Mga Batayang Estadistika

| Nilai Portofolio | $ 1,059,950,051 |

| Posisi Saat Ini | 106 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

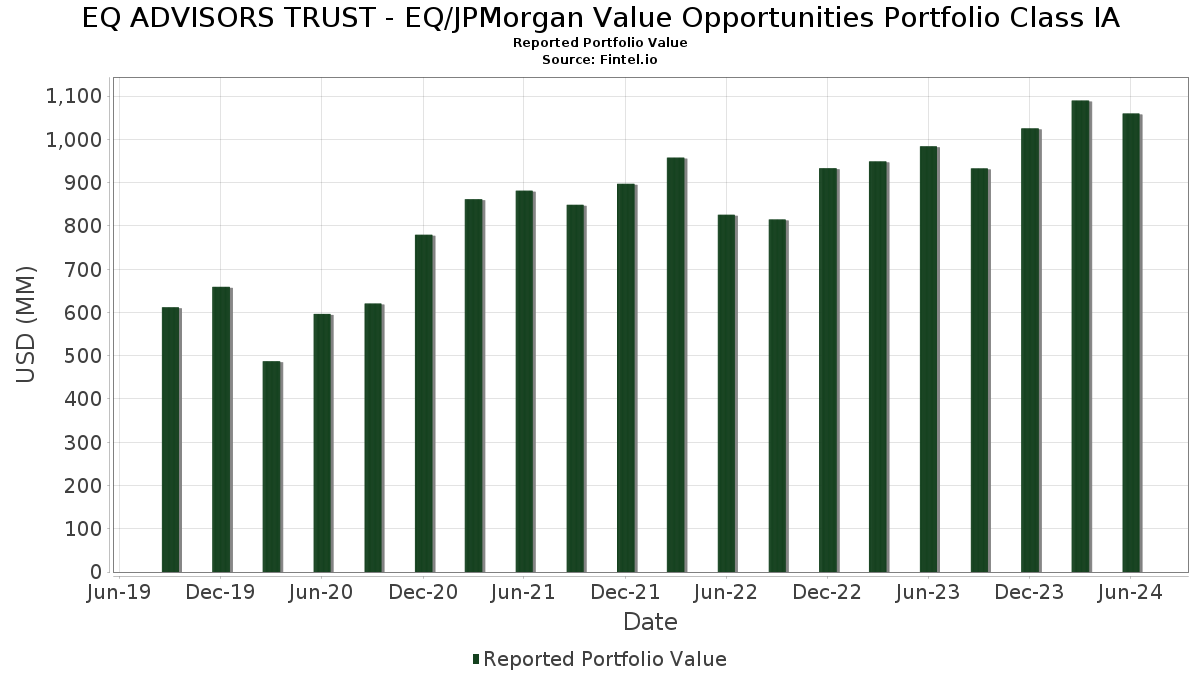

EQ ADVISORS TRUST - EQ/JPMorgan Value Opportunities Portfolio Class IA telah mengungkapkan total kepemilikan 106 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 1,059,950,051 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama EQ ADVISORS TRUST - EQ/JPMorgan Value Opportunities Portfolio Class IA adalah Exxon Mobil Corporation (US:XOM) , Chevron Corporation (US:CVX) , Berkshire Hathaway Inc. (US:BRK.B) , CVS Health Corporation (US:CVS) , and Citigroup Inc. (US:C) . Posisi baru EQ ADVISORS TRUST - EQ/JPMorgan Value Opportunities Portfolio Class IA meliputi: FED HM LN BK BD 7/1/2020 (US:US313384YV57) , Corning Incorporated (US:GLW) , GE Vernova Inc. (US:GEV) , American Tower Corporation (US:AMT) , and AutoZone, Inc. (US:AZO) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.08 | 15.89 | 1.4981 | 1.4981 | |

| 0.33 | 37.76 | 3.5612 | 1.4211 | |

| 0.21 | 13.81 | 1.3023 | 1.3023 | |

| 0.33 | 12.67 | 1.1952 | 1.1952 | |

| 0.27 | 22.36 | 2.1082 | 1.1681 | |

| 0.48 | 28.39 | 2.6774 | 1.1066 | |

| 0.05 | 13.88 | 1.3089 | 0.8331 | |

| 0.29 | 18.00 | 1.6975 | 0.8163 | |

| 0.09 | 7.54 | 0.7113 | 0.7113 | |

| 0.19 | 12.38 | 1.1672 | 0.6811 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.65 | 25.90 | 2.4425 | -2.3966 | |

| 0.10 | 15.33 | 1.4460 | -1.0938 | |

| 0.02 | 5.03 | 0.4745 | -1.0377 | |

| 0.08 | 6.08 | 0.5732 | -0.9983 | |

| 0.12 | 5.04 | 0.4757 | -0.8568 | |

| 0.14 | 5.37 | 0.5063 | -0.8313 | |

| 0.10 | 7.21 | 0.6801 | -0.7706 | |

| 0.01 | 2.22 | 0.2096 | -0.7690 | |

| 0.00 | 0.00 | -0.7348 | ||

| 0.02 | 2.70 | 0.2546 | -0.7318 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2024-08-26 untuk periode pelaporan 2024-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| XOM / Exxon Mobil Corporation | 0.33 | 63.28 | 37.76 | 61.71 | 3.5612 | 1.4211 | |||

| CVX / Chevron Corporation | 0.23 | -6.76 | 35.49 | -7.54 | 3.3471 | -0.1707 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.08 | -0.68 | 32.69 | -3.92 | 3.0824 | -0.0352 | |||

| CVS / CVS Health Corporation | 0.48 | 123.69 | 28.39 | 65.64 | 2.6774 | 1.1066 | |||

| C / Citigroup Inc. | 0.43 | -10.77 | 27.52 | -10.46 | 2.5950 | -0.2214 | |||

| BAC / Bank of America Corporation | 0.65 | -53.23 | 25.90 | -50.95 | 2.4425 | -2.3966 | |||

| ABBV / AbbVie Inc. | 0.13 | 29.69 | 22.66 | 22.16 | 2.1371 | 0.4371 | |||

| LW / Lamb Weston Holdings, Inc. | 0.27 | 176.10 | 22.36 | 117.93 | 2.1082 | 1.1681 | |||

| TFC / Truist Financial Corporation | 0.56 | -21.53 | 21.81 | -21.80 | 2.0570 | -0.4989 | |||

| CAH / Cardinal Health, Inc. | 0.20 | 26.71 | 19.76 | 11.34 | 1.8635 | 0.2370 | |||

| BMY / Bristol-Myers Squibb Company | 0.47 | 27.09 | 19.60 | -2.68 | 1.8482 | 0.0029 | |||

| EMR / Emerson Electric Co. | 0.17 | 34.60 | 19.26 | 30.73 | 1.8164 | 0.4662 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.11 | -1.05 | 18.70 | 26.41 | 1.7631 | 0.4077 | |||

| CARR / Carrier Global Corporation | 0.29 | 72.50 | 18.00 | 87.20 | 1.6975 | 0.8163 | |||

| DLR / Digital Realty Trust, Inc. | 0.12 | 34.84 | 17.86 | 42.34 | 1.6841 | 0.5344 | |||

| PM / Philip Morris International Inc. | 0.17 | 40.34 | 17.58 | 55.21 | 1.6583 | 0.6201 | |||

| HON / Honeywell International Inc. | 0.08 | 38.40 | 17.11 | 44.00 | 1.6137 | 0.5246 | |||

| UNH / UnitedHealth Group Incorporated | 0.03 | 14.02 | 17.07 | 15.17 | 1.6099 | 0.0223 | |||

| SBAC / SBA Communications Corporation | 0.08 | 15.89 | 1.4981 | 1.4981 | |||||

| STX / Seagate Technology Holdings plc | 0.15 | -1.22 | 15.62 | 9.63 | 1.4728 | 0.1673 | |||

| FI / Fiserv, Inc. | 0.10 | -40.67 | 15.33 | -44.68 | 1.4460 | -1.0938 | |||

| US313384YV57 / FED HM LN BK BD 7/1/2020 | 15.02 | 33.66 | 1.4163 | -0.4642 | |||||

| MCD / McDonald's Corporation | 0.06 | 41.74 | 14.67 | 56.38 | 1.3830 | 0.3161 | |||

| CPAY / Corpay, Inc. | 0.05 | 209.60 | 13.88 | 167.37 | 1.3089 | 0.8331 | |||

| ELS / Equity LifeStyle Properties, Inc. | 0.21 | 13.81 | 1.3023 | 1.3023 | |||||

| EQIX / Equinix, Inc. | 0.02 | 43.30 | 13.66 | 50.37 | 1.2883 | 0.3333 | |||

| FDX / FedEx Corporation | 0.04 | -14.82 | 13.33 | -11.85 | 1.2573 | -0.1287 | |||

| FITB / Fifth Third Bancorp | 0.36 | -7.95 | 13.29 | -9.73 | 1.2537 | -0.0960 | |||

| VTR / Ventas, Inc. | 0.26 | -1.04 | 13.17 | 16.50 | 1.2422 | 0.2061 | |||

| WFC / Wells Fargo & Company | 0.22 | 21.00 | 13.07 | 23.98 | 1.2324 | 0.2665 | |||

| TRV / The Travelers Companies, Inc. | 0.06 | -2.27 | 12.80 | -13.65 | 1.2069 | -0.1513 | |||

| GLW / Corning Incorporated | 0.33 | 12.67 | 1.1952 | 1.1952 | |||||

| NEE / NextEra Energy, Inc. | 0.18 | 0.31 | 12.45 | 11.15 | 1.1742 | 0.1476 | |||

| MDLZ / Mondelez International, Inc. | 0.19 | 189.19 | 12.38 | 172.72 | 1.1672 | 0.6811 | |||

| FCX / Freeport-McMoRan Inc. | 0.25 | 26.07 | 12.33 | 30.31 | 1.1632 | 0.2957 | |||

| PFGC / Performance Food Group Company | 0.18 | -7.90 | 12.07 | -18.43 | 1.1380 | -0.2177 | |||

| WMT / Walmart Inc. | 0.18 | -33.64 | 11.95 | -25.33 | 1.1273 | -0.3397 | |||

| BJ / BJ's Wholesale Club Holdings, Inc. | 0.14 | 10.03 | 11.95 | 27.77 | 1.1268 | 0.2698 | |||

| TOL / Toll Brothers, Inc. | 0.10 | 39.61 | 11.92 | 24.29 | 1.1238 | 0.2452 | |||

| CC / The Chemours Company | 0.51 | -8.66 | 11.44 | -21.49 | 1.0788 | -0.2565 | |||

| CCL / Carnival Corporation & plc | 0.60 | 51.41 | 11.24 | 73.48 | 1.0598 | 0.4661 | |||

| FIS / Fidelity National Information Services, Inc. | 0.15 | -34.60 | 11.17 | -33.56 | 1.0532 | -0.4872 | |||

| REGN / Regeneron Pharmaceuticals, Inc. | 0.01 | 28.40 | 10.12 | 40.22 | 0.9545 | 0.2930 | |||

| XEL / Xcel Energy Inc. | 0.18 | 44.07 | 9.70 | 43.16 | 0.9147 | 0.2938 | |||

| EQR / Equity Residential | 0.14 | 11.23 | 9.48 | 22.20 | 0.8939 | 0.1831 | |||

| AER / AerCap Holdings N.V. | 0.09 | -44.62 | 8.38 | -40.62 | 0.7905 | -0.5031 | |||

| D / Dominion Energy, Inc. | 0.17 | 40.29 | 8.36 | 39.74 | 0.7884 | 0.2402 | |||

| SQ / Block, Inc. | 0.13 | 92.83 | 8.17 | 47.05 | 0.7707 | 0.2613 | |||

| TT / Trane Technologies plc | 0.02 | 38.95 | 8.17 | 52.26 | 0.7703 | 0.2786 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.01 | -1.97 | 7.91 | -6.73 | 0.7464 | -0.0313 | |||

| GPK / Graphic Packaging Holding Company | 0.29 | -1.45 | 7.59 | -11.48 | 0.7154 | -0.0700 | |||

| NTRS / Northern Trust Corporation | 0.09 | 7.54 | 0.7113 | 0.7113 | |||||

| CSX / CSX Corporation | 0.22 | -40.78 | 7.43 | -46.56 | 0.7009 | -0.5737 | |||

| MET / MetLife, Inc. | 0.10 | -51.90 | 7.21 | -54.44 | 0.6801 | -0.7706 | |||

| GEV / GE Vernova Inc. | 0.04 | 6.79 | 0.6403 | 0.6403 | |||||

| MCHP / Microchip Technology Incorporated | 0.07 | -22.59 | 6.62 | -21.04 | 0.6238 | -0.1440 | |||

| BIIB / Biogen Inc. | 0.03 | 94.33 | 6.49 | 108.92 | 0.6120 | 0.3273 | |||

| VZ / Verizon Communications Inc. | 0.15 | 18.74 | 6.18 | 16.69 | 0.5828 | 0.0975 | |||

| MDT / Medtronic plc | 0.08 | -60.75 | 6.08 | -64.56 | 0.5732 | -0.9983 | |||

| NOC / Northrop Grumman Corporation | 0.01 | -20.59 | 5.95 | -22.59 | 0.5615 | -0.2401 | |||

| CMS / CMS Energy Corporation | 0.10 | -2.06 | 5.92 | -3.38 | 0.5586 | -0.0032 | |||

| DAL / Delta Air Lines, Inc. | 0.12 | -31.32 | 5.90 | -31.94 | 0.5565 | -0.2380 | |||

| BKR / Baker Hughes Company | 0.17 | -1.04 | 5.88 | 3.89 | 0.5548 | 0.0359 | |||

| AMT / American Tower Corporation | 0.03 | 5.84 | 0.5505 | 0.5505 | |||||

| CHTR / Charter Communications, Inc. | 0.02 | -39.21 | 5.83 | -53.25 | 0.5502 | -0.6671 | |||

| AZO / AutoZone, Inc. | 0.00 | 5.67 | 0.5347 | 0.5347 | |||||

| MHK / Mohawk Industries, Inc. | 0.05 | -43.23 | 5.62 | -50.74 | 0.5302 | -0.5156 | |||

| MAS / Masco Corporation | 0.08 | -1.25 | 5.50 | -16.55 | 0.5190 | -0.0853 | |||

| SCHW / The Charles Schwab Corporation | 0.07 | -51.13 | 5.50 | -50.22 | 0.5186 | -0.4937 | |||

| RCL / Royal Caribbean Cruises Ltd. | 0.03 | -40.10 | 5.48 | -31.31 | 0.5169 | -0.2143 | |||

| WMG / Warner Music Group Corp. | 0.18 | 5.45 | 0.5137 | 0.5137 | |||||

| ADM / Archer-Daniels-Midland Company | 0.09 | -0.98 | 5.40 | -4.70 | 0.5088 | -0.0100 | |||

| CMCSA / Comcast Corporation | 0.14 | -56.15 | 5.37 | -60.84 | 0.5063 | -0.8313 | |||

| NI / NiSource Inc. | 0.18 | 5.30 | 0.4997 | 0.4997 | |||||

| JNJ / Johnson & Johnson | 0.04 | -29.28 | 5.26 | -37.56 | 0.4961 | -0.3660 | |||

| SLGN / Silgan Holdings Inc. | 0.12 | -60.20 | 5.04 | -65.31 | 0.4757 | -0.8568 | |||

| NXPI / NXP Semiconductors N.V. | 0.02 | -71.92 | 5.03 | -69.51 | 0.4745 | -1.0377 | |||

| KTB / Kontoor Brands, Inc. | 0.07 | -54.18 | 4.94 | -49.70 | 0.4655 | -0.4336 | |||

| BMRN / BioMarin Pharmaceutical Inc. | 0.06 | 11.87 | 4.93 | 5.46 | 0.4647 | 0.0365 | |||

| CME / CME Group Inc. | 0.02 | 817.34 | 4.89 | 873.51 | 0.4609 | 0.4095 | |||

| HSY / The Hershey Company | 0.02 | 4.52 | 0.4264 | 0.4264 | |||||

| IP / International Paper Company | 0.10 | 4.19 | 0.3950 | 0.3950 | |||||

| US7587501039 / Regal-Beloit Corp. | 0.03 | 100.36 | 4.12 | 50.44 | 0.3885 | 0.1375 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.01 | 41.32 | 3.97 | 58.45 | 0.3748 | 0.1450 | |||

| WBD / Warner Bros. Discovery, Inc. | 0.53 | -43.55 | 3.92 | -51.90 | 0.3698 | -0.3772 | |||

| TDG / TransDigm Group Incorporated | 0.00 | 3.88 | 0.3655 | 0.3655 | |||||

| HPE / Hewlett Packard Enterprise Company | 0.18 | -43.29 | 3.79 | -15.75 | 0.3572 | -0.1744 | |||

| AA / Alcoa Corporation | 0.09 | -41.58 | 3.65 | -31.22 | 0.3445 | -0.1423 | |||

| UBER / Uber Technologies, Inc. | 0.05 | 3.63 | 0.3419 | 0.3419 | |||||

| NBIX / Neurocrine Biosciences, Inc. | 0.02 | -18.92 | 3.35 | 14.50 | 0.3158 | -0.0384 | |||

| MTG / MGIC Investment Corporation | 0.15 | 3.30 | 0.3112 | 0.3112 | |||||

| AON / Aon plc | 0.01 | 3.16 | 0.2980 | 0.2980 | |||||

| MPC / Marathon Petroleum Corporation | 0.02 | -34.65 | 3.15 | -43.74 | 0.2971 | -0.2161 | |||

| NVT / nVent Electric plc | 0.04 | 3.06 | 0.2883 | 0.2883 | |||||

| BAX / Baxter International Inc. | 0.09 | -1.04 | 2.96 | -22.54 | 0.2791 | -0.0711 | |||

| NXT / Nextracker Inc. | 0.06 | 2.92 | 0.2750 | 0.2750 | |||||

| CPRI / Capri Holdings Limited | 0.08 | -1.38 | 2.77 | -27.99 | 0.2609 | -0.0912 | |||

| ORCL / Oracle Corporation | 0.02 | -80.06 | 2.70 | -73.30 | 0.2546 | -0.7318 | |||

| FCNCA / First Citizens BancShares, Inc. | 0.00 | 2.70 | 0.2542 | 0.2542 | |||||

| LYV / Live Nation Entertainment, Inc. | 0.03 | 2.49 | 0.2346 | 0.2346 | |||||

| AES / The AES Corporation | 0.14 | 2.44 | 0.2298 | 0.2298 | |||||

| FSLR / First Solar, Inc. | 0.01 | -82.28 | 2.30 | 10.78 | 0.2171 | -0.2088 | |||

| AMZN / Amazon.com, Inc. | 0.01 | -80.58 | 2.22 | -79.19 | 0.2096 | -0.7690 | |||

| ICE / Intercontinental Exchange, Inc. | 0.02 | -62.59 | 2.15 | -60.14 | 0.2024 | -0.3227 | |||

| SIRI / Sirius XM Holdings Inc. | 0.34 | 0.96 | 0.0906 | 0.0906 | |||||

| Viking Holdings Ltd. / EC (BMG93A5A1010) | 0.00 | 0.12 | 0.0113 | 0.0113 | |||||

| ILMN / Illumina, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2659 | ||||

| GE / General Electric Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.3005 | ||||

| LHX / L3Harris Technologies, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2363 | ||||

| META / Meta Platforms, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.7348 | ||||

| AAL / American Airlines Group Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.4811 |