Mga Batayang Estadistika

| Nilai Portofolio | $ 104,140,715 |

| Posisi Saat Ini | 45 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

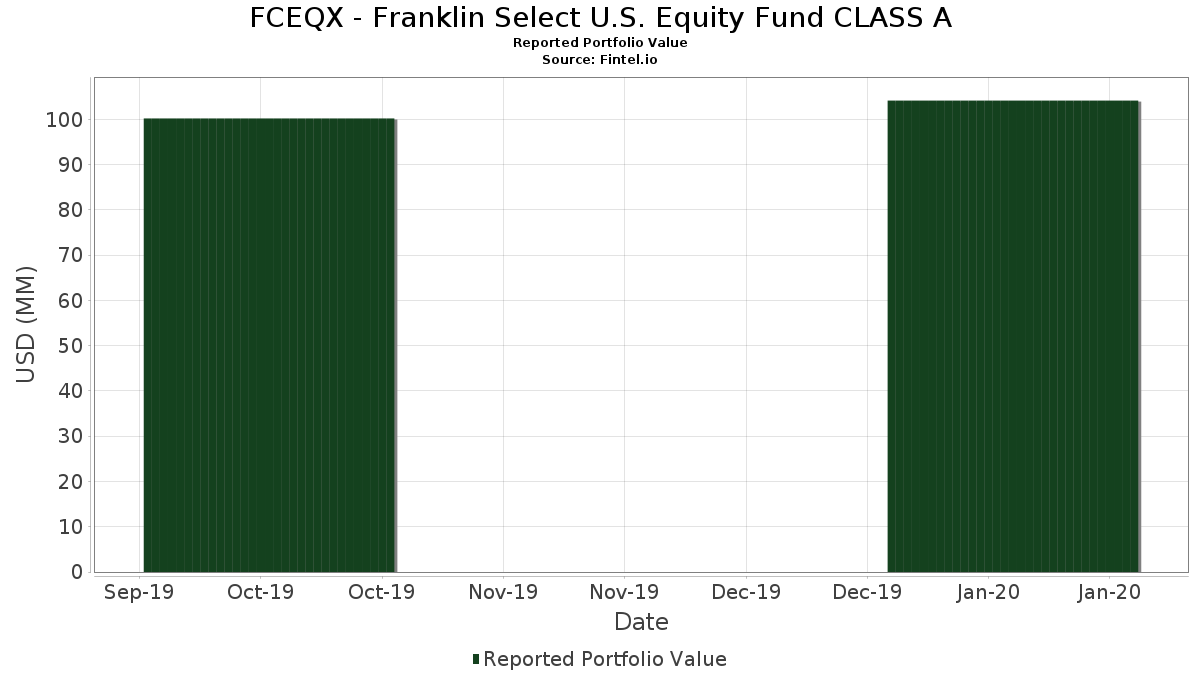

FCEQX - Franklin Select U.S. Equity Fund CLASS A telah mengungkapkan total kepemilikan 45 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 104,140,715 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama FCEQX - Franklin Select U.S. Equity Fund CLASS A adalah Microsoft Corporation (US:MSFT) , Amazon.com, Inc. (US:AMZN) , Alphabet Inc. (US:GOOGL) , Mastercard Incorporated (US:MA) , and NextEra Energy, Inc. (US:NEE) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.01 | 3.34 | 3.1661 | 0.6531 | |

| 0.03 | 5.08 | 4.8111 | 0.3986 | |

| 0.01 | 3.09 | 2.9237 | 0.3733 | |

| 0.00 | 4.80 | 4.5486 | 0.3505 | |

| 0.00 | 3.90 | 3.6924 | 0.3072 | |

| 0.01 | 2.01 | 1.9075 | 0.2031 | |

| 0.01 | 3.62 | 3.4304 | 0.1847 | |

| 0.01 | 2.69 | 2.5465 | 0.1693 | |

| 0.01 | 2.49 | 2.3630 | 0.1536 | |

| 0.01 | 2.14 | 2.0250 | 0.1489 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.00 | -1.1154 | ||

| 0.06 | 0.81 | 0.7672 | -0.3343 | |

| 0.01 | 2.19 | 2.0741 | -0.2544 | |

| 0.03 | 2.57 | 2.4358 | -0.2454 | |

| 0.00 | 0.00 | -0.2264 | ||

| 0.05 | 2.49 | 2.3592 | -0.2211 | |

| 0.01 | 1.26 | 1.1938 | -0.1838 | |

| 0.01 | 2.37 | 2.2408 | -0.1632 | |

| 0.00 | 0.77 | 0.7254 | -0.1591 | |

| 0.01 | 1.53 | 1.4456 | -0.1497 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2020-03-31 untuk periode pelaporan 2020-01-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.03 | -4.18 | 5.08 | 13.76 | 4.8111 | 0.3986 | |||

| AMZN / Amazon.com, Inc. | 0.00 | 0.00 | 4.80 | 13.05 | 4.5486 | 0.3505 | |||

| GOOGL / Alphabet Inc. | 0.00 | 0.00 | 3.90 | 13.85 | 3.6924 | 0.3072 | |||

| MA / Mastercard Incorporated | 0.01 | -3.37 | 3.62 | 10.30 | 3.4304 | 0.1847 | |||

| NEE / NextEra Energy, Inc. | 0.01 | -4.38 | 3.52 | 7.62 | 3.3314 | 0.1007 | |||

| NOW / ServiceNow, Inc. | 0.01 | -3.89 | 3.34 | 31.48 | 3.1661 | 0.6531 | |||

| AAPL / Apple Inc. | 0.01 | -3.86 | 3.09 | 19.62 | 2.9237 | 0.3733 | |||

| ADI / Analog Devices, Inc. | 0.03 | -3.65 | 2.90 | -0.82 | 2.7452 | -0.1434 | |||

| VRSK / Verisk Analytics, Inc. | 0.02 | -4.50 | 2.76 | 7.23 | 2.6153 | 0.0703 | |||

| SPGI / S&P Global Inc. | 0.01 | -3.16 | 2.70 | 10.27 | 2.5548 | 0.1367 | |||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | 0.01 | -4.41 | 2.69 | 11.77 | 2.5465 | 0.1693 | |||

| C.WSA / Citigroup, Inc. | 0.01 | -3.80 | 2.67 | 9.86 | 2.5332 | 0.1276 | |||

| AMAT / Applied Materials, Inc. | 0.05 | -3.80 | 2.65 | 2.84 | 2.5070 | -0.0373 | |||

| INXN / InterXion Holding N.V. | 0.03 | -3.90 | 2.57 | -5.20 | 2.4358 | -0.2454 | |||

| SBAC / SBA Communications Corporation | 0.01 | -3.76 | 2.55 | -0.23 | 2.4189 | -0.1103 | |||

| TFX / Teleflex Incorporated | 0.01 | -2.88 | 2.51 | 3.85 | 2.3759 | -0.0112 | |||

| ICE / Intercontinental Exchange, Inc. | 0.03 | -4.20 | 2.50 | 1.30 | 2.3682 | -0.0713 | |||

| CRM / Salesforce, Inc. | 0.01 | -4.20 | 2.49 | 11.64 | 2.3630 | 0.1536 | |||

| AZN / AstraZeneca PLC - Depositary Receipt (Common Stock) | 0.05 | -3.95 | 2.49 | -4.56 | 2.3592 | -0.2211 | |||

| UNH / UnitedHealth Group Incorporated | 0.01 | -3.19 | 2.48 | 4.38 | 2.3490 | 0.0006 | |||

| DIS / The Walt Disney Company | 0.02 | -4.31 | 2.46 | 1.87 | 2.3286 | -0.0567 | |||

| NKE / NIKE, Inc. | 0.03 | -4.16 | 2.44 | 3.09 | 2.3102 | -0.0289 | |||

| RTN / Raytheon Co. | 0.01 | -5.18 | 2.43 | -1.26 | 2.3005 | -0.1311 | |||

| ECL / Ecolab Inc. | 0.01 | -4.74 | 2.37 | -2.71 | 2.2408 | -0.1632 | |||

| MTD / Mettler-Toledo International Inc. | 0.00 | -3.11 | 2.36 | 4.10 | 2.2383 | -0.0059 | |||

| SCHW / The Charles Schwab Corporation | 0.05 | -4.04 | 2.27 | 7.38 | 2.1518 | 0.0605 | |||

| SYK / Stryker Corporation | 0.01 | -4.59 | 2.19 | -7.05 | 2.0741 | -0.2544 | |||

| NVDA / NVIDIA Corporation | 0.01 | -4.24 | 2.14 | 12.65 | 2.0250 | 0.1489 | |||

| FTV / Fortive Corporation | 0.03 | -4.08 | 2.12 | 4.19 | 2.0041 | -0.0035 | |||

| LW / Lamb Weston Holdings, Inc. | 0.02 | -4.21 | 2.08 | 12.13 | 1.9707 | 0.1360 | |||

| TYL / Tyler Technologies, Inc. | 0.01 | -3.12 | 2.01 | 16.83 | 1.9075 | 0.2031 | |||

| RSG / Republic Services, Inc. | 0.02 | -4.25 | 1.93 | 3.99 | 1.8281 | -0.0061 | |||

| EL / The Estée Lauder Companies Inc. | 0.01 | -4.34 | 1.72 | 0.23 | 1.6309 | -0.0671 | |||

| MNST / Monster Beverage Corporation | 0.02 | -3.98 | 1.61 | 13.99 | 1.5207 | 0.1278 | |||

| WAT / Waters Corporation | 0.01 | -2.74 | 1.59 | 2.91 | 1.5075 | -0.0219 | |||

| APH / Amphenol Corporation | 0.02 | -4.28 | 1.56 | -5.13 | 1.4740 | -0.1469 | |||

| ILMN / Illumina, Inc. | 0.01 | -3.66 | 1.53 | -5.46 | 1.4456 | -0.1497 | |||

| STZ / Constellation Brands, Inc. | 0.01 | -5.00 | 1.43 | -5.98 | 1.3559 | -0.1495 | |||

| CGNX / Cognex Corporation | 0.03 | -4.22 | 1.39 | -5.19 | 1.3150 | -0.1323 | |||

| BWXT / BWX Technologies, Inc. | 0.02 | -4.40 | 1.38 | 4.62 | 1.3080 | 0.0035 | |||

| APTV / Aptiv PLC | 0.01 | -4.50 | 1.26 | -9.62 | 1.1938 | -0.1838 | |||

| COG / Cabot Oil & Gas Corp. | 0.06 | -3.85 | 0.81 | -27.38 | 0.7672 | -0.3343 | |||

| ABMD / Abiomed Inc. | 0.00 | -4.64 | 0.77 | -14.43 | 0.7254 | -0.1591 | |||

| US20605P1012 / Concho Resources, Inc. | 0.01 | -4.26 | 0.68 | 7.57 | 0.6462 | 0.0187 | |||

| ADYEY / Adyen N.V. - Depositary Receipt (Common Stock) | 0.00 | -1.60 | 0.34 | 29.66 | 0.3231 | 0.0622 | |||

| FDX / FedEx Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -1.1154 | ||||

| ALB / Albemarle Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.2264 |