Mga Batayang Estadistika

| Nilai Portofolio | $ 367,946,000 |

| Posisi Saat Ini | 63 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

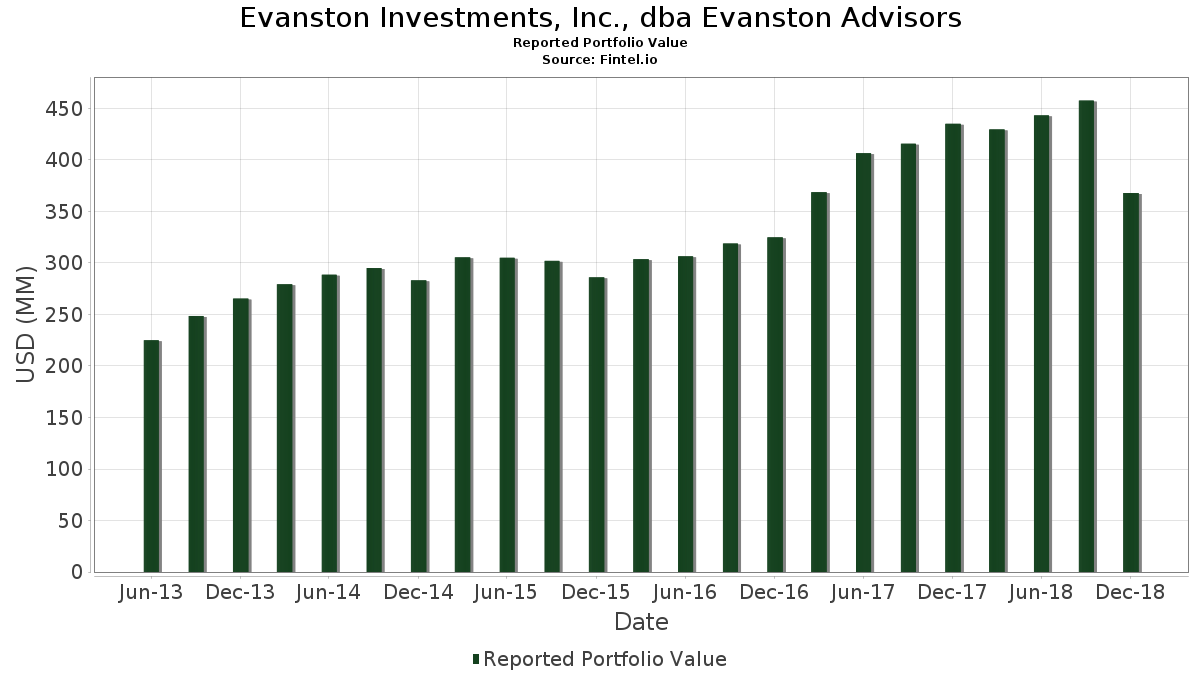

Evanston Investments, Inc., dba Evanston Advisors telah mengungkapkan total kepemilikan 63 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 367,946,000 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Evanston Investments, Inc., dba Evanston Advisors adalah SPDR S&P 500 ETF (US:SPY) , Invesco BulletShares 2019 Corporate Bond ETF (US:BSCJ) , Invesco Capital Management LLC - Invesco BulletShares 2022 Corporate Bond ETF (US:BSCM) , Invesco BulletShares 2020 Corporate Bond ETF (US:US46138J5020) , and Invesco Capital Management LLC - Invesco BulletShares 2021 Corporate Bond ETF (US:BSCL) . Posisi baru Evanston Investments, Inc., dba Evanston Advisors meliputi: The Chemours Company (US:CC) , iShares Trust - iShares Core S&P Small-Cap ETF (US:IJR) , Akorn, Inc. (US:AKRX) , Glu Mobile Inc. (US:US3798901068) , and Energous Corporation (US:WATT) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.19 | 47.35 | 12.8693 | 12.8693 | |

| 1.42 | 17.45 | 4.7428 | 4.7428 | |

| 0.94 | 18.99 | 5.1611 | 4.4167 | |

| 0.05 | 8.86 | 2.4074 | 2.4074 | |

| 0.29 | 8.18 | 2.2223 | 2.2223 | |

| 0.13 | 8.17 | 2.2204 | 2.2204 | |

| 0.04 | 7.93 | 2.1552 | 2.1552 | |

| 0.21 | 7.83 | 2.1278 | 2.1278 | |

| 0.15 | 7.38 | 2.0044 | 2.0044 | |

| 0.43 | 7.24 | 1.9663 | 1.9663 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.00 | -1.9168 | ||

| 0.00 | 0.00 | -1.8882 | ||

| 0.00 | 0.00 | -1.8491 | ||

| 0.00 | 0.00 | -1.7245 | ||

| 0.00 | 0.00 | -1.6697 | ||

| 0.00 | 0.00 | -1.6465 | ||

| 0.00 | 0.00 | -1.5585 | ||

| 0.12 | 7.36 | 1.9992 | -0.3408 | |

| 0.09 | 6.45 | 1.7535 | -0.2871 | |

| 0.01 | 1.03 | 0.2802 | -0.1699 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2019-02-11 untuk periode pelaporan 2018-12-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SPY / SPDR S&P 500 ETF | 0.19 | 47.35 | 12.8693 | 12.8693 | |||||

| BSCJ / Invesco BulletShares 2019 Corporate Bond ETF | 1.02 | -2.53 | 21.45 | -2.63 | 5.8291 | 1.0165 | |||

| BSCM / Invesco Capital Management LLC - Invesco BulletShares 2022 Corporate Bond ETF | 1.04 | 0.89 | 21.34 | 0.67 | 5.7989 | 1.1683 | |||

| US46138J5020 / Invesco BulletShares 2020 Corporate Bond ETF | 1.01 | -2.10 | 21.31 | -2.15 | 5.7924 | 1.0336 | |||

| BSCL / Invesco Capital Management LLC - Invesco BulletShares 2021 Corporate Bond ETF | 1.02 | -2.07 | 21.25 | -2.02 | 5.7750 | 1.0365 | |||

| BSCN / Invesco Exchange-Traded Self-Indexed Fund Trust - Invesco BulletShares 2023 Corporate Bond ETF | 0.94 | 458.77 | 18.99 | 457.38 | 5.1611 | 4.4167 | |||

| IAU / iShares Gold Trust | 1.42 | -2.02 | 17.45 | 5.35 | 4.7428 | 4.7428 | |||

| AMGN / Amgen Inc. | 0.05 | -2.82 | 8.86 | -8.74 | 2.4074 | 2.4074 | |||

| OMC / Omnicom Group Inc. | 0.12 | -2.85 | 8.78 | 4.60 | 2.3862 | 0.5522 | |||

| CNP / CenterPoint Energy, Inc. | 0.31 | -1.99 | 8.64 | 0.07 | 2.3482 | 0.4618 | |||

| INTC / Intel Corporation | 0.18 | -1.12 | 8.60 | -1.87 | 2.3381 | 0.4226 | |||

| ABBV / AbbVie Inc. | 0.09 | 0.75 | 8.47 | -1.80 | 2.3022 | 0.4176 | |||

| KR / The Kroger Co. | 0.31 | -2.30 | 8.43 | -7.71 | 2.2903 | 0.2953 | |||

| RGA / Reinsurance Group of America, Incorporated | 0.06 | -0.48 | 8.22 | -3.47 | 2.2329 | 0.3734 | |||

| CC / The Chemours Company | 0.29 | 8.18 | 2.2223 | 2.2223 | |||||

| SYY / Sysco Corporation | 0.13 | -1.94 | 8.17 | -16.11 | 2.2204 | 2.2204 | |||

| CP / Canadian Pacific Kansas City Limited | 0.04 | -2.30 | 7.93 | -18.12 | 2.1552 | 2.1552 | |||

| CDW / CDW Corporation | 0.10 | 0.05 | 7.84 | -8.80 | 2.1299 | 0.2525 | |||

| US40416M1053 / Hd Supply Inc. | 0.21 | 1.44 | 7.83 | -11.05 | 2.1278 | 2.1278 | |||

| CVS / CVS Health Corporation | 0.12 | -2.23 | 7.76 | -18.63 | 2.1087 | 0.0252 | |||

| TD / The Toronto-Dominion Bank | 0.15 | 0.45 | 7.38 | -17.85 | 2.0044 | 2.0044 | |||

| NTAP / NetApp, Inc. | 0.12 | -1.13 | 7.36 | -31.32 | 1.9992 | -0.3408 | |||

| PCAR / PACCAR Inc | 0.13 | 3.51 | 7.24 | -13.27 | 1.9688 | 0.1440 | |||

| HST / Host Hotels & Resorts, Inc. | 0.43 | 1.08 | 7.24 | -20.13 | 1.9663 | 1.9663 | |||

| ABC / Amerisource Bergen Corp. | 0.10 | -1.01 | 7.20 | -20.13 | 1.9579 | -0.0129 | |||

| EBAY / eBay Inc. | 0.25 | 4.27 | 6.96 | -11.37 | 1.8916 | 1.8916 | |||

| COF / Capital One Financial Corporation | 0.09 | 2.04 | 6.93 | -18.75 | 1.8848 | 0.0200 | |||

| VLO / Valero Energy Corporation | 0.09 | 4.81 | 6.45 | -30.92 | 1.7535 | -0.2871 | |||

| ALE / ALLETE, Inc. | 0.05 | -1.82 | 3.96 | -0.25 | 1.0760 | 1.0760 | |||

| CVI / CVR Energy, Inc. | 0.11 | -1.17 | 3.64 | -15.27 | 0.9895 | 0.0507 | |||

| PRI / Primerica, Inc. | 0.04 | -1.91 | 3.53 | -20.49 | 0.9588 | 0.9588 | |||

| SHO / Sunstone Hotel Investors, Inc. | 0.25 | 2.45 | 3.24 | -18.53 | 0.8795 | 0.8795 | |||

| PBH / Prestige Consumer Healthcare Inc. | 0.10 | 1.31 | 3.21 | -17.44 | 0.8711 | 0.8711 | |||

| VSH / Vishay Intertechnology, Inc. | 0.18 | 6.14 | 3.20 | -6.04 | 0.8705 | 0.8705 | |||

| WOR / Worthington Enterprises, Inc. | 0.09 | 2.87 | 3.13 | -17.35 | 0.8507 | 0.8507 | |||

| TEN / Tsakos Energy Navigation Limited | 0.09 | 13.14 | 2.47 | -26.46 | 0.6721 | -0.0627 | |||

| WMT / Walmart Inc. | 0.01 | -49.56 | 1.03 | -49.95 | 0.2802 | -0.1699 | |||

| VFINX / Vanguard Index Funds - Vanguard Index Trust 500 Index Fund | 0.00 | 7.94 | 0.96 | -7.09 | 0.2598 | 0.2598 | |||

| XOM / Exxon Mobil Corporation | 0.01 | -2.08 | 0.79 | -21.46 | 0.2158 | -0.0051 | |||

| AAPL / Apple Inc. | 0.00 | 81.20 | 0.55 | 26.67 | 0.1498 | 0.0547 | |||

| GLD / SPDR Gold Trust | 0.00 | 0.00 | 0.43 | 7.58 | 0.1158 | 0.0293 | |||

| GRMN / Garmin Ltd. | 0.01 | 0.00 | 0.42 | -9.59 | 0.1152 | 0.0128 | |||

| NLY / Annaly Capital Management, Inc. | 0.04 | 0.00 | 0.42 | -3.90 | 0.1139 | 0.1139 | |||

| MMM / 3M Company | 0.00 | 0.65 | 0.41 | -8.79 | 0.1128 | 0.0134 | |||

| IJR / iShares Trust - iShares Core S&P Small-Cap ETF | 0.01 | 0.40 | 0.1079 | 0.1079 | |||||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | 0.00 | 0.31 | -4.37 | 0.0832 | 0.0132 | |||

| APO / Apollo Global Management, Inc. | 0.01 | 0.00 | 0.24 | -29.19 | 0.0666 | 0.0666 | |||

| BX / Blackstone Inc. | 0.01 | 0.00 | 0.24 | -21.97 | 0.0647 | 0.0647 | |||

| UNP / Union Pacific Corporation | 0.00 | 0.00 | 0.23 | -15.16 | 0.0639 | 0.0639 | |||

| TM / Toyota Motor Corporation - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 0.23 | -6.83 | 0.0631 | 0.0086 | |||

| CSCO / Cisco Systems, Inc. | 0.00 | 0.00 | 0.21 | -11.11 | 0.0565 | 0.0054 | |||

| SLV / iShares Silver Trust | 0.01 | 0.00 | 0.20 | 5.79 | 0.0546 | 0.0131 | |||

| GE / General Electric Company | 0.02 | 73.80 | 0.14 | 16.53 | 0.0383 | 0.0119 | |||

| LIND / Lindblad Expeditions Holdings, Inc. | 0.01 | 0.00 | 0.14 | -9.40 | 0.0367 | 0.0041 | |||

| NOK / Nokia Oyj - Depositary Receipt (Common Stock) | 0.02 | 99.65 | 0.12 | 108.93 | 0.0318 | 0.0318 | |||

| AKRX / Akorn, Inc. | 0.03 | 0.09 | 0.0231 | 0.0231 | |||||

| XETWX / Eaton Vance Tax-Managed Global | 0.01 | 0.00 | 0.08 | -21.15 | 0.0223 | 0.0223 | |||

| US3798901068 / Glu Mobile Inc. | 0.01 | 0.08 | 0.0220 | 0.0220 | |||||

| WATT / Energous Corporation | 0.01 | 0.06 | 0.0174 | 0.0174 | |||||

| 03765K104 / Aphria Inc. | 0.01 | 0.06 | 0.0155 | 0.0155 | |||||

| ACB / Aurora Cannabis Inc. | 0.01 | 0.05 | 0.0144 | 0.0144 | |||||

| GMO / | 0.19 | 4.17 | 0.04 | -35.82 | 0.0117 | -0.0030 | |||

| US45773Y1055 / InnerWorkings, Inc. | 0.01 | 0.00 | 0.04 | -53.16 | 0.0101 | 0.0101 | |||

| OHI / Omega Healthcare Investors, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0717 | ||||

| IBM / International Business Machines Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -1.9168 | ||||

| GT / The Goodyear Tire & Rubber Company | 0.00 | -100.00 | 0.00 | -100.00 | -1.6697 | ||||

| SU / Suncor Energy Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| SAFM / Sanderson Farms, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| US00C4U1L353 / Mylan N.V. | 0.00 | -100.00 | 0.00 | -100.00 | -1.7245 | ||||

| MET / MetLife, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.8491 | ||||

| HUN / Huntsman Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -1.6465 | ||||

| WNC / Wabash National Corporation | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| AMAT / Applied Materials, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.5585 | ||||

| HBI / Hanesbrands Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| CAIAF / CA Immobilien Anlagen AG | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| PBE / Invesco Exchange-Traded Fund Trust - Invesco Biotechnology & Genome ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| Invesco Exch Trd Slf Idx Fd / BULSHS2018 COR (46138J106) | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| OMCL / Omnicell, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | ||||

| PFE / Pfizer Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0524 | ||||

| T / AT&T Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.8882 |