Mga Batayang Estadistika

| Nilai Portofolio | $ 382,953,984 |

| Posisi Saat Ini | 51 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

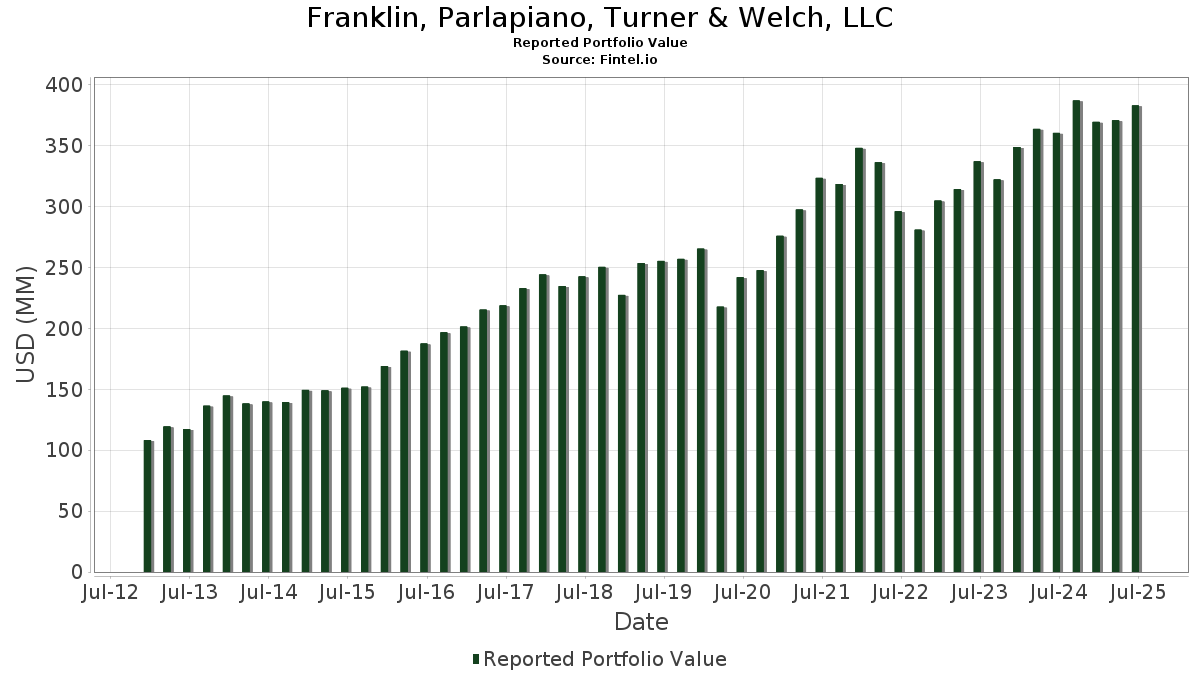

Franklin, Parlapiano, Turner & Welch, LLC telah mengungkapkan total kepemilikan 51 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 382,953,984 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Franklin, Parlapiano, Turner & Welch, LLC adalah Vanguard Index Funds - Vanguard S&P 500 ETF (US:VOO) , iShares Trust - iShares Residential and Multisector Real Estate ETF (US:REZ) , Vanguard Bond Index Funds - Vanguard Intermediate-Term Bond ETF (US:BIV) , iShares Trust - iShares Russell 1000 ETF (US:IWB) , and Microsoft Corporation (US:MSFT) . Posisi baru Franklin, Parlapiano, Turner & Welch, LLC meliputi: Netflix, Inc. (US:NFLX) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.12 | 68.64 | 17.9225 | 1.5367 | |

| 0.02 | 12.34 | 3.2222 | 0.7214 | |

| 0.02 | 9.52 | 2.4848 | 0.3919 | |

| 0.10 | 34.27 | 8.9496 | 0.3775 | |

| 0.07 | 7.57 | 1.9774 | 0.1813 | |

| 0.06 | 10.01 | 2.6142 | 0.1500 | |

| 0.08 | 9.18 | 2.3965 | 0.1229 | |

| 0.01 | 5.04 | 1.3148 | 0.0859 | |

| 0.00 | 0.29 | 0.0748 | 0.0748 | |

| 0.07 | 10.47 | 2.7333 | 0.0742 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.47 | 39.10 | 10.2090 | -0.7877 | |

| 0.04 | 6.23 | 1.6264 | -0.3766 | |

| 0.09 | 8.92 | 2.3287 | -0.3350 | |

| 0.09 | 9.58 | 2.5024 | -0.3203 | |

| 0.03 | 7.60 | 1.9853 | -0.2415 | |

| 0.05 | 7.72 | 2.0155 | -0.2159 | |

| 0.05 | 8.11 | 2.1186 | -0.2118 | |

| 0.03 | 10.48 | 2.7365 | -0.1803 | |

| 0.48 | 37.48 | 9.7858 | -0.1733 | |

| 0.05 | 6.74 | 1.7607 | -0.1544 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-25 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.12 | 2.21 | 68.64 | 12.97 | 17.9225 | 1.5367 | |||

| REZ / iShares Trust - iShares Residential and Multisector Real Estate ETF | 0.47 | 0.64 | 39.10 | -4.12 | 10.2090 | -0.7877 | |||

| BIV / Vanguard Bond Index Funds - Vanguard Intermediate-Term Bond ETF | 0.48 | 0.48 | 37.48 | 1.49 | 9.7858 | -0.1733 | |||

| IWB / iShares Trust - iShares Russell 1000 ETF | 0.10 | -2.59 | 34.27 | 7.83 | 8.9496 | 0.3775 | |||

| MSFT / Microsoft Corporation | 0.02 | 0.43 | 12.34 | 33.08 | 3.2222 | 0.7214 | |||

| V / Visa Inc. | 0.03 | -4.35 | 10.48 | -3.10 | 2.7365 | -0.1803 | |||

| RTX / RTX Corporation | 0.07 | -3.69 | 10.47 | 6.17 | 2.7333 | 0.0742 | |||

| HLI / Houlihan Lokey, Inc. | 0.06 | -1.66 | 10.01 | 9.58 | 2.6142 | 0.1500 | |||

| XOM / Exxon Mobil Corporation | 0.09 | 1.02 | 9.58 | -8.44 | 2.5024 | -0.3203 | |||

| HUBB / Hubbell Incorporated | 0.02 | -0.64 | 9.52 | 22.62 | 2.4848 | 0.3919 | |||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0.08 | 0.29 | 9.18 | 8.86 | 2.3965 | 0.1229 | |||

| WEC / WEC Energy Group, Inc. | 0.09 | -5.56 | 8.92 | -9.71 | 2.3287 | -0.3350 | |||

| PG / The Procter & Gamble Company | 0.05 | 0.44 | 8.11 | -6.10 | 2.1186 | -0.2118 | |||

| APD / Air Products and Chemicals, Inc. | 0.03 | 1.05 | 8.05 | -3.35 | 2.1030 | -0.1444 | |||

| EXPD / Expeditors International of Washington, Inc. | 0.07 | 1.14 | 7.76 | -3.90 | 2.0273 | -0.1516 | |||

| MDT / Medtronic plc | 0.09 | 0.55 | 7.73 | -2.46 | 2.0176 | -0.1189 | |||

| JNJ / Johnson & Johnson | 0.05 | 1.28 | 7.72 | -6.71 | 2.0155 | -0.2159 | |||

| PSA / Public Storage | 0.03 | 1.20 | 7.67 | -0.79 | 2.0020 | -0.0822 | |||

| CHKP / Check Point Software Technologies Ltd. | 0.03 | 2.78 | 7.65 | -0.23 | 1.9971 | -0.0703 | |||

| MMC / Marsh & McLennan Companies, Inc. | 0.03 | 2.77 | 7.60 | -7.92 | 1.9853 | -0.2415 | |||

| CNI / Canadian National Railway Company | 0.07 | 6.52 | 7.57 | 13.71 | 1.9774 | 0.1813 | |||

| ACN / Accenture plc | 0.02 | 1.48 | 7.28 | -2.79 | 1.9002 | -0.1188 | |||

| PEP / PepsiCo, Inc. | 0.05 | 7.83 | 6.74 | -5.04 | 1.7607 | -0.1544 | |||

| BDX / Becton, Dickinson and Company | 0.04 | 11.53 | 6.23 | -16.13 | 1.6264 | -0.3766 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.01 | 0.00 | 5.04 | 10.51 | 1.3148 | 0.0859 | |||

| PSX / Phillips 66 | 0.03 | 0.00 | 3.88 | -3.39 | 1.0130 | -0.0699 | |||

| IWM / iShares Trust - iShares Russell 2000 ETF | 0.02 | 0.00 | 3.35 | 8.16 | 0.8761 | 0.0396 | |||

| COP / ConocoPhillips | 0.03 | 0.00 | 2.54 | -14.55 | 0.6639 | -0.1386 | |||

| VV / Vanguard Index Funds - Vanguard Large-Cap ETF | 0.01 | 0.00 | 2.50 | 11.00 | 0.6534 | 0.0454 | |||

| AAPL / Apple Inc. | 0.01 | 0.00 | 2.17 | -7.63 | 0.5662 | -0.0669 | |||

| IJR / iShares Trust - iShares Core S&P Small-Cap ETF | 0.02 | 0.00 | 1.99 | 4.52 | 0.5197 | 0.0061 | |||

| IWF / iShares Trust - iShares Russell 1000 Growth ETF | 0.00 | 0.00 | 1.69 | 17.59 | 0.4416 | 0.0537 | |||

| EFA / iShares Trust - iShares MSCI EAFE ETF | 0.01 | 0.00 | 1.28 | 9.37 | 0.3354 | 0.0187 | |||

| WMT / Walmart Inc. | 0.01 | 0.00 | 0.94 | 11.36 | 0.2459 | 0.0179 | |||

| NVDA / NVIDIA Corporation | 0.01 | 0.00 | 0.83 | 45.87 | 0.2168 | 0.0632 | |||

| VB / Vanguard Index Funds - Vanguard Small-Cap ETF | 0.00 | 0.00 | 0.79 | 6.88 | 0.2070 | 0.0069 | |||

| VNQ / Vanguard Specialized Funds - Vanguard Real Estate ETF | 0.01 | 0.00 | 0.77 | -1.67 | 0.1999 | -0.0100 | |||

| EEM / iShares, Inc. - iShares MSCI Emerging Markets ETF | 0.01 | -2.00 | 0.68 | 8.08 | 0.1783 | 0.0081 | |||

| CL / Colgate-Palmolive Company | 0.01 | 0.00 | 0.55 | -3.01 | 0.1433 | -0.0093 | |||

| LLY / Eli Lilly and Company | 0.00 | 0.00 | 0.46 | -5.51 | 0.1209 | -0.0114 | |||

| GOOGL / Alphabet Inc. | 0.00 | 0.00 | 0.45 | 14.03 | 0.1169 | 0.0110 | |||

| ABBV / AbbVie Inc. | 0.00 | 0.00 | 0.40 | -11.33 | 0.1043 | -0.0173 | |||

| AMZN / Amazon.com, Inc. | 0.00 | 0.00 | 0.39 | 15.22 | 0.1010 | 0.0105 | |||

| VSS / Vanguard International Equity Index Funds - Vanguard FTSE All-World ex-US Small-Cap ETF | 0.00 | 0.00 | 0.31 | 16.30 | 0.0820 | 0.0092 | |||

| GE / General Electric Company | 0.00 | 0.00 | 0.29 | 29.02 | 0.0755 | 0.0149 | |||

| IWD / iShares Trust - iShares Russell 1000 Value ETF | 0.00 | 0.00 | 0.29 | 3.23 | 0.0753 | -0.0000 | |||

| ABT / Abbott Laboratories | 0.00 | 0.00 | 0.29 | 2.86 | 0.0752 | -0.0006 | |||

| NFLX / Netflix, Inc. | 0.00 | 0.29 | 0.0748 | 0.0748 | |||||

| MCD / McDonald's Corporation | 0.00 | 0.00 | 0.24 | -6.18 | 0.0635 | -0.0066 | |||

| ACWX / iShares Trust - iShares MSCI ACWI ex U.S. ETF | 0.00 | 0.00 | 0.24 | 10.14 | 0.0625 | 0.0038 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | 0.21 | 0.0561 | 0.0561 | |||||

| CVX / Chevron Corporation | 0.00 | -100.00 | 0.00 | 0.0000 |