Mga Batayang Estadistika

| Nilai Portofolio | $ 441,823,652 |

| Posisi Saat Ini | 161 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

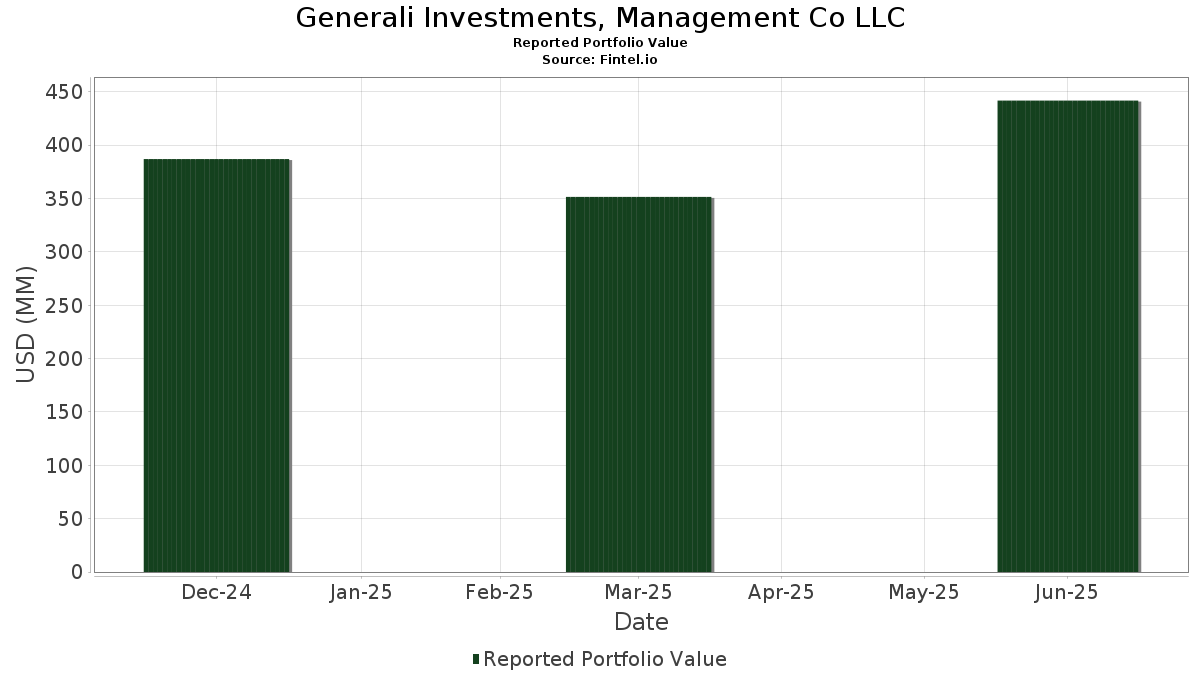

Generali Investments, Management Co LLC telah mengungkapkan total kepemilikan 161 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 441,823,652 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Generali Investments, Management Co LLC adalah NVIDIA Corporation (US:NVDA) , Microsoft Corporation (US:MSFT) , Amazon.com, Inc. (US:AMZN) , Alphabet Inc. (US:GOOGL) , and Meta Platforms, Inc. (US:META) . Posisi baru Generali Investments, Management Co LLC meliputi: American International Group, Inc. (US:AIG) , The Progressive Corporation (US:PGR) , Monolithic Power Systems, Inc. (US:MPWR) , HCA Healthcare, Inc. (US:HCA) , and The Select Sector SPDR Trust - The Health Care Select Sector SPDR Fund (US:XLV) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.05 | 9.52 | 2.1558 | 1.6778 | |

| 0.06 | 8.45 | 1.9133 | 1.4540 | |

| 0.05 | 12.99 | 2.9401 | 1.3095 | |

| 0.21 | 32.51 | 7.3571 | 1.1934 | |

| 0.01 | 6.25 | 1.4152 | 0.9786 | |

| 0.06 | 4.32 | 0.9774 | 0.7464 | |

| 0.04 | 8.03 | 1.8182 | 0.6967 | |

| 0.03 | 4.39 | 0.9931 | 0.5684 | |

| 0.00 | 4.45 | 1.0080 | 0.5390 | |

| 0.01 | 2.63 | 0.5963 | 0.5381 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.01 | 2.67 | 0.6036 | -1.3525 | |

| 0.10 | 19.58 | 4.4324 | -1.0952 | |

| 0.01 | 7.23 | 1.6361 | -0.5440 | |

| 0.13 | 28.04 | 6.3459 | -0.5268 | |

| 0.02 | 2.81 | 0.6355 | -0.4769 | |

| 0.02 | 1.31 | 0.2956 | -0.4636 | |

| 0.05 | 5.78 | 1.3088 | -0.4630 | |

| 0.04 | 4.78 | 1.0811 | -0.4322 | |

| 0.01 | 3.25 | 0.7351 | -0.4300 | |

| 0.08 | 5.73 | 1.2963 | -0.4238 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-11 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| NVDA / NVIDIA Corporation | 0.21 | 3.05 | 32.51 | 50.01 | 7.3571 | 1.1934 | |||

| MSFT / Microsoft Corporation | 0.06 | -3.08 | 30.69 | 28.25 | 6.9466 | 0.1390 | |||

| AMZN / Amazon.com, Inc. | 0.13 | 0.77 | 28.04 | 16.04 | 6.3459 | -0.5268 | |||

| GOOGL / Alphabet Inc. | 0.15 | 4.74 | 26.32 | 19.20 | 5.9577 | -0.3240 | |||

| META / Meta Platforms, Inc. | 0.03 | -7.23 | 24.92 | 18.64 | 5.6396 | -0.3347 | |||

| AAPL / Apple Inc. | 0.10 | 9.26 | 19.58 | 0.78 | 4.4324 | -1.0952 | |||

| AVGO / Broadcom Inc. | 0.05 | 37.83 | 12.99 | 126.61 | 2.9401 | 1.3095 | |||

| NFLX / Netflix, Inc. | 0.01 | -25.28 | 9.80 | 7.16 | 2.2174 | -0.3832 | |||

| AMAT / Applied Materials, Inc. | 0.05 | 349.94 | 9.52 | 466.90 | 2.1558 | 1.6778 | |||

| PLTR / Palantir Technologies Inc. | 0.06 | 224.57 | 8.45 | 423.73 | 1.9133 | 1.4540 | |||

| PANW / Palo Alto Networks, Inc. | 0.04 | 70.13 | 8.03 | 103.78 | 1.8182 | 0.6967 | |||

| LLY / Eli Lilly and Company | 0.01 | 0.06 | 7.23 | -5.69 | 1.6361 | -0.5440 | |||

| CRWD / CrowdStrike Holdings, Inc. | 0.01 | 182.36 | 6.25 | 307.30 | 1.4152 | 0.9786 | |||

| XLC / The Select Sector SPDR Trust - The Communication Services Select Sector SPDR Fund | 0.05 | -17.39 | 5.78 | -7.16 | 1.3088 | -0.4630 | |||

| KO / The Coca-Cola Company | 0.08 | -3.99 | 5.73 | -5.28 | 1.2963 | -0.4238 | |||

| GS / The Goldman Sachs Group, Inc. | 0.01 | 29.22 | 5.67 | 67.17 | 1.2839 | 0.3188 | |||

| JPM / JPMorgan Chase & Co. | 0.02 | 0.90 | 5.50 | 19.08 | 1.2444 | -0.0689 | |||

| ISRG / Intuitive Surgical, Inc. | 0.01 | 15.26 | 4.94 | 26.30 | 1.1176 | 0.0055 | |||

| TSLA / Tesla, Inc. | 0.02 | 55.63 | 4.79 | 90.50 | 1.0849 | 0.3691 | |||

| XOM / Exxon Mobil Corporation | 0.04 | -0.81 | 4.78 | -10.23 | 1.0811 | -0.4322 | |||

| NOW / ServiceNow, Inc. | 0.00 | 109.46 | 4.45 | 170.21 | 1.0080 | 0.5390 | |||

| AMD / Advanced Micro Devices, Inc. | 0.03 | 113.10 | 4.39 | 194.03 | 0.9931 | 0.5684 | |||

| BAC / Bank of America Corporation | 0.09 | -2.51 | 4.35 | 10.40 | 0.9854 | -0.1364 | |||

| NKE / NIKE, Inc. | 0.06 | 375.96 | 4.32 | 432.43 | 0.9774 | 0.7464 | |||

| BSX / Boston Scientific Corporation | 0.04 | 29.59 | 4.30 | 37.78 | 0.9725 | 0.0855 | |||

| SYK / Stryker Corporation | 0.01 | 7.30 | 4.28 | 13.88 | 0.9677 | -0.1003 | |||

| VEEV / Veeva Systems Inc. | 0.01 | 9.27 | 4.26 | 35.65 | 0.9648 | 0.0710 | |||

| C / Citigroup Inc. | 0.05 | 6.59 | 4.11 | 27.62 | 0.9308 | 0.0142 | |||

| ABBV / AbbVie Inc. | 0.02 | 26.32 | 3.95 | 11.76 | 0.8929 | -0.1113 | |||

| CRM / Salesforce, Inc. | 0.01 | 23.64 | 3.57 | 25.47 | 0.8083 | -0.0014 | |||

| CVX / Chevron Corporation | 0.02 | 1.53 | 3.51 | -13.21 | 0.7940 | -0.3558 | |||

| PSA / Public Storage | 0.01 | -2.72 | 3.35 | -4.78 | 0.7580 | -0.2423 | |||

| GLW / Corning Incorporated | 0.06 | 23.76 | 3.34 | 42.01 | 0.7561 | 0.0868 | |||

| ITW / Illinois Tool Works Inc. | 0.01 | -20.36 | 3.25 | -20.71 | 0.7351 | -0.4300 | |||

| DIS / The Walt Disney Company | 0.03 | -17.97 | 3.14 | 2.95 | 0.7114 | -0.1573 | |||

| QQEW / First Trust Exchange-Traded Fund - First Trust NASDAQ-100 Equal Weighted Index Fund | 0.02 | 17.13 | 3.12 | 32.02 | 0.7056 | 0.0339 | |||

| CSCO / Cisco Systems, Inc. | 0.04 | -8.34 | 2.97 | 2.91 | 0.6723 | -0.1487 | |||

| PG / The Procter & Gamble Company | 0.02 | -23.09 | 2.81 | -28.21 | 0.6355 | -0.4769 | |||

| JNJ / Johnson & Johnson | 0.02 | -14.78 | 2.80 | -21.62 | 0.6334 | -0.3822 | |||

| DHR / Danaher Corporation | 0.01 | 8.17 | 2.74 | 4.11 | 0.6198 | -0.1286 | |||

| CCI / Crown Castle Inc. | 0.03 | 0.00 | 2.70 | -1.57 | 0.6118 | -0.1694 | |||

| XLE / The Select Sector SPDR Trust - The Energy Select Sector SPDR Fund | 0.03 | 310.28 | 2.70 | 272.04 | 0.6114 | 0.4048 | |||

| MCD / McDonald's Corporation | 0.01 | -58.48 | 2.67 | -61.23 | 0.6036 | -1.3525 | |||

| AVAV / AeroVironment, Inc. | 0.01 | 439.51 | 2.63 | 1,191.18 | 0.5963 | 0.5381 | |||

| IBM / International Business Machines Corporation | 0.01 | 59.04 | 2.61 | 88.29 | 0.5899 | 0.1962 | |||

| HD / The Home Depot, Inc. | 0.01 | -17.09 | 2.60 | -17.17 | 0.5876 | -0.3040 | |||

| ABT / Abbott Laboratories | 0.02 | 0.00 | 2.56 | 2.40 | 0.5794 | -0.1318 | |||

| UNH / UnitedHealth Group Incorporated | 0.01 | 55.64 | 2.53 | -7.43 | 0.5730 | -0.2048 | |||

| V / Visa Inc. | 0.01 | 31.61 | 2.46 | 33.19 | 0.5560 | 0.0312 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.01 | 12.84 | 2.40 | -8.18 | 0.5438 | -0.2006 | |||

| D / Dominion Energy, Inc. | 0.04 | 17.90 | 2.39 | 18.66 | 0.5400 | -0.0318 | |||

| ADP / Automatic Data Processing, Inc. | 0.01 | 4.67 | 2.38 | 5.51 | 0.5379 | -0.1029 | |||

| ORCL / Oracle Corporation | 0.01 | 87.39 | 2.36 | 192.56 | 0.5338 | 0.3046 | |||

| WMT / Walmart Inc. | 0.02 | 0.00 | 2.25 | 11.25 | 0.5082 | -0.0660 | |||

| MA / Mastercard Incorporated | 0.00 | 36.29 | 2.11 | 39.59 | 0.4766 | 0.0473 | |||

| INTU / Intuit Inc. | 0.00 | 0.00 | 2.05 | 28.16 | 0.4636 | 0.0088 | |||

| MRK / Merck & Co., Inc. | 0.03 | 30.53 | 2.00 | 14.97 | 0.4522 | -0.0422 | |||

| AIG / American International Group, Inc. | 0.02 | 1.86 | 0.4218 | 0.4218 | |||||

| QCOM / QUALCOMM Incorporated | 0.01 | 46.31 | 1.86 | 51.51 | 0.4201 | 0.0716 | |||

| PGR / The Progressive Corporation | 0.01 | 1.84 | 0.4175 | 0.4175 | |||||

| WFC / Wells Fargo & Company | 0.02 | 0.00 | 1.74 | 11.45 | 0.3947 | -0.0504 | |||

| EOG / EOG Resources, Inc. | 0.01 | -14.91 | 1.74 | -20.77 | 0.3947 | -0.2312 | |||

| AMGN / Amgen Inc. | 0.01 | -4.55 | 1.73 | -14.60 | 0.3908 | -0.1841 | |||

| LIN / Linde plc | 0.00 | 11.58 | 1.68 | 12.31 | 0.3801 | -0.0454 | |||

| PEP / PepsiCo, Inc. | 0.01 | -20.56 | 1.63 | -30.15 | 0.3688 | -0.2947 | |||

| TXN / Texas Instruments Incorporated | 0.01 | 130.05 | 1.63 | 165.58 | 0.3686 | 0.1941 | |||

| SRE / Sempra | 0.02 | -38.79 | 1.59 | -35.12 | 0.3598 | -0.3369 | |||

| GILD / Gilead Sciences, Inc. | 0.01 | 4.47 | 1.50 | 3.17 | 0.3393 | -0.0738 | |||

| SNOW / Snowflake Inc. | 0.01 | 131.48 | 1.46 | 254.37 | 0.3306 | 0.2132 | |||

| PFE / Pfizer Inc. | 0.06 | 128.21 | 1.37 | 118.05 | 0.3091 | 0.1309 | |||

| FTNT / Fortinet, Inc. | 0.01 | 119.45 | 1.35 | 140.93 | 0.3066 | 0.1465 | |||

| TTD / The Trade Desk, Inc. | 0.02 | -26.26 | 1.35 | -3.10 | 0.3047 | -0.0906 | |||

| VRSN / VeriSign, Inc. | 0.00 | -24.93 | 1.34 | -14.71 | 0.3031 | -0.1436 | |||

| EBAY / eBay Inc. | 0.02 | -55.43 | 1.31 | -51.09 | 0.2956 | -0.4636 | |||

| CL / Colgate-Palmolive Company | 0.01 | -14.73 | 1.30 | -17.43 | 0.2951 | -0.1538 | |||

| GEHC / GE HealthCare Technologies Inc. | 0.02 | 54.84 | 1.30 | 41.92 | 0.2943 | 0.0337 | |||

| MDLZ / Mondelez International, Inc. | 0.02 | -28.14 | 1.29 | -28.66 | 0.2925 | -0.2229 | |||

| PM / Philip Morris International Inc. | 0.01 | -17.04 | 1.22 | -4.92 | 0.2755 | -0.0888 | |||

| XLY / The Select Sector SPDR Trust - The Consumer Discretionary Select Sector SPDR Fund | 0.01 | 2,200.83 | 1.21 | 2,470.21 | 0.2735 | 0.2599 | |||

| TER / Teradyne, Inc. | 0.01 | 344.96 | 1.20 | 384.62 | 0.2709 | 0.2005 | |||

| ADBE / Adobe Inc. | 0.00 | -0.52 | 1.12 | 0.27 | 0.2531 | -0.0643 | |||

| EMR / Emerson Electric Co. | 0.01 | 0.00 | 1.10 | 21.51 | 0.2481 | -0.0087 | |||

| CME / CME Group Inc. | 0.00 | -45.62 | 1.08 | -43.62 | 0.2453 | -0.3012 | |||

| MMM / 3M Company | 0.01 | 0.00 | 1.06 | 3.50 | 0.2409 | -0.0516 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 6.21 | 1.05 | -3.21 | 0.2386 | -0.0714 | |||

| COP / ConocoPhillips | 0.01 | -10.83 | 1.05 | -23.93 | 0.2375 | -0.1548 | |||

| CAT / Caterpillar Inc. | 0.00 | 0.00 | 1.03 | 17.64 | 0.2325 | -0.0161 | |||

| DELL / Dell Technologies Inc. | 0.01 | 448.16 | 0.95 | 640.63 | 0.2148 | 0.1781 | |||

| ECL / Ecolab Inc. | 0.00 | 28.00 | 0.95 | 35.82 | 0.2147 | 0.0161 | |||

| VZ / Verizon Communications Inc. | 0.02 | -49.48 | 0.93 | -51.90 | 0.2096 | -0.3377 | |||

| WMB / The Williams Companies, Inc. | 0.01 | 31.91 | 0.89 | 38.51 | 0.2019 | 0.0186 | |||

| BMY / Bristol-Myers Squibb Company | 0.02 | -35.95 | 0.85 | -51.49 | 0.1914 | -0.3041 | |||

| FCX / Freeport-McMoRan Inc. | 0.02 | -9.04 | 0.82 | 3.92 | 0.1860 | -0.0388 | |||

| T / AT&T Inc. | 0.03 | -42.50 | 0.81 | -41.26 | 0.1842 | -0.2097 | |||

| ELV / Elevance Health, Inc. | 0.00 | -18.83 | 0.79 | -27.52 | 0.1778 | -0.1304 | |||

| CI / The Cigna Group | 0.00 | 0.00 | 0.76 | 0.26 | 0.1718 | -0.0434 | |||

| CVS / CVS Health Corporation | 0.01 | 117.91 | 0.75 | 121.66 | 0.1692 | 0.0732 | |||

| ICE / Intercontinental Exchange, Inc. | 0.00 | -36.19 | 0.71 | -32.28 | 0.1597 | -0.1364 | |||

| SPGI / S&P Global Inc. | 0.00 | 0.00 | 0.67 | 3.72 | 0.1515 | -0.0322 | |||

| MPWR / Monolithic Power Systems, Inc. | 0.00 | 0.63 | 0.1423 | 0.1423 | |||||

| INTC / Intel Corporation | 0.03 | -22.97 | 0.58 | -24.14 | 0.1302 | -0.0855 | |||

| NEE / NextEra Energy, Inc. | 0.01 | 0.00 | 0.55 | -2.30 | 0.1253 | -0.0357 | |||

| TWLO / Twilio Inc. | 0.00 | 570.85 | 0.55 | 760.94 | 0.1248 | 0.1064 | |||

| HCA / HCA Healthcare, Inc. | 0.00 | 0.54 | 0.1218 | 0.1218 | |||||

| XLV / The Select Sector SPDR Trust - The Health Care Select Sector SPDR Fund | 0.00 | 0.49 | 0.1106 | 0.1106 | |||||

| NEM / Newmont Corporation | 0.01 | 36.69 | 0.49 | 65.08 | 0.1103 | 0.0261 | |||

| SNPS / Synopsys, Inc. | 0.00 | 0.00 | 0.43 | 19.39 | 0.0976 | -0.0051 | |||

| 1BKNG / Booking Holdings Inc. | 0.00 | 0.43 | 0.0968 | 0.0968 | |||||

| APH / Amphenol Corporation | 0.00 | 0.41 | 0.0936 | 0.0936 | |||||

| COIN / Coinbase Global, Inc. | 0.00 | 0.71 | 0.40 | 105.67 | 0.0903 | 0.0349 | |||

| PSX / Phillips 66 | 0.00 | -16.01 | 0.37 | -18.94 | 0.0833 | -0.0459 | |||

| MPC / Marathon Petroleum Corporation | 0.00 | -31.63 | 0.33 | -22.01 | 0.0754 | -0.0463 | |||

| OKE / ONEOK, Inc. | 0.00 | 40.61 | 0.33 | 15.66 | 0.0737 | -0.0065 | |||

| NBIX / Neurocrine Biosciences, Inc. | 0.00 | 0.32 | 0.0722 | 0.0722 | |||||

| CEG / Constellation Energy Corporation | 0.00 | 383.74 | 0.32 | 690.00 | 0.0716 | 0.0600 | |||

| PPG / PPG Industries, Inc. | 0.00 | 0.00 | 0.32 | 3.96 | 0.0714 | -0.0150 | |||

| BDX / Becton, Dickinson and Company | 0.00 | 0.00 | 0.31 | -25.00 | 0.0695 | -0.0468 | |||

| SBUX / Starbucks Corporation | 0.00 | -23.48 | 0.29 | -28.54 | 0.0664 | -0.0505 | |||

| VLO / Valero Energy Corporation | 0.00 | 3.69 | 0.29 | 5.15 | 0.0649 | -0.0125 | |||

| NET / Cloudflare, Inc. | 0.00 | 0.27 | 0.0617 | 0.0617 | |||||

| TJX / The TJX Companies, Inc. | 0.00 | 44.55 | 0.27 | 46.15 | 0.0603 | 0.0085 | |||

| TRGP / Targa Resources Corp. | 0.00 | 59.54 | 0.26 | 38.22 | 0.0599 | 0.0055 | |||

| TRV / The Travelers Companies, Inc. | 0.00 | 518.42 | 0.25 | 527.50 | 0.0568 | 0.0454 | |||

| COR / Cencora, Inc. | 0.00 | 0.25 | 0.0564 | 0.0564 | |||||

| BIIB / Biogen Inc. | 0.00 | 0.00 | 0.25 | -8.21 | 0.0557 | -0.0207 | |||

| KMI / Kinder Morgan, Inc. | 0.01 | 25.25 | 0.23 | 28.89 | 0.0526 | 0.0013 | |||

| OXY / Occidental Petroleum Corporation | 0.01 | -10.83 | 0.21 | -24.47 | 0.0484 | -0.0319 | |||

| FANG / Diamondback Energy, Inc. | 0.00 | 18.28 | 0.20 | 1.51 | 0.0458 | -0.0109 | |||

| CMCSA / Comcast Corporation | 0.01 | 0.00 | 0.20 | -3.45 | 0.0444 | -0.0134 | |||

| IDXX / IDEXX Laboratories, Inc. | 0.00 | 0.19 | 0.0436 | 0.0436 | |||||

| SHW / The Sherwin-Williams Company | 0.00 | -11.04 | 0.18 | -12.50 | 0.0413 | -0.0181 | |||

| OKTA / Okta, Inc. | 0.00 | 0.18 | 0.0404 | 0.0404 | |||||

| MO / Altria Group, Inc. | 0.00 | 0.00 | 0.17 | -2.27 | 0.0391 | -0.0113 | |||

| EXR / Extra Space Storage Inc. | 0.00 | 0.17 | 0.0384 | 0.0384 | |||||

| FTV / Fortive Corporation | 0.00 | -78.21 | 0.15 | -84.50 | 0.0340 | -0.2414 | |||

| RVTY / Revvity, Inc. | 0.00 | 0.00 | 0.15 | -9.15 | 0.0339 | -0.0128 | |||

| APD / Air Products and Chemicals, Inc. | 0.00 | 453.33 | 0.14 | 438.46 | 0.0317 | 0.0242 | |||

| UEC / Uranium Energy Corp. | 0.02 | 0.14 | 0.0315 | 0.0315 | |||||

| RSG / Republic Services, Inc. | 0.00 | -48.32 | 0.13 | -47.62 | 0.0300 | -0.0418 | |||

| SLB / Schlumberger Limited | 0.00 | -24.36 | 0.13 | -38.79 | 0.0297 | -0.0314 | |||

| HIMS / Hims & Hers Health, Inc. | 0.00 | 0.12 | 0.0282 | 0.0282 | |||||

| WAT / Waters Corporation | 0.00 | 0.12 | 0.0281 | 0.0281 | |||||

| NUE / Nucor Corporation | 0.00 | -47.47 | 0.12 | -43.66 | 0.0273 | -0.0335 | |||

| LB / LandBridge Company LLC | 0.00 | 0.12 | 0.0265 | 0.0265 | |||||

| DD / DuPont de Nemours, Inc. | 0.00 | -41.95 | 0.11 | -47.14 | 0.0253 | -0.0344 | |||

| EQT / EQT Corporation | 0.00 | 6.20 | 0.11 | 15.38 | 0.0240 | -0.0021 | |||

| STLD / Steel Dynamics, Inc. | 0.00 | 0.09 | 0.0198 | 0.0198 | |||||

| QQQM / Invesco Exchange-Traded Fund Trust II - Invesco NASDAQ 100 ETF | 0.00 | -52.38 | 0.07 | -43.80 | 0.0154 | -0.0192 | |||

| LYB / LyondellBasell Industries N.V. | 0.00 | 0.00 | 0.07 | -17.72 | 0.0148 | -0.0079 | |||

| MCO / Moody's Corporation | 0.00 | 0.06 | 0.0145 | 0.0145 | |||||

| UPS / United Parcel Service, Inc. | 0.00 | 0.00 | 0.06 | -8.70 | 0.0145 | -0.0054 | |||

| HUM / Humana Inc. | 0.00 | -54.34 | 0.06 | -58.39 | 0.0143 | -0.0283 | |||

| MSCI / MSCI Inc. | 0.00 | 0.06 | 0.0139 | 0.0139 | |||||

| BRO / Brown & Brown, Inc. | 0.00 | 0.06 | 0.0136 | 0.0136 | |||||

| HIG / The Hartford Insurance Group, Inc. | 0.00 | 0.06 | 0.0136 | 0.0136 | |||||

| STE / STERIS plc | 0.00 | 0.06 | 0.0127 | 0.0127 | |||||

| PODD / Insulet Corporation | 0.00 | 0.05 | 0.0124 | 0.0124 | |||||

| DVN / Devon Energy Corporation | 0.00 | -68.08 | 0.05 | -72.86 | 0.0123 | -0.0445 | |||

| RAL / Ralliant Corporation | 0.00 | 0.05 | 0.0105 | 0.0105 | |||||

| FDS / FactSet Research Systems Inc. | 0.00 | 0.04 | 0.0096 | 0.0096 | |||||

| KHC / The Kraft Heinz Company | 0.00 | 0.00 | 0.02 | -15.38 | 0.0050 | -0.0024 | |||

| XLB / The Select Sector SPDR Trust - The Materials Select Sector SPDR Fund | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ONC / BeOne Medicines AG - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| XLI / The Select Sector SPDR Trust - The Industrial Select Sector SPDR Fund | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ETN / Eaton Corporation plc | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| XLF / The Select Sector SPDR Trust - The Financial Select Sector SPDR Fund | 0.00 | -100.00 | 0.00 | 0.0000 |