Mga Batayang Estadistika

| Nilai Portofolio | $ 97,352,008 |

| Posisi Saat Ini | 80 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

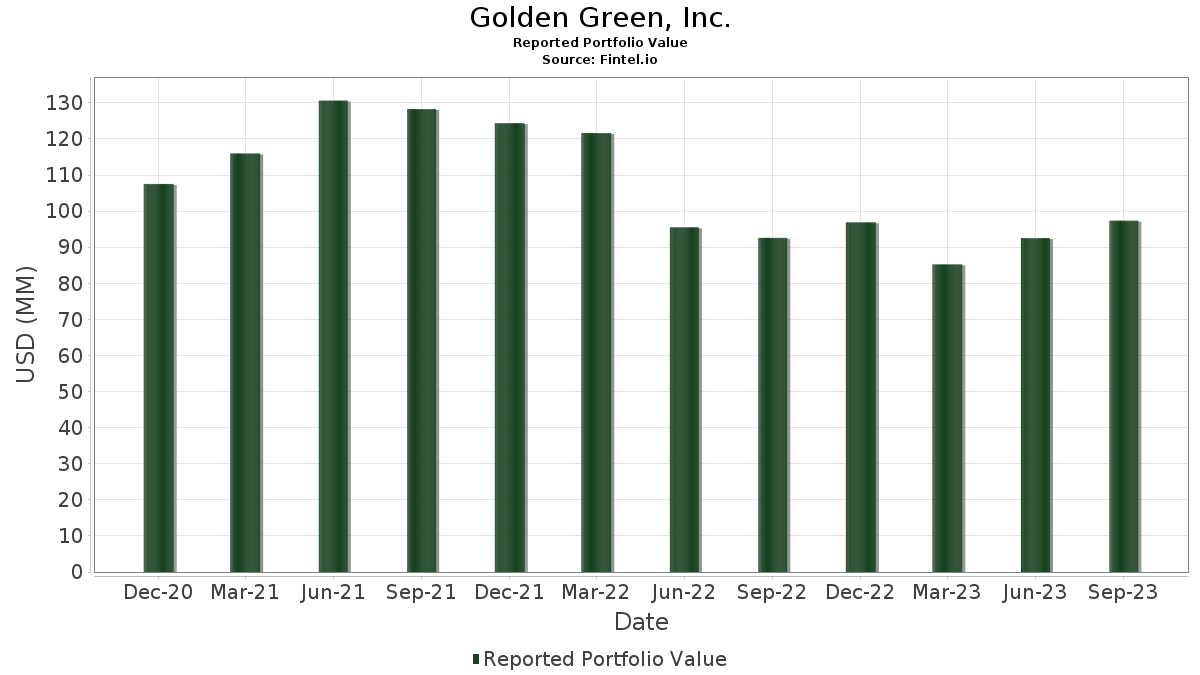

Golden Green, Inc. telah mengungkapkan total kepemilikan 80 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 97,352,008 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Golden Green, Inc. adalah Apple Inc. (US:AAPL) , ALPS ETF Trust - Alerian MLP ETF (US:AMLP) , Global X Funds - Global X MLP & Energy Infrastructure ETF (US:MLPX) , ETFis Series Trust I - InfraCap MLP ETF (US:AMZA) , and Global X Funds - Global X MLP ETF (US:MLPA) . Posisi baru Golden Green, Inc. meliputi: Energy Transfer LP - Limited Partnership (US:ET) , Foot Locker, Inc. (US:FL) , Energy Transfer LP - Limited Partnership (US:ET) , International Game Technology PLC (US:IGT) , and .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.03 | 1.22 | 1.2480 | 1.2480 | |

| 0.00 | 1.50 | 1.5380 | 0.4910 | |

| 0.03 | 0.45 | 0.4622 | 0.4622 | |

| 0.03 | 0.45 | 0.4599 | 0.4599 | |

| 0.01 | 2.30 | 2.3618 | 0.4447 | |

| 0.00 | 0.30 | 0.3062 | 0.3062 | |

| 0.12 | 2.80 | 2.8811 | 0.2987 | |

| 0.00 | 0.22 | 0.2307 | 0.2307 | |

| 0.09 | 3.91 | 4.0120 | 0.1990 | |

| 0.00 | 1.89 | 1.9366 | 0.1615 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.07 | 11.63 | 11.9445 | -2.3522 | |

| 0.00 | 1.85 | 1.9037 | -0.4077 | |

| 0.00 | 0.00 | -0.2833 | ||

| 0.13 | 1.25 | 1.2800 | -0.2628 | |

| 0.00 | 0.00 | -0.2477 | ||

| 0.14 | 1.50 | 1.5419 | -0.2474 | |

| 0.00 | 0.00 | -0.2225 | ||

| 0.31 | 3.36 | 3.4517 | -0.2206 | |

| 0.12 | 3.50 | 3.5936 | -0.1908 | |

| 0.01 | 1.97 | 2.0271 | -0.1643 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2023-10-31 untuk periode pelaporan 2023-09-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AAPL / Apple Inc. | 0.07 | -0.41 | 11.63 | -12.09 | 11.9445 | -2.3522 | |||

| AMLP / ALPS ETF Trust - Alerian MLP ETF | 0.09 | 2.86 | 3.91 | 10.72 | 4.0120 | 0.1990 | |||

| MLPX / Global X Funds - Global X MLP & Energy Infrastructure ETF | 0.09 | 2.81 | 3.91 | 4.83 | 4.0116 | -0.0150 | |||

| AMZA / ETFis Series Trust I - InfraCap MLP ETF | 0.11 | 2.90 | 3.82 | 8.46 | 3.9253 | 0.1171 | |||

| MLPA / Global X Funds - Global X MLP ETF | 0.09 | 2.98 | 3.80 | 6.96 | 3.9008 | 0.0636 | |||

| PFF / iShares Trust - iShares Preferred and Income Securities ETF | 0.12 | 2.50 | 3.50 | -0.09 | 3.5936 | -0.1908 | |||

| PGX / Invesco Exchange-Traded Fund Trust II - Invesco Preferred ETF | 0.31 | 2.69 | 3.36 | -1.09 | 3.4517 | -0.2206 | |||

| CSWC / Capital Southwest Corporation | 0.12 | 1.09 | 2.80 | 17.37 | 2.8811 | 0.2987 | |||

| META / Meta Platforms, Inc. | 0.01 | 23.91 | 2.30 | 29.67 | 2.3618 | 0.4447 | |||

| HTGC / Hercules Capital, Inc. | 0.14 | 0.87 | 2.27 | 11.92 | 2.3345 | 0.1395 | |||

| TSLX / Sixth Street Specialty Lending, Inc. | 0.10 | 1.08 | 1.98 | 10.52 | 2.0294 | 0.0977 | |||

| MSFT / Microsoft Corporation | 0.01 | 4.97 | 1.97 | -2.66 | 2.0271 | -0.1643 | |||

| DVN / Devon Energy Corporation | 0.04 | 2.92 | 1.91 | 1.54 | 1.9614 | -0.0707 | |||

| ARCC / Ares Capital Corporation | 0.10 | 2.50 | 1.89 | 6.17 | 1.9453 | 0.0182 | |||

| LLY / Eli Lilly and Company | 0.00 | 0.23 | 1.89 | 14.80 | 1.9366 | 0.1615 | |||

| NFLX / Netflix, Inc. | 0.00 | 1.09 | 1.85 | -13.33 | 1.9037 | -0.4077 | |||

| MAIN / Main Street Capital Corporation | 0.04 | 3.60 | 1.72 | 5.12 | 1.7718 | -0.0011 | |||

| PNNT / PennantPark Investment Corporation | 0.25 | 1.96 | 1.66 | 13.92 | 1.7067 | 0.1302 | |||

| OBDC / Blue Owl Capital Corporation | 0.12 | 3.37 | 1.64 | 6.69 | 1.6874 | 0.0231 | |||

| PFLT / PennantPark Floating Rate Capital Ltd. | 0.15 | 1.75 | 1.64 | 1.87 | 1.6806 | -0.0557 | |||

| RITM / Rithm Capital Corp. | 0.17 | 3.31 | 1.59 | 2.64 | 1.6361 | -0.0410 | |||

| AMZN / Amazon.com, Inc. | 0.01 | 7.46 | 1.51 | 4.79 | 1.5500 | -0.0063 | |||

| TPVG / TriplePoint Venture Growth BDC Corp. | 0.14 | 2.11 | 1.50 | -9.31 | 1.5419 | -0.2474 | |||

| NVDA / NVIDIA Corporation | 0.00 | 50.31 | 1.50 | 54.65 | 1.5380 | 0.4910 | |||

| AGNC / AGNC Investment Corp. | 0.16 | 3.80 | 1.47 | -3.29 | 1.5087 | -0.1325 | |||

| NLY / Annaly Capital Management, Inc. | 0.07 | 4.87 | 1.32 | -1.42 | 1.3560 | -0.0912 | |||

| FSK / FS KKR Capital Corp. | 0.06 | 3.22 | 1.28 | 5.98 | 1.3121 | 0.0093 | |||

| MFA / MFA Financial, Inc. | 0.13 | 2.10 | 1.25 | -12.68 | 1.2800 | -0.2628 | |||

| ET / Energy Transfer LP - Limited Partnership | Call | 0.03 | 1.22 | 1.2480 | 1.2480 | ||||

| XOM / Exxon Mobil Corporation | 0.01 | -0.97 | 1.20 | 8.57 | 1.2358 | 0.0382 | |||

| ETY / Eaton Vance Tax-Managed Diversified Equity Income Fund | 0.10 | 3.19 | 1.19 | -4.41 | 1.2237 | -0.1235 | |||

| COST / Costco Wholesale Corporation | 0.00 | 13.65 | 0.95 | 19.35 | 0.9761 | 0.1149 | |||

| GOOGL / Alphabet Inc. | 0.01 | 8.60 | 0.93 | 18.77 | 0.9559 | 0.1087 | |||

| SBLK / Star Bulk Carriers Corp. | 0.05 | 2.64 | 0.89 | 11.76 | 0.9179 | 0.0541 | |||

| HTD / John Hancock Tax-Advantaged Dividend Income Fund | 0.05 | 5.06 | 0.87 | -8.54 | 0.8916 | -0.1340 | |||

| AVGO / Broadcom Inc. | 0.00 | -3.81 | 0.86 | -7.92 | 0.8839 | -0.1258 | |||

| PXD / Pioneer Natural Resources Company | 0.00 | 14.86 | 0.85 | 27.20 | 0.8748 | 0.1515 | |||

| IVR / Invesco Mortgage Capital Inc. | 0.08 | 7.99 | 0.83 | -5.82 | 0.8491 | -0.0989 | |||

| V / Visa Inc. | 0.00 | 0.06 | 0.79 | -3.07 | 0.8109 | -0.0695 | |||

| OXY / Occidental Petroleum Corporation | 0.01 | -0.99 | 0.73 | 9.25 | 0.7528 | 0.0278 | |||

| COP / ConocoPhillips | 0.01 | -0.98 | 0.72 | 14.56 | 0.7358 | 0.0596 | |||

| BKNG / Booking Holdings Inc. | 0.00 | 18.58 | 0.67 | 35.43 | 0.6874 | 0.1533 | |||

| PFFD / Global X Funds - Global X U.S. Preferred ETF | 0.03 | 10.00 | 0.65 | 6.72 | 0.6694 | 0.0094 | |||

| CVX / Chevron Corporation | 0.00 | -1.61 | 0.63 | 5.53 | 0.6473 | 0.0014 | |||

| HPF / John Hancock Preferred Income Fund II | 0.04 | 2.48 | 0.59 | -1.68 | 0.6023 | -0.0426 | |||

| HPS / John Hancock Preferred Income Fund III | 0.04 | 2.40 | 0.58 | -2.51 | 0.5993 | -0.0479 | |||

| PFFV / Global X Funds - Global X Variable Rate Preferred ETF | 0.03 | 11.23 | 0.58 | 14.37 | 0.5975 | 0.0478 | |||

| HPI / John Hancock Preferred Income Fund | 0.04 | 2.54 | 0.58 | -2.03 | 0.5956 | -0.0432 | |||

| CRM / Salesforce, Inc. | 0.00 | 16.11 | 0.55 | 11.34 | 0.5659 | 0.0317 | |||

| UNH / UnitedHealth Group Incorporated | 0.00 | 8.08 | 0.55 | 13.51 | 0.5609 | 0.0404 | |||

| UBER / Uber Technologies, Inc. | 0.01 | -1.83 | 0.52 | 4.46 | 0.5297 | -0.0032 | |||

| SHOP / Shopify Inc. | 0.01 | 4.19 | 0.47 | -12.03 | 0.4813 | -0.0941 | |||

| HD / The Home Depot, Inc. | 0.00 | 49.02 | 0.46 | 45.25 | 0.4718 | 0.1293 | |||

| AMD / Advanced Micro Devices, Inc. | 0.00 | 41.10 | 0.45 | 27.17 | 0.4674 | 0.0813 | |||

| FL / Foot Locker, Inc. | Put | 0.03 | 0.45 | 0.4622 | 0.4622 | ||||

| ET / Energy Transfer LP - Limited Partnership | 0.03 | 0.45 | 0.4599 | 0.4599 | |||||

| LVS / Las Vegas Sands Corp. | 0.01 | 22.04 | 0.43 | -3.60 | 0.4402 | -0.0400 | |||

| MCD / McDonald's Corporation | 0.00 | -1.46 | 0.43 | -13.06 | 0.4381 | -0.0918 | |||

| PBR / Petróleo Brasileiro S.A. - Petrobras - Depositary Receipt (Common Stock) | 0.03 | 1.24 | 0.41 | 9.70 | 0.4188 | 0.0172 | |||

| WDAY / Workday, Inc. | 0.00 | -1.07 | 0.38 | -6.00 | 0.3869 | -0.0457 | |||

| NOW / ServiceNow, Inc. | 0.00 | -0.60 | 0.37 | -1.07 | 0.3807 | -0.0244 | |||

| TTWO / Take-Two Interactive Software, Inc. | 0.00 | -1.92 | 0.35 | -6.42 | 0.3602 | -0.0449 | |||

| SEVN / Seven Hills Realty Trust | 0.03 | 7.53 | 0.34 | 14.73 | 0.3444 | 0.0278 | |||

| MA / Mastercard Incorporated | 0.00 | 0.00 | 0.32 | 0.64 | 0.3237 | -0.0146 | |||

| CAT / Caterpillar Inc. | 0.00 | 0.30 | 0.3062 | 0.3062 | |||||

| FBRT / Franklin BSP Realty Trust, Inc. | 0.02 | 11.74 | 0.28 | 4.46 | 0.2891 | -0.0020 | |||

| SPTS / SPDR Series Trust - SPDR Portfolio Short Term Treasury ETF | 0.01 | -5.42 | 0.27 | -5.61 | 0.2766 | -0.0318 | |||

| BXMT / Blackstone Mortgage Trust, Inc. | 0.01 | 12.34 | 0.27 | 17.54 | 0.2761 | 0.0287 | |||

| SCHW / The Charles Schwab Corporation | 0.00 | -0.55 | 0.27 | -3.62 | 0.2733 | -0.0252 | |||

| TTD / The Trade Desk, Inc. | 0.00 | -1.57 | 0.24 | -0.41 | 0.2516 | -0.0141 | |||

| PCH / PotlatchDeltic Corporation | 0.00 | -2.93 | 0.23 | -16.67 | 0.2317 | -0.0607 | |||

| PANW / Palo Alto Networks, Inc. | 0.00 | 0.22 | 0.2307 | 0.2307 | |||||

| KEY / KeyCorp | 0.02 | -2.06 | 0.22 | 14.43 | 0.2281 | 0.0177 | |||

| WFC / Wells Fargo & Company | 0.01 | 0.11 | 0.22 | -4.39 | 0.2245 | -0.0220 | |||

| WDS / Woodside Energy Group Ltd - Depositary Receipt (Common Stock) | 0.01 | -1.68 | 0.21 | -1.42 | 0.2140 | -0.0140 | |||

| IJH / iShares Trust - iShares Core S&P Mid-Cap ETF | 0.00 | -0.72 | 0.21 | -5.07 | 0.2118 | -0.0236 | |||

| IGT / International Game Technology PLC | Call | 0.01 | 0.15 | 0.1561 | 0.1561 | ||||

| NYCB / Flagstar Financial, Inc. | 0.01 | -2.14 | 0.13 | -0.78 | 0.1317 | -0.0086 | |||

| HIVE / HIVE Digital Technologies Ltd. | 0.01 | 0.03 | 0.0316 | 0.0316 | |||||

| HUT / Hut 8 Corp. | 0.01 | 0.03 | 0.0300 | 0.0300 | |||||

| DIS / The Walt Disney Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.2477 | ||||

| LOW / Lowe's Companies, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.2225 | ||||

| FITB / Fifth Third Bancorp | Call | 0.00 | -100.00 | 0.00 | -100.00 | -0.2833 |