Mga Batayang Estadistika

| Nilai Portofolio | $ 497,721,125 |

| Posisi Saat Ini | 95 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

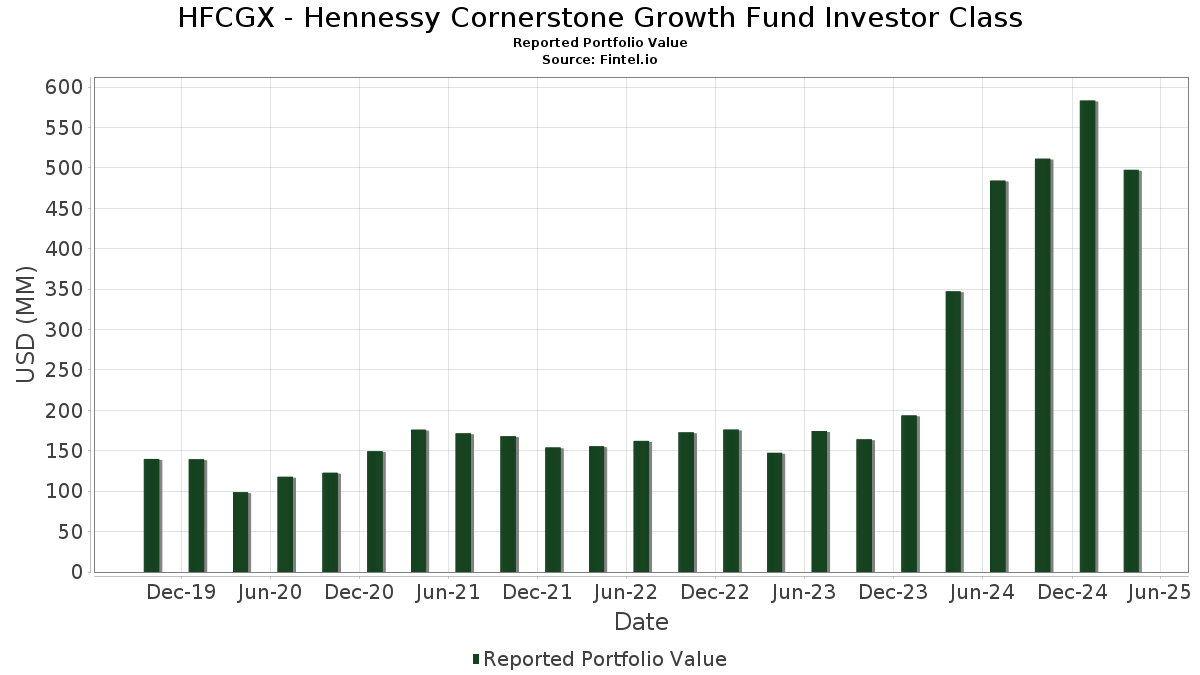

HFCGX - Hennessy Cornerstone Growth Fund Investor Class telah mengungkapkan total kepemilikan 95 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 497,721,125 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama HFCGX - Hennessy Cornerstone Growth Fund Investor Class adalah First American Funds Inc - First American Government Obligations Fund Class X (US:FGXXX) , Groupon, Inc. (US:GRPN) , Live Nation Entertainment, Inc. (US:LYV) , CSG Systems International, Inc. (US:CSGS) , and Graham Holdings Company (US:GHC) . Posisi baru HFCGX - Hennessy Cornerstone Growth Fund Investor Class meliputi: CSG Systems International, Inc. (US:CSGS) , Graham Holdings Company (US:GHC) , Fresh Del Monte Produce Inc. (US:FDP) , Charter Communications, Inc. (US:CHTR) , and Porch Group, Inc. (US:PRCH) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.16 | 9.84 | 1.9769 | 1.9769 | |

| 0.01 | 9.65 | 1.9382 | 1.9382 | |

| 0.28 | 9.60 | 1.9283 | 1.9283 | |

| 24.83 | 24.83 | 4.9870 | 1.7308 | |

| 0.02 | 8.15 | 1.6373 | 1.6373 | |

| 1.40 | 8.13 | 1.6325 | 1.6325 | |

| 0.14 | 8.00 | 1.6075 | 1.6075 | |

| 0.14 | 7.81 | 1.5690 | 1.5690 | |

| 0.23 | 7.80 | 1.5660 | 1.5660 | |

| 1.01 | 7.77 | 1.5616 | 1.5616 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.05 | 4.05 | 0.8144 | -3.9223 | |

| 0.03 | 5.87 | 1.1782 | -3.2045 | |

| 0.98 | 0.98 | 0.1973 | -2.9040 | |

| 0.03 | 4.92 | 0.9887 | -2.7822 | |

| 0.02 | 3.50 | 0.7035 | -2.4804 | |

| 0.15 | 4.24 | 0.8513 | -2.4500 | |

| 0.11 | 2.28 | 0.4582 | -2.4076 | |

| 0.10 | 3.29 | 0.6601 | -2.1261 | |

| 0.04 | 1.81 | 0.3630 | -1.9153 | |

| 0.36 | 2.76 | 0.5549 | -1.8490 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-06-26 untuk periode pelaporan 2025-04-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| FGXXX / First American Funds Inc - First American Government Obligations Fund Class X | 24.83 | 30.75 | 24.83 | 30.75 | 4.9870 | 1.7308 | |||

| GRPN / Groupon, Inc. | 0.56 | -35.09 | 10.28 | 12.89 | 2.0642 | 0.5032 | |||

| LYV / Live Nation Entertainment, Inc. | 0.08 | -23.66 | 9.96 | -30.11 | 2.0007 | -0.4433 | |||

| CSGS / CSG Systems International, Inc. | 0.16 | 9.84 | 1.9769 | 1.9769 | |||||

| GHC / Graham Holdings Company | 0.01 | 9.65 | 1.9382 | 1.9382 | |||||

| FDP / Fresh Del Monte Produce Inc. | 0.28 | 9.60 | 1.9283 | 1.9283 | |||||

| ALL / The Allstate Corporation | 0.04 | -26.53 | 8.67 | -24.22 | 1.7420 | -0.2205 | |||

| CHTR / Charter Communications, Inc. | 0.02 | 8.15 | 1.6373 | 1.6373 | |||||

| PRCH / Porch Group, Inc. | 1.40 | 8.13 | 1.6325 | 1.6325 | |||||

| BHF / Brighthouse Financial, Inc. | 0.14 | 8.00 | 1.6075 | 1.6075 | |||||

| CHEF / The Chefs' Warehouse, Inc. | 0.14 | 7.81 | 1.5690 | 1.5690 | |||||

| MIICF / Millicom International Cellular SA | 0.23 | 7.80 | 1.5660 | 1.5660 | |||||

| COMP / Compass, Inc. | 1.01 | 7.77 | 1.5616 | 1.5616 | |||||

| ATRO / Astronics Corporation | 0.34 | 7.76 | 1.5593 | 1.5593 | |||||

| BTSG / BrightSpring Health Services, Inc. | 0.44 | 7.71 | 1.5487 | 1.5487 | |||||

| SNEX / StoneX Group Inc. | 0.09 | 89.29 | 7.67 | 154.95 | 1.5407 | -0.0015 | |||

| WMK / Weis Markets, Inc. | 0.09 | 7.66 | 1.5387 | 1.5387 | |||||

| PBI / Pitney Bowes Inc. | 0.88 | 7.66 | 1.5384 | 1.5384 | |||||

| FMS / Fresenius Medical Care AG - Depositary Receipt (Common Stock) | 0.30 | 7.62 | 1.5315 | 1.5315 | |||||

| CAH / Cardinal Health, Inc. | 0.05 | 7.62 | 1.5298 | 1.5298 | |||||

| TDS / Telephone and Data Systems, Inc. | 0.20 | 7.61 | 1.5295 | 1.5295 | |||||

| PSMT / PriceSmart, Inc. | 0.07 | 7.61 | 1.5290 | 1.5290 | |||||

| EVER / EverQuote, Inc. | 0.32 | 7.60 | 1.5260 | 1.5260 | |||||

| BJ / BJ's Wholesale Club Holdings, Inc. | 0.06 | 7.58 | 1.5232 | 1.5232 | |||||

| VZ / Verizon Communications Inc. | 0.17 | 7.57 | 1.5204 | 1.5204 | |||||

| WMT / Walmart Inc. | 0.08 | 7.53 | 1.5121 | 1.5121 | |||||

| NOMD / Nomad Foods Limited | 0.38 | 7.52 | 1.5111 | 1.5111 | |||||

| HMN / Horace Mann Educators Corporation | 0.18 | 7.50 | 1.5062 | 1.5062 | |||||

| DRVN / Driven Brands Holdings Inc. | 0.45 | 7.48 | 1.5026 | 1.5026 | |||||

| VIRT / Virtu Financial, Inc. | 0.19 | 97.72 | 7.47 | 150.30 | 1.5005 | -0.4380 | |||

| ADT / ADT Inc. | 0.93 | 7.47 | 1.5002 | 1.5002 | |||||

| 1KR / The Kroger Co. | 0.10 | 7.46 | 1.4993 | 1.4993 | |||||

| FOXA / Fox Corporation | 0.15 | 7.46 | 1.4983 | 1.4983 | |||||

| CASY / Casey's General Stores, Inc. | 0.02 | 7.45 | 1.4961 | 1.4961 | |||||

| PPC / Pilgrim's Pride Corporation | 0.14 | 7.42 | 1.4911 | 1.4911 | |||||

| AXS / AXIS Capital Holdings Limited | 0.08 | 7.41 | 1.4879 | 1.4879 | |||||

| UGI / UGI Corporation | 0.22 | 7.34 | 1.4741 | 1.4741 | |||||

| SUN / Sunoco LP - Limited Partnership | 0.13 | 7.27 | 1.4613 | 1.4613 | |||||

| POST / Post Holdings, Inc. | 0.06 | 149.81 | 7.27 | 174.77 | 1.4595 | -0.4332 | |||

| ALHC / Alignment Healthcare, Inc. | 0.41 | 7.21 | 1.4488 | 1.4488 | |||||

| FNF / Fidelity National Financial, Inc. | 0.10 | 6.58 | 1.3227 | 1.3227 | |||||

| MKL / Markel Group Inc. | 0.00 | 6.55 | 1.3152 | 1.3152 | |||||

| THG / The Hanover Insurance Group, Inc. | 0.04 | 6.53 | 1.3113 | 1.3113 | |||||

| TRV / The Travelers Companies, Inc. | 0.02 | 6.52 | 1.3105 | 1.3105 | |||||

| L / Loews Corporation | 0.07 | 6.49 | 1.3047 | 1.3047 | |||||

| EZPW / EZCORP, Inc. | 0.40 | 6.48 | 1.3009 | 1.3009 | |||||

| ORI / Old Republic International Corporation | 0.17 | 6.39 | 1.2840 | 1.2840 | |||||

| UNM / Unum Group | 0.08 | 11.68 | 6.38 | 79.45 | 1.2823 | -0.5417 | |||

| ROOT / Root, Inc. | 0.05 | 6.31 | 1.2682 | 1.2682 | |||||

| EAT / Brinker International, Inc. | 0.05 | 6.24 | 1.2545 | 1.2545 | |||||

| CNO / CNO Financial Group, Inc. | 0.16 | 6.21 | 1.2476 | 1.2476 | |||||

| SFM / Sprouts Farmers Market, Inc. | 0.03 | -78.75 | 5.87 | -77.05 | 1.1782 | -3.2045 | |||

| LRN / Stride, Inc. | 0.03 | -78.77 | 4.92 | -77.62 | 0.9887 | -2.7822 | |||

| UTI / Universal Technical Institute, Inc. | 0.15 | -78.48 | 4.24 | -77.98 | 0.8513 | -2.4500 | |||

| CLS / Celestica Inc. | 0.05 | -78.77 | 4.05 | -85.32 | 0.8144 | -3.9223 | |||

| IESC / IES Holdings, Inc. | 0.02 | -78.78 | 3.50 | -81.14 | 0.7035 | -2.4804 | |||

| REVG / REV Group, Inc. | 0.10 | -78.54 | 3.29 | -79.78 | 0.6601 | -2.1261 | |||

| VSEC / VSE Corporation | 0.03 | -78.80 | 3.15 | -76.28 | 0.6337 | -1.6472 | |||

| THC / Tenet Healthcare Corporation | 0.02 | -78.76 | 2.99 | -78.45 | 0.6002 | -1.7774 | |||

| SPNT / SiriusPoint Ltd. | 0.17 | -78.74 | 2.84 | -75.48 | 0.5714 | -1.4175 | |||

| AMRX / Amneal Pharmaceuticals, Inc. | 0.36 | -78.75 | 2.76 | -80.30 | 0.5549 | -1.8490 | |||

| TREE / LendingTree, Inc. | 0.05 | -78.77 | 2.70 | -75.62 | 0.5420 | -1.3558 | |||

| URBN / Urban Outfitters, Inc. | 0.05 | -78.80 | 2.56 | -79.82 | 0.5142 | -1.6604 | |||

| AZZ / AZZ Inc. | 0.03 | -78.59 | 2.48 | -78.35 | 0.4985 | -1.4671 | |||

| EME / EMCOR Group, Inc. | 0.01 | -78.89 | 2.44 | -81.12 | 0.4910 | -1.7297 | |||

| TEVA / Teva Pharmaceutical Industries Limited - Depositary Receipt (Common Stock) | 0.16 | -78.76 | 2.43 | -81.42 | 0.4885 | -1.7557 | |||

| FTI / TechnipFMC plc | 0.09 | -78.75 | 2.41 | -80.08 | 0.4844 | -1.5914 | |||

| MOGA / Moog, Inc. - Class A | 0.01 | -78.75 | 2.32 | -80.44 | 0.4670 | -1.5705 | |||

| MCY / Mercury General Corporation | 0.04 | -78.80 | 2.29 | -76.43 | 0.4609 | -1.2084 | |||

| TPC / Tutor Perini Corporation | 0.11 | -84.68 | 2.28 | -86.35 | 0.4582 | -2.4076 | |||

| AIZ / Assurant, Inc. | 0.01 | -78.83 | 2.24 | -81.05 | 0.4491 | -1.5732 | |||

| DVA / DaVita Inc. | 0.02 | -78.93 | 2.22 | -83.07 | 0.4464 | -1.8048 | |||

| BKD / Brookdale Senior Living Inc. | 0.33 | -78.15 | 2.18 | -69.04 | 0.4386 | -0.7709 | |||

| GFF / Griffon Corporation | 0.03 | -78.76 | 2.06 | -80.92 | 0.4132 | -1.4346 | |||

| BLBD / Blue Bird Corporation | 0.06 | -78.77 | 1.98 | -79.22 | 0.3979 | -1.2362 | |||

| GAP / The Gap, Inc. | 0.09 | -78.75 | 1.90 | -80.67 | 0.3810 | -1.3015 | |||

| GBX / The Greenbrier Companies, Inc. | 0.04 | -78.75 | 1.81 | -86.40 | 0.3630 | -1.9153 | |||

| TOL / Toll Brothers, Inc. | 0.02 | -78.93 | 1.70 | -84.35 | 0.3424 | -1.5255 | |||

| DELL / Dell Technologies Inc. | 0.02 | -78.66 | 1.68 | -81.11 | 0.3374 | -1.1870 | |||

| MBC / MasterBrand, Inc. | 0.12 | -78.77 | 1.44 | -85.11 | 0.2895 | -1.3697 | |||

| TBCH / Turtle Beach Corporation | 0.12 | -78.75 | 1.43 | -86.18 | 0.2872 | -1.4862 | |||

| AMWD / American Woodmark Corporation | 0.02 | -78.87 | 1.28 | -83.99 | 0.2572 | -1.1141 | |||

| LBRT / Liberty Energy Inc. | 0.10 | -78.72 | 1.20 | -86.64 | 0.2407 | -1.2967 | |||

| PVH / PVH Corp. | 0.02 | -78.84 | 1.19 | -83.73 | 0.2394 | -1.0156 | |||

| DFH / Dream Finders Homes, Inc. | 0.05 | -78.78 | 1.15 | -79.16 | 0.2312 | -0.7159 | |||

| FOR / Forestar Group Inc. | 0.05 | -78.76 | 1.06 | -82.86 | 0.2120 | -0.8437 | |||

| CMPR / Cimpress plc | 0.02 | -78.77 | 1.00 | -86.58 | 0.2009 | -1.0772 | |||

| KOP / Koppers Holdings Inc. | 0.04 | -78.82 | 0.99 | -82.18 | 0.1999 | -0.7566 | |||

| FXFXX / First American Funds Inc - First American Treasury Obligations Fund Class X | 0.98 | -80.69 | 0.98 | -80.70 | 0.1973 | -2.9040 | |||

| NX / Quanex Building Products Corporation | 0.06 | -78.76 | 0.97 | -83.39 | 0.1942 | -0.8030 | |||

| AEO / American Eagle Outfitters, Inc. | 0.08 | -78.74 | 0.88 | -86.13 | 0.1762 | -0.9085 | |||

| GES / Guess?, Inc. | 0.07 | -78.42 | 0.80 | -81.20 | 0.1599 | -0.5661 | |||

| STLAP / Stellantis N.V. | 0.08 | -78.74 | 0.72 | -84.98 | 0.1441 | -0.6746 | |||

| PLAY / Dave & Buster's Entertainment, Inc. | 0.03 | -78.80 | 0.65 | -84.69 | 0.1303 | -0.5958 | |||

| JELD / JELD-WEN Holding, Inc. | 0.10 | -78.75 | 0.57 | -86.86 | 0.1142 | -0.6274 |