Mga Batayang Estadistika

| Nilai Portofolio | $ 557,803,404 |

| Posisi Saat Ini | 52 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

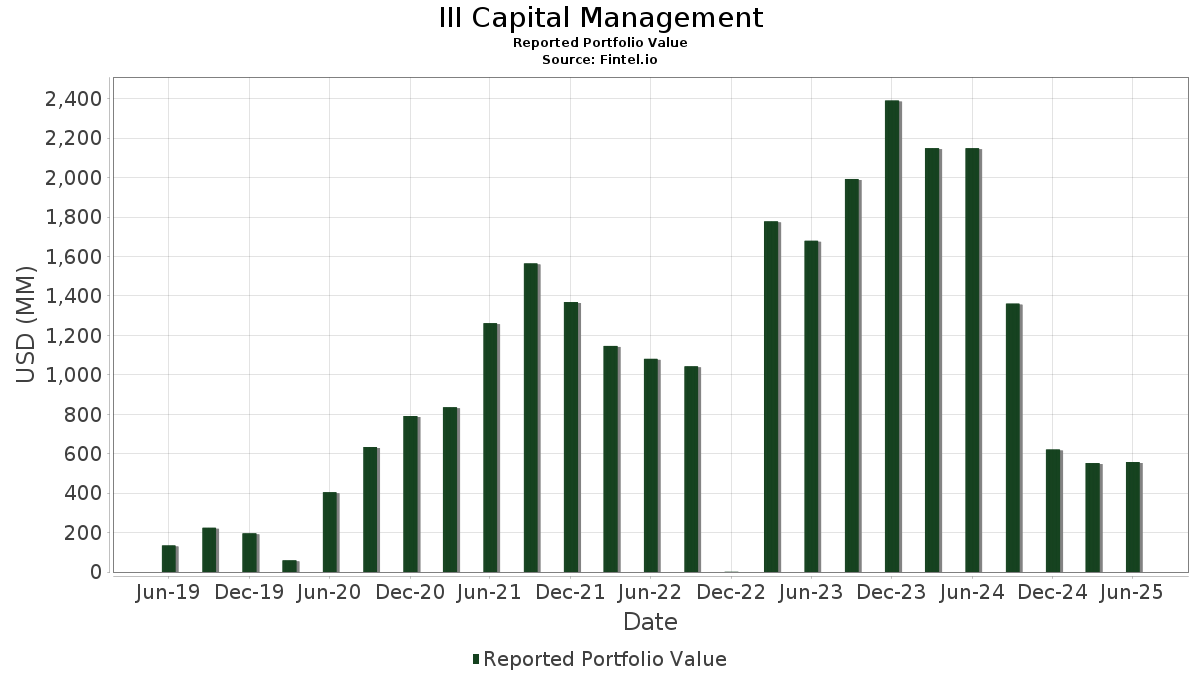

III Capital Management telah mengungkapkan total kepemilikan 52 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 557,803,404 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama III Capital Management adalah SPDR S&P 500 ETF (US:SPY) , Vanguard Scottsdale Funds - Vanguard Short-Term Corporate Bond ETF (US:VCSH) , Innoviva Inc Bond (US:US45781MAB72) , iShares Trust - iShares iBoxx $ High Yield Corporate Bond ETF (US:HYG) , and Invesco Exchange-Traded Fund Trust - Invesco S&P 500 Equal Weight ETF (US:RSP) . Posisi baru III Capital Management meliputi: Vanguard Scottsdale Funds - Vanguard Short-Term Corporate Bond ETF (US:VCSH) , Innoviva Inc Bond (US:US45781MAB72) , Invesco Exchange-Traded Fund Trust - Invesco S&P 500 Equal Weight ETF (US:RSP) , Ralph Lauren Corporation (US:RL) , and Mohawk Industries, Inc. (US:MHK) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.33 | 203.40 | 36.4638 | 36.4638 | |

| 2.16 | 171.72 | 30.7850 | 30.7850 | |

| 0.05 | 9.09 | 1.6291 | 1.6291 | |

| 0.04 | 3.96 | 0.7102 | 0.5064 | |

| 0.06 | 5.10 | 0.9139 | 0.4914 | |

| 0.03 | 4.82 | 0.8637 | 0.4756 | |

| 0.01 | 2.12 | 0.3807 | 0.3807 | |

| 0.04 | 1.95 | 0.3491 | 0.3491 | |

| 0.06 | 3.99 | 0.7153 | 0.3358 | |

| 0.01 | 1.65 | 0.2950 | 0.2950 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.00 | -21.3535 | ||

| 0.25 | 20.08 | 3.6002 | -15.3947 | |

| 26.23 | 4.7030 | -1.3041 | ||

| 0.08 | 1.12 | 0.1999 | -0.6834 | |

| 1.04 | 2.19 | 0.3922 | -0.6751 | |

| 0.08 | 0.47 | 0.0835 | -0.6536 | |

| 0.01 | 1.78 | 0.3182 | -0.3001 | |

| 0.01 | 3.47 | 0.6230 | -0.2777 | |

| 1.44 | 0.2579 | -0.1744 | ||

| 0.11 | 2.69 | 0.4820 | -0.1690 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-14 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| SPY / SPDR S&P 500 ETF | 0.33 | 203.40 | 36.4638 | 36.4638 | |||||

| VCSH / Vanguard Scottsdale Funds - Vanguard Short-Term Corporate Bond ETF | 2.16 | 171.72 | 30.7850 | 30.7850 | |||||

| US45781MAB72 / Innoviva Inc Bond | 26.23 | -20.94 | 4.7030 | -1.3041 | |||||

| HYG / iShares Trust - iShares iBoxx $ High Yield Corporate Bond ETF | 0.25 | -81.28 | 20.08 | -80.86 | 3.6002 | -15.3947 | |||

| SOUTHERN CO / NOTE 4.500% 6/1 (842587DZ7) | 18.12 | 0.0000 | |||||||

| RSP / Invesco Exchange-Traded Fund Trust - Invesco S&P 500 Equal Weight ETF | 0.05 | 9.09 | 1.6291 | 1.6291 | |||||

| WEC ENERGY GROUP INC / NOTE 4.375% 6/0 (92939UAR7) | 5.77 | 0.0000 | |||||||

| WDC / Western Digital Corporation | 0.08 | -27.15 | 5.30 | 15.30 | 0.9510 | 0.1181 | |||

| HRI / Herc Holdings Inc. | 0.04 | 8.40 | 5.26 | 6.32 | 0.9436 | 0.0473 | |||

| CRH / CRH plc | 0.06 | 109.29 | 5.10 | 118.42 | 0.9139 | 0.4914 | |||

| FUN / Six Flags Entertainment Corporation | 0.16 | 32.91 | 4.83 | 13.37 | 0.8666 | 0.0948 | |||

| H / Hyatt Hotels Corporation | 0.03 | 97.14 | 4.82 | 124.78 | 0.8637 | 0.4756 | |||

| OUT / OUTFRONT Media Inc. | 0.29 | 28.88 | 4.73 | 30.31 | 0.8479 | 0.1909 | |||

| SEAGATE HDD CAYMAN / NOTE 3.500% 6/0 (81180WBL4) | 4.59 | 0.0000 | |||||||

| META / Meta Platforms, Inc. | 0.01 | -14.29 | 4.43 | 9.77 | 0.7939 | 0.0635 | |||

| BWA / BorgWarner Inc. | 0.13 | -5.71 | 4.42 | 10.17 | 0.7923 | 0.0661 | |||

| DRVN / Driven Brands Holdings Inc. | 0.25 | 0.00 | 4.39 | 2.45 | 0.7870 | 0.0113 | |||

| ACI / Albertsons Companies, Inc. | 0.20 | 10.27 | 4.39 | 7.87 | 0.7867 | 0.0502 | |||

| URBN / Urban Outfitters, Inc. | 0.06 | 37.50 | 3.99 | 90.31 | 0.7153 | 0.3358 | |||

| DLTR / Dollar Tree, Inc. | 0.04 | 166.67 | 3.96 | 251.78 | 0.7102 | 0.5064 | |||

| CHTR / Charter Communications, Inc. | 0.01 | -37.04 | 3.47 | -30.17 | 0.6230 | -0.2777 | |||

| CZR / Caesars Entertainment, Inc. | 0.10 | 25.03 | 2.84 | 42.01 | 0.5085 | 0.1468 | |||

| RTO / Rentokil Initial plc - Depositary Receipt (Common Stock) | 0.11 | -28.66 | 2.69 | -25.23 | 0.4820 | -0.1690 | |||

| UBER / Uber Technologies, Inc. | 0.03 | -14.48 | 2.39 | 9.52 | 0.4291 | 0.0334 | |||

| WYNN / Wynn Resorts, Limited | 0.03 | -16.67 | 2.34 | -6.55 | 0.4198 | -0.0337 | |||

| LCID / Lucid Group, Inc. | Put | 1.04 | -57.44 | 2.19 | -62.90 | 0.3922 | -0.6751 | ||

| WSM / Williams-Sonoma, Inc. | 0.01 | 2.12 | 0.3807 | 0.3807 | |||||

| KHC / The Kraft Heinz Company | 0.08 | 141.38 | 1.98 | 104.86 | 0.3556 | 0.1803 | |||

| VZ / Verizon Communications Inc. | 0.04 | 1.95 | 0.3491 | 0.3491 | |||||

| TPR / Tapestry, Inc. | 0.02 | -22.22 | 1.84 | -3.00 | 0.3306 | -0.0136 | |||

| CAR / Avis Budget Group, Inc. | 0.01 | -76.67 | 1.78 | -48.02 | 0.3182 | -0.3001 | |||

| NCLH / Norwegian Cruise Line Holdings Ltd. | 0.09 | 87.72 | 1.74 | 100.81 | 0.3112 | 0.1547 | |||

| RL / Ralph Lauren Corporation | 0.01 | 1.65 | 0.2950 | 0.2950 | |||||

| MHK / Mohawk Industries, Inc. | 0.01 | 1.57 | 0.2819 | 0.2819 | |||||

| XLP / The Select Sector SPDR Trust - The Consumer Staples Select Sector SPDR Fund | 0.02 | 0.00 | 1.56 | -0.89 | 0.2802 | -0.0052 | |||

| NXST / Nexstar Media Group, Inc. | 0.01 | -10.00 | 1.56 | -13.17 | 0.2790 | -0.0454 | |||

| US08862EAB56 / BEYOND MEAT INC CONV 0% 03/15/2027 | 1.44 | -39.76 | 0.2579 | -0.1744 | |||||

| BYD / Boyd Gaming Corporation | 0.01 | 1.17 | 0.2104 | 0.2104 | |||||

| PCG / PG&E Corporation | Put | 0.08 | -71.83 | 1.12 | -77.15 | 0.1999 | -0.6834 | ||

| T / AT&T Inc. | 0.03 | 0.87 | 0.1556 | 0.1556 | |||||

| EXPE / Expedia Group, Inc. | 0.01 | -16.67 | 0.84 | -16.37 | 0.1512 | -0.0314 | |||

| APP / AppLovin Corporation | 0.00 | 0.70 | 0.1255 | 0.1255 | |||||

| CABO / Cable One, Inc. | 0.00 | 0.54 | 0.0974 | 0.0974 | |||||

| GDEN / Golden Entertainment, Inc. | 0.02 | 0.00 | 0.50 | 11.58 | 0.0898 | 0.0085 | |||

| FLYY / Spirit Aviation Holdings, Inc. | 0.10 | 0.49 | 0.0874 | 0.0874 | |||||

| VSTS / Vestis Corporation | 0.08 | -80.24 | 0.47 | -88.58 | 0.0835 | -0.6536 | |||

| XLF / The Select Sector SPDR Trust - The Financial Select Sector SPDR Fund | 0.01 | 0.42 | 0.0751 | 0.0751 | |||||

| XLU / The Select Sector SPDR Trust - The Utilities Select Sector SPDR Fund | 0.00 | 0.33 | 0.0586 | 0.0586 | |||||

| MSTR / Strategy Inc | 0.00 | 0.24 | 0.0428 | 0.0428 | |||||

| LCID / Lucid Group, Inc. | 0.09 | -18.63 | 0.20 | -29.03 | 0.0356 | -0.0151 | |||

| BYND / Beyond Meat, Inc. | Put | 0.03 | -9.97 | 0.10 | 4.00 | 0.0186 | 0.0004 | ||

| BBAI.WS / BigBear.ai Holdings, Inc. - Equity Warrant | 0.04 | -3.06 | 0.10 | 172.22 | 0.0176 | 0.0111 | |||

| BKNG / Booking Holdings Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| CCOI / Cogent Communications Holdings, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| BKLN / Invesco Exchange-Traded Fund Trust II - Invesco Senior Loan ETF | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| LSEA / Landsea Homes Corporation | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| LZ / LegalZoom.com, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| WBD / Warner Bros. Discovery, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| HYG / iShares Trust - iShares iBoxx $ High Yield Corporate Bond ETF | Call | 0.00 | -100.00 | 0.00 | -100.00 | -21.3535 |