Mga Batayang Estadistika

| Nilai Portofolio | $ 724,676,765 |

| Posisi Saat Ini | 52 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

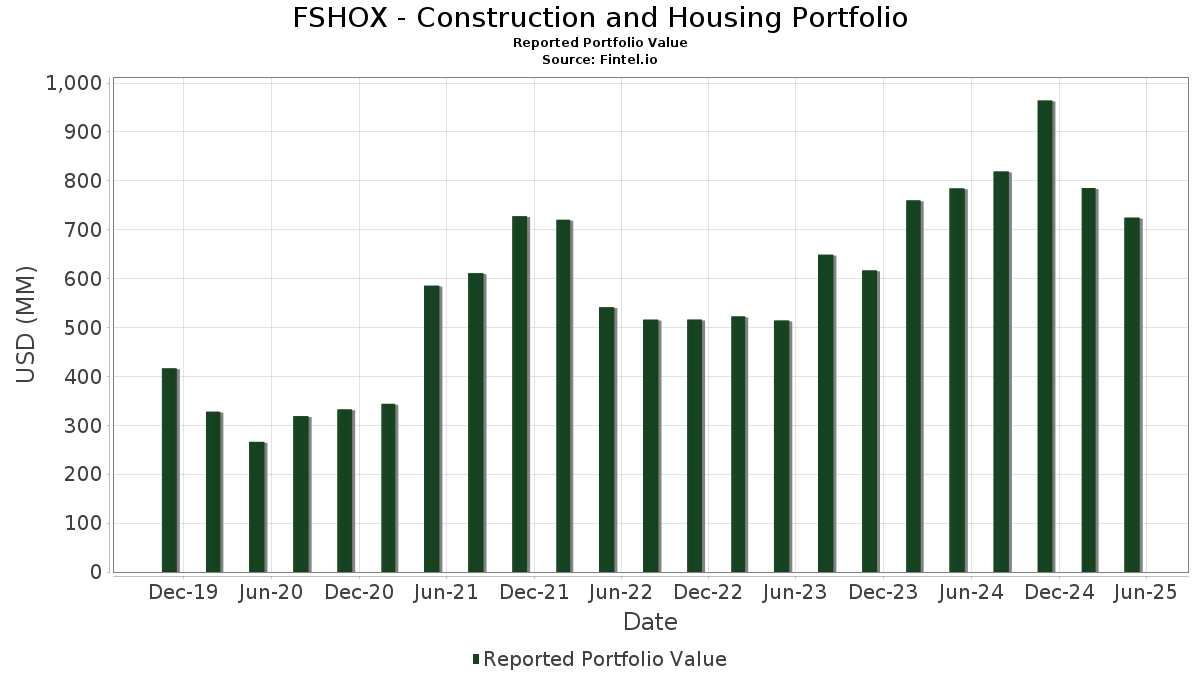

FSHOX - Construction and Housing Portfolio telah mengungkapkan total kepemilikan 52 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 724,676,765 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama FSHOX - Construction and Housing Portfolio adalah The Home Depot, Inc. (US:HD) , Lowe's Companies, Inc. (US:LOW) , Trane Technologies plc (US:TT) , Johnson Controls International plc (US:JCI) , and CRH plc (US:CRH) . Posisi baru FSHOX - Construction and Housing Portfolio meliputi: James Hardie Industries plc - Depositary Receipt (Common Stock) (US:JHIUF) , RH (US:RH) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.11 | 47.78 | 6.6086 | 1.2713 | |

| 0.46 | 46.37 | 6.4143 | 1.1168 | |

| 0.08 | 26.42 | 3.6551 | 0.9813 | |

| 0.03 | 13.16 | 1.8200 | 0.5725 | |

| 0.05 | 29.33 | 4.0565 | 0.5553 | |

| 0.16 | 3.60 | 0.4973 | 0.4973 | |

| 0.02 | 10.91 | 1.5089 | 0.3903 | |

| 0.01 | 1.99 | 0.2756 | 0.2756 | |

| 0.03 | 11.96 | 1.6545 | 0.2750 | |

| 0.05 | 7.41 | 1.0254 | 0.2379 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.32 | 116.85 | 16.1635 | -2.7151 | |

| 0.41 | 93.51 | 12.9350 | -0.8171 | |

| 0.11 | 11.66 | 1.6125 | -0.4497 | |

| 0.33 | 30.38 | 4.2021 | -0.3720 | |

| 0.12 | 6.12 | 0.8466 | -0.2824 | |

| 0.42 | 11.40 | 1.5768 | -0.2017 | |

| 0.05 | 7.75 | 1.0718 | -0.1572 | |

| 0.04 | 11.46 | 1.5853 | -0.1382 | |

| 0.19 | 13.81 | 1.9108 | -0.1229 | |

| 0.08 | 4.06 | 0.5611 | -0.1097 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-24 untuk periode pelaporan 2025-05-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| HD / The Home Depot, Inc. | 0.32 | -14.88 | 116.85 | -20.96 | 16.1635 | -2.7151 | |||

| LOW / Lowe's Companies, Inc. | 0.41 | -4.35 | 93.51 | -13.17 | 12.9350 | -0.8171 | |||

| TT / Trane Technologies plc | 0.11 | -6.03 | 47.78 | 14.31 | 6.6086 | 1.2713 | |||

| JCI / Johnson Controls International plc | 0.46 | -5.54 | 46.37 | 11.78 | 6.4143 | 1.1168 | |||

| CRH / CRH plc | 0.33 | -4.62 | 30.38 | -15.19 | 4.2021 | -0.3720 | |||

| MLM / Martin Marietta Materials, Inc. | 0.05 | -5.62 | 29.33 | 6.96 | 4.0565 | 0.5553 | |||

| QAA / Quanta Services, Inc. | 0.08 | -4.35 | 26.42 | 26.20 | 3.6551 | 0.9813 | |||

| INVH / Invitation Homes Inc. | 0.64 | -5.55 | 21.62 | -6.41 | 2.9911 | 0.0405 | |||

| SUI / Sun Communities, Inc. | 0.17 | 3.31 | 20.79 | -6.33 | 2.8752 | 0.0415 | |||

| PHM / PulteGroup, Inc. | 0.17 | 1.07 | 16.58 | -4.07 | 2.2939 | 0.0864 | |||

| SGI / Somnigroup International Inc. | 0.23 | -3.36 | 14.85 | -1.58 | 2.0539 | 0.1274 | |||

| CARR / Carrier Global Corporation | 0.20 | -6.76 | 14.08 | 2.45 | 1.9471 | 0.1926 | |||

| FND / Floor & Decor Holdings, Inc. | 0.19 | 16.92 | 13.81 | -13.26 | 1.9108 | -0.1229 | |||

| CSL / Carlisle Companies Incorporated | 0.03 | 20.72 | 13.16 | 34.69 | 1.8200 | 0.5725 | |||

| ELME / Elme Communities | 0.79 | -5.18 | 12.61 | -12.43 | 1.7445 | -0.0946 | |||

| BLD / TopBuild Corp. | 0.04 | -5.04 | 12.15 | -12.32 | 1.6802 | -0.0890 | |||

| EME / EMCOR Group, Inc. | 0.03 | -4.05 | 11.96 | 10.72 | 1.6545 | 0.2750 | |||

| BLDR / Builders FirstSource, Inc. | 0.11 | -6.82 | 11.66 | -27.82 | 1.6125 | -0.4497 | |||

| ESS / Essex Property Trust, Inc. | 0.04 | -6.81 | 11.46 | -15.08 | 1.5853 | -0.1382 | |||

| WSC / WillScot Holdings Corporation | 0.42 | 0.07 | 11.40 | -18.15 | 1.5768 | -0.2017 | |||

| FIX / Comfort Systems USA, Inc. | 0.02 | -5.39 | 10.91 | 24.53 | 1.5089 | 0.3903 | |||

| TOL / Toll Brothers, Inc. | 0.10 | -1.87 | 10.74 | -8.36 | 1.4861 | -0.0110 | |||

| CPT / Camden Property Trust | 0.09 | -0.06 | 10.11 | -5.35 | 1.3988 | 0.0344 | |||

| ACM / AECOM | 0.09 | -1.40 | 10.01 | 8.27 | 1.3841 | 0.2038 | |||

| AWI / Armstrong World Industries, Inc. | 0.05 | 9.69 | 8.26 | 11.09 | 1.1431 | 0.1932 | |||

| WSM / Williams-Sonoma, Inc. | 0.05 | -3.15 | 7.75 | -19.48 | 1.0718 | -0.1572 | |||

| SSD / Simpson Manufacturing Co., Inc. | 0.05 | 26.93 | 7.41 | 20.21 | 1.0254 | 0.2379 | |||

| DHI / D.R. Horton, Inc. | 0.06 | -7.22 | 6.96 | -13.63 | 0.9626 | -0.0662 | |||

| NVR / NVR, Inc. | 0.00 | -7.80 | 6.72 | -9.45 | 0.9301 | -0.0182 | |||

| AZEK / The AZEK Company Inc. | 0.12 | -34.50 | 6.12 | -30.78 | 0.8466 | -0.2824 | |||

| EXP / Eagle Materials Inc. | 0.03 | -8.06 | 5.63 | -17.81 | 0.7787 | -0.0960 | |||

| US31635A1051 / Fidelity Cash Central Fund | 5.27 | 11.78 | 5.27 | 11.79 | 0.7291 | 0.1269 | |||

| AAON / AAON, Inc. | 0.05 | -19.76 | 5.00 | 0.60 | 0.6914 | 0.0570 | |||

| CVCO / Cavco Industries, Inc. | 0.01 | 7.62 | 4.90 | -11.04 | 0.6777 | -0.0256 | |||

| VMC / Vulcan Materials Company | 0.02 | -9.75 | 4.47 | -3.27 | 0.6177 | 0.0282 | |||

| KBH / KB Home | 0.08 | -8.67 | 4.06 | -22.77 | 0.5611 | -0.1097 | |||

| FLR / Fluor Corporation | 0.09 | -6.12 | 3.65 | 2.64 | 0.5049 | 0.0508 | |||

| JHIUF / James Hardie Industries plc - Depositary Receipt (Common Stock) | 0.16 | 3.60 | 0.4973 | 0.4973 | |||||

| MTH / Meritage Homes Corporation | 0.05 | -8.50 | 3.46 | -19.69 | 0.4786 | -0.0715 | |||

| LEN / Lennar Corporation | 0.03 | -7.34 | 3.32 | -17.83 | 0.4596 | -0.0568 | |||

| EQR / Equity Residential | 0.05 | -16.97 | 3.16 | -21.47 | 0.4373 | -0.0768 | |||

| SHW / The Sherwin-Williams Company | 0.01 | 0.00 | 2.47 | -0.92 | 0.3410 | 0.0232 | |||

| COMP / Compass, Inc. | 0.40 | 23.75 | 2.37 | -18.66 | 0.3282 | -0.0442 | |||

| AMWD / American Woodmark Corporation | 0.04 | 10.61 | 2.12 | 0.43 | 0.2926 | 0.0237 | |||

| RH / RH | 0.01 | 1.99 | 0.2756 | 0.2756 | |||||

| US31635A3032 / Fidelity Securities Lending Cash Central Fund | 1.62 | -15.63 | 1.62 | -15.64 | 0.2239 | -0.0211 | |||

| WHR / Whirlpool Corporation | 0.02 | 17.27 | 1.59 | -10.07 | 0.2200 | -0.0058 | |||

| WSO / Watsco, Inc. | 0.00 | -19.46 | 1.47 | -29.15 | 0.2031 | -0.0616 | |||

| UHALB / U-Haul Holding Company - Series N | 0.02 | 0.00 | 1.40 | -7.33 | 0.1941 | 0.0007 | |||

| APOG / Apogee Enterprises, Inc. | 0.03 | 0.00 | 1.34 | -19.40 | 0.1851 | -0.0269 | |||

| MAA / Mid-America Apartment Communities, Inc. | 0.00 | 0.00 | 0.02 | -5.56 | 0.0024 | 0.0000 | |||

| BLU INVESTMENTS LLC PP / EC (N/A) | 11.99 | 0.00 | 0.0005 | 0.0005 |