Mga Batayang Estadistika

| Nilai Portofolio | $ 533,402,215 |

| Posisi Saat Ini | 117 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

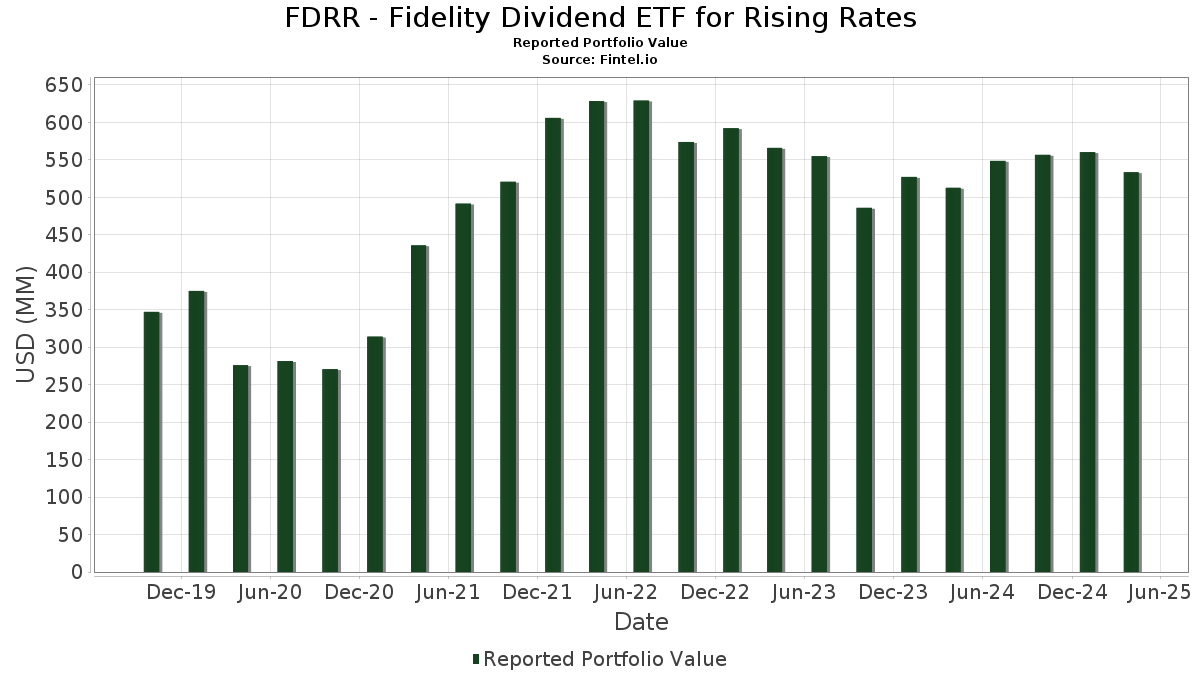

FDRR - Fidelity Dividend ETF for Rising Rates telah mengungkapkan total kepemilikan 117 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 533,402,215 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama FDRR - Fidelity Dividend ETF for Rising Rates adalah Apple Inc. (US:AAPL) , Microsoft Corporation (US:MSFT) , NVIDIA Corporation (US:NVDA) , Alphabet Inc. (US:GOOGL) , and Fidelity Securities Lending Cash Central Fund (US:US31635A3032) . Posisi baru FDRR - Fidelity Dividend ETF for Rising Rates meliputi: Alphabet Inc. (US:GOOGL) , Meta Platforms, Inc. (US:META) , ABN AMRO Bank N.V. - Depositary Receipt (Common Stock) (US:ABMRF) , Microchip Technology Incorporated (US:MCHP) , and Yamaha Motor Co., Ltd. (US:YAMHF) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.11 | 16.96 | 3.2648 | 3.2648 | |

| 0.02 | 12.09 | 2.3266 | 2.3266 | |

| 15.20 | 15.20 | 2.9255 | 2.0229 | |

| 0.29 | 5.97 | 1.1488 | 1.1488 | |

| 0.11 | 4.95 | 0.9534 | 0.9534 | |

| 0.60 | 4.72 | 0.9087 | 0.9087 | |

| 0.01 | 4.13 | 0.7953 | 0.7953 | |

| 0.08 | 4.00 | 0.7695 | 0.7695 | |

| 0.05 | 3.56 | 0.6851 | 0.6851 | |

| 0.08 | 3.50 | 0.6740 | 0.6740 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.28 | 30.98 | 5.9629 | -1.2091 | |

| 0.07 | 13.35 | 2.5705 | -0.8637 | |

| 0.01 | 0.58 | 0.1109 | -0.6426 | |

| 0.02 | 5.51 | 1.0615 | -0.5274 | |

| 0.17 | 36.50 | 7.0268 | -0.4687 | |

| 0.09 | 2.45 | 0.4725 | -0.4393 | |

| 0.00 | 0.00 | -0.4372 | ||

| 0.02 | 0.56 | 0.1070 | -0.4355 | |

| 0.01 | 0.56 | 0.1069 | -0.4136 | |

| 0.01 | 0.55 | 0.1051 | -0.3663 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-06-26 untuk periode pelaporan 2025-04-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AAPL / Apple Inc. | 0.17 | -2.74 | 36.50 | -12.43 | 7.0268 | -0.4687 | |||

| MSFT / Microsoft Corporation | 0.09 | -2.75 | 34.05 | -7.39 | 6.5551 | -0.0565 | |||

| NVDA / NVIDIA Corporation | 0.28 | -14.38 | 30.98 | -22.33 | 5.9629 | -1.2091 | |||

| GOOGL / Alphabet Inc. | 0.11 | 16.96 | 3.2648 | 3.2648 | |||||

| US31635A3032 / Fidelity Securities Lending Cash Central Fund | 15.20 | 202.77 | 15.20 | 202.79 | 2.9255 | 2.0229 | |||

| AVGO / Broadcom Inc. | 0.07 | -19.62 | 13.35 | -30.08 | 2.5705 | -0.8637 | |||

| META / Meta Platforms, Inc. | 0.02 | 12.09 | 2.3266 | 2.3266 | |||||

| LLY / Eli Lilly and Company | 0.01 | -8.63 | 11.44 | 1.27 | 2.2027 | 0.1709 | |||

| JPM / JPMorgan Chase & Co. | 0.05 | -6.09 | 11.06 | -14.06 | 2.1284 | -0.1851 | |||

| JNJ / Johnson & Johnson | 0.05 | 4.46 | 7.95 | 7.32 | 1.5297 | 0.1982 | |||

| ABBV / AbbVie Inc. | 0.04 | -3.59 | 7.67 | 2.28 | 1.4758 | 0.1279 | |||

| HD / The Home Depot, Inc. | 0.02 | 14.19 | 7.64 | -0.07 | 1.4711 | 0.0958 | |||

| MCD / McDonald's Corporation | 0.02 | 34.21 | 7.49 | 48.61 | 1.4425 | 0.5357 | |||

| CSCO / Cisco Systems, Inc. | 0.13 | -9.78 | 7.30 | -14.05 | 1.4057 | -0.1221 | |||

| IBM / International Business Machines Corporation | 0.03 | -16.78 | 7.22 | -21.29 | 1.3889 | -0.2595 | |||

| UNH / UnitedHealth Group Incorporated | 0.02 | -0.88 | 6.92 | -24.82 | 1.3328 | -0.3233 | |||

| BAC / Bank of America Corporation | 0.17 | 0.13 | 6.64 | -13.75 | 1.2776 | -0.1061 | |||

| WFC / Wells Fargo & Company | 0.09 | -10.65 | 6.54 | -19.49 | 1.2585 | -0.2016 | |||

| CME / CME Group Inc. | 0.02 | 20.51 | 6.43 | 41.18 | 1.2383 | 0.4189 | |||

| TJX / The TJX Companies, Inc. | 0.05 | 14.86 | 6.28 | 18.45 | 1.2097 | 0.2557 | |||

| TXN / Texas Instruments Incorporated | 0.04 | -3.11 | 6.25 | -16.00 | 1.2034 | -0.1348 | |||

| PG / The Procter & Gamble Company | 0.04 | 3.42 | 6.22 | 1.29 | 1.1967 | 0.0931 | |||

| MRK / Merck & Co., Inc. | 0.07 | 28.10 | 6.12 | 10.46 | 1.1772 | 0.1816 | |||

| ABMRF / ABN AMRO Bank N.V. - Depositary Receipt (Common Stock) | 0.29 | 5.97 | 1.1488 | 1.1488 | |||||

| PM / Philip Morris International Inc. | 0.03 | -7.80 | 5.96 | 21.36 | 1.1476 | 0.2642 | |||

| XOM / Exxon Mobil Corporation | 0.06 | 9.69 | 5.87 | 8.46 | 1.1303 | 0.1568 | |||

| CVS / CVS Health Corporation | 0.09 | 36.40 | 5.87 | 61.09 | 1.1296 | 0.4746 | |||

| KO / The Coca-Cola Company | 0.08 | 7.20 | 5.70 | 22.53 | 1.0973 | 0.2606 | |||

| AMGN / Amgen Inc. | 0.02 | -28.82 | 5.51 | -34.11 | 1.0615 | -0.5274 | |||

| C / Citigroup Inc. | 0.08 | 2.08 | 5.36 | -14.28 | 1.0320 | -0.0926 | |||

| MS / Morgan Stanley | 0.05 | -6.98 | 5.36 | -22.45 | 1.0309 | -0.2107 | |||

| PFE / Pfizer Inc. | 0.21 | 9.10 | 5.24 | 0.42 | 1.0096 | 0.0704 | |||

| F / Ford Motor Company | 0.51 | 78.26 | 5.12 | 77.06 | 0.9864 | 0.4659 | |||

| GE / General Electric Company | 0.03 | -16.48 | 5.10 | -17.31 | 0.9815 | -0.1273 | |||

| DELL / Dell Technologies Inc. | 0.06 | -8.17 | 5.08 | -18.67 | 0.9780 | -0.1452 | |||

| GM / General Motors Company | 0.11 | 20.97 | 4.97 | 10.63 | 0.9575 | 0.1491 | |||

| MCHP / Microchip Technology Incorporated | 0.11 | 4.95 | 0.9534 | 0.9534 | |||||

| AFG / American Financial Group, Inc. | 0.04 | 30.63 | 4.81 | 37.41 | 0.9265 | 0.2615 | |||

| MBG / Mercedes-Benz Group AG | 0.08 | 83.70 | 4.79 | 78.89 | 0.9220 | 0.4405 | |||

| YAMHF / Yamaha Motor Co., Ltd. | 0.60 | 4.72 | 0.9087 | 0.9087 | |||||

| USB / U.S. Bancorp | 0.12 | 22.62 | 4.67 | 3.53 | 0.8983 | 0.0877 | |||

| NLY / Annaly Capital Management, Inc. | 0.24 | 44.95 | 4.65 | 48.06 | 0.8943 | 0.2985 | |||

| PRU / Prudential Financial, Inc. | 0.05 | -4.04 | 4.64 | -11.67 | 0.8934 | 0.0181 | |||

| RTX / RTX Corporation | 0.04 | -15.25 | 4.58 | -17.11 | 0.8816 | -0.1118 | |||

| HPQ / HP Inc. | 0.18 | -1.42 | 4.53 | -22.44 | 0.8729 | -0.1785 | |||

| SBUX / Starbucks Corporation | 0.05 | 22.04 | 4.27 | -9.28 | 0.8221 | -0.0243 | |||

| NKE / NIKE, Inc. | 0.08 | 79.54 | 4.24 | 31.68 | 0.8170 | 0.2374 | |||

| PEP / PepsiCo, Inc. | 0.03 | 19.52 | 4.21 | 7.54 | 0.8098 | 0.1064 | |||

| HON / Honeywell International Inc. | 0.02 | 0.01 | 4.19 | -5.89 | 0.8058 | 0.0058 | |||

| LMT / Lockheed Martin Corporation | 0.01 | 5.50 | 4.18 | 8.89 | 0.8043 | 0.1142 | |||

| ADP / Automatic Data Processing, Inc. | 0.01 | 4.13 | 0.7953 | 0.7953 | |||||

| CAT / Caterpillar Inc. | 0.01 | -3.98 | 4.05 | -20.04 | 0.7802 | -0.1314 | |||

| OMF / OneMain Holdings, Inc. | 0.08 | 4.00 | 0.7695 | 0.7695 | |||||

| UNP / Union Pacific Corporation | 0.02 | 9.56 | 3.93 | -4.63 | 0.7569 | 0.0154 | |||

| MO / Altria Group, Inc. | 0.07 | -2.38 | 3.86 | 10.56 | 0.7435 | 0.1153 | |||

| WHR / Whirlpool Corporation | 0.05 | 3.56 | 0.6851 | 0.6851 | |||||

| TPG / TPG Inc. | 0.08 | 3.50 | 0.6740 | 0.6740 | |||||

| CVX / Chevron Corporation | 0.03 | 2.94 | 3.45 | -6.12 | 0.6641 | 0.0033 | |||

| 1 / CK Hutchison Holdings Limited | 0.61 | 21.37 | 3.43 | 36.24 | 0.6607 | 0.2078 | |||

| H4W / Jardine Matheson Holdings Limited | 0.08 | 3.41 | 0.6556 | 0.6556 | |||||

| STLAP / Stellantis N.V. | 0.36 | 3.35 | 0.6457 | 0.6457 | |||||

| SINGF / Singapore Airlines Limited | 0.64 | 3.28 | 0.6316 | 0.6316 | |||||

| UPS / United Parcel Service, Inc. | 0.03 | 32.88 | 3.24 | 10.84 | 0.6240 | 0.0982 | |||

| LIN / Linde plc | 0.01 | 6.43 | 3.22 | 8.13 | 0.6194 | 0.0843 | |||

| PCAR / PACCAR Inc | 0.03 | 8.07 | 3.00 | -12.09 | 0.5768 | -0.0360 | |||

| KHC / The Kraft Heinz Company | 0.10 | 2.85 | 0.5496 | 0.5496 | |||||

| RAND / Randstad N.V. | 0.07 | 36.09 | 2.77 | -4.92 | 0.5323 | -0.0199 | |||

| CA / Carrefour SA | 0.18 | 2.76 | 0.5309 | 0.5309 | |||||

| NEE / NextEra Energy, Inc. | 0.04 | 5.23 | 2.46 | -1.64 | 0.4736 | 0.0238 | |||

| T / AT&T Inc. | 0.09 | -58.53 | 2.45 | -51.61 | 0.4725 | -0.4393 | |||

| VZ / Verizon Communications Inc. | 0.05 | -48.98 | 2.31 | -42.93 | 0.4445 | -0.2831 | |||

| SO / The Southern Company | 0.02 | 6.47 | 2.25 | 16.55 | 0.4326 | 0.0858 | |||

| DUK / Duke Energy Corporation | 0.02 | 7.77 | 2.16 | 17.43 | 0.4152 | 0.0849 | |||

| AMT / American Tower Corporation | 0.01 | -11.90 | 2.06 | 1.47 | 0.3975 | 0.0112 | |||

| DIS / The Walt Disney Company | 0.02 | 1.98 | 0.3817 | 0.3817 | |||||

| US31635A1051 / Fidelity Cash Central Fund | 1.83 | 289.01 | 1.83 | 289.17 | 0.3530 | 0.2682 | |||

| EOG / EOG Resources, Inc. | 0.02 | 10.87 | 1.79 | -2.77 | 0.3452 | 0.0136 | |||

| EXC / Exelon Corporation | 0.04 | 11.66 | 1.78 | 30.97 | 0.3419 | 0.0980 | |||

| CMCSA / Comcast Corporation | 0.05 | -46.96 | 1.73 | -46.11 | 0.3331 | -0.2443 | |||

| PLD / Prologis, Inc. | 0.02 | -3.87 | 1.67 | -17.65 | 0.3209 | -0.0429 | |||

| TMUS / T-Mobile US, Inc. | 0.01 | 1.64 | 0.3148 | 0.3148 | |||||

| D / Dominion Energy, Inc. | 0.03 | 11.84 | 1.60 | 9.42 | 0.3087 | 0.0451 | |||

| APD / Air Products and Chemicals, Inc. | 0.01 | 11.05 | 1.49 | -10.20 | 0.2864 | -0.0116 | |||

| CCI / Crown Castle Inc. | 0.01 | 4.36 | 1.46 | 23.62 | 0.2812 | 0.0687 | |||

| DVN / Devon Energy Corporation | 0.05 | 55.68 | 1.42 | 38.92 | 0.2729 | 0.0893 | |||

| O / Realty Income Corporation | 0.02 | 6.63 | 1.41 | 13.46 | 0.2712 | 0.0354 | |||

| EIX / Edison International | 0.03 | 59.90 | 1.38 | 58.53 | 0.2650 | 0.1088 | |||

| FANG / Diamondback Energy, Inc. | 0.01 | 1.34 | 0.2581 | 0.2581 | |||||

| FMC / FMC Corporation | 0.03 | 1.34 | 0.2574 | 0.2574 | |||||

| PSA / Public Storage | 0.00 | -12.80 | 1.32 | -12.26 | 0.2537 | -0.0163 | |||

| VICI / VICI Properties Inc. | 0.04 | -7.15 | 1.25 | -0.16 | 0.2405 | 0.0155 | |||

| SPG / Simon Property Group, Inc. | 0.01 | -24.61 | 1.23 | -31.76 | 0.2363 | -0.0871 | |||

| CHRD / Chord Energy Corporation | 0.01 | 1.17 | 0.2255 | 0.2255 | |||||

| IP / International Paper Company | 0.03 | 8.20 | 1.17 | -11.17 | 0.2251 | -0.0116 | |||

| AES / The AES Corporation | 0.12 | 1.17 | 0.2246 | 0.2246 | |||||

| VNOM / Viper Energy, Inc. | 0.03 | 1.16 | 0.2226 | 0.2226 | |||||

| AMCR / Amcor plc | 0.12 | 38.84 | 1.12 | 31.38 | 0.2161 | 0.0625 | |||

| DOW / Dow Inc. | 0.04 | 78.57 | 1.10 | 39.87 | 0.2114 | 0.0702 | |||

| LYB / LyondellBasell Industries N.V. | 0.02 | 69.73 | 0.98 | 30.45 | 0.1889 | 0.0537 | |||

| OHI / Omega Healthcare Investors, Inc. | 0.03 | -29.55 | 0.98 | -25.82 | 0.1882 | -0.0487 | |||

| GLPI / Gaming and Leisure Properties, Inc. | 0.02 | -15.01 | 0.97 | -15.94 | 0.1859 | -0.0207 | |||

| FVJ / Fortescue Ltd | 0.09 | 0.96 | 0.1839 | 0.1839 | |||||

| HST / Host Hotels & Resorts, Inc. | 0.06 | 0.84 | 0.1611 | 0.1611 | |||||

| EA / Electronic Arts Inc. | 0.01 | -72.38 | 0.84 | -67.39 | 0.1610 | -0.3001 | |||

| FOXA / Fox Corporation | 0.01 | -85.86 | 0.58 | -86.25 | 0.1109 | -0.6426 | |||

| NWSA / News Corporation | 0.02 | -80.89 | 0.56 | -81.60 | 0.1070 | -0.4355 | |||

| NYT / The New York Times Company | 0.01 | -79.99 | 0.56 | -80.82 | 0.1069 | -0.4136 | |||

| PARA / Paramount Global | 0.05 | -73.40 | 0.55 | -71.31 | 0.1067 | -0.2405 | |||

| OMC / Omnicom Group Inc. | 0.01 | -76.26 | 0.55 | -79.17 | 0.1051 | -0.3663 | |||

| IPG / The Interpublic Group of Companies, Inc. | 0.02 | -75.53 | 0.49 | -78.58 | 0.0948 | -0.3184 | |||

| NXST / Nexstar Media Group, Inc. | 0.00 | -78.02 | 0.48 | -78.53 | 0.0919 | -0.3078 | |||

| WMG / Warner Music Group Corp. | 0.02 | -78.01 | 0.47 | -78.98 | 0.0897 | -0.3082 | |||

| SIRI / Sirius XM Holdings Inc. | 0.02 | 0.42 | 0.0803 | 0.0803 | |||||

| ABN / ABN AMRO Bank N.V. - Depositary Receipt (Common Stock) | 0.29 | 0.25 | 0.0473 | 0.0473 | |||||

| UST BILLS 0% 05/29/2025 / DBT (US912797NN35) | 0.08 | 0.0163 | 0.0163 | ||||||

| S and P500 EMINI FUT JUN25 ESM5 / DE (N/A) | 0.02 | 0.0044 | 0.0044 | ||||||

| NEM / Newmont Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.2399 | ||||

| 9104 / Mitsui O.S.K. Lines, Ltd. | 0.00 | -100.00 | 0.00 | -100.00 | -0.4372 | ||||

| SP500 MIC EMIN FUTJUN25 HWAM5 / DE (N/A) | -0.01 | -0.0022 | -0.0022 |