Mga Batayang Estadistika

| Nilai Portofolio | $ 285,916,625 |

| Posisi Saat Ini | 169 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

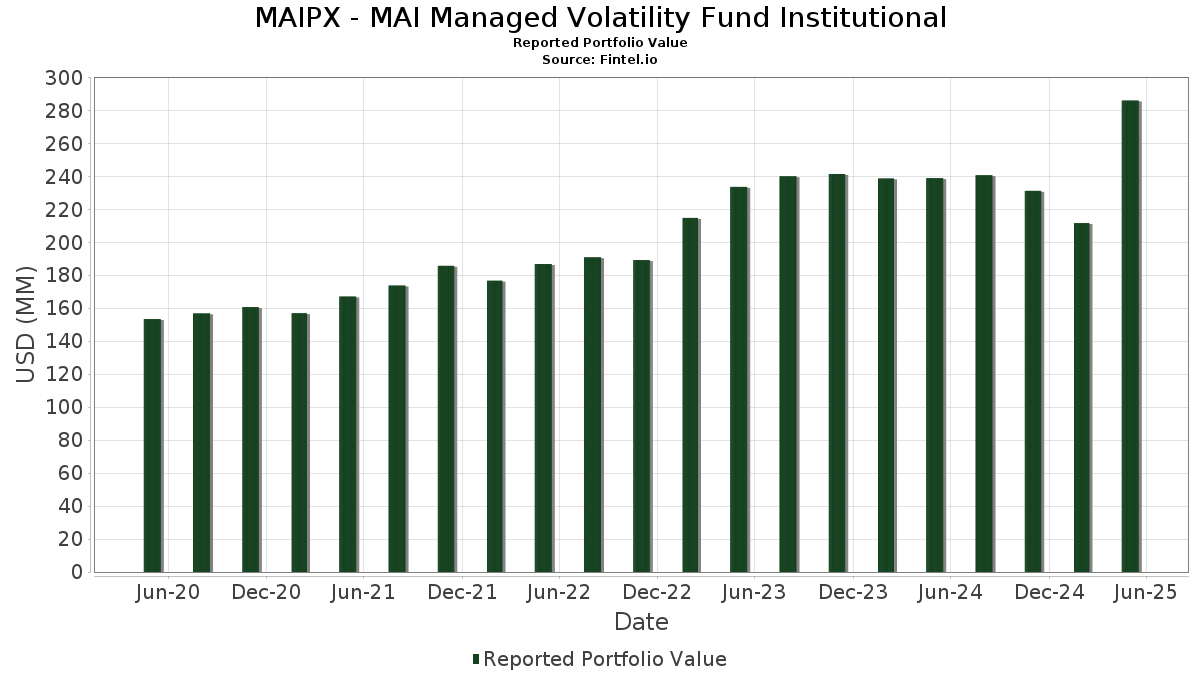

MAIPX - MAI Managed Volatility Fund Institutional telah mengungkapkan total kepemilikan 169 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 285,916,625 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama MAIPX - MAI Managed Volatility Fund Institutional adalah First American Funds Inc - First American Government Obligations Fund Class X (US:FGXXX) , Microsoft Corporation (US:MSFT) , Apple Inc. (US:AAPL) , United States Treasury Note/Bond (US:US91282CHL81) , and NVIDIA Corporation (US:NVDA) . Posisi baru MAIPX - MAI Managed Volatility Fund Institutional meliputi: United States Treasury Note/Bond (US:US91282CHL81) , United States Treasury Note/Bond (US:US91282CFP14) , Tesla, Inc. (US:TSLA) , Super Micro Computer, Inc. (IT:1SMCI) , and Palantir Technologies Inc. (US:PLTR) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 5.10 | 2.4305 | 2.4305 | ||

| 5.10 | 2.4305 | 2.4305 | ||

| 5.10 | 2.4305 | 2.4305 | ||

| 0.05 | 6.65 | 3.1684 | 1.9874 | |

| 0.03 | 6.41 | 3.0511 | 0.8276 | |

| 0.01 | 1.73 | 0.8249 | 0.8249 | |

| 0.02 | 9.09 | 4.3263 | 0.6667 | |

| 0.00 | 2.01 | 0.9576 | 0.1923 | |

| 9.89 | 4.7094 | 0.1368 | ||

| 9.89 | 4.7094 | 0.1368 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 1.18 | 0.5622 | -0.9248 | |

| 0.04 | 8.21 | 3.9078 | -0.7078 | |

| 0.00 | 0.39 | 0.1858 | -0.4754 | |

| 0.00 | 0.71 | 0.3374 | -0.4095 | |

| 30.62 | 30.62 | 14.5803 | -0.3712 | |

| 0.01 | 1.60 | 0.7635 | -0.2482 | |

| 0.01 | 0.31 | 0.1480 | -0.1451 | |

| -0.24 | -0.1142 | -0.1142 | ||

| -0.24 | -0.1142 | -0.1142 | ||

| -0.24 | -0.1142 | -0.1142 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-18 untuk periode pelaporan 2025-05-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| FGXXX / First American Funds Inc - First American Government Obligations Fund Class X | 30.62 | -4.34 | 30.62 | -4.34 | 14.5803 | -0.3712 | |||

| U.S. Treasury Note/Bond / DBT (US91282CKK61) | 10.06 | -0.27 | 4.7906 | 0.0790 | |||||

| U.S. Treasury Note/Bond / DBT (US91282CKK61) | 10.06 | -0.27 | 4.7906 | 0.0790 | |||||

| U.S. Treasury Note/Bond / DBT (US91282CKK61) | 10.06 | -0.27 | 4.7906 | 0.0790 | |||||

| U.S. Treasury Bill / DBT (US912797MH75) | 9.89 | 1.03 | 4.7094 | 0.1368 | |||||

| U.S. Treasury Bill / DBT (US912797MH75) | 9.89 | 1.03 | 4.7094 | 0.1368 | |||||

| U.S. Treasury Bill / DBT (US912797MH75) | 9.89 | 1.03 | 4.7094 | 0.1368 | |||||

| MSFT / Microsoft Corporation | 0.02 | 0.00 | 9.09 | 15.97 | 4.3263 | 0.6667 | |||

| AAPL / Apple Inc. | 0.04 | 0.00 | 8.21 | -16.95 | 3.9078 | -0.7078 | |||

| U.S. Treasury Note/Bond / DBT (US91282CLS88) | 7.51 | -0.04 | 3.5760 | 0.0668 | |||||

| U.S. Treasury Note/Bond / DBT (US91282CLS88) | 7.51 | -0.04 | 3.5760 | 0.0668 | |||||

| U.S. Treasury Note/Bond / DBT (US91282CLS88) | 7.51 | -0.04 | 3.5760 | 0.0668 | |||||

| US91282CHL81 / United States Treasury Note/Bond | 7.50 | -0.09 | 3.5719 | 0.0646 | |||||

| NVDA / NVIDIA Corporation | 0.05 | 143.28 | 6.65 | 163.17 | 3.1684 | 1.9874 | |||

| AVGO / Broadcom Inc. | 0.03 | 10.89 | 6.41 | 34.60 | 3.0511 | 0.8276 | |||

| V / Visa Inc. | 0.01 | 0.00 | 5.21 | 0.68 | 2.4797 | 0.0638 | |||

| U.S. Treasury Inflation Indexed Bonds / DBT (US91282CML27) | 5.10 | 2.4305 | 2.4305 | ||||||

| U.S. Treasury Inflation Indexed Bonds / DBT (US91282CML27) | 5.10 | 2.4305 | 2.4305 | ||||||

| U.S. Treasury Inflation Indexed Bonds / DBT (US91282CML27) | 5.10 | 2.4305 | 2.4305 | ||||||

| U.S. Treasury Note/Bond / DBT (US91282CLY56) | 5.02 | -0.04 | 2.3893 | 0.0447 | |||||

| U.S. Treasury Note/Bond / DBT (US91282CLY56) | 5.02 | -0.04 | 2.3893 | 0.0447 | |||||

| U.S. Treasury Note/Bond / DBT (US91282CMB45) | 5.02 | 0.24 | 2.3888 | 0.0510 | |||||

| U.S. Treasury Note/Bond / DBT (US91282CMB45) | 5.02 | 0.24 | 2.3888 | 0.0510 | |||||

| U.S. Treasury Note/Bond / DBT (US91282CMB45) | 5.02 | 0.24 | 2.3888 | 0.0510 | |||||

| GOOGL / Alphabet Inc. | 0.03 | 0.00 | 4.92 | 0.86 | 2.3438 | 0.0642 | |||

| META / Meta Platforms, Inc. | 0.01 | 0.00 | 4.72 | -3.10 | 2.2473 | -0.0276 | |||

| AMZN / Amazon.com, Inc. | 0.02 | 0.00 | 4.58 | -3.41 | 2.1828 | -0.0343 | |||

| ORCL / Oracle Corporation | 0.02 | -5.22 | 3.85 | -5.52 | 1.8350 | -0.0701 | |||

| HD / The Home Depot, Inc. | 0.01 | 0.00 | 3.69 | -7.15 | 1.7556 | -0.0989 | |||

| JPM / JPMorgan Chase & Co. | 0.01 | 0.00 | 3.39 | -0.24 | 1.6162 | 0.0269 | |||

| US91282CFP14 / United States Treasury Note/Bond | 3.00 | -0.03 | 1.4282 | 0.0268 | |||||

| NOW / ServiceNow, Inc. | 0.00 | 0.00 | 2.47 | 8.76 | 1.1767 | 0.1153 | |||

| NEE / NextEra Energy, Inc. | 0.03 | -9.19 | 2.40 | -8.58 | 1.1418 | -0.0834 | |||

| BAC / Bank of America Corporation | 0.05 | -4.56 | 2.22 | -8.65 | 1.0564 | -0.0779 | |||

| ABT / Abbott Laboratories | 0.02 | 0.00 | 2.12 | -3.20 | 1.0073 | -0.0136 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 0.00 | 2.11 | -1.91 | 1.0040 | -0.0001 | |||

| CB / Chubb Limited | 0.01 | 0.00 | 2.10 | 4.12 | 0.9991 | 0.0577 | |||

| HON / Honeywell International Inc. | 0.01 | 0.00 | 2.04 | 6.47 | 0.9722 | 0.0765 | |||

| INTU / Intuit Inc. | 0.00 | 0.00 | 2.01 | 22.77 | 0.9576 | 0.1923 | |||

| RTX / RTX Corporation | 0.01 | 0.00 | 2.00 | 2.62 | 0.9512 | 0.0420 | |||

| U.S. Treasury Bill / DBT (US912797LN52) | 2.00 | 1.06 | 0.9512 | 0.0280 | |||||

| U.S. Treasury Bill / DBT (US912797LN52) | 2.00 | 1.06 | 0.9512 | 0.0280 | |||||

| U.S. Treasury Bill / DBT (US912797LN52) | 2.00 | 1.06 | 0.9512 | 0.0280 | |||||

| QCOM / QUALCOMM Incorporated | 0.01 | 0.00 | 1.84 | -7.64 | 0.8750 | -0.0541 | |||

| ABBV / AbbVie Inc. | 0.01 | 0.00 | 1.76 | -10.95 | 0.8368 | -0.0851 | |||

| CSCO / Cisco Systems, Inc. | 0.03 | 0.00 | 1.73 | -1.70 | 0.8260 | 0.0020 | |||

| TSLA / Tesla, Inc. | 0.01 | 1.73 | 0.8249 | 0.8249 | |||||

| WMT / Walmart Inc. | 0.02 | 0.00 | 1.70 | 0.12 | 0.8116 | 0.0164 | |||

| AMGN / Amgen Inc. | 0.01 | -20.86 | 1.60 | -25.96 | 0.7635 | -0.2482 | |||

| WFC / Wells Fargo & Company | 0.02 | 0.00 | 1.46 | -4.52 | 0.6942 | -0.0190 | |||

| AMD / Advanced Micro Devices, Inc. | 0.01 | 0.00 | 1.38 | 10.93 | 0.6573 | 0.0758 | |||

| KMI / Kinder Morgan, Inc. | 0.05 | 0.00 | 1.35 | 3.45 | 0.6427 | 0.0334 | |||

| COST / Costco Wholesale Corporation | 0.00 | 0.00 | 1.32 | -0.75 | 0.6290 | 0.0070 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | -41.65 | 1.18 | -62.93 | 0.5622 | -0.9248 | |||

| MET / MetLife, Inc. | 0.01 | 0.00 | 1.16 | -8.79 | 0.5534 | -0.0419 | |||

| DIS / The Walt Disney Company | 0.01 | 0.00 | 1.14 | -0.61 | 0.5405 | 0.0067 | |||

| SCHW / The Charles Schwab Corporation | 0.01 | 0.00 | 1.12 | 11.07 | 0.5356 | 0.0626 | |||

| UNP / Union Pacific Corporation | 0.00 | 0.00 | 1.09 | -10.14 | 0.5192 | -0.0476 | |||

| CMCSA / Comcast Corporation | 0.03 | -7.37 | 1.03 | -10.75 | 0.4906 | -0.0486 | |||

| MPC / Marathon Petroleum Corporation | 0.01 | 0.00 | 0.93 | 7.00 | 0.4445 | 0.0371 | |||

| C / Citigroup Inc. | 0.01 | 0.00 | 0.90 | -5.75 | 0.4291 | -0.0177 | |||

| MDT / Medtronic plc | 0.01 | 0.00 | 0.89 | -9.82 | 0.4246 | -0.0373 | |||

| MCD / McDonald's Corporation | 0.00 | 0.00 | 0.88 | 1.85 | 0.4205 | 0.0153 | |||

| PG / The Procter & Gamble Company | 0.00 | 0.00 | 0.83 | -2.24 | 0.3949 | -0.0015 | |||

| MDLZ / Mondelez International, Inc. | 0.01 | -23.14 | 0.79 | -19.32 | 0.3743 | -0.0803 | |||

| XOM / Exxon Mobil Corporation | 0.01 | 0.00 | 0.75 | -8.10 | 0.3570 | -0.0241 | |||

| UPS / United Parcel Service, Inc. | 0.01 | 0.00 | 0.75 | -18.05 | 0.3567 | -0.0703 | |||

| AMT / American Tower Corporation | 0.00 | -21.94 | 0.74 | -18.53 | 0.3542 | -0.0722 | |||

| BA / The Boeing Company | 0.00 | 0.00 | 0.73 | 18.67 | 0.3484 | 0.0605 | |||

| T / AT&T Inc. | 0.03 | -25.37 | 0.71 | -24.28 | 0.3388 | -0.1003 | |||

| JNJ / Johnson & Johnson | 0.00 | -52.89 | 0.71 | -55.72 | 0.3374 | -0.4095 | |||

| WY / Weyerhaeuser Company | 0.03 | 0.00 | 0.65 | -14.00 | 0.3104 | -0.0433 | |||

| APD / Air Products and Chemicals, Inc. | 0.00 | 0.00 | 0.65 | -11.75 | 0.3079 | -0.0344 | |||

| NKE / NIKE, Inc. | 0.01 | 0.00 | 0.64 | -23.78 | 0.3042 | -0.0870 | |||

| CVS / CVS Health Corporation | 0.01 | 0.00 | 0.61 | -2.56 | 0.2906 | -0.0019 | |||

| USB / U.S. Bancorp | 0.01 | 0.00 | 0.60 | -6.97 | 0.2863 | -0.0159 | |||

| DEO / Diageo plc - Depositary Receipt (Common Stock) | 0.01 | 0.00 | 0.59 | 0.17 | 0.2791 | 0.0058 | |||

| CVX / Chevron Corporation | 0.00 | 0.00 | 0.57 | -13.81 | 0.2707 | -0.0374 | |||

| BMY / Bristol-Myers Squibb Company | 0.01 | 0.00 | 0.54 | -19.00 | 0.2560 | -0.0541 | |||

| MRK / Merck & Co., Inc. | 0.01 | 0.00 | 0.52 | -16.83 | 0.2475 | -0.0440 | |||

| EOG / EOG Resources, Inc. | 0.00 | 0.00 | 0.52 | -14.57 | 0.2461 | -0.0362 | |||

| PFE / Pfizer Inc. | 0.02 | 0.00 | 0.49 | -11.09 | 0.2331 | -0.0242 | |||

| FTNT / Fortinet, Inc. | 0.00 | 0.00 | 0.49 | -5.60 | 0.2329 | -0.0095 | |||

| BUD / Anheuser-Busch InBev SA/NV - Depositary Receipt (Common Stock) | 0.01 | 0.00 | 0.40 | 17.75 | 0.1900 | 0.0318 | |||

| PEP / PepsiCo, Inc. | 0.00 | -67.82 | 0.39 | -72.44 | 0.1858 | -0.4754 | |||

| CARR / Carrier Global Corporation | 0.01 | 0.00 | 0.38 | 9.74 | 0.1828 | 0.0196 | |||

| MO / Altria Group, Inc. | 0.01 | -54.36 | 0.31 | -50.56 | 0.1480 | -0.1451 | |||

| INTC / Intel Corporation | 0.02 | 0.00 | 0.30 | -17.81 | 0.1433 | -0.0273 | |||

| SLB / Schlumberger Limited | 0.01 | 0.00 | 0.29 | -20.81 | 0.1400 | -0.0331 | |||

| OTIS / Otis Worldwide Corporation | 0.00 | 0.00 | 0.26 | -4.46 | 0.1224 | -0.0032 | |||

| OXY / Occidental Petroleum Corporation | 0.00 | 0.00 | 0.14 | -16.67 | 0.0645 | -0.0113 | |||

| 1SMCI / Super Micro Computer, Inc. | 0.00 | 0.12 | 0.0551 | 0.0551 | |||||

| WBD / Warner Bros. Discovery, Inc. | 0.01 | 0.00 | 0.08 | -13.68 | 0.0394 | -0.0050 | |||

| PLTR / Palantir Technologies Inc. | 0.00 | 0.07 | 0.0349 | 0.0349 | |||||

| VTRS / Viatris Inc. | 0.00 | 0.00 | 0.02 | -4.35 | 0.0108 | -0.0003 | |||

| OXY.WS / Occidental Petroleum Corporation - Equity Warrant | 0.01 | -27.27 | 0.0038 | -0.0014 | |||||

| OGN / Organon & Co. | 0.00 | 0.00 | 0.01 | -40.00 | 0.0030 | -0.0017 | |||

| CBOE S&P 500 INDEX / DE (43W992E32) | -0.00 | -0.0009 | -0.0009 | ||||||

| CBOE S&P 500 INDEX / DE (43W992E32) | -0.00 | -0.0009 | -0.0009 | ||||||

| CBOE S&P 500 INDEX / DE (43W992E32) | -0.00 | -0.0009 | -0.0009 | ||||||

| CBOE S&P 500 INDEX / DE (43W992FL1) | -0.00 | -0.0014 | -0.0014 | ||||||

| CBOE S&P 500 INDEX / DE (43W992FL1) | -0.00 | -0.0014 | -0.0014 | ||||||

| CBOE S&P 500 INDEX / DE (43W992FL1) | -0.00 | -0.0014 | -0.0014 | ||||||

| CBOE S&P 500 INDEX / DE (N/A) | -0.00 | -0.0015 | -0.0015 | ||||||

| CBOE S&P 500 INDEX / DE (N/A) | -0.00 | -0.0015 | -0.0015 | ||||||

| CBOE S&P 500 INDEX / DE (N/A) | -0.00 | -0.0015 | -0.0015 | ||||||

| CBOE S&P 500 INDEX / DE (43W992HK1) | -0.00 | -0.0015 | -0.0015 | ||||||

| CBOE S&P 500 INDEX / DE (43W992HK1) | -0.00 | -0.0015 | -0.0015 | ||||||

| CBOE S&P 500 INDEX / DE (43W992HK1) | -0.00 | -0.0015 | -0.0015 | ||||||

| CBOE S&P 500 INDEX / DE (N/A) | -0.00 | -0.0018 | -0.0018 | ||||||

| CBOE S&P 500 INDEX / DE (N/A) | -0.00 | -0.0018 | -0.0018 | ||||||

| CBOE S&P 500 INDEX / DE (N/A) | -0.00 | -0.0018 | -0.0018 | ||||||

| CBOE S&P 500 INDEX / DE (N/A) | -0.01 | -0.0036 | -0.0036 | ||||||

| CBOE S&P 500 INDEX / DE (N/A) | -0.01 | -0.0036 | -0.0036 | ||||||

| CBOE S&P 500 INDEX / DE (N/A) | -0.01 | -0.0036 | -0.0036 | ||||||

| CBOE S&P 500 INDEX / DE (594998A30) | -0.01 | -0.0046 | -0.0046 | ||||||

| CBOE S&P 500 INDEX / DE (594998A30) | -0.01 | -0.0046 | -0.0046 | ||||||

| CBOE S&P 500 INDEX / DE (594998A30) | -0.01 | -0.0046 | -0.0046 | ||||||

| CBOE S&P 500 INDEX / DE (594998BS4) | -0.01 | -0.0048 | -0.0048 | ||||||

| CBOE S&P 500 INDEX / DE (594998BS4) | -0.01 | -0.0048 | -0.0048 | ||||||

| CBOE S&P 500 INDEX / DE (594998BS4) | -0.01 | -0.0048 | -0.0048 | ||||||

| CBOE S&P 500 INDEX / DE (43W992E65) | -0.01 | -0.0049 | -0.0049 | ||||||

| CBOE S&P 500 INDEX / DE (43W992E65) | -0.01 | -0.0049 | -0.0049 | ||||||

| CBOE S&P 500 INDEX / DE (43W992E65) | -0.01 | -0.0049 | -0.0049 | ||||||

| CBOE S&P 500 INDEX / DE (43W992EH1) | -0.03 | -0.0138 | -0.0138 | ||||||

| CBOE S&P 500 INDEX / DE (43W992EH1) | -0.03 | -0.0138 | -0.0138 | ||||||

| CBOE S&P 500 INDEX / DE (43W992EH1) | -0.03 | -0.0138 | -0.0138 | ||||||

| CBOE S&P 500 INDEX / DE (N/A) | -0.03 | -0.0139 | -0.0139 | ||||||

| CBOE S&P 500 INDEX / DE (N/A) | -0.03 | -0.0139 | -0.0139 | ||||||

| CBOE S&P 500 INDEX / DE (N/A) | -0.03 | -0.0139 | -0.0139 | ||||||

| CBOE S&P 500 INDEX / DE (N/A) | -0.03 | -0.0159 | -0.0159 | ||||||

| CBOE S&P 500 INDEX / DE (N/A) | -0.03 | -0.0159 | -0.0159 | ||||||

| CBOE S&P 500 INDEX / DE (N/A) | -0.03 | -0.0159 | -0.0159 | ||||||

| CBOE S&P 500 INDEX / DE (59299RMB9) | -0.04 | -0.0202 | -0.0202 | ||||||

| CBOE S&P 500 INDEX / DE (59299RMB9) | -0.04 | -0.0202 | -0.0202 | ||||||

| CBOE S&P 500 INDEX / DE (59299RMB9) | -0.04 | -0.0202 | -0.0202 | ||||||

| CBOE S&P 500 INDEX / DE (N/A) | -0.11 | -0.0533 | -0.0533 | ||||||

| CBOE S&P 500 INDEX / DE (N/A) | -0.11 | -0.0533 | -0.0533 | ||||||

| CBOE S&P 500 INDEX / DE (N/A) | -0.11 | -0.0533 | -0.0533 | ||||||

| CBOE S&P 500 INDEX / DE (N/A) | -0.12 | -0.0559 | -0.0559 | ||||||

| CBOE S&P 500 INDEX / DE (N/A) | -0.12 | -0.0559 | -0.0559 | ||||||

| CBOE S&P 500 INDEX / DE (N/A) | -0.12 | -0.0559 | -0.0559 | ||||||

| CBOE S&P 500 INDEX / DE (N/A) | -0.13 | -0.0597 | -0.0597 | ||||||

| CBOE S&P 500 INDEX / DE (N/A) | -0.13 | -0.0597 | -0.0597 | ||||||

| CBOE S&P 500 INDEX / DE (N/A) | -0.13 | -0.0597 | -0.0597 | ||||||

| CBOE S&P 500 INDEX / DE (57199JM89) | -0.13 | -0.0602 | -0.0602 | ||||||

| CBOE S&P 500 INDEX / DE (57199JM89) | -0.13 | -0.0602 | -0.0602 | ||||||

| CBOE S&P 500 INDEX / DE (57199JM89) | -0.13 | -0.0602 | -0.0602 | ||||||

| CBOE S&P 500 INDEX / DE (57Q99V519) | -0.13 | -0.0628 | -0.0628 | ||||||

| CBOE S&P 500 INDEX / DE (57Q99V519) | -0.13 | -0.0628 | -0.0628 | ||||||

| CBOE S&P 500 INDEX / DE (57Q99V519) | -0.13 | -0.0628 | -0.0628 | ||||||

| CBOE S&P 500 INDEX / DE (N/A) | -0.15 | -0.0715 | -0.0715 | ||||||

| CBOE S&P 500 INDEX / DE (N/A) | -0.15 | -0.0715 | -0.0715 | ||||||

| CBOE S&P 500 INDEX / DE (N/A) | -0.15 | -0.0715 | -0.0715 | ||||||

| CBOE S&P 500 INDEX / DE (N/A) | -0.17 | -0.0789 | -0.0789 | ||||||

| CBOE S&P 500 INDEX / DE (N/A) | -0.17 | -0.0789 | -0.0789 | ||||||

| CBOE S&P 500 INDEX / DE (N/A) | -0.17 | -0.0789 | -0.0789 | ||||||

| CBOE S&P 500 INDEX / DE (N/A) | -0.20 | -0.0939 | -0.0939 | ||||||

| CBOE S&P 500 INDEX / DE (N/A) | -0.20 | -0.0939 | -0.0939 | ||||||

| CBOE S&P 500 INDEX / DE (N/A) | -0.20 | -0.0939 | -0.0939 | ||||||

| CBOE S&P 500 INDEX / DE (58999TEY9) | -0.22 | -0.1057 | -0.1057 | ||||||

| CBOE S&P 500 INDEX / DE (58999TEY9) | -0.22 | -0.1057 | -0.1057 | ||||||

| CBOE S&P 500 INDEX / DE (58999TEY9) | -0.22 | -0.1057 | -0.1057 | ||||||

| CBOE S&P 500 INDEX / DE (N/A) | -0.23 | -0.1099 | -0.1099 | ||||||

| CBOE S&P 500 INDEX / DE (N/A) | -0.23 | -0.1099 | -0.1099 | ||||||

| CBOE S&P 500 INDEX / DE (N/A) | -0.23 | -0.1099 | -0.1099 | ||||||

| CBOE S&P 500 INDEX / DE (N/A) | -0.24 | -0.1142 | -0.1142 | ||||||

| CBOE S&P 500 INDEX / DE (N/A) | -0.24 | -0.1142 | -0.1142 | ||||||

| CBOE S&P 500 INDEX / DE (N/A) | -0.24 | -0.1142 | -0.1142 |