Mga Batayang Estadistika

| Nilai Portofolio | $ 113,072,000 |

| Posisi Saat Ini | 66 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

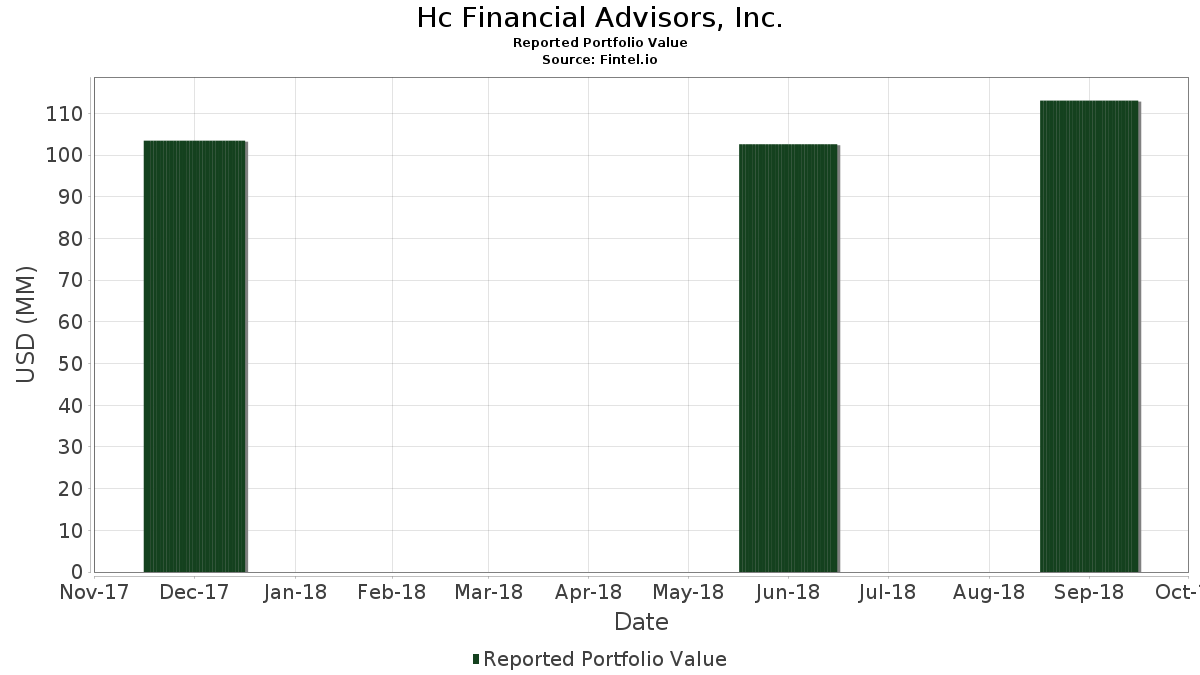

Hc Financial Advisors, Inc. telah mengungkapkan total kepemilikan 66 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 113,072,000 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Hc Financial Advisors, Inc. adalah FlexShares Trust - FlexShares iBoxx 3-Year Target Duration TIPS Index Fund (US:TDTT) , Apple Inc. (US:AAPL) , SSGA Active Trust - SPDR DoubleLine Total Return Tactical ETF (US:TOTL) , Visa Inc. (US:V) , and The Home Depot, Inc. (US:HD) . Posisi baru Hc Financial Advisors, Inc. meliputi: The Estée Lauder Companies Inc. (US:EL) , Intuitive Surgical, Inc. (US:ISRG) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.29 | 6.91 | 6.1129 | 6.1129 | |

| 0.02 | 5.13 | 4.5387 | 4.5387 | |

| 0.09 | 4.19 | 3.7083 | 3.7083 | |

| 0.03 | 3.87 | 3.4199 | 3.4199 | |

| 0.02 | 3.83 | 3.3863 | 3.3863 | |

| 0.03 | 3.74 | 3.3094 | 3.3094 | |

| 0.03 | 3.19 | 2.8256 | 2.8256 | |

| 0.03 | 3.07 | 2.7133 | 2.7133 | |

| 0.02 | 2.96 | 2.6187 | 2.6187 | |

| 0.06 | 2.80 | 2.4754 | 2.4754 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.01 | 0.66 | 0.5810 | -0.1451 | |

| 0.01 | 0.35 | 0.3095 | -0.1154 | |

| 0.01 | 0.86 | 0.7588 | -0.1145 | |

| 0.01 | 0.69 | 0.6138 | -0.0412 | |

| 0.01 | 0.35 | 0.3060 | -0.0205 | |

| 0.00 | 0.50 | 0.4387 | -0.0126 | |

| 0.01 | 1.25 | 1.1081 | -0.0010 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2018-10-18 untuk periode pelaporan 2018-09-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| TDTT / FlexShares Trust - FlexShares iBoxx 3-Year Target Duration TIPS Index Fund | 0.29 | 22.06 | 6.91 | 20.29 | 6.1129 | 6.1129 | |||

| AAPL / Apple Inc. | 0.02 | -1.14 | 5.13 | 20.55 | 4.5387 | 4.5387 | |||

| TOTL / SSGA Active Trust - SPDR DoubleLine Total Return Tactical ETF | 0.09 | 4.42 | 4.19 | 3.76 | 3.7083 | 3.7083 | |||

| V / Visa Inc. | 0.03 | 0.55 | 3.87 | 13.94 | 3.4199 | 3.4199 | |||

| HD / The Home Depot, Inc. | 0.02 | 0.70 | 3.83 | 6.93 | 3.3863 | 3.3863 | |||

| DIS / The Walt Disney Company | 0.03 | 12.26 | 3.74 | 25.23 | 3.3094 | 3.3094 | |||

| PFE / Pfizer Inc. | 0.07 | 0.52 | 3.28 | 22.08 | 2.9043 | 0.2826 | |||

| NTRS / Northern Trust Corporation | 0.03 | 3.46 | 3.19 | 2.70 | 2.8256 | 2.8256 | |||

| MSFT / Microsoft Corporation | 0.03 | 5.32 | 3.07 | 22.13 | 2.7133 | 2.7133 | |||

| ADP / Automatic Data Processing, Inc. | 0.02 | 56.74 | 2.96 | 76.04 | 2.6187 | 2.6187 | |||

| NFRA / FlexShares Trust - FlexShares STOXX Global Broad Infrastructure Index Fund | 0.06 | 13.85 | 2.80 | 15.66 | 2.4754 | 2.4754 | |||

| DES / WisdomTree Trust - WisdomTree U.S. SmallCap Dividend Fund | 0.09 | 10.24 | 2.79 | 10.50 | 2.4675 | 2.4675 | |||

| BDX / Becton, Dickinson and Company | 0.01 | -1.63 | 2.72 | 7.17 | 2.4064 | 2.4064 | |||

| HON / Honeywell International Inc. | 0.02 | 7.27 | 2.56 | 23.95 | 2.2614 | 2.2614 | |||

| AMGN / Amgen Inc. | 0.01 | -0.92 | 2.33 | 11.26 | 2.0615 | 2.0615 | |||

| VZ / Verizon Communications Inc. | 0.04 | 51.60 | 2.31 | 60.89 | 2.0447 | 2.0447 | |||

| USB / U.S. Bancorp | 0.04 | 5.25 | 2.27 | 11.12 | 2.0067 | 2.0067 | |||

| HBAN / Huntington Bancshares Incorporated | 0.15 | 11.33 | 2.19 | 12.51 | 1.9404 | 0.0398 | |||

| JNJ / Johnson & Johnson | 0.02 | 7.20 | 2.18 | 22.06 | 1.9280 | 1.9280 | |||

| CAT / Caterpillar Inc. | 0.01 | 0.00 | 2.12 | 12.41 | 1.8749 | 1.8749 | |||

| FDX / FedEx Corporation | 0.01 | 5.90 | 2.01 | 12.31 | 1.7750 | 1.7750 | |||

| MMM / 3M Company | 0.01 | 49.36 | 2.01 | 59.97 | 1.7741 | 0.5519 | |||

| ACN / Accenture plc | 0.01 | 1.23 | 2.00 | 5.32 | 1.7697 | 1.7697 | |||

| QDF / FlexShares Trust - FlexShares Quality Dividend Index Fund | 0.04 | 1.11 | 1.91 | 5.64 | 1.6883 | 1.6883 | |||

| WFC / Wells Fargo & Company | 0.03 | -3.55 | 1.83 | -8.56 | 1.6158 | 1.6158 | |||

| MCD / McDonald's Corporation | 0.01 | 4.91 | 1.78 | 11.98 | 1.5786 | 1.5786 | |||

| GOOG / Alphabet Inc. | 0.00 | 2.85 | 1.72 | 10.03 | 1.5238 | 1.5238 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.01 | -0.87 | 1.61 | -0.06 | 1.4230 | 1.4230 | |||

| DUK / Duke Energy Corporation | 0.02 | 445.87 | 1.61 | 452.58 | 1.4221 | 1.1385 | |||

| SBUX / Starbucks Corporation | 0.03 | 233.48 | 1.56 | 288.06 | 1.3797 | 1.3797 | |||

| RTX / RTX Corporation | 0.01 | -4.13 | 1.56 | 7.15 | 1.3788 | 1.3788 | |||

| NKE / NIKE, Inc. | 0.02 | -0.17 | 1.50 | 6.08 | 1.3266 | 1.3266 | |||

| SLB / Schlumberger Limited | 0.02 | 43.97 | 1.49 | 30.84 | 1.3133 | 1.3133 | |||

| CL / Colgate-Palmolive Company | 0.02 | -1.85 | 1.48 | 1.37 | 1.3071 | 1.3071 | |||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0.02 | 5.06 | 1.46 | 19.79 | 1.2903 | 1.2903 | |||

| ADBE / Adobe Inc. | 0.01 | -0.09 | 1.43 | 10.62 | 1.2620 | 1.2620 | |||

| CSCO / Cisco Systems, Inc. | 0.03 | -1.69 | 1.41 | 11.20 | 1.2470 | 1.2470 | |||

| PG / The Procter & Gamble Company | 0.02 | 17.13 | 1.36 | 24.84 | 1.2001 | 1.2001 | |||

| SYK / Stryker Corporation | 0.01 | -2.20 | 1.28 | 2.98 | 1.1320 | 1.1320 | |||

| STZ / Constellation Brands, Inc. | 0.01 | 11.73 | 1.25 | 10.11 | 1.1081 | -0.0010 | |||

| INTC / Intel Corporation | 0.03 | 9.47 | 1.21 | 4.15 | 1.0666 | 1.0666 | |||

| DOW / Dow Inc. | 0.02 | 0.64 | 1.05 | -1.77 | 0.9330 | 0.9330 | |||

| PEP / PepsiCo, Inc. | 0.01 | 4.22 | 1.00 | 7.04 | 0.8870 | 0.8870 | |||

| EL / The Estée Lauder Companies Inc. | 0.01 | 0.97 | 0.8623 | 0.8623 | |||||

| ABT / Abbott Laboratories | 0.01 | -2.47 | 0.95 | 17.20 | 0.8437 | 0.8437 | |||

| COST / Costco Wholesale Corporation | 0.00 | -0.51 | 0.92 | 11.80 | 0.8128 | 0.8128 | |||

| IWB / iShares Trust - iShares Russell 1000 ETF | 0.01 | 3.92 | 0.90 | 10.62 | 0.7924 | 0.7924 | |||

| CVX / Chevron Corporation | 0.01 | -0.99 | 0.86 | -4.24 | 0.7588 | -0.1145 | |||

| XOM / Exxon Mobil Corporation | 0.01 | -6.13 | 0.81 | -3.47 | 0.7137 | 0.7137 | |||

| GOOGL / Alphabet Inc. | 0.00 | 0.00 | 0.77 | 6.92 | 0.6836 | 0.6836 | |||

| PWB / Invesco Exchange-Traded Fund Trust - Invesco Large Cap Growth ETF | 0.01 | -3.59 | 0.69 | 3.27 | 0.6138 | -0.0412 | |||

| PRF / Invesco Exchange-Traded Fund Trust - Invesco RAFI US 1000 ETF | 0.01 | -16.47 | 0.66 | -11.81 | 0.5810 | -0.1451 | |||

| AMZN / Amazon.com, Inc. | 0.00 | 22.57 | 0.63 | 44.39 | 0.5581 | 0.5581 | |||

| DON / WisdomTree Trust - WisdomTree U.S. MidCap Dividend Fund | 0.02 | -0.76 | 0.61 | 2.17 | 0.5412 | 0.5412 | |||

| EZM / WisdomTree Trust - WisdomTree U.S. MidCap Fund | 0.01 | 3.18 | 0.61 | 6.28 | 0.5386 | 0.5386 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | 0.21 | 0.52 | 14.98 | 0.4617 | 0.4617 | |||

| SPY / SPDR S&P 500 ETF | 0.00 | 0.00 | 0.50 | 7.13 | 0.4387 | -0.0126 | |||

| ISRG / Intuitive Surgical, Inc. | 0.00 | 0.40 | 0.3555 | 0.3555 | |||||

| WY / Weyerhaeuser Company | 0.01 | 32.07 | 0.36 | 16.77 | 0.3202 | 0.3202 | |||

| PXF / Invesco Exchange-Traded Fund Trust II - Invesco RAFI Developed Markets ex-U.S. ETF | 0.01 | -20.30 | 0.35 | -19.72 | 0.3095 | -0.1154 | |||

| VEA / Vanguard Tax-Managed Funds - Vanguard FTSE Developed Markets ETF | 0.01 | 2.41 | 0.35 | 3.28 | 0.3060 | -0.0205 | |||

| ORCL / Oracle Corporation | 0.01 | -87.04 | 0.34 | -84.84 | 0.3025 | 0.3025 | |||

| T / AT&T Inc. | 0.01 | -85.98 | 0.26 | -85.33 | 0.2291 | 0.2291 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.00 | 0.00 | 0.22 | 7.32 | 0.1946 | 0.1946 | |||

| EMB / iShares Trust - iShares J.P. Morgan USD Emerging Markets Bond ETF | 0.00 | 0.00 | 0.22 | 1.41 | 0.1910 | 0.1910 | |||

| IBM / International Business Machines Corporation | 0.00 | -89.57 | 0.21 | -88.71 | 0.1848 | 0.1848 | |||

| TAP / Molson Coors Beverage Company | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 | |||

| UPS / United Parcel Service, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | 0.0000 | 0.0000 |