Mga Batayang Estadistika

| Nilai Portofolio | $ 186,354,570 |

| Posisi Saat Ini | 89 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

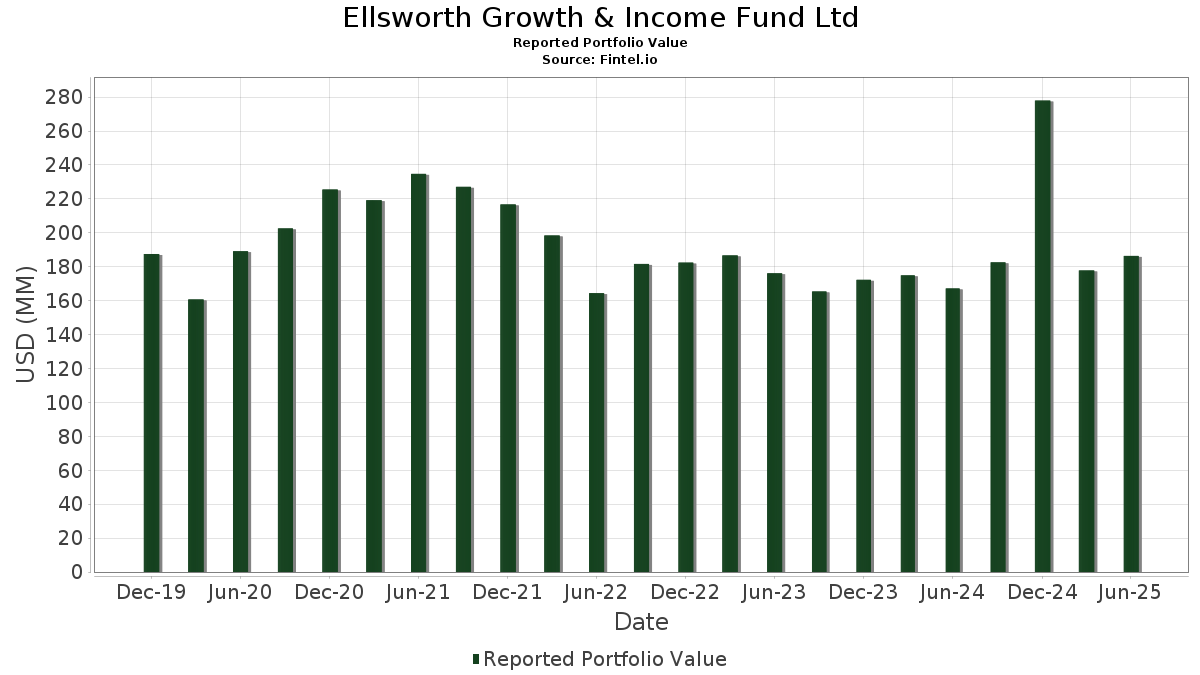

Ellsworth Growth & Income Fund Ltd telah mengungkapkan total kepemilikan 89 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 186,354,570 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Ellsworth Growth & Income Fund Ltd adalah Broadcom Inc. (US:AVGO) , CONV. NOTE (US:US665531AJ80) , T-Mobile US, Inc. (US:TMUS) , Microsoft Corporation (US:MSFT) , and Microchip Technology Incorporated - Preferred Stock (US:MCHPP) . Posisi baru Ellsworth Growth & Income Fund Ltd meliputi: CONV. NOTE (US:US665531AJ80) , Redfin Corp (US:US75737FAE88) , CONV. NOTE (US:US803607AD25) , Array Technologies Inc (US:US04271TAB61) , and CONV. NOTE (US:US531229AQ58) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 3.25 | 2.0795 | 2.0795 | ||

| 2.94 | 1.8811 | 1.8811 | ||

| 2.92 | 1.8689 | 1.8689 | ||

| 2.83 | 1.8121 | 1.8121 | ||

| 2.92 | 1.8682 | 1.6864 | ||

| 2.51 | 1.6024 | 1.6024 | ||

| 2.49 | 1.5923 | 1.5923 | ||

| 2.48 | 1.5836 | 1.5836 | ||

| 2.40 | 1.5355 | 1.5355 | ||

| 0.05 | 3.43 | 2.1949 | 1.5038 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 2.46 | 1.5710 | -0.6580 | ||

| 2.33 | 1.4890 | -0.6006 | ||

| 0.01 | 3.48 | 2.2276 | -0.5180 | |

| 1.63 | 1.0405 | -0.4955 | ||

| 0.03 | 0.19 | 0.1198 | -0.3638 | |

| 3.25 | 2.0770 | -0.2922 | ||

| 3.77 | 2.4088 | -0.2721 | ||

| 0.00 | 3.18 | 2.0349 | -0.2617 | |

| 2.29 | 1.4644 | -0.2214 | ||

| 0.05 | 2.16 | 1.3836 | -0.2134 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-29 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AVGO / Broadcom Inc. | 0.02 | 0.00 | 5.26 | 64.65 | 3.3636 | 1.1140 | |||

| BE / Bloom Energy Corporation | 3.85 | 47.10 | 2.4634 | 0.6199 | |||||

| US665531AJ80 / CONV. NOTE | 3.77 | -1.08 | 2.4088 | -0.2721 | |||||

| PSN / Parsons Corporation | 3.74 | 6.65 | 2.3906 | -0.0777 | |||||

| M2PM34 / MP Materials Corp. - Depositary Receipt (Common Stock) | 3.73 | 25.54 | 2.3863 | 0.2932 | |||||

| PRGS / Progress Software Corporation | 3.72 | 10.07 | 2.3770 | -0.0003 | |||||

| TMUS / T-Mobile US, Inc. | 0.01 | 0.00 | 3.48 | -10.67 | 2.2276 | -0.5180 | |||

| MSFT / Microsoft Corporation | 0.01 | -12.50 | 3.48 | 15.92 | 2.2268 | 0.1120 | |||

| MCHPP / Microchip Technology Incorporated - Preferred Stock | 0.05 | 164.10 | 3.43 | 249.75 | 2.1949 | 1.5038 | |||

| LITE / Lumentum Holdings Inc. | 3.38 | 30.46 | 2.1611 | 0.3369 | |||||

| HPE.PRC / Hewlett Packard Enterprise Company - Preferred Security | 0.06 | 0.00 | 3.36 | 23.34 | 2.1464 | 0.2302 | |||

| TXNM / TXNM Energy, Inc. | 3.25 | 2.0795 | 2.0795 | ||||||

| PPL Capital Funding Inc / DBT (US69352PAS20) | 3.25 | -3.48 | 2.0770 | -0.2922 | |||||

| EQIX / Equinix, Inc. | 0.00 | 0.00 | 3.18 | -2.45 | 2.0349 | -0.2617 | |||

| D1LR34 / Digital Realty Trust, Inc. - Depositary Receipt (Common Stock) | 3.16 | 6.15 | 2.0220 | -0.0753 | |||||

| UBERD / Uber Technologies, Inc. - Depositary Receipt (Common Stock) | 3.06 | 17.13 | 1.9592 | 0.1177 | |||||

| US83406F1104 / SoFi Technologies, Inc. | 3.06 | 42.03 | 1.9559 | 0.4396 | |||||

| NBR / Nabors Industries Ltd. | 3.00 | 12.89 | 1.9205 | 0.0472 | |||||

| CLSKW / CleanSpark, Inc. - Equity Warrant | 2.95 | 35.57 | 1.8873 | 0.3545 | |||||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | 2.94 | 1.8811 | 1.8811 | ||||||

| United States Treasury Bill / DBT (US912797MG92) | 2.92 | 1.8689 | 1.8689 | ||||||

| BBIO / BridgeBio Pharma, Inc. | 2.92 | 1,032.17 | 1.8682 | 1.6864 | |||||

| W1EC34 / WEC Energy Group, Inc. - Depositary Receipt (Common Stock) | 2.83 | 1.8121 | 1.8121 | ||||||

| CSGS / CSG Systems International, Inc. | 2.83 | 4.47 | 1.8091 | -0.0975 | |||||

| EVH / Evolent Health, Inc. | 2.80 | 110.47 | 1.7880 | 0.8521 | |||||

| I2ND34 / indie Semiconductor, Inc. - Depositary Receipt (Common Stock) | 2.75 | 50.22 | 1.7603 | 0.4697 | |||||

| US75737FAE88 / Redfin Corp | 2.71 | 2.73 | 1.7317 | -0.1243 | |||||

| US3434125080 / FLUOR CORP PC 6.5% PERP | 2.63 | 23.46 | 1.6797 | 0.1816 | |||||

| Integer Holdings Corp / DBT (US45826HAC34) | 2.51 | 1.6024 | 1.6024 | ||||||

| ARES.PRB / Ares Management Corporation - Preferred Security | 0.05 | 0.00 | 2.49 | 9.98 | 1.5931 | -0.0025 | |||

| United States Treasury Bill / DBT (US912797PY71) | 2.49 | 1.5923 | 1.5923 | ||||||

| BTSGU / BrightSpring Health Services, Inc. | 0.03 | 0.00 | 2.48 | 26.97 | 1.5838 | 0.2107 | |||

| M2KS34 / MKS Inc. - Depositary Receipt (Common Stock) | 2.48 | 1.5836 | 1.5836 | ||||||

| Galaxy Digital Holdings LP / DBT (US36317GAB23) | 2.46 | 45.99 | 1.5733 | 0.3867 | |||||

| US803607AD25 / CONV. NOTE | 2.46 | -22.40 | 1.5710 | -0.6580 | |||||

| 5290 / Vertex Corporation | 2.40 | 1.5355 | 1.5355 | ||||||

| A1KA34 / Akamai Technologies, Inc. - Depositary Receipt (Common Stock) | 2.38 | -0.38 | 1.5213 | -0.1599 | |||||

| OSIS / OSI Systems, Inc. | 2.38 | 11.43 | 1.5210 | 0.0180 | |||||

| US04271TAB61 / Array Technologies Inc | 2.33 | -21.54 | 1.4890 | -0.6006 | |||||

| Jazz Investments I Ltd / DBT (US472145AG66) | 2.29 | -4.39 | 1.4644 | -0.2214 | |||||

| ANIP / ANI Pharmaceuticals, Inc. | 2.27 | 1.02 | 1.4511 | -0.1304 | |||||

| NEE.PRT / NextEra Energy, Inc. - Debt/Equity Composite Units | 0.05 | 0.00 | 2.21 | -2.85 | 1.4150 | -0.1888 | |||

| AMT / American Tower Corporation | 0.01 | 0.00 | 2.21 | 1.56 | 1.4135 | -0.1188 | |||

| L1YV34 / Live Nation Entertainment, Inc. - Depositary Receipt (Common Stock) | 2.18 | 5.06 | 1.3942 | -0.0670 | |||||

| VZ / Verizon Communications Inc. | 0.05 | 0.00 | 2.16 | -4.63 | 1.3836 | -0.2134 | |||

| C1MS34 / CMS Energy Corporation - Depositary Receipt (Common Stock) | 2.13 | -3.88 | 1.3628 | -0.1983 | |||||

| COIN / Coinbase Global, Inc. - Depositary Receipt (Common Stock) | 2.10 | 1.3410 | 1.3410 | ||||||

| A1KA34 / Akamai Technologies, Inc. - Depositary Receipt (Common Stock) | 2.08 | 1.3270 | 1.3270 | ||||||

| BOX / Box, Inc. | 2.06 | 6.88 | 1.3206 | -0.0398 | |||||

| US531229AQ58 / CONV. NOTE | 2.00 | 9.36 | 1.2773 | -0.0087 | |||||

| US30063PAD78 / EXACT SCIENCES CORP CONV 2% 03/01/2030 144A | 1.98 | 7.97 | 1.2658 | -0.0250 | |||||

| United States Treasury Bill / DBT (US912797MH75) | 1.97 | 1.2597 | 1.2597 | ||||||

| Pagaya Technologies Ltd / DBT (US69549FAA75) | 1.95 | 59.95 | 1.2490 | 0.3892 | |||||

| GTLS.PRB / Chart Industries, Inc. - Preferred Stock | 0.03 | 0.00 | 1.79 | 10.30 | 1.1436 | 0.0018 | |||

| T / AT&T Inc. | 0.06 | 0.00 | 1.74 | 2.36 | 1.1105 | -0.0844 | |||

| N2TN34 / Nutanix, Inc. - Depositary Receipt (Common Stock) | 1.70 | 7.24 | 1.0895 | -0.0291 | |||||

| BA.PRA / The Boeing Company - Preferred Security | 0.03 | 0.00 | 1.70 | 13.68 | 1.0894 | 0.0340 | |||

| CCI / Crown Castle Inc. | 0.02 | 0.00 | 1.65 | -1.49 | 1.0578 | -0.1239 | |||

| SBAC / SBA Communications Corporation | 0.01 | 0.00 | 1.64 | 6.69 | 1.0513 | -0.0332 | |||

| Oddity Finance LLC / DBT (US67579RAA86) | 1.63 | 1.0428 | 1.0428 | ||||||

| A1PL34 / Applied Digital Corporation - Depositary Receipt (Common Stock) | 1.63 | -25.45 | 1.0405 | -0.4955 | |||||

| TMDX / TransMedics Group, Inc. | 1.61 | 49.30 | 1.0270 | 0.2696 | |||||

| CDLX / Cardlytics, Inc. | 1.55 | 0.9917 | 0.9917 | ||||||

| DIS / The Walt Disney Company | 0.01 | 0.00 | 1.55 | 25.71 | 0.9914 | 0.1226 | |||

| SNOWD / Snowflake Inc. - Depositary Receipt (Common Stock) | 1.40 | 33.02 | 0.8967 | 0.1543 | |||||

| US92347MAB63 / VERITONE INC CONV 1.75% 11/15/2026 | 1.33 | 0.00 | 0.8515 | -0.0861 | |||||

| US02043QAB32 / CONV. NOTE | 1.30 | 12.74 | 0.8324 | 0.0197 | |||||

| FOUR.PRA / Shift4 Payments, Inc. - Preferred Stock | 0.01 | 1.23 | 0.7882 | 0.7882 | |||||

| Pacira BioSciences Inc / DBT (US695127AJ95) | 1.23 | 0.7844 | 0.7844 | ||||||

| RIOT / Riot Platforms, Inc. - Depositary Receipt (Common Stock) | 1.20 | 34.08 | 0.7649 | 0.1366 | |||||

| Rivian Automotive Inc / DBT (US76954AAB98) | 1.02 | 4.19 | 0.6519 | -0.0369 | |||||

| F1EC34 / FirstEnergy Corp. - Depositary Receipt (Common Stock) | 1.01 | 0.6485 | 0.6485 | ||||||

| ITRACHEALTH CORP 8.00 6/30/27 CVT(PP) / DBT (000000000) | 1.00 | 0.6395 | 0.6395 | ||||||

| US758075AF22 / REDWOOD TRUST INC | 0.99 | 0.30 | 0.6335 | -0.0616 | |||||

| PYPL / PayPal Holdings, Inc. | 0.01 | 0.00 | 0.97 | 13.92 | 0.6179 | 0.0206 | |||

| KKR.PRD / KKR & Co. Inc. - Preferred Stock | 0.02 | 0.00 | 0.96 | 8.44 | 0.6170 | -0.0091 | |||

| CYBR / CyberArk Software Ltd. | 0.93 | 0.5928 | 0.5928 | ||||||

| PAR / PAR Technology Corporation | 0.89 | 5.95 | 0.5703 | -0.0223 | |||||

| US60471A1016 / Mirion Technologies, Inc. | 0.81 | 0.5173 | 0.5173 | ||||||

| Array Technologies Inc / DBT (US04271TAC45) | 0.79 | 0.5074 | 0.5074 | ||||||

| US2935941151 / Enovix Corp. Warrant | 0.73 | 15.24 | 0.4648 | 0.0206 | |||||

| US453204AD18 / CONV. NOTE | 0.62 | 9.67 | 0.3994 | -0.0016 | |||||

| MMYT / MakeMyTrip Limited | 0.59 | 0.3757 | 0.3757 | ||||||

| N2ET34 / Cloudflare, Inc. - Depositary Receipt (Common Stock) | 0.41 | 0.2628 | 0.2628 | ||||||

| BTDR / Bitdeer Technologies Group | 0.36 | 0.2319 | 0.2319 | ||||||

| United States Treasury Bill / DBT (US912797PW16) | 0.23 | 0.1458 | 0.1458 | ||||||

| Invacare Holdings Corp / EP (US46124A3095) | 0.03 | 0.00 | 0.19 | -72.74 | 0.1198 | -0.3638 | |||

| United States Treasury Bill / DBT (US912797PQ48) | 0.09 | 0.0572 | 0.0572 | ||||||

| AMERIVON HOLDINGS LLC - PRIVATE PLACEMENT / EP (000000000) | 0.27 | 0.00 | 0.0000 | 0.0000 | |||||

| INVACARE CORP SR GLBL COCO 26 / EC (000000000) | 0.01 | 0.00 | 0.0000 | 0.0000 | |||||

| AMERIVON HOLDINGS LLC - PRIVATE PLACEMENT / EP (000000000) | 0.81 | 0.00 | 0.0000 | 0.0000 | |||||

| INVACARE CORP / DBT (000000000) | 0.00 | 0.0000 | 0.0000 |