Mga Batayang Estadistika

| Nilai Portofolio | $ 367,202,179 |

| Posisi Saat Ini | 83 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

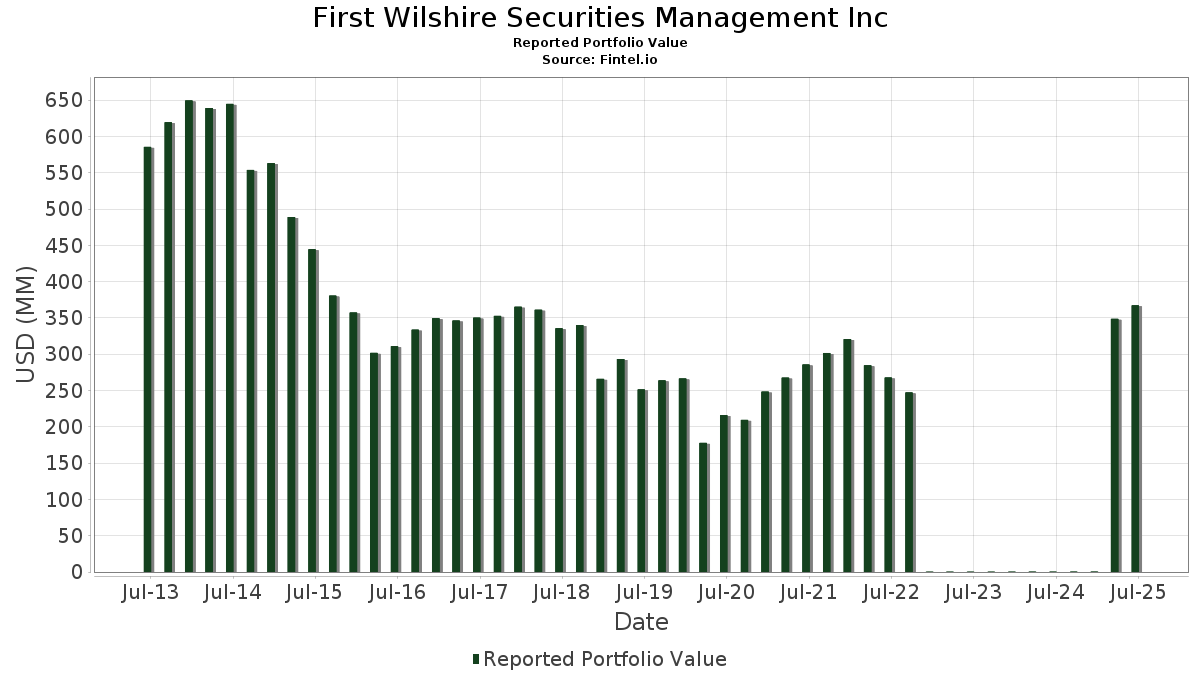

First Wilshire Securities Management Inc telah mengungkapkan total kepemilikan 83 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 367,202,179 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama First Wilshire Securities Management Inc adalah iShares Trust - iShares 0-3 Month Treasury Bond ETF (US:SGOV) , EZCORP, Inc. (US:EZPW) , Camtek Ltd. (US:CAMT) , Liberty Global Ltd. (US:LBTYA) , and Ecovyst Inc. (US:ECVT) . Posisi baru First Wilshire Securities Management Inc meliputi: Orion Group Holdings, Inc. (US:ORN) , Magnachip Semiconductor Corporation (US:MX) , Pure Cycle Corporation (US:PCYO) , Citigroup Inc. (US:C) , and . Industri unggulan First Wilshire Securities Management Inc adalah "Petroleum Refining And Related Industries" (sic 29) , "Motor Freight Transportation And Warehousing" (sic 42) , and "Mining And Quarrying Of Nonmetallic Minerals, Except Fuels" (sic 14) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.29 | 24.36 | 6.6326 | 3.3571 | |

| 0.70 | 7.26 | 1.9783 | 1.9783 | |

| 0.53 | 4.81 | 1.3108 | 1.3108 | |

| 0.47 | 15.16 | 4.1284 | 1.2642 | |

| 0.22 | 4.94 | 1.3461 | 1.0994 | |

| 0.53 | 12.78 | 3.4804 | 1.0887 | |

| 2.20 | 18.11 | 4.9321 | 0.9857 | |

| 1.30 | 3.80 | 1.0349 | 0.5885 | |

| 4.06 | 9.98 | 2.7191 | 0.5065 | |

| 0.46 | 1.83 | 0.4994 | 0.4994 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.38 | 38.26 | 10.4199 | -1.7591 | |

| 0.90 | 12.17 | 3.3150 | -1.4234 | |

| 0.70 | 4.55 | 1.2380 | -1.2560 | |

| 2.33 | 23.29 | 6.3424 | -1.2457 | |

| 2.26 | 31.35 | 8.5382 | -1.2199 | |

| 0.07 | 6.85 | 1.8661 | -1.0755 | |

| 0.19 | 5.33 | 1.4524 | -0.7027 | |

| 0.02 | 8.67 | 2.3611 | -0.3813 | |

| 0.46 | 4.76 | 1.2953 | -0.2907 | |

| 0.26 | 4.07 | 1.1079 | -0.2205 |

Pengajuan 13D/G

Ini adalah daftar pengajuan 13D dan 13G yang dibuat dalam setahun terakhir (jika ada). Klik ikon tautan untuk melihat riwayat transaksi lengkap. Baris berwarna hijau menunjukkan posisi baru. Baris berwarna merah menunjukkan posisi yang sudah ditutup.

| Tanggal File | Formulir | Keamanan | Sebelumnya Saham |

Saat ini Saham |

ΔPersentase Saham | % Kepemilikan |

% ΔKepemilikan | |

|---|---|---|---|---|---|---|---|---|

| 2025-02-13 | GIFI / Gulf Island Fabrication, Inc. | 1,002,339 | 980,333 | -2.20 | 6.00 | -3.23 | ||

| 2025-02-13 | MTRX / Matrix Service Company | 2,169,925 | 1,346,563 | -37.94 | 4.90 | -38.75 | ||

| 2025-02-13 | FGI / FGI Industries Ltd. | 872,056 | 745,183 | -14.55 | 7.80 | -17.89 | ||

| 2025-02-13 | SONX / Sonendo, Inc. | 33,000 | 7.90 | |||||

| 2025-02-13 | SILC / Silicom Ltd. | 499,563 | 390,700 | -21.79 | 6.30 | -7.35 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-14 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SGOV / iShares Trust - iShares 0-3 Month Treasury Bond ETF | 0.38 | -9.92 | 38.26 | -9.90 | 10.4199 | -1.7591 | |||

| EZPW / EZCORP, Inc. | 2.26 | -2.28 | 31.35 | -7.86 | 8.5382 | -1.2199 | |||

| CAMT / Camtek Ltd. | 0.29 | 47.85 | 24.36 | 113.25 | 6.6326 | 3.3571 | |||

| LBTYA / Liberty Global Ltd. | 2.33 | 1.21 | 23.29 | -11.98 | 6.3424 | -1.2457 | |||

| ECVT / Ecovyst Inc. | 2.20 | -0.85 | 18.11 | 31.61 | 4.9321 | 0.9857 | |||

| TPH / Tri Pointe Homes, Inc. | 0.47 | 51.65 | 15.16 | 51.79 | 4.1284 | 1.2642 | |||

| SD / SandRidge Energy, Inc. | 1.24 | 7.27 | 13.40 | 1.64 | 3.6496 | -0.1320 | |||

| NWPX / NWPX Infrastructure, Inc. | 0.33 | 0.01 | 13.35 | -0.69 | 3.6367 | -0.2199 | |||

| AVNW / Aviat Networks, Inc. | 0.53 | 22.15 | 12.78 | 53.26 | 3.4804 | 1.0887 | |||

| MTRX / Matrix Service Company | 0.90 | -32.21 | 12.17 | -26.32 | 3.3150 | -1.4234 | |||

| GILT / Gilat Satellite Networks Ltd. | 1.47 | 1.02 | 10.41 | 12.79 | 2.8345 | 0.1880 | |||

| CRNT / Ceragon Networks Ltd. | 4.06 | 23.63 | 9.98 | 29.41 | 2.7191 | 0.5065 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.02 | -0.60 | 8.67 | -9.33 | 2.3611 | -0.3813 | |||

| RELL / Richardson Electronics, Ltd. | 0.84 | 11.97 | 8.09 | -3.17 | 2.2024 | -0.1931 | |||

| TPC / Tutor Perini Corporation | 0.16 | -38.15 | 7.66 | 24.82 | 2.0861 | 0.3260 | |||

| HUN / Huntsman Corporation | 0.70 | 7.26 | 1.9783 | 1.9783 | |||||

| BIL / SPDR Series Trust - SPDR Bloomberg 1-3 Month T-Bill ETF | 0.07 | -33.19 | 6.85 | -33.20 | 1.8661 | -1.0755 | |||

| GIFI / Gulf Island Fabrication, Inc. | 1.02 | 4.14 | 6.78 | 7.21 | 1.8457 | 0.0327 | |||

| SILC / Silicom Ltd. | 0.39 | -1.03 | 6.02 | 2.85 | 1.6402 | -0.0389 | |||

| RBBN / Ribbon Communications Inc. | 1.33 | -0.45 | 5.34 | 1.85 | 1.4537 | -0.0496 | |||

| IMAX / IMAX Corporation | 0.19 | -33.11 | 5.33 | -29.03 | 1.4524 | -0.7027 | |||

| AGM / Federal Agricultural Mortgage Corporation | 0.03 | -0.50 | 5.31 | 3.09 | 1.4451 | -0.0310 | |||

| VTS / Vitesse Energy, Inc. | 0.22 | 539.66 | 4.94 | 474.65 | 1.3461 | 1.0994 | |||

| ORN / Orion Group Holdings, Inc. | 0.53 | 4.81 | 1.3108 | 1.3108 | |||||

| LBTYK / Liberty Global Ltd. | 0.46 | -0.15 | 4.76 | -14.00 | 1.2953 | -0.2907 | |||

| EWBC / East West Bancorp, Inc. | 0.05 | -3.18 | 4.75 | 8.92 | 1.2931 | 0.0429 | |||

| SIGA / SIGA Technologies, Inc. | 0.70 | -56.06 | 4.55 | -47.73 | 1.2380 | -1.2560 | |||

| LXFR / Luxfer Holdings PLC | 0.35 | -1.20 | 4.27 | 1.47 | 1.1626 | -0.0440 | |||

| LMNR / Limoneira Company | 0.26 | -0.55 | 4.07 | -12.18 | 1.1079 | -0.2205 | |||

| SATX / Satixfy Communications Ltd. | 1.30 | 0.00 | 3.80 | 144.22 | 1.0349 | 0.5885 | |||

| CRDA / Crawford & Co. - Class A | 0.35 | -0.95 | 3.69 | -8.25 | 1.0062 | -0.1485 | |||

| ANDE / The Andersons, Inc. | 0.10 | 3.10 | 3.56 | -11.74 | 0.9683 | -0.1870 | |||

| JEF / Jefferies Financial Group Inc. | 0.05 | -0.45 | 2.90 | 1.61 | 0.7891 | -0.0286 | |||

| MSFT / Microsoft Corporation | 0.00 | 0.00 | 1.99 | 32.51 | 0.5418 | 0.1112 | |||

| MX / Magnachip Semiconductor Corporation | 0.46 | 1.83 | 0.4994 | 0.4994 | |||||

| CRD.B / Crawford & Company | 0.14 | -2.31 | 1.50 | -10.61 | 0.4083 | -0.0729 | |||

| SGC / Superior Group of Companies, Inc. | 0.14 | -0.66 | 1.46 | -6.49 | 0.3967 | -0.0500 | |||

| SIRI / Sirius XM Holdings Inc. | 0.06 | -0.05 | 1.40 | 1.82 | 0.3818 | -0.0130 | |||

| PCYO / Pure Cycle Corporation | 0.12 | 1.27 | 0.3461 | 0.3461 | |||||

| XLY / The Select Sector SPDR Trust - The Consumer Discretionary Select Sector SPDR Fund | 0.01 | 0.00 | 1.26 | 10.14 | 0.3432 | 0.0148 | |||

| SCHD / Schwab Strategic Trust - Schwab U.S. Dividend Equity ETF | 0.04 | 0.00 | 1.16 | -5.22 | 0.3166 | -0.0352 | |||

| XLK / The Select Sector SPDR Trust - The Technology Select Sector SPDR Fund | 0.00 | 0.00 | 1.00 | 22.70 | 0.2724 | 0.0385 | |||

| CHKP / Check Point Software Technologies Ltd. | 0.00 | 0.00 | 0.95 | -2.86 | 0.2593 | -0.0220 | |||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.00 | 0.00 | 0.87 | 10.55 | 0.2371 | 0.0112 | |||

| GE / General Electric Company | 0.00 | 0.00 | 0.82 | 28.68 | 0.2236 | 0.0405 | |||

| MPC / Marathon Petroleum Corporation | 0.00 | 0.00 | 0.80 | 14.06 | 0.2165 | 0.0165 | |||

| TTEK / Tetra Tech, Inc. | 0.02 | 0.00 | 0.77 | 23.09 | 0.2105 | 0.0302 | |||

| VHT / Vanguard World Fund - Vanguard Health Care ETF | 0.00 | 0.00 | 0.76 | -6.20 | 0.2063 | -0.0253 | |||

| ATLX / Atlas Lithium Corporation | 0.19 | 210.31 | 0.71 | 126.92 | 0.1929 | 0.1034 | |||

| IHI / iShares Trust - iShares U.S. Medical Devices ETF | 0.01 | 0.00 | 0.71 | 3.97 | 0.1928 | -0.0023 | |||

| SHEL / Shell plc - Depositary Receipt (Common Stock) | 0.01 | 1.26 | 0.68 | -2.74 | 0.1841 | -0.0152 | |||

| BAC / Bank of America Corporation | 0.01 | 0.00 | 0.64 | 13.37 | 0.1734 | 0.0124 | |||

| XLF / The Select Sector SPDR Trust - The Financial Select Sector SPDR Fund | 0.01 | 0.00 | 0.63 | 5.04 | 0.1704 | -0.0003 | |||

| AMZN / Amazon.com, Inc. | 0.00 | 0.00 | 0.60 | 15.41 | 0.1633 | 0.0142 | |||

| SHV / iShares Trust - iShares Short Treasury Bond ETF | 0.01 | 1.05 | 0.58 | 0.88 | 0.1568 | -0.0067 | |||

| ABT / Abbott Laboratories | 0.00 | 0.00 | 0.54 | 2.64 | 0.1482 | -0.0040 | |||

| CSCO / Cisco Systems, Inc. | 0.01 | 0.00 | 0.53 | 12.47 | 0.1450 | 0.0092 | |||

| HD / The Home Depot, Inc. | 0.00 | 0.00 | 0.49 | 0.00 | 0.1323 | -0.0070 | |||

| DGX / Quest Diagnostics Incorporated | 0.00 | 0.00 | 0.42 | 6.30 | 0.1150 | 0.0009 | |||

| J / Jacobs Solutions Inc. | 0.00 | 0.00 | 0.40 | 8.77 | 0.1083 | 0.0034 | |||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 0.39 | -14.32 | 0.1061 | -0.0242 | |||

| IYT / iShares Trust - iShares U.S. Transportation ETF | 0.01 | 0.00 | 0.38 | 6.98 | 0.1045 | 0.0017 | |||

| XLC / The Select Sector SPDR Trust - The Communication Services Select Sector SPDR Fund | 0.00 | 0.00 | 0.38 | 12.46 | 0.1034 | 0.0066 | |||

| JNJ / Johnson & Johnson | 0.00 | 9.38 | 0.37 | 0.82 | 0.1000 | -0.0045 | |||

| FGI / FGI Industries Ltd. | 0.56 | -25.50 | 0.36 | -37.46 | 0.0978 | -0.0670 | |||

| GOOGL / Alphabet Inc. | 0.00 | 2.16 | 0.36 | 16.29 | 0.0975 | 0.0093 | |||

| VYM / Vanguard Whitehall Funds - Vanguard High Dividend Yield ETF | 0.00 | 0.00 | 0.35 | 3.28 | 0.0944 | -0.0018 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | 0.00 | 0.35 | 18.15 | 0.0942 | 0.0103 | |||

| PG / The Procter & Gamble Company | 0.00 | 0.00 | 0.32 | -6.47 | 0.0868 | -0.0110 | |||

| CMC / Commercial Metals Company | 0.01 | 0.00 | 0.32 | 6.02 | 0.0866 | 0.0008 | |||

| CUBI / Customers Bancorp, Inc. | 0.00 | 0.00 | 0.29 | 17.14 | 0.0784 | 0.0078 | |||

| GEV / GE Vernova Inc. | 0.00 | 0.28 | 0.0768 | 0.0768 | |||||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.00 | 0.00 | 0.28 | 10.67 | 0.0764 | 0.0036 | |||

| SHY / iShares Trust - iShares 1-3 Year Treasury Bond ETF | 0.00 | -4.50 | 0.28 | -4.45 | 0.0762 | -0.0077 | |||

| CVX / Chevron Corporation | 0.00 | 3.33 | 0.24 | -11.59 | 0.0665 | -0.0127 | |||

| NEAR / iShares U.S. ETF Trust - iShares Short Duration Bond Active ETF | 0.00 | 0.00 | 0.24 | 0.43 | 0.0642 | -0.0031 | |||

| C / Citigroup Inc. | 0.00 | 0.21 | 0.0585 | 0.0585 | |||||

| BILS / SPDR Series Trust - SPDR Bloomberg 3-12 Month T-Bill ETF | 0.00 | -2.42 | 0.21 | -2.30 | 0.0578 | -0.0046 | |||

| CHN / The China Fund, Inc. | 0.01 | -4.37 | 0.21 | 10.70 | 0.0565 | 0.0028 | |||

| PFE / Pfizer Inc. | 0.01 | -2.32 | 0.20 | -6.88 | 0.0555 | -0.0071 | |||

| PSTL / Postal Realty Trust, Inc. | 0.01 | 20.34 | 0.19 | 23.72 | 0.0528 | 0.0080 | |||

| PFXF / VanEck ETF Trust - VanEck Preferred Securities ex Financials ETF | 0.01 | -4.90 | 0.18 | -2.67 | 0.0496 | -0.0042 | |||

| SEED / Origin Agritech Limited | 0.02 | 0.00 | 0.02 | -50.00 | 0.0054 | -0.0055 | |||

| SNRE / Sunrise Communications AG - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 |