Mga Batayang Estadistika

| Nilai Portofolio | $ 188,983,726 |

| Posisi Saat Ini | 83 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

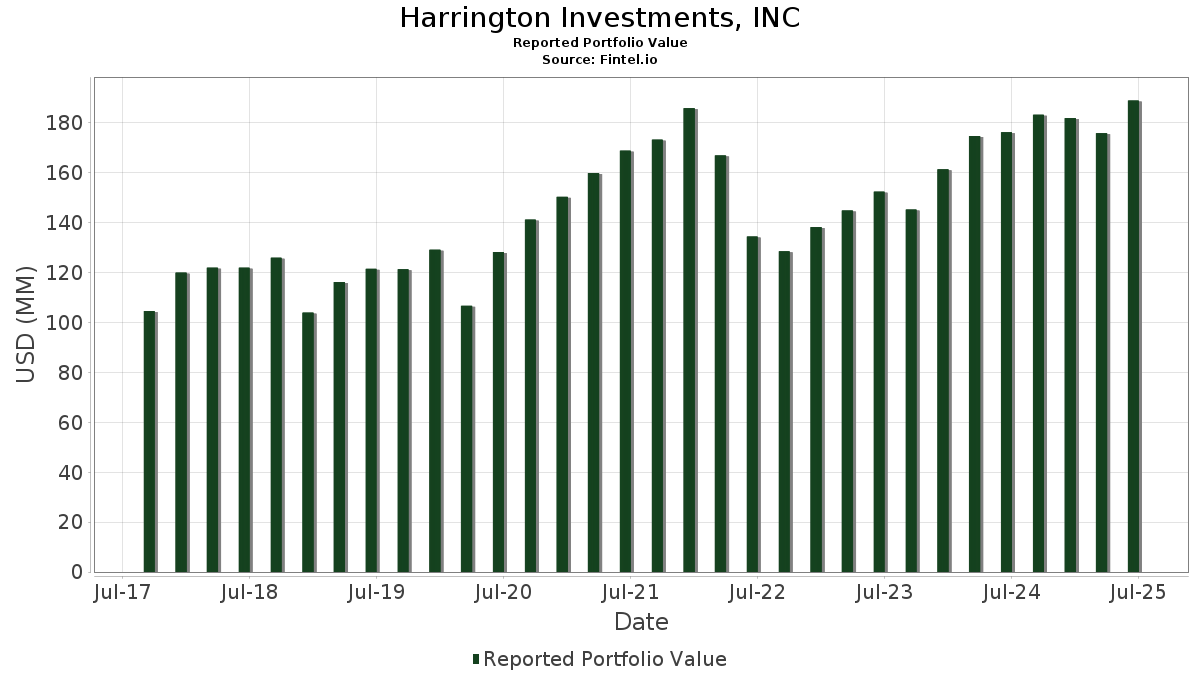

Harrington Investments, INC telah mengungkapkan total kepemilikan 83 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 188,983,726 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Harrington Investments, INC adalah Microsoft Corporation (US:MSFT) , Apple Inc. (US:AAPL) , Netflix, Inc. (US:NFLX) , Oracle Corporation (US:ORCL) , and Alphabet Inc. (US:GOOGL) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.04 | 7.94 | 4.2006 | 1.3035 | |

| 0.03 | 13.75 | 7.2749 | 1.2855 | |

| 0.01 | 9.41 | 4.9779 | 1.2022 | |

| 0.00 | 3.78 | 1.9982 | 0.3247 | |

| 0.01 | 2.20 | 1.1631 | 0.2134 | |

| 0.03 | 5.98 | 3.1646 | 0.1928 | |

| 0.06 | 5.16 | 2.7303 | 0.1909 | |

| 0.02 | 1.75 | 0.9286 | 0.1678 | |

| 0.03 | 6.05 | 3.2024 | 0.1636 | |

| 0.02 | 2.64 | 1.3967 | 0.1612 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.06 | 13.05 | 6.9063 | -1.1930 | |

| 0.01 | 4.03 | 2.1324 | -0.6973 | |

| 0.02 | 5.37 | 2.8404 | -0.5948 | |

| 0.01 | 2.09 | 1.1062 | -0.4552 | |

| 0.03 | 3.08 | 1.6288 | -0.3810 | |

| 0.01 | 2.89 | 1.5266 | -0.3081 | |

| 0.04 | 3.31 | 1.7513 | -0.2922 | |

| 0.03 | 2.75 | 1.4554 | -0.2752 | |

| 0.18 | 4.41 | 2.3351 | -0.1927 | |

| 0.01 | 2.75 | 1.4576 | -0.1569 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-14 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| MSFT / Microsoft Corporation | 0.03 | -1.51 | 13.75 | 30.50 | 7.2749 | 1.2855 | |||

| AAPL / Apple Inc. | 0.06 | -0.81 | 13.05 | -8.39 | 6.9063 | -1.1930 | |||

| NFLX / Netflix, Inc. | 0.01 | -1.36 | 9.41 | 41.65 | 4.9779 | 1.2022 | |||

| ORCL / Oracle Corporation | 0.04 | -0.38 | 7.94 | 55.77 | 4.2006 | 1.3035 | |||

| GOOGL / Alphabet Inc. | 0.03 | -0.65 | 6.05 | 13.21 | 3.2024 | 0.1636 | |||

| AMZN / Amazon.com, Inc. | 0.03 | -0.78 | 5.98 | 14.41 | 3.1646 | 0.1928 | |||

| MMC / Marsh & McLennan Companies, Inc. | 0.02 | -0.85 | 5.37 | -11.17 | 2.8404 | -0.5948 | |||

| GOOG / Alphabet Inc. | 0.03 | -2.05 | 5.29 | 11.22 | 2.7969 | 0.0951 | |||

| COST / Costco Wholesale Corporation | 0.01 | -1.66 | 5.27 | 2.93 | 2.7899 | -0.1222 | |||

| SCHW / The Charles Schwab Corporation | 0.06 | -0.89 | 5.16 | 15.52 | 2.7303 | 0.1909 | |||

| SCHO / Schwab Strategic Trust - Schwab Short-Term U.S. Treasury ETF | 0.18 | -0.91 | 4.41 | -0.74 | 2.3351 | -0.1927 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.01 | -0.64 | 4.03 | -19.05 | 2.1324 | -0.6973 | |||

| TJX / The TJX Companies, Inc. | 0.03 | -0.95 | 4.01 | 0.43 | 2.1224 | -0.1483 | |||

| INTU / Intuit Inc. | 0.00 | 0.00 | 3.78 | 28.30 | 1.9982 | 0.3247 | |||

| QCOM / QUALCOMM Incorporated | 0.02 | -0.11 | 3.67 | 3.55 | 1.9435 | -0.0727 | |||

| SYK / Stryker Corporation | 0.01 | -1.51 | 3.36 | 4.68 | 1.7761 | -0.0469 | |||

| SBUX / Starbucks Corporation | 0.04 | -1.43 | 3.31 | -7.93 | 1.7513 | -0.2922 | |||

| CHD / Church & Dwight Co., Inc. | 0.03 | -0.26 | 3.08 | -12.93 | 1.6288 | -0.3810 | |||

| AMGN / Amgen Inc. | 0.01 | -0.25 | 2.89 | -10.60 | 1.5266 | -0.3081 | |||

| XYL / Xylem Inc. | 0.02 | 0.55 | 2.84 | 8.85 | 1.5033 | 0.0199 | |||

| ITW / Illinois Tool Works Inc. | 0.01 | -2.71 | 2.75 | -2.99 | 1.4576 | -0.1569 | |||

| ED / Consolidated Edison, Inc. | 0.03 | -0.43 | 2.75 | -9.66 | 1.4554 | -0.2752 | |||

| EMR / Emerson Electric Co. | 0.02 | -0.12 | 2.64 | 21.45 | 1.3967 | 0.1612 | |||

| EBAY / eBay Inc. | 0.03 | -0.93 | 2.60 | 8.92 | 1.3773 | 0.0186 | |||

| AMAL / Amalgamated Financial Corp. | 0.08 | 0.44 | 2.51 | 8.98 | 1.3292 | 0.0190 | |||

| ECL / Ecolab Inc. | 0.01 | 1.67 | 2.44 | 8.06 | 1.2919 | 0.0074 | |||

| DE / Deere & Company | 0.00 | -1.25 | 2.38 | 7.02 | 1.2579 | -0.0053 | |||

| DLR / Digital Realty Trust, Inc. | 0.01 | 1.31 | 2.33 | 23.26 | 1.2312 | 0.1580 | |||

| GILD / Gilead Sciences, Inc. | 0.02 | -0.60 | 2.21 | -1.65 | 1.1688 | -0.1079 | |||

| FSLR / First Solar, Inc. | 0.01 | 0.49 | 2.20 | 31.62 | 1.1631 | 0.2134 | |||

| PYPL / PayPal Holdings, Inc. | 0.03 | -0.15 | 2.19 | 13.74 | 1.1572 | 0.0640 | |||

| APD / Air Products and Chemicals, Inc. | 0.01 | -20.41 | 2.09 | -23.89 | 1.1062 | -0.4552 | |||

| CNI / Canadian National Railway Company | 0.02 | -0.10 | 2.07 | 6.64 | 1.0960 | -0.0082 | |||

| VEEV / Veeva Systems Inc. | 0.01 | -0.29 | 2.01 | 23.98 | 1.0644 | 0.1420 | |||

| MA / Mastercard Incorporated | 0.00 | 1.18 | 1.98 | 3.73 | 1.0464 | -0.0374 | |||

| SYY / Sysco Corporation | 0.02 | -0.66 | 1.82 | 0.22 | 0.9651 | -0.0690 | |||

| VZ / Verizon Communications Inc. | 0.04 | -0.39 | 1.82 | -5.01 | 0.9635 | -0.1259 | |||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 0.03 | -0.52 | 1.78 | -1.11 | 0.9430 | -0.0816 | |||

| JCI / Johnson Controls International plc | 0.02 | -0.54 | 1.75 | 31.09 | 0.9286 | 0.1678 | |||

| GHC / Graham Holdings Company | 0.00 | -1.18 | 1.74 | -2.68 | 0.9224 | -0.0960 | |||

| GWW / W.W. Grainger, Inc. | 0.00 | 0.12 | 1.74 | 5.47 | 0.9181 | -0.0175 | |||

| INTC / Intel Corporation | 0.08 | -0.46 | 1.70 | -1.85 | 0.9010 | -0.0849 | |||

| PLD / Prologis, Inc. | 0.02 | -0.07 | 1.60 | -6.05 | 0.8470 | -0.1214 | |||

| PG / The Procter & Gamble Company | 0.01 | -0.61 | 1.55 | -7.12 | 0.8217 | -0.1284 | |||

| MDT / Medtronic plc | 0.02 | -0.42 | 1.38 | -3.37 | 0.7284 | -0.0817 | |||

| GLD / SPDR Gold Trust | 0.00 | 14.37 | 1.36 | 21.03 | 0.7188 | 0.0806 | |||

| BOH / Bank of Hawaii Corporation | 0.02 | -0.10 | 1.35 | -2.17 | 0.7148 | -0.0703 | |||

| ZM / Zoom Communications Inc. | 0.02 | -3.73 | 1.30 | 1.72 | 0.6872 | -0.0383 | |||

| ASML / ASML Holding N.V. - Depositary Receipt (Common Stock) | 0.00 | 1.16 | 1.26 | 22.30 | 0.6649 | 0.0810 | |||

| NVDD / Direxion Shares ETF Trust - Direxion Daily NVDA Bear 1X Shares | 0.01 | -6.59 | 1.19 | 36.28 | 0.6283 | 0.1326 | |||

| ISRG / Intuitive Surgical, Inc. | 0.00 | -2.92 | 1.17 | 6.54 | 0.6211 | -0.0054 | |||

| AMD / Advanced Micro Devices, Inc. | 0.01 | 4.36 | 1.09 | 44.22 | 0.5748 | 0.1464 | |||

| HMC / Honda Motor Co., Ltd. - Depositary Receipt (Common Stock) | 0.04 | -0.52 | 1.05 | 5.75 | 0.5553 | -0.0091 | |||

| JPM / JPMorgan Chase & Co. | 0.00 | 0.00 | 0.93 | 18.26 | 0.4903 | 0.0446 | |||

| HOLX / Hologic, Inc. | 0.01 | -0.85 | 0.91 | 4.60 | 0.4811 | -0.0131 | |||

| KEY / KeyCorp | 0.05 | 0.83 | 0.84 | 9.78 | 0.4461 | 0.0098 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | 0.00 | 0.73 | -8.77 | 0.3856 | -0.0683 | |||

| UPS / United Parcel Service, Inc. | 0.01 | -1.02 | 0.72 | -9.17 | 0.3829 | -0.0700 | |||

| DOC / Healthpeak Properties, Inc. | 0.04 | -0.17 | 0.69 | -13.59 | 0.3669 | -0.0891 | |||

| TGT / Target Corporation | 0.01 | -3.10 | 0.69 | -8.45 | 0.3669 | -0.0635 | |||

| ORA / Ormat Technologies, Inc. | 0.01 | -0.19 | 0.66 | 18.23 | 0.3467 | 0.0314 | |||

| PHG / Koninklijke Philips N.V. - Depositary Receipt (Common Stock) | 0.03 | 3.88 | 0.61 | -1.94 | 0.3206 | -0.0306 | |||

| DAR / Darling Ingredients Inc. | 0.02 | 8.13 | 0.58 | 31.22 | 0.3071 | 0.0559 | |||

| FICO / Fair Isaac Corporation | 0.00 | -3.10 | 0.57 | -3.87 | 0.3028 | -0.0359 | |||

| SHOP / Shopify Inc. | 0.00 | 0.00 | 0.57 | 20.97 | 0.3023 | 0.0335 | |||

| TT / Trane Technologies plc | 0.00 | 0.00 | 0.54 | 29.71 | 0.2845 | 0.0491 | |||

| TREX / Trex Company, Inc. | 0.01 | -1.62 | 0.50 | -7.81 | 0.2626 | -0.0438 | |||

| AVGO / Broadcom Inc. | 0.00 | -6.61 | 0.49 | 53.80 | 0.2574 | 0.0775 | |||

| V / Visa Inc. | 0.00 | -4.24 | 0.40 | -2.91 | 0.2123 | -0.0228 | |||

| HASI / HA Sustainable Infrastructure Capital, Inc. | 0.01 | 4.30 | 0.39 | -4.18 | 0.2066 | -0.0251 | |||

| ADI / Analog Devices, Inc. | 0.00 | 0.00 | 0.36 | 17.76 | 0.1899 | 0.0170 | |||

| WBD / Warner Bros. Discovery, Inc. | 0.03 | -0.08 | 0.36 | 6.57 | 0.1894 | -0.0013 | |||

| IWM / iShares Trust - iShares Russell 2000 ETF | 0.00 | 0.00 | 0.35 | 8.10 | 0.1838 | 0.0012 | |||

| IEMG / iShares, Inc. - iShares Core MSCI Emerging Markets ETF | 0.01 | -8.15 | 0.34 | 2.42 | 0.1789 | -0.0092 | |||

| NUSC / Nushares ETF Trust - Nuveen ESG Small-Cap ETF | 0.01 | 0.00 | 0.31 | 6.27 | 0.1618 | -0.0018 | |||

| TMUS / T-Mobile US, Inc. | 0.00 | 0.00 | 0.29 | -10.53 | 0.1529 | -0.0310 | |||

| VEA / Vanguard Tax-Managed Funds - Vanguard FTSE Developed Markets ETF | 0.01 | -9.09 | 0.29 | 2.15 | 0.1508 | -0.0081 | |||

| CB / Chubb Limited | 0.00 | 0.00 | 0.27 | -3.87 | 0.1446 | -0.0173 | |||

| SNY / Sanofi - Depositary Receipt (Common Stock) | 0.01 | 0.00 | 0.24 | -13.00 | 0.1279 | -0.0298 | |||

| IAU / iShares Gold Trust | 0.00 | 0.00 | 0.24 | 5.75 | 0.1268 | -0.0020 | |||

| VCSH / Vanguard Scottsdale Funds - Vanguard Short-Term Corporate Bond ETF | 0.00 | 0.00 | 0.24 | 0.85 | 0.1262 | -0.0084 | |||

| META / Meta Platforms, Inc. | 0.00 | 0.23 | 0.1199 | 0.1199 | |||||

| DHR / Danaher Corporation | 0.00 | 0.00 | 0.23 | -3.43 | 0.1193 | -0.0137 |