Mga Batayang Estadistika

| Nilai Portofolio | $ 23,406,744 |

| Posisi Saat Ini | 53 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

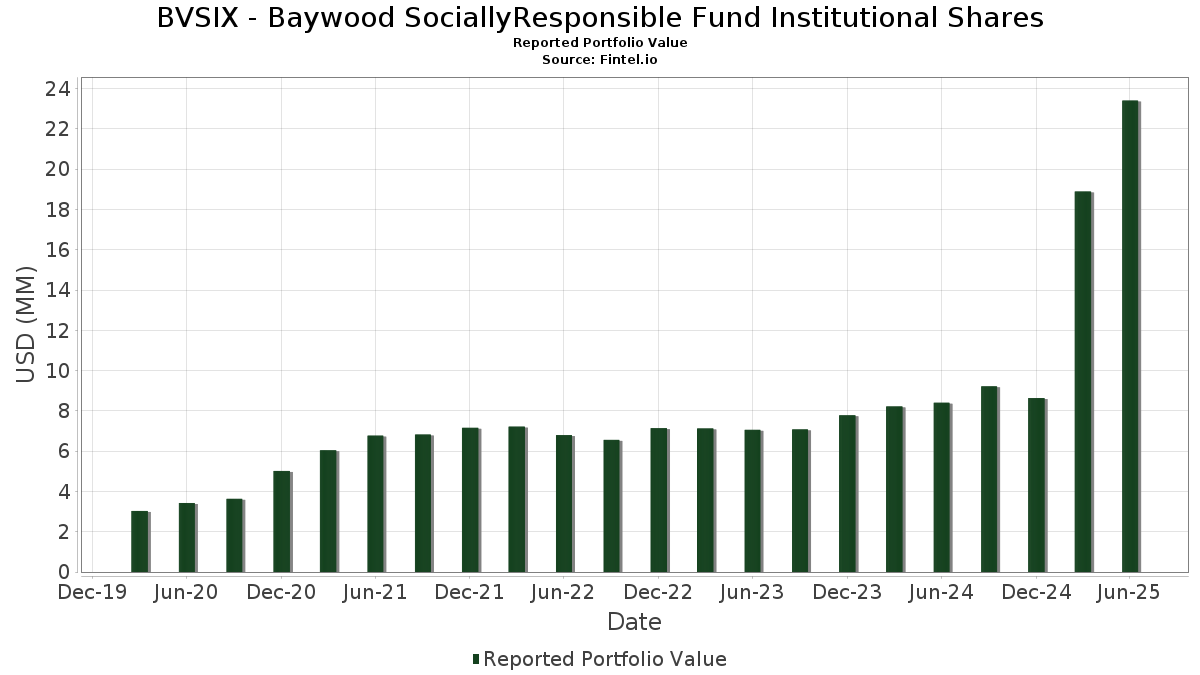

BVSIX - Baywood SociallyResponsible Fund Institutional Shares telah mengungkapkan total kepemilikan 53 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 23,406,744 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama BVSIX - Baywood SociallyResponsible Fund Institutional Shares adalah First American Funds Inc - First American Government Obligations Fund Class X (US:FGXXX) , nVent Electric plc (US:NVT) , W. R. Berkley Corporation (US:WRB) , American Express Company (US:AXP) , and Medtronic plc (US:MDT) . Posisi baru BVSIX - Baywood SociallyResponsible Fund Institutional Shares meliputi: NIKE, Inc. (US:NKE) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 2.39 | 2.39 | 10.2117 | 1.6265 | |

| 0.00 | 0.48 | 2.0477 | 1.1118 | |

| 0.00 | 0.35 | 1.5052 | 1.0144 | |

| 0.00 | 0.31 | 1.3334 | 0.6808 | |

| 0.00 | 0.14 | 0.6068 | 0.6068 | |

| 0.03 | 0.45 | 1.9395 | 0.5566 | |

| 0.00 | 0.36 | 1.5542 | 0.5459 | |

| 0.00 | 0.36 | 1.5385 | 0.5437 | |

| 0.01 | 0.75 | 3.1835 | 0.5038 | |

| 0.01 | 0.87 | 3.7225 | 0.4231 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.58 | 2.4894 | -0.8910 | |

| 0.00 | 0.58 | 2.4718 | -0.7556 | |

| 0.01 | 0.83 | 3.5611 | -0.7109 | |

| 0.02 | 0.72 | 3.0635 | -0.6185 | |

| 0.03 | 0.45 | 1.9168 | -0.6129 | |

| 0.01 | 0.52 | 2.2296 | -0.5755 | |

| 0.02 | 0.36 | 1.5566 | -0.5442 | |

| 0.02 | 0.53 | 2.2493 | -0.4731 | |

| 0.03 | 0.34 | 1.4658 | -0.3948 | |

| 0.00 | 0.22 | 0.9465 | -0.3828 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-14 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| FGXXX / First American Funds Inc - First American Government Obligations Fund Class X | 2.39 | 47.32 | 2.39 | 47.32 | 10.2117 | 1.6265 | |||

| NVT / nVent Electric plc | 0.01 | 0.00 | 0.87 | 39.81 | 3.7225 | 0.4231 | |||

| WRB / W. R. Berkley Corporation | 0.01 | 0.00 | 0.83 | 3.22 | 3.5611 | -0.7109 | |||

| AXP / American Express Company | 0.00 | 0.00 | 0.83 | 18.60 | 3.5417 | -0.1583 | |||

| MDT / Medtronic plc | 0.01 | 26.03 | 0.80 | 22.29 | 3.4248 | -0.0449 | |||

| KTB / Kontoor Brands, Inc. | 0.01 | 43.04 | 0.75 | 47.23 | 3.1835 | 0.5038 | |||

| KMI / Kinder Morgan, Inc. | 0.02 | 0.00 | 0.72 | 3.02 | 3.0635 | -0.6185 | |||

| IBM / International Business Machines Corporation | 0.00 | 9.09 | 0.71 | 29.25 | 3.0213 | 0.1278 | |||

| KVUE / Kenvue Inc. | 0.03 | 38.82 | 0.69 | 21.13 | 2.9407 | -0.0654 | |||

| US21871X1090 / Corebridge Financial, Inc. | 0.02 | 18.37 | 0.62 | 32.97 | 2.6379 | 0.1833 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 0.00 | 0.58 | -8.92 | 2.4894 | -0.8910 | |||

| CME / CME Group Inc. | 0.00 | -8.70 | 0.58 | -5.25 | 2.4718 | -0.7556 | |||

| T / AT&T Inc. | 0.02 | 0.00 | 0.53 | 2.33 | 2.2493 | -0.4731 | |||

| AIG / American International Group, Inc. | 0.01 | 0.00 | 0.52 | -1.51 | 2.2296 | -0.5755 | |||

| NXPI / NXP Semiconductors N.V. | 0.00 | 29.41 | 0.48 | 48.61 | 2.0527 | 0.3438 | |||

| APD / Air Products and Chemicals, Inc. | 0.00 | 183.33 | 0.48 | 172.16 | 2.0477 | 1.1118 | |||

| LH / Labcorp Holdings Inc. | 0.00 | 20.69 | 0.46 | 36.20 | 1.9618 | 0.1769 | |||

| XRAY / DENTSPLY SIRONA Inc. | 0.03 | 63.43 | 0.45 | 73.95 | 1.9395 | 0.5566 | |||

| HR / Healthcare Realty Trust Incorporated | 0.03 | 0.00 | 0.45 | -6.28 | 1.9168 | -0.6129 | |||

| BDX / Becton, Dickinson and Company | 0.00 | 47.06 | 0.43 | 10.54 | 1.8390 | -0.2207 | |||

| SOLV / Solventum Corporation | 0.01 | 36.59 | 0.42 | 36.33 | 1.8137 | 0.1647 | |||

| TPL / Texas Pacific Land Corporation | 0.00 | 33.33 | 0.42 | 6.30 | 1.8045 | -0.2979 | |||

| AZN / AstraZeneca PLC - Depositary Receipt (Common Stock) | 0.01 | 25.00 | 0.38 | 18.89 | 1.6413 | -0.0692 | |||

| GPK / Graphic Packaging Holding Company | 0.02 | 13.07 | 0.36 | -8.31 | 1.5566 | -0.5442 | |||

| GPC / Genuine Parts Company | 0.00 | 87.50 | 0.36 | 91.05 | 1.5542 | 0.5459 | |||

| CMI / Cummins Inc. | 0.00 | 83.33 | 0.36 | 91.49 | 1.5385 | 0.5437 | |||

| GOOGL / Alphabet Inc. | 0.00 | 233.33 | 0.35 | 282.61 | 1.5052 | 1.0144 | |||

| MMM / 3M Company | 0.00 | 21.05 | 0.35 | 25.45 | 1.4953 | 0.0194 | |||

| CSCO / Cisco Systems, Inc. | 0.01 | 13.64 | 0.35 | 27.68 | 1.4814 | 0.0453 | |||

| UNP / Union Pacific Corporation | 0.00 | 36.36 | 0.35 | 33.20 | 1.4738 | 0.0993 | |||

| AVTR / Avantor, Inc. | 0.03 | 17.51 | 0.34 | -2.28 | 1.4658 | -0.3948 | |||

| NTAP / NetApp, Inc. | 0.00 | 10.34 | 0.34 | 33.86 | 1.4561 | 0.1087 | |||

| MDLZ / Mondelez International, Inc. | 0.01 | 8.70 | 0.34 | 8.01 | 1.4400 | -0.2108 | |||

| WY / Weyerhaeuser Company | 0.01 | 98.46 | 0.33 | 74.21 | 1.4153 | 0.4086 | |||

| COHR / Coherent Corp. | 0.00 | 84.21 | 0.31 | 153.66 | 1.3334 | 0.6808 | |||

| O / Realty Income Corporation | 0.01 | 0.00 | 0.31 | -0.64 | 1.3214 | -0.3266 | |||

| BN / Brookfield Corporation | 0.00 | 25.16 | 0.31 | 47.60 | 1.3141 | 0.2121 | |||

| CLVT / Clarivate Plc | 0.06 | 0.00 | 0.26 | 9.54 | 1.1293 | -0.1491 | |||

| REGN / Regeneron Pharmaceuticals, Inc. | 0.00 | 66.67 | 0.26 | 37.89 | 1.1210 | 0.1146 | |||

| HAS / Hasbro, Inc. | 0.00 | 6.67 | 0.24 | 28.26 | 1.0088 | 0.0331 | |||

| CBOE / Cboe Global Markets, Inc. | 0.00 | 0.00 | 0.23 | 3.10 | 0.9959 | -0.2010 | |||

| TFC / Truist Financial Corporation | 0.01 | 0.00 | 0.23 | 4.50 | 0.9914 | -0.1839 | |||

| WEC / WEC Energy Group, Inc. | 0.00 | 15.79 | 0.23 | 10.63 | 0.9790 | -0.1162 | |||

| MRK / Merck & Co., Inc. | 0.00 | 0.00 | 0.22 | -11.95 | 0.9465 | -0.3828 | |||

| GLW / Corning Incorporated | 0.00 | 13.51 | 0.22 | 30.18 | 0.9433 | 0.0473 | |||

| PKG / Packaging Corporation of America | 0.00 | 22.22 | 0.21 | 16.29 | 0.8853 | -0.0574 | |||

| CMCSA / Comcast Corporation | 0.01 | 129.17 | 0.20 | 122.73 | 0.8383 | 0.3699 | |||

| PHG / Koninklijke Philips N.V. - Depositary Receipt (Common Stock) | 0.01 | 4.22 | 0.19 | -1.58 | 0.8014 | -0.2073 | |||

| DVN / Devon Energy Corporation | 0.01 | 23.26 | 0.17 | 5.00 | 0.7200 | -0.1306 | |||

| PEP / PepsiCo, Inc. | 0.00 | 0.00 | 0.16 | -11.73 | 0.6767 | -0.2750 | |||

| IBKR / Interactive Brokers Group, Inc. | 0.00 | 300.00 | 0.16 | 34.78 | 0.6626 | 0.0495 | |||

| NKE / NIKE, Inc. | 0.00 | 0.14 | 0.6068 | 0.6068 | |||||

| INTC / Intel Corporation | 0.01 | 0.00 | 0.13 | -1.57 | 0.5357 | -0.1370 |