Mga Batayang Estadistika

| Nilai Portofolio | $ 452,989,459 |

| Posisi Saat Ini | 448 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

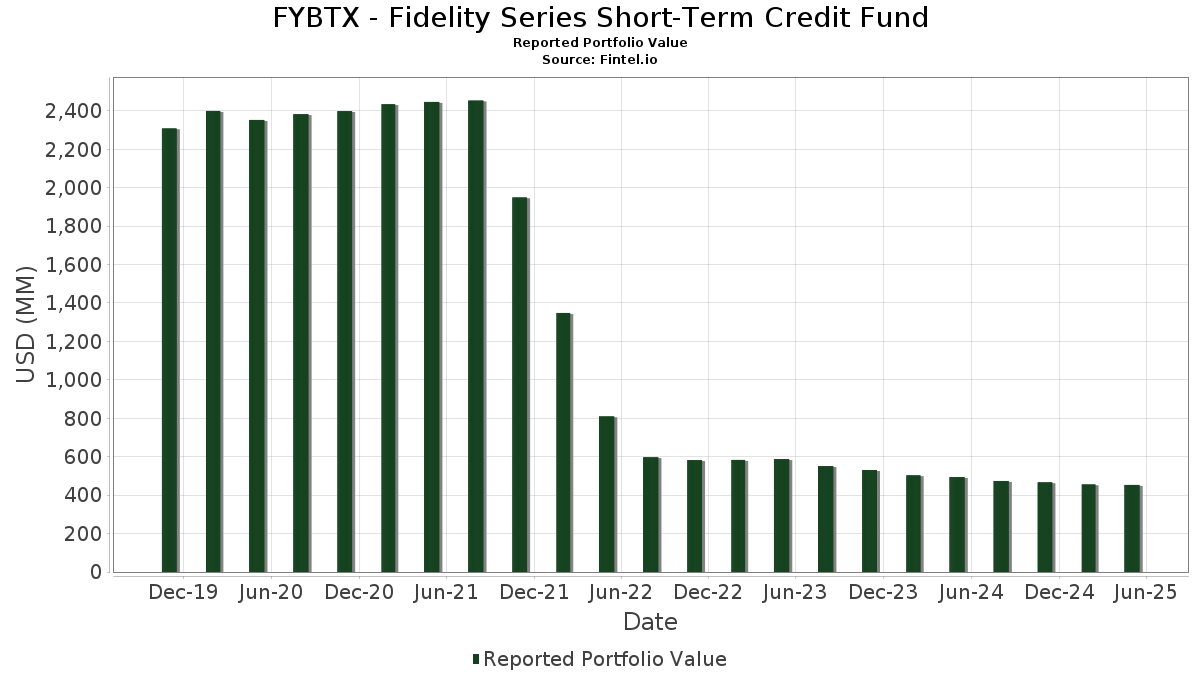

FYBTX - Fidelity Series Short-Term Credit Fund telah mengungkapkan total kepemilikan 448 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 452,989,459 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama FYBTX - Fidelity Series Short-Term Credit Fund adalah Bank of America Corp (US:US06051GLG28) , BAT International Finance PLC (GB:US05530QAN07) , Bayer US Finance II LLC (US:US07274NAJ28) , Ford Motor Credit Co LLC (US:US345397D260) , and Bank of America Corp. (US:US06051GKW86) . Posisi baru FYBTX - Fidelity Series Short-Term Credit Fund meliputi: Bank of America Corp (US:US06051GLG28) , BAT International Finance PLC (GB:US05530QAN07) , Bayer US Finance II LLC (US:US07274NAJ28) , Ford Motor Credit Co LLC (US:US345397D260) , and Bank of America Corp. (US:US06051GKW86) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 4.59 | 1.0140 | 1.0140 | ||

| 17.27 | 3.8200 | 0.6655 | ||

| 2.00 | 0.4423 | 0.4423 | ||

| 1.60 | 0.3533 | 0.3533 | ||

| 1.60 | 0.3529 | 0.3529 | ||

| 1.59 | 0.3521 | 0.3521 | ||

| 1.59 | 0.3513 | 0.3513 | ||

| 1.55 | 0.3428 | 0.3428 | ||

| 1.49 | 0.3302 | 0.3302 | ||

| 1.40 | 0.3091 | 0.3091 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 16.96 | 3.7506 | -4.0881 | ||

| 1.38 | 1.38 | 0.3052 | -1.5584 | |

| 1.01 | 0.2229 | -0.3263 | ||

| 0.35 | 0.0775 | -0.1354 | ||

| 0.67 | 0.1489 | -0.0715 | ||

| 0.59 | 0.1299 | -0.0711 | ||

| 1.11 | 0.2461 | -0.0620 | ||

| 0.64 | 0.1413 | -0.0401 | ||

| 0.80 | 0.1777 | -0.0301 | ||

| 1.02 | 0.2263 | -0.0290 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-24 untuk periode pelaporan 2025-05-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| UST NOTES 4% 12/15/2027 / DBT (US91282CMB45) | 17.27 | 19.36 | 3.8200 | 0.6655 | |||||

| UST NOTES 4.25% 11/30/2026 / DBT (US91282CLY56) | 16.96 | -52.84 | 3.7506 | -4.0881 | |||||

| US06051GLG28 / Bank of America Corp | 8.13 | 0.21 | 1.7977 | 0.0294 | |||||

| US05530QAN07 / BAT International Finance PLC | 6.44 | 0.72 | 1.4249 | 0.0306 | |||||

| US07274NAJ28 / Bayer US Finance II LLC | 6.23 | 0.13 | 1.3770 | 0.0217 | |||||

| US345397D260 / Ford Motor Credit Co LLC | 5.06 | -0.77 | 1.1183 | 0.0077 | |||||

| US06051GKW86 / Bank of America Corp. | 5.03 | -0.04 | 1.1126 | 0.0154 | |||||

| US46647PDG81 / JPMorgan Chase & Co. | 5.03 | 0.08 | 1.1113 | 0.0168 | |||||

| US55336VBR06 / MPLX LP | 4.89 | 0.60 | 1.0808 | 0.0219 | |||||

| US37045XDD57 / General Motors Financial Co Inc | 4.84 | 0.73 | 1.0711 | 0.0230 | |||||

| US12530MAA36 / CF Hippolyta LLC, Series 2020-1, Class A1 | 4.76 | 0.83 | 1.0523 | 0.0235 | |||||

| US91282CGP05 / United States Treasury Note/Bond | 4.59 | 1.0140 | 1.0140 | ||||||

| US136385AZ48 / Canadian Natural Resources Ltd | 4.37 | 0.67 | 0.9656 | 0.0202 | |||||

| US00774MAS44 / AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 4.10 | 0.49 | 0.9065 | 0.0173 | |||||

| US928668BB76 / Volkswagen Group of America Finance LLC | 3.83 | 0.10 | 0.8467 | 0.0132 | |||||

| US37045XBG07 / General Motors Financial Co Inc | 3.10 | -0.19 | 0.6863 | 0.0085 | |||||

| US12530MAE57 / CF Hippolyta LLC | 3.08 | 0.92 | 0.6802 | 0.0159 | |||||

| ATHENE GLOBAL FUNDING 5.516% 03/25/2027 144A / DBT (US04685A3T66) | 3.04 | -0.20 | 0.6726 | 0.0083 | |||||

| US00206RML32 / AT&T Inc | 3.03 | 0.63 | 0.6695 | 0.0138 | |||||

| US055522AA43 / BLOX TRUST 2021 BLOX | 3.02 | 0.84 | 0.6668 | 0.0150 | |||||

| US38141GZK39 / Goldman Sachs Group Inc/The | 2.90 | 0.42 | 0.6409 | 0.0117 | |||||

| US36191YAE86 / GS MTG SECS TR 2011-GC5 5.209% 08/10/2044 144A | 2.68 | -0.74 | 0.5918 | 0.0041 | |||||

| US539439AX74 / Lloyds Banking Group PLC | 2.65 | -0.11 | 0.5850 | 0.0076 | |||||

| US60687YCL11 / Mizuho Financial Group Inc | 2.44 | -0.20 | 0.5403 | 0.0065 | |||||

| SAN / Banco Santander, S.A. - Depositary Receipt (Common Stock) | 2.44 | 0.21 | 0.5387 | 0.0089 | |||||

| US404280DZ92 / HSBC HOLDINGS PLC REGD V/R 5.88700000 | 2.42 | -0.45 | 0.5351 | 0.0052 | |||||

| US06738ECJ29 / Barclays PLC | 2.42 | -0.45 | 0.5351 | 0.0054 | |||||

| US3140X4V450 / Fannie Mae Pool | 2.23 | -4.99 | 0.4930 | -0.0185 | |||||

| ARES XXXIV CLO LTD AR3 TSFR3M+132 04/17/2033 144A / ABS-CBDO (US04015GAX79) | 2.21 | 0.14 | 0.4892 | 0.0077 | |||||

| US91159HJK77 / US Bancorp | 2.10 | 0.24 | 0.4652 | 0.0077 | |||||

| US61744YAP34 / Morgan Stanley | 2.07 | 0.24 | 0.4568 | 0.0077 | |||||

| AERCAP IRELAND CAP LTD / AERCAP GLOBAL AVIATION TR 6.45% 04/15/2027 / DBT (US00774MBG96) | 2.06 | -0.29 | 0.4565 | 0.0052 | |||||

| US14040HDB87 / Capital One Financial Corp | 2.06 | -0.53 | 0.4563 | 0.0040 | |||||

| US172967LS86 / Citigroup Inc | 2.05 | 0.24 | 0.4533 | 0.0078 | |||||

| US693475BK03 / PNC FINANCIAL SERVICES GROUP INC ( | 2.04 | -0.05 | 0.4503 | 0.0061 | |||||

| US502431AP47 / L3Harris Technologies, Inc. | 2.03 | -0.05 | 0.4484 | 0.0063 | |||||

| US95000U3A91 / Wells Fargo & Co. | 2.01 | 0.05 | 0.4435 | 0.0067 | |||||

| WELLS FARGO CARD ISSUANCE TRUST 4.29% 10/15/2029 / ABS-CBDO (US92970QAE52) | 2.00 | 0.4423 | 0.4423 | ||||||

| US22822VAE11 / Crown Castle International Corp | 1.97 | -0.15 | 0.4366 | 0.0055 | |||||

| US172967LD18 / Citigroup Inc | 1.97 | 0.00 | 0.4365 | 0.0063 | |||||

| US775109CG49 / Rogers Communications, Inc. | 1.96 | 0.77 | 0.4327 | 0.0094 | |||||

| US03740LAD47 / Aon Corp / Aon Global Holdings PLC | 1.94 | 0.62 | 0.4295 | 0.0088 | |||||

| US29449WAL19 / Equitable Financial Life Global Funding | 1.92 | 0.58 | 0.4249 | 0.0085 | |||||

| US00912XAV64 / Air Lease Corp | 1.88 | 92.92 | 0.4160 | 0.2033 | |||||

| US251526CS67 / Deutsche Bank AG/New York NY | 1.87 | -0.27 | 0.4131 | 0.0047 | |||||

| US639057AF59 / NatWest Group PLC | 1.85 | -0.16 | 0.4091 | 0.0051 | |||||

| US097023DG73 / Boeing Co/The | 1.72 | 0.70 | 0.3801 | 0.0079 | |||||

| US95000U2S19 / Wells Fargo & Co | 1.70 | 0.53 | 0.3767 | 0.0075 | |||||

| US172967LW98 / Citigroup Inc | 1.67 | 0.12 | 0.3700 | 0.0057 | |||||

| US61747YFD22 / Morgan Stanley | 1.65 | 0.12 | 0.3655 | 0.0057 | |||||

| VOYA CLO 2019-2 LLC AR TSFR3M+120 07/20/2032 144A / ABS-CBDO (US92917RAL33) | 1.63 | -1.40 | 0.3594 | -0.0000 | |||||

| US573874AN44 / Marvell Technology Inc | 1.60 | 0.3533 | 0.3533 | ||||||

| GA GLOBAL FUNDING TRUST 4.4% 09/23/2027 144A / DBT (US36143L2N47) | 1.60 | 0.3529 | 0.3529 | ||||||

| US126650CX62 / Cvs Health Corporation Senior Note Callable M/w Bond | 1.59 | 0.3521 | 0.3521 | ||||||

| US29103DAJ54 / Emera US Finance LP | 1.59 | 0.3513 | 0.3513 | ||||||

| US23311VAJ61 / DCP Midstream Operating LP | 1.58 | -0.13 | 0.3502 | 0.0045 | |||||

| US87264ABR59 / T-MOBILE USA INC 2.25% 02/15/2026 | 1.57 | 0.51 | 0.3477 | 0.0068 | |||||

| US225401AV01 / Credit Suisse Group AG | 1.56 | -0.26 | 0.3455 | 0.0041 | |||||

| US404280DU06 / HSBC Holdings PLC | 1.55 | -0.39 | 0.3429 | 0.0037 | |||||

| US00130HCH66 / AES Corp/The | 1.55 | 0.3428 | 0.3428 | ||||||

| US74977RDS04 / COOPERATIEVE RABOBANK UA | 1.54 | -0.07 | 0.3396 | 0.0048 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 1.53 | -0.20 | 0.3378 | 0.0043 | |||||

| US61747YFA82 / Morgan Stanley | 1.53 | -0.07 | 0.3373 | 0.0046 | |||||

| CBOM / Credit Bank of Moscow (public joint-stock company) | 1.52 | -0.07 | 0.3366 | 0.0045 | |||||

| US87264ABD63 / CORP. NOTE | 1.52 | 0.33 | 0.3362 | 0.0057 | |||||

| AVGO / Broadcom Inc. - Depositary Receipt (Common Stock) | 1.52 | 0.07 | 0.3360 | 0.0051 | |||||

| I1RP34 / Trane Technologies plc - Depositary Receipt (Common Stock) | 1.52 | -0.13 | 0.3358 | 0.0043 | |||||

| DGZ / DB Gold Short ETN | 1.52 | -0.26 | 0.3358 | 0.0039 | |||||

| US37046US851 / General Motors Financial Co Inc | 1.51 | -0.26 | 0.3344 | 0.0038 | |||||

| US928668BU57 / Volkswagen Group of America, Inc. | 1.50 | -0.46 | 0.3322 | 0.0033 | |||||

| US126650DS68 / CVS Health Corp | 1.50 | -0.07 | 0.3322 | 0.0045 | |||||

| US44891ACF21 / Hyundai Capital America | 1.50 | -0.27 | 0.3319 | 0.0040 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 1.50 | -0.79 | 0.3313 | 0.0021 | |||||

| US456837AM56 / ING Groep NV | 1.50 | 0.54 | 0.3313 | 0.0063 | |||||

| US46647PDA12 / JPMorgan Chase & Co. | 1.49 | 0.3302 | 0.3302 | ||||||

| COREBRIDGE GLOBAL FUNDING 4.9% 01/07/2028 144A / DBT (US00138CBD92) | 1.47 | 162.75 | 0.3260 | 0.2036 | |||||

| JOHN DEERE OWNER TRUST 2024 4.96% 11/15/2028 / ABS-CBDO (US47800RAD52) | 1.47 | -0.14 | 0.3246 | 0.0042 | |||||

| I1CE34 / Intercontinental Exchange, Inc. - Depositary Receipt (Common Stock) | 1.46 | 0.34 | 0.3231 | 0.0059 | |||||

| US05329WAM47 / AutoNation Inc | 1.46 | 0.00 | 0.3224 | 0.0048 | |||||

| US25470DAL38 / Discovery Communications LLC | 1.46 | -0.14 | 0.3224 | 0.0042 | |||||

| US62954HAZ10 / NXP BV / NXP Funding LLC / NXP USA Inc | 1.45 | 0.07 | 0.3202 | 0.0048 | |||||

| US960413AT94 / Westlake Chemical Corp. | 1.44 | -0.07 | 0.3183 | 0.0044 | |||||

| US126650DF48 / CVS Health Corporation 3.00%, due 08/15/2026 | 1.43 | 0.28 | 0.3166 | 0.0056 | |||||

| SOUTH BOW USA INFRASTRUCTURE HOLDINGS LLC 4.911% 09/01/2027 144A / DBT (US83007CAA09) | 1.43 | 393.10 | 0.3162 | 0.2530 | |||||

| US92348KBS15 / Verizon Master Trust | 1.43 | -0.28 | 0.3154 | 0.0036 | |||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 1.41 | 0.00 | 0.3114 | 0.0043 | |||||

| US404119BS74 / Hca Inc Bond | 1.40 | -0.28 | 0.3102 | 0.0038 | |||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 1.40 | -0.14 | 0.3100 | 0.0040 | |||||

| US842587DM64 / SOUTHERN CO SR UNSECURED 10/25 5.15 | 1.40 | -0.21 | 0.3100 | 0.0039 | |||||

| BNP / BNP Paribas SA | 1.40 | 0.3091 | 0.3091 | ||||||

| PM / Philip Morris International Inc. - Depositary Receipt (Common Stock) | 1.39 | 0.3076 | 0.3076 | ||||||

| FLATIRON CLO 28 LTD / FLATIRON CLO 28 LLC A1 TSFR3M+132 07/15/2036 144A / ABS-CBDO (US33884EAC57) | 1.39 | -0.29 | 0.3068 | 0.0035 | |||||

| US31635A1051 / Fidelity Cash Central Fund | 1.38 | -83.86 | 1.38 | -83.86 | 0.3052 | -1.5584 | |||

| F1AN34 / Diamondback Energy, Inc. - Depositary Receipt (Common Stock) | 1.38 | -0.29 | 0.3045 | 0.0035 | |||||

| US09261HAC16 / Blackstone Private Credit Fund | 1.38 | -0.79 | 0.3044 | 0.0020 | |||||

| DELL INTL/EMC CORP 4.75% 04/01/2028 / DBT (US24703TAL08) | 1.38 | 0.3043 | 0.3043 | ||||||

| US78398AAD54 / SFS Auto Receivables Securitization Trust, Series 2023-1A, Class A3 | 1.38 | -4.25 | 0.3041 | -0.0091 | |||||

| US38141GZR81 / Goldman Sachs Group Inc/The | 1.37 | 0.22 | 0.3041 | 0.0050 | |||||

| US95000U2V48 / WELLS FARGO & COMPANY REGD V/R MTN 3.52600000 | 1.37 | 0.37 | 0.3036 | 0.0053 | |||||

| US172967LP48 / Citigroup Inc (variable) Bond | 1.37 | 0.15 | 0.3027 | 0.0048 | |||||

| US46590XAS53 / JBS USA/FOOD/FINANCE REGD 2.50000000 | 1.37 | 0.3025 | 0.3025 | ||||||

| US83370G5999 / Societe Generale SA, ELN, (linked to Nasdaq 100 Index) | 1.37 | 0.3021 | 0.3021 | ||||||

| US03027XAM20 / American Tower Corp. | 1.37 | 0.22 | 0.3020 | 0.0050 | |||||

| US18551PAC32 / Cleco Corporate Holdings LLC | 1.36 | 0.3016 | 0.3016 | ||||||

| BANK OF AMERICA CORPORATION 4.623%/VAR 05/09/2029 / DBT (US06051GMT30) | 1.36 | 0.3007 | 0.3007 | ||||||

| US61747YEK73 / Morgan Stanley | 1.35 | 0.37 | 0.2989 | 0.0055 | |||||

| ORCL / Oracle Corporation - Depositary Receipt (Common Stock) | 1.31 | 0.08 | 0.2903 | 0.0045 | |||||

| WORLD OMNI AUTO RECEIVABLES TR 2024-A 4.86% 03/15/2029 / ABS-CBDO (US98164RAD89) | 1.31 | -0.23 | 0.2888 | 0.0036 | |||||

| GMF FLOORPLAN OWNER REVOLVING TR 5.13% 03/15/2029 144A / ABS-CBDO (US361886DA91) | 1.27 | -0.24 | 0.2816 | 0.0034 | |||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 1.27 | -0.24 | 0.2806 | 0.0035 | |||||

| GLENCORE FDG LLC 5.338% 04/04/2027 144A / DBT (US378272BR82) | 1.26 | -0.32 | 0.2795 | 0.0032 | |||||

| O1KE34 / ONEOK, Inc. - Depositary Receipt (Common Stock) | 1.26 | 979.49 | 0.2794 | 0.2538 | |||||

| MERCEDES-BENZ FINANCE NORTH AMERICA LLC 4.75% 08/01/2027 144A / DBT (US58769JAU16) | 1.25 | -0.24 | 0.2770 | 0.0034 | |||||

| JUNIPER VALLEY PARK CLO LLC AR TSFR3M+125 07/20/2036 144A / ABS-CBDO (US48206KAQ94) | 1.25 | -0.16 | 0.2767 | 0.0035 | |||||

| ENEL FINANCE INTL NV 5.125% 06/26/2029 144A / DBT (US29278GBD97) | 1.25 | 0.32 | 0.2754 | 0.0049 | |||||

| ICON INVESTMENTS SIX DESIGNATED ACTIVITY CO 5.809% 05/08/2027 / DBT (US45115AAA25) | 1.24 | -0.40 | 0.2751 | 0.0027 | |||||

| NEUBERGER BERMAN LN ADVISERS NBLA CLO 50 LTD / NEUBERGER BERMAN LN AR TSFR3M+125 07/23/2036 144A / ABS-CBDO (US64134VAQ95) | 1.23 | -0.40 | 0.2727 | 0.0028 | |||||

| US23636ABE01 / Danske Bank A/S | 1.23 | -0.48 | 0.2726 | 0.0026 | |||||

| US00138CAU27 / Corebridge Global Funding | 1.22 | -0.33 | 0.2687 | 0.0030 | |||||

| VERIZON MASTER TRUST 4.62% 11/20/2030 / ABS-CBDO (US92348KDM27) | 1.18 | 0.00 | 0.2608 | 0.0038 | |||||

| VOLKSWAGEN AUTO LOAN ENHANCED TRUST 2024-1 4.63% 07/20/2029 / ABS-CBDO (US92868RAD08) | 1.18 | 0.08 | 0.2606 | 0.0038 | |||||

| FLATIRON CLO 23-1A AR LLC TSFR3M+124 04/17/2036 144A / ABS-CBDO (US33883DAQ79) | 1.18 | 0.2605 | 0.2605 | ||||||

| US92348KBZ57 / VZMT 2023-5 A1A | 1.17 | -0.34 | 0.2594 | 0.0029 | |||||

| MAGNETITE XXII LTD / MAGNETITE XXII LLC ARR TSFR3M+125 07/15/2036 144A / ABS-CBDO (US55954HAW25) | 1.17 | -0.43 | 0.2583 | 0.0027 | |||||

| MERCEDES-BENZ AUTO LEASE TR 2024-B 4.89% 02/15/2028 / ABS-CBDO (US58769GAD51) | 1.16 | -0.09 | 0.2574 | 0.0033 | |||||

| US34528QGA67 / Ford Credit Floorplan Master Owner Trust A | 1.16 | -0.34 | 0.2570 | 0.0029 | |||||

| US24703TAD81 / CORP. NOTE | 1.15 | -0.52 | 0.2553 | 0.0024 | |||||

| US446150BC73 / Huntington Bancshares Inc/OH | 1.15 | -0.09 | 0.2536 | 0.0035 | |||||

| US03027XBV10 / American Tower Corp | 1.14 | 0.2530 | 0.2530 | ||||||

| US928563AC98 / VMware Inc | 1.14 | 0.2530 | 0.2530 | ||||||

| M1CH34 / Microchip Technology Incorporated - Depositary Receipt (Common Stock) | 1.14 | 0.2528 | 0.2528 | ||||||

| ATHENE GLOBAL FUNDING 4.95% 01/07/2027 144A / DBT (US04685A4E88) | 1.14 | -0.18 | 0.2514 | 0.0032 | |||||

| US89352HAW97 / TransCanada PipeLines Ltd | 1.13 | 0.2501 | 0.2501 | ||||||

| BUCKHORN PARK CLO LTD ARR TSFR3M+107 07/18/2034 144A / ABS-CBDO (US118382BA70) | 1.13 | -0.27 | 0.2495 | 0.0029 | |||||

| US45262BAF04 / Imperial Brands Finance PLC | 1.13 | 0.2491 | 0.2491 | ||||||

| US89788MAL63 / Truist Financial Corp. | 1.13 | 0.09 | 0.2490 | 0.0037 | |||||

| US38141GWZ35 / Goldman Sachs Group Inc/The | 1.12 | 0.36 | 0.2473 | 0.0045 | |||||

| US05492PAA66 / BANC OF AMERICA MERRILL LYNCH BAMLL 2019 BPR ANM 144A | 1.11 | -21.23 | 0.2461 | -0.0620 | |||||

| AXP / American Express Company - Depositary Receipt (Common Stock) | 1.11 | 0.2446 | 0.2446 | ||||||

| N1WG34 / NatWest Group plc - Depositary Receipt (Common Stock) | 1.10 | 0.2435 | 0.2435 | ||||||

| CHASE AUTO OWNER TRUST 4.94% 07/25/2029 144A / ABS-CBDO (US16144YAC21) | 1.10 | -0.45 | 0.2423 | 0.0025 | |||||

| JACKSON NATL LIFE GLOBAL FDG 4.9% 01/13/2027 144A / DBT (US46849LVC26) | 1.08 | -0.09 | 0.2395 | 0.0032 | |||||

| DRYDEN 68 CLO LTD ARR TSFR3M+110 07/15/2035 144A / ABS-CBDO (US26252QAS12) | 1.05 | -0.66 | 0.2322 | 0.0017 | |||||

| MADISON PK FDG XLV LTD / MADISON PK FDG XLV LLC ARR TSFR3M+108 07/15/2034 144A / ABS-CBDO (US55820BAS60) | 1.04 | -0.38 | 0.2308 | 0.0025 | |||||

| TMUST 24-1A A 5.05% 09/20/2029 144A / ABS-CBDO (US87267RAA32) | 1.04 | -0.19 | 0.2306 | 0.0028 | |||||

| US225401AF50 / Credit Suisse Group AG | 1.04 | 0.10 | 0.2301 | 0.0035 | |||||

| BA / The Boeing Company - Depositary Receipt (Common Stock) | 1.04 | 0.10 | 0.2296 | 0.0034 | |||||

| US80282KBF21 / Santander Holdings USA, Inc. | 1.02 | -0.49 | 0.2265 | 0.0021 | |||||

| WHEELS FLEET LEASE FUNDING 1 LLC 24-1A A1 5.49% 02/18/2039 144A / ABS-CBDO (US96328GBM87) | 1.02 | -12.64 | 0.2263 | -0.0290 | |||||

| US606822CS14 / MITSUBISHI UFJ FINANCIAL GROUP INC | 1.02 | -0.20 | 0.2257 | 0.0028 | |||||

| US29278NAN30 / Energy Transfer Operating LP | 1.01 | -0.20 | 0.2241 | 0.0028 | |||||

| US92939UAJ51 / WEC Energy Group, Inc. | 1.01 | -0.10 | 0.2241 | 0.0031 | |||||

| MASSMUTUAL GLOBAL FDG II 5.1% 04/09/2027 144A / DBT (US57629W4S64) | 1.01 | -0.10 | 0.2241 | 0.0029 | |||||

| SAMMONS FINANCIAL GROUP GLOBAL FUNDING 5.05% 01/10/2028 144A / DBT (US79587J2B82) | 1.01 | 0.40 | 0.2237 | 0.0042 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 1.01 | 0.2232 | 0.2232 | ||||||

| MORGAN STANLEY BK NA SALT LAKE 4.968%/VAR 07/14/2028 / DBT (US61690U8E33) | 1.01 | 0.00 | 0.2230 | 0.0033 | |||||

| JPM / JPMorgan Chase & Co. - Depositary Receipt (Common Stock) | 1.01 | -60.02 | 0.2229 | -0.3263 | |||||

| US83368RBR21 / Societe Generale SA | 1.01 | -0.30 | 0.2229 | 0.0025 | |||||

| US25215DAP42 / Dexia Credit Local SA/New York NY | 1.01 | -0.30 | 0.2226 | 0.0025 | |||||

| US097023CU76 / BOEING CO 5.04% 05/01/2027 | 1.01 | 0.30 | 0.2225 | 0.0037 | |||||

| DAIMLER TRUCKS FINANCE NORTH AMERICA LLC 5% 01/15/2027 144A / DBT (US233853AV24) | 1.01 | 0.00 | 0.2225 | 0.0031 | |||||

| US053332BE19 / AutoZone, Inc. | 1.01 | -0.20 | 0.2223 | 0.0027 | |||||

| US88947EAS90 / Toll Brothers Inc Bond | 1.00 | -0.20 | 0.2213 | 0.0029 | |||||

| US256677AK14 / Dollar General Corp. | 1.00 | -0.10 | 0.2211 | 0.0031 | |||||

| CBOM / Credit Bank of Moscow (public joint-stock company) | 1.00 | 38.47 | 0.2205 | 0.0635 | |||||

| US38141GZU11 / Goldman Sachs Group Inc/The | 1.00 | 0.00 | 0.2204 | 0.0032 | |||||

| US92343VDY74 / Verizon Communications Inc | 1.00 | 0.20 | 0.2202 | 0.0037 | |||||

| ALA TRUST 2025-OANA A 6.04263% 06/15/2030 144A / ABS-MBS (US009920AA71) | 0.99 | 0.2198 | 0.2198 | ||||||

| MARS INC 4.6% 03/01/2028 144A / DBT (US571676AX38) | 0.99 | 0.2193 | 0.2193 | ||||||

| ENTERPRISE FLEET FINANCING LLC 2024-1 5.23% 03/20/2030 144A / ABS-CBDO (US29375PAB67) | 0.99 | -12.00 | 0.2190 | -0.0263 | |||||

| VICI PROPERTIES LP 4.75% 04/01/2028 / DBT (US925650AJ26) | 0.99 | 0.2182 | 0.2182 | ||||||

| US25746UDF30 / Dominion Energy Inc | 0.98 | 0.41 | 0.2178 | 0.0041 | |||||

| US12513GBD07 / CDW LLC / CDW Finance Corp | 0.98 | 0.41 | 0.2177 | 0.0041 | |||||

| US29250NAR61 / Enbridge Inc | 0.98 | 0.31 | 0.2176 | 0.0039 | |||||

| US36264FAK75 / CORP. NOTE | 0.98 | 0.51 | 0.2174 | 0.0042 | |||||

| US125523CB40 / CIGNA CORP | 0.98 | 0.20 | 0.2172 | 0.0036 | |||||

| US80282KAZ93 / Santander Holdings USA Inc | 0.98 | 0.41 | 0.2168 | 0.0038 | |||||

| US95000U2A01 / Wells Fargo & Co | 0.98 | 0.31 | 0.2167 | 0.0039 | |||||

| US21036PAS74 / Constellation Brands Inc | 0.98 | 0.10 | 0.2165 | 0.0033 | |||||

| US61744YAK47 / Morgan Stanley | 0.98 | 0.51 | 0.2162 | 0.0042 | |||||

| US913017CR85 / United Technolo Bond | 0.98 | 0.62 | 0.2159 | 0.0043 | |||||

| US161175BJ23 / Charter Communications Operating LLC / Charter Communications Operating Capital | 0.98 | 0.83 | 0.2158 | 0.0050 | |||||

| US404119CH01 / HCA Inc | 0.97 | 0.41 | 0.2155 | 0.0040 | |||||

| US26441CAX39 / Duke Energy Corp | 0.97 | 0.62 | 0.2155 | 0.0045 | |||||

| US30040WAQ15 / EVERSOURCE ENERGY | 0.97 | 0.62 | 0.2150 | 0.0043 | |||||

| US68389XBU81 / ORACLE CORP SR UNSECURED 04/27 2.8 | 0.97 | 0.62 | 0.2148 | 0.0044 | |||||

| US00206RJX17 / AT&T Inc | 0.96 | 0.74 | 0.2122 | 0.0047 | |||||

| US855244AV14 / Starbucks Corp | 0.96 | 0.42 | 0.2116 | 0.0037 | |||||

| OHA CREDIT FUNDING 22 LTD A1 TSFR3M+ 07/20/2038 144A / ABS-CBDO (US67121HAA32) | 0.96 | 0.2116 | 0.2116 | ||||||

| US46647PBR64 / JPMorgan Chase & Co | 0.95 | 0.63 | 0.2110 | 0.0042 | |||||

| BX Trust 2025-ROIC VAR 03/15/2030 144A / ABS-MBS (US05593VAA17) | 0.94 | -0.63 | 0.2085 | 0.0017 | |||||

| HARTWICK PARK CLO LTD AR TSFR3M+116 01/20/2037 144A / ABS-CBDO (US417403AN28) | 0.93 | -0.43 | 0.2049 | 0.0022 | |||||

| US02005NBQ25 / Ally Financial Inc | 0.92 | 0.2037 | 0.2037 | ||||||

| US337738BD90 / Fiserv Inc | 0.92 | -0.11 | 0.2036 | 0.0027 | |||||

| US233331AY31 / DTE Energy Co. | 0.92 | 0.2033 | 0.2033 | ||||||

| US15189YAG17 / CenterPoint Energy Resources Corp | 0.92 | 0.22 | 0.2031 | 0.0034 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 0.92 | -0.11 | 0.2029 | 0.0026 | |||||

| US744573AV86 / Public Service Enterprise Group Inc | 0.92 | 0.2029 | 0.2029 | ||||||

| US65473PAN50 / NiSource Inc | 0.92 | 0.2029 | 0.2029 | ||||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 0.92 | 0.2027 | 0.2027 | ||||||

| US031162DP23 / Amgen Inc | 0.92 | 0.22 | 0.2027 | 0.0032 | |||||

| US606822CN27 / Mitsubishi UFJ Financial Group Inc | 0.92 | -0.22 | 0.2025 | 0.0025 | |||||

| US186108CK02 / Cleveland Electric Illuminating Co. (The) | 0.92 | 0.2024 | 0.2024 | ||||||

| US378272BK30 / Glencore Funding LLC | 0.92 | 0.2024 | 0.2024 | ||||||

| US591894CE82 / Metropolitan Edison Co | 0.91 | 0.2023 | 0.2023 | ||||||

| GS / The Goldman Sachs Group, Inc. - Depositary Receipt (Common Stock) | 0.91 | 0.2023 | 0.2023 | ||||||

| US26884LAF67 / EQT Corp. | 0.91 | 0.2022 | 0.2022 | ||||||

| US61747YEV39 / Morgan Stanley | 0.91 | 0.2018 | 0.2018 | ||||||

| US226373AR90 / Crestwood Midstream Partners LP / Crestwood Midstream Finance Corp | 0.91 | 0.2016 | 0.2016 | ||||||

| US928563AE54 / VMware, Inc. | 0.91 | 0.2015 | 0.2015 | ||||||

| US56585ABD37 / Marathon Petroleum Corp | 0.91 | 0.2014 | 0.2014 | ||||||

| US26441CBW47 / Duke Energy Corp | 0.91 | 0.2014 | 0.2014 | ||||||

| US12513GBG38 / CDW LLC / CDW Finance Corp | 0.91 | 0.2013 | 0.2013 | ||||||

| US925650AB99 / VICI Properties LP | 0.91 | 0.2013 | 0.2013 | ||||||

| US969457CK40 / WILLIAMS COMPANIES INC | 0.91 | 0.2012 | 0.2012 | ||||||

| US26884LAQ23 / EQT Corp. | 0.91 | 0.2010 | 0.2010 | ||||||

| US87612BBG68 / Targa Resources Partners LP / Targa Resources Partners Finance Corp | 0.91 | 0.2009 | 0.2009 | ||||||

| US595112CA91 / Micron Technology Inc | 0.91 | 0.2008 | 0.2008 | ||||||

| US12592BAQ77 / CNH Industrial Capital LLC | 0.91 | 0.2008 | 0.2008 | ||||||

| US03027XCC20 / American Tower Corp | 0.91 | 0.2007 | 0.2007 | ||||||

| US958254AF13 / Western Midstream Operating LP | 0.91 | 0.2007 | 0.2007 | ||||||

| US19828AAB35 / Columbia Pipelines Holding Co LLC | 0.91 | 0.2006 | 0.2006 | ||||||

| US29336TAC45 / EnLink Midstream LLC | 0.91 | 0.2001 | 0.2001 | ||||||

| US84756NAH26 / Spectra Energy Partners LP | 0.90 | 0.1999 | 0.1999 | ||||||

| US79588TAC45 / SAMMONS FINANCIAL GROUP SR UNSECURED 144A 05/27 4.45 | 0.90 | 0.1998 | 0.1998 | ||||||

| US29278GAW87 / Enel Finance International NV | 0.90 | 0.1991 | 0.1991 | ||||||

| PORSCHE INNOVATIVE LEASE OWNER TRUST 2024-2 4.35% 10/20/2027 144A / ABS-CBDO (US73328NAE13) | 0.90 | -0.22 | 0.1990 | 0.0024 | |||||

| US29446MAJ18 / Equinor ASA | 0.89 | 0.45 | 0.1974 | 0.0038 | |||||

| VOYA CLO 2022-1 LTD / VOYA CLO 2022-1 LLC A1R TSFR3M+125 04/20/2035 144A / ABS-CBDO (US92918UAL52) | 0.89 | -0.22 | 0.1971 | 0.0024 | |||||

| US92867YAD67 / VOLKSWAGEN AUTO LOAN ENHANCED TRUST 2023-2 5.48% 12/20/2028 | 0.89 | -0.22 | 0.1968 | 0.0023 | |||||

| CHASE AUTO OWNER TRUST 5.22% 07/25/2029 144A / ABS-CBDO (US16144LAC00) | 0.89 | -0.45 | 0.1967 | 0.0020 | |||||

| US161175CM43 / Charter Communications Operating LLC / Charter Communications Operating Capital | 0.89 | -0.34 | 0.1958 | 0.0022 | |||||

| FLATIRON RR CLO 22 LLC AR TSFR3M+91 10/15/2034 144A / ABS-CBDO (US33883QAQ82) | 0.88 | -0.79 | 0.1953 | 0.0013 | |||||

| HYUNDAI CAP AMER 5.45% 06/24/2026 144A / DBT (US44891ADA25) | 0.88 | -0.45 | 0.1940 | 0.0018 | |||||

| OXYD / Occidental Petroleum Corporation - Depositary Receipt (Common Stock) | 0.88 | -0.34 | 0.1935 | 0.0021 | |||||

| CAPITAL ONE PRIME AUTO RECEIVABLES TR 2024-1 4.62% 07/16/2029 / ABS-CBDO (US14043NAD12) | 0.87 | -0.23 | 0.1931 | 0.0023 | |||||

| WHEELS FLEET LEASE FUNDING 1 LLC 4.8% 09/19/2039 144A / ABS-CBDO (US96328GBZ90) | 0.87 | -0.35 | 0.1915 | 0.0020 | |||||

| US98164DAD93 / WORLD OMNI AUTO RECEIVABLES TR 2023-D 5.79% 02/15/2029 | 0.86 | -0.46 | 0.1903 | 0.0018 | |||||

| JACKSON NATL LIFE GLOBAL FDG 5.55% 07/02/2027 144A / DBT (US46849LVA69) | 0.85 | -0.24 | 0.1871 | 0.0022 | |||||

| EQUITABLE FINANCIAL LIFE GLOBAL FUNDING 4.6% 04/01/2027 144A / DBT (US29449WAU18) | 0.83 | 0.1837 | 0.1837 | ||||||

| US46591JAA43 / JP Morgan Chase Commercial Mortgage Securities Trust 2019-BKWD | 0.82 | -1.91 | 0.1815 | -0.0008 | |||||

| DAIMLER TRUCKS RETAIL TRUST 2024-1 5.49% 12/15/2027 / ABS-CBDO (US233874AC06) | 0.81 | -0.61 | 0.1802 | 0.0016 | |||||

| US05401AAB70 / Avolon Holdings Funding Ltd | 0.81 | 0.00 | 0.1788 | 0.0026 | |||||

| US96328GBG10 / Wheels Fleet Lease Funding 1 LLC | 0.80 | -15.74 | 0.1777 | -0.0301 | |||||

| BARINGS CLO LTD 2019-III A1RR TSFR3M+114 01/20/2036 144A / ABS-CBDO (US06761KAW18) | 0.80 | -0.12 | 0.1768 | 0.0024 | |||||

| ENTERPRISE FLEET FINANCING 2024-3 LLC 4.98% 08/21/2028 144A / ABS-CBDO (US29375QAC24) | 0.78 | -0.38 | 0.1730 | 0.0018 | |||||

| US05522RDH84 / BA Credit Card Trust | 0.77 | -0.13 | 0.1712 | 0.0021 | |||||

| A1JG34 / Arthur J. Gallagher & Co. - Depositary Receipt (Common Stock) | 0.76 | 0.13 | 0.1689 | 0.0026 | |||||

| FORDF 2025-1 A1 4.63% 04/15/2030 / ABS-CBDO (US34529BAA44) | 0.73 | 0.1621 | 0.1621 | ||||||

| CARMAX AUTO OWNER TRUST 2024-3 4.89% 07/16/2029 / ABS-CBDO (US14319GAD34) | 0.72 | -0.28 | 0.1594 | 0.0020 | |||||

| WORLD OMNI AUTO TRUST 2024-C A3 4.43% 12/17/2029 / ABS-CBDO (US98164NAD75) | 0.72 | -0.28 | 0.1586 | 0.0018 | |||||

| BX COMMERCIAL MORTGAGE TRUST 2025-SPOT TSFR1M+144.34 04/15/2040 144A / ABS-MBS (US12433FAA66) | 0.72 | 0.1581 | 0.1581 | ||||||

| VALLEY STREAM PK CLO LTD / VY STREAM PK CLO LLC ARR TSFR3M+119 01/20/2037 144A / ABS-CBDO (US92013AAT60) | 0.70 | -0.57 | 0.1542 | 0.0012 | |||||

| H1PE34 / Hewlett Packard Enterprise Company - Depositary Receipt (Common Stock) | 0.70 | -0.14 | 0.1539 | 0.0022 | |||||

| BUNGE LTD FIN CORP 4.1% 01/07/2028 / DBT (US120568BD12) | 0.69 | 0.44 | 0.1531 | 0.0028 | |||||

| ENTERPRISE FLEET FINANCING 2025-1 LLC 4.82% 02/20/2029 144A / ABS-CBDO (US29390HAC34) | 0.68 | 0.00 | 0.1494 | 0.0020 | |||||

| AFFIRM ASSET SECURITIZATION TRUST 2024-X2 5.22% 12/17/2029 144A / ABS-CBDO (US00833QAA31) | 0.67 | -33.43 | 0.1489 | -0.0715 | |||||

| US595112BN22 / MICRON TECHNOLOGY INC SR UNSECURED 02/29 5.327 | 0.67 | -0.15 | 0.1481 | 0.0020 | |||||

| US74971CAA18 / RR 16 Ltd | 0.67 | 0.15 | 0.1478 | 0.0022 | |||||

| AMUR EQUIP FIN RECEIVABLES XV LLC 4.7% 09/22/2031 144A / ABS-CBDO (US03237FAB13) | 0.66 | 0.1463 | 0.1463 | ||||||

| US31374CNW28 / Fannie Mae Pool | 0.66 | -6.02 | 0.1452 | -0.0069 | |||||

| US24702EAC49 / Dell Equipment Finance Trust, Series 2023-3, Class A3 | 0.64 | -1.68 | 0.1426 | -0.0003 | |||||

| ARES LII CLO LTD A1RR TSFR3M+88 04/22/2031 144A / ABS-CBDO (US04009AAW09) | 0.64 | -23.32 | 0.1413 | -0.0401 | |||||

| 2914 / Japan Tobacco Inc. | 0.63 | 0.1399 | 0.1399 | ||||||

| US881943AD65 / Tesla Electric Vehicle Trust 2023-1 | 0.61 | -0.33 | 0.1350 | 0.0016 | |||||

| WORLD OMNI AUTO RECEIVABLES TR 2024-B 5.27% 09/17/2029 / ABS-CBDO (US98164HAD08) | 0.61 | -0.49 | 0.1344 | 0.0014 | |||||

| PALMER SQUARE LOAN FUNDING 2024-3 LTD A1 TSFR3M+108 08/08/2032 144A / ABS-CBDO (US69690EAA73) | 0.60 | -8.37 | 0.1332 | -0.0100 | |||||

| HCA INC 5% 03/01/2028 / DBT (US404119CY34) | 0.60 | 0.34 | 0.1318 | 0.0022 | |||||

| US15089QAM69 / Celanese US Holdings LLC | 0.59 | -36.33 | 0.1299 | -0.0711 | |||||

| MARS INC 4.45% 03/01/2027 144A / DBT (US571676AW54) | 0.58 | 0.1288 | 0.1288 | ||||||

| US00751YAH99 / Advance Auto Parts Inc | 0.58 | 0.17 | 0.1276 | 0.0020 | |||||

| CITIZENS AUTO RECEIVABLES TRUST 2024-1 5.11% 04/17/2028 144A / ABS-CBDO (US17331QAD88) | 0.58 | -0.17 | 0.1275 | 0.0016 | |||||

| PNCS34 / The PNC Financial Services Group, Inc. - Depositary Receipt (Common Stock) | 0.57 | -0.17 | 0.1271 | 0.0016 | |||||

| CARMAX AUTO OWNER TRUST 2024-1 4.92% 10/16/2028 / ABS-CBDO (US14318WAD92) | 0.57 | -0.35 | 0.1267 | 0.0013 | |||||

| HPS CORPORATE LENDING FUND 5.3% 06/05/2027 144A / DBT (US40440VAL99) | 0.57 | 0.1253 | 0.1253 | ||||||

| H1PE34 / Hewlett Packard Enterprise Company - Depositary Receipt (Common Stock) | 0.57 | 0.36 | 0.1250 | 0.0022 | |||||

| US29250NBW48 / ENBRIDGE INC 5.9% 11/15/2026 | 0.56 | -0.36 | 0.1234 | 0.0013 | |||||

| US928668CA84 / Volkswagen Group of America Finance LLC | 0.56 | -0.54 | 0.1233 | 0.0012 | |||||

| TESLA 2024-A A3 5.3% 06/21/2027 144A / ABS-CBDO (US88166VAD82) | 0.56 | -0.36 | 0.1231 | 0.0013 | |||||

| US04033GAB32 / ARI Fleet Lease Trust 2023-B | 0.55 | -17.46 | 0.1223 | -0.0239 | |||||

| US708696CA52 / Pennsylvania Electric Co | 0.55 | -0.18 | 0.1220 | 0.0017 | |||||

| US165183CU69 / Chesapeake Funding II LLC | 0.53 | -17.36 | 0.1180 | -0.0226 | |||||

| US15135BAY74 / Centene Corp | 0.52 | 0.96 | 0.1161 | 0.0029 | |||||

| BX COML MTG TR 2024-MDHS 6.8415% 05/15/2041 144A / ABS-MBS (US12433BAA52) | 0.52 | -1.32 | 0.1161 | 0.0003 | |||||

| US91159HJM34 / US BANCORP REGD V/R 5.77500000 | 0.52 | 0.1141 | 0.1141 | ||||||

| DELL INTL/EMC CORP 5% 04/01/2030 / DBT (US24703TAM80) | 0.50 | 0.1096 | 0.1096 | ||||||

| WELLS FARGO COML MTG 2024-GRP A TSFR1M+179.132 10/15/2041 144A / ABS-MBS (US95003YAA01) | 0.49 | 0.00 | 0.1092 | 0.0015 | |||||

| BX COML MTG TR 2024-XL4 A TSFR1M+144.203 02/15/2039 144A / ABS-MBS (US05611VAA98) | 0.49 | -2.57 | 0.1088 | -0.0013 | |||||

| FORD CREDIT AUTO OWNER TRUST 2024-D 4.84% 08/15/2029 / ABS-CBDO (US34535VAD64) | 0.49 | -0.20 | 0.1078 | 0.0014 | |||||

| LPL HOLDINGS INC 4.9% 04/03/2028 / DBT (US50212YAN40) | 0.49 | 0.1074 | 0.1074 | ||||||

| US90291VAC46 / USAOT 2023-A A3 | 0.48 | -16.58 | 0.1068 | -0.0195 | |||||

| PRPM 2024-RPL2 A1 LLC VAR 05/25/2054 144A / ABS-CBDO (US69381DAA37) | 0.48 | -4.02 | 0.1056 | -0.0029 | |||||

| US595112BV48 / Micron Technology Inc | 0.47 | -0.42 | 0.1043 | 0.0010 | |||||

| US337932AN77 / FirstEnergy Corp | 0.47 | 0.65 | 0.1032 | 0.0022 | |||||

| US732916AD30 / PORSCHE FINL AUTO SECURITIZATION TR 2023 5.79% 01/22/2029 144A | 0.47 | -18.13 | 0.1029 | -0.0210 | |||||

| US13607C3925 / Canadian Imperial Bank of Commerce, ELN, (linked to S&P 500 Index) | 0.45 | 0.1000 | 0.1000 | ||||||

| AFFIRM ASSET SECURITIZATION TR 2025-X1 A 5.24% 04/15/2030 144A / ABS-CBDO (US00834MAA18) | 0.45 | 0.0995 | 0.0995 | ||||||

| US539439AQ24 / Lloyds Banking Group PLC | 0.45 | 0.0990 | 0.0990 | ||||||

| IMB / Imperial Brands PLC | 0.44 | 0.00 | 0.0981 | 0.0014 | |||||

| NISSAN MASTER OWNER TR RECEIVABLE 5.05% 02/15/2029 144A / ABS-CBDO (US65479VAB27) | 0.44 | -0.45 | 0.0979 | 0.0010 | |||||

| US22822VAS07 / CROWN CASTLE INTL CORP 1.35% 07/15/2025 | 0.44 | 1.14 | 0.0978 | 0.0023 | |||||

| SFS AUTO RECEIVABLES SECURITIZATION TR 2024-1 4.95% 05/21/2029 144A / ABS-CBDO (US78435VAC63) | 0.44 | -0.23 | 0.0976 | 0.0012 | |||||

| DLLMT 2024-1 LLC 4.84% 08/21/2028 144A / ABS-CBDO (US23347AAE10) | 0.44 | -0.23 | 0.0968 | 0.0013 | |||||

| GPJA / Georgia Power Company - Preferred Security | 0.43 | 0.23 | 0.0952 | 0.0016 | |||||

| COREBRIDGE GLOBAL FUNDING 4.65% 08/20/2027 144A / DBT (US00138CBB37) | 0.43 | 0.00 | 0.0940 | 0.0013 | |||||

| US80282KBF21 / Santander Holdings USA, Inc. | 0.41 | -0.72 | 0.0915 | 0.0007 | |||||

| HOLCIM FINANCE US LLC 4.6% 04/07/2027 144A / DBT (US43475RAA41) | 0.41 | 0.0914 | 0.0914 | ||||||

| MET TOWER GLOBAL FUNDING 4% 10/01/2027 144A / DBT (US58989V2J25) | 0.41 | 0.00 | 0.0911 | 0.0015 | |||||

| HYUNDAI AUTO LEASE SECURITIZATION TRUST 2024-B 5.41% 05/17/2027 144A / ABS-CBDO (US44934FAD78) | 0.41 | -0.24 | 0.0905 | 0.0010 | |||||

| DAIMLER TRUCKS FINANCE NORTH AMERICA LLC 5.125% 09/25/2027 144A / DBT (US233853AY62) | 0.40 | -0.25 | 0.0891 | 0.0011 | |||||

| US67103HAM97 / OREILLY AUTOMOTIVE INC 5.75% 11/20/2026 | 0.40 | -0.25 | 0.0884 | 0.0011 | |||||

| D1TE34 / DTE Energy Company - Depositary Receipt (Common Stock) | 0.40 | 0.00 | 0.0878 | 0.0013 | |||||

| TAUBMAN CENTERS COMMERCIAL MORTGAGE TRUST 24-DPM A TSFR1M+139.27 12/15/2039 144A / ABS-MBS (US87231EAA55) | 0.39 | -0.26 | 0.0867 | 0.0012 | |||||

| DELL EQUIPMENT FINANCE TRUST 24-1 5.39% 03/22/2030 144A / ABS-CBDO (US24702GAE52) | 0.38 | -0.52 | 0.0840 | 0.0008 | |||||

| FORDF 2025-1 A1 4.84% 04/15/2030 / ABS-CBDO (US34529BAC00) | 0.37 | 0.0808 | 0.0808 | ||||||

| ARES CLO AR TSFR3M+127 10/15/2032 144A / ABS-CBDO (US04017WAL63) | 0.36 | -16.59 | 0.0801 | -0.0145 | |||||

| US3140X4QF66 / Fannie Mae Pool | 0.36 | -5.54 | 0.0793 | -0.0035 | |||||

| US448980AD42 / HALST_23-B | 0.35 | -64.14 | 0.0775 | -0.1354 | |||||

| WHEELS FLEET LEASE FUNDING 1 LLC 4.87% 06/21/2039 144A / ABS-CBDO (US96328GBT31) | 0.33 | -0.30 | 0.0736 | 0.0009 | |||||

| US24703GAC87 / Dell Equipment Finance Trust | 0.33 | -27.95 | 0.0731 | -0.0269 | |||||

| VISTRA OPERATIONS CO LLC 5.05% 12/30/2026 144A / DBT (US92840VAT98) | 0.32 | -0.31 | 0.0716 | 0.0010 | |||||

| GLENCORE FDG LLC 4.907% 04/01/2028 144A / DBT (US378272BY34) | 0.31 | 0.0682 | 0.0682 | ||||||

| BX TRUST 2025-DIME A TSFR1M+115 02/15/2035 144A / ABS-MBS (US05613UAA97) | 0.31 | -0.32 | 0.0681 | 0.0009 | |||||

| US12651QAA76 / CSMC 2017-CHOP A 1ML+75 07/15/2032 | 0.30 | 0.33 | 0.0668 | 0.0011 | |||||

| HOLCIM FINANCE US LLC 4.7% 04/07/2028 144A / DBT (US43475RAB24) | 0.30 | 0.0660 | 0.0660 | ||||||

| C1PB34 / The Campbell's Company - Depositary Receipt (Common Stock) | 0.29 | -0.34 | 0.0648 | 0.0008 | |||||

| US969457CH11 / Williams Cos Inc/The | 0.29 | -0.34 | 0.0644 | 0.0008 | |||||

| E1XC34 / Exelon Corporation - Depositary Receipt (Common Stock) | 0.29 | 0.34 | 0.0644 | 0.0011 | |||||

| LYG / Lloyds Banking Group plc - Depositary Receipt (Common Stock) | 0.28 | 0.00 | 0.0629 | 0.0010 | |||||

| CITIZENS AUTO RECEIVABLES TRUST 2024-2 5.33% 08/15/2028 144A / ABS-CBDO (US17331XAD30) | 0.28 | -0.71 | 0.0619 | 0.0006 | |||||

| US3136ASU954 / FNR 2016-42 FL 1ML+35 07/25/2046 | 0.28 | -7.00 | 0.0618 | -0.0037 | |||||

| BROOKFIELD 2024-MF23 A TSFR1M+149.177 06/15/2041 144A / ABS-MBS (US05593JAA88) | 0.28 | 0.00 | 0.0617 | 0.0009 | |||||

| ENTERPRISE FLEET FINANCING 2024-4 LLC 4.56% 11/20/2028 144A / ABS-CBDO (US29374MAC29) | 0.28 | 0.00 | 0.0609 | 0.0008 | |||||

| GMF FLOORPLAN OWNER REVOLVING TR 4.73% 11/15/2029 144A / ABS-CBDO (US361886DQ44) | 0.27 | -0.37 | 0.0601 | 0.0008 | |||||

| US29374LAB62 / Enterprise Fleet Financing 2023-3 LLC | 0.27 | -12.90 | 0.0599 | -0.0077 | |||||

| US3136ANWT03 / Fannie Mae REMICS | 0.26 | -6.38 | 0.0584 | -0.0032 | |||||

| MERCEDES-BENZ AUTO LEASE TRUST 2024-A 5.32% 01/18/2028 / ABS-CBDO (US58770JAD63) | 0.26 | -0.38 | 0.0577 | 0.0007 | |||||

| SANTANDER DRIVE AUTO RECEIVABLES TR 4.74% 01/16/2029 / ABS-CBDO (US80288DAC02) | 0.26 | 0.00 | 0.0575 | 0.0007 | |||||

| US91684MAA18 / UPSTART SECURITIZATION TRUST 2023-3 A 6.9% 10/20/2033 144A | 0.26 | -27.53 | 0.0572 | -0.0205 | |||||

| US14318XAC92 / CarMax Auto Owner Trust 2023-4 | 0.26 | -0.39 | 0.0567 | 0.0006 | |||||

| US3140X46L58 / Fannie Mae Pool | 0.25 | -5.95 | 0.0561 | -0.0027 | |||||

| HYUNDAI AUTO RECEIVABLES TR 2024-A 4.99% 02/15/2029 / ABS-CBDO (US448973AD90) | 0.25 | -0.40 | 0.0555 | 0.0007 | |||||

| ALLY AUTO RECEIVABLES TRUST 2024-1 5.08% 12/15/2028 / ABS-CBDO (US02008FAC86) | 0.24 | 0.00 | 0.0536 | 0.0007 | |||||

| TOYOTA LEASE OWNER TRUST 2024-A 5.25% 04/20/2027 144A / ABS-CBDO (US89238GAD34) | 0.24 | -4.78 | 0.0530 | -0.0019 | |||||

| SBNA AUTO LEASE TRUST 2024-B 5.56% 11/22/2027 144A / ABS-CBDO (US78437VAE02) | 0.23 | -0.43 | 0.0515 | 0.0005 | |||||

| DELL EQUIP FIN TR 2024-2 4.59% 08/22/2030 144A / ABS-CBDO (US24704EAE86) | 0.23 | -0.43 | 0.0508 | 0.0006 | |||||

| PALMER SQUARE LOAN FUNDING 2024-2 LTD A1N TSFR3M+100 01/15/2033 144A / ABS-CBDO (US69703RAA32) | 0.23 | -9.20 | 0.0503 | -0.0043 | |||||

| A1PH34 / Amphenol Corporation - Depositary Receipt (Common Stock) | 0.22 | 0.00 | 0.0498 | 0.0008 | |||||

| MERCHANTS FLEET FUNDING LLC 5.82% 04/20/2037 144A / ABS-CBDO (US588926AF24) | 0.22 | -6.87 | 0.0482 | -0.0028 | |||||

| P1NW34 / Pinnacle West Capital Corporation - Depositary Receipt (Common Stock) | 0.21 | 0.0472 | 0.0472 | ||||||

| BLP COML MTG 2024-IND2 A TSFR1M+139.208 03/15/2041 144A / ABS-MBS (US05625AAA97) | 0.21 | 0.00 | 0.0460 | 0.0007 | |||||

| KUBOTA CREDIT OWNER TRUST 2024-2 5.26% 11/15/2028 144A / ABS-CBDO (US50117DAC02) | 0.20 | 0.00 | 0.0447 | 0.0006 | |||||

| CHESAPEAKE FUNDING II LLC 5.52% 05/15/2036 144A / ABS-CBDO (US165183DE19) | 0.19 | -11.32 | 0.0417 | -0.0047 | |||||

| SBNA AUTO LEASE TRUST 2024-C 4.56% 02/22/2028 144A / ABS-CBDO (US78398DAC11) | 0.19 | -0.53 | 0.0415 | 0.0005 | |||||

| AVIS BUDGET RENTCAR FDG AE LLC 4.8% 08/20/2029 144A / ABS-CBDO (US05377RKL77) | 0.18 | 0.0387 | 0.0387 | ||||||

| CARMAX AUTO OWNER TR 2024-2 5.5% 01/16/2029 / ABS-CBDO (US14319EAE68) | 0.17 | 0.00 | 0.0385 | 0.0004 | |||||

| US3137AFZS42 / FHR 3949 MK 4.5% 10/34 | 0.17 | -6.21 | 0.0369 | -0.0017 | |||||

| ENTERPRISE FLEET FINANCING 2024-2 5.61% 04/20/2028 144A / ABS-CBDO (US29375RAC07) | 0.16 | -0.63 | 0.0348 | 0.0003 | |||||

| US98164FAD42 / WOART 23-C A3 5.15% 11-15-28 | 0.14 | -0.70 | 0.0315 | 0.0003 | |||||

| US3140X4ET98 / Fannie Mae Pool | 0.14 | -2.88 | 0.0300 | -0.0005 | |||||

| SFS AUTO RECEIVABLES SECURITIZATION TR 2024-2 5.33% 11/20/2029 144A / ABS-CBDO (US78397XAC83) | 0.13 | 0.00 | 0.0295 | 0.0003 | |||||

| CFMT 2024-HB13 LLC VAR 05/25/2034 144A / ABS-CBDO (US12530VAA35) | 0.13 | -9.93 | 0.0282 | -0.0026 | |||||

| BX COML MTG TR 2024-GPA3 A TSFR1M+149.25 12/15/2029 144A / ABS-MBS (US123910AA98) | 0.12 | -5.56 | 0.0263 | -0.0013 | |||||

| US 2YR NOTE (CBT) FUT SEP25 TUU5 / DIR (N/A) | 0.12 | 0.0257 | 0.0257 | ||||||

| US23292HAC51 / DLLAA 2023-1 LLC | 0.12 | 0.00 | 0.0255 | 0.0003 | |||||

| ARI FLEET LEASE TRUST 2024-B 5.26% 04/15/2033 144A / ABS-CBDO (US04033HAC97) | 0.11 | -1.72 | 0.0254 | 0.0001 | |||||

| US881561BU72 / TMTS 2003-4HE A 1ML+43 9/34 | 0.11 | 0.00 | 0.0250 | 0.0003 | |||||

| OPORTUN FUNDING TRUST 2024-3 5.26% 08/15/2029 144A / ABS-CBDO (US68377NAA90) | 0.11 | -26.35 | 0.0242 | -0.0083 | |||||

| US165183CZ56 / Chesapeake Funding II LLC, Series 2023-2A, Class A1 | 0.10 | -15.38 | 0.0221 | -0.0034 | |||||

| ARI FLEET LEASE TRUST 2025-A 4.38% 01/17/2034 144A / ABS-CBDO (US04033CAB28) | 0.10 | 0.0220 | 0.0220 | ||||||

| VOLVO FINANCIAL EQUIPMENT LLC SERIES 2024-1 4.29% 10/16/2028 144A / ABS-CBDO (US92887QAC15) | 0.09 | 0.00 | 0.0207 | 0.0003 | |||||

| BOFA AUTO TR 2024-1A A3 5.35% 11/15/2028 144A / ABS-CBDO (US09709AAC62) | 0.09 | -1.12 | 0.0197 | 0.0002 | |||||

| US68373BAA98 / OPEN TR 2023-AIR TSFR1M+308.92 10/15/2028 144A | 0.09 | -39.73 | 0.0195 | -0.0123 | |||||

| US12530QAA40 / CFMT 2023-H12 LLC | 0.09 | -9.37 | 0.0194 | -0.0017 | |||||

| US1266713Y02 / CWL 2004-2 3A4 1ML+25 7/34 | 0.08 | -3.49 | 0.0185 | -0.0003 | |||||

| DLLAD 2024-1 LLC 5.3% 07/20/2029 144A / ABS-CBDO (US23346MAC01) | 0.07 | 0.00 | 0.0164 | 0.0001 | |||||

| CFMT 2024-HB15 LLC VAR 08/25/2034 144A / ABS-CBDO (US15723AAA97) | 0.07 | -13.16 | 0.0147 | -0.0019 | |||||

| US29374FAB94 / Enterprise Fleet Financing 2022-3 LLC | 0.06 | -27.38 | 0.0136 | -0.0048 | |||||

| AFFIRM ASSET SECURITIZATION TR 2024-X1 6.27% 05/15/2029 144A / ABS-CBDO (US00834XAA72) | 0.02 | -61.82 | 0.0048 | -0.0073 | |||||

| MARLETTE FUNDING TRUST 2024-1 5.95% 07/17/2034 144A / ABS-CBDO (US57108VAA08) | 0.02 | -47.37 | 0.0046 | -0.0038 | |||||

| US313920NH91 / FNR 2001-40 Z 6% 8/31 | 0.02 | -10.00 | 0.0040 | -0.0003 | |||||

| US36201VEZ13 / GNMA 7.00% 8/32 #594252 | 0.02 | -6.25 | 0.0035 | -0.0001 | |||||

| US36225A2E95 / GNMA 7.00% 4/28 #780773 | 0.00 | -25.00 | 0.0008 | -0.0001 | |||||

| US36213M7E26 / GNMA 7.00% 5/31 #558993 | 0.00 | 0.00 | 0.0007 | -0.0000 | |||||

| US70069FFL67 / PPSI 2005-WCH1 M4 1ML+83 1/36 | 0.00 | -86.67 | 0.0006 | -0.0028 | |||||

| US36208V5C54 / GNMA 7.00% 7/28 #462643 | 0.00 | 0.00 | 0.0006 | -0.0000 | |||||

| US36225BPH59 / GINNIE MAE I POOL GN 781324 | 0.00 | 0.00 | 0.0005 | -0.0000 | |||||

| US36209JYU95 / GNMA 7.00% 6/28 #473323 | 0.00 | 0.00 | 0.0005 | -0.0000 | |||||

| US36201FXA01 / GNMA 7.00% 6/32 #582173 | 0.00 | 0.00 | 0.0005 | -0.0000 | |||||

| US36209N4P48 / GNMA 7.00% 2/30 #477030 | 0.00 | 0.00 | 0.0005 | -0.0000 | |||||

| US3128FQ4A76 / FHLG 30YR 8.5% 08/01/2027# | 0.00 | -50.00 | 0.0004 | -0.0000 | |||||

| US36210APY72 / GNMA 7.00% 9/28 #486539 | 0.00 | 0.00 | 0.0004 | -0.0000 | |||||

| US36208XSV46 / GNMA 7.00% 8/28 #464132 | 0.00 | 0.00 | 0.0004 | -0.0000 | |||||

| US36210CNJ89 / GNMA 7.00% 11/28 #488293 | 0.00 | 0.00 | 0.0003 | -0.0000 | |||||

| US36213EXC55 / GNMA 7.00% 3/32 #552475 | 0.00 | 0.00 | 0.0003 | -0.0000 | |||||

| US36209MHV90 / GNMA 7.00% 8/28 #475544 | 0.00 | 0.00 | 0.0002 | -0.0000 | |||||

| US36210AR908 / GNMA 7.00% 10/28 #486612 | 0.00 | -100.00 | 0.0002 | -0.0000 | |||||

| US3128FPPS71 / FHLG 30YR 8.5% 06/01/2027# | 0.00 | -100.00 | 0.0002 | -0.0000 | |||||

| US36208QTR73 / GNMA 7.00% 1/29 #457860 | 0.00 | -100.00 | 0.0002 | -0.0000 | |||||

| US36210BDW28 / GNMA 7.00% 4/29 #487117 | 0.00 | 0.0002 | -0.0000 | ||||||

| US81744FCU93 / SEMT 2004-6 A3B 6ML+44 7/34 | 0.00 | 0.0002 | -0.0000 | ||||||

| US36201M3F73 / GNMA 7.00% 6/32 #587698 | 0.00 | 0.0002 | -0.0000 | ||||||

| US36201GZR90 / GNMA 7.00% 8/32 #583152 | 0.00 | 0.0002 | -0.0000 | ||||||

| US36213E2H82 / GNMA 7.00% 5/32 #552576 | 0.00 | 0.0002 | -0.0000 | ||||||

| US36208YFM66 / GNMA POOL 464672 GN 01/28 FIXED 7 | 0.00 | 0.0002 | -0.0000 | ||||||

| US36209PCT21 / GNMA 7.00% 7/28 #477182 | 0.00 | 0.0002 | -0.0000 | ||||||

| US36209TWN52 / GOVT NATL MORTG ASSN 7.00% 10/15/2028 GNMA SF | 0.00 | 0.0001 | -0.0000 | ||||||

| US36210RKU31 / GNMA 7.00% 5/29 #499907 | 0.00 | 0.0001 | -0.0000 | ||||||

| US36201MEE84 / GINNIE MAE I POOL GN 587033 | 0.00 | 0.0001 | -0.0000 | ||||||

| US36210CMD29 / GOVT NATL MORTG ASSN 7.00% 07/15/2029 GNMA SF | 0.00 | 0.0001 | -0.0000 | ||||||

| US36200QJD79 / GNMA 7.00% 3/32 #569160 | 0.00 | 0.0001 | -0.0000 | ||||||

| US36209KCT34 / GNMA 7.00% 6/28 #473582 | 0.00 | 0.0001 | -0.0000 | ||||||

| US36201JFJ34 / GNMA 7.00% 4/32 #584369 | 0.00 | 0.0001 | -0.0000 | ||||||

| US36212CD736 / GNMA 7.00% 7/31 #529426 | 0.00 | 0.0001 | -0.0000 | ||||||

| US36209EX496 / Ginnie Mae I Pool | 0.00 | 0.0001 | -0.0000 | ||||||

| US36209LMH68 / GNMA 7.00% 1/31 #474760 | 0.00 | 0.0001 | -0.0000 | ||||||

| US36209DE597 / GNMA 7.00% 9/28 #468256 | 0.00 | 0.0001 | -0.0000 | ||||||

| US36212VD223 / GNMA 7.00% 3/31 #544721 | 0.00 | 0.0001 | -0.0000 | ||||||

| US36225BC898 / GNMA 7.00% 12/28 #780995 | 0.00 | 0.0001 | -0.0000 | ||||||

| US36209CTR78 / GNMA 7.00% 4/28 #467760 | 0.00 | 0.0001 | -0.0000 | ||||||

| US36209L3H76 / GNMA 7.00% 7/28 #475200 | 0.00 | 0.0001 | -0.0000 | ||||||

| US31283G3U95 / FHLG 30YR 8.5% 08/01/2027# | 0.00 | 0.0001 | -0.0000 | ||||||

| US36201DAT90 / GNMA 7.00% 8/32 #579718 | 0.00 | 0.0001 | -0.0000 | ||||||

| US36207KBA79 / GNMA 7.00% 8/28 #433933 | 0.00 | 0.0001 | -0.0000 | ||||||

| US36209CAU09 / GNMA 7.00% 9/28 #467219 | 0.00 | 0.0000 | -0.0000 | ||||||

| US36209MDU53 / GNMA 7.00% 6/28 #475415 | 0.00 | 0.0000 | -0.0000 | ||||||

| US36225BLH95 / GNMA 7.00% 12/28 #781228 | 0.00 | 0.0000 | -0.0000 | ||||||

| US36200WBY66 / GNMA 7.00% 1/32 #574355 | 0.00 | 0.0000 | -0.0000 | ||||||

| US36210VZL88 / GNMA 7.00% 7/29 #503947 | 0.00 | 0.0000 | -0.0000 | ||||||

| US36208PNT11 / GNMA 7.00% 4/28 #456802 | 0.00 | 0.0000 | -0.0000 | ||||||

| US36200Q3K87 / Ginnie Mae I Pool | 0.00 | 0.0000 | -0.0000 | ||||||

| US36209DT389 / GNMA 7.00% 1/28 #468670 | 0.00 | 0.0000 | -0.0000 | ||||||

| US36225BBU17 / GNMA 7.00% 1/29 #780951 | 0.00 | 0.0000 | -0.0000 | ||||||

| US36209LML70 / GNMA 7.00% 2/31 #474763 | 0.00 | 0.0000 | -0.0000 | ||||||

| US36208VTU97 / GNMA | 0.00 | 0.0000 | -0.0000 | ||||||

| US36225BG519 / GNMA 7.00% 12/29 #781120 | 0.00 | 0.0000 | -0.0000 | ||||||

| US36209LMQ67 / GNMA 7.00% 3/31 #474767 | 0.00 | 0.0000 | -0.0000 | ||||||

| US31385HX989 / FNMA 7.50% 11/31 #545304 | 0.00 | 0.0000 | -0.0000 | ||||||

| US36211EUG15 / GNMA 7.00% 6/29 #510983 | 0.00 | 0.0000 | -0.0000 | ||||||

| US31283HCS22 / FHLMC Gold Pools, 30 Year | 0.00 | 0.0000 | -0.0000 | ||||||

| US3128FFB478 / FHLG 30YR 8.5% 08/01/2026# | 0.00 | 0.0000 | -0.0000 | ||||||

| US36210ASL25 / GNMA 7.00% 10/28 #486623 | 0.00 | 0.0000 | -0.0000 | ||||||

| US36209AR934 / GNMA 7.00% 2/28 #465912 | 0.00 | 0.0000 | -0.0000 | ||||||

| US36213BQD72 / GNMA 7.00% 3/31 #549552 | 0.00 | 0.0000 | -0.0000 | ||||||

| US36209GZR19 / GNMA 7.00% 4/29 #471552 | 0.00 | 0.0000 | -0.0000 | ||||||

| US36208FK666 / Ginnie Mae I Pool | 0.00 | 0.0000 | -0.0000 | ||||||

| US31292GS492 / FHLG 30YR 8.5% 07/01/2027# | 0.00 | 0.0000 | -0.0000 | ||||||

| US31283GYN14 / FHLG 30YR 8.5% 05/01/2027# | 0.00 | 0.0000 | -0.0000 |