Mga Batayang Estadistika

| Nilai Portofolio | $ 267,420,537 |

| Posisi Saat Ini | 135 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

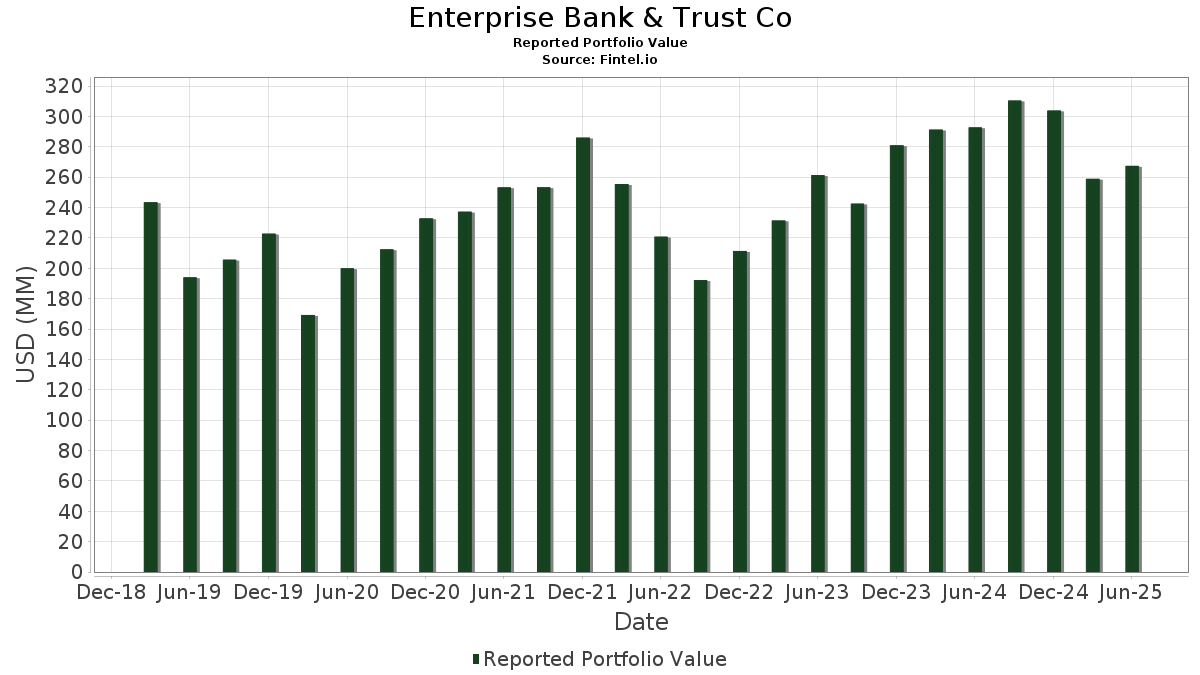

Enterprise Bank & Trust Co telah mengungkapkan total kepemilikan 135 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 267,420,537 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Enterprise Bank & Trust Co adalah iShares Trust - iShares Core S&P Mid-Cap ETF (US:IJH) , Microsoft Corporation (US:MSFT) , NVIDIA Corporation (US:NVDA) , Apple Inc. (US:AAPL) , and Amazon.com, Inc. (US:AMZN) . Posisi baru Enterprise Bank & Trust Co meliputi: Becton, Dickinson and Company (US:BDX) , Lam Research Corporation (US:LRCX) , BigBear.ai Holdings, Inc. (US:BBAI) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.10 | 15.98 | 5.9741 | 1.5484 | |

| 0.04 | 18.66 | 6.9779 | 1.4435 | |

| 0.01 | 8.17 | 3.0556 | 0.5402 | |

| 0.32 | 9.21 | 3.4451 | 0.4109 | |

| 0.05 | 9.92 | 3.7084 | 0.3863 | |

| 0.03 | 8.56 | 3.2024 | 0.3737 | |

| 0.00 | 0.90 | 0.3357 | 0.3357 | |

| 0.01 | 1.66 | 0.6197 | 0.2857 | |

| 0.04 | 7.80 | 2.9163 | 0.2509 | |

| 0.01 | 1.65 | 0.6177 | 0.2355 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 1.72 | 0.6420 | -0.9585 | |

| 0.01 | 2.39 | 0.8940 | -0.6725 | |

| 0.07 | 14.31 | 5.3505 | -0.6305 | |

| 0.31 | 19.29 | 7.2145 | -0.4571 | |

| 0.02 | 2.99 | 1.1174 | -0.2564 | |

| 0.02 | 2.35 | 0.8798 | -0.1768 | |

| 0.01 | 4.52 | 1.6892 | -0.1639 | |

| 0.00 | 1.79 | 0.6705 | -0.1554 | |

| 0.01 | 2.23 | 0.8340 | -0.1292 | |

| 0.03 | 1.09 | 0.4068 | -0.1147 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-07 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| IJH / iShares Trust - iShares Core S&P Mid-Cap ETF | 0.31 | -8.61 | 19.29 | -2.86 | 7.2145 | -0.4571 | |||

| MSFT / Microsoft Corporation | 0.04 | -1.71 | 18.66 | 30.23 | 6.9779 | 1.4435 | |||

| NVDA / NVIDIA Corporation | 0.10 | -4.35 | 15.98 | 39.43 | 5.9741 | 1.5484 | |||

| AAPL / Apple Inc. | 0.07 | 0.04 | 14.31 | -7.59 | 5.3505 | -0.6305 | |||

| AMZN / Amazon.com, Inc. | 0.05 | -0.00 | 9.92 | 15.31 | 3.7084 | 0.3863 | |||

| SPY / SPDR S&P 500 ETF | 0.02 | -0.58 | 9.45 | 9.81 | 3.5340 | 0.2095 | |||

| DFAE / Dimensional ETF Trust - Dimensional Emerging Core Equity Market ETF | 0.32 | 4.89 | 9.21 | 17.28 | 3.4451 | 0.4109 | |||

| JPM / JPMorgan Chase & Co. | 0.03 | -1.06 | 8.56 | 16.93 | 3.2024 | 0.3737 | |||

| META / Meta Platforms, Inc. | 0.01 | -2.02 | 8.17 | 25.48 | 3.0556 | 0.5402 | |||

| GOOGL / Alphabet Inc. | 0.04 | -0.83 | 7.80 | 13.01 | 2.9163 | 0.2509 | |||

| COST / Costco Wholesale Corporation | 0.01 | -1.22 | 7.13 | 3.39 | 2.6668 | 0.0025 | |||

| LLY / Eli Lilly and Company | 0.01 | -0.24 | 4.52 | -5.84 | 1.6892 | -0.1639 | |||

| PANW / Palo Alto Networks, Inc. | 0.02 | -0.27 | 3.94 | 19.62 | 1.4730 | 0.2008 | |||

| ABT / Abbott Laboratories | 0.03 | 0.62 | 3.92 | 3.18 | 1.4663 | -0.0017 | |||

| MA / Mastercard Incorporated | 0.01 | 0.10 | 3.90 | 2.63 | 1.4575 | -0.0095 | |||

| AGG / iShares Trust - iShares Core U.S. Aggregate Bond ETF | 0.04 | -3.50 | 3.87 | -3.25 | 1.4482 | -0.0976 | |||

| TJX / The TJX Companies, Inc. | 0.03 | -0.55 | 3.85 | 0.84 | 1.4410 | -0.0351 | |||

| V / Visa Inc. | 0.01 | -0.25 | 3.84 | 1.05 | 1.4346 | -0.0318 | |||

| HD / The Home Depot, Inc. | 0.01 | -0.14 | 3.46 | -0.12 | 1.2934 | -0.0439 | |||

| CMG / Chipotle Mexican Grill, Inc. | 0.06 | 0.00 | 3.26 | 11.83 | 1.2200 | 0.0931 | |||

| ICE / Intercontinental Exchange, Inc. | 0.02 | 0.00 | 3.14 | 6.34 | 1.1738 | 0.0338 | |||

| CVX / Chevron Corporation | 0.02 | -1.84 | 2.99 | -15.97 | 1.1174 | -0.2564 | |||

| CRM / Salesforce, Inc. | 0.01 | 0.08 | 2.98 | 1.71 | 1.1125 | -0.0175 | |||

| HON / Honeywell International Inc. | 0.01 | 1.66 | 2.97 | 11.81 | 1.1120 | 0.0846 | |||

| UNP / Union Pacific Corporation | 0.01 | 2.75 | 2.63 | 0.08 | 0.9849 | -0.0318 | |||

| GOOG / Alphabet Inc. | 0.01 | -2.08 | 2.57 | 11.19 | 0.9628 | 0.0683 | |||

| SPGI / S&P Global Inc. | 0.00 | 0.00 | 2.49 | 3.79 | 0.9317 | 0.0043 | |||

| ACN / Accenture plc | 0.01 | 8.44 | 2.46 | 3.85 | 0.9187 | 0.0051 | |||

| GD / General Dynamics Corporation | 0.01 | -2.27 | 2.44 | 4.58 | 0.9136 | 0.0111 | |||

| UNH / UnitedHealth Group Incorporated | 0.01 | -1.03 | 2.39 | -41.06 | 0.8940 | -0.6725 | |||

| AMT / American Tower Corporation | 0.01 | 1.55 | 2.37 | 3.13 | 0.8876 | -0.0013 | |||

| PEP / PepsiCo, Inc. | 0.02 | -2.34 | 2.35 | -14.00 | 0.8798 | -0.1768 | |||

| MMC / Marsh & McLennan Companies, Inc. | 0.01 | -0.18 | 2.23 | -10.55 | 0.8340 | -0.1292 | |||

| MCD / McDonald's Corporation | 0.01 | 0.00 | 2.18 | -6.48 | 0.8155 | -0.0851 | |||

| ADI / Analog Devices, Inc. | 0.01 | 0.00 | 2.18 | 18.04 | 0.8148 | 0.1017 | |||

| PG / The Procter & Gamble Company | 0.01 | 2.91 | 1.81 | -3.77 | 0.6768 | -0.0499 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | 2.91 | 1.79 | -16.18 | 0.6705 | -0.1554 | |||

| NEE / NextEra Energy, Inc. | 0.03 | -0.68 | 1.77 | -2.70 | 0.6601 | -0.0410 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.00 | -62.50 | 1.72 | -58.58 | 0.6420 | -0.9585 | |||

| AVGO / Broadcom Inc. | 0.01 | 16.40 | 1.66 | 91.78 | 0.6197 | 0.2857 | |||

| ORCL / Oracle Corporation | 0.01 | 6.74 | 1.65 | 66.94 | 0.6177 | 0.2355 | |||

| MDLZ / Mondelez International, Inc. | 0.02 | 0.71 | 1.62 | 0.12 | 0.6043 | -0.0192 | |||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.00 | -2.48 | 1.58 | 7.83 | 0.5924 | 0.0247 | |||

| MSI / Motorola Solutions, Inc. | 0.00 | 0.00 | 1.57 | -3.98 | 0.5874 | -0.0444 | |||

| VWO / Vanguard International Equity Index Funds - Vanguard FTSE Emerging Markets ETF | 0.03 | 0.00 | 1.48 | 9.32 | 0.5528 | 0.0303 | |||

| NKE / NIKE, Inc. | 0.02 | -5.21 | 1.42 | 6.04 | 0.5325 | 0.0140 | |||

| CDW / CDW Corporation | 0.01 | -1.44 | 1.42 | 9.84 | 0.5302 | 0.0316 | |||

| RTX / RTX Corporation | 0.01 | 2.05 | 1.38 | 12.52 | 0.5143 | 0.0421 | |||

| DIS / The Walt Disney Company | 0.01 | 1.40 | 1.37 | 27.40 | 0.5113 | 0.0967 | |||

| VEA / Vanguard Tax-Managed Funds - Vanguard FTSE Developed Markets ETF | 0.02 | -1.36 | 1.36 | 10.62 | 0.5102 | 0.0338 | |||

| FCX / Freeport-McMoRan Inc. | 0.03 | -0.56 | 1.35 | 13.89 | 0.5061 | 0.0469 | |||

| CARR / Carrier Global Corporation | 0.02 | 3.75 | 1.22 | 19.70 | 0.4547 | 0.0625 | |||

| FDUS / Fidus Investment Corporation | 0.06 | 0.00 | 1.13 | -0.96 | 0.4223 | -0.0180 | |||

| SCHW / The Charles Schwab Corporation | 0.01 | 3.54 | 1.10 | 20.73 | 0.4096 | 0.0590 | |||

| SLB / Schlumberger Limited | 0.03 | -0.35 | 1.09 | -19.48 | 0.4068 | -0.1147 | |||

| EFA / iShares Trust - iShares MSCI EAFE ETF | 0.01 | -0.94 | 1.03 | 8.30 | 0.3857 | 0.0180 | |||

| JNJ / Johnson & Johnson | 0.01 | 19.36 | 0.96 | 9.93 | 0.3602 | 0.0218 | |||

| GSK / GSK plc - Depositary Receipt (Common Stock) | 0.02 | -0.65 | 0.94 | -1.47 | 0.3512 | -0.0172 | |||

| DHR / Danaher Corporation | 0.00 | -2.28 | 0.93 | -5.88 | 0.3476 | -0.0337 | |||

| SHY / iShares Trust - iShares 1-3 Year Treasury Bond ETF | 0.01 | 0.00 | 0.93 | 0.11 | 0.3462 | -0.0108 | |||

| VO / Vanguard Index Funds - Vanguard Mid-Cap ETF | 0.00 | 0.90 | 0.3357 | 0.3357 | |||||

| IWF / iShares Trust - iShares Russell 1000 Growth ETF | 0.00 | 0.00 | 0.87 | 17.59 | 0.3250 | 0.0395 | |||

| ADBE / Adobe Inc. | 0.00 | -1.36 | 0.84 | -0.47 | 0.3158 | -0.0120 | |||

| BX / Blackstone Inc. | 0.01 | -12.93 | 0.83 | -6.88 | 0.3088 | -0.0335 | |||

| TPL / Texas Pacific Land Corporation | 0.00 | 0.00 | 0.78 | -20.25 | 0.2903 | -0.0858 | |||

| BAC / Bank of America Corporation | 0.02 | 0.00 | 0.75 | 13.42 | 0.2814 | 0.0251 | |||

| CLS / Celestica Inc. | 0.00 | 0.00 | 0.74 | 97.85 | 0.2755 | 0.1315 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | 0.00 | 0.73 | -8.77 | 0.2725 | -0.0359 | |||

| CSCO / Cisco Systems, Inc. | 0.01 | 8.60 | 0.72 | 22.09 | 0.2710 | 0.0417 | |||

| QUS / SPDR Series Trust - SPDR MSCI USA StrategicFactors ETF | 0.00 | 0.00 | 0.71 | 4.10 | 0.2659 | 0.0020 | |||

| ETN / Eaton Corporation plc | 0.00 | -26.23 | 0.71 | -3.16 | 0.2643 | -0.0175 | |||

| DD / DuPont de Nemours, Inc. | 0.01 | 1.84 | 0.70 | -6.41 | 0.2623 | -0.0274 | |||

| TXN / Texas Instruments Incorporated | 0.00 | 0.00 | 0.66 | 15.47 | 0.2460 | 0.0261 | |||

| RY / Royal Bank of Canada | 0.00 | 0.00 | 0.63 | 16.64 | 0.2361 | 0.0271 | |||

| XOM / Exxon Mobil Corporation | 0.01 | 7.08 | 0.62 | -2.83 | 0.2311 | -0.0148 | |||

| VB / Vanguard Index Funds - Vanguard Small-Cap ETF | 0.00 | 0.59 | 0.2190 | 0.2190 | |||||

| IBM / International Business Machines Corporation | 0.00 | 0.00 | 0.58 | 18.50 | 0.2183 | 0.0281 | |||

| BA / The Boeing Company | 0.00 | -0.50 | 0.58 | 22.32 | 0.2174 | 0.0337 | |||

| EXR / Extra Space Storage Inc. | 0.00 | 0.00 | 0.58 | -0.69 | 0.2157 | -0.0087 | |||

| AMD / Advanced Micro Devices, Inc. | 0.00 | -6.28 | 0.57 | 29.48 | 0.2137 | 0.0432 | |||

| CMCSA / Comcast Corporation | 0.02 | 21.20 | 0.57 | 17.32 | 0.2129 | 0.0253 | |||

| TRU / TransUnion | 0.01 | 0.00 | 0.56 | 6.03 | 0.2106 | 0.0054 | |||

| TD / The Toronto-Dominion Bank | 0.01 | 0.00 | 0.56 | 22.59 | 0.2093 | 0.0329 | |||

| BLK / BlackRock, Inc. | 0.00 | 0.00 | 0.55 | 10.87 | 0.2064 | 0.0141 | |||

| WMT / Walmart Inc. | 0.01 | 0.00 | 0.53 | 11.51 | 0.1995 | 0.0145 | |||

| COR / Cencora, Inc. | 0.00 | 23.18 | 0.51 | 32.73 | 0.1913 | 0.0425 | |||

| XLC / The Select Sector SPDR Trust - The Communication Services Select Sector SPDR Fund | 0.00 | 0.00 | 0.48 | 12.38 | 0.1802 | 0.0148 | |||

| MRK / Merck & Co., Inc. | 0.01 | 0.00 | 0.46 | -11.80 | 0.1705 | -0.0292 | |||

| BHB / Bar Harbor Bankshares | 0.02 | -18.32 | 0.45 | -17.10 | 0.1688 | -0.0414 | |||

| EMR / Emerson Electric Co. | 0.00 | 0.00 | 0.45 | 21.68 | 0.1682 | 0.0253 | |||

| NOW / ServiceNow, Inc. | 0.00 | -36.90 | 0.45 | -18.55 | 0.1676 | -0.0449 | |||

| ABBV / AbbVie Inc. | 0.00 | 0.00 | 0.43 | -11.39 | 0.1601 | -0.0266 | |||

| VZ / Verizon Communications Inc. | 0.01 | -1.11 | 0.38 | -5.88 | 0.1440 | -0.0137 | |||

| MUB / iShares Trust - iShares National Muni Bond ETF | 0.00 | 0.00 | 0.34 | -0.86 | 0.1287 | -0.0055 | |||

| VUG / Vanguard Index Funds - Vanguard Growth ETF | 0.00 | -4.85 | 0.34 | 12.79 | 0.1287 | 0.0105 | |||

| KO / The Coca-Cola Company | 0.00 | 0.00 | 0.34 | -1.17 | 0.1269 | -0.0058 | |||

| ZBH / Zimmer Biomet Holdings, Inc. | 0.00 | 6.26 | 0.33 | -14.43 | 0.1244 | -0.0256 | |||

| BIIB / Biogen Inc. | 0.00 | -1.69 | 0.33 | -9.89 | 0.1230 | -0.0178 | |||

| MET / MetLife, Inc. | 0.00 | 0.00 | 0.32 | 0.00 | 0.1214 | -0.0038 | |||

| TFC / Truist Financial Corporation | 0.01 | 49.20 | 0.32 | 56.04 | 0.1211 | 0.0409 | |||

| BMO / Bank of Montreal | 0.00 | 0.00 | 0.32 | 16.19 | 0.1208 | 0.0131 | |||

| IYR / iShares Trust - iShares U.S. Real Estate ETF | 0.00 | -4.96 | 0.32 | -5.93 | 0.1187 | -0.0117 | |||

| GBTC / Grayscale Bitcoin Trust (BTC) | 0.00 | 0.00 | 0.31 | 29.88 | 0.1174 | 0.0242 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 0.31 | 0.1168 | 0.1168 | |||||

| LIN / Linde plc | 0.00 | -1.93 | 0.31 | -1.27 | 0.1161 | -0.0053 | |||

| FDX / FedEx Corporation | 0.00 | 6.57 | 0.31 | -0.64 | 0.1158 | -0.0046 | |||

| BDX / Becton, Dickinson and Company | 0.00 | 0.30 | 0.1136 | 0.1136 | |||||

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.00 | 0.00 | 0.30 | 10.58 | 0.1133 | 0.0075 | |||

| IWB / iShares Trust - iShares Russell 1000 ETF | 0.00 | 0.00 | 0.30 | 10.49 | 0.1106 | 0.0074 | |||

| MAS / Masco Corporation | 0.00 | -26.13 | 0.30 | -31.71 | 0.1105 | -0.0564 | |||

| PFE / Pfizer Inc. | 0.01 | 0.00 | 0.29 | -4.56 | 0.1099 | -0.0088 | |||

| BR / Broadridge Financial Solutions, Inc. | 0.00 | 0.00 | 0.29 | 0.00 | 0.1091 | -0.0033 | |||

| IWR / iShares Trust - iShares Russell Mid-Cap ETF | 0.00 | 0.00 | 0.29 | 8.30 | 0.1074 | 0.0048 | |||

| VTV / Vanguard Index Funds - Vanguard Value ETF | 0.00 | 0.00 | 0.28 | 2.18 | 0.1053 | -0.0010 | |||

| SYK / Stryker Corporation | 0.00 | 0.00 | 0.28 | 6.13 | 0.1039 | 0.0029 | |||

| LRCX / Lam Research Corporation | 0.00 | 0.26 | 0.0961 | 0.0961 | |||||

| VRSK / Verisk Analytics, Inc. | 0.00 | 0.00 | 0.26 | 4.49 | 0.0960 | 0.0013 | |||

| NFLX / Netflix, Inc. | 0.00 | -14.09 | 0.25 | 23.41 | 0.0946 | 0.0154 | |||

| TSLA / Tesla, Inc. | 0.00 | -13.13 | 0.25 | 6.41 | 0.0935 | 0.0028 | |||

| COP / ConocoPhillips | 0.00 | 0.00 | 0.25 | -14.73 | 0.0934 | -0.0195 | |||

| VLO / Valero Energy Corporation | 0.00 | 0.00 | 0.24 | 1.67 | 0.0910 | -0.0014 | |||

| ROK / Rockwell Automation, Inc. | 0.00 | 0.24 | 0.0896 | 0.0896 | |||||

| MBB / iShares Trust - iShares MBS ETF | 0.00 | 0.00 | 0.23 | 0.00 | 0.0872 | -0.0028 | |||

| APD / Air Products and Chemicals, Inc. | 0.00 | 0.00 | 0.23 | -4.17 | 0.0862 | -0.0069 | |||

| IWD / iShares Trust - iShares Russell 1000 Value ETF | 0.00 | 0.00 | 0.23 | 3.20 | 0.0845 | -0.0001 | |||

| BK / The Bank of New York Mellon Corporation | 0.00 | 0.00 | 0.23 | 8.65 | 0.0845 | 0.0042 | |||

| BMY / Bristol-Myers Squibb Company | 0.00 | 0.00 | 0.22 | -24.23 | 0.0832 | -0.0300 | |||

| BNS / The Bank of Nova Scotia | 0.00 | 0.22 | 0.0822 | 0.0822 | |||||

| EOG / EOG Resources, Inc. | 0.00 | 0.00 | 0.21 | -6.96 | 0.0803 | -0.0086 | |||

| BND / Vanguard Bond Index Funds - Vanguard Total Bond Market ETF | 0.00 | 0.00 | 0.21 | 0.47 | 0.0797 | -0.0024 | |||

| LHX / L3Harris Technologies, Inc. | 0.00 | 0.21 | 0.0792 | 0.0792 | |||||

| PVBC / Provident Bancorp, Inc. | 0.02 | 0.00 | 0.21 | 8.85 | 0.0782 | 0.0040 | |||

| HYG / iShares Trust - iShares iBoxx $ High Yield Corporate Bond ETF | 0.00 | 0.00 | 0.21 | 1.99 | 0.0769 | -0.0008 | |||

| EBC / Eastern Bankshares, Inc. | 0.01 | -52.88 | 0.17 | -56.17 | 0.0652 | -0.0883 | |||

| BBAI / BigBear.ai Holdings, Inc. | 0.01 | 0.07 | 0.0254 | 0.0254 | |||||

| MTB / M&T Bank Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VNQ / Vanguard Specialized Funds - Vanguard Real Estate ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| NBN / Northeast Bank | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VTWO / Vanguard Scottsdale Funds - Vanguard Russell 2000 ETF | 0.00 | -100.00 | 0.00 | 0.0000 |