Mga Batayang Estadistika

| Profil Orang Dalam | FIDUCIARY MANAGEMENT INC /WI/ |

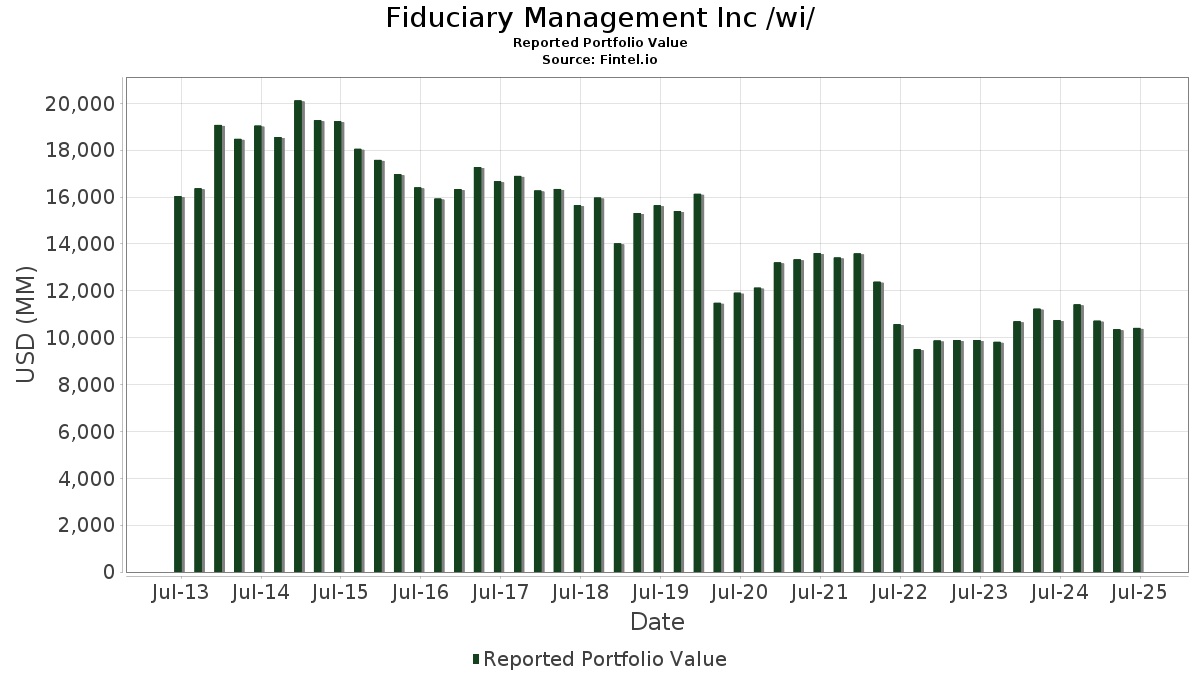

| Nilai Portofolio | $ 10,413,172,311 |

| Posisi Saat Ini | 67 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

Fiduciary Management Inc /wi/ telah mengungkapkan total kepemilikan 67 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 10,413,172,311 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Fiduciary Management Inc /wi/ adalah Ferguson Enterprises Inc. (US:FERG) , Booking Holdings Inc. (US:BKNG) , Aramark (US:ARMK) , The Charles Schwab Corporation (US:SCHW) , and Carrier Global Corporation (US:CARR) . Posisi baru Fiduciary Management Inc /wi/ meliputi: Capital One Financial Corporation (US:COF) , Becton, Dickinson and Company (US:BDX) , MSA Safety Incorporated (US:MSA) , Louisiana-Pacific Corporation (US:LPX) , and . Industri unggulan Fiduciary Management Inc /wi/ adalah "Holding And Other Investment Offices" (sic 67) , "Personal Services" (sic 72) , and "Health Services" (sic 80) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.73 | 154.69 | 1.4856 | 1.4856 | |

| 0.90 | 154.28 | 1.4816 | 1.4816 | |

| 2.72 | 591.42 | 5.6796 | 1.2607 | |

| 0.53 | 88.50 | 0.8499 | 0.8499 | |

| 12.66 | 530.04 | 5.0901 | 0.7423 | |

| 0.89 | 76.60 | 0.7356 | 0.7356 | |

| 2.42 | 176.91 | 1.6989 | 0.6252 | |

| 0.10 | 568.08 | 5.4554 | 0.6030 | |

| 1.70 | 216.79 | 2.0819 | 0.5408 | |

| 2.99 | 170.49 | 1.6373 | 0.3869 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 4.24 | 186.47 | 1.7907 | -1.5955 | |

| 0.45 | 218.25 | 2.0959 | -1.2806 | |

| 0.77 | 82.83 | 0.7955 | -1.0502 | |

| 0.45 | 139.79 | 1.3425 | -1.0493 | |

| 0.90 | 81.35 | 0.7813 | -0.8258 | |

| 1.89 | 77.38 | 0.7431 | -0.6148 | |

| 5.41 | 182.77 | 1.7552 | -0.5957 | |

| 1.97 | 124.61 | 1.1966 | -0.3578 | |

| 8.33 | 216.74 | 2.0814 | -0.3354 | |

| 0.81 | 216.24 | 2.0766 | -0.2691 |

Pengajuan 13D/G

Ini adalah daftar pengajuan 13D dan 13G yang dibuat dalam setahun terakhir (jika ada). Klik ikon tautan untuk melihat riwayat transaksi lengkap. Baris berwarna hijau menunjukkan posisi baru. Baris berwarna merah menunjukkan posisi yang sudah ditutup.

| Tanggal File | Formulir | Keamanan | Sebelumnya Saham |

Saat ini Saham |

ΔPersentase Saham | % Kepemilikan |

% ΔKepemilikan | |

|---|---|---|---|---|---|---|---|---|

| 2025-02-20 | G / Genpact Limited | 8,737,813 | 5.00 | |||||

| 2025-02-20 | TRS / TriMas Corporation | 2,013,835 | 5.00 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-14 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| FERG / Ferguson Enterprises Inc. | 2.72 | -4.86 | 591.42 | 29.30 | 5.6796 | 1.2607 | |||

| BKNG / Booking Holdings Inc. | 0.10 | -10.00 | 568.08 | 13.10 | 5.4554 | 0.6030 | |||

| ARMK / Aramark | 12.66 | -2.90 | 530.04 | 17.77 | 5.0901 | 0.7423 | |||

| SCHW / The Charles Schwab Corporation | 4.39 | -5.32 | 400.13 | 10.36 | 3.8426 | 0.3398 | |||

| CARR / Carrier Global Corporation | 3.50 | -4.75 | 256.06 | 9.95 | 2.4590 | 0.2093 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.45 | -31.54 | 218.25 | -37.56 | 2.0959 | -1.2806 | |||

| ARW / Arrow Electronics, Inc. | 1.70 | 10.73 | 216.79 | 35.90 | 2.0819 | 0.5408 | |||

| SONY / Sony Group Corporation - Depositary Receipt (Common Stock) | 8.33 | -15.49 | 216.74 | -13.36 | 2.0814 | -0.3354 | |||

| PGR / The Progressive Corporation | 0.81 | -5.55 | 216.24 | -10.94 | 2.0766 | -0.2691 | |||

| AVY / Avery Dennison Corporation | 1.23 | -5.14 | 215.14 | -6.47 | 2.0661 | -0.1561 | |||

| DGX / Quest Diagnostics Incorporated | 1.19 | -5.28 | 212.92 | 0.56 | 2.0447 | -0.0008 | |||

| UL / Unilever PLC - Depositary Receipt (Common Stock) | 3.29 | -5.16 | 201.12 | -2.58 | 1.9314 | -0.0631 | |||

| CSX / CSX Corporation | 6.03 | -3.84 | 196.84 | 6.62 | 1.8903 | 0.1067 | |||

| CSL / Carlisle Companies Incorporated | 0.52 | -2.53 | 195.04 | 6.89 | 1.8730 | 0.1102 | |||

| MAS / Masco Corporation | 3.02 | -4.97 | 194.11 | -12.05 | 1.8641 | -0.2680 | |||

| KMX / CarMax, Inc. | 2.87 | 8.37 | 193.13 | -6.53 | 1.8547 | -0.1414 | |||

| G / Genpact Limited | 4.24 | -39.10 | 186.47 | -46.80 | 1.7907 | -1.5955 | |||

| GOOGL / Alphabet Inc. | 1.05 | -23.24 | 184.34 | -12.53 | 1.7702 | -0.2656 | |||

| SLB / Schlumberger Limited | 5.41 | -7.12 | 182.77 | -24.89 | 1.7552 | -0.5957 | |||

| VVV / Valvoline Inc. | 4.78 | 0.17 | 180.92 | 8.97 | 1.7374 | 0.1335 | |||

| HSIC / Henry Schein, Inc. | 2.45 | -0.39 | 179.11 | 6.24 | 1.7201 | 0.0914 | |||

| SYY / Sysco Corporation | 2.36 | -4.74 | 178.98 | -3.85 | 1.7188 | -0.0795 | |||

| PHG / Koninklijke Philips N.V. - Depositary Receipt (Common Stock) | 7.46 | -0.70 | 178.97 | -6.25 | 1.7187 | -0.1255 | |||

| NVT / nVent Electric plc | 2.42 | 13.91 | 176.91 | 59.18 | 1.6989 | 0.6252 | |||

| FCFS / FirstCash Holdings, Inc. | 1.29 | -0.38 | 174.35 | 11.89 | 1.6743 | 0.1690 | |||

| DCI / Donaldson Company, Inc. | 2.49 | -0.43 | 172.61 | 2.97 | 1.6576 | 0.0381 | |||

| GTES / Gates Industrial Corporation plc | 7.43 | 2.20 | 171.02 | 27.85 | 1.6424 | 0.3501 | |||

| OMF / OneMain Holdings, Inc. | 2.99 | 12.96 | 170.49 | 31.73 | 1.6373 | 0.3869 | |||

| FMS / Fresenius Medical Care AG - Depositary Receipt (Common Stock) | 5.66 | -4.94 | 161.60 | 9.08 | 1.5519 | 0.1206 | |||

| SSD / Simpson Manufacturing Co., Inc. | 1.02 | 11.69 | 158.92 | 10.43 | 1.5262 | 0.1359 | |||

| CCEP / Coca-Cola Europacific Partners PLC | 1.70 | -17.11 | 157.19 | -11.70 | 1.5096 | -0.2101 | |||

| COF / Capital One Financial Corporation | 0.73 | 154.69 | 1.4856 | 1.4856 | |||||

| BDX / Becton, Dickinson and Company | 0.90 | 154.28 | 1.4816 | 1.4816 | |||||

| NSIT / Insight Enterprises, Inc. | 1.09 | 14.81 | 150.49 | 5.70 | 1.4452 | 0.0698 | |||

| RYAAY / Ryanair Holdings plc - Depositary Receipt (Common Stock) | 2.54 | -17.11 | 146.76 | 12.83 | 1.4094 | 0.1528 | |||

| UNH / UnitedHealth Group Incorporated | 0.45 | -5.21 | 139.79 | -43.54 | 1.3425 | -1.0493 | |||

| CNM / Core & Main, Inc. | 2.31 | -18.65 | 139.51 | 1.62 | 1.3398 | 0.0135 | |||

| ZION / Zions Bancorporation, National Association | 2.65 | 15.69 | 137.69 | 20.51 | 1.3223 | 0.2185 | |||

| HLI / Houlihan Lokey, Inc. | 0.75 | -0.48 | 135.20 | 10.89 | 1.2984 | 0.1205 | |||

| PRI / Primerica, Inc. | 0.49 | -0.37 | 133.85 | -4.18 | 1.2854 | -0.0640 | |||

| DLTR / Dollar Tree, Inc. | 1.33 | -5.19 | 132.19 | 25.08 | 1.2694 | 0.2485 | |||

| WTM / White Mountains Insurance Group, Ltd. | 0.07 | -0.44 | 128.35 | -7.17 | 1.2326 | -0.1031 | |||

| PLXS / Plexus Corp. | 0.93 | -0.38 | 126.43 | 5.20 | 1.2141 | 0.0531 | |||

| SKX / Skechers U.S.A., Inc. | 1.97 | -30.31 | 124.61 | -22.56 | 1.1966 | -0.3578 | |||

| CDW / CDW Corporation | 0.68 | -5.35 | 121.50 | 5.47 | 1.1668 | 0.0539 | |||

| ATR / AptarGroup, Inc. | 0.76 | -0.45 | 119.54 | 4.95 | 1.1479 | 0.0476 | |||

| ALLE / Allegion plc | 0.82 | -5.88 | 117.84 | 3.98 | 1.1316 | 0.0368 | |||

| FBIN / Fortune Brands Innovations, Inc. | 2.28 | -0.40 | 117.51 | -15.78 | 1.1285 | -0.2194 | |||

| HAYW / Hayward Holdings, Inc. | 8.05 | 20.04 | 111.15 | 19.00 | 1.0674 | 0.1651 | |||

| ICLR / ICON Public Limited Company | 0.65 | 50.10 | 94.62 | 24.76 | 0.9087 | 0.1760 | |||

| MSA / MSA Safety Incorporated | 0.53 | 88.50 | 0.8499 | 0.8499 | |||||

| BLK / BlackRock, Inc. | 0.08 | -4.13 | 88.41 | 6.27 | 0.8490 | 0.0454 | |||

| TKR / The Timken Company | 1.14 | -0.42 | 82.92 | 0.52 | 0.7963 | -0.0006 | |||

| BJ / BJ's Wholesale Club Holdings, Inc. | 0.77 | -54.12 | 82.83 | -56.64 | 0.7955 | -1.0502 | |||

| ORLY / O'Reilly Automotive, Inc. | 0.90 | 677.30 | 81.35 | -51.10 | 0.7813 | -0.8258 | |||

| RHI / Robert Half Inc. | 1.89 | -26.85 | 77.38 | -44.95 | 0.7431 | -0.6148 | |||

| LPX / Louisiana-Pacific Corporation | 0.89 | 76.60 | 0.7356 | 0.7356 | |||||

| AIT / Applied Industrial Technologies, Inc. | 0.23 | -0.73 | 54.58 | 2.40 | 0.5241 | 0.0092 | |||

| CTS / CTS Corporation | 1.19 | -0.58 | 50.51 | 1.95 | 0.4850 | 0.0064 | |||

| WEIR / The Weir Group PLC | 0.07 | -1.63 | 2.31 | 12.07 | 0.0222 | 0.0023 | |||

| SDXAY / Sodexo S.A. - Depositary Receipt (Common Stock) | 0.13 | 6.13 | 1.58 | 1.86 | 0.0152 | 0.0002 | |||

| ASHTY / Ashtead Group plc - Depositary Receipt (Common Stock) | 0.01 | 6.91 | 1.31 | 27.57 | 0.0126 | 0.0027 | |||

| BMRRY / B&M European Value Retail S.A. - Depositary Receipt (Common Stock) | 0.08 | -1.62 | 1.22 | 8.47 | 0.0117 | 0.0008 | |||

| IFJPY / Informa plc - Depositary Receipt (Common Stock) | 0.01 | 15.47 | 0.29 | 22.88 | 0.0028 | 0.0005 | |||

| RHHBY / Roche Holding AG - Depositary Receipt (Common Stock) | 0.01 | -2.18 | 0.23 | -2.98 | 0.0022 | -0.0001 | |||

| RXEEY / Rexel S.A. - Depositary Receipt (Common Stock) | 0.01 | 0.23 | 0.0022 | 0.0022 | |||||

| EDNMY / Edenred SE - Depositary Receipt (Common Stock) | 0.01 | -2.16 | 0.18 | -7.29 | 0.0017 | -0.0001 | |||

| SNN / Smith & Nephew plc - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| IJR / iShares Trust - iShares Core S&P Small-Cap ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| MCHP / Microchip Technology Incorporated | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.00 | -100.00 | 0.00 | 0.0000 |