Mga Batayang Estadistika

| Nilai Portofolio | $ 3,847,396,379 |

| Posisi Saat Ini | 127 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

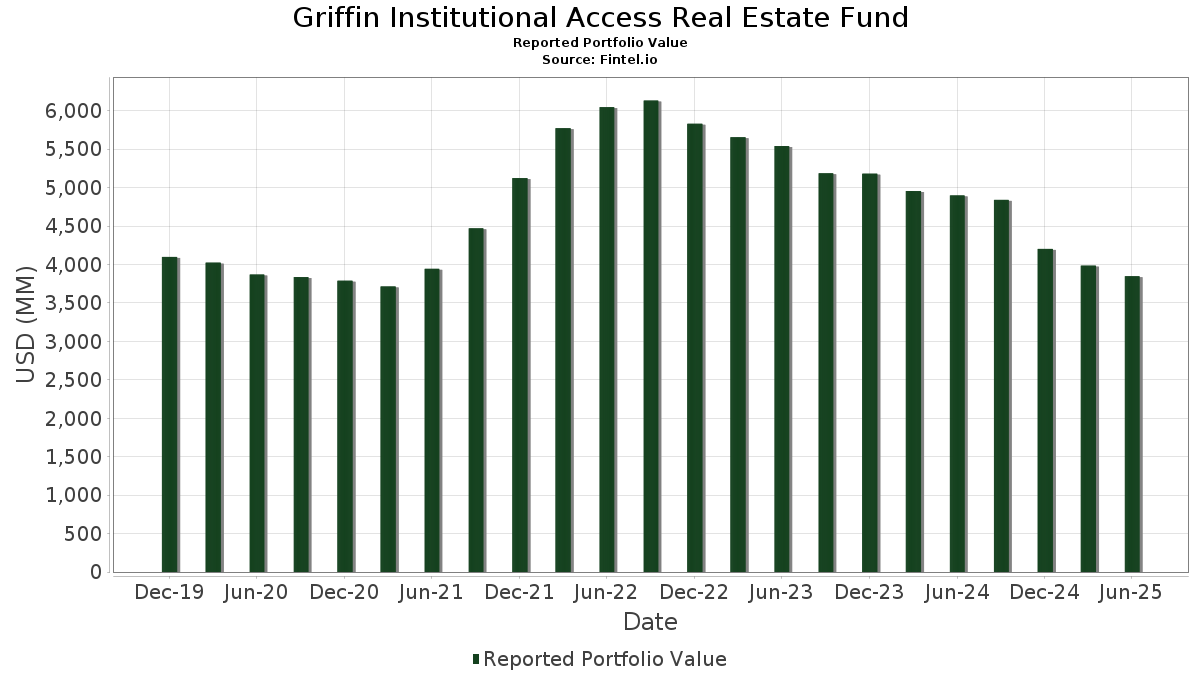

Griffin Institutional Access Real Estate Fund telah mengungkapkan total kepemilikan 127 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 3,847,396,379 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Griffin Institutional Access Real Estate Fund adalah Welltower Inc. (US:WELL) , Equinix, Inc. (US:EQIX) , Prologis, Inc. (US:PLD) , Digital Realty Trust, Inc. (US:DLR) , and Ventas, Inc. (US:VTR) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 206.06 | 282.21 | 7.3211 | 7.3211 | |

| 0.22 | 256.58 | 6.6561 | 6.6561 | |

| 0.15 | 170.31 | 4.4180 | 4.4180 | |

| 0.01 | 155.69 | 4.0390 | 4.0390 | |

| 0.14 | 146.13 | 3.7909 | 3.7909 | |

| 0.05 | 143.99 | 3.7353 | 3.7353 | |

| 0.08 | 136.61 | 3.5440 | 3.5440 | |

| 0.09 | 129.32 | 3.3548 | 3.3548 | |

| 120.07 | 3.1149 | 3.1149 | ||

| 0.12 | 118.35 | 3.0701 | 3.0701 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.67 | 22.13 | 0.5740 | -0.4479 | |

| 0.69 | 72.08 | 1.8699 | -0.2221 | |

| 0.22 | 9.61 | 0.2494 | -0.1716 | |

| 0.05 | 5.57 | 0.1446 | -0.1688 | |

| 0.44 | 29.56 | 0.7669 | -0.1533 | |

| 0.10 | 77.93 | 2.0217 | -0.1510 | |

| 0.60 | 34.53 | 0.8959 | -0.1448 | |

| 0.18 | 12.36 | 0.3207 | -0.1446 | |

| 0.69 | 43.29 | 1.1230 | -0.1363 | |

| 0.27 | 30.95 | 0.8029 | -0.1216 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-26 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| CBRE U.S. Logistics Partners, L.P. / RE (N/A) | 206.06 | 282.21 | 7.3211 | 7.3211 | |||||

| Cortland Growth and Income Fund, L.P. / RE (N/A) | 0.22 | 256.58 | 6.6561 | 6.6561 | |||||

| Ventas Life Science and Healthcare Real Estate Fund / RE (N/A) | 0.15 | 170.31 | 4.4180 | 4.4180 | |||||

| Morgan Stanley Prime Property Fund / RE (N/A) | 0.01 | 155.69 | 4.0390 | 4.0390 | |||||

| TA Realty Logistics Fund, L.P. / RE (N/A) | 0.14 | 146.13 | 3.7909 | 3.7909 | |||||

| Prologis Targeted U.S. Logistics Fund, L.P. / RE (N/A) | 0.05 | 143.99 | 3.7353 | 3.7353 | |||||

| Dream U.S. Industrial Fund, L.P. / RE (N/A) | 0.08 | 136.61 | 3.5440 | 3.5440 | |||||

| Clarion Lion Properties Fund, L.P. / RE (N/A) | 0.09 | 129.32 | 3.3548 | 3.3548 | |||||

| Ares Real Estate Enhanced Income Fund, L.P. / RE (N/A) | 120.07 | 3.1149 | 3.1149 | ||||||

| CBRE U.S. Credit Partners, L.P. / RE (N/A) | 0.12 | 118.35 | 3.0701 | 3.0701 | |||||

| CBRE U.S. Core Partners, L.P. / RE (N/A) | 76.68 | 116.98 | 3.0346 | 3.0346 | |||||

| Oaktree Real Estate Income Fund, L.P. / RE (N/A) | 116.60 | 3.0250 | 3.0250 | ||||||

| Third Point Private CRE Credit Fund L.P. / RE (N/A) | 0.11 | 108.92 | 2.8256 | 2.8256 | |||||

| Article Student Living Income and Growth L.P. / RE (N/A) | 0.09 | 101.73 | 2.6391 | 2.6391 | |||||

| Clarion Lion Industrial Trust, L.P. / RE (N/A) | 0.03 | 96.57 | 2.5052 | 2.5052 | |||||

| WELL / Welltower Inc. | 0.52 | -8.62 | 80.21 | -8.31 | 2.0809 | -0.0810 | |||

| EQIX / Equinix, Inc. | 0.10 | -9.15 | 77.93 | -11.37 | 2.0217 | -0.1510 | |||

| Clarion Gables Multifamily Trust, L.P. / RE (N/A) | 0.05 | 76.55 | 1.9857 | 1.9857 | |||||

| PLD / Prologis, Inc. | 0.69 | -9.46 | 72.08 | -14.86 | 1.8699 | -0.2221 | |||

| DLR / Digital Realty Trust, Inc. | 0.31 | -11.96 | 54.11 | 7.11 | 1.4036 | 0.1553 | |||

| Manulife U.S. Real Estate Fund, L.P. / RE (N/A) | 0.04 | 51.40 | 1.3334 | 1.3334 | |||||

| Brookfield Senior Mezzanine Real Estate Finance Fund / RE (N/A) | 0.11 | 49.94 | 1.2956 | 1.2956 | |||||

| Principal Real Estate Liquid Debt Fund, L.P. / RE (N/A) | 2.18 | 49.61 | 1.2871 | 1.2871 | |||||

| TA Realty Core Property Fund, L.P. / RE (N/A) | 0.04 | 48.81 | 1.2662 | 1.2662 | |||||

| VTR / Ventas, Inc. | 0.69 | -7.51 | 43.29 | -15.06 | 1.1230 | -0.1363 | |||

| EXR / Extra Space Storage Inc. | 0.28 | -9.54 | 41.77 | -10.18 | 1.0835 | -0.0656 | |||

| Stockbridge Smart Markets Fund, L.P. / RE (N/A) | 0.02 | 40.91 | 1.0614 | 1.0614 | |||||

| UDR / UDR, Inc. | 0.92 | -6.23 | 37.42 | -15.24 | 0.9708 | -0.1202 | |||

| JPM U.S. Real Estate Mezzanine Debt Fund, L.P. / RE (N/A) | 0.37 | 37.20 | 0.9651 | 0.9651 | |||||

| Affinius U.S. Government Building Fund / RE (N/A) | 36.09 | 0.9363 | 0.9363 | ||||||

| O / Realty Income Corporation | 0.60 | -17.43 | 34.53 | -18.00 | 0.8959 | -0.1448 | |||

| CPT / Camden Property Trust | 0.27 | -10.22 | 30.95 | -17.27 | 0.8029 | -0.1216 | |||

| SPG / Simon Property Group, Inc. | 0.19 | -12.68 | 30.28 | -15.47 | 0.7855 | -0.0997 | |||

| Heitman Core Real Estate Debt Income Trust / RE (N/A) | 0.04 | 29.96 | 0.7773 | 0.7773 | |||||

| EQR / Equity Residential | 0.44 | -15.80 | 29.56 | -20.61 | 0.7669 | -0.1533 | |||

| Sentinel Real Estate Fund, L.P. / RE (N/A) | 0.00 | 28.41 | 0.7371 | 0.7371 | |||||

| DOC / Healthpeak Properties, Inc. | 1.61 | -1.88 | 28.21 | -15.03 | 0.7319 | -0.0886 | |||

| Sagard U.S. Property Fund / RE (N/A) | 26.66 | 0.6915 | 0.6915 | ||||||

| CrossHarbor Strategic Debt Fund, L.P. / RE (N/A) | 26.50 | 0.6875 | 0.6875 | ||||||

| PSA / Public Storage | 0.09 | -16.20 | 26.07 | -17.84 | 0.6764 | -0.1078 | |||

| KIM / Kimco Realty Corporation | 1.24 | 14.97 | 26.05 | 13.78 | 0.6757 | 0.1100 | |||

| BRX / Brixmor Property Group Inc. | 1.00 | 13.53 | 26.03 | 11.35 | 0.6753 | 0.0976 | |||

| IRM / Iron Mountain Incorporated | 0.24 | -8.90 | 24.26 | 8.60 | 0.6294 | 0.0774 | |||

| PRISA, L.P. / RE (N/A) | 0.01 | 23.50 | 0.6096 | 0.6096 | |||||

| ADC / Agree Realty Corporation | 0.31 | 7.21 | 22.85 | 1.47 | 0.5928 | 0.0363 | |||

| INVH / Invitation Homes Inc. | 0.67 | -43.15 | 22.13 | -46.49 | 0.5740 | -0.4479 | |||

| VICI / VICI Properties Inc. | 0.59 | 2.51 | 19.32 | 2.44 | 0.5012 | 0.0352 | |||

| HST / Host Hotels & Resorts, Inc. | 1.17 | -19.55 | 17.94 | -13.04 | 0.4654 | -0.0444 | |||

| CUZ / Cousins Properties Incorporated | 0.57 | -1.83 | 17.22 | -0.06 | 0.4467 | 0.0209 | |||

| KRG / Kite Realty Group Trust | 0.75 | -3.62 | 17.04 | -2.41 | 0.4420 | 0.0106 | |||

| OHI / Omega Healthcare Investors, Inc. | 0.43 | 51.71 | 15.85 | 46.02 | 0.4111 | 0.1429 | |||

| AMH / American Homes 4 Rent | 0.41 | 98.06 | 14.90 | 88.94 | 0.3866 | 0.1917 | |||

| REXR / Rexford Industrial Realty, Inc. | 0.40 | -19.14 | 14.19 | -26.53 | 0.3682 | -0.1092 | |||

| Heitman America Real Estate Trust, L.P. / RE (N/A) | 0.01 | 13.84 | 0.3591 | 0.3591 | |||||

| VNO / Vornado Realty Trust | 0.35 | 2.38 | 13.32 | 5.85 | 0.3455 | 0.0346 | |||

| CUBE / CubeSmart | 0.31 | -0.50 | 13.16 | -0.99 | 0.3414 | 0.0130 | |||

| AHR / American Healthcare REIT, Inc. | 0.36 | -15.61 | 13.10 | 2.32 | 0.3399 | 0.0235 | |||

| FRT / Federal Realty Investment Trust | 0.14 | -3.83 | 13.05 | -6.62 | 0.3386 | -0.0068 | |||

| BXP / Boston Properties, Inc. | 0.18 | -34.62 | 12.36 | -34.35 | 0.3207 | -0.1446 | |||

| BGO Diversified US Property Fund, L.P. / RE (N/A) | 0.00 | 11.51 | 0.2985 | 0.2985 | |||||

| FR / First Industrial Realty Trust, Inc. | 0.22 | -1.90 | 10.77 | -12.50 | 0.2793 | -0.0248 | |||

| NNN / NNN REIT, Inc. | 0.22 | -44.26 | 9.61 | -43.57 | 0.2494 | -0.1716 | |||

| UBS Trumbull Property Fund / RE (N/A) | 0.00 | 9.12 | 0.2366 | 0.2366 | |||||

| BNL / Broadstone Net Lease, Inc. | 0.55 | 5.44 | 8.86 | -0.68 | 0.2297 | 0.0094 | |||

| HR / Healthcare Realty Trust Incorporated | 0.53 | 99.82 | 8.44 | 87.53 | 0.2189 | 0.1077 | |||

| US61747C5821 / Morgan Stanley Institutional Liquidity Funds - Treasury Portfolio | 8.32 | 3.55 | 8.32 | 3.55 | 0.2158 | 0.0173 | |||

| SUI / Sun Communities, Inc. | 0.06 | -38.06 | 7.94 | -39.09 | 0.2059 | -0.1161 | |||

| NTST / NETSTREIT Corp. | 0.40 | -1.68 | 6.80 | 5.02 | 0.1765 | 0.0164 | |||

| COLD / Americold Realty Trust, Inc. | 0.40 | -13.17 | 6.63 | -32.72 | 0.1720 | -0.0715 | |||

| Voya Commercial Mortgage Lending Fund, L.P. / RE (N/A) | 6.19 | 0.1607 | 0.1607 | ||||||

| DRH / DiamondRock Hospitality Company | 0.80 | 0.76 | 6.17 | -0.03 | 0.1600 | 0.0076 | |||

| LINE / Lineage, Inc. | 0.13 | -12.06 | 5.71 | -34.72 | 0.1480 | -0.0680 | |||

| LAMR / Lamar Advertising Company | 0.05 | -58.80 | 5.57 | -56.06 | 0.1446 | -0.1688 | |||

| MAC / The Macerich Company | 0.33 | 3.09 | 5.28 | -2.87 | 0.1370 | 0.0027 | |||

| ARE / Alexandria Real Estate Equities, Inc. | 0.07 | -10.13 | 4.85 | -29.45 | 0.1258 | -0.0441 | |||

| AMH.PRH / American Homes 4 Rent - Preferred Stock | 0.20 | 0.00 | 4.69 | -0.47 | 0.1216 | 0.0052 | |||

| DLR.PRK / Digital Realty Trust, Inc. - Preferred Stock | 0.20 | 0.00 | 4.48 | -1.63 | 0.1161 | 0.0037 | |||

| IRT / Independence Realty Trust, Inc. | 0.24 | -34.97 | 4.30 | -28.68 | 0.1115 | -0.0199 | |||

| NSA.PRA / National Storage Affiliates Trust - Preferred Stock | 0.19 | 0.00 | 4.27 | 2.11 | 0.1107 | 0.0074 | |||

| ESRT / Empire State Realty Trust, Inc. | 0.46 | 8.82 | 3.76 | 12.58 | 0.0975 | 0.0150 | |||

| SHO / Sunstone Hotel Investors, Inc. | 0.40 | 66.72 | 3.44 | 53.82 | 0.0893 | 0.0340 | |||

| SHO.PRH / Sunstone Hotel Investors, Inc. - Preferred Stock | 0.15 | 0.00 | 3.10 | 1.67 | 0.0804 | 0.0051 | |||

| REXR.PRB / Rexford Industrial Realty, Inc. - Preferred Stock | 0.13 | 0.00 | 3.00 | -2.22 | 0.0778 | 0.0020 | |||

| PSA.PRH / Public Storage - Preferred Stock | 0.13 | 0.00 | 2.98 | -2.23 | 0.0774 | 0.0020 | |||

| LXP / LXP Industrial Trust | 0.33 | -42.07 | 2.72 | -44.69 | 0.0707 | -0.0510 | |||

| VNO.PRL / Vornado Realty Trust - Preferred Stock | 0.15 | 3.33 | 2.65 | 4.66 | 0.0687 | 0.0062 | |||

| KIM.PRM / Kimco Realty Corporation - Preferred Stock | 0.13 | 9.50 | 2.64 | 4.38 | 0.0686 | 0.0060 | |||

| REGCP / Regency Centers Corporation - Preferred Stock | 0.11 | 5.19 | 2.62 | 6.94 | 0.0680 | 0.0074 | |||

| DEI / Douglas Emmett, Inc. | 0.17 | -33.17 | 2.57 | -45.86 | 0.0667 | -0.0453 | |||

| EPR.PRG / EPR Properties - Preferred Stock | 0.12 | 0.05 | 2.46 | 0.99 | 0.0638 | 0.0036 | |||

| FRT.PRC / Federal Realty Investment Trust - Preferred Stock | 0.12 | 0.00 | 2.42 | -1.86 | 0.0629 | 0.0018 | |||

| DRH.PRA / DiamondRock Hospitality Company - Preferred Stock | 0.10 | 6.75 | 2.34 | 5.46 | 0.0607 | 0.0059 | |||

| SLG.PRI / SL Green Realty Corp. - Preferred Stock | 0.10 | 13.62 | 2.27 | 10.45 | 0.0590 | 0.0081 | |||

| PEB.PRE / Pebblebrook Hotel Trust - Preferred Stock | 0.13 | 0.00 | 2.23 | 2.38 | 0.0580 | 0.0040 | |||

| PEB.PRG / Pebblebrook Hotel Trust - Preferred Stock | 0.12 | 0.00 | 2.08 | -0.91 | 0.0539 | 0.0021 | |||

| BFS.PRD / Saul Centers, Inc. - Preferred Stock | 0.10 | 0.00 | 2.05 | 0.29 | 0.0532 | 0.0027 | |||

| ELME / Elme Communities | 0.12 | -56.35 | 1.97 | -50.15 | 0.0511 | -0.0351 | |||

| APLE / Apple Hospitality REIT, Inc. | 0.17 | 1.96 | 0.0510 | 0.0510 | |||||

| REXR.PRC / Rexford Industrial Realty, Inc. - Preferred Stock | 0.09 | 0.00 | 1.91 | -2.66 | 0.0494 | 0.0011 | |||

| DBRG.PRI / DigitalBridge Group, Inc. - Preferred Stock | 0.09 | 2.25 | 1.87 | -10.37 | 0.0484 | -0.0030 | |||

| PSA.PRL / Public Storage - Preferred Stock | 0.10 | 0.00 | 1.86 | -3.37 | 0.0483 | 0.0007 | |||

| VNO.PRM / Vornado Realty Trust - Preferred Stock | 0.11 | 10.05 | 1.84 | 11.49 | 0.0478 | 0.0070 | |||

| INN.PRE / Summit Hotel Properties, Inc. - Preferred Stock | 0.09 | 0.00 | 1.66 | -11.24 | 0.0430 | -0.0032 | |||

| ADC.PRA / Agree Realty Corporation - Preferred Stock | 0.09 | 0.00 | 1.53 | -1.36 | 0.0396 | 0.0013 | |||

| VNO.PRN / Vornado Realty Trust - Preferred Stock | 0.09 | 7.65 | 1.51 | 7.63 | 0.0392 | 0.0045 | |||

| SHO.PRI / Sunstone Hotel Investors, Inc. - Preferred Stock | 0.08 | 0.00 | 1.42 | 0.64 | 0.0368 | 0.0020 | |||

| DLR.PRL / Digital Realty Trust, Inc. - Preferred Stock | 0.06 | 4.18 | 1.24 | 3.41 | 0.0323 | 0.0026 | |||

| DLR.PRJ / Digital Realty Trust, Inc. - Preferred Stock | 0.06 | 0.00 | 1.22 | 0.58 | 0.0317 | 0.0017 | |||

| GNL.PRD / Global Net Lease, Inc. - Preferred Stock | 0.05 | 26.06 | 1.20 | 23.43 | 0.0312 | 0.0071 | |||

| HPP / Hudson Pacific Properties, Inc. | 0.42 | 111.36 | 1.14 | -60.99 | 0.0296 | -0.0198 | |||

| BFS.PRE / Saul Centers, Inc. - Preferred Stock | 0.05 | 0.00 | 1.10 | 1.48 | 0.0285 | 0.0018 | |||

| AMH.PRG / American Homes 4 Rent - Preferred Stock | 0.04 | 0.00 | 0.98 | 2.83 | 0.0255 | 0.0019 | |||

| KIM.PRL / Kimco Realty Corporation - Preferred Stock | 0.05 | 11.36 | 0.96 | 6.18 | 0.0250 | 0.0026 | |||

| PEB.PRH / Pebblebrook Hotel Trust - Preferred Stock | 0.06 | 0.00 | 0.95 | 0.42 | 0.0246 | 0.0013 | |||

| US16208T2015 / Chatham Lodging Trust | 0.05 | 0.00 | 0.91 | 0.55 | 0.0236 | 0.0012 | |||

| US9290427940 / VORNADO REALTY TRUST SER O 4.45% PERP PFD | 0.06 | 0.00 | 0.90 | -1.53 | 0.0233 | 0.0008 | |||

| PSA.PRF / Public Storage - Preferred Stock | 0.04 | 0.00 | 0.87 | -3.85 | 0.0227 | 0.0002 | |||

| US25401T3068 / DIGITALBRIDGE GROUP INC 7.125% SER J PFD PERP | 0.04 | 7.25 | 0.76 | -5.93 | 0.0197 | -0.0003 | |||

| GNL.PRA / Global Net Lease, Inc. - Preferred Stock | 0.03 | 1.92 | 0.75 | -0.27 | 0.0194 | 0.0009 | |||

| PEB.PRF / Pebblebrook Hotel Trust - Preferred Stock | 0.04 | 0.00 | 0.71 | 0.28 | 0.0185 | 0.0009 | |||

| INN.PRF / Summit Hotel Properties, Inc. - Preferred Stock | 0.03 | 0.00 | 0.56 | -8.29 | 0.0146 | -0.0006 | |||

| REGCO / Regency Centers Corporation - Preferred Stock | 0.02 | 0.00 | 0.48 | 2.34 | 0.0125 | 0.0009 | |||

| PSA.PRG / Public Storage - Preferred Stock | 0.02 | 0.00 | 0.44 | -4.40 | 0.0113 | 0.0001 | |||

| HPP.PRC / Hudson Pacific Properties, Inc. - Preferred Stock | 0.03 | -34.50 | 0.42 | -25.98 | 0.0108 | -0.0031 | |||

| PSA.PRJ / Public Storage - Preferred Stock | 0.02 | 0.00 | 0.35 | -5.68 | 0.0091 | -0.0001 | |||

| GNL.PRE / Global Net Lease, Inc. - Preferred Stock | 0.01 | 11.27 | 0.21 | 8.63 | 0.0056 | 0.0007 | |||

| PSA.PRI / Public Storage - Preferred Stock | 0.01 | 0.00 | 0.21 | -4.98 | 0.0055 | -0.0000 |