Mga Batayang Estadistika

| Nilai Portofolio | $ 1,587,939,686 |

| Posisi Saat Ini | 306 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

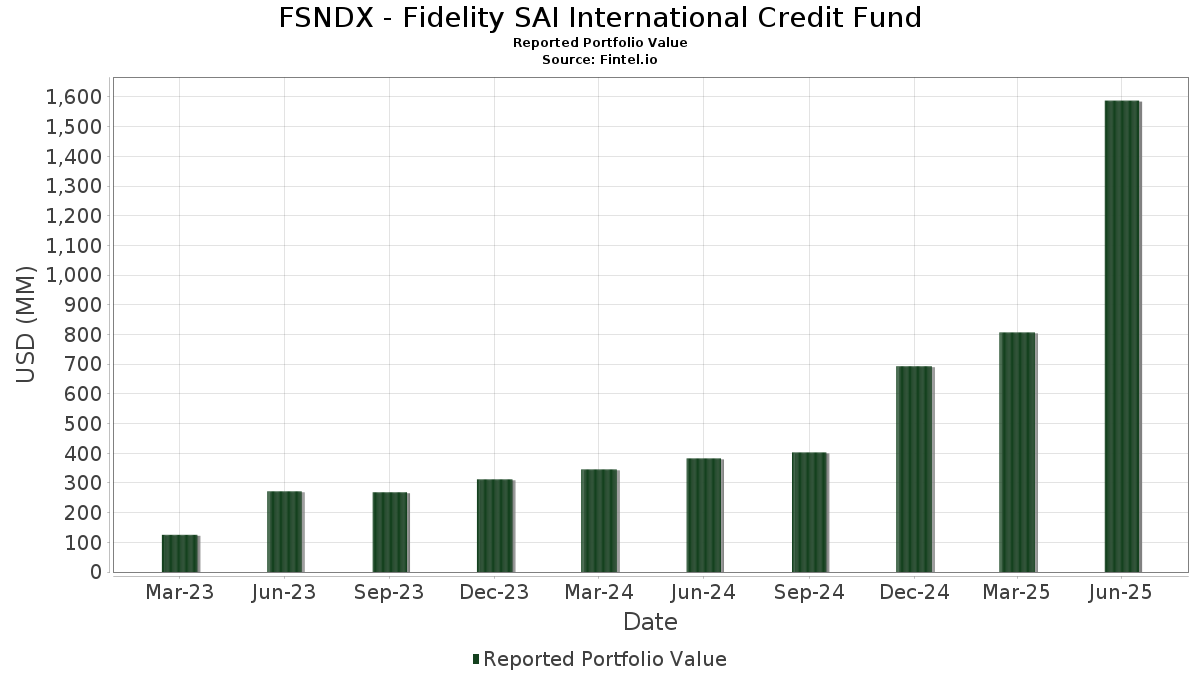

FSNDX - Fidelity SAI International Credit Fund telah mengungkapkan total kepemilikan 306 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 1,587,939,686 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama FSNDX - Fidelity SAI International Credit Fund adalah Fidelity Cash Central Fund (US:US31635A1051) , United States Treas Bds Bond (US:US912810QE10) , Usa Treasury 6 1/4% 30yr Notes 05/15/2030 (US:US912810FM54) , Volkswagen International Finance NV (NL:XS2187689380) , and British American Tobacco PLC (GB:XS2391779134) . Posisi baru FSNDX - Fidelity SAI International Credit Fund meliputi: United States Treas Bds Bond (US:US912810QE10) , Usa Treasury 6 1/4% 30yr Notes 05/15/2030 (US:US912810FM54) , Volkswagen International Finance NV (NL:XS2187689380) , British American Tobacco PLC (GB:XS2391779134) , and Canadian Government Bond (CA:CA135087P329) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 29.35 | 1.8439 | 1.8439 | ||

| 28.94 | 1.8181 | 1.8181 | ||

| 26.06 | 1.6371 | 1.6371 | ||

| 20.91 | 1.3136 | 1.3136 | ||

| 18.66 | 1.1725 | 1.1725 | ||

| 17.67 | 1.1099 | 1.1099 | ||

| 15.59 | 0.9793 | 0.9793 | ||

| 14.11 | 0.8868 | 0.8868 | ||

| 12.48 | 0.7842 | 0.7842 | ||

| 11.04 | 0.6939 | 0.6939 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 48.50 | 3.0474 | -2.8415 | ||

| 20.00 | 1.2567 | -1.1822 | ||

| -15.95 | -1.0020 | -1.0020 | ||

| 0.88 | 0.0553 | -0.8545 | ||

| 13.83 | 0.8689 | -0.8006 | ||

| 12.27 | 0.7712 | -0.7604 | ||

| 12.74 | 0.8002 | -0.7494 | ||

| 11.31 | 0.7105 | -0.6609 | ||

| 10.65 | 0.6689 | -0.6247 | ||

| 11.31 | 0.7107 | -0.6159 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-22 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US31635A1051 / Fidelity Cash Central Fund | 91.17 | 118.80 | 91.19 | 118.80 | 5.7295 | 0.6329 | |||

| UST NOTES 4.125% 10/31/2031 / DBT (US91282CLU35) | 48.50 | 0.72 | 3.0474 | -2.8415 | |||||

| US912810QE10 / United States Treas Bds Bond | 29.35 | 1.8439 | 1.8439 | ||||||

| UST NOTES 4% 04/30/2032 / DBT (US91282CNA52) | 28.94 | 1.8181 | 1.8181 | ||||||

| EUROPEAN UNION 4% 04/04/2044 REGS / DBT (EU000A3K4EL9) | 28.82 | 182.74 | 1.8108 | 0.5642 | |||||

| UST NOTES 4.25% 05/15/2035 / DBT (US91282CNC19) | 26.06 | 1.6371 | 1.6371 | ||||||

| UST NOTES 4.125% 05/31/2032 / DBT (US91282CNF40) | 20.91 | 1.3136 | 1.3136 | ||||||

| ING / ING Groep N.V. - Depositary Receipt (Common Stock) | 20.73 | 69.72 | 1.3026 | -0.1911 | |||||

| RWE FINANCE US LLC 5.875% 04/16/2034 144A / DBT (US749983AA01) | 20.08 | 214.36 | 1.2614 | 0.4804 | |||||

| US912810FM54 / Usa Treasury 6 1/4% 30yr Notes 05/15/2030 | 20.00 | 0.29 | 1.2567 | -1.1822 | |||||

| KREDITANSTALT FUR WIEDER(UNGTD 2.75% 01/17/2035 REGS / DBT (DE000A383TE2) | 18.66 | 1.1725 | 1.1725 | ||||||

| UST NOTES 4.125% 03/31/2032 / DBT (US91282CMT52) | 17.67 | 1.1099 | 1.1099 | ||||||

| BNSB34 / The Bank of Nova Scotia - Depositary Receipt (Common Stock) | 15.96 | 63.47 | 1.0031 | -0.1914 | |||||

| XS2187689380 / Volkswagen International Finance NV | 15.70 | 103.01 | 0.9863 | 0.0407 | |||||

| CBOM / Credit Bank of Moscow (public joint-stock company) | 15.59 | 0.9793 | 0.9793 | ||||||

| XS2391779134 / British American Tobacco PLC | 15.46 | 91.49 | 0.9712 | -0.0160 | |||||

| CA135087P329 / Canadian Government Bond | 14.70 | 343.03 | 0.9239 | 0.5180 | |||||

| US07274EAL74 / BAYER US FINANCE LLC 144A LIFE SR UNSEC 6.5% 11-21-33 | 14.67 | 78.18 | 0.9217 | -0.0851 | |||||

| UNITED STATES TREASURY BOND 5% 05/15/2045 / DBT (US912810UL07) | 14.11 | 0.8868 | 0.8868 | ||||||

| US91282CCR07 / U.S. Treasury Notes | 13.83 | 1.30 | 0.8689 | -0.8006 | |||||

| XS2690137299 / Lloyds Banking Group PLC | 13.26 | 51.27 | 0.8331 | -0.2388 | |||||

| UST NOTES 4.625% 04/30/2029 / DBT (US91282CKP58) | 12.74 | 0.51 | 0.8002 | -0.7494 | |||||

| PM / Philip Morris International Inc. - Depositary Receipt (Common Stock) | 12.48 | 0.7842 | 0.7842 | ||||||

| DANSKE / Danske Bank A/S | 12.29 | 41.27 | 0.7721 | -0.2917 | |||||

| US912810SY55 / United States Treasury Note/Bond | 12.27 | -2.00 | 0.7712 | -0.7604 | |||||

| HTHROW / Heathrow Funding Ltd | 12.05 | 127.84 | 0.7569 | 0.1103 | |||||

| XS2370445921 / THE BERKELEY GROUP PLC 2.5% 08/11/2031 REGS | 11.85 | 112.06 | 0.7447 | 0.0612 | |||||

| BARRY CALLEBAUT SVCS NV 4.25% 08/19/2031 REGS / DBT (BE6360449621) | 11.84 | 317.38 | 0.7441 | 0.3971 | |||||

| BAT INTL FINANCE PLC 4.125% 04/12/2032 REGS / DBT (XS2801975991) | 11.50 | 83.02 | 0.7227 | -0.0459 | |||||

| ENBW INTERNATIONAL FINANCE BV 3.75% 11/20/2035 REGS / DBT (XS2942479044) | 11.38 | 53.39 | 0.7150 | -0.1923 | |||||

| CA135087N597 / Canadian Government Bond | 11.31 | 4.28 | 0.7107 | -0.6159 | |||||

| UST NOTES 3.625% 09/30/2031 / DBT (US91282CLM19) | 11.31 | 0.84 | 0.7105 | -0.6609 | |||||

| VIE / Veolia Environnement SA | 11.04 | 0.6939 | 0.6939 | ||||||

| AU3FN0029609 / AAI Ltd | 10.92 | 128.71 | 0.6864 | 0.1023 | |||||

| XS2643776680 / ADMIRAL GROUP PLC 8.5% 01/06/2034 REGS | 10.82 | 145.67 | 0.6797 | 0.1411 | |||||

| XS2586739729 / Imperial Brands Finance Netherlands BV | 10.76 | 221.65 | 0.6759 | 0.2668 | |||||

| NOVO NORDISK FINANCE NETHERLANDS BV 3.625% 05/27/2037 REGS / DBT (XS3002555822) | 10.72 | 0.6734 | 0.6734 | ||||||

| XS2563349765 / NATWEST GRP PLC(UNGTD) 7.416%/VAR 06/06/2033 REGS | 10.69 | 67.39 | 0.6718 | -0.1093 | |||||

| UST NOTES 4.125% 02/29/2032 / DBT (US91282CMR96) | 10.65 | 0.64 | 0.6689 | -0.6247 | |||||

| BNP / BNP Paribas SA | 10.57 | 16.44 | 0.6639 | -0.4458 | |||||

| NORTHUMBRIAN WATER FINANCE PLC 4.5% 02/14/2031 REGS / DBT (XS2585804946) | 10.51 | 159.59 | 0.6605 | 0.1652 | |||||

| US71654QDE98 / Petroleos Mexicanos | 10.21 | 69.73 | 0.6413 | -0.0941 | |||||

| CA135087N266 / Canada Government Bond | 9.76 | 1,693.20 | 0.6130 | 0.5464 | |||||

| XS2693304813 / Mobico Group plc | 9.58 | 68.78 | 0.6016 | -0.0922 | |||||

| KREDITANSTALT FUR WIEDER(UNGTD 4% 03/15/2029 / DBT (US500769KC79) | 9.55 | 0.66 | 0.6003 | -0.5604 | |||||

| US07274EAK91 / BAYER US FINANCE LLC 144A LIFE SR UNSEC 6.375% 11-21-30 | 9.49 | 136.93 | 0.5963 | 0.1064 | |||||

| FR001400FDG9 / Electricite de France SA | 9.47 | 267.99 | 0.5951 | 0.2803 | |||||

| CA135087M276 / CANADA, GOVERNMENT OF 1.5% 06/01/2031 | 9.42 | 239.23 | 0.5917 | 0.2521 | |||||

| FR001400KHH8 / ENGIE SA 4.25% 09/06/2034 REGS | 9.37 | 47.12 | 0.5887 | -0.1902 | |||||

| ABN / ABN AMRO Bank N.V. - Depositary Receipt (Common Stock) | 9.22 | 105.67 | 0.5791 | 0.0310 | |||||

| HEIMSTADEN BOSTAD AB 3.875% 11/05/2029 REGS / DBT (XS2931248848) | 9.10 | 130.36 | 0.5721 | 0.0887 | |||||

| UNITED STATES TREASURY BOND 4.5% 11/15/2054 / DBT (US912810UE63) | 9.05 | -3.28 | 0.5688 | -0.5759 | |||||

| UST NOTES 4.625% 02/15/2035 / DBT (US91282CMM00) | 9.02 | 0.5665 | 0.5665 | ||||||

| UST NOTES 4.75% 02/15/2045 / DBT (US912810UJ50) | 8.88 | 0.5581 | 0.5581 | ||||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 8.66 | 0.5442 | 0.5442 | ||||||

| DE000A3E5XN1 / Kreditanstalt fuer Wiederaufbau | 8.62 | 0.5417 | 0.5417 | ||||||

| UBSG34 / UBS Group AG - Depositary Receipt (Common Stock) | 8.57 | 103.83 | 0.5387 | 0.0242 | |||||

| UST NOTES 4% 03/31/2030 / DBT (US91282CMU26) | 8.55 | 0.5371 | 0.5371 | ||||||

| XS1040508597 / Imperial Brands Finance PLC | 8.34 | 82.30 | 0.5242 | -0.0355 | |||||

| DHL / Deutsche Post AG | 8.19 | 0.5145 | 0.5145 | ||||||

| T1OW34 / American Tower Corporation - Depositary Receipt (Common Stock) | 8.14 | 0.5117 | 0.5117 | ||||||

| SHURGARD LUXEMBOURG SARL 4% 05/27/2035 REGS / DBT (BE6364767150) | 8.11 | 0.5094 | 0.5094 | ||||||

| RYBD34 / Royal Bank of Canada - Depositary Receipt (Common Stock) | 8.10 | 0.5092 | 0.5092 | ||||||

| FLUXYS SA 4% 11/28/2030 REGS / DBT (BE0390222884) | 8.10 | 0.5091 | 0.5091 | ||||||

| XS2679898184 / REWE International Finance BV | 8.08 | 101.32 | 0.5074 | 0.0168 | |||||

| XS2010045511 / NGG Finance plc | 8.03 | 99.70 | 0.5043 | 0.0128 | |||||

| XS2431318802 / Logicor Financing Sarl | 8.00 | 389.95 | 0.5024 | 0.3027 | |||||

| XS2592017300 / Deutsche Bank AG | 7.86 | 98.21 | 0.4940 | 0.0089 | |||||

| AMPRION GMBH 3.625% 05/21/2031 REGS / DBT (DE000A383BP6) | 7.82 | 614.81 | 0.4914 | 0.3576 | |||||

| AU0000249302 / AUSTRALIA GOVT AUD REG S 3.75% 05-21-34 | 7.72 | 0.4848 | 0.4848 | ||||||

| 5831 / Shizuoka Financial Group,Inc. | 7.70 | 0.4837 | 0.4837 | ||||||

| GPEF / Great Portland Estates Plc - Equity Right | 7.69 | 88.81 | 0.4835 | -0.0150 | |||||

| 5831 / Shizuoka Financial Group,Inc. | 7.47 | 4.35 | 0.4692 | -0.4061 | |||||

| 5831 / Shizuoka Financial Group,Inc. | 7.47 | 4.32 | 0.4691 | -0.4062 | |||||

| FR0013283371 / RCI Banque SA | 7.43 | 106.47 | 0.4671 | 0.0267 | |||||

| ZF EUROPE FINANCE BV 4.75% 01/31/2029 REGS / DBT (XS2757520965) | 7.42 | 116.39 | 0.4661 | 0.0468 | |||||

| XS2051670300 / Blackstone Property Partners Europe Holdings Sarl | 7.35 | 200.33 | 0.4616 | 0.1624 | |||||

| XS2180916525 / SOUTHERN WATER SERVICES FIN LTD | 7.20 | 263.12 | 0.4522 | 0.2097 | |||||

| 2914 / Japan Tobacco Inc. | 7.17 | 0.4504 | 0.4504 | ||||||

| CH1255915014 / UBS GROUP AG 4.75%/VAR 03/17/2032 REGS | 7.12 | 117.40 | 0.4475 | 0.0468 | |||||

| XS2431319107 / Logicor Financing Sarl | 7.12 | 25.22 | 0.4471 | -0.2478 | |||||

| BBV / Banco Bilbao Vizcaya Argentaria, S.A. - Depositary Receipt (Common Stock) | 7.09 | 72.51 | 0.4455 | -0.0571 | |||||

| ANGLIAN WATER SVCS FINANC PLC 6.293% 07/30/2030 REGS / DBT (XS0151948980) | 7.01 | 113.18 | 0.4402 | 0.0383 | |||||

| XS2381272207 / ENBW ENERGIE BADEN-WUERTTEM AG 1.375%/VAR 08/31/2081 REGS | 6.93 | 70.47 | 0.4356 | -0.0618 | |||||

| CPI PROPERTY GROUP SA 6% 01/27/2032 REGS / DBT (XS2904791774) | 6.77 | 58.60 | 0.4256 | -0.0967 | |||||

| XS2346516250 / Natwest Group PLC | 6.59 | 131.53 | 0.4139 | 0.0660 | |||||

| XS0093312550 / ANGLIAN WAT FIN | 6.54 | 0.4109 | 0.4109 | ||||||

| UST NOTES 4.25% 02/28/2029 / DBT (US91282CKD29) | 6.53 | 0.59 | 0.4105 | -0.3838 | |||||

| MCD / McDonald's Corporation - Depositary Receipt (Common Stock) | 6.51 | 0.4089 | 0.4089 | ||||||

| XS2560756798 / SEVERN TRENT WATER UTIL FIN 4.625% 11/30/2034 REGS | 6.46 | 82.46 | 0.4058 | -0.0272 | |||||

| SHA0 / Schaeffler AG | 6.44 | 81.18 | 0.4047 | -0.0301 | |||||

| XS2597114284 / HSBC Holdings PLC | 6.33 | 66.53 | 0.3979 | -0.0672 | |||||

| STELLANTIS FINANCE US INC 5.75% 03/18/2030 144A / DBT (US85855CAK62) | 6.30 | 158.68 | 0.3962 | 0.0981 | |||||

| MOTABILITY OPERATIONS GRP PLC 3.625% 01/22/2033 REGS / DBT (XS2978917156) | 6.30 | 72.42 | 0.3956 | -0.0510 | |||||

| XS2290544068 / CPI Property Group SA | 6.29 | 211.28 | 0.3953 | 0.1481 | |||||

| UNITED STATES TREASURY BOND 4.5% 02/15/2044 / DBT (US912810TZ12) | 6.28 | -2.21 | 0.3946 | -0.3908 | |||||

| XS1991126431 / Cooperatieve Rabobank UA | 6.22 | 72.52 | 0.3909 | -0.0502 | |||||

| US202712BN45 / Commonwealth Bank of Australia | 6.19 | 201.71 | 0.3888 | 0.1379 | |||||

| XS2630465875 / WERFENLIFE SA 4.625% 06/06/2028 REGS | 6.16 | 71.30 | 0.3871 | -0.0527 | |||||

| XS2264968665 / Ivory Coast Government International Bond | 6.01 | 0.3775 | 0.3775 | ||||||

| XS2397251807 / HEIMSTADEN BOSTAD AB 3.625/VAR PERP REGS | 5.82 | 139.87 | 0.3660 | 0.0690 | |||||

| STAB / Standard Chartered PLC - Preferred Security | 5.73 | 135.30 | 0.3602 | 0.0622 | |||||

| WESSEX WATER SERVS FIN PLC 6.125% 09/19/2034 REGS / DBT (XS3025173710) | 5.71 | 101.09 | 0.3589 | 0.0115 | |||||

| SOUTHERN GAS NETWORKS PLC 3.5% 10/16/2030 REGS / DBT (XS2914661843) | 5.67 | 124.68 | 0.3564 | 0.0476 | |||||

| PROLOGIS INTL FDG II SA 4.375% 07/01/2036 REGS / DBT (XS2847688251) | 5.58 | 181.01 | 0.3505 | 0.1077 | |||||

| K8553U105 / Sunlands Online Education Group | 5.56 | 99.18 | 0.3494 | 0.0079 | |||||

| US912810TM09 / United States Treasury Note/Bond | 5.47 | -2.22 | 0.3439 | -0.3406 | |||||

| US12803RAC88 / CaixaBank SA | 5.44 | 66.88 | 0.3416 | -0.0568 | |||||

| LEG / LEG Immobilien SE | 5.42 | 100.22 | 0.3407 | 0.0095 | |||||

| R1IN34 / Realty Income Corporation - Depositary Receipt (Common Stock) | 5.39 | 0.3388 | 0.3388 | ||||||

| ENEL FINANCE INTL NV 5.5% 06/26/2034 144A / DBT (US29278GBE70) | 5.29 | 161.69 | 0.3326 | 0.0852 | |||||

| US83368RBS04 / Societe Generale SA | 5.27 | 9.13 | 0.3312 | -0.2595 | |||||

| XS2685873908 / HSBC Holdings plc | 5.26 | 121.97 | 0.3307 | 0.0407 | |||||

| UST NOTES 4% 06/30/2032 / DBT (US91282CNJ61) | 5.23 | 0.3286 | 0.3286 | ||||||

| CBRE GLOBAL INVESTOR PAN EUROPEAN CORE FUND 4.75% 03/27/2034 REGS / DBT (XS2793256137) | 5.08 | 115.90 | 0.3191 | 0.0313 | |||||

| P3 GROUP SARL 4% 04/19/2032 REGS / DBT (XS2901491261) | 5.07 | 104.97 | 0.3185 | 0.0161 | |||||

| XS2667626233 / Virgin Money UK PLC | 4.95 | 70.66 | 0.3110 | -0.0438 | |||||

| CANADA GOVERNMENT OF 3% 06/01/2034 / DBT (CA135087R481) | 4.89 | 3.40 | 0.3073 | -0.2711 | |||||

| EOAN / E.ON SE | 4.88 | 20.18 | 0.3068 | -0.1901 | |||||

| SCOTTISH HYDRO ELECTRIC TRANSMISSION PLC 3.375% 09/04/2032 REGS / DBT (XS2894895684) | 4.83 | 52.43 | 0.3033 | -0.0840 | |||||

| SOUTH WEST WATER FINANCE PLC 5.75% 12/11/2032 REGS / DBT (XS2956847805) | 4.80 | 501.88 | 0.3018 | 0.2042 | |||||

| SEVERN TRENT WATER UTIL FIN 3.875% 08/04/2035 REGS / DBT (XS2991273462) | 4.76 | 95.36 | 0.2989 | 0.0011 | |||||

| SRG / Snam S.p.A. | 4.71 | 0.2962 | 0.2962 | ||||||

| XS2055106210 / Aroundtown SA | 4.71 | 50.18 | 0.2958 | -0.0877 | |||||

| DE000A3E5VX4 / AMPRION GMBH /EUR/ REGD REG S EMTN 0.62500000 | 4.68 | 32.19 | 0.2941 | -0.1390 | |||||

| DE000A3514F3 / Amprion GmbH | 4.63 | 199.29 | 0.2909 | 0.1016 | |||||

| AU3CB0299816 / AUSNET SERVICES | 4.61 | 0.2895 | 0.2895 | ||||||

| CA135087Q723 / Canadian Government Bond | 4.58 | 3.55 | 0.2876 | -0.2529 | |||||

| XS2624976077 / ING Groep NV | 4.57 | -1.02 | 0.2869 | -0.2772 | |||||

| SAMHALLSBYGGNADSBOLAGET I NORDEN HOLDING AB 2.25% 07/12/2027 REGS / DBT (XS2962827312) | 4.57 | 11.37 | 0.2869 | -0.2144 | |||||

| XS2271225281 / Grand City Properties SA | 4.57 | 219.23 | 0.2869 | 0.1119 | |||||

| XS1140961563 / JOHN LEWIS PLC SR UNSECURED REGS 12/34 4.25 | 4.55 | 967.14 | 0.2856 | 0.2335 | |||||

| XS2398746144 / Blackstone Property Partners Europe Holdings Sarl | 4.49 | 25.67 | 0.2821 | -0.1548 | |||||

| UST NOTES 4.125% 02/28/2027 / DBT (US91282CMP31) | 4.42 | 0.14 | 0.2779 | -0.2622 | |||||

| XS2356039268 / GTC AURORA LUXEMBOURG SA 2.25% 06/23/2026 REGS | 4.40 | 11.77 | 0.2764 | -0.2049 | |||||

| US91282CJJ18 / US TREASURY NOTE 4.5% 11-15-33 | 4.37 | 0.32 | 0.2743 | -0.2579 | |||||

| XS2384289554 / QBE INS GROUP LTD 2.5%/VAR 09/13/2038 REGS | 4.36 | 57.13 | 0.2741 | -0.0655 | |||||

| XS2306517876 / DNB Bank ASA | 4.36 | 166.65 | 0.2738 | 0.0740 | |||||

| JYSK / Jyske Bank A/S | 4.35 | 139.72 | 0.2734 | 0.0514 | |||||

| PUB / Publicis Groupe S.A. | 4.35 | 0.2731 | 0.2731 | ||||||

| US09659W2R48 / BNP Paribas SA | 4.23 | 81.03 | 0.2656 | -0.0200 | |||||

| XS2552367687 / BARCLAYS PLC (UNGTD) 8.407%/VAR 11/14/2032 REGS | 4.23 | 6.91 | 0.2655 | -0.2179 | |||||

| XS1423777215 / Argentum Netherlands BV for Swiss Re Ltd | 4.14 | 5.43 | 0.2600 | -0.2200 | |||||

| LONDON POWER NETWORKS PLC 3.837% 06/11/2037 REGS / DBT (XS3090913883) | 4.07 | 0.2556 | 0.2556 | ||||||

| US46115HBZ91 / Intesa Sanpaolo SpA | 4.02 | 42.40 | 0.2524 | -0.0926 | |||||

| 5831 / Shizuoka Financial Group,Inc. | 3.95 | 110.73 | 0.2481 | 0.0189 | |||||

| CABK / CaixaBank, S.A. | 3.93 | 10.91 | 0.2471 | -0.1866 | |||||

| XS1700429308 / Aroundtown SA | 3.92 | 447.91 | 0.2465 | 0.1590 | |||||

| CARLSBERG BREWERIES A/S 3.25% 02/28/2032 REGS / DBT (XS3002420498) | 3.90 | 37.36 | 0.2451 | -0.1023 | |||||

| SE0016589105 / HEIMSTADEN AB 4.375% 03/06/2027 REGS | 3.88 | 11.23 | 0.2441 | -0.1830 | |||||

| XS2617442525 / Volkswagen Bank GmbH | 3.88 | 0.2435 | 0.2435 | ||||||

| XS2560994381 / COMMERZBANK AG 8.625%/VAR 02/28/2033 REGS | 3.84 | 54.34 | 0.2411 | -0.0630 | |||||

| HYLN / Hyliion Holdings Corp. | 3.83 | 180.44 | 0.2406 | 0.0736 | |||||

| KBC / KBC Group NV | 3.82 | 54.20 | 0.2397 | -0.0629 | |||||

| US91282CJN20 / US TREASURY N/B 4.375% 11-30-28 | 3.78 | 0.53 | 0.2373 | -0.2222 | |||||

| CR8C5U / Commerzbank AG - Equity Warrant | 3.68 | 71.29 | 0.2313 | -0.0315 | |||||

| PTFIDBOM0009 / FIDELIDADE COMPANHIA 4.25%/VAR 09/04/2031 REGS | 3.67 | 25.36 | 0.2305 | -0.1274 | |||||

| UNITED STATES TREASURY BOND 4.125% 08/15/2044 / DBT (US912810UD80) | 3.60 | -2.23 | 0.2259 | -0.2238 | |||||

| XS1980255779 / AROUNDTOWN SA | 3.53 | 9.75 | 0.2220 | -0.1717 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 3.51 | 23.95 | 0.2205 | -0.1258 | |||||

| CECV / Ceconomy AG | 3.51 | 72.16 | 0.2204 | -0.0288 | |||||

| BNP / BNP Paribas SA | 3.47 | 71.78 | 0.2181 | -0.0290 | |||||

| JYSK / Jyske Bank A/S | 3.46 | 47.99 | 0.2176 | -0.0686 | |||||

| UST NOTES 4% 02/15/2034 / DBT (US91282CJZ59) | 3.46 | 0.32 | 0.2176 | -0.2046 | |||||

| CH1174335740 / CREDIT SUISSE GRP AG 2.875/VAR 04/02/2032 REGS | 3.46 | 11.37 | 0.2173 | -0.1624 | |||||

| XS2468125609 / BLACKSTONE PRIVATE CREDIT FUND 4.875% 04/14/2026 REGS | 3.41 | 37.02 | 0.2140 | -0.0900 | |||||

| UST NOTES 4.375% 12/31/2029 / DBT (US91282CMD01) | 3.28 | 0.64 | 0.2061 | -0.1924 | |||||

| UST NOTES 3.75% 08/31/2031 / DBT (US91282CLJ89) | 3.27 | 0.83 | 0.2054 | -0.1911 | |||||

| CEBB / Nationwide Building Society - Preferred Security | 3.10 | 0.1951 | 0.1951 | ||||||

| US404280DV88 / HSBC Holdings PLC | 3.01 | 47.60 | 0.1892 | -0.0603 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 3.01 | 0.1891 | 0.1891 | ||||||

| SHA0 / Schaeffler AG | 3.01 | 1,298.60 | 0.1890 | 0.1627 | |||||

| UNITED UTILITIES WATER FINANCE PLC 3.5% 02/27/2033 REGS / DBT (XS3011736108) | 2.97 | 53.89 | 0.1867 | -0.0494 | |||||

| XS2621539910 / HSBC Holdings plc | 2.95 | 42.20 | 0.1855 | -0.0684 | |||||

| XS2356450846 / ANGLIAN WATER (OSPREY) FINANCING PLC 2% 07/31/2028 REGS | 2.91 | 266.42 | 0.1830 | 0.0857 | |||||

| XS2289852522 / WHITBREAD GROUP PLC 2.375% 05/31/2027 REGS | 2.90 | 915.38 | 0.1825 | 0.1475 | |||||

| ANGLIAN WATER SVCS FINANC PLC 5.875% 06/20/2031 REGS / DBT (XS2638380506) | 2.89 | 8.54 | 0.1813 | -0.1438 | |||||

| ENBW INTERNATIONAL FINANCE BV 3.5% 07/22/2031 REGS / DBT (XS2862984510) | 2.88 | 20.18 | 0.1812 | -0.1122 | |||||

| CITYCON TREASURY BV 5.375% 07/08/2031 REGS / DBT (XS3043331977) | 2.86 | 0.1799 | 0.1799 | ||||||

| FR0013283371 / RCI Banque SA | 2.85 | 561.72 | 0.1792 | 0.1264 | |||||

| XS2629470761 / BOSCH (ROBERT) GMBH 4.375% 06/02/2043 REGS | 2.85 | 76.16 | 0.1788 | -0.0188 | |||||

| AU0000075681 / Australia Government Bond | 2.83 | 194.27 | 0.1776 | 0.0601 | |||||

| XS2416978190 / ZURICH FINANCE (IRELAND) DAC 3.5%/VAR 05/02/2052 REGS | 2.79 | 1.90 | 0.1756 | -0.1598 | |||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 2.77 | 0.1742 | 0.1742 | ||||||

| AROUNDTOWN FINANCE SARL 7.875%/VAR PERP / EP (XS2812484728) | 2.71 | 224.55 | 0.1703 | 0.0682 | |||||

| XS2412732708 / SIRIUS REAL ESTATE LTD /EUR/ REGD REG S 1.75000000 | 2.68 | 41.11 | 0.1687 | -0.0640 | |||||

| CABK / CaixaBank, S.A. | 2.64 | 0.1660 | 0.1660 | ||||||

| XS2403426427 / PRUDENTIAL PLC 2.95%/VAR 11/03/2033 REGS | 2.62 | 8.71 | 0.1647 | -0.1301 | |||||

| UNITED STATES TREASURY BOND 4.625% 05/15/2044 / DBT (US912810UB25) | 2.57 | -2.25 | 0.1614 | -0.1600 | |||||

| XS0907301260 / WOLTERS KLUWER-C | 2.57 | 0.1612 | 0.1612 | ||||||

| XS2259808702 / National Express Group PLC | 2.56 | 294.90 | 0.1606 | 0.0814 | |||||

| XS1713463559 / ENEL SOCIETA PER AZIONI 3.375%/VAR 11/24/2081 REGS | 2.53 | 57.00 | 0.1592 | -0.0382 | |||||

| DEQ1 / Deutsche EuroShop AG - Depositary Receipt (Common Stock) | 2.47 | 0.1554 | 0.1554 | ||||||

| XS2346973741 / CIMIC GROUP LTD 1.5% 05/28/2029 REGS | 2.30 | -18.72 | 0.1446 | -0.2017 | |||||

| FISERV FUNDING UNLTD CO 3.5% 06/15/2032 / DBT (XS3060660050) | 2.10 | 0.1321 | 0.1321 | ||||||

| XS2290533020 / CPI PROPERTY GROUP SA 3.75%/VAR PERP REGS | 2.08 | 29.45 | 0.1307 | -0.0658 | |||||

| AMPRION GMBH 3.125% 08/27/2030 REGS / DBT (DE000A383QQ2) | 2.00 | 9.93 | 0.1260 | -0.0971 | |||||

| XS1664647499 / BAT Capital Corp. | 1.96 | 7.06 | 0.1230 | -0.1006 | |||||

| CH1142754311 / CREDIT SUISSE GRP AG 2.125%/VAR 11/15/2029 REGS | 1.96 | 130.54 | 0.1228 | 0.0190 | |||||

| FR00140066D6 / ENGIE - Loyalty Line 2024 | 1.90 | 10.65 | 0.1196 | -0.0907 | |||||

| KPN / Koninklijke KPN N.V. | 1.89 | 35.14 | 0.1189 | -0.0524 | |||||

| ZF EUROPE FINANCE BV 7% 06/12/2030 REGS / DBT (XS3091660194) | 1.65 | 0.1038 | 0.1038 | ||||||

| FR001400D6O8 / ELEC DE FRANCE | 1.65 | 9.45 | 0.1034 | -0.0804 | |||||

| XS2488626883 / Duke Energy Corp | 1.64 | 25.40 | 0.1030 | -0.0569 | |||||

| SUPERNOVA INVEST GMBH 5% 06/24/2030 REGS / DBT (XS3103692250) | 1.62 | 0.1019 | 0.1019 | ||||||

| US91282CJQ50 / United States Treasury Note/Bond - When Issued | 1.59 | 0.89 | 0.1000 | -0.0930 | |||||

| XS2027596530 / Romanian Government International Bond | 1.55 | 0.0976 | 0.0976 | ||||||

| XS2595035234 / FORD MTR CR CO LLC 6.86% 06/05/2026 | 1.53 | 16.93 | 0.0963 | -0.0640 | |||||

| SW FINANCE I PLC 7.375% 12/12/2041 REGS / DBT (XS2731297235) | 1.49 | 20.70 | 0.0938 | -0.0575 | |||||

| XS1261170515 / Argentum Netherlands BV for Swiss Re Ltd | 1.49 | 0.20 | 0.0937 | -0.0885 | |||||

| XS2325617939 / SOUTHERN WTR SERVICES FIN LTD 1.625% 03/30/2027 REGS | 1.47 | 276.47 | 0.0925 | 0.0447 | |||||

| WARNERMEDIA HOLDINGS INC 4.693% 05/17/2033 / DBT (XS2721621154) | 1.40 | -41.02 | 0.0877 | -0.2019 | |||||

| XS2387675395 / SOUTHERN COMPANY EUSA5 1.875/VAR 09/15/2081 | 1.36 | 9.73 | 0.0857 | -0.0663 | |||||

| CR8C5U / Commerzbank AG - Equity Warrant | 1.35 | 10.11 | 0.0849 | -0.0652 | |||||

| XS2553549903 / HSBC HOLDINGS PLC 8.201%/VAR 11/16/2034 REGS | 1.26 | 84.31 | 0.0790 | -0.0045 | |||||

| UST NOTES 4.125% 07/31/2031 / DBT (US91282CLD10) | 1.21 | 0.75 | 0.0762 | -0.0711 | |||||

| GOOGL / Alphabet Inc. - Depositary Receipt (Common Stock) | 1.17 | 0.0733 | 0.0733 | ||||||

| MSBR34 / Morgan Stanley - Depositary Receipt (Common Stock) | 1.14 | 11.30 | 0.0719 | -0.0538 | |||||

| CITYCON TREASURY BV 5% 03/11/2030 REGS / DBT (XS2956850189) | 1.11 | 46.11 | 0.0697 | -0.0231 | |||||

| UNITED STATES TREASURY BOND 4.625% 11/15/2044 / DBT (US912810UF39) | 1.11 | -2.21 | 0.0695 | -0.0689 | |||||

| GOOGL / Alphabet Inc. - Depositary Receipt (Common Stock) | 1.09 | 0.0683 | 0.0683 | ||||||

| US48128B5497 / JPMORGAN CHASE and CO 4.625% PERP PFD | 1.08 | 10.76 | 0.0679 | -0.0515 | |||||

| XS2347379377 / Tritax EuroBox PLC | 1.01 | 9.92 | 0.0634 | -0.0488 | |||||

| SIG COMBIBLOC PURCHASECO SARL 3.75% 03/19/2030 REGS / DBT (XS3017995518) | 0.93 | 9.82 | 0.0584 | -0.0451 | |||||

| XS2560422581 / BARCLAYS PLC (UNGTD) 5.262%/VAR 01/29/2034 REGS | 0.88 | -88.17 | 0.0553 | -0.8545 | |||||

| GOOGL / Alphabet Inc. - Depositary Receipt (Common Stock) | 0.81 | 0.0510 | 0.0510 | ||||||

| ANGLIAN WATER SVCS FINANC PLC 6.25% 09/12/2044 REGS / DBT (XS2898771774) | 0.79 | 10.28 | 0.0499 | -0.0382 | |||||

| XS1345415472 / Santander UK Group Holdings PLC | 0.75 | 6.83 | 0.0472 | -0.0388 | |||||

| XS2254262285 / Travis Perkins PLC | 0.74 | -54.58 | 0.0464 | -0.1524 | |||||

| XS1888180996 / Vodafone Group PLC | 0.72 | 6.52 | 0.0452 | -0.0374 | |||||

| US91282CJR34 / United States Treasury Note/Bond - When Issued | 0.70 | 0.72 | 0.0440 | -0.0411 | |||||

| 5831 / Shizuoka Financial Group,Inc. | 0.69 | 0.0435 | 0.0435 | ||||||

| US LONG BOND(CBT) FUT SEP25 USU5 / DIR (N/A) | 0.59 | 0.0374 | 0.0374 | ||||||

| XS2010032618 / SAMHALLSBYGGNADSBOLAGET I NORDEN AB 2.624/VAR PERP REGS | 0.54 | 22.05 | 0.0338 | -0.0201 | |||||

| US912810TH14 / United States Treasury Note/Bond | 0.48 | -2.24 | 0.0302 | -0.0298 | |||||

| XS2195190876 / SSE PLC 3.74%/VAR PERP REGS | 0.46 | 6.78 | 0.0287 | -0.0237 | |||||

| US912810SQ22 / United States Treasury Note/Bond | 0.43 | -1.83 | 0.0271 | -0.0266 | |||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.43 | 0.0269 | 0.0269 | ||||||

| WPC / W. P. Carey Inc. | 0.36 | 10.64 | 0.0229 | -0.0174 | |||||

| TITANIUM 2L BONDCO SARL PIK 6.25% 01/14/2031 / DBT (DE000A3L3AG9) | 0.30 | 0.34 | 0.0186 | -0.0174 | |||||

| US91282CGM73 / United States Treasury Note/Bond | 0.19 | 0.52 | 0.0121 | -0.0113 | |||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | 0.16 | 0.0098 | 0.0098 | ||||||

| CA135087Q236 / Canadian Government Bond | 0.12 | -78.17 | 0.0074 | -0.0582 | |||||

| XS2342732562 / VOLKSWAGEN INTL FINANCE NV 3.748%/VAR PERP REGS | 0.12 | 10.48 | 0.0073 | -0.0056 | |||||

| BNP / BNP Paribas SA | 0.10 | 0.0062 | 0.0062 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.06 | 0.0040 | 0.0040 | ||||||

| BNP / BNP Paribas SA | 0.05 | 0.0033 | 0.0033 | ||||||

| XS0989394589 / Credit Suisse Group AG | 0.04 | -8.89 | 0.0026 | -0.0030 | |||||

| EURO-BUND FUTURE SEP25 RXU5 / DIR (DE000F1NGF53) | 0.04 | 0.0023 | 0.0023 | ||||||

| GSCM SWAP CDS 06/20/30 UCGIM B / DCR (N/A) | 0.02 | 0.0014 | 0.0014 | ||||||

| FX Forward: USD/JPY settle 2025-07-08 / DFE (N/A) | 0.01 | 0.0005 | 0.0005 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | 0.01 | 0.0004 | 0.0004 | ||||||

| BNP / BNP Paribas SA | 0.00 | 0.0000 | 0.0000 | ||||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | -0.00 | -0.0000 | -0.0000 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0.00 | -0.0000 | -0.0000 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.00 | -0.0001 | -0.0001 | ||||||

| FX Forward: USD/GBP settle 2025-07-08 / DFE (N/A) | -0.00 | -0.0001 | -0.0001 | ||||||

| FX Forward: USD/AUD settle 2025-07-08 / DFE (N/A) | -0.00 | -0.0003 | -0.0003 | ||||||

| FX Forward: USD/CAD settle 2025-07-08 / DFE (N/A) | -0.00 | -0.0003 | -0.0003 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.00 | -0.0003 | -0.0003 | ||||||

| FX Forward: USD/AUD settle 2025-07-08 / DFE (N/A) | -0.00 | -0.0003 | -0.0003 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.01 | -0.0004 | -0.0004 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.01 | -0.0004 | -0.0004 | ||||||

| FX Forward: USD/AUD settle 2025-07-08 / DFE (N/A) | -0.01 | -0.0005 | -0.0005 | ||||||

| FX Forward: USD/AUD settle 2025-07-08 / DFE (N/A) | -0.01 | -0.0007 | -0.0007 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0.01 | -0.0009 | -0.0009 | ||||||

| BNP / BNP Paribas SA | -0.02 | -0.0010 | -0.0010 | ||||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | -0.02 | -0.0010 | -0.0010 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0.02 | -0.0011 | -0.0011 | ||||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | -0.02 | -0.0011 | -0.0011 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.02 | -0.0013 | -0.0013 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0.02 | -0.0014 | -0.0014 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.02 | -0.0015 | -0.0015 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0.03 | -0.0020 | -0.0020 | ||||||

| FX Forward: USD/CAD settle 2025-07-08 / DFE (N/A) | -0.03 | -0.0021 | -0.0021 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.04 | -0.0024 | -0.0024 | ||||||

| BNP / BNP Paribas SA | -0.04 | -0.0025 | -0.0025 | ||||||

| FX Forward: USD/CAD settle 2025-07-08 / DFE (N/A) | -0.04 | -0.0025 | -0.0025 | ||||||

| FX Forward: USD/AUD settle 2025-07-08 / DFE (N/A) | -0.05 | -0.0032 | -0.0032 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.06 | -0.0037 | -0.0037 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.07 | -0.0041 | -0.0041 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0.07 | -0.0045 | -0.0045 | ||||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | -0.08 | -0.0050 | -0.0050 | ||||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | -0.10 | -0.0065 | -0.0065 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.12 | -0.0073 | -0.0073 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.13 | -0.0084 | -0.0084 | ||||||

| FX Forward: USD/GBP settle 2025-07-08 / DFE (N/A) | -0.17 | -0.0109 | -0.0109 | ||||||

| FX Forward: USD/GBP settle 2025-07-08 / DFE (N/A) | -0.19 | -0.0118 | -0.0118 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.23 | -0.0147 | -0.0147 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.25 | -0.0160 | -0.0160 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0.27 | -0.0167 | -0.0167 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.31 | -0.0197 | -0.0197 | ||||||

| BNP / BNP Paribas SA | -0.35 | -0.0220 | -0.0220 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0.40 | -0.0249 | -0.0249 | ||||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | -0.41 | -0.0259 | -0.0259 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.49 | -0.0306 | -0.0306 | ||||||

| LONG GILT FUTURE SEP25 G U5 / DIR (GB00MP6FM953) | -0.59 | -0.0369 | -0.0369 | ||||||

| FX Forward: USD/EUR settle 2025-07-08 / DFE (N/A) | -0.59 | -0.0373 | -0.0373 | ||||||

| FX Forward: USD/GBP settle 2025-07-08 / DFE (N/A) | -0.61 | -0.0385 | -0.0385 | ||||||

| BA.C / Bank of America Corporation - Depositary Receipt (Common Stock) | -0.84 | -0.0527 | -0.0527 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -0.87 | -0.0549 | -0.0549 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -1.01 | -0.0635 | -0.0635 | ||||||

| XS1450864779 / China Government Bond - JPMorgan Chase | -1.08 | -0.0677 | -0.0677 | ||||||

| FX Forward: USD/EUR settle 2025-07-08 / DFE (N/A) | -1.66 | -0.1042 | -0.1042 | ||||||

| BNP / BNP Paribas SA | -3.41 | -0.2141 | -0.2141 | ||||||

| FX Forward: USD/EUR settle 2025-07-08 / DFE (N/A) | -15.95 | -1.0020 | -1.0020 |