Mga Batayang Estadistika

| Nilai Portofolio | $ 289,832,960 |

| Posisi Saat Ini | 109 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

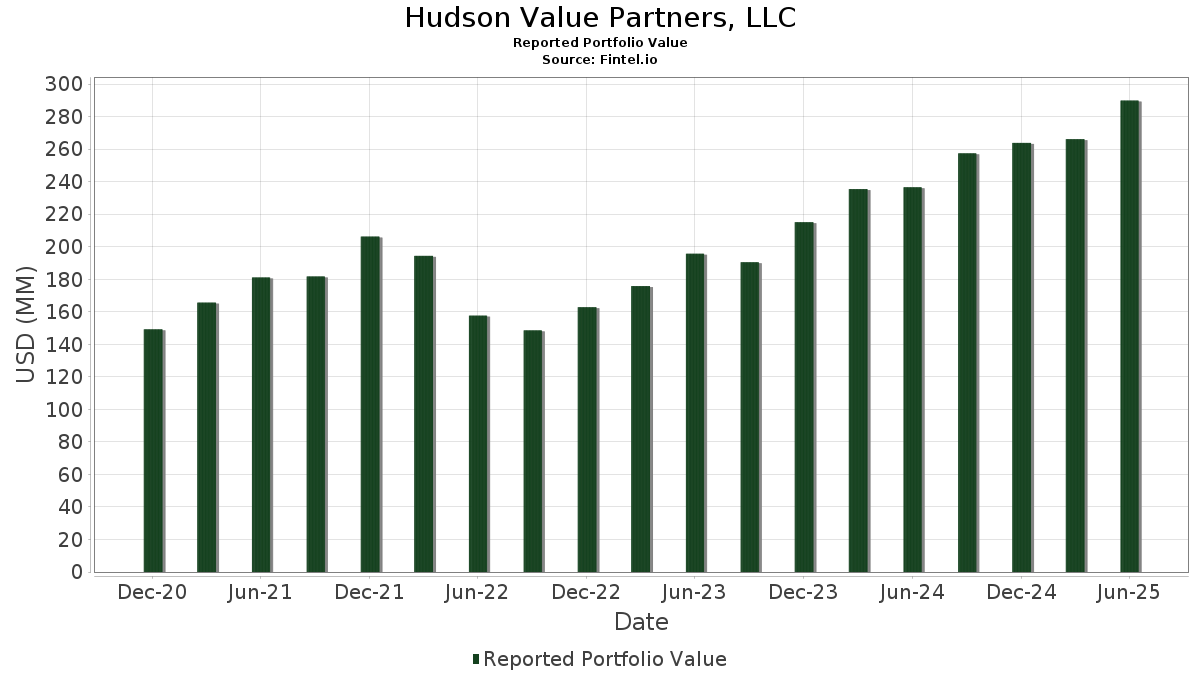

Hudson Value Partners, LLC telah mengungkapkan total kepemilikan 109 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 289,832,960 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Hudson Value Partners, LLC adalah Berkshire Hathaway Inc. (US:BRK.B) , Microsoft Corporation (US:MSFT) , Apple Inc. (US:AAPL) , Alphabet Inc. (US:GOOGL) , and Visa Inc. (US:V) . Posisi baru Hudson Value Partners, LLC meliputi: Thermo Fisher Scientific Inc. (US:TMO) , QXO, Inc. (US:QXO) , iShares, Inc. - iShares MSCI Brazil ETF (US:EWZ) , Micron Technology, Inc. (US:MU) , and Airbnb, Inc. (US:ABNB) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.01 | 3.75 | 1.2951 | 1.2951 | |

| 0.05 | 7.89 | 2.7239 | 0.8523 | |

| 0.03 | 15.29 | 5.2720 | 0.7028 | |

| 0.01 | 6.07 | 2.0917 | 0.6915 | |

| 0.08 | 5.11 | 1.7605 | 0.6592 | |

| 0.08 | 1.63 | 0.5616 | 0.5616 | |

| 0.02 | 5.09 | 1.7562 | 0.3414 | |

| 0.04 | 5.42 | 1.8687 | 0.3317 | |

| 0.02 | 2.15 | 0.7428 | 0.3027 | |

| 0.03 | 0.85 | 0.2939 | 0.2939 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.04 | 21.01 | 7.2465 | -1.2425 | |

| 0.06 | 4.88 | 1.6838 | -1.1264 | |

| 0.07 | 13.82 | 4.7696 | -1.0436 | |

| 0.02 | 5.39 | 1.8582 | -0.6543 | |

| 0.03 | 5.15 | 1.7763 | -0.6121 | |

| 0.01 | 8.03 | 2.7682 | -0.5219 | |

| 0.09 | 5.07 | 1.7482 | -0.4300 | |

| 0.01 | 2.03 | 0.6998 | -0.3622 | |

| 0.06 | 7.05 | 2.4299 | -0.3417 | |

| 0.05 | 4.32 | 1.4905 | -0.2957 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-18 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| BRK.B / Berkshire Hathaway Inc. | 0.04 | 1.99 | 21.01 | -6.97 | 7.2465 | -1.2425 | |||

| MSFT / Microsoft Corporation | 0.03 | -5.11 | 15.29 | 25.74 | 5.2720 | 0.7028 | |||

| AAPL / Apple Inc. | 0.07 | -3.25 | 13.82 | -10.64 | 4.7696 | -1.0436 | |||

| GOOGL / Alphabet Inc. | 0.08 | 1.35 | 13.26 | 15.50 | 4.5743 | 0.2606 | |||

| V / Visa Inc. | 0.02 | 0.96 | 8.29 | 2.28 | 2.8581 | -0.1872 | |||

| COST / Costco Wholesale Corporation | 0.01 | -12.40 | 8.03 | -8.32 | 2.7682 | -0.5219 | |||

| NVDA / NVIDIA Corporation | 0.05 | 8.74 | 7.89 | 58.51 | 2.7239 | 0.8523 | |||

| BLDR / Builders FirstSource, Inc. | 0.06 | 2.30 | 7.05 | -4.46 | 2.4299 | -0.3417 | |||

| MKL / Markel Group Inc. | 0.00 | 5.72 | 6.94 | 12.95 | 2.3943 | 0.0840 | |||

| ASML / ASML Holding N.V. - Depositary Receipt (Common Stock) | 0.01 | 34.61 | 6.07 | 62.82 | 2.0917 | 0.6915 | |||

| MDU / MDU Resources Group, Inc. | 0.35 | 1.66 | 5.82 | 0.21 | 2.0069 | -0.1755 | |||

| GLW / Corning Incorporated | 0.11 | 0.61 | 5.74 | 15.58 | 1.9805 | 0.1131 | |||

| GOOGL / Alphabet Inc. | 0.03 | -1.05 | 5.73 | 12.35 | 1.9776 | 0.0605 | |||

| AMGN / Amgen Inc. | 0.02 | 25.53 | 5.53 | 12.52 | 1.9073 | 0.0608 | |||

| ESAB / ESAB Corporation | 0.05 | 2.31 | 5.51 | 5.86 | 1.9013 | -0.0558 | |||

| DELL / Dell Technologies Inc. | 0.04 | -1.49 | 5.42 | 32.50 | 1.8687 | 0.3317 | |||

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.02 | -27.12 | 5.39 | -19.40 | 1.8582 | -0.6543 | |||

| QCOM / QUALCOMM Incorporated | 0.03 | -2.62 | 5.17 | 0.98 | 1.7819 | -0.1414 | |||

| JNJ / Johnson & Johnson | 0.03 | -12.01 | 5.15 | -18.95 | 1.7763 | -0.6121 | |||

| ECG / Everus Construction Group, Inc. | 0.08 | 1.70 | 5.11 | 74.23 | 1.7605 | 0.6592 | |||

| JPM / JPMorgan Chase & Co. | 0.02 | 14.40 | 5.09 | 35.20 | 1.7562 | 0.3414 | |||

| FNF / Fidelity National Financial, Inc. | 0.09 | 1.53 | 5.07 | -12.54 | 1.7482 | -0.4300 | |||

| FNV / Franco-Nevada Corporation | 0.03 | -2.49 | 5.04 | 1.45 | 1.7372 | -0.1290 | |||

| MRK / Merck & Co., Inc. | 0.06 | -25.96 | 4.88 | -34.71 | 1.6838 | -1.1264 | |||

| AMTM / Amentum Holdings, Inc. | 0.19 | -1.37 | 4.38 | 27.96 | 1.5119 | 0.2242 | |||

| BATRA / Atlanta Braves Holdings, Inc. | 0.09 | 0.68 | 4.33 | 12.92 | 1.4916 | 0.0523 | |||

| KNF / Knife River Corporation | 0.05 | 0.48 | 4.32 | -9.07 | 1.4905 | -0.2957 | |||

| ZBRA / Zebra Technologies Corporation | 0.01 | 3.68 | 4.26 | 13.13 | 1.4707 | 0.0542 | |||

| AMZN / Amazon.com, Inc. | 0.02 | 2.87 | 4.05 | 18.62 | 1.3973 | 0.1136 | |||

| MCD / McDonald's Corporation | 0.01 | 1.56 | 3.78 | -5.00 | 1.3033 | -0.1918 | |||

| TMO / Thermo Fisher Scientific Inc. | 0.01 | 3.75 | 1.2951 | 1.2951 | |||||

| CP / Canadian Pacific Kansas City Limited | 0.05 | 13.37 | 3.74 | 28.09 | 1.2883 | 0.1923 | |||

| DE / Deere & Company | 0.01 | 3.71 | 3.46 | 12.35 | 1.1924 | 0.0358 | |||

| WMT / Walmart Inc. | 0.03 | -10.95 | 3.29 | -0.81 | 1.1344 | -0.1120 | |||

| XLK / The Select Sector SPDR Trust - The Technology Select Sector SPDR Fund | 0.01 | -9.40 | 3.11 | 11.11 | 1.0729 | 0.0206 | |||

| CRWD / CrowdStrike Holdings, Inc. | 0.00 | -9.51 | 2.54 | 30.73 | 0.8773 | 0.1459 | |||

| UBER / Uber Technologies, Inc. | 0.03 | 1.50 | 2.52 | 30.01 | 0.8681 | 0.1402 | |||

| NFLX / Netflix, Inc. | 0.00 | -6.49 | 2.47 | 34.28 | 0.8511 | 0.1604 | |||

| META / Meta Platforms, Inc. | 0.00 | 26.68 | 2.47 | 62.20 | 0.8509 | 0.2793 | |||

| XLC / The Select Sector SPDR Trust - The Communication Services Select Sector SPDR Fund | 0.02 | 63.48 | 2.15 | 84.10 | 0.7428 | 0.3027 | |||

| HD / The Home Depot, Inc. | 0.01 | -28.22 | 2.03 | -28.20 | 0.6998 | -0.3622 | |||

| LLY / Eli Lilly and Company | 0.00 | -1.01 | 1.91 | -6.56 | 0.6583 | -0.1095 | |||

| GVIP / Goldman Sachs ETF Trust - Goldman Sachs Hedge Industry VIP ETF | 0.01 | 27.06 | 1.84 | 49.19 | 0.6329 | 0.1705 | |||

| URI / United Rentals, Inc. | 0.00 | 0.00 | 1.68 | 20.20 | 0.5788 | 0.0541 | |||

| QXO / QXO, Inc. | 0.08 | 1.63 | 0.5616 | 0.5616 | |||||

| SPY / SPDR S&P 500 ETF | 0.00 | 1.77 | 1.60 | 12.46 | 0.5508 | 0.0168 | |||

| AMD / Advanced Micro Devices, Inc. | 0.01 | 0.00 | 1.59 | 38.11 | 0.5488 | 0.1158 | |||

| BKNG / Booking Holdings Inc. | 0.00 | -5.34 | 1.54 | 18.93 | 0.5310 | 0.0445 | |||

| ABT / Abbott Laboratories | 0.01 | 0.00 | 1.47 | 2.52 | 0.5063 | -0.0315 | |||

| EMR / Emerson Electric Co. | 0.01 | 0.00 | 1.45 | 21.58 | 0.4998 | 0.0522 | |||

| NOW / ServiceNow, Inc. | 0.00 | 0.00 | 1.39 | 29.22 | 0.4804 | 0.0750 | |||

| MLM / Martin Marietta Materials, Inc. | 0.00 | -0.21 | 1.31 | 14.56 | 0.4508 | 0.0223 | |||

| KO / The Coca-Cola Company | 0.02 | -1.49 | 1.29 | -2.65 | 0.4441 | -0.0529 | |||

| MAR / Marriott International, Inc. | 0.00 | 0.00 | 1.21 | 14.61 | 0.4169 | 0.0208 | |||

| VHT / Vanguard World Fund - Vanguard Health Care ETF | 0.00 | -5.30 | 1.19 | -11.21 | 0.4099 | -0.0930 | |||

| ET / Energy Transfer LP - Limited Partnership | 0.06 | 0.00 | 1.17 | -2.49 | 0.4050 | -0.0476 | |||

| GTLS / Chart Industries, Inc. | 0.01 | 0.00 | 1.11 | 14.09 | 0.3827 | 0.0170 | |||

| KKR / KKR & Co. Inc. | 0.01 | 0.00 | 1.04 | 15.14 | 0.3594 | 0.0190 | |||

| FDX / FedEx Corporation | 0.00 | 0.00 | 1.02 | -6.78 | 0.3512 | -0.0593 | |||

| DIS / The Walt Disney Company | 0.01 | -13.43 | 1.00 | 8.84 | 0.3439 | -0.0007 | |||

| ADP / Automatic Data Processing, Inc. | 0.00 | 0.00 | 0.94 | 0.97 | 0.3244 | -0.0258 | |||

| QQQ / Invesco QQQ Trust, Series 1 | 0.00 | 1.76 | 0.92 | 19.69 | 0.3188 | 0.0286 | |||

| CM / Canadian Imperial Bank of Commerce | 0.01 | 0.00 | 0.89 | 25.85 | 0.3073 | 0.0411 | |||

| SMH / VanEck ETF Trust - VanEck Semiconductor ETF | 0.00 | -3.20 | 0.86 | 27.64 | 0.2964 | 0.0434 | |||

| NVT / nVent Electric plc | 0.01 | -11.39 | 0.86 | 23.91 | 0.2949 | 0.0354 | |||

| EWZ / iShares, Inc. - iShares MSCI Brazil ETF | 0.03 | 0.85 | 0.2939 | 0.2939 | |||||

| XLI / The Select Sector SPDR Trust - The Industrial Select Sector SPDR Fund | 0.01 | -5.07 | 0.84 | 6.84 | 0.2912 | -0.0058 | |||

| AVGO / Broadcom Inc. | 0.00 | -0.65 | 0.84 | 63.42 | 0.2901 | 0.0969 | |||

| ZS / Zscaler, Inc. | 0.00 | 0.50 | 0.76 | 59.00 | 0.2624 | 0.0826 | |||

| IAI / iShares Trust - iShares U.S. Broker-Dealers & Securities Exchanges ETF | 0.00 | -0.98 | 0.75 | 19.40 | 0.2593 | 0.0229 | |||

| DHR / Danaher Corporation | 0.00 | -26.96 | 0.72 | -29.61 | 0.2476 | -0.1358 | |||

| BITB / Bitwise Bitcoin ETF Trust | 0.01 | -3.15 | 0.70 | 26.32 | 0.2403 | 0.0332 | |||

| DXCM / DexCom, Inc. | 0.01 | -16.18 | 0.70 | 7.08 | 0.2402 | -0.0041 | |||

| NCDL / Nuveen Churchill Direct Lending Corp. | 0.04 | 0.00 | 0.70 | -4.66 | 0.2398 | -0.0343 | |||

| MU / Micron Technology, Inc. | 0.01 | 0.69 | 0.2379 | 0.2379 | |||||

| XOM / Exxon Mobil Corporation | 0.01 | 0.00 | 0.69 | -9.34 | 0.2377 | -0.0481 | |||

| GDX / VanEck ETF Trust - VanEck Gold Miners ETF | 0.01 | 24.94 | 0.68 | 41.42 | 0.2334 | 0.0536 | |||

| RSP / Invesco Exchange-Traded Fund Trust - Invesco S&P 500 Equal Weight ETF | 0.00 | 0.05 | 0.67 | 4.88 | 0.2300 | -0.0088 | |||

| PEP / PepsiCo, Inc. | 0.00 | -11.88 | 0.64 | -22.44 | 0.2196 | -0.0886 | |||

| DUK / Duke Energy Corporation | 0.01 | 0.00 | 0.59 | -3.26 | 0.2051 | -0.0259 | |||

| BA / The Boeing Company | 0.00 | 0.00 | 0.59 | 22.92 | 0.2038 | 0.0230 | |||

| CVX / Chevron Corporation | 0.00 | -20.65 | 0.51 | -32.09 | 0.1760 | -0.1064 | |||

| ABNB / Airbnb, Inc. | 0.00 | 0.49 | 0.1694 | 0.1694 | |||||

| XLE / The Select Sector SPDR Trust - The Energy Select Sector SPDR Fund | 0.01 | -4.10 | 0.49 | -12.90 | 0.1677 | -0.0423 | |||

| SNAP / Snap Inc. | 0.05 | 119.11 | 0.46 | 119.05 | 0.1587 | 0.0796 | |||

| VOO / Vanguard Index Funds - Vanguard S&P 500 ETF | 0.00 | -48.21 | 0.45 | -42.71 | 0.1559 | -0.1409 | |||

| CNR / Core Natural Resources, Inc. | 0.01 | 0.45 | 0.1548 | 0.1548 | |||||

| PG / The Procter & Gamble Company | 0.00 | 0.00 | 0.41 | -6.45 | 0.1401 | -0.0232 | |||

| REGN / Regeneron Pharmaceuticals, Inc. | 0.00 | 0.40 | 0.1375 | 0.1375 | |||||

| WTM / White Mountains Insurance Group, Ltd. | 0.00 | 0.00 | 0.37 | -6.82 | 0.1276 | -0.0215 | |||

| IBM / International Business Machines Corporation | 0.00 | -0.08 | 0.35 | 18.71 | 0.1205 | 0.0096 | |||

| HACK / Amplify ETF Trust - Amplify Cybersecurity ETF | 0.00 | 0.00 | 0.33 | 20.59 | 0.1132 | 0.0106 | |||

| PPG / PPG Industries, Inc. | 0.00 | -2.43 | 0.32 | 1.59 | 0.1104 | -0.0081 | |||

| PH / Parker-Hannifin Corporation | 0.00 | 0.00 | 0.30 | 15.33 | 0.1038 | 0.0054 | |||

| EPD / Enterprise Products Partners L.P. - Limited Partnership | 0.01 | 0.00 | 0.29 | -9.32 | 0.1009 | -0.0202 | |||

| AZTA / Azenta, Inc. | 0.01 | -19.12 | 0.24 | -28.19 | 0.0835 | -0.0431 | |||

| EMXC / iShares, Inc. - iShares MSCI Emerging Markets ex China ETF | 0.00 | 0.00 | 0.24 | 14.35 | 0.0827 | 0.0041 | |||

| TSLA / Tesla, Inc. | 0.00 | -69.58 | 0.24 | -62.71 | 0.0825 | -0.1586 | |||

| TJX / The TJX Companies, Inc. | 0.00 | 0.00 | 0.24 | 1.28 | 0.0823 | -0.0062 | |||

| NVDA / NVIDIA Corporation | Call | 0.00 | 0.24 | 0.0818 | 0.0818 | ||||

| CSCO / Cisco Systems, Inc. | 0.00 | 0.22 | 0.0769 | 0.0769 | |||||

| ORCL / Oracle Corporation | 0.00 | 0.22 | 0.0766 | 0.0766 | |||||

| JPIE / J.P. Morgan Exchange-Traded Fund Trust - JPMorgan Income ETF | 0.00 | 0.22 | 0.0759 | 0.0759 | |||||

| NSC / Norfolk Southern Corporation | 0.00 | 0.00 | 0.22 | 7.96 | 0.0750 | -0.0006 | |||

| GLD / SPDR Gold Trust | 0.00 | 0.21 | 0.0736 | 0.0736 | |||||

| MET / MetLife, Inc. | 0.00 | 0.21 | 0.0721 | 0.0721 | |||||

| DTM / DT Midstream, Inc. | 0.00 | -34.47 | 0.21 | -25.45 | 0.0721 | -0.0331 | |||

| AMAT / Applied Materials, Inc. | 0.00 | 0.21 | 0.0707 | 0.0707 | |||||

| GOOGL / Alphabet Inc. | Call | 0.00 | 0.05 | 0.0182 | 0.0182 | ||||

| STEW / SRH Total Return Fund, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BXSL / Blackstone Secured Lending Fund | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| RIO / Rio Tinto Group - Depositary Receipt (Common Stock) | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| VBR / Vanguard Index Funds - Vanguard Small-Cap Value ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| IBKR / Interactive Brokers Group, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| ABBV / AbbVie Inc. | 0.00 | -100.00 | 0.00 | 0.0000 |