Mga Batayang Estadistika

| Nilai Portofolio | $ 394,604,208 |

| Posisi Saat Ini | 124 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

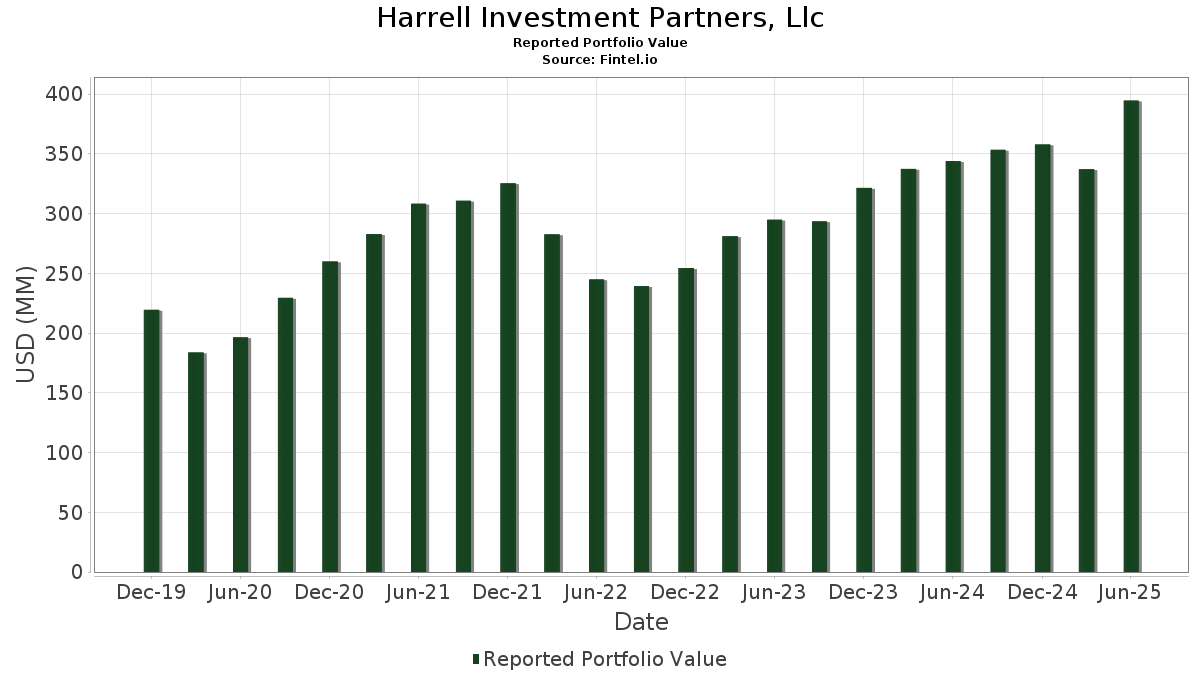

Harrell Investment Partners, Llc telah mengungkapkan total kepemilikan 124 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 394,604,208 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Harrell Investment Partners, Llc adalah Broadcom Inc. (US:AVGO) , NVIDIA Corporation (US:NVDA) , Apple Inc. (US:AAPL) , Microsoft Corporation (US:MSFT) , and JPMorgan Chase & Co. (US:JPM) . Posisi baru Harrell Investment Partners, Llc meliputi: Netflix, Inc. (US:NFLX) , Oracle Corporation (US:ORCL) , Vertex Pharmaceuticals Incorporated (US:VRTX) , Monster Beverage Corporation (US:MNST) , and Autodesk, Inc. (US:ADSK) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.14 | 22.59 | 5.7250 | 2.9441 | |

| 0.11 | 29.19 | 7.3977 | 2.7577 | |

| 0.03 | 6.07 | 1.5381 | 1.4427 | |

| 0.00 | 5.43 | 1.3754 | 1.3754 | |

| 0.04 | 19.54 | 4.9530 | 1.0687 | |

| 0.01 | 4.66 | 1.1812 | 1.0179 | |

| 0.02 | 3.79 | 0.9611 | 0.9611 | |

| 0.01 | 2.91 | 0.7385 | 0.7385 | |

| 0.04 | 9.47 | 2.4000 | 0.6109 | |

| 0.01 | 8.37 | 2.1204 | 0.5642 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.06 | 2.88 | 0.7302 | -2.3033 | |

| 0.03 | 4.04 | 1.0227 | -2.0326 | |

| 0.02 | 6.19 | 1.5687 | -1.5749 | |

| 0.00 | 0.30 | 0.0754 | -1.5082 | |

| 0.02 | 1.92 | 0.4860 | -1.3880 | |

| 0.01 | 3.36 | 0.8515 | -1.2622 | |

| 0.11 | 22.53 | 5.7097 | -1.2219 | |

| 0.01 | 2.62 | 0.6646 | -1.0784 | |

| 0.02 | 1.76 | 0.4471 | -0.9667 | |

| 0.04 | 3.97 | 1.0071 | -0.8009 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-15 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| AVGO / Broadcom Inc. | 0.11 | 13.34 | 29.19 | 86.60 | 7.3977 | 2.7577 | |||

| NVDA / NVIDIA Corporation | 0.14 | 65.28 | 22.59 | 140.94 | 5.7250 | 2.9441 | |||

| AAPL / Apple Inc. | 0.11 | 4.37 | 22.53 | -3.60 | 5.7097 | -1.2219 | |||

| MSFT / Microsoft Corporation | 0.04 | 12.63 | 19.54 | 49.24 | 4.9530 | 1.0687 | |||

| JPM / JPMorgan Chase & Co. | 0.06 | 3.18 | 16.03 | 21.96 | 4.0611 | 0.1637 | |||

| MSI / Motorola Solutions, Inc. | 0.03 | 10.31 | 11.73 | 5.93 | 2.9728 | -0.3115 | |||

| WMT / Walmart Inc. | 0.12 | 11.59 | 11.43 | 24.28 | 2.8970 | 0.1690 | |||

| ETN / Eaton Corporation plc | 0.03 | 8.25 | 10.68 | 42.16 | 2.7075 | 0.4786 | |||

| AMZN / Amazon.com, Inc. | 0.04 | 36.15 | 9.47 | 57.00 | 2.4000 | 0.6109 | |||

| META / Meta Platforms, Inc. | 0.01 | 24.52 | 8.37 | 59.46 | 2.1204 | 0.5642 | |||

| HD / The Home Depot, Inc. | 0.02 | 3.55 | 7.90 | 3.58 | 2.0014 | -0.2598 | |||

| GOOGL / Alphabet Inc. | 0.04 | 0.06 | 7.53 | 14.03 | 1.9094 | -0.0503 | |||

| CME / CME Group Inc. | 0.02 | 13.33 | 6.69 | 17.75 | 1.6949 | 0.0102 | |||

| V / Visa Inc. | 0.02 | 22.43 | 6.35 | 24.03 | 1.6104 | 0.0909 | |||

| XLK / The Select Sector SPDR Trust - The Technology Select Sector SPDR Fund | 0.02 | -52.38 | 6.19 | -41.60 | 1.5687 | -1.5749 | |||

| CB / Chubb Limited | 0.02 | 11.07 | 6.11 | 6.55 | 1.5496 | -0.1524 | |||

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.02 | 3.51 | 6.11 | 14.47 | 1.5483 | -0.0347 | |||

| ABBV / AbbVie Inc. | 0.03 | 2,028.84 | 6.07 | 1,790.65 | 1.5381 | 1.4427 | |||

| JNJ / Johnson & Johnson | 0.04 | 8.21 | 5.87 | -0.32 | 1.4864 | -0.2590 | |||

| MPC / Marathon Petroleum Corporation | 0.04 | 8.74 | 5.82 | 23.98 | 1.4743 | 0.0826 | |||

| DRI / Darden Restaurants, Inc. | 0.03 | 15.63 | 5.81 | 21.32 | 1.4712 | 0.0519 | |||

| SLAB / Silicon Laboratories Inc. | 0.04 | 0.00 | 5.76 | 30.93 | 1.4589 | 0.1546 | |||

| NFLX / Netflix, Inc. | 0.00 | 5.43 | 1.3754 | 1.3754 | |||||

| JCI / Johnson Controls International plc | 0.05 | 9.76 | 5.39 | 44.74 | 1.3660 | 0.2613 | |||

| TT / Trane Technologies plc | 0.01 | -31.19 | 5.07 | -10.68 | 1.2848 | -0.3985 | |||

| ADI / Analog Devices, Inc. | 0.02 | 10.54 | 4.93 | 30.47 | 1.2504 | 0.1287 | |||

| APD / Air Products and Chemicals, Inc. | 0.02 | 3.62 | 4.84 | -0.90 | 1.2262 | -0.2219 | |||

| O / Realty Income Corporation | 0.08 | 13.89 | 4.67 | 13.09 | 1.1824 | -0.0410 | |||

| TSLA / Tesla, Inc. | 0.01 | 590.49 | 4.66 | 747.27 | 1.1812 | 1.0179 | |||

| XOM / Exxon Mobil Corporation | 0.04 | 45.98 | 4.51 | 32.31 | 1.1428 | 0.1320 | |||

| XLV / The Select Sector SPDR Trust - The Health Care Select Sector SPDR Fund | 0.03 | -57.57 | 4.04 | -60.83 | 1.0227 | -2.0326 | |||

| FIS / Fidelity National Information Services, Inc. | 0.05 | 14.04 | 4.03 | 24.35 | 1.0223 | 0.0599 | |||

| XLC / The Select Sector SPDR Trust - The Communication Services Select Sector SPDR Fund | 0.04 | -42.07 | 3.97 | -34.83 | 1.0071 | -0.8009 | |||

| MDT / Medtronic plc | 0.04 | -0.39 | 3.89 | -3.36 | 0.9849 | -0.2080 | |||

| VZ / Verizon Communications Inc. | 0.09 | 4.22 | 3.83 | -0.60 | 0.9695 | -0.1718 | |||

| ORCL / Oracle Corporation | 0.02 | 3.79 | 0.9611 | 0.9611 | |||||

| UNP / Union Pacific Corporation | 0.02 | 10.18 | 3.58 | 7.28 | 0.9072 | -0.0822 | |||

| CRM / Salesforce, Inc. | 0.01 | 4.55 | 3.48 | 6.24 | 0.8808 | -0.0895 | |||

| UNH / UnitedHealth Group Incorporated | 0.01 | -20.85 | 3.36 | -52.85 | 0.8515 | -1.2622 | |||

| CMI / Cummins Inc. | 0.01 | 18.60 | 3.28 | 23.96 | 0.8312 | 0.0463 | |||

| PEG / Public Service Enterprise Group Incorporated | 0.04 | 19.41 | 3.09 | 22.12 | 0.7823 | 0.0327 | |||

| CMCSA / Comcast Corporation | 0.08 | -11.11 | 3.03 | -14.02 | 0.7676 | -0.2774 | |||

| ANET / Arista Networks Inc | 0.03 | 117.09 | 2.94 | 186.74 | 0.7457 | 0.4412 | |||

| BA / The Boeing Company | 0.01 | 2.91 | 0.7385 | 0.7385 | |||||

| XLF / The Select Sector SPDR Trust - The Financial Select Sector SPDR Fund | 0.06 | -73.21 | 2.88 | -71.83 | 0.7302 | -2.3033 | |||

| XLY / The Select Sector SPDR Trust - The Consumer Discretionary Select Sector SPDR Fund | 0.01 | -59.46 | 2.62 | -55.38 | 0.6646 | -1.0784 | |||

| GOOG / Alphabet Inc. | 0.01 | 160.00 | 2.60 | 195.11 | 0.6584 | 0.3974 | |||

| NEE / NextEra Energy, Inc. | 0.04 | 13.35 | 2.46 | 11.01 | 0.6236 | -0.0339 | |||

| TXN / Texas Instruments Incorporated | 0.01 | 28.03 | 2.11 | 47.90 | 0.5354 | 0.1118 | |||

| VRTX / Vertex Pharmaceuticals Incorporated | 0.00 | 1.94 | 0.4910 | 0.4910 | |||||

| XLP / The Select Sector SPDR Trust - The Consumer Staples Select Sector SPDR Fund | 0.02 | -69.39 | 1.92 | -69.66 | 0.4860 | -1.3880 | |||

| MNST / Monster Beverage Corporation | 0.03 | 1.90 | 0.4813 | 0.4813 | |||||

| BBY / Best Buy Co., Inc. | 0.03 | -17.71 | 1.89 | -24.97 | 0.4783 | -0.2676 | |||

| ADSK / Autodesk, Inc. | 0.01 | 1.84 | 0.4661 | 0.4661 | |||||

| IGV / iShares Trust - iShares Expanded Tech-Software Sector ETF | 0.02 | -69.92 | 1.76 | -62.99 | 0.4471 | -0.9667 | |||

| KO / The Coca-Cola Company | 0.02 | -12.41 | 1.76 | -13.45 | 0.4450 | -0.1569 | |||

| DIS / The Walt Disney Company | 0.01 | 1.67 | 0.4243 | 0.4243 | |||||

| SHOP / Shopify Inc. | 0.01 | 1.62 | 0.4114 | 0.4114 | |||||

| TJX / The TJX Companies, Inc. | 0.01 | -50.46 | 1.52 | -49.79 | 0.3856 | -0.5129 | |||

| CVX / Chevron Corporation | 0.01 | -27.30 | 1.44 | -37.80 | 0.3651 | -0.3215 | |||

| LRCX / Lam Research Corporation | 0.01 | 133.20 | 1.13 | 212.40 | 0.2876 | 0.1798 | |||

| NXPI / NXP Semiconductors N.V. | 0.01 | -60.28 | 1.13 | -54.34 | 0.2867 | -0.4481 | |||

| REGN / Regeneron Pharmaceuticals, Inc. | 0.00 | 1.06 | 0.2674 | 0.2674 | |||||

| SBUX / Starbucks Corporation | 0.01 | 1.02 | 0.2584 | 0.2584 | |||||

| ISRG / Intuitive Surgical, Inc. | 0.00 | 0.98 | 0.2483 | 0.2483 | |||||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 0.03 | 0.93 | 0.2363 | 0.2363 | |||||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.01 | 0.92 | 0.2342 | 0.2342 | |||||

| ICE / Intercontinental Exchange, Inc. | 0.01 | -2.12 | 0.92 | 4.06 | 0.2341 | -0.0291 | |||

| PG / The Procter & Gamble Company | 0.01 | 33.20 | 0.87 | 24.50 | 0.2204 | 0.0133 | |||

| VEU / Vanguard International Equity Index Funds - Vanguard FTSE All-World ex-US ETF | 0.01 | -8.05 | 0.85 | 1.91 | 0.2165 | -0.0321 | |||

| SEIC / SEI Investments Company | 0.01 | 0.81 | 0.2057 | 0.2057 | |||||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.00 | -7.93 | 0.80 | 1.65 | 0.2026 | -0.0305 | |||

| VST / Vistra Corp. | 0.00 | 0.79 | 0.2008 | 0.2008 | |||||

| COP / ConocoPhillips | 0.01 | 162.53 | 0.78 | 124.28 | 0.1968 | 0.0941 | |||

| QCOM / QUALCOMM Incorporated | 0.00 | 0.77 | 0.1949 | 0.1949 | |||||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0.01 | 0.76 | 0.1926 | 0.1926 | |||||

| VFH / Vanguard World Fund - Vanguard Financials ETF | 0.01 | 0.75 | 0.1889 | 0.1889 | |||||

| FDS / FactSet Research Systems Inc. | 0.00 | 0.74 | 0.1874 | 0.1874 | |||||

| XSW / SPDR Series Trust - SPDR S&P Software & Services ETF | 0.00 | 0.70 | 0.1786 | 0.1786 | |||||

| DE / Deere & Company | 0.00 | 0.70 | 0.1778 | 0.1778 | |||||

| HCA / HCA Healthcare, Inc. | 0.00 | 176.26 | 0.70 | 206.17 | 0.1762 | 0.1088 | |||

| EXPD / Expeditors International of Washington, Inc. | 0.01 | 0.69 | 0.1752 | 0.1752 | |||||

| SCHB / Schwab Strategic Trust - Schwab U.S. Broad Market ETF | 0.03 | 0.69 | 0.1747 | 0.1747 | |||||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | 0.69 | 0.1738 | 0.1738 | |||||

| PYPL / PayPal Holdings, Inc. | 0.01 | 0.67 | 0.1695 | 0.1695 | |||||

| SPY / SPDR S&P 500 ETF | 0.00 | 0.00 | 0.65 | 10.56 | 0.1645 | -0.0098 | |||

| RJF / Raymond James Financial, Inc. | 0.00 | 0.39 | 0.64 | 10.94 | 0.1620 | -0.0091 | |||

| T / AT&T Inc. | 0.02 | -23.53 | 0.60 | -21.82 | 0.1528 | -0.0757 | |||

| PLTR / Palantir Technologies Inc. | 0.00 | 0.23 | 0.60 | 62.06 | 0.1518 | 0.0420 | |||

| SHEL / Shell plc - Depositary Receipt (Common Stock) | 0.01 | -9.50 | 0.58 | -12.95 | 0.1465 | -0.0507 | |||

| YUM / Yum! Brands, Inc. | 0.00 | 0.56 | 0.1412 | 0.1412 | |||||

| SPGI / S&P Global Inc. | 0.00 | -78.63 | 0.56 | -77.81 | 0.1412 | -0.6035 | |||

| WDAY / Workday, Inc. | 0.00 | 0.54 | 0.1381 | 0.1381 | |||||

| WM / Waste Management, Inc. | 0.00 | 0.53 | 0.1344 | 0.1344 | |||||

| SQ / Block, Inc. | 0.01 | 0.53 | 0.1341 | 0.1341 | |||||

| INTC / Intel Corporation | 0.02 | 3.24 | 0.52 | 1.96 | 0.1316 | -0.0196 | |||

| VPL / Vanguard International Equity Index Funds - Vanguard FTSE Pacific ETF | 0.01 | -52.83 | 0.51 | -46.56 | 0.1299 | -0.1543 | |||

| AMAT / Applied Materials, Inc. | 0.00 | 62.24 | 0.49 | 105.02 | 0.1242 | 0.0532 | |||

| EEMA / iShares, Inc. - iShares MSCI Emerging Markets Asia ETF | 0.01 | 0.48 | 0.1212 | 0.1212 | |||||

| LLY / Eli Lilly and Company | 0.00 | -17.97 | 0.46 | -22.77 | 0.1163 | -0.0597 | |||

| NKE / NIKE, Inc. | 0.01 | 0.45 | 0.1147 | 0.1147 | |||||

| FI / Fiserv, Inc. | 0.00 | -80.46 | 0.43 | -84.77 | 0.1097 | -0.7315 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 0.00 | 0.39 | -8.82 | 0.0997 | -0.0282 | |||

| MU / Micron Technology, Inc. | 0.00 | 0.38 | 0.0968 | 0.0968 | |||||

| ILMN / Illumina, Inc. | 0.00 | 0.37 | 0.0948 | 0.0948 | |||||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | 0.00 | 0.37 | 0.0931 | 0.0931 | |||||

| STEL / Stellar Bancorp, Inc. | 0.01 | 0.00 | 0.36 | 1.13 | 0.0910 | -0.0143 | |||

| CSCO / Cisco Systems, Inc. | 0.00 | 0.34 | 0.0860 | 0.0860 | |||||

| PSX / Phillips 66 | 0.00 | 63.27 | 0.32 | 57.71 | 0.0804 | 0.0207 | |||

| PM / Philip Morris International Inc. | 0.00 | -68.13 | 0.31 | -63.51 | 0.0782 | -0.1722 | |||

| ALL / The Allstate Corporation | 0.00 | -80.52 | 0.31 | -81.07 | 0.0779 | -0.4034 | |||

| MRK / Merck & Co., Inc. | 0.00 | -93.68 | 0.30 | -94.44 | 0.0754 | -1.5082 | |||

| HON / Honeywell International Inc. | 0.00 | 0.30 | 0.0750 | 0.0750 | |||||

| IVE / iShares Trust - iShares S&P 500 Value ETF | 0.00 | 29.21 | 0.29 | 33.02 | 0.0725 | 0.0085 | |||

| AZO / AutoZone, Inc. | 0.00 | 0.29 | 0.0724 | 0.0724 | |||||

| ELF / e.l.f. Beauty, Inc. | 0.00 | 0.27 | 0.0687 | 0.0687 | |||||

| GS / The Goldman Sachs Group, Inc. | 0.00 | 0.25 | 0.0623 | 0.0623 | |||||

| SAH / Sonic Automotive, Inc. | 0.00 | 0.24 | 0.0608 | 0.0608 | |||||

| AMD / Advanced Micro Devices, Inc. | 0.00 | -76.93 | 0.23 | -68.25 | 0.0580 | -0.1550 | |||

| TRGP / Targa Resources Corp. | 0.00 | -1.62 | 0.22 | -14.67 | 0.0561 | -0.0208 | |||

| VT / Vanguard International Equity Index Funds - Vanguard Total World Stock ETF | 0.00 | 0.22 | 0.0545 | 0.0545 | |||||

| MS / Morgan Stanley | 0.00 | 0.21 | 0.0528 | 0.0528 | |||||

| YUMC / Yum China Holdings, Inc. | 0.00 | 0.21 | 0.0520 | 0.0520 | |||||

| LPRO / Open Lending Corporation | 0.02 | 0.00 | 0.04 | -29.51 | 0.0110 | -0.0073 | |||

| AIG / American International Group, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| STE / STERIS plc | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CMG / Chipotle Mexican Grill, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| LHX / L3Harris Technologies, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| DXCM / DexCom, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| EL / The Estée Lauder Companies Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VCSA / Vacasa, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| EW / Edwards Lifesciences Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| APH / Amphenol Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| AEP / American Electric Power Company, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| SNPS / Synopsys, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0661 | ||||

| FANG / Diamondback Energy, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| PGR / The Progressive Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CDNS / Cadence Design Systems, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| IQV / IQVIA Holdings Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ABT / Abbott Laboratories | 0.00 | -100.00 | 0.00 | 0.0000 |