Mga Batayang Estadistika

| Manajer | Robert Rodriguez And Steven Romick |

| Profil Orang Dalam | First Pacific Advisors, LLC |

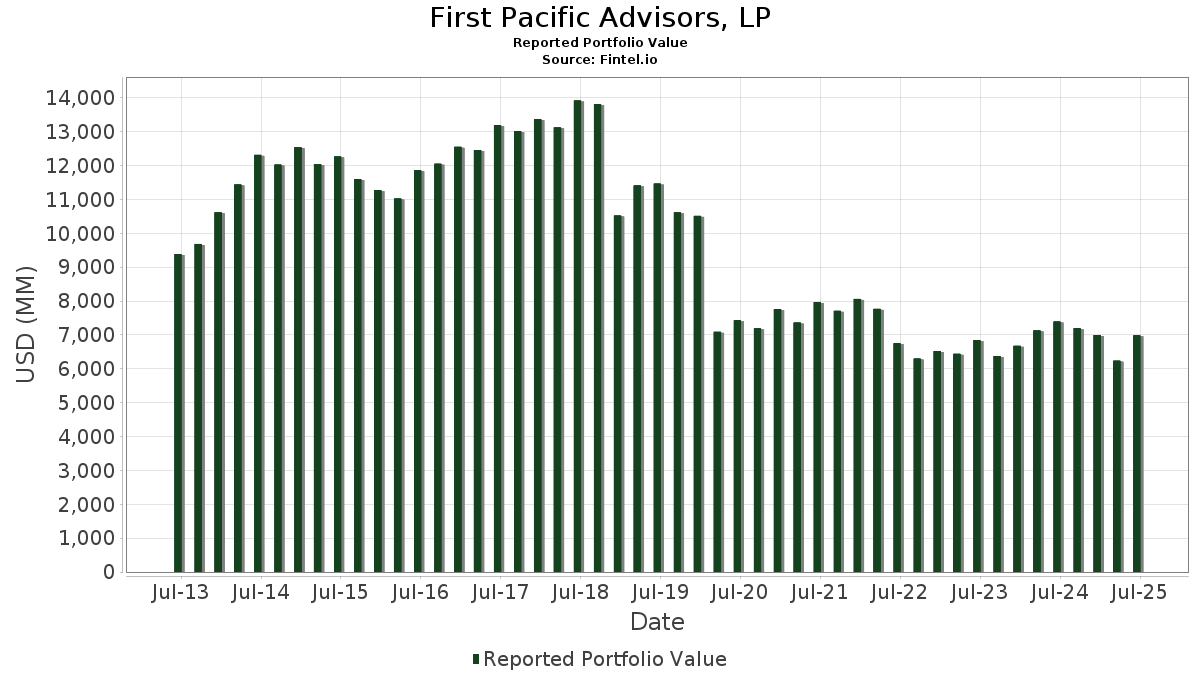

| Nilai Portofolio | $ 6,987,991,029 |

| Posisi Saat Ini | 63 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

First Pacific Advisors, LP telah mengungkapkan total kepemilikan 63 dalam pengajuan SEC terbaru mereka. Manajer portofolio tercantum sebagai Robert Rodriguez And Steven Romick. Nilai portofolio terbaru dihitung sebesar $ 6,987,991,029 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama First Pacific Advisors, LP adalah Meta Platforms, Inc. (US:META) , Analog Devices, Inc. (US:ADI) , TE Connectivity plc (US:TEL) , Citigroup Inc. (US:C) , and Alphabet Inc. (US:GOOGL) . Posisi baru First Pacific Advisors, LP meliputi: CONV. NOTE (US:US94419LAM37) , CONV. NOTE (US:US94419LAF85) , Vipshop Holdings Limited - Depositary Receipt (Common Stock) (US:VIPS) , Maravai LifeSciences Holdings, Inc. (US:MRVI) , and AerSale Corporation (US:ASLE) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.78 | 573.50 | 8.2069 | 0.9771 | |

| 1.26 | 273.53 | 3.9142 | 0.6992 | |

| 2.00 | 102.88 | 1.4722 | 0.6987 | |

| 0.09 | 35.43 | 0.5069 | 0.5069 | |

| 0.96 | 140.23 | 2.0067 | 0.4724 | |

| 7.02 | 87.25 | 1.2485 | 0.3964 | |

| 2.66 | 448.11 | 6.4126 | 0.3338 | |

| 2.09 | 496.28 | 7.1019 | 0.2950 | |

| 1.46 | 320.56 | 4.5873 | 0.1769 | |

| 0.99 | 156.15 | 2.2345 | 0.1679 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.65 | 232.61 | 3.3288 | -1.0218 | |

| 11.09 | 395.86 | 5.6648 | -0.8165 | |

| 4.11 | 302.40 | 4.3275 | -0.7264 | |

| 2.03 | 162.99 | 2.3324 | -0.6927 | |

| 2.43 | 163.40 | 2.3384 | -0.6795 | |

| 3.94 | 115.83 | 1.6576 | -0.3877 | |

| 0.17 | 34.56 | 0.4946 | -0.3821 | |

| 5.33 | 80.23 | 1.1481 | -0.2204 | |

| 2.58 | 141.12 | 2.0194 | -0.1970 | |

| 5.25 | 447.14 | 6.3987 | -0.1778 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-01 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| META / Meta Platforms, Inc. | 0.78 | -0.70 | 573.50 | 27.16 | 8.2069 | 0.9771 | |||

| ADI / Analog Devices, Inc. | 2.09 | -0.97 | 496.28 | 16.88 | 7.1019 | 0.2950 | |||

| TEL / TE Connectivity plc | 2.66 | -0.99 | 448.11 | 18.18 | 6.4126 | 0.3338 | |||

| C / Citigroup Inc. | 5.25 | -9.10 | 447.14 | 9.00 | 6.3987 | -0.1778 | |||

| GOOGL / Alphabet Inc. | 2.48 | -3.01 | 436.77 | 10.53 | 6.2503 | -0.0844 | |||

| CMCSA / Comcast Corporation | 11.09 | 1.23 | 395.86 | -2.09 | 5.6648 | -0.8165 | |||

| AMZN / Amazon.com, Inc. | 1.46 | 1.05 | 320.56 | 16.52 | 4.5873 | 0.1769 | |||

| IFF / International Flavors & Fragrances Inc. | 4.11 | 1.22 | 302.40 | -4.08 | 4.3275 | -0.7264 | |||

| GOOG / Alphabet Inc. | 1.58 | -1.28 | 280.07 | 12.09 | 4.0078 | 0.0025 | |||

| FERG / Ferguson Enterprises Inc. | 1.26 | 0.36 | 273.53 | 36.39 | 3.9142 | 0.6992 | |||

| CHTR / Charter Communications, Inc. | 0.63 | 1.21 | 256.12 | 12.27 | 3.6652 | 0.0081 | |||

| AON / Aon plc | 0.65 | -4.12 | 232.61 | -14.29 | 3.3288 | -1.0218 | |||

| NXPI / NXP Semiconductors N.V. | 0.76 | 1.08 | 167.12 | 16.20 | 2.3915 | 0.0860 | |||

| LPLA / LPL Financial Holdings Inc. | 0.44 | -3.15 | 166.30 | 11.01 | 2.3798 | -0.0218 | |||

| KMX / CarMax, Inc. | 2.43 | 0.63 | 163.40 | -13.20 | 2.3384 | -0.6795 | |||

| WFC / Wells Fargo & Company | 2.03 | -22.61 | 162.99 | -13.63 | 2.3324 | -0.6927 | |||

| MTN / Vail Resorts, Inc. | 0.99 | 23.36 | 156.15 | 21.13 | 2.2345 | 0.1679 | |||

| JEF / Jefferies Financial Group Inc. | 2.58 | -0.02 | 141.12 | 2.07 | 2.0194 | -0.1970 | |||

| ICLR / ICON Public Limited Company | 0.96 | 76.27 | 140.23 | 46.52 | 2.0067 | 0.4724 | |||

| MAR / Marriott International, Inc. | 0.45 | 1.27 | 123.14 | 16.15 | 1.7622 | 0.0626 | |||

| KMI / Kinder Morgan, Inc. | 3.94 | -11.90 | 115.83 | -9.21 | 1.6576 | -0.3877 | |||

| FBIN / Fortune Brands Innovations, Inc. | 2.00 | 152.16 | 102.88 | 113.23 | 1.4722 | 0.6987 | |||

| UBER / Uber Technologies, Inc. | 1.03 | -14.37 | 95.97 | 9.65 | 1.3734 | -0.0297 | |||

| BIO / Bio-Rad Laboratories, Inc. | 0.39 | 3.86 | 93.38 | 2.91 | 1.3363 | -0.1184 | |||

| WAB / Westinghouse Air Brake Technologies Corporation | 0.44 | 1.40 | 91.27 | 17.05 | 1.3061 | 0.0561 | |||

| NOV / NOV Inc. | 7.02 | 100.99 | 87.25 | 64.15 | 1.2485 | 0.3964 | |||

| DEI / Douglas Emmett, Inc. | 5.33 | -0.02 | 80.23 | -6.02 | 1.1481 | -0.2204 | |||

| HWM / Howmet Aerospace Inc. | 0.43 | -29.72 | 79.53 | 0.84 | 1.1380 | -0.1262 | |||

| NATL / NCR Atleos Corporation | 2.29 | -0.02 | 65.27 | 8.13 | 0.9341 | -0.0336 | |||

| VNO / Vornado Realty Trust | 1.68 | -0.02 | 64.11 | 3.36 | 0.9174 | -0.0769 | |||

| US94419LAM37 / CONV. NOTE | 51.45 | 0.24 | 0.7363 | -0.0866 | |||||

| DELL / Dell Technologies Inc. | 0.42 | 0.00 | 51.31 | 34.50 | 0.7342 | 0.1227 | |||

| ECHOSTAR CORP / NOTE 3.875%11/3 (278768AB2) | 47.10 | 0.0000 | |||||||

| VYX / NCR Voyix Corporation | 3.91 | 5.58 | 45.85 | 27.02 | 0.6561 | 0.0774 | |||

| SATS / EchoStar Corporation | 1.44 | 36.65 | 39.77 | 47.98 | 0.5691 | 0.1383 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.09 | 35.43 | 0.5069 | 0.5069 | |||||

| GPOR / Gulfport Energy Corporation | 0.17 | -42.15 | 34.56 | -36.80 | 0.4946 | -0.3821 | |||

| AVGO / Broadcom Inc. | 0.12 | -38.72 | 32.94 | 0.89 | 0.4714 | -0.0520 | |||

| PCG / PG&E Corporation | 1.10 | 1.26 | 15.38 | -17.84 | 0.2201 | -0.0800 | |||

| LAUR / Laureate Education, Inc. | 0.40 | -6.69 | 9.31 | 6.68 | 0.1332 | -0.0067 | |||

| RUSHA / Rush Enterprises, Inc. | 0.16 | -7.84 | 8.19 | -11.13 | 0.1173 | -0.0305 | |||

| STGW / Stagwell Inc. | 1.19 | 0.00 | 5.36 | -25.63 | 0.0768 | -0.0388 | |||

| SGOV / iShares Trust - iShares 0-3 Month Treasury Bond ETF | 0.05 | 15.08 | 4.85 | 15.11 | 0.0693 | 0.0019 | |||

| US94419LAF85 / CONV. NOTE | 4.67 | 1.08 | 0.0668 | -0.0072 | |||||

| TDW / Tidewater Inc. | 0.09 | 0.00 | 4.38 | 9.12 | 0.0627 | -0.0017 | |||

| OEC / Orion S.A. | 0.37 | 9.58 | 3.86 | -11.11 | 0.0552 | -0.0144 | |||

| NFLX / Netflix, Inc. | 0.00 | 0.00 | 3.13 | 43.58 | 0.0448 | 0.0099 | |||

| NX / Quanex Building Products Corporation | 0.15 | 15.95 | 2.93 | 17.87 | 0.0419 | 0.0021 | |||

| VIPS / Vipshop Holdings Limited - Depositary Receipt (Common Stock) | 0.18 | 2.70 | 0.0387 | 0.0387 | |||||

| RSVR / Reservoir Media, Inc. | 0.33 | 4,906.33 | 2.52 | 4,946.00 | 0.0361 | 0.0353 | |||

| PDLB / Ponce Financial Group, Inc. | 0.18 | 0.00 | 2.51 | 9.22 | 0.0360 | -0.0009 | |||

| ESGR / Enstar Group Limited | 0.01 | 0.00 | 2.32 | 1.22 | 0.0332 | -0.0036 | |||

| VT / Vanguard International Equity Index Funds - Vanguard Total World Stock ETF | 0.02 | 3.25 | 2.16 | 14.44 | 0.0309 | 0.0007 | |||

| PBFS / Pioneer Bancorp, Inc. | 0.17 | 0.00 | 2.01 | 2.71 | 0.0287 | -0.0026 | |||

| PARR / Par Pacific Holdings, Inc. | 0.07 | 1.14 | 1.93 | 88.09 | 0.0276 | 0.0112 | |||

| ALGT / Allegiant Travel Company | 0.03 | 0.00 | 1.88 | 6.40 | 0.0269 | -0.0014 | |||

| MRVI / Maravai LifeSciences Holdings, Inc. | 0.74 | 1.79 | 0.0256 | 0.0256 | |||||

| WLY / John Wiley & Sons, Inc. | 0.04 | 0.00 | 1.75 | 0.11 | 0.0250 | -0.0030 | |||

| DAR / Darling Ingredients Inc. | 0.04 | 1.62 | 0.0231 | 0.0231 | |||||

| ASLE / AerSale Corporation | 0.25 | 1.50 | 0.0215 | 0.0215 | |||||

| UPWK / Upwork Inc. | 0.10 | 0.00 | 1.41 | 3.00 | 0.0202 | -0.0018 | |||

| EBC / Eastern Bankshares, Inc. | 0.09 | 0.00 | 1.31 | -6.89 | 0.0188 | -0.0038 | |||

| AVTR / Avantor, Inc. | 0.07 | 1.01 | 0.0144 | 0.0144 | |||||

| SHC / Sotera Health Company | 0.00 | -100.00 | 0.00 | 0.0000 |