Mga Batayang Estadistika

| Nilai Portofolio | $ 64,058,288 |

| Posisi Saat Ini | 54 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

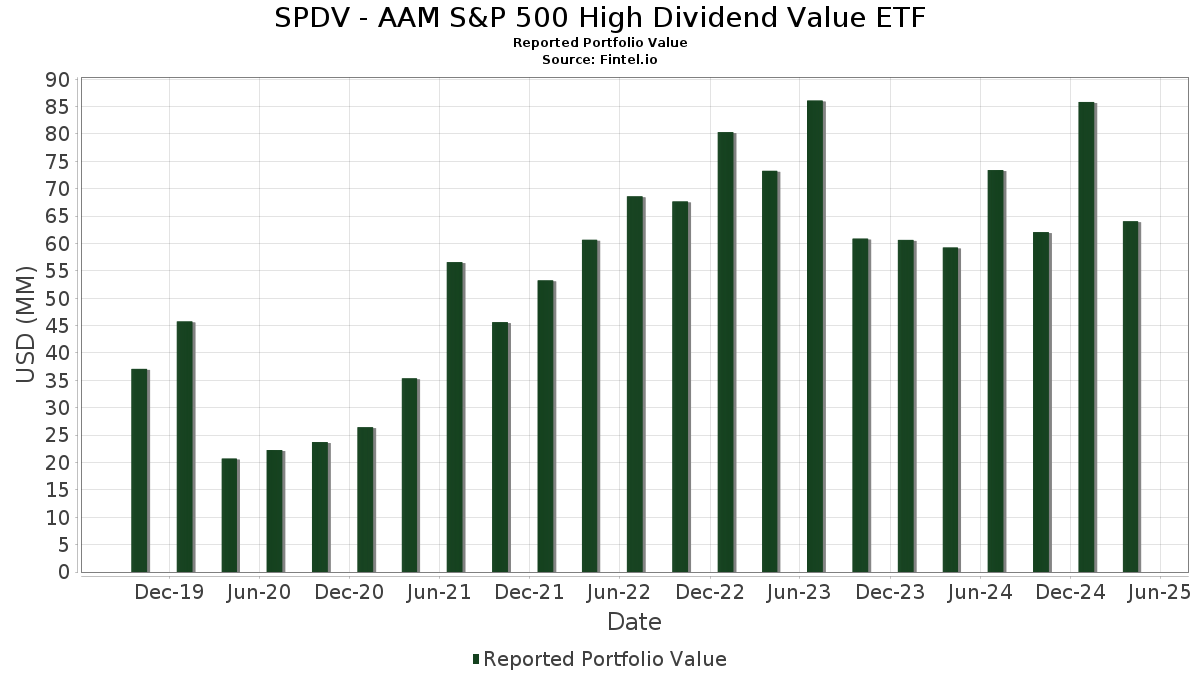

SPDV - AAM S&P 500 High Dividend Value ETF telah mengungkapkan total kepemilikan 54 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 64,058,288 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama SPDV - AAM S&P 500 High Dividend Value ETF adalah AT&T Inc. (US:T) , Gilead Sciences, Inc. (US:GILD) , Altria Group, Inc. (US:MO) , WEC Energy Group, Inc. (US:WEC) , and Verizon Communications Inc. (US:VZ) . Posisi baru SPDV - AAM S&P 500 High Dividend Value ETF meliputi: The Southern Company (US:SO) , Johnson & Johnson (US:JNJ) , RTX Corporation (US:RTX) , EOG Resources, Inc. (US:EOG) , and .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.02 | 1.47 | 2.2992 | 2.2992 | |

| 0.01 | 1.42 | 2.2238 | 2.2238 | |

| 0.01 | 1.34 | 2.1024 | 2.1024 | |

| 0.05 | 1.25 | 1.9542 | 1.9542 | |

| 0.02 | 1.21 | 1.8926 | 1.8926 | |

| 0.01 | 1.12 | 1.7481 | 1.7481 | |

| 0.03 | 1.04 | 1.6235 | 1.6235 | |

| 0.13 | 1.32 | 2.0660 | 0.8116 | |

| 0.03 | 1.33 | 2.0816 | 0.6526 | |

| 0.03 | 1.49 | 2.3275 | 0.6393 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.01 | 0.91 | 1.4167 | -2.5370 | |

| 0.02 | 1.26 | 1.9767 | -1.1478 | |

| 0.02 | 1.12 | 1.7572 | -0.4955 | |

| 0.05 | 1.11 | 1.7422 | -0.4279 | |

| 0.04 | 1.16 | 1.8148 | -0.4135 | |

| 0.05 | 0.89 | 1.3902 | -0.4071 | |

| 0.00 | 1.20 | 1.8699 | -0.3732 | |

| 0.02 | 1.19 | 1.8580 | -0.3449 | |

| 0.08 | 1.05 | 1.6504 | -0.3218 | |

| 0.01 | 1.30 | 2.0369 | -0.3189 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-06-30 untuk periode pelaporan 2025-04-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| T / AT&T Inc. | 0.06 | -23.04 | 1.63 | -10.21 | 2.5465 | 0.4322 | |||

| GILD / Gilead Sciences, Inc. | 0.01 | -27.93 | 1.53 | -20.99 | 2.3907 | 0.1335 | |||

| MO / Altria Group, Inc. | 0.03 | -13.33 | 1.52 | -1.81 | 2.3736 | 0.5700 | |||

| WEC / WEC Energy Group, Inc. | 0.01 | -22.23 | 1.49 | -14.21 | 2.3339 | 0.3052 | |||

| VZ / Verizon Communications Inc. | 0.03 | -8.07 | 1.49 | 2.84 | 2.3275 | 0.6393 | |||

| SO / The Southern Company | 0.02 | 1.47 | 2.2992 | 2.2992 | |||||

| HAS / Hasbro, Inc. | 0.02 | -5.51 | 1.44 | 1.12 | 2.2516 | 0.5908 | |||

| IBM / International Business Machines Corporation | 0.01 | -25.31 | 1.44 | -29.37 | 2.2467 | -0.1258 | |||

| JNJ / Johnson & Johnson | 0.01 | 1.42 | 2.2238 | 2.2238 | |||||

| TAP / Molson Coors Beverage Company | 0.02 | -11.38 | 1.39 | -6.89 | 2.1784 | 0.4337 | |||

| RTX / RTX Corporation | 0.01 | 1.34 | 2.1024 | 2.1024 | |||||

| LKQ / LKQ Corporation | 0.03 | 6.31 | 1.33 | 8.66 | 2.0816 | 0.6526 | |||

| KHC / The Kraft Heinz Company | 0.05 | 3.33 | 1.33 | 0.76 | 2.0737 | 0.5388 | |||

| F / Ford Motor Company | 0.13 | 23.70 | 1.32 | 22.79 | 2.0660 | 0.8116 | |||

| NRG / NRG Energy, Inc. | 0.01 | -39.71 | 1.30 | -35.48 | 2.0369 | -0.3189 | |||

| LMT / Lockheed Martin Corporation | 0.00 | -26.69 | 1.28 | -21.53 | 2.0075 | 0.1079 | |||

| CAG / Conagra Brands, Inc. | 0.05 | 6.13 | 1.28 | 1.27 | 2.0016 | 0.5278 | |||

| TPR / Tapestry, Inc. | 0.02 | -51.28 | 1.26 | -52.82 | 1.9767 | -1.1478 | |||

| ADM / Archer-Daniels-Midland Company | 0.03 | 13.66 | 1.26 | 5.96 | 1.9746 | 0.5844 | |||

| AMCR / Amcor plc | 0.14 | -5.74 | 1.26 | -10.78 | 1.9689 | 0.3229 | |||

| PFE / Pfizer Inc. | 0.05 | 1.25 | 1.9542 | 1.9542 | |||||

| CSCO / Cisco Systems, Inc. | 0.02 | -31.28 | 1.24 | -34.57 | 1.9376 | -0.2701 | |||

| NEE / NextEra Energy, Inc. | 0.02 | -5.07 | 1.23 | -11.22 | 1.9180 | 0.3055 | |||

| CMCSA / Comcast Corporation | 0.04 | -7.62 | 1.21 | -6.19 | 1.8988 | 0.3900 | |||

| PFG / Principal Financial Group, Inc. | 0.02 | 1.21 | 1.8926 | 1.8926 | |||||

| SPG / Simon Property Group, Inc. | 0.01 | -21.13 | 1.21 | -28.66 | 1.8864 | -0.0844 | |||

| SNA / Snap-on Incorporated | 0.00 | -29.63 | 1.20 | -37.83 | 1.8699 | -0.3732 | |||

| CF / CF Industries Holdings, Inc. | 0.02 | -25.98 | 1.19 | -37.10 | 1.8580 | -0.3449 | |||

| IPG / The Interpublic Group of Companies, Inc. | 0.05 | -5.06 | 1.18 | -16.78 | 1.8384 | 0.1900 | |||

| OMC / Omnicom Group Inc. | 0.02 | -4.31 | 1.17 | -16.02 | 1.8377 | 0.2054 | |||

| PRU / Prudential Financial, Inc. | 0.01 | -30.34 | 1.17 | -25.89 | 1.8287 | -0.0023 | |||

| CVX / Chevron Corporation | 0.01 | -8.68 | 1.17 | -16.70 | 1.8258 | 0.1908 | |||

| KMI / Kinder Morgan, Inc. | 0.04 | -36.53 | 1.16 | -39.24 | 1.8148 | -0.4135 | |||

| BXP / Boston Properties, Inc. | 0.02 | -16.85 | 1.16 | -27.57 | 1.8095 | -0.0532 | |||

| DOC / Healthpeak Properties, Inc. | 0.06 | -9.04 | 1.14 | -21.44 | 1.7889 | 0.0901 | |||

| BMY / Bristol-Myers Squibb Company | 0.02 | -31.68 | 1.12 | -41.81 | 1.7572 | -0.4955 | |||

| EOG / EOG Resources, Inc. | 0.01 | 1.12 | 1.7481 | 1.7481 | |||||

| HST / Host Hotels & Resorts, Inc. | 0.08 | -7.02 | 1.11 | -21.45 | 1.7422 | 0.0883 | |||

| RF / Regions Financial Corporation | 0.05 | 8.47 | 1.11 | -3.47 | 1.7422 | -0.4279 | |||

| VLO / Valero Energy Corporation | 0.01 | -2.35 | 1.11 | -14.75 | 1.7366 | 0.2170 | |||

| IVZ / Invesco Ltd. | 0.08 | -13.84 | 1.05 | -37.63 | 1.6504 | -0.3218 | |||

| BBY / Best Buy Co., Inc. | 0.02 | -5.59 | 1.05 | -26.73 | 1.6440 | -0.0281 | |||

| HPQ / HP Inc. | 0.04 | 5.85 | 1.04 | -16.69 | 1.6318 | 0.1704 | |||

| CFG / Citizens Financial Group, Inc. | 0.03 | 1.04 | 1.6235 | 1.6235 | |||||

| LYB / LyondellBasell Industries N.V. | 0.02 | 12.83 | 1.00 | -13.22 | 1.5717 | 0.2206 | |||

| VTRS / Viatris Inc. | 0.12 | -4.28 | 1.00 | -28.56 | 1.5703 | -0.0689 | |||

| UPS / United Parcel Service, Inc. | 0.01 | -11.46 | 0.96 | -26.12 | 1.4962 | -0.0145 | |||

| ARE / Alexandria Real Estate Equities, Inc. | 0.01 | 4.11 | 0.95 | -22.31 | 1.4933 | 0.0600 | |||

| SWKS / Skyworks Solutions, Inc. | 0.01 | 14.11 | 0.94 | -17.31 | 1.4722 | 0.1434 | |||

| SWK / Stanley Black & Decker, Inc. | 0.02 | -10.17 | 0.91 | -38.81 | 1.4219 | -0.3105 | |||

| VST / Vistra Corp. | 0.01 | -65.36 | 0.91 | -73.29 | 1.4167 | -2.5370 | |||

| APA / APA Corporation | 0.06 | 18.96 | 0.89 | -15.73 | 1.3919 | 0.1604 | |||

| HPE / Hewlett Packard Enterprise Company | 0.05 | -24.63 | 0.89 | -42.34 | 1.3902 | -0.4071 | |||

| US8252528851 / Invesco Government & Agency Portfolio, Institutional Class | 0.19 | 60.75 | 0.19 | 60.87 | 0.2904 | 0.1557 |