Mga Batayang Estadistika

| Nilai Portofolio | $ 1,015,358,002 |

| Posisi Saat Ini | 167 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

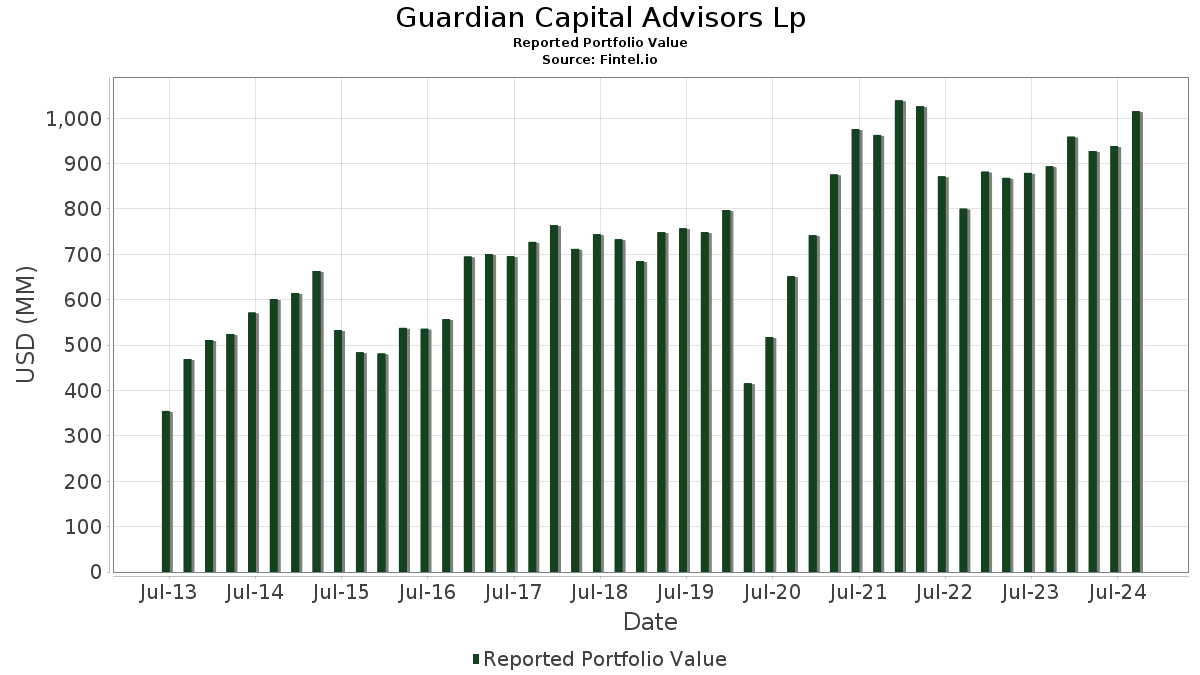

Guardian Capital Advisors Lp telah mengungkapkan total kepemilikan 167 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 1,015,358,002 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Guardian Capital Advisors Lp adalah Royal Bank of Canada (US:RY) , The Toronto-Dominion Bank (US:TD) , MicroSectors Gold Miners -3X Inverse Leveraged ETNs due June 29, 2040 (US:GDXD) , The Bank of Nova Scotia (CA:BNS) , and Enbridge Inc. - Preferred Stock (US:EBGEF) . Posisi baru Guardian Capital Advisors Lp meliputi: Vanguard Scottsdale Funds - Vanguard Long-Term Treasury ETF (US:VGLT) , Broadcom Inc. (US:AVGO) , Lam Research Corporation (US:LRCX) , Citigroup, Inc. (US:C.WSA) , and .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.10 | 11.11 | 1.0941 | 0.8160 | |

| 0.40 | 11.25 | 1.1081 | 0.3563 | |

| 0.01 | 3.90 | 0.3846 | 0.3517 | |

| 0.73 | 46.50 | 4.5801 | 0.3101 | |

| 0.51 | 63.42 | 6.2462 | 0.3065 | |

| 0.80 | 32.92 | 3.2423 | 0.2269 | |

| 0.35 | 21.15 | 2.0833 | 0.2055 | |

| 0.33 | 15.57 | 1.5335 | 0.1989 | |

| 0.29 | 15.44 | 1.5210 | 0.1873 | |

| 0.05 | 16.34 | 1.6092 | 0.1788 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.13 | 7.23 | 0.7122 | -0.7433 | |

| 0.13 | 15.38 | 1.5150 | -0.4580 | |

| 0.02 | 0.84 | 0.0826 | -0.2489 | |

| 0.60 | 20.60 | 2.0286 | -0.2179 | |

| 0.01 | 0.60 | 0.0587 | -0.2146 | |

| 0.07 | 30.70 | 3.0239 | -0.2104 | |

| 0.09 | 20.64 | 2.0327 | -0.1967 | |

| 0.23 | 26.80 | 2.6394 | -0.1955 | |

| 0.03 | 5.27 | 0.5189 | -0.1883 | |

| 0.10 | 20.26 | 1.9952 | -0.1808 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2024-11-12 untuk periode pelaporan 2024-09-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| RY / Royal Bank of Canada | 0.51 | 1.39 | 63.42 | 13.74 | 6.2462 | 0.3065 | |||

| TD / The Toronto-Dominion Bank | 0.73 | 1.35 | 46.50 | 16.01 | 4.5801 | 0.3101 | |||

| GDXD / MicroSectors Gold Miners -3X Inverse Leveraged ETNs due June 29, 2040 | 0.37 | 2.60 | 34.12 | 10.14 | 3.3605 | 0.0605 | |||

| BNS / The Bank of Nova Scotia | 0.61 | -3.83 | 33.30 | 13.54 | 3.2795 | 0.1557 | |||

| EBGEF / Enbridge Inc. - Preferred Stock | 0.80 | 0.73 | 32.92 | 16.30 | 3.2423 | 0.2269 | |||

| MSFT / Microsoft Corporation | 0.07 | 12.07 | 30.70 | 1.12 | 3.0239 | -0.2104 | |||

| CNI / Canadian National Railway Company | 0.23 | 1.60 | 26.80 | 0.70 | 2.6394 | -0.1955 | |||

| CM / Canadian Imperial Bank of Commerce | 0.35 | -3.07 | 21.15 | 19.99 | 2.0833 | 0.2055 | |||

| AAPL / Apple Inc. | 0.09 | 1.56 | 20.64 | -1.39 | 2.0327 | -0.1967 | |||

| CNQ / Canadian Natural Resources Limited | 0.60 | 1.18 | 20.60 | -2.34 | 2.0286 | -0.2179 | |||

| JPM / JPMorgan Chase & Co. | 0.10 | -0.46 | 20.26 | -0.83 | 1.9952 | -0.1808 | |||

| VUG / Vanguard Index Funds - Vanguard Growth ETF | 0.04 | 3.08 | 16.84 | -0.37 | 1.6583 | -0.1420 | |||

| MCD / McDonald's Corporation | 0.05 | 0.59 | 16.34 | 21.68 | 1.6092 | 0.1788 | |||

| JNJ / Johnson & Johnson | 0.10 | -0.41 | 15.64 | 7.97 | 1.5403 | -0.0027 | |||

| BAM / Brookfield Asset Management Ltd. | 0.33 | 1.78 | 15.57 | 24.27 | 1.5335 | 0.1989 | |||

| BN / Brookfield Corporation | 0.29 | 2.09 | 15.44 | 23.34 | 1.5210 | 0.1873 | |||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.13 | 0.45 | 15.38 | -16.95 | 1.5150 | -0.4580 | |||

| PEP / PepsiCo, Inc. | 0.09 | 2.08 | 15.34 | 6.94 | 1.5111 | -0.0171 | |||

| DUK / Duke Energy Corporation | 0.13 | 1.10 | 14.70 | 14.26 | 1.4482 | 0.0774 | |||

| EMR / Emerson Electric Co. | 0.13 | 0.54 | 14.54 | -1.48 | 1.4324 | -0.1401 | |||

| TU / TELUS Corporation | 0.85 | -2.95 | 14.24 | 6.91 | 1.4028 | -0.0164 | |||

| BCE / BCE Inc. | 0.39 | 7.12 | 13.68 | 17.82 | 1.3471 | 0.1106 | |||

| NTR / Nutrien Ltd. | 0.27 | -3.41 | 13.24 | -1.03 | 1.3044 | -0.1211 | |||

| FTS / Fortis Inc. | 0.29 | 3.44 | 13.09 | 18.93 | 1.2897 | 0.1169 | |||

| ING / ING Groep N.V. - Depositary Receipt (Common Stock) | 0.73 | 0.01 | 12.96 | -1.99 | 1.2764 | -0.1320 | |||

| WMT / Walmart Inc. | 0.16 | 1.37 | 12.73 | 17.01 | 1.2541 | 0.0949 | |||

| IMO / Imperial Oil Limited | 0.17 | -0.24 | 12.28 | 6.62 | 1.2097 | -0.0174 | |||

| NGG / National Grid plc - Depositary Receipt (Common Stock) | 0.17 | 0.13 | 11.90 | 14.17 | 1.1722 | 0.0617 | |||

| EWJV / iShares Trust - iShares MSCI Japan Value ETF | 0.35 | -0.92 | 11.70 | 0.20 | 1.1523 | -0.0915 | |||

| SAP / SAP SE - Depositary Receipt (Common Stock) | 0.05 | 0.11 | 11.67 | 11.75 | 1.1492 | 0.0370 | |||

| DFEM / Dimensional ETF Trust - Dimensional Emerging Markets Core Equity 2 ETF | 0.40 | 51.19 | 11.25 | 59.42 | 1.1081 | 0.3563 | |||

| RCI / Rogers Communications Inc. | 0.28 | 3.65 | 11.18 | 12.67 | 1.1012 | 0.0441 | |||

| TIP / iShares Trust - iShares TIPS Bond ETF | 0.10 | 311.36 | 11.11 | 325.59 | 1.0941 | 0.8160 | |||

| UNH / UnitedHealth Group Incorporated | 0.02 | 4.20 | 11.09 | 21.34 | 1.0920 | 0.1186 | |||

| MA / Mastercard Incorporated | 0.02 | 6.77 | 10.94 | 22.22 | 1.0774 | 0.1239 | |||

| SNY / Sanofi - Depositary Receipt (Common Stock) | 0.18 | 0.54 | 10.49 | 12.92 | 1.0332 | 0.0435 | |||

| CVX / Chevron Corporation | 0.07 | 2.09 | 10.42 | -1.48 | 1.0267 | -0.1005 | |||

| SU / Suncor Energy Inc. | 0.27 | -0.32 | 10.32 | 1.53 | 1.0164 | -0.0663 | |||

| PPL / Pembina Pipeline Corporation | 0.23 | -3.88 | 9.78 | 7.60 | 0.9633 | -0.0049 | |||

| SLF / Sun Life Financial Inc. | 0.17 | 0.21 | 9.72 | 17.06 | 0.9576 | 0.0728 | |||

| COST / Costco Wholesale Corporation | 0.01 | -5.74 | 9.50 | -6.47 | 0.9351 | -0.1463 | |||

| TRP / TC Energy Corporation | 0.18 | -2.23 | 8.93 | 23.38 | 0.8796 | 0.1085 | |||

| TTE / TotalEnergies SE - Depositary Receipt (Common Stock) | 0.13 | 0.61 | 8.37 | -3.02 | 0.8243 | -0.0950 | |||

| TXN / Texas Instruments Incorporated | 0.04 | -0.51 | 8.35 | -1.50 | 0.8222 | -0.0806 | |||

| AXP / American Express Company | 0.03 | -0.79 | 8.21 | 11.52 | 0.8089 | 0.0244 | |||

| TSM / Taiwan Semiconductor Manufacturing Company Limited - Depositary Receipt (Common Stock) | 0.05 | -0.30 | 8.07 | -10.20 | 0.7950 | -0.1625 | |||

| ORCL / Oracle Corporation | 0.05 | -1.06 | 7.57 | 16.41 | 0.7456 | 0.0529 | |||

| MGA / Magna International Inc. | 0.18 | 5.50 | 7.45 | -0.49 | 0.7336 | -0.0638 | |||

| AFL / Aflac Incorporated | 0.07 | 2.37 | 7.36 | 28.02 | 0.7244 | 0.1124 | |||

| KBWB / Invesco Exchange-Traded Fund Trust II - Invesco KBW Bank ETF | 0.13 | -49.40 | 7.23 | -47.08 | 0.7122 | -0.7433 | |||

| DEO / Diageo plc - Depositary Receipt (Common Stock) | 0.05 | -5.84 | 7.11 | 1.99 | 0.7001 | -0.0423 | |||

| GOOGL / Alphabet Inc. | 0.04 | 16.25 | 6.82 | 1.55 | 0.6718 | -0.0437 | |||

| RTX / RTX Corporation | 0.05 | 2.12 | 6.79 | 26.16 | 0.6684 | 0.0954 | |||

| SPY / SPDR S&P 500 ETF | 0.01 | -0.08 | 6.37 | 1.22 | 0.6273 | -0.0430 | |||

| BHP / BHP Group Limited - Depositary Receipt (Common Stock) | 0.10 | 0.12 | 6.25 | 6.69 | 0.6157 | -0.0084 | |||

| OTEX / Open Text Corporation | 0.19 | 7.72 | 6.17 | 13.86 | 0.6078 | 0.0305 | |||

| MUFG / Mitsubishi UFJ Financial Group, Inc. - Depositary Receipt (Common Stock) | 0.60 | 6.77 | 6.12 | -2.69 | 0.6031 | -0.0671 | |||

| MFC / Manulife Financial Corporation | 0.19 | -3.84 | 5.65 | 4.86 | 0.5569 | -0.0174 | |||

| CMCSA / Comcast Corporation | 0.13 | -1.08 | 5.54 | 10.21 | 0.5454 | 0.0101 | |||

| QCOM / QUALCOMM Incorporated | 0.03 | -0.06 | 5.27 | -20.65 | 0.5189 | -0.1883 | |||

| NKE / NIKE, Inc. | 0.06 | 2.68 | 5.12 | 26.17 | 0.5039 | 0.0719 | |||

| SBUX / Starbucks Corporation | 0.05 | 2.60 | 5.10 | 37.85 | 0.5025 | 0.1083 | |||

| AEP / American Electric Power Company, Inc. | 0.05 | 2.41 | 4.98 | 18.62 | 0.4900 | 0.0432 | |||

| AEM / Agnico Eagle Mines Limited | 0.06 | -17.49 | 4.96 | -7.55 | 0.4886 | -0.0829 | |||

| ABCL / AbCellera Biologics Inc. | 1.79 | 0.00 | 4.59 | -8.20 | 0.4522 | -0.0806 | |||

| DHR / Danaher Corporation | 0.01 | 1,017.20 | 3.90 | 1,167.53 | 0.3846 | 0.3517 | |||

| AZN / AstraZeneca PLC - Depositary Receipt (Common Stock) | 0.05 | 4.24 | 3.83 | 5.49 | 0.3769 | -0.0096 | |||

| FCX / Freeport-McMoRan Inc. | 0.07 | 2.57 | 3.63 | 0.17 | 0.3571 | -0.0285 | |||

| TRI / Thomson Reuters Corporation | 0.02 | 9.05 | 3.51 | 10.88 | 0.3453 | 0.0084 | |||

| UL / Unilever PLC - Depositary Receipt (Common Stock) | 0.05 | 0.85 | 3.41 | 15.31 | 0.3354 | 0.0208 | |||

| BIP / Brookfield Infrastructure Partners L.P. - Limited Partnership | 0.10 | -8.70 | 3.40 | 7.87 | 0.3348 | -0.0009 | |||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.01 | 0.62 | 3.39 | 1.96 | 0.3337 | -0.0202 | |||

| WFC / Wells Fargo & Company | 0.06 | -1.28 | 3.38 | -8.45 | 0.3329 | -0.0603 | |||

| PFE / Pfizer Inc. | 0.11 | -16.83 | 3.18 | -15.90 | 0.3136 | -0.0897 | |||

| ELV / Elevance Health, Inc. | 0.01 | 0.00 | 3.14 | -4.38 | 0.3097 | -0.0405 | |||

| DIS / The Walt Disney Company | 0.03 | 3.75 | 3.10 | 0.65 | 0.3052 | -0.0228 | |||

| MKTX / MarketAxess Holdings Inc. | 0.01 | -7.62 | 2.94 | 14.20 | 0.2900 | 0.0154 | |||

| WCN / Waste Connections, Inc. | 0.02 | -2.76 | 2.81 | -3.60 | 0.2771 | -0.0338 | |||

| INTU / Intuit Inc. | 0.00 | -8.19 | 2.62 | -12.03 | 0.2578 | -0.0592 | |||

| LLY / Eli Lilly and Company | 0.00 | -3.15 | 2.58 | -8.85 | 0.2545 | -0.0475 | |||

| NDAQ / Nasdaq, Inc. | 0.03 | 30.39 | 2.51 | 54.56 | 0.2470 | 0.0741 | |||

| WAT / Waters Corporation | 0.01 | 16.27 | 2.43 | 44.56 | 0.2396 | 0.0603 | |||

| VEA / Vanguard Tax-Managed Funds - Vanguard FTSE Developed Markets ETF | 0.05 | 0.00 | 2.40 | 3.27 | 0.2364 | -0.0112 | |||

| BXP / Boston Properties, Inc. | 0.03 | 7.63 | 2.39 | 38.70 | 0.2351 | 0.0518 | |||

| ILMN / Illumina, Inc. | 0.02 | 49.43 | 2.20 | 70.38 | 0.2170 | 0.0792 | |||

| GOOGL / Alphabet Inc. | 0.01 | 4.00 | 2.14 | -9.11 | 0.2112 | -0.0401 | |||

| BEP / Brookfield Renewable Partners L.P. - Limited Partnership | 0.07 | 0.57 | 1.85 | 8.01 | 0.1821 | -0.0002 | |||

| CME / CME Group Inc. | 0.01 | -22.65 | 1.85 | -9.95 | 0.1818 | -0.0366 | |||

| NVDA / NVIDIA Corporation | 0.02 | 106.34 | 1.79 | 78.96 | 0.1760 | 0.0696 | |||

| AMZN / Amazon.com, Inc. | 0.01 | 154.57 | 1.78 | 136.03 | 0.1755 | 0.0951 | |||

| JD / JD.com, Inc. - Depositary Receipt (Common Stock) | 0.04 | 63.41 | 1.73 | 162.16 | 0.1700 | 0.0998 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | -1.44 | 1.72 | 8.95 | 0.1690 | 0.0012 | |||

| PLTR / Palantir Technologies Inc. | 0.04 | 51.57 | 1.63 | 94.50 | 0.1602 | 0.0711 | |||

| TECK / Teck Resources Limited | 0.03 | -2.73 | 1.61 | 1.97 | 0.1582 | -0.0096 | |||

| CCJ / Cameco Corporation | 0.03 | -0.05 | 1.59 | -9.11 | 0.1562 | -0.0297 | |||

| VRSK / Verisk Analytics, Inc. | 0.01 | 8.78 | 1.56 | 5.32 | 0.1541 | -0.0042 | |||

| GIB / CGI Inc. | 0.01 | 20.25 | 1.51 | 34.14 | 0.1482 | 0.0287 | |||

| BKNG / Booking Holdings Inc. | 0.00 | 28.07 | 1.50 | 31.57 | 0.1474 | 0.0263 | |||

| LIN / Linde plc | 0.00 | -26.31 | 1.50 | -19.53 | 0.1474 | -0.0507 | |||

| CP / Canadian Pacific Kansas City Limited | 0.02 | -34.39 | 1.40 | -31.75 | 0.1376 | -0.0805 | |||

| ONON / On Holding AG | 0.03 | 2.20 | 1.37 | 37.68 | 0.1354 | 0.0290 | |||

| ADP / Automatic Data Processing, Inc. | 0.00 | 62.37 | 1.31 | 94.20 | 0.1285 | 0.0570 | |||

| PANW / Palo Alto Networks, Inc. | 0.00 | -12.05 | 1.20 | -14.09 | 0.1184 | -0.0306 | |||

| SHOP / Shopify Inc. | 0.02 | 216.89 | 1.19 | 280.83 | 0.1174 | 0.0840 | |||

| CVE / Cenovus Energy Inc. | 0.07 | -26.93 | 1.16 | -35.94 | 0.1145 | -0.0788 | |||

| AQN / Algonquin Power & Utilities Corp. | 0.19 | -4.94 | 1.08 | -13.86 | 0.1059 | -0.0271 | |||

| TRV / The Travelers Companies, Inc. | 0.00 | 0.00 | 1.07 | 13.56 | 0.1056 | 0.0050 | |||

| BIL / SPDR Series Trust - SPDR Bloomberg 1-3 Month T-Bill ETF | 0.01 | 25.88 | 1.07 | 25.73 | 0.1055 | 0.0148 | |||

| SQ / Block, Inc. | 0.02 | 21.92 | 1.06 | 24.91 | 0.1048 | 0.0141 | |||

| ROP / Roper Technologies, Inc. | 0.00 | 1.59 | 0.88 | 0.69 | 0.0865 | -0.0064 | |||

| ETN / Eaton Corporation plc | 0.00 | 0.87 | 0.0859 | 0.0859 | |||||

| TAC / TransAlta Corporation | 0.08 | -10.27 | 0.85 | 35.89 | 0.0839 | 0.0171 | |||

| BAX / Baxter International Inc. | 0.02 | -74.99 | 0.84 | -73.04 | 0.0826 | -0.2489 | |||

| COPX / Global X Funds - Global X Copper Miners ETF | 0.02 | 0.00 | 0.84 | 1.33 | 0.0824 | -0.0056 | |||

| GLW / Corning Incorporated | 0.02 | 0.00 | 0.80 | -2.07 | 0.0792 | -0.0083 | |||

| VGLT / Vanguard Scottsdale Funds - Vanguard Long-Term Treasury ETF | 0.01 | 0.80 | 0.0790 | 0.0790 | |||||

| NEE / NextEra Energy, Inc. | 0.01 | 59.32 | 0.80 | 86.28 | 0.0789 | 0.0331 | |||

| SHY / iShares Trust - iShares 1-3 Year Treasury Bond ETF | 0.01 | -8.10 | 0.80 | -6.66 | 0.0788 | -0.0125 | |||

| AVGO / Broadcom Inc. | 0.00 | 0.76 | 0.0750 | 0.0750 | |||||

| ACN / Accenture plc | 0.00 | -53.30 | 0.76 | -44.36 | 0.0749 | -0.0707 | |||

| AGG / iShares Trust - iShares Core U.S. Aggregate Bond ETF | 0.01 | 3.34 | 0.75 | 7.19 | 0.0734 | -0.0007 | |||

| LRCX / Lam Research Corporation | 0.00 | 0.73 | 0.0000 | ||||||

| PM / Philip Morris International Inc. | 0.01 | -0.43 | 0.70 | 16.78 | 0.0686 | 0.0051 | |||

| BAC / Bank of America Corporation | 0.02 | 0.00 | 0.69 | -6.09 | 0.0684 | -0.0103 | |||

| V / Visa Inc. | 0.00 | 4.15 | 0.67 | 10.03 | 0.0659 | 0.0011 | |||

| VEVFX / Vanguard Scottsdale Funds - Vanguard Explorer Value Fund | 0.01 | 0.00 | 0.61 | 1.49 | 0.0604 | -0.0039 | |||

| WPM / Wheaton Precious Metals Corp. | 0.01 | -77.94 | 0.60 | -76.80 | 0.0587 | -0.2146 | |||

| META / Meta Platforms, Inc. | 0.00 | -1.45 | 0.59 | 6.17 | 0.0577 | -0.0010 | |||

| BEPC / Brookfield Renewable Corporation | 0.02 | 6.28 | 0.58 | 14.82 | 0.0572 | 0.0033 | |||

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.00 | 0.00 | 0.55 | 2.03 | 0.0546 | -0.0033 | |||

| XLF / The Select Sector SPDR Trust - The Financial Select Sector SPDR Fund | 0.01 | 0.00 | 0.55 | 7.59 | 0.0545 | -0.0003 | |||

| ABCB / Ameris Bancorp | 0.01 | -5.75 | 0.49 | 8.61 | 0.0485 | 0.0002 | |||

| MO / Altria Group, Inc. | 0.01 | 0.00 | 0.49 | 8.44 | 0.0482 | 0.0002 | |||

| HYG / iShares Trust - iShares iBoxx $ High Yield Corporate Bond ETF | 0.01 | -15.66 | 0.48 | -13.00 | 0.0468 | -0.0114 | |||

| FANG / Diamondback Energy, Inc. | 0.00 | -29.73 | 0.46 | -38.37 | 0.0455 | -0.0343 | |||

| EEMS / iShares, Inc. - iShares MSCI Emerging Markets Small-Cap ETF | 0.01 | 0.00 | 0.45 | 1.81 | 0.0442 | -0.0028 | |||

| DXJ / WisdomTree Trust - WisdomTree Japan Hedged Equity Fund | 0.00 | 0.00 | 0.43 | -9.58 | 0.0428 | -0.0084 | |||

| UPS / United Parcel Service, Inc. | 0.00 | 0.00 | 0.41 | -1.68 | 0.0404 | -0.0041 | |||

| XHB / SPDR Series Trust - SPDR S&P Homebuilders ETF | 0.00 | 0.00 | 0.39 | 23.32 | 0.0381 | 0.0047 | |||

| PG / The Procter & Gamble Company | 0.00 | -8.28 | 0.37 | -4.69 | 0.0361 | -0.0049 | |||

| TSLA / Tesla, Inc. | 0.00 | -12.42 | 0.36 | 0.28 | 0.0352 | -0.0027 | |||

| CL / Colgate-Palmolive Company | 0.00 | 0.00 | 0.34 | 5.23 | 0.0337 | -0.0010 | |||

| FNV / Franco-Nevada Corporation | 0.00 | 4.84 | 0.33 | 4.73 | 0.0328 | -0.0011 | |||

| T / AT&T Inc. | 0.01 | -68.82 | 0.33 | -63.21 | 0.0322 | -0.0623 | |||

| LQD / iShares Trust - iShares iBoxx $ Investment Grade Corporate Bond ETF | 0.00 | 27.30 | 0.33 | 33.20 | 0.0321 | 0.0060 | |||

| HD / The Home Depot, Inc. | 0.00 | -20.10 | 0.33 | -4.97 | 0.0320 | -0.0045 | |||

| MRK / Merck & Co., Inc. | 0.00 | 0.00 | 0.32 | -9.86 | 0.0316 | -0.0063 | |||

| C.WSA / Citigroup, Inc. | 0.00 | 0.32 | 0.0000 | ||||||

| ICSH / iShares U.S. ETF Trust - iShares Ultra Short Duration Bond Active ETF | 0.01 | 14.81 | 0.31 | 15.07 | 0.0309 | 0.0018 | |||

| QQQ / Invesco QQQ Trust, Series 1 | 0.00 | 0.00 | 0.31 | -4.29 | 0.0308 | -0.0040 | |||

| CSCO / Cisco Systems, Inc. | 0.01 | -11.65 | 0.31 | 0.98 | 0.0305 | -0.0023 | |||

| MMM / 3M Company | 0.00 | 7.07 | 0.30 | 44.23 | 0.0296 | 0.0074 | |||

| PDS / Precision Drilling Corporation | 0.00 | -15.96 | 0.30 | -24.30 | 0.0292 | -0.0125 | |||

| LQDH / iShares U.S. ETF Trust - iShares Interest Rate Hedged Corporate Bond ETF | 0.00 | 27.10 | 0.29 | 27.19 | 0.0286 | 0.0042 | |||

| QSR / Restaurant Brands International Inc. | 0.00 | 17.57 | 0.27 | 22.62 | 0.0267 | 0.0031 | |||

| UNP / Union Pacific Corporation | 0.00 | 0.00 | 0.26 | 9.36 | 0.0254 | 0.0003 | |||

| QQEW / First Trust Exchange-Traded Fund - First Trust NASDAQ-100 Equal Weighted Index Fund | 0.00 | 0.00 | 0.25 | -1.17 | 0.0251 | -0.0024 | |||

| PRU / Prudential Financial, Inc. | 0.00 | -3.40 | 0.25 | -4.15 | 0.0250 | -0.0032 | |||

| IAU / iShares Gold Trust | 0.01 | 0.00 | 0.25 | 12.05 | 0.0247 | 0.0009 | |||

| DGRO / iShares Trust - iShares Core Dividend Growth ETF | 0.00 | 0.00 | 0.25 | 7.30 | 0.0246 | -0.0002 | |||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0.00 | 0.00 | 0.25 | 4.18 | 0.0245 | -0.0009 | |||

| COF / Capital One Financial Corporation | 0.00 | -3.28 | 0.22 | 3.85 | 0.0213 | -0.0009 | |||

| CPG / Veren Inc. | 0.03 | -21.11 | 0.19 | -35.76 | 0.0183 | -0.0124 | |||

| PSLV / Sprott Physical Silver Trust | 0.02 | 0.00 | 0.17 | 0.58 | 0.0169 | -0.0013 | |||

| HL / Hecla Mining Company | 0.02 | 0.00 | 0.13 | 19.09 | 0.0129 | 0.0011 | |||

| UUUU / Energy Fuels Inc. | 0.01 | 0.00 | 0.07 | -13.41 | 0.0070 | -0.0017 | |||

| KULR / KULR Technology Group, Inc. | 0.05 | 88.00 | 0.01 | 50.00 | 0.0013 | 0.0003 | |||

| ENPH / Enphase Energy, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0341 | ||||

| EL / The Estée Lauder Companies Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CRM / Salesforce, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| GS / The Goldman Sachs Group, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| INTC / Intel Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.0443 | ||||

| WYNN / Wynn Resorts, Limited | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| AES / The AES Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -0.0458 | ||||

| BTE / Baytex Energy Corp. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PAAS / Pan American Silver Corp. | 0.00 | -100.00 | 0.00 | 0.0000 |