Mga Batayang Estadistika

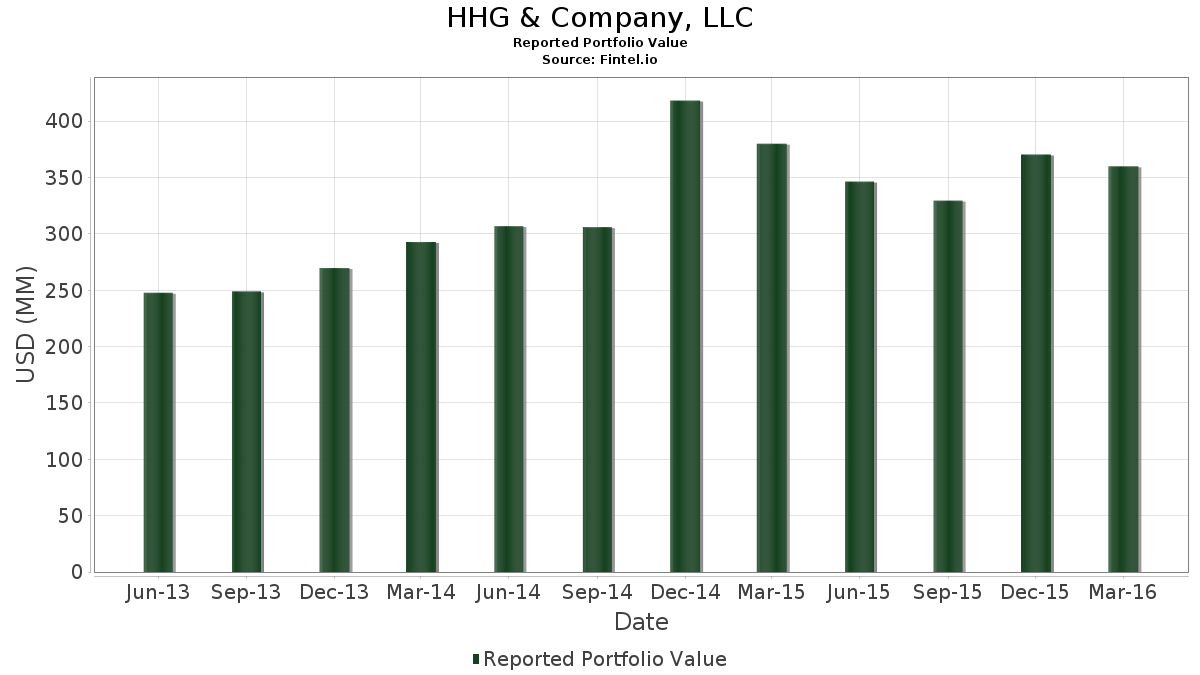

| Nilai Portofolio | $ 359,975,000 |

| Posisi Saat Ini | 134 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

HHG & Company, LLC telah mengungkapkan total kepemilikan 134 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 359,975,000 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama HHG & Company, LLC adalah Coca-Cola Europacific Partners PLC (US:CCEP) , iShares Trust - iShares Core 60/40 Balanced Allocation ETF (US:AOR) , Exxon Mobil Corporation (US:XOM) , Pfizer Inc. (US:PFE) , and Anheuser-Busch InBev SA/NV - Depositary Receipt (Common Stock) (US:BUD) . Posisi baru HHG & Company, LLC meliputi: Digital Realty Trust, Inc. (US:DLR) , Realty Income Corporation (US:O) , The J. M. Smucker Company (US:SJM) , StoneMor Inc (US:STON) , and Centene Corporation (US:CNC) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.52 | 20.60 | 5.7218 | 2.0873 | |

| 0.02 | 2.45 | 0.6812 | 0.6812 | |

| 0.05 | 5.47 | 1.5201 | 0.4800 | |

| 0.21 | 17.14 | 4.7628 | 0.4357 | |

| 0.01 | 1.35 | 0.3742 | 0.3742 | |

| 0.14 | 7.82 | 2.1710 | 0.3664 | |

| 0.02 | 1.27 | 0.3522 | 0.3522 | |

| 1.25 | 0.3459 | 0.3459 | ||

| 0.03 | 3.29 | 0.9142 | 0.2410 | |

| 0.14 | 5.62 | 1.5623 | 0.2321 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.74 | 37.78 | 10.4943 | -7.1186 | |

| 0.00 | 0.00 | -0.6120 | ||

| 0.00 | 0.00 | -0.5617 | ||

| 0.00 | 0.00 | -0.3085 | ||

| 0.37 | 10.99 | 3.0538 | -0.2375 | |

| 0.00 | 0.00 | -0.2095 | ||

| 0.00 | 0.00 | -0.1655 | ||

| 0.34 | 8.37 | 2.3238 | -0.1543 | |

| 0.00 | 0.00 | -0.1414 | ||

| 0.19 | 3.09 | 0.8584 | -0.1282 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2016-04-20 untuk periode pelaporan 2016-03-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| CCEP / Coca-Cola Europacific Partners PLC | 0.74 | -43.81 | 37.78 | -42.10 | 10.4943 | -7.1186 | |||

| AOR / iShares Trust - iShares Core 60/40 Balanced Allocation ETF | 0.52 | 50.77 | 20.60 | 52.98 | 5.7218 | 2.0873 | |||

| XOM / Exxon Mobil Corporation | 0.21 | -0.26 | 17.14 | 6.96 | 4.7628 | 0.4357 | |||

| PFE / Pfizer Inc. | 0.37 | -1.81 | 10.99 | -9.84 | 3.0538 | -0.2375 | |||

| BUD / Anheuser-Busch InBev SA/NV - Depositary Receipt (Common Stock) | 0.08 | -0.53 | 10.27 | -0.80 | 2.8516 | 0.0583 | |||

| TYG / Tortoise Energy Infrastructure Corporation | 0.34 | 3.05 | 8.37 | -8.88 | 2.3238 | -0.1543 | |||

| IBM / International Business Machines Corporation | 0.05 | -2.16 | 8.23 | 7.67 | 2.2865 | 0.2229 | |||

| JNJ / Johnson & Johnson | 0.07 | 1.79 | 8.07 | 7.23 | 2.2424 | 0.2103 | |||

| VZ / Verizon Communications Inc. | 0.14 | -0.09 | 7.82 | 16.90 | 2.1710 | 0.3664 | |||

| T / AT&T Inc. | 0.14 | 0.25 | 5.62 | 14.12 | 1.5623 | 0.2321 | |||

| AAPL / Apple Inc. | 0.05 | 37.14 | 5.47 | 42.02 | 1.5201 | 0.4800 | |||

| GE / General Electric Company | 0.17 | -6.91 | 5.40 | -5.00 | 1.4998 | -0.0342 | |||

| MMM / 3M Company | 0.03 | 0.40 | 5.34 | 11.06 | 1.4845 | 0.1856 | |||

| MSFT / Microsoft Corporation | 0.10 | -2.97 | 5.31 | -3.42 | 1.4759 | -0.0090 | |||

| ECL / Ecolab Inc. | 0.05 | 1.17 | 5.03 | -1.35 | 1.3968 | 0.0209 | |||

| UPS / United Parcel Service, Inc. | 0.04 | 0.44 | 4.37 | 10.07 | 1.2143 | 0.1423 | |||

| KMB / Kimberly-Clark Corporation | 0.03 | -1.00 | 3.94 | 4.59 | 1.0951 | 0.0777 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.03 | 1.43 | 3.93 | 8.99 | 1.0915 | 0.1183 | |||

| PEP / PepsiCo, Inc. | 0.04 | -2.18 | 3.87 | 0.34 | 1.0751 | 0.0339 | |||

| VIG / Vanguard Specialized Funds - Vanguard Dividend Appreciation ETF | 0.04 | -13.56 | 3.58 | -9.68 | 0.9931 | -0.0753 | |||

| CVX / Chevron Corporation | 0.04 | 4.03 | 3.45 | 10.32 | 0.9592 | 0.1143 | |||

| DLR / Digital Realty Trust, Inc. | 3.45 | 17.21 | 0.9576 | 0.1637 | |||||

| PG / The Procter & Gamble Company | 0.04 | 2.61 | 3.41 | 6.37 | 0.9467 | 0.0819 | |||

| WELL / Welltower Inc. | 0.05 | 3.86 | 3.38 | 5.83 | 0.9376 | 0.0767 | |||

| BMY / Bristol-Myers Squibb Company | 0.05 | -1.00 | 3.30 | -8.06 | 0.9159 | -0.0521 | |||

| 920355104 / Valspar Corp. | 0.03 | 2.26 | 3.29 | 31.96 | 0.9142 | 0.2410 | |||

| ADP / Automatic Data Processing, Inc. | 0.04 | 0.65 | 3.19 | 6.56 | 0.8848 | 0.0779 | |||

| PFF / iShares Trust - iShares Preferred and Income Securities ETF | 0.08 | -1.33 | 3.14 | -0.85 | 0.8728 | 0.0174 | |||

| SPY / SPDR S&P 500 ETF | 0.02 | -0.78 | 3.13 | 0.03 | 0.8684 | 0.0248 | |||

| MCD / McDonald's Corporation | 0.02 | -0.32 | 3.12 | 6.05 | 0.8664 | 0.0726 | |||

| NTG / Tortoise Midstream Energy Fund, Inc. | 0.19 | -10.18 | 3.09 | -15.46 | 0.8584 | -0.1282 | |||

| STE / STERIS plc | 0.04 | 0.88 | 3.06 | -4.86 | 0.8487 | -0.0181 | |||

| WEC / WEC Energy Group, Inc. | 0.05 | -0.58 | 3.00 | 16.41 | 0.8337 | 0.1378 | |||

| IVW / iShares Trust - iShares S&P 500 Growth ETF | 0.03 | -2.32 | 2.96 | -2.24 | 0.8234 | 0.0049 | |||

| DVY / iShares Trust - iShares Select Dividend ETF | 0.04 | -5.61 | 2.93 | 2.56 | 0.8139 | 0.0427 | |||

| GIS / General Mills, Inc. | 0.05 | 0.42 | 2.93 | 10.33 | 0.8131 | 0.0970 | |||

| O / Realty Income Corporation | 2.91 | 21.53 | 0.8076 | 0.1619 | |||||

| ORCL / Oracle Corporation | 0.07 | 1.24 | 2.88 | 13.37 | 0.7987 | 0.1141 | |||

| BDX / Becton, Dickinson and Company | 0.02 | -1.43 | 2.84 | -2.87 | 0.7889 | -0.0004 | |||

| XEL / Xcel Energy Inc. | 0.06 | 0.70 | 2.70 | 17.26 | 0.7512 | 0.1287 | |||

| RSG / Republic Services, Inc. | 0.06 | 0.64 | 2.69 | 8.99 | 0.7478 | 0.0811 | |||

| ACN / Accenture plc | 0.02 | -3.98 | 2.67 | 6.02 | 0.7431 | 0.0621 | |||

| SBUX / Starbucks Corporation | 0.04 | -0.09 | 2.66 | -0.63 | 0.7398 | 0.0163 | |||

| VFC / V.F. Corporation | 0.04 | 1.86 | 2.64 | 5.97 | 0.7342 | 0.0610 | |||

| RTX / RTX Corporation | 0.03 | 3.50 | 2.61 | 7.82 | 0.7242 | 0.0715 | |||

| AJG / Arthur J. Gallagher & Co. | 0.06 | 4.44 | 2.51 | 13.49 | 0.6964 | 0.1001 | |||

| TJX / The TJX Companies, Inc. | 0.03 | -4.97 | 2.50 | 5.00 | 0.6945 | 0.0518 | |||

| SJM / The J. M. Smucker Company | 0.02 | 2.45 | 0.6812 | 0.6812 | |||||

| 74005P104 / Praxair, Inc. | 0.02 | 3.04 | 2.43 | 15.18 | 0.6745 | 0.1055 | |||

| RDS.A / Shell Plc - ADR (Representing Ordinary Shares - Class A) | 0.05 | 13.95 | 2.40 | 21.76 | 0.6653 | 0.1344 | |||

| NVS / Novartis AG - Depositary Receipt (Common Stock) | 0.03 | 3.87 | 2.38 | -12.55 | 0.6600 | -0.0734 | |||

| CBSH / Commerce Bancshares, Inc. | 0.05 | 2.41 | 2.37 | 8.20 | 0.6595 | 0.0672 | |||

| LLTC / Linear Technology Corp. | 0.05 | 3.56 | 2.25 | 8.65 | 0.6245 | 0.0660 | |||

| VOE / Vanguard Index Funds - Vanguard Mid-Cap Value ETF | 0.02 | -4.41 | 2.15 | -3.15 | 0.5984 | -0.0020 | |||

| STON / StoneMor Inc | 2.11 | -9.83 | 0.5859 | -0.0455 | |||||

| UNH / UnitedHealth Group Incorporated | 0.02 | 0.64 | 2.09 | 10.27 | 0.5817 | 0.0691 | |||

| OMC / Omnicom Group Inc. | 0.03 | 3.42 | 2.08 | 13.82 | 0.5789 | 0.0847 | |||

| NEE / NextEra Energy, Inc. | 0.02 | -2.93 | 2.01 | 10.56 | 0.5586 | 0.0676 | |||

| MO / Altria Group, Inc. | 0.03 | -1.21 | 1.97 | 6.32 | 0.5464 | 0.0470 | |||

| 19041P105 / CBS Corp. | 0.04 | 0.00 | 1.96 | 16.91 | 0.5453 | 0.0921 | |||

| JPM / JPMorgan Chase & Co. | 0.03 | 2.14 | 1.87 | -8.41 | 0.5206 | -0.0317 | |||

| GLD / SPDR Gold Trust | 0.02 | -2.45 | 1.87 | 13.12 | 0.5198 | 0.0733 | |||

| MA / Mastercard Incorporated | 0.02 | 6.17 | 1.86 | 3.10 | 0.5178 | 0.0298 | |||

| KO / The Coca-Cola Company | 0.04 | 0.56 | 1.84 | 8.60 | 0.5120 | 0.0539 | |||

| WAT / Waters Corporation | 0.01 | -1.24 | 1.83 | -3.22 | 0.5098 | -0.0020 | |||

| SDY / SPDR Series Trust - SPDR S&P Dividend ETF | 0.02 | -9.94 | 1.82 | -2.15 | 0.5048 | 0.0035 | |||

| CSCO / Cisco Systems, Inc. | 0.06 | -2.02 | 1.76 | 2.75 | 0.4878 | 0.0265 | |||

| CVS / CVS Health Corporation | 0.02 | -1.65 | 1.73 | 4.35 | 0.4798 | 0.0330 | |||

| SYK / Stryker Corporation | 0.01 | 6.16 | 1.61 | 22.54 | 0.4470 | 0.0925 | |||

| CTSH / Cognizant Technology Solutions Corporation | 0.02 | 26.59 | 1.53 | 32.27 | 0.4248 | 0.1127 | |||

| RTN / Raytheon Co. | 0.01 | -4.17 | 1.52 | -5.63 | 0.4234 | -0.0126 | |||

| APH / Amphenol Corporation | 0.03 | 3.57 | 1.49 | 14.68 | 0.4145 | 0.0633 | |||

| MRK / Merck & Co., Inc. | 0.03 | -3.52 | 1.45 | -3.33 | 0.4036 | -0.0021 | |||

| PM / Philip Morris International Inc. | 0.01 | -1.94 | 1.43 | 9.39 | 0.3981 | 0.0445 | |||

| DOW / Dow Inc. | 0.02 | -2.64 | 1.43 | -7.40 | 0.3964 | -0.0196 | |||

| NKE / NIKE, Inc. | 0.02 | -0.77 | 1.38 | -2.41 | 0.3828 | 0.0017 | |||

| BA / The Boeing Company | 0.01 | 0.00 | 1.35 | 0.3742 | 0.3742 | ||||

| INTC / Intel Corporation | 0.04 | -4.34 | 1.34 | -10.15 | 0.3711 | -0.0303 | |||

| EMR / Emerson Electric Co. | 0.02 | 1.12 | 1.33 | 14.94 | 0.3697 | 0.0572 | |||

| DLS / WisdomTree Trust - WisdomTree International SmallCap Dividend Fund | 0.02 | 0.00 | 1.30 | 1.41 | 0.3606 | 0.0151 | |||

| 904784709 / Unilever N.V. | 0.03 | -1.66 | 1.29 | 1.41 | 0.3597 | 0.0150 | |||

| CNC / Centene Corporation | 0.02 | 1.27 | 0.3522 | 0.3522 | |||||

| CB / Chubb Limited | 0.01 | -1.39 | 1.26 | 0.56 | 0.3495 | 0.0118 | |||

| BCE / BCE Inc. | 0.03 | 5.04 | 1.25 | 23.89 | 0.3472 | 0.0749 | |||

| LMRK / Landmark Infrastructure Partners LP - Unit | 1.25 | 0.3459 | 0.3459 | ||||||

| HON / Honeywell International Inc. | 0.01 | -0.74 | 1.24 | 7.36 | 0.3445 | 0.0327 | |||

| IVE / iShares Trust - iShares S&P 500 Value ETF | 0.01 | -5.81 | 1.23 | -4.37 | 0.3403 | -0.0055 | |||

| IWP / iShares Trust - iShares Russell Mid-Cap Growth ETF | 0.01 | -3.05 | 1.22 | -2.72 | 0.3384 | 0.0004 | |||

| TROW / T. Rowe Price Group, Inc. | 0.02 | 2.87 | 1.20 | 5.75 | 0.3320 | 0.0269 | |||

| APU / AmeriGas Partners, L.P. | 0.03 | 0.14 | 1.16 | 27.13 | 0.3228 | 0.0761 | |||

| VGK / Vanguard International Equity Index Funds - Vanguard FTSE Europe ETF | 0.02 | -2.68 | 1.11 | -5.38 | 0.3078 | -0.0083 | |||

| DIS / The Walt Disney Company | 0.01 | -3.72 | 1.10 | -8.97 | 0.3045 | -0.0205 | |||

| AON / Aon plc | 0.01 | -1.05 | 1.09 | 12.05 | 0.3022 | 0.0401 | |||

| WFC / Wells Fargo & Company | 0.02 | 7.55 | 1.07 | -4.31 | 0.2961 | -0.0046 | |||

| GPC / Genuine Parts Company | 0.01 | -0.47 | 1.06 | 15.14 | 0.2959 | 0.0462 | |||

| V / Visa Inc. | 0.01 | -16.39 | 0.97 | -17.55 | 0.2689 | -0.0480 | |||

| BNDX / Vanguard Charlotte Funds - Vanguard Total International Bond ETF | 0.02 | 0.00 | 0.90 | 3.20 | 0.2509 | 0.0147 | |||

| GLW / Corning Incorporated | 0.04 | 92.91 | 0.89 | 120.74 | 0.2484 | 0.1390 | |||

| MET / MetLife, Inc. | 0.02 | -4.86 | 0.87 | -13.31 | 0.2425 | -0.0293 | |||

| PEAK / Healthpeak Properties, Inc. | 0.03 | -1.92 | 0.83 | -16.43 | 0.2303 | -0.0375 | |||

| VIAB / Viacom, Inc. | 0.02 | 0.00 | 0.77 | 0.26 | 0.2142 | 0.0066 | |||

| LLY / Eli Lilly and Company | 0.01 | -4.61 | 0.74 | -18.47 | 0.2047 | -0.0393 | |||

| VOD / Vodafone Group Public Limited Company - Depositary Receipt (Common Stock) | 0.02 | 5.53 | 0.73 | 4.75 | 0.2022 | 0.0146 | |||

| WRK / WestRock Company | 0.02 | -6.03 | 0.72 | -19.66 | 0.1997 | -0.0419 | |||

| HBI / Hanesbrands Inc. | 0.03 | 1.60 | 0.72 | -2.18 | 0.1995 | 0.0013 | |||

| PGF / Invesco Exchange-Traded Fund Trust - Invesco Financial Preferred ETF | 0.04 | 0.00 | 0.69 | -0.14 | 0.1925 | 0.0052 | |||

| OIH / VanEck ETF Trust - VanEck Oil Services ETF | 0.03 | 1.52 | 0.69 | 2.07 | 0.1920 | 0.1920 | |||

| COP / ConocoPhillips | 0.02 | -18.93 | 0.69 | -30.10 | 0.1903 | -0.0742 | |||

| DOV / Dover Corporation | 0.01 | -0.39 | 0.66 | 4.63 | 0.1822 | 0.0130 | |||

| AZN / AstraZeneca PLC - Depositary Receipt (Common Stock) | 0.02 | -1.39 | 0.65 | -18.16 | 0.1803 | -0.0338 | |||

| WETF / Wisdomtree Investments Inc | 0.06 | 0.00 | 0.64 | -27.11 | 0.1778 | -0.0592 | |||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 0.03 | -2.97 | 0.63 | -6.65 | 0.1756 | -0.0072 | |||

| RDS.A / Shell Plc - ADR (Representing Ordinary Shares - Class A) | 0.01 | 3.32 | 0.56 | 9.38 | 0.1556 | 0.0174 | |||

| ABT / Abbott Laboratories | 0.01 | -0.51 | 0.53 | -7.38 | 0.1464 | -0.0072 | |||

| HSBC / HSBC Holdings plc - Depositary Receipt (Common Stock) | 0.02 | 5.19 | 0.52 | -17.09 | 0.1456 | -0.0250 | |||

| AMLP / ALPS ETF Trust - Alerian MLP ETF | 0.04 | 0.55 | 0.44 | -8.92 | 0.1220 | -0.0082 | |||

| HEFA / iShares Trust - iShares Currency Hedged MSCI EAFE ETF | 0.02 | -4.74 | 0.41 | -10.57 | 0.1128 | -0.0098 | |||

| SCHF / Schwab Strategic Trust - Schwab International Equity ETF | 0.01 | 0.40 | 0.1120 | 0.1120 | |||||

| OPK / OPKO Health, Inc. | 0.04 | 0.00 | 0.38 | 3.52 | 0.1061 | 0.0065 | |||

| NTC / Nuveen Connecticut Premium Income Municipal Fund, Inc. | 0.03 | -11.09 | 0.36 | -7.85 | 0.1011 | -0.0055 | |||

| SCHE / Schwab Strategic Trust - Schwab Emerging Markets Equity ETF | 0.02 | 0.36 | 0.1011 | 0.1011 | |||||

| VWO / Vanguard International Equity Index Funds - Vanguard FTSE Emerging Markets ETF | 0.01 | 0.00 | 0.36 | 0.0989 | 0.0989 | ||||

| PBCT / People`s United Financial Inc | 0.02 | 0.08 | 0.35 | -1.14 | 0.0961 | 0.0016 | |||

| IDV / iShares Trust - iShares International Select Dividend ETF | 0.01 | 0.56 | 0.33 | 1.53 | 0.0920 | 0.0040 | |||

| TPZ / Tortoise Essential Energy Fund | 0.02 | -5.46 | 0.32 | -2.17 | 0.0875 | 0.0006 | |||

| PBI / Pitney Bowes Inc. | 0.01 | 0.29 | 0.0797 | 0.0797 | |||||

| ETB / Eaton Vance Tax-Managed Buy-Write Income Fund | 0.02 | 0.00 | 0.28 | -2.78 | 0.0778 | 0.0000 | |||

| CRIS / Curis, Inc. | 0.15 | 0.00 | 0.25 | -44.72 | 0.0683 | -0.0518 | |||

| DBA / Invesco DB Multi-Sector Commodity Trust - Invesco DB Agriculture Fund | 0.01 | 0.00 | 0.24 | -0.41 | 0.0669 | 0.0016 | |||

| F / Ford Motor Company | 0.02 | -1.40 | 0.22 | -5.56 | 0.0614 | -0.0018 | |||

| GRFS / Grifols, S.A. - Depositary Receipt (Common Stock) | 0.01 | 0.22 | 0.0611 | 0.0611 | |||||

| PAA / Plains All American Pipeline, L.P. - Limited Partnership | 0.01 | 0.18 | 0.22 | -9.09 | 0.0611 | -0.0042 | |||

| BSCO / Invesco Exchange-Traded Self-Indexed Fund Trust - Invesco BulletShares 2024 Corporate Bond ETF | 0.01 | 0.00 | 0.22 | 4.33 | 0.0603 | 0.0603 | |||

| KMI / Kinder Morgan, Inc. | 0.01 | 0.00 | 0.21 | 0.0589 | 0.0589 | ||||

| BX / Blackstone Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0802 | ||||

| UBS / UBS Group AG | 0.00 | -100.00 | 0.00 | -100.00 | -0.0580 | ||||

| TRV / The Travelers Companies, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.3085 | ||||

| XLI / The Select Sector SPDR Trust - The Industrial Select Sector SPDR Fund | 0.00 | 0.00 | 0.0000 | 0.0000 | |||||

| MDT / Medtronic plc | 0.00 | 0.00 | 0.0000 | 0.0000 | |||||

| DXJ / WisdomTree Trust - WisdomTree Japan Hedged Equity Fund | 0.00 | -100.00 | 0.00 | -100.00 | -0.1655 | ||||

| EEP / Enbridge Energy Partners, L.P. | 0.00 | -100.00 | 0.00 | -100.00 | -0.0648 | ||||

| VEA / Vanguard Tax-Managed Funds - Vanguard FTSE Developed Markets ETF | 0.00 | -100.00 | 0.00 | -100.00 | -0.1414 | ||||

| BCS / Barclays PLC - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | -100.00 | -0.0710 | ||||

| HNT / Health Net Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.6120 | ||||

| NLOK / NortonLifeLock Inc | 0.00 | -100.00 | 0.00 | -100.00 | -0.2095 | ||||

| CL / Colgate-Palmolive Company | 0.00 | -100.00 | 0.00 | -100.00 | -0.5617 |