Mga Batayang Estadistika

| Nilai Portofolio | $ 1,068,960,601 |

| Posisi Saat Ini | 188 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

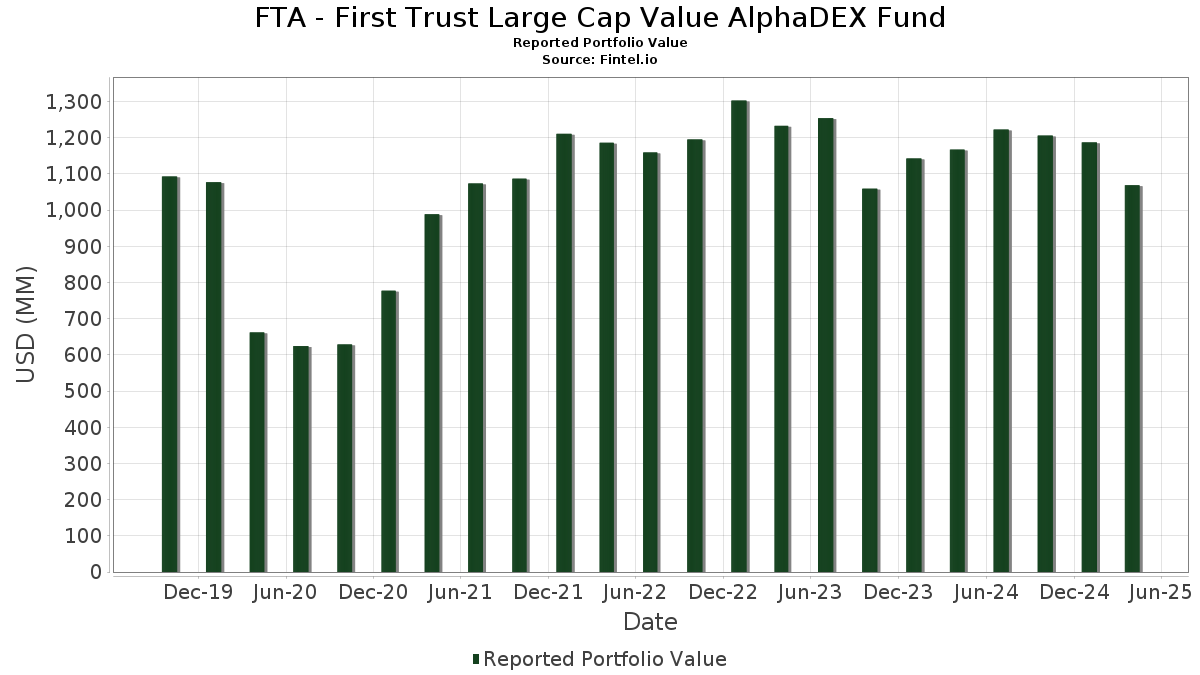

FTA - First Trust Large Cap Value AlphaDEX Fund telah mengungkapkan total kepemilikan 188 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 1,068,960,601 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama FTA - First Trust Large Cap Value AlphaDEX Fund adalah Newmont Corporation (US:NEM) , Western Digital Corporation (US:WDC) , Block, Inc. (US:SQ) , Hewlett Packard Enterprise Company (US:HPE) , and Steel Dynamics, Inc. (US:STLD) . Posisi baru FTA - First Trust Large Cap Value AlphaDEX Fund meliputi: Block, Inc. (US:SQ) , Avantor, Inc. (US:AVTR) , NRG Energy, Inc. (US:NRG) , Uber Technologies, Inc. (US:UBER) , and NXP Semiconductors N.V. (US:NXPI) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.19 | 10.84 | 1.0141 | 1.0141 | |

| 0.25 | 10.93 | 1.0222 | 0.8357 | |

| 0.21 | 10.99 | 1.0282 | 0.8321 | |

| 0.12 | 8.92 | 0.8345 | 0.6465 | |

| 0.50 | 6.46 | 0.6041 | 0.6041 | |

| 0.06 | 9.79 | 0.9153 | 0.5669 | |

| 0.15 | 9.54 | 0.8919 | 0.5451 | |

| 0.04 | 5.80 | 0.5426 | 0.5426 | |

| 0.01 | 7.61 | 0.7117 | 0.5411 | |

| 0.02 | 8.98 | 0.8401 | 0.4743 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.00 | -0.9754 | ||

| 0.05 | 4.96 | 0.4639 | -0.4436 | |

| 0.10 | 5.18 | 0.4843 | -0.4399 | |

| 0.04 | 1.82 | 0.1698 | -0.3984 | |

| 0.01 | 3.90 | 0.3645 | -0.3883 | |

| 0.12 | 7.94 | 0.7423 | -0.3614 | |

| 0.02 | 1.94 | 0.1810 | -0.3292 | |

| 0.19 | 6.41 | 0.5996 | -0.3219 | |

| 0.11 | 6.66 | 0.6233 | -0.2708 | |

| 0.02 | 3.86 | 0.3611 | -0.2631 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-06-25 untuk periode pelaporan 2025-04-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NEM / Newmont Corporation | 0.21 | 282.82 | 10.99 | 372.16 | 1.0282 | 0.8321 | |||

| WDC / Western Digital Corporation | 0.25 | 632.44 | 10.93 | 393.41 | 1.0222 | 0.8357 | |||

| SQ / Block, Inc. | 0.19 | 10.84 | 1.0141 | 1.0141 | |||||

| HPE / Hewlett Packard Enterprise Company | 0.65 | 33.81 | 10.59 | 2.42 | 0.9905 | 0.1199 | |||

| STLD / Steel Dynamics, Inc. | 0.08 | -11.81 | 10.45 | -10.77 | 0.9772 | -0.0087 | |||

| CF / CF Industries Holdings, Inc. | 0.13 | 5.58 | 10.10 | -10.27 | 0.9449 | -0.0031 | |||

| F / Ford Motor Company | 1.00 | -4.55 | 10.05 | -5.21 | 0.9404 | 0.0473 | |||

| PHM / PulteGroup, Inc. | 0.10 | 2.44 | 10.05 | -7.64 | 0.9403 | 0.0238 | |||

| ADM / Archer-Daniels-Midland Company | 0.21 | 1.76 | 10.02 | -5.15 | 0.9372 | 0.0477 | |||

| DHI / D.R. Horton, Inc. | 0.08 | 6.36 | 10.01 | -5.30 | 0.9364 | 0.0462 | |||

| NUE / Nucor Corporation | 0.08 | -6.21 | 9.99 | -12.83 | 0.9347 | -0.0306 | |||

| CNC / Centene Corporation | 0.17 | -3.50 | 9.93 | -9.80 | 0.9289 | 0.0018 | |||

| SYF / Synchrony Financial | 0.19 | 48.42 | 9.89 | 11.78 | 0.9247 | 0.1800 | |||

| ON / ON Semiconductor Corporation | 0.25 | 87.31 | 9.83 | 42.08 | 0.9194 | 0.3368 | |||

| MKL / Markel Group Inc. | 0.01 | -18.65 | 9.80 | -9.73 | 0.9165 | 0.0290 | |||

| DOV / Dover Corporation | 0.06 | 147.94 | 9.79 | 129.66 | 0.9153 | 0.5669 | |||

| VZ / Verizon Communications Inc. | 0.22 | 6.57 | 9.79 | 19.20 | 0.9153 | 0.2241 | |||

| TROW / T. Rowe Price Group, Inc. | 0.11 | 19.04 | 9.71 | -9.84 | 0.9082 | 0.0013 | |||

| GM / General Motors Company | 0.21 | 9.54 | 9.69 | 0.20 | 0.9064 | 0.0920 | |||

| TRMB / Trimble Inc. | 0.15 | 90.06 | 9.54 | 119.52 | 0.8919 | 0.5451 | |||

| LEN / Lennar Corporation | 0.09 | 14.89 | 9.53 | -4.92 | 0.8916 | 0.0474 | |||

| ACGL / Arch Capital Group Ltd. | 0.10 | 1.28 | 9.50 | -4.11 | 0.8884 | 0.0785 | |||

| CINF / Cincinnati Financial Corporation | 0.07 | -5.93 | 9.49 | -4.44 | 0.8880 | 0.0514 | |||

| CMCSA / Comcast Corporation | 0.27 | -1.64 | 9.34 | -0.06 | 0.8733 | 0.0866 | |||

| CSL / Carlisle Companies Incorporated | 0.02 | 78.10 | 8.98 | 115.09 | 0.8401 | 0.4743 | |||

| XOM / Exxon Mobil Corporation | 0.08 | -12.53 | 8.95 | -13.51 | 0.8369 | -0.0342 | |||

| MU / Micron Technology, Inc. | 0.12 | 251.64 | 8.92 | 279.01 | 0.8345 | 0.6465 | |||

| BIIB / Biogen Inc. | 0.07 | 8.07 | 8.91 | -9.09 | 0.8338 | 0.0082 | |||

| VLO / Valero Energy Corporation | 0.08 | -10.24 | 8.86 | -21.66 | 0.8283 | -0.1234 | |||

| EOG / EOG Resources, Inc. | 0.08 | -7.57 | 8.67 | -18.93 | 0.8107 | -0.0895 | |||

| COG / Cabot Oil & Gas Corp. | 0.35 | -14.54 | 8.56 | -24.29 | 0.8008 | -0.1513 | |||

| COP / ConocoPhillips | 0.10 | -8.68 | 8.55 | -17.66 | 0.7996 | -0.0745 | |||

| FANG / Diamondback Energy, Inc. | 0.06 | -0.90 | 8.32 | -20.41 | 0.7780 | -0.1020 | |||

| EXC / Exelon Corporation | 0.17 | -21.01 | 8.20 | -7.38 | 0.7673 | 0.0215 | |||

| CVX / Chevron Corporation | 0.06 | -16.27 | 8.19 | -23.64 | 0.7664 | -0.1372 | |||

| DVN / Devon Energy Corporation | 0.27 | -15.37 | 8.19 | -24.53 | 0.7662 | -0.1477 | |||

| COF / Capital One Financial Corporation | 0.04 | -3.82 | 8.10 | -14.89 | 0.7579 | -0.0438 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.02 | -41.00 | 8.07 | -28.25 | 0.7548 | -0.1648 | |||

| XEL / Xcel Energy Inc. | 0.11 | -7.76 | 8.05 | -2.95 | 0.7529 | 0.0544 | |||

| RS / Reliance, Inc. | 0.03 | -27.86 | 8.05 | -28.18 | 0.7525 | -0.1907 | |||

| OXY / Occidental Petroleum Corporation | 0.20 | -3.20 | 8.04 | -18.23 | 0.7523 | -0.0759 | |||

| NWSA / News Corporation | 0.30 | 95.68 | 8.03 | 88.72 | 0.7511 | 0.3928 | |||

| WFC / Wells Fargo & Company | 0.11 | 29.56 | 7.97 | 16.75 | 0.7456 | 0.1707 | |||

| EG / Everest Group, Ltd. | 0.02 | -22.82 | 7.96 | -20.30 | 0.7445 | -0.0965 | |||

| CVS / CVS Health Corporation | 0.12 | -48.74 | 7.94 | -39.46 | 0.7423 | -0.3614 | |||

| STT / State Street Corporation | 0.09 | 45.17 | 7.93 | 25.87 | 0.7418 | 0.2112 | |||

| T / AT&T Inc. | 0.29 | -22.14 | 7.89 | -9.11 | 0.7384 | 0.0070 | |||

| HAL / Halliburton Company | 0.40 | 3.64 | 7.87 | -21.06 | 0.7362 | -0.1033 | |||

| GPN / Global Payments Inc. | 0.10 | -4.65 | 7.85 | -28.41 | 0.7343 | -0.1624 | |||

| HBAN / Huntington Bancshares Incorporated | 0.54 | 4.82 | 7.80 | -11.44 | 0.7297 | -0.0121 | |||

| PFE / Pfizer Inc. | 0.32 | 102.49 | 7.76 | 86.39 | 0.7262 | 0.3754 | |||

| C / Citigroup Inc. | 0.11 | 31.30 | 7.76 | 10.25 | 0.7261 | 0.1333 | |||

| CTSH / Cognizant Technology Solutions Corporation | 0.11 | -2.79 | 7.75 | -13.43 | 0.7250 | -0.0289 | |||

| TSN / Tyson Foods, Inc. | 0.13 | -12.95 | 7.74 | -5.62 | 0.7235 | 0.0333 | |||

| ES / Eversource Energy | 0.13 | 32.07 | 7.72 | 44.88 | 0.7219 | 0.2553 | |||

| BLDR / Builders FirstSource, Inc. | 0.06 | 10.63 | 7.72 | -20.88 | 0.7218 | -0.0995 | |||

| KHC / The Kraft Heinz Company | 0.26 | 95.19 | 7.71 | 90.34 | 0.7209 | 0.3799 | |||

| USB / U.S. Bancorp | 0.19 | 50.02 | 7.70 | 26.64 | 0.7203 | 0.2083 | |||

| MTB / M&T Bank Corporation | 0.05 | 39.28 | 7.65 | 17.50 | 0.7159 | 0.1674 | |||

| MRK / Merck & Co., Inc. | 0.09 | 108.69 | 7.65 | 99.01 | 0.7155 | 0.3842 | |||

| REGN / Regeneron Pharmaceuticals, Inc. | 0.01 | 557.42 | 7.61 | 264.77 | 0.7117 | 0.5411 | |||

| MPC / Marathon Petroleum Corporation | 0.06 | -7.40 | 7.60 | -12.68 | 0.7110 | -0.0220 | |||

| US21871X1090 / Corebridge Financial, Inc. | 0.26 | -15.12 | 7.56 | -20.84 | 0.7075 | -0.0863 | |||

| AIG / American International Group, Inc. | 0.09 | -19.02 | 7.56 | -10.38 | 0.7068 | -0.0032 | |||

| TFC / Truist Financial Corporation | 0.20 | -12.92 | 7.51 | -9.91 | 0.7024 | -0.0277 | |||

| TGT / Target Corporation | 0.08 | 25.26 | 7.47 | -12.16 | 0.6985 | -0.0174 | |||

| PCAR / PACCAR Inc | 0.08 | 3.31 | 7.47 | -15.95 | 0.6984 | -0.0496 | |||

| EIX / Edison International | 0.14 | 79.44 | 7.32 | 77.82 | 0.6846 | 0.3380 | |||

| CFG / Citizens Financial Group, Inc. | 0.20 | 3.29 | 7.26 | -19.90 | 0.6788 | -0.0841 | |||

| DOW / Dow Inc. | 0.23 | 11.13 | 7.06 | -12.95 | 0.6604 | -0.0225 | |||

| FDX / FedEx Corporation | 0.03 | 11.60 | 6.95 | -11.38 | 0.6504 | -0.0103 | |||

| LYB / LyondellBasell Industries N.V. | 0.11 | -18.38 | 6.66 | -37.24 | 0.6233 | -0.2708 | |||

| AVTR / Avantor, Inc. | 0.50 | 6.46 | 0.6041 | 0.6041 | |||||

| LDOS / Leidos Holdings, Inc. | 0.04 | 3.24 | 6.42 | 6.98 | 0.6004 | 0.0952 | |||

| SLB / Schlumberger Limited | 0.19 | -29.04 | 6.41 | -41.43 | 0.5996 | -0.3219 | |||

| ULTA / Ulta Beauty, Inc. | 0.02 | 67.62 | 6.35 | 60.92 | 0.5942 | 0.2618 | |||

| KR / The Kroger Co. | 0.09 | -36.20 | 6.28 | -25.27 | 0.5873 | -0.1201 | |||

| DG / Dollar General Corporation | 0.07 | -39.11 | 6.27 | -19.72 | 0.5866 | -0.0711 | |||

| CHTR / Charter Communications, Inc. | 0.02 | 31.35 | 6.26 | 49.00 | 0.5853 | 0.2316 | |||

| ATO / Atmos Energy Corporation | 0.04 | -12.87 | 6.12 | -1.78 | 0.5720 | 0.0477 | |||

| ED / Consolidated Edison, Inc. | 0.05 | -43.02 | 6.00 | -31.47 | 0.5613 | -0.1760 | |||

| OC / Owens Corning | 0.04 | -15.78 | 5.99 | -33.64 | 0.5605 | -0.1999 | |||

| AKAM / Akamai Technologies, Inc. | 0.07 | 67.81 | 5.89 | 35.36 | 0.5510 | 0.1846 | |||

| DUK / Duke Energy Corporation | 0.05 | -37.62 | 5.89 | -32.03 | 0.5507 | -0.1787 | |||

| TRV / The Travelers Companies, Inc. | 0.02 | -35.67 | 5.88 | -30.70 | 0.5498 | -0.1644 | |||

| AEP / American Electric Power Company, Inc. | 0.05 | -40.39 | 5.84 | -34.35 | 0.5458 | -0.2026 | |||

| HIG / The Hartford Insurance Group, Inc. | 0.05 | -37.56 | 5.84 | -31.34 | 0.5458 | -0.1698 | |||

| DTE / DTE Energy Company | 0.04 | -38.33 | 5.83 | -29.53 | 0.5454 | -0.1513 | |||

| ABT / Abbott Laboratories | 0.04 | 5.80 | 0.5426 | 0.5426 | |||||

| NVR / NVR, Inc. | 0.00 | 59.72 | 5.79 | 41.99 | 0.5418 | 0.1983 | |||

| HSY / The Hershey Company | 0.03 | 39.84 | 5.75 | 56.67 | 0.5381 | 0.2289 | |||

| AFL / Aflac Incorporated | 0.05 | 169.90 | 5.75 | 173.12 | 0.5381 | 0.3608 | |||

| D / Dominion Energy, Inc. | 0.10 | -32.16 | 5.71 | -33.64 | 0.5339 | -0.1904 | |||

| BK / The Bank of New York Mellon Corporation | 0.07 | -63.53 | 5.64 | -35.35 | 0.5278 | -0.1691 | |||

| BAC / Bank of America Corporation | 0.14 | 48.75 | 5.62 | 28.11 | 0.5261 | 0.1565 | |||

| CSX / CSX Corporation | 0.20 | 6.04 | 5.61 | -9.45 | 0.5251 | 0.0031 | |||

| GIS / General Mills, Inc. | 0.10 | 3.14 | 5.59 | -2.68 | 0.5224 | 0.0391 | |||

| CB / Chubb Limited | 0.02 | -35.39 | 5.58 | -32.02 | 0.5215 | -0.1690 | |||

| L / Loews Corporation | 0.06 | -34.93 | 5.56 | -33.88 | 0.5201 | -0.1880 | |||

| HOLX / Hologic, Inc. | 0.10 | 12.86 | 5.55 | -8.95 | 0.5187 | 0.0059 | |||

| RF / Regions Financial Corporation | 0.27 | 4.67 | 5.53 | -13.30 | 0.5171 | -0.0198 | |||

| SNA / Snap-on Incorporated | 0.02 | -2.59 | 5.48 | -13.93 | 0.5126 | -0.0236 | |||

| HPQ / HP Inc. | 0.21 | 66.44 | 5.44 | 30.96 | 0.5083 | 0.1589 | |||

| OMC / Omnicom Group Inc. | 0.07 | 46.57 | 5.41 | 28.62 | 0.5057 | 0.1517 | |||

| FITB / Fifth Third Bancorp | 0.15 | 4.30 | 5.40 | -15.40 | 0.5047 | -0.0323 | |||

| ZBH / Zimmer Biomet Holdings, Inc. | 0.05 | -34.09 | 5.36 | -37.96 | 0.5012 | -0.2261 | |||

| BBY / Best Buy Co., Inc. | 0.08 | 12.72 | 5.33 | -12.45 | 0.4988 | -0.0141 | |||

| JBHT / J.B. Hunt Transport Services, Inc. | 0.04 | 62.92 | 5.19 | 24.26 | 0.4859 | 0.1338 | |||

| FOXA / Fox Corporation | 0.10 | -51.51 | 5.18 | -52.83 | 0.4843 | -0.4399 | |||

| UPS / United Parcel Service, Inc. | 0.05 | 61.92 | 5.10 | 35.07 | 0.4770 | 0.1591 | |||

| PSX / Phillips 66 | 0.05 | -47.87 | 4.96 | -53.98 | 0.4639 | -0.4436 | |||

| NRG / NRG Energy, Inc. | 0.04 | 4.63 | 0.4327 | 0.4327 | |||||

| BAH / Booz Allen Hamilton Holding Corporation | 0.04 | 4.62 | 0.4326 | 0.4326 | |||||

| ARE / Alexandria Real Estate Equities, Inc. | 0.06 | 1.97 | 4.62 | -23.89 | 0.4324 | -0.0790 | |||

| UBER / Uber Technologies, Inc. | 0.06 | 4.48 | 0.4191 | 0.4191 | |||||

| STX / Seagate Technology Holdings plc | 0.05 | -1.75 | 4.32 | -7.18 | 0.4039 | 0.0122 | |||

| CNP / CenterPoint Energy, Inc. | 0.11 | -42.01 | 4.31 | -30.96 | 0.4034 | -0.1226 | |||

| FE / FirstEnergy Corp. | 0.10 | -34.84 | 4.28 | -29.79 | 0.3999 | -0.1129 | |||

| DGX / Quest Diagnostics Incorporated | 0.02 | -40.97 | 4.24 | -35.50 | 0.3970 | -0.1570 | |||

| LHX / L3Harris Technologies, Inc. | 0.02 | 99.56 | 4.24 | 107.14 | 0.3962 | 0.2240 | |||

| ZM / Zoom Communications Inc. | 0.05 | 6.98 | 4.24 | -4.60 | 0.3962 | 0.0224 | |||

| AMAT / Applied Materials, Inc. | 0.03 | 4.19 | 0.3914 | 0.3914 | |||||

| LH / Labcorp Holdings Inc. | 0.02 | 4.17 | 0.3903 | 0.3903 | |||||

| BFB / Brown-Forman Corp. - Class B | 0.12 | 8.21 | 4.14 | 14.22 | 0.3869 | 0.0819 | |||

| DELL / Dell Technologies Inc. | 0.04 | -47.92 | 4.06 | 6.04 | 0.3794 | 0.0497 | |||

| WEC / WEC Energy Group, Inc. | 0.04 | -16.55 | 4.05 | -7.94 | 0.3788 | 0.0084 | |||

| MDLZ / Mondelez International, Inc. | 0.06 | 74.86 | 4.05 | 105.49 | 0.3785 | 0.2126 | |||

| HCA / HCA Healthcare, Inc. | 0.01 | -10.22 | 4.02 | -14.67 | 0.3764 | -0.0092 | |||

| PPG / PPG Industries, Inc. | 0.04 | 5.64 | 4.01 | -0.35 | 0.3752 | 0.0363 | |||

| MOH / Molina Healthcare, Inc. | 0.01 | -41.50 | 4.00 | -38.38 | 0.3742 | -0.1724 | |||

| AEE / Ameren Corporation | 0.04 | -41.21 | 3.98 | -38.07 | 0.3726 | -0.1690 | |||

| FNF / Fidelity National Financial, Inc. | 0.06 | -16.58 | 3.97 | -8.13 | 0.3710 | 0.0074 | |||

| CMS / CMS Energy Corporation | 0.05 | -41.25 | 3.95 | -34.44 | 0.3696 | -0.1379 | |||

| NXPI / NXP Semiconductors N.V. | 0.02 | 3.91 | 0.3655 | 0.3655 | |||||

| ELV / Elevance Health, Inc. | 0.01 | -58.99 | 3.90 | -56.42 | 0.3645 | -0.3883 | |||

| QCOM / QUALCOMM Incorporated | 0.03 | 157.16 | 3.89 | 110.94 | 0.3643 | 0.2133 | |||

| HRL / Hormel Foods Corporation | 0.13 | -1.95 | 3.89 | -2.21 | 0.3643 | 0.0289 | |||

| AVY / Avery Dennison Corporation | 0.02 | 108.86 | 3.87 | 92.45 | 0.3624 | 0.1928 | |||

| ALL / The Allstate Corporation | 0.02 | -68.56 | 3.86 | -46.68 | 0.3611 | -0.2631 | |||

| NOC / Northrop Grumman Corporation | 0.01 | -39.24 | 3.83 | -33.83 | 0.3582 | -0.1487 | |||

| LNT / Alliant Energy Corporation | 0.06 | -39.15 | 3.82 | -36.92 | 0.3575 | -0.1527 | |||

| NSC / Norfolk Southern Corporation | 0.02 | 96.85 | 3.81 | 72.76 | 0.3565 | 0.1707 | |||

| KIM / Kimco Realty Corporation | 0.19 | 6.68 | 3.79 | -5.06 | 0.3546 | 0.0184 | |||

| PKG / Packaging Corporation of America | 0.02 | 9.93 | 3.78 | -4.04 | 0.3533 | 0.0218 | |||

| PRU / Prudential Financial, Inc. | 0.04 | -29.73 | 3.71 | -40.23 | 0.3467 | -0.1755 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.02 | 6.11 | 3.68 | -15.13 | 0.3446 | -0.0210 | |||

| CG / The Carlyle Group Inc. | 0.09 | 3.57 | 0.3341 | 0.3341 | |||||

| JEF / Jefferies Financial Group Inc. | 0.08 | 3.52 | 0.3288 | 0.3288 | |||||

| LUV / Southwest Airlines Co. | 0.12 | 98.87 | 3.36 | 81.06 | 0.3138 | 0.1578 | |||

| ALGN / Align Technology, Inc. | 0.01 | 2.14 | 0.2002 | 0.2002 | |||||

| ROST / Ross Stores, Inc. | 0.02 | 2.13 | 0.1996 | 0.1996 | |||||

| LMT / Lockheed Martin Corporation | 0.00 | -48.79 | 2.10 | -47.15 | 0.1963 | -0.1381 | |||

| CASY / Casey's General Stores, Inc. | 0.00 | 2.09 | 0.1955 | 0.1955 | |||||

| CI / The Cigna Group | 0.01 | -60.49 | 2.03 | -54.34 | 0.1896 | -0.1842 | |||

| IFF / International Flavors & Fragrances Inc. | 0.03 | 1.26 | 1.98 | -1.54 | 0.1855 | 0.0091 | |||

| WRB / W. R. Berkley Corporation | 0.03 | -20.47 | 1.98 | -3.09 | 0.1849 | 0.0131 | |||

| GD / General Dynamics Corporation | 0.01 | -54.50 | 1.96 | -51.82 | 0.1832 | -0.1590 | |||

| HUM / Humana Inc. | 0.01 | -54.87 | 1.94 | -59.66 | 0.1818 | -0.2238 | |||

| GPC / Genuine Parts Company | 0.02 | -68.41 | 1.94 | -68.06 | 0.1810 | -0.3292 | |||

| RJF / Raymond James Financial, Inc. | 0.01 | -60.56 | 1.94 | -63.54 | 0.1810 | -0.2599 | |||

| LRCX / Lam Research Corporation | 0.03 | 1.93 | 0.1809 | 0.1809 | |||||

| IEX / IDEX Corporation | 0.01 | 8.93 | 1.89 | -11.70 | 0.1764 | -0.0011 | |||

| EMR / Emerson Electric Co. | 0.02 | -22.28 | 1.88 | -10.60 | 0.1759 | 0.0080 | |||

| LOW / Lowe's Companies, Inc. | 0.01 | 2.31 | 1.88 | -12.07 | 0.1759 | -0.0041 | |||

| FTV / Fortive Corporation | 0.03 | -0.88 | 1.87 | -15.05 | 0.1748 | -0.0105 | |||

| FCX / Freeport-McMoRan Inc. | 0.05 | -2.73 | 1.87 | -2.25 | 0.1746 | 0.0138 | |||

| MMM / 3M Company | 0.01 | -58.62 | 1.86 | -62.24 | 0.1736 | -0.2401 | |||

| MDT / Medtronic plc | 0.02 | -58.15 | 1.85 | -60.95 | 0.1731 | -0.2258 | |||

| MET / MetLife, Inc. | 0.02 | -33.62 | 1.84 | -20.58 | 0.1723 | -0.0128 | |||

| TDY / Teledyne Technologies Incorporated | 0.00 | -56.10 | 1.84 | -60.00 | 0.1718 | -0.2148 | |||

| KMB / Kimberly-Clark Corporation | 0.01 | -6.17 | 1.82 | -8.41 | 0.1700 | 0.0077 | |||

| ODFL / Old Dominion Freight Line, Inc. | 0.01 | 3.10 | 1.82 | -14.85 | 0.1700 | -0.0097 | |||

| EQT / EQT Corporation | 0.04 | -72.18 | 1.82 | -73.10 | 0.1698 | -0.3984 | |||

| RPM / RPM International Inc. | 0.02 | 2.89 | 1.81 | -13.27 | 0.1693 | -0.0064 | |||

| DIS / The Walt Disney Company | 0.02 | -56.40 | 1.81 | -58.79 | 0.1691 | -0.1952 | |||

| PLD / Prologis, Inc. | 0.02 | 1.79 | 0.1678 | 0.1678 | |||||

| EXPD / Expeditors International of Washington, Inc. | 0.02 | -10.92 | 1.79 | -13.80 | 0.1677 | -0.0074 | |||

| UNP / Union Pacific Corporation | 0.01 | -1.13 | 1.79 | -12.81 | 0.1675 | -0.0021 | |||

| SSNC / SS&C Technologies Holdings, Inc. | 0.02 | -12.27 | 1.78 | -18.09 | 0.1661 | -0.0164 | |||

| TER / Teradyne, Inc. | 0.02 | 27.51 | 1.76 | -2.06 | 0.1649 | 0.0073 | |||

| NKE / NIKE, Inc. | 0.03 | 15.28 | 1.74 | -15.43 | 0.1630 | -0.0106 | |||

| DD / DuPont de Nemours, Inc. | 0.03 | -51.93 | 1.73 | -58.71 | 0.1622 | -0.1913 | |||

| PKI / Revvity Inc. | 0.02 | 2.01 | 1.73 | -24.43 | 0.1620 | -0.0310 | |||

| IQV / IQVIA Holdings Inc. | 0.01 | 7.79 | 1.73 | -17.03 | 0.1614 | -0.0136 | |||

| PFG / Principal Financial Group, Inc. | 0.02 | -6.43 | 1.72 | -15.78 | 0.1613 | -0.0089 | |||

| MAS / Masco Corporation | 0.03 | 0.92 | 1.71 | -22.88 | 0.1599 | -0.0267 | |||

| GEHC / GE HealthCare Technologies Inc. | 0.02 | -54.73 | 1.71 | -56.61 | 0.1599 | -0.1851 | |||

| US61747C5821 / Morgan Stanley Institutional Liquidity Funds - Treasury Portfolio | 1.23 | 10.32 | 1.23 | 10.38 | 0.1155 | 0.0212 | |||

| RGA / Reinsurance Group of America, Incorporated | 0.00 | -100.00 | 0.00 | -100.00 | -0.1822 | ||||

| NDSN / Nordson Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.1798 | ||||

| DAL / Delta Air Lines, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.9754 |