Mga Batayang Estadistika

| Nilai Portofolio | $ 58,677,000 |

| Posisi Saat Ini | 48 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

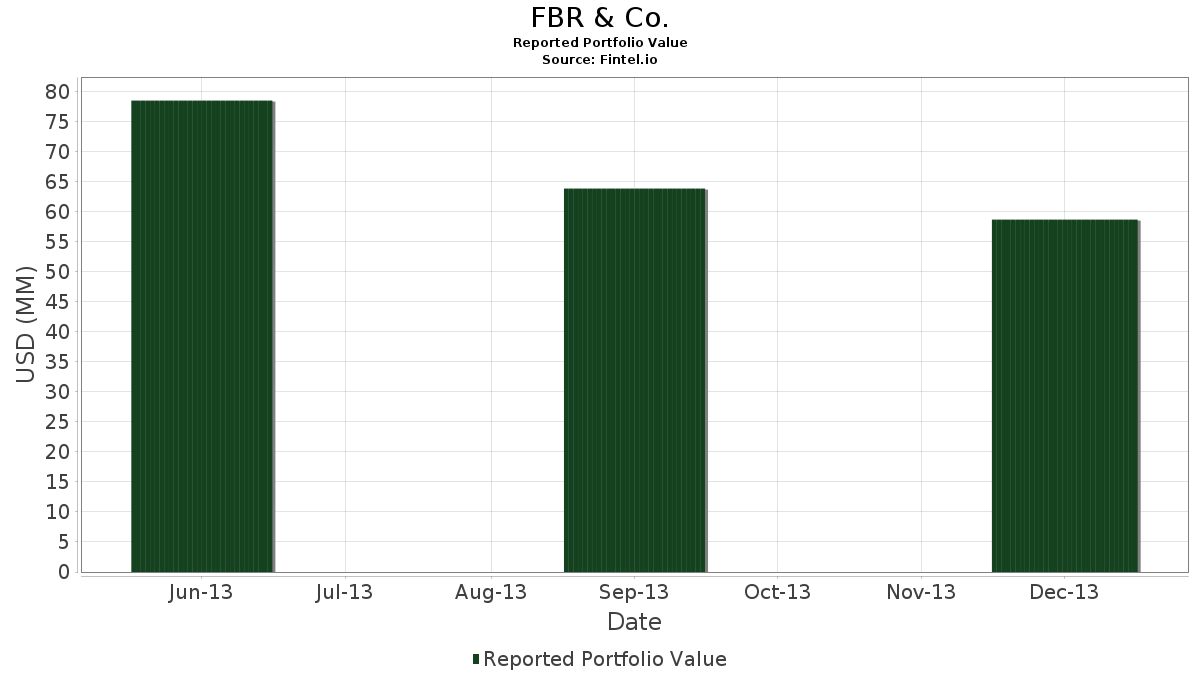

FBR & Co. telah mengungkapkan total kepemilikan 48 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 58,677,000 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama FBR & Co. adalah AK Steel Holding Corp. 1.5% Bond due 2019-11-15 (US:US001546AP59) , Morgan Stanley Institutional Fund Trust. - MSIFT Senior Loan Portfolio USD Cls IS (US:MSLEX) , NMI Holdings, Inc. (US:NMIH) , XPO Logistics, Inc. Bond (US:983793AA8) , and aTyr Pharma, Inc. (US:LIFE) . Posisi baru FBR & Co. meliputi: AK Steel Holding Corp. 1.5% Bond due 2019-11-15 (US:US001546AP59) , NMI Holdings, Inc. (US:NMIH) , XPO Logistics, Inc. Bond (US:983793AA8) , Starwood Property Trust Inc Bond (US:85571BAB1) , and PVR PARTNERS L P (IN:PVR) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 6.56 | 11.1867 | 9.7404 | ||

| 0.31 | 4.00 | 6.8102 | 6.8102 | |

| 0.04 | 3.03 | 5.1673 | 5.1673 | |

| 0.10 | 2.68 | 4.5725 | 4.5725 | |

| 0.05 | 2.56 | 4.3680 | 4.3680 | |

| 0.10 | 1.93 | 3.2875 | 3.2875 | |

| 0.09 | 1.55 | 2.6382 | 2.6382 | |

| 0.05 | 1.28 | 2.1814 | 2.1814 | |

| 0.02 | 1.20 | 2.0400 | 2.0400 | |

| 2.77 | 4.7139 | 1.4053 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.00 | -34.5648 | ||

| 0.00 | 0.00 | -2.1135 | ||

| 0.12 | 2.12 | 3.6062 | -1.1428 | |

| 0.00 | 0.00 | -1.0681 | ||

| 0.00 | 0.00 | -0.6838 | ||

| 0.04 | 1.19 | 2.0332 | -0.1348 | |

| 0.00 | 0.13 | 0.2267 | -0.0093 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2014-02-11 untuk periode pelaporan 2013-12-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US001546AP59 / AK Steel Holding Corp. 1.5% Bond due 2019-11-15 | 6.56 | 586.61 | 11.1867 | 9.7404 | |||||

| MSLEX / Morgan Stanley Institutional Fund Trust. - MSIFT Senior Loan Portfolio USD Cls IS | 0.20 | 0.00 | 4.91 | 0.00 | 8.3610 | 0.9388 | |||

| NMIH / NMI Holdings, Inc. | 0.31 | 4.00 | 6.8102 | 6.8102 | |||||

| 983793AA8 / XPO Logistics, Inc. Bond | 3.25 | 0.0000 | |||||||

| LIFE / aTyr Pharma, Inc. | 0.04 | 0.00 | 3.03 | 1.30 | 5.1673 | 5.1673 | |||

| 85571BAB1 / Starwood Property Trust Inc Bond | 2.77 | 26.47 | 4.7139 | 1.4053 | |||||

| PVR / PVR PARTNERS L P | 0.10 | 2.68 | 4.5725 | 4.5725 | |||||

| 012423AA7 / Albany Molecular Research, Inc. 2.25% Bond | 2.66 | 0.0000 | |||||||

| HCN / Welltower Inc. | 0.05 | 2.56 | 4.3680 | 4.3680 | |||||

| ARPI / American Residential Properties, Inc. | 0.12 | -30.93 | 2.12 | -32.59 | 3.6062 | -1.1428 | |||

| AGNC / AGNC Investment Corp. | 0.10 | 1.93 | 3.2875 | 3.2875 | |||||

| US74973WAB37 / Rti Intl Metals Inc Bond | 1.79 | 27.62 | 3.0557 | 1.2658 | |||||

| 94733AAA2 / Web.com Group, Inc. Bond | 1.68 | 0.0000 | |||||||

| CVA / Covanta Holding Corporation | 0.09 | 1.55 | 2.6382 | 2.6382 | |||||

| CSE / Capitalsource Inc | 0.10 | -9.09 | 1.44 | 9.95 | 2.4490 | 0.4717 | |||

| 02208RAE6 / Altra Industrial Motion Corp. 2.75% Bond Due 2013-03-01 | 1.37 | 0.0000 | |||||||

| 242309AB8 / DealerTrack Technologies, Inc. Bond | 1.29 | 0.0000 | |||||||

| SNEC / Sanchez Energy Corp | 0.05 | 1.28 | 2.1814 | 2.1814 | |||||

| UNS / Uns Energy Corp | 0.02 | 1.20 | 2.0400 | 2.0400 | |||||

| 859319303 / Sterling Financial Corp | 0.04 | -30.00 | 1.19 | -16.75 | 2.0332 | -0.1348 | |||

| 590328AA8 / Merrimack Pharmaceuticals, Inc. Bond | 1.03 | 0.0000 | |||||||

| AMERICAN RESIDENTIAL / (02927E306) | 0.05 | 0.90 | 0.0000 | ||||||

| SPF / | 0.09 | 0.78 | 1.3293 | 1.3293 | |||||

| EPR.PRC / EPR Properties - Preferred Stock | 0.04 | 0.72 | 10.49 | 1.2202 | 0.2399 | ||||

| DISH / DISH Network Corporation | Call | 0.50 | 0.0000 | ||||||

| ACMP / | 0.01 | 16.39 | 0.40 | 36.27 | 0.6851 | 0.2388 | |||

| SXL / Sunoco Logistics Partners L.P. | 0.01 | 17.24 | 0.39 | 28.81 | 0.6630 | 0.2061 | |||

| Y / Alleghany Corp. | 0.01 | 15.15 | 0.39 | 10.89 | 0.6595 | 0.1315 | |||

| KMP / | 0.00 | 27.03 | 0.38 | 28.47 | 0.6459 | 0.1996 | |||

| OKS / ONEOK Partners, L.P. | 0.01 | 20.37 | 0.34 | 19.58 | 0.5829 | 0.1502 | |||

| PAA / Plains All American Pipeline, L.P. - Limited Partnership | 0.01 | 13.73 | 0.30 | 11.52 | 0.5113 | 0.1043 | |||

| US26885B1008 / EQT Midstream Partners LP | 0.00 | 0.00 | 0.29 | 19.50 | 0.4908 | 0.1262 | |||

| US1182301010 / Buckeye Partners, L.P. | 0.00 | 0.00 | 0.28 | 8.40 | 0.4840 | 0.0876 | |||

| ANDX / Tesoro Logistics LP | 0.01 | 65.92 | 0.26 | 49.43 | 0.4482 | 0.1819 | |||

| DCP / DCP Midstream LP - Unit | 0.01 | 47.66 | 0.26 | 49.71 | 0.4465 | 0.1818 | |||

| CQP / Cheniere Energy Partners, L.P. - Limited Partnership | 0.01 | 21.13 | 0.25 | 31.55 | 0.4192 | 0.1363 | |||

| DISH / DISH Network Corporation | Call | 0.24 | 0.0000 | ||||||

| US04929Q1022 / Atlas Energy Group LLC | 0.01 | 24.39 | 0.24 | 6.70 | 0.4073 | 0.0684 | |||

| EVA / Enviva Inc. | 0.01 | 16.95 | 0.23 | 6.85 | 0.3988 | 0.0675 | |||

| RRMS / Rose Rock Midstream, L.P. | 0.01 | 0.00 | 0.23 | 20.83 | 0.3954 | 0.1049 | |||

| MWE / MarkWest Energy Partners, LP | 0.00 | 133.33 | 0.23 | 113.89 | 0.3937 | 0.2303 | |||

| NGLS / Targa Resources Partners LP | 0.00 | 0.00 | 0.17 | 1.76 | 0.2948 | 0.0376 | |||

| AL / Air Lease Corporation | 0.01 | 0.00 | 0.16 | 13.04 | 0.2659 | 0.0571 | |||

| CMLP / Crestwood Midstream Partners Lp | 0.01 | 0.15 | 0.2556 | 0.2556 | |||||

| EPB / | 0.00 | 0.00 | 0.13 | -14.74 | 0.2267 | -0.0093 | |||

| WES / Western Midstream Partners, LP - Limited Partnership | 0.00 | 0.00 | 0.12 | 2.50 | 0.2096 | 0.0281 | |||

| NTLS / NTELOS Holdings Corp. | Put | 0.02 | 77.78 | 0.0273 | 0.0137 | ||||

| ANF / Abercrombie & Fitch Co. | Call | 0.01 | 0.0000 | ||||||

| ARKANSAS BEST CORP-DEL / (040790107) | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PNG / PAA Natural Gas Storage, L.P. | 0.00 | -100.00 | 0.00 | -100.00 | -2.1135 | ||||

| HCBK / Hudson City Bancorp, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.6838 | ||||

| NBHC / National Bank Holdings Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -34.5648 | ||||

| / Array BioPharma, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.0681 |