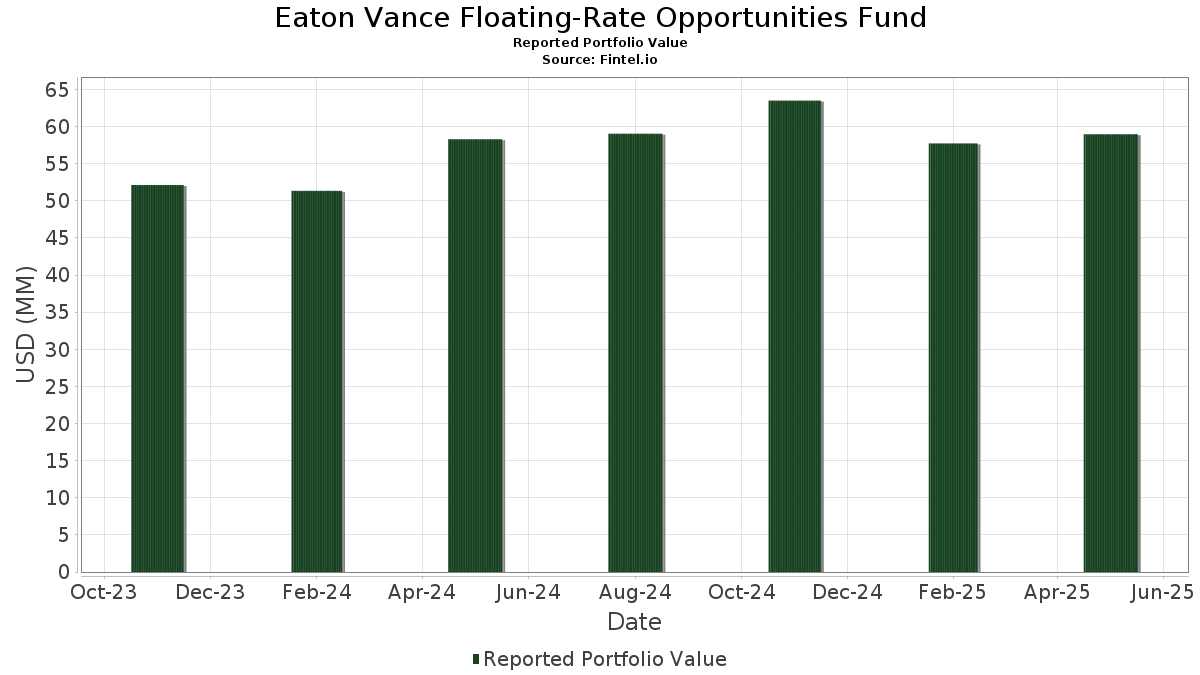

Eaton Vance Floating-Rate Opportunities Fund telah mengungkapkan total kepemilikan 58 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 58,958,633 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Eaton Vance Floating-Rate Opportunities Fund adalah Morgan Stanley Institutional Liquidity Funds Government Portfolio, Institutional Class (US:US61747C7074) , Carlyle US CLO 2022-6 Ltd (KY:US14317NAG34) , Benefit Street Partners CLO XXXII Ltd (JE:US08181GAA67) , Octagon 68 Ltd (KY:US675950AA72) , and Basswood Park CLO, Ltd. (KY:US07025AAA16) . Posisi baru Eaton Vance Floating-Rate Opportunities Fund meliputi: Carlyle US CLO 2022-6 Ltd (KY:US14317NAG34) , Benefit Street Partners CLO XXXII Ltd (JE:US08181GAA67) , Octagon 68 Ltd (KY:US675950AA72) , Basswood Park CLO, Ltd. (KY:US07025AAA16) , and Crown City CLO I (KY:US22823TAE55) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 5.65 | 5.65 | 9.5879 | 4.5505 | |

| 0.49 | 0.8343 | 0.8343 | ||

| 0.17 | 0.2891 | 0.2891 | ||

| 0.12 | 0.2015 | 0.2015 | ||

| 0.09 | 0.1467 | 0.1467 | ||

| 0.07 | 0.1210 | 0.1210 | ||

| 0.03 | 0.0482 | 0.0482 | ||

| 0.00 | 0.03 | 0.0438 | 0.0438 | |

| 1.97 | 3.3439 | 0.0376 | ||

| 0.00 | 0.02 | 0.0303 | 0.0303 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 1.99 | 3.3788 | -0.1583 | ||

| 3.06 | 5.1828 | -0.1422 | ||

| 2.02 | 3.4232 | -0.1053 | ||

| 3.05 | 5.1651 | -0.0769 | ||

| 1.67 | 2.8346 | -0.0758 | ||

| 0.68 | 1.1605 | -0.0720 | ||

| 1.29 | 2.1957 | -0.0606 | ||

| 3.05 | 5.1737 | -0.0597 | ||

| 1.01 | 1.7111 | -0.0573 | ||

| 2.01 | 3.4022 | -0.0534 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-21 untuk periode pelaporan 2025-05-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US61747C7074 / Morgan Stanley Institutional Liquidity Funds Government Portfolio, Institutional Class | 5.65 | 92.10 | 5.65 | 92.11 | 9.5879 | 4.5505 | |||

| US14317NAG34 / Carlyle US CLO 2022-6 Ltd | 3.06 | -1.77 | 5.1828 | -0.1422 | |||||

| US08181GAA67 / Benefit Street Partners CLO XXXII Ltd | 3.05 | -0.23 | 5.1737 | -0.0597 | |||||

| US675950AA72 / Octagon 68 Ltd | 3.05 | -0.56 | 5.1651 | -0.0769 | |||||

| Elmwood CLO XI Ltd / ABS-CBDO (US29002MAE84) | 2.51 | -0.16 | 4.2540 | -0.0468 | |||||

| Golub Capital Partners CLO 52 B R Ltd / ABS-CBDO (US381946AA09) | 2.02 | -0.44 | 3.4304 | -0.0478 | |||||

| Madison Park Funding XXII Ltd / ABS-CBDO (US55819VAJ52) | 2.02 | -0.59 | 3.4303 | -0.0519 | |||||

| Harvest US CLO 2024-2 Ltd / ABS-CBDO (US41756XAA54) | 2.02 | -2.09 | 3.4232 | -0.1053 | |||||

| US07025AAA16 / Basswood Park CLO, Ltd. | 2.01 | -0.64 | 3.4022 | -0.0534 | |||||

| Elmwood CLO VI Ltd / ABS-CBDO (US29001WAJ62) | 1.99 | -3.58 | 3.3788 | -0.1583 | |||||

| US22823TAE55 / Crown City CLO I | 1.97 | 2.07 | 3.3439 | 0.0376 | |||||

| US22846GAA40 / Crown Point CLO 10 Ltd | 1.67 | -1.71 | 2.8346 | -0.0758 | |||||

| TCW CLO 2024-3 Ltd / ABS-CBDO (US87252WAA99) | 1.54 | -0.84 | 2.6092 | -0.0468 | |||||

| Bryant Park Funding 2024-23 Ltd / ABS-CBDO (US11765DAA19) | 1.52 | -0.65 | 2.5862 | -0.0413 | |||||

| Oaktree CLO 2019-4 Ltd / ABS-CBDO (US67400JAE38) | 1.51 | -0.07 | 2.5537 | -0.0247 | |||||

| Jamestown CLO XV Ltd / ABS-CBDO (US47050VAE11) | 1.29 | -1.82 | 2.1957 | -0.0606 | |||||

| US38137TAD46 / GoldenTree Loan Opportunities XII Ltd., Series 2016-12A, Class ER | 1.25 | -0.48 | 2.1240 | -0.0299 | |||||

| Post CLO 2018-1 Ltd / ABS-CBDO (US73742VAE11) | 1.04 | 0.19 | 1.7577 | -0.0131 | |||||

| Neuberger Berman CLO XVII Ltd / ABS-CBDO (US64129VAQ68) | 1.02 | -0.78 | 1.7299 | -0.0289 | |||||

| Harvest US CLO 2024-3 Ltd / ABS-CBDO (US41756RAA86) | 1.01 | -2.42 | 1.7111 | -0.0573 | |||||

| US74980YAA29 / RR 17 Ltd | 1.00 | 0.00 | 1.7034 | -0.0164 | |||||

| Ares LXI CLO Ltd / ABS-CBDO (US04019EAE05) | 1.00 | -1.76 | 1.7029 | -0.0468 | |||||

| OCP Aegis CLO 2023-29 Ltd / ABS-CBDO (US67118EAG26) | 0.99 | -1.70 | 1.6719 | -0.0445 | |||||

| USI Inc 2024 Term Loan D / LON (US90351NAR61) | 0.98 | -0.31 | 1.6632 | -0.0196 | |||||

| XS2066744231 / Carnival PLC | 0.77 | -0.26 | 1.3110 | -0.0143 | |||||

| US26658NAP42 / Engineered Machinery Holdings Inc | 0.74 | -0.27 | 1.2572 | -0.0152 | |||||

| US04649VBC37 / Asurion LLC, Term Loan B | 0.74 | -0.54 | 1.2477 | -0.0173 | |||||

| XAG4768PAN15 / INEOS US FINANCE LLC | 0.72 | -1.91 | 1.2193 | -0.0338 | |||||

| Autokiniton US Holdings Inc 2024 Term Loan B / LON (US05278HAC07) | 0.71 | -2.99 | 1.2107 | -0.0486 | |||||

| US89364MCA09 / TRANSDIGM INC | 0.69 | -0.29 | 1.1699 | -0.0140 | |||||

| US42804VBB62 / HERTZ CORPORATION 2021 TERM LOAN B | 0.68 | -4.87 | 1.1605 | -0.0720 | |||||

| CQP Holdco LP 2024 1st Lien Term Loan B / LON (US12657QAE35) | 0.67 | 0.00 | 1.1430 | -0.0095 | |||||

| US18972FAC68 / CLYDESDALE ACQUISITION HOLDINGS T/L B (HILEX POLY/ | 0.61 | -0.32 | 1.0422 | -0.0133 | |||||

| Epicor Software Corporation 2024 Term Loan E / LON (US29426NAZ78) | 0.56 | -0.36 | 0.9461 | -0.0119 | |||||

| US90385KAJ07 / BANK LOAN NOTE | 0.50 | -0.20 | 0.8442 | -0.0083 | |||||

| Charter NEX US Inc 2024 Term Loan B1 / LON (US16125TAM45) | 0.49 | -0.20 | 0.8354 | -0.0094 | |||||

| Focus Financial Partners LLC 2025 Incremental Term Loan B / LON (US34416DBD93) | 0.49 | 0.8343 | 0.8343 | ||||||

| Triton Water Holdings Inc 2025 Term Loan B / LON (US89678QAD88) | 0.49 | -0.41 | 0.8342 | -0.0106 | |||||

| US00771PAJ03 / AEGION CORPORATION TERM LOAN | 0.49 | -1.01 | 0.8320 | -0.0169 | |||||

| US33774UAC27 / Fiserv Investment Solutions Inc | 0.49 | -0.21 | 0.8241 | -0.0094 | |||||

| Wand NewCo 3 Inc 2025 Repriced Term Loan B / LON (US93369PAM68) | 0.48 | -1.85 | 0.8119 | -0.0226 | |||||

| US05606CAR16 / BW NHHC Holdco, Inc. 2022 1st Lien Second Out Term Loan | 0.47 | -0.21 | 0.7920 | -0.0080 | |||||

| US83066YAB83 / SKILLSOFT (US NE 06/30/28 | 0.44 | 1.39 | 0.7418 | 0.0029 | |||||

| Sabre GLBL Inc 2024 Term Loan B1 / LON (US78571YBK55) | 0.42 | -0.94 | 0.7141 | -0.0142 | |||||

| US00488YAB20 / ACProducts, Inc. 2021 Term Loan B | 0.37 | -1.34 | 0.6248 | -0.0148 | |||||

| US05765WAA18 / TIBCO Software Inc | 0.37 | -0.81 | 0.6213 | -0.0104 | |||||

| US45332JAA07 / Rackspace Hosting Inc | 0.25 | -3.50 | 0.4209 | -0.0192 | |||||

| Central Parent Inc 2024 Term Loan B / LON (US15477BAE74) | 0.22 | -2.63 | 0.3766 | -0.0151 | |||||

| US31556PAB31 / Fertitta Entertainment LLC, Term Loan B | 0.20 | -1.01 | 0.3334 | -0.0059 | |||||

| Employbridge Holding Company 2025 First Out Term Loan / LON (29216HAD3) | 0.17 | 0.2891 | 0.2891 | ||||||

| US42804VBC46 / HERTZ CORPORATION 2021 TERM LOAN C | 0.13 | -5.00 | 0.2272 | -0.0135 | |||||

| Employbridge Holding Company 2025 Second Out Term Loan / LON (US29216HAE18) | 0.12 | 0.2015 | 0.2015 | ||||||

| Veritas US Inc 2024 Priority Term Loan / LON (000000000) | 0.09 | 0.1467 | 0.1467 | ||||||

| US78571YBJ82 / SABRE TERM B 1LN 06/30/2028 | 0.07 | 0.00 | 0.1263 | -0.0015 | |||||

| Employbridge Holding Company 2025 First Out Delayed Draw Term Loan / LON (US29216HAC51) | 0.07 | 0.1210 | 0.1210 | ||||||

| Clover Holdings SPV III LLC 2024 USD Term Loan / LON (000000000) | 0.03 | 0.0482 | 0.0482 | ||||||

| COHESITY GLOBAL INC / EP (000000000) | 0.00 | 0.03 | 0.0438 | 0.0438 | |||||

| COHESITY GLOBAL INC / EP (000000000) | 0.00 | 0.02 | 0.0303 | 0.0303 |