Mga Batayang Estadistika

| Nilai Portofolio | $ 123,938,472 |

| Posisi Saat Ini | 123 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

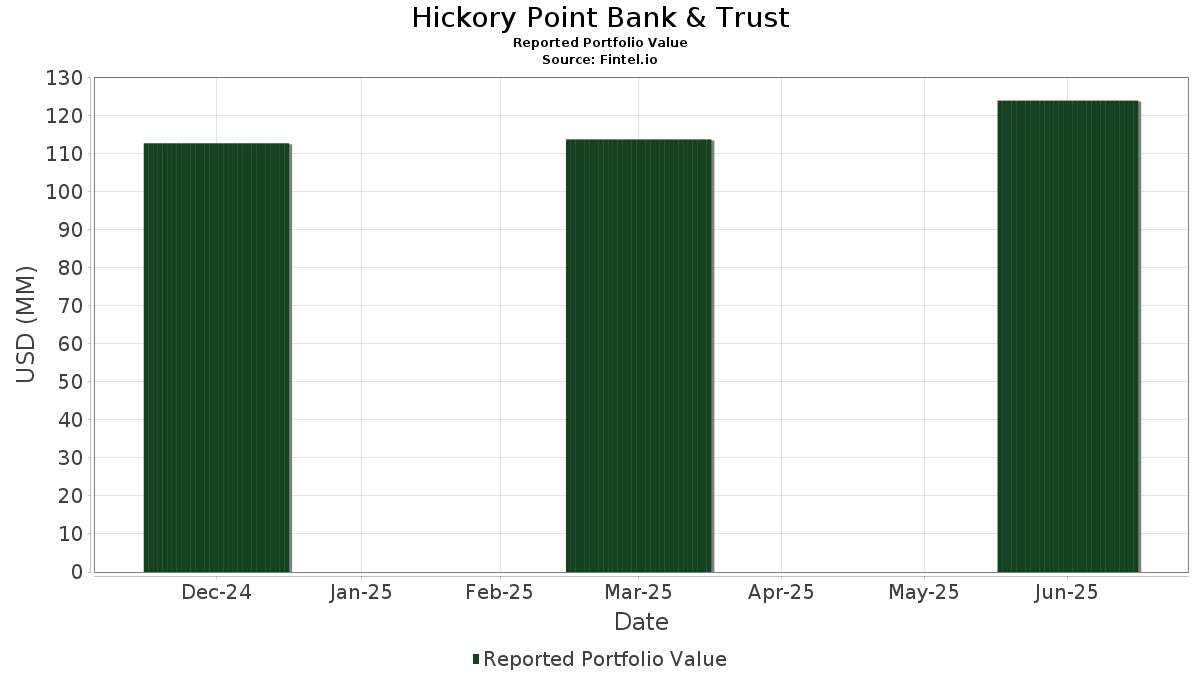

Hickory Point Bank & Trust telah mengungkapkan total kepemilikan 123 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 123,938,472 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Hickory Point Bank & Trust adalah iShares Trust - iShares Core S&P Total U.S. Stock Market ETF (US:ITOT) , SPDR S&P 500 ETF (US:SPY) , iShares Trust - iShares Core MSCI EAFE ETF (US:IEFA) , Vanguard Scottsdale Funds - Vanguard Intermediate-Term Treasury ETF (US:VGIT) , and Microsoft Corporation (US:MSFT) . Posisi baru Hickory Point Bank & Trust meliputi: Vanguard Scottsdale Funds - Vanguard Intermediate-Term Corporate Bond ETF (US:VICS.X) , SPDR Gold Trust (US:GLD) , GE Vernova Inc. (US:GEV) , Globus Medical, Inc. (US:GMED) , and .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.02 | 2.64 | 2.1265 | 0.5488 | |

| 0.01 | 0.61 | 0.4887 | 0.4887 | |

| 0.01 | 3.19 | 2.5710 | 0.4533 | |

| 0.00 | 3.04 | 2.4536 | 0.3470 | |

| 0.03 | 2.46 | 1.9823 | 0.2923 | |

| 0.01 | 1.95 | 1.5714 | 0.2849 | |

| 0.00 | 0.26 | 0.2078 | 0.2078 | |

| 0.00 | 0.26 | 0.2071 | 0.2071 | |

| 0.01 | 1.25 | 1.0065 | 0.2000 | |

| 0.00 | 0.22 | 0.1786 | 0.1786 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.03 | 3.02 | 2.4392 | -1.1846 | |

| 0.00 | 1.89 | 1.5239 | -0.3038 | |

| 0.01 | 2.29 | 1.8508 | -0.2416 | |

| 0.01 | 1.28 | 1.0365 | -0.2259 | |

| 0.01 | 0.80 | 0.6494 | -0.1422 | |

| 0.01 | 1.26 | 1.0175 | -0.1389 | |

| 0.00 | 0.34 | 0.2724 | -0.1105 | |

| 0.01 | 0.82 | 0.6618 | -0.1096 | |

| 0.00 | 0.30 | 0.2400 | -0.1078 | |

| 0.02 | 0.73 | 0.5906 | -0.0878 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-08 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| ITOT / iShares Trust - iShares Core S&P Total U.S. Stock Market ETF | 0.14 | -1.35 | 18.80 | 9.19 | 15.1723 | 0.0301 | |||

| SPY / SPDR S&P 500 ETF | 0.02 | -0.46 | 13.50 | 9.94 | 10.8930 | 0.0966 | |||

| IEFA / iShares Trust - iShares Core MSCI EAFE ETF | 0.09 | 0.38 | 7.44 | 10.76 | 6.0058 | 0.0972 | |||

| VGIT / Vanguard Scottsdale Funds - Vanguard Intermediate-Term Treasury ETF | 0.05 | 7.16 | 3.22 | 7.91 | 2.5992 | -0.0258 | |||

| MSFT / Microsoft Corporation | 0.01 | -0.16 | 3.19 | 32.31 | 2.5710 | 0.4533 | |||

| META / Meta Platforms, Inc. | 0.00 | -0.89 | 3.04 | 26.93 | 2.4536 | 0.3470 | |||

| AGG / iShares Trust - iShares Core U.S. Aggregate Bond ETF | 0.03 | -26.86 | 3.02 | -26.64 | 2.4392 | -1.1846 | |||

| NVDA / NVIDIA Corporation | 0.02 | 0.75 | 2.64 | 46.88 | 2.1265 | 0.5488 | |||

| VYM / Vanguard Whitehall Funds - Vanguard High Dividend Yield ETF | 0.02 | 5.83 | 2.59 | 9.43 | 2.0883 | 0.0082 | |||

| VGK / Vanguard International Equity Index Funds - Vanguard FTSE Europe ETF | 0.03 | 15.80 | 2.46 | 27.78 | 1.9823 | 0.2923 | |||

| AAPL / Apple Inc. | 0.01 | 4.36 | 2.29 | -3.61 | 1.8508 | -0.2416 | |||

| JPM / JPMorgan Chase & Co. | 0.01 | 12.62 | 1.95 | 33.08 | 1.5714 | 0.2849 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.00 | -0.38 | 1.89 | -9.14 | 1.5239 | -0.3038 | |||

| AMZN / Amazon.com, Inc. | 0.01 | 1.38 | 1.53 | 16.93 | 1.2313 | 0.0836 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.00 | 4.12 | 1.43 | 15.08 | 1.1517 | 0.0609 | |||

| GOOGL / Alphabet Inc. | 0.01 | -1.05 | 1.41 | 12.77 | 1.1402 | 0.0384 | |||

| DIS / The Walt Disney Company | 0.01 | -0.08 | 1.32 | 25.50 | 1.0648 | 0.1405 | |||

| XOM / Exxon Mobil Corporation | 0.01 | -1.29 | 1.28 | -10.52 | 1.0365 | -0.2259 | |||

| ADM / Archer-Daniels-Midland Company | 0.02 | 0.52 | 1.28 | 10.44 | 1.0334 | 0.0143 | |||

| CVX / Chevron Corporation | 0.01 | 12.02 | 1.26 | -4.11 | 1.0175 | -0.1389 | |||

| EFA / iShares Trust - iShares MSCI EAFE ETF | 0.01 | 24.34 | 1.25 | 35.99 | 1.0065 | 0.2000 | |||

| IWM / iShares Trust - iShares Russell 2000 ETF | 0.01 | 5.64 | 1.14 | 14.23 | 0.9203 | 0.0426 | |||

| CAT / Caterpillar Inc. | 0.00 | 0.00 | 1.05 | 17.75 | 0.8457 | 0.0628 | |||

| DE / Deere & Company | 0.00 | 24.18 | 1.04 | 34.54 | 0.8427 | 0.1601 | |||

| BAC / Bank of America Corporation | 0.02 | 0.79 | 1.01 | 14.24 | 0.8163 | 0.0380 | |||

| VWO / Vanguard International Equity Index Funds - Vanguard FTSE Emerging Markets ETF | 0.02 | 0.00 | 0.99 | 9.30 | 0.7965 | 0.0022 | |||

| CSCO / Cisco Systems, Inc. | 0.01 | -0.16 | 0.98 | 12.24 | 0.7918 | 0.0231 | |||

| RSG / Republic Services, Inc. | 0.00 | -2.23 | 0.92 | -0.43 | 0.7410 | -0.0700 | |||

| PG / The Procter & Gamble Company | 0.01 | 0.00 | 0.82 | -6.50 | 0.6618 | -0.1096 | |||

| MRK / Merck & Co., Inc. | 0.01 | 1.37 | 0.80 | -10.67 | 0.6494 | -0.1422 | |||

| UNP / Union Pacific Corporation | 0.00 | 1.02 | 0.80 | -1.60 | 0.6444 | -0.0693 | |||

| GD / General Dynamics Corporation | 0.00 | 1.48 | 0.80 | 8.58 | 0.6436 | -0.0023 | |||

| KO / The Coca-Cola Company | 0.01 | 0.00 | 0.77 | -1.16 | 0.6193 | -0.0639 | |||

| WMT / Walmart Inc. | 0.01 | 8.95 | 0.74 | 21.41 | 0.6001 | 0.0612 | |||

| VZ / Verizon Communications Inc. | 0.02 | -0.54 | 0.73 | -5.06 | 0.5906 | -0.0878 | |||

| BSV / Vanguard Bond Index Funds - Vanguard Short-Term Bond ETF | 0.01 | 1.09 | 0.73 | 1.53 | 0.5905 | -0.0427 | |||

| NEM / Newmont Corporation | 0.01 | 0.42 | 0.70 | 21.22 | 0.5629 | 0.0567 | |||

| ECL / Ecolab Inc. | 0.00 | 0.00 | 0.68 | 6.25 | 0.5491 | -0.0139 | |||

| IJK / iShares Trust - iShares S&P Mid-Cap 400 Growth ETF | 0.01 | 0.00 | 0.65 | 9.20 | 0.5271 | 0.0013 | |||

| C / Citigroup Inc. | 0.01 | 0.00 | 0.65 | 19.89 | 0.5259 | 0.0480 | |||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.00 | -1.13 | 0.65 | 9.31 | 0.5216 | 0.0015 | |||

| ORCL / Oracle Corporation | 0.00 | 6.82 | 0.62 | 67.12 | 0.5003 | 0.1739 | |||

| VICS.X / Vanguard Scottsdale Funds - Vanguard Intermediate-Term Corporate Bond ETF | 0.01 | 0.61 | 0.4887 | 0.4887 | |||||

| CMI / Cummins Inc. | 0.00 | 5.52 | 0.59 | 10.20 | 0.4799 | 0.0056 | |||

| IJT / iShares Trust - iShares S&P Small-Cap 600 Growth ETF | 0.00 | 0.00 | 0.59 | 6.85 | 0.4792 | -0.0095 | |||

| GE / General Electric Company | 0.00 | 0.00 | 0.57 | 28.67 | 0.4606 | 0.0703 | |||

| PWR / Quanta Services, Inc. | 0.00 | -1.96 | 0.57 | 46.13 | 0.4576 | 0.1156 | |||

| QQQ / Invesco QQQ Trust, Series 1 | 0.00 | 0.00 | 0.56 | 17.68 | 0.4513 | 0.0333 | |||

| BLK / BlackRock, Inc. | 0.00 | 0.00 | 0.56 | 10.93 | 0.4504 | 0.0077 | |||

| HEDJ / WisdomTree Trust - WisdomTree Europe Hedged Equity Fund | 0.01 | 0.00 | 0.55 | 1.30 | 0.4416 | -0.0332 | |||

| KMI / Kinder Morgan, Inc. | 0.02 | 0.00 | 0.55 | 3.02 | 0.4402 | -0.0253 | |||

| DRI / Darden Restaurants, Inc. | 0.00 | -3.77 | 0.53 | 0.96 | 0.4265 | -0.0339 | |||

| SO / The Southern Company | 0.01 | 0.00 | 0.53 | -0.19 | 0.4255 | -0.0388 | |||

| IBM / International Business Machines Corporation | 0.00 | -3.16 | 0.52 | 14.95 | 0.4222 | 0.0214 | |||

| MDLZ / Mondelez International, Inc. | 0.01 | 2.67 | 0.52 | 2.17 | 0.4181 | -0.0283 | |||

| HBT / HBT Financial, Inc. | 0.02 | 0.00 | 0.50 | 12.50 | 0.4068 | 0.0127 | |||

| AMP / Ameriprise Financial, Inc. | 0.00 | -0.64 | 0.50 | 9.67 | 0.4026 | 0.0021 | |||

| TEL / TE Connectivity plc | 0.00 | 2.62 | 0.50 | 22.52 | 0.3998 | 0.0441 | |||

| VO / Vanguard Index Funds - Vanguard Mid-Cap ETF | 0.00 | -17.40 | 0.48 | -10.71 | 0.3838 | -0.0841 | |||

| EFG / iShares Trust - iShares MSCI EAFE Growth ETF | 0.00 | 0.00 | 0.47 | 11.99 | 0.3772 | 0.0102 | |||

| UPRO / ProShares Trust - ProShares UltraPro S&P500 | 0.01 | 1.41 | 0.46 | 25.75 | 0.3704 | 0.0487 | |||

| NOBL / ProShares Trust - ProShares S&P 500 Dividend Aristocrats ETF | 0.00 | 0.00 | 0.45 | -1.31 | 0.3656 | -0.0387 | |||

| GM / General Motors Company | 0.01 | 0.00 | 0.45 | 4.64 | 0.3645 | -0.0151 | |||

| FTXP / Foothills Exploration, Inc. | 0.00 | -5.78 | 0.44 | 24.43 | 0.3534 | 0.0432 | |||

| PEP / PepsiCo, Inc. | 0.00 | 5.57 | 0.44 | -7.02 | 0.3533 | -0.0608 | |||

| COST / Costco Wholesale Corporation | 0.00 | -0.68 | 0.43 | 3.86 | 0.3482 | -0.0168 | |||

| TSLA / Tesla, Inc. | 0.00 | 3.87 | 0.43 | 27.16 | 0.3442 | 0.0496 | |||

| XLU / The Select Sector SPDR Trust - The Utilities Select Sector SPDR Fund | 0.01 | -1.89 | 0.42 | 1.68 | 0.3425 | -0.0248 | |||

| JNJ / Johnson & Johnson | 0.00 | 0.00 | 0.42 | -8.04 | 0.3419 | -0.0626 | |||

| HSY / The Hershey Company | 0.00 | 1.00 | 0.42 | -2.11 | 0.3380 | -0.0378 | |||

| LOW / Lowe's Companies, Inc. | 0.00 | 0.81 | 0.41 | -4.17 | 0.3344 | -0.0456 | |||

| CNI / Canadian National Railway Company | 0.00 | 0.38 | 0.41 | 7.07 | 0.3307 | -0.0056 | |||

| MDY / SPDR S&P MidCap 400 ETF Trust | 0.00 | 0.00 | 0.40 | 6.13 | 0.3213 | -0.0084 | |||

| MCK / McKesson Corporation | 0.00 | -9.74 | 0.39 | -1.78 | 0.3122 | -0.0340 | |||

| ETN / Eaton Corporation plc | 0.00 | 30.38 | 0.38 | 71.75 | 0.3091 | 0.1124 | |||

| TRV / The Travelers Companies, Inc. | 0.00 | -1.46 | 0.38 | -0.52 | 0.3065 | -0.0285 | |||

| COF / Capital One Financial Corporation | 0.00 | 2.24 | 0.38 | 21.47 | 0.3059 | 0.0311 | |||

| PFE / Pfizer Inc. | 0.02 | -6.05 | 0.38 | -10.07 | 0.3029 | -0.0644 | |||

| BK / The Bank of New York Mellon Corporation | 0.00 | 2.50 | 0.37 | 11.31 | 0.3019 | 0.0064 | |||

| NUW / Nuveen AMT-Free Municipal Value Fund | 0.03 | 0.00 | 0.37 | -0.53 | 0.3013 | -0.0285 | |||

| RTX / RTX Corporation | 0.00 | 0.00 | 0.37 | 10.18 | 0.2971 | 0.0034 | |||

| MA / Mastercard Incorporated | 0.00 | -0.77 | 0.36 | 1.69 | 0.2911 | -0.0207 | |||

| BA / The Boeing Company | 0.00 | 0.00 | 0.36 | 22.60 | 0.2896 | 0.0327 | |||

| NIM / Nuveen Select Maturities Municipal Fund | 0.04 | 0.00 | 0.36 | -2.99 | 0.2887 | -0.0349 | |||

| KYN / Kayne Anderson Energy Infrastructure Fund, Inc. | 0.03 | 9.96 | 0.34 | 9.21 | 0.2776 | 0.0001 | |||

| ALL / The Allstate Corporation | 0.00 | -0.53 | 0.34 | -3.12 | 0.2761 | -0.0350 | |||

| FI / Fiserv, Inc. | 0.00 | -0.71 | 0.34 | -22.53 | 0.2724 | -0.1105 | |||

| MCD / McDonald's Corporation | 0.00 | 28.74 | 0.33 | 20.66 | 0.2640 | 0.0251 | |||

| KRE / SPDR Series Trust - SPDR S&P Regional Banking ETF | 0.01 | 1.86 | 0.32 | 6.23 | 0.2619 | -0.0063 | |||

| COP / ConocoPhillips | 0.00 | -0.28 | 0.32 | -14.74 | 0.2618 | -0.0730 | |||

| DD / DuPont de Nemours, Inc. | 0.00 | 1.09 | 0.32 | -7.00 | 0.2574 | -0.0447 | |||

| KHC / The Kraft Heinz Company | 0.01 | 1.28 | 0.31 | -14.04 | 0.2470 | -0.0662 | |||

| USB / U.S. Bancorp | 0.01 | 2.12 | 0.31 | 9.32 | 0.2466 | 0.0011 | |||

| IQLT / iShares Trust - iShares MSCI Intl Quality Factor ETF | 0.01 | 0.00 | 0.31 | 8.93 | 0.2466 | -0.0002 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.00 | -0.40 | 0.30 | -18.87 | 0.2434 | -0.0834 | |||

| T / AT&T Inc. | 0.01 | -16.17 | 0.30 | -14.33 | 0.2420 | -0.0654 | |||

| BDX / Becton, Dickinson and Company | 0.00 | 0.00 | 0.30 | -24.81 | 0.2400 | -0.1078 | |||

| AMGN / Amgen Inc. | 0.00 | -0.94 | 0.29 | -11.18 | 0.2374 | -0.0540 | |||

| TIP / iShares Trust - iShares TIPS Bond ETF | 0.00 | 0.00 | 0.29 | -1.01 | 0.2366 | -0.0237 | |||

| ROP / Roper Technologies, Inc. | 0.00 | -0.39 | 0.29 | -4.26 | 0.2360 | -0.0325 | |||

| INTC / Intel Corporation | 0.01 | -3.15 | 0.28 | -4.50 | 0.2234 | -0.0314 | |||

| IJR / iShares Trust - iShares Core S&P Small-Cap ETF | 0.00 | 8.20 | 0.27 | 13.22 | 0.2212 | 0.0080 | |||

| TOL / Toll Brothers, Inc. | 0.00 | 6.49 | 0.26 | 15.42 | 0.2114 | 0.0113 | |||

| DHI / D.R. Horton, Inc. | 0.00 | -0.69 | 0.26 | 0.77 | 0.2111 | -0.0173 | |||

| GLD / SPDR Gold Trust | 0.00 | 0.26 | 0.2078 | 0.2078 | |||||

| GEV / GE Vernova Inc. | 0.00 | 0.26 | 0.2071 | 0.2071 | |||||

| ETR / Entergy Corporation | 0.00 | -9.04 | 0.25 | -11.66 | 0.2024 | -0.0470 | |||

| WES / Western Midstream Partners, LP - Limited Partnership | 0.01 | 0.00 | 0.25 | -5.77 | 0.1983 | -0.0304 | |||

| FLRN / SPDR Series Trust - SPDR Bloomberg Investment Grade Floating Rate ETF | 0.01 | 0.00 | 0.24 | 0.00 | 0.1963 | -0.0175 | |||

| WFC / Wells Fargo & Company | 0.00 | 0.00 | 0.24 | 11.52 | 0.1957 | 0.0046 | |||

| GOVT / iShares Trust - iShares U.S. Treasury Bond ETF | 0.01 | 0.00 | 0.24 | 0.00 | 0.1948 | -0.0175 | |||

| PM / Philip Morris International Inc. | 0.00 | 0.00 | 0.24 | 14.98 | 0.1924 | 0.0097 | |||

| PEG / Public Service Enterprise Group Incorporated | 0.00 | -0.46 | 0.24 | 1.72 | 0.1920 | -0.0135 | |||

| UPS / United Parcel Service, Inc. | 0.00 | 0.00 | 0.23 | -8.37 | 0.1862 | -0.0349 | |||

| SOLV / Solventum Corporation | 0.00 | 0.00 | 0.23 | -0.44 | 0.1836 | -0.0170 | |||

| WBD / Warner Bros. Discovery, Inc. | 0.02 | -2.39 | 0.23 | 4.15 | 0.1827 | -0.0083 | |||

| MET / MetLife, Inc. | 0.00 | -0.39 | 0.23 | 0.00 | 0.1825 | -0.0168 | |||

| DVY / iShares Trust - iShares Select Dividend ETF | 0.00 | 0.00 | 0.23 | -1.32 | 0.1820 | -0.0185 | |||

| ABT / Abbott Laboratories | 0.00 | 0.00 | 0.22 | 2.31 | 0.1791 | -0.0112 | |||

| GMED / Globus Medical, Inc. | 0.00 | 0.22 | 0.1786 | 0.1786 | |||||

| BMY / Bristol-Myers Squibb Company | 0.00 | 0.00 | 0.21 | -24.29 | 0.1716 | -0.0748 | |||

| LLY / Eli Lilly and Company | 0.00 | 1.95 | 0.20 | -3.79 | 0.1642 | -0.0217 | |||

| LMT / Lockheed Martin Corporation | 0.00 | 0.20 | 0.1618 | 0.1618 | |||||

| HPQ / HP Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ABBV / AbbVie Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| OKE / ONEOK, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| DHR / Danaher Corporation | 0.00 | -100.00 | 0.00 | 0.0000 |