Mga Batayang Estadistika

| Nilai Portofolio | $ 374,226,424 |

| Posisi Saat Ini | 40 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

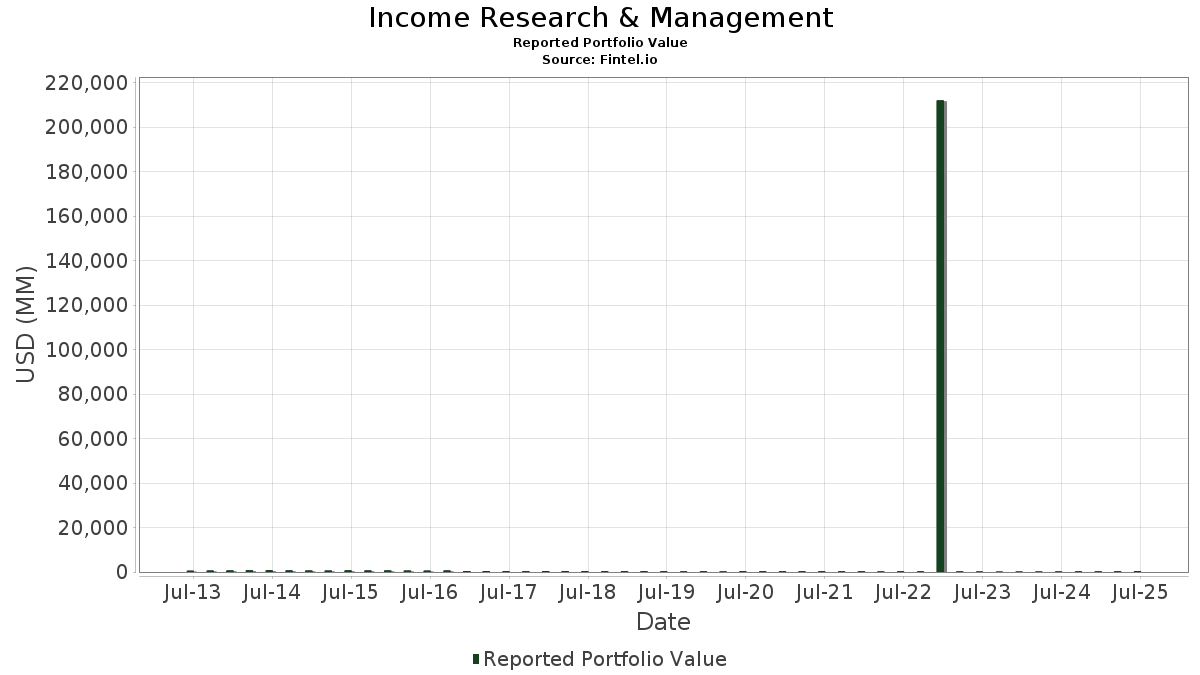

Income Research & Management telah mengungkapkan total kepemilikan 40 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 374,226,424 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Income Research & Management adalah Vanguard Bond Index Funds - Vanguard Long-Term Bond ETF (US:BLV) , Vanguard Scottsdale Funds - Vanguard Long-Term Treasury ETF (US:VGLT) , Vanguard World Fund - Vanguard Extended Duration Treasury ETF (US:EDV) , CONVERTIBLE ZERO (US:US30212PBE43) , and Euronet Worldwide Inc (US:US298736AL30) . Posisi baru Income Research & Management meliputi: Vanguard Bond Index Funds - Vanguard Long-Term Bond ETF (US:BLV) , Vanguard Scottsdale Funds - Vanguard Long-Term Treasury ETF (US:VGLT) , Vanguard World Fund - Vanguard Extended Duration Treasury ETF (US:EDV) , CONV. NOTE (US:US852234AK99) , and CONV. NOTE (US:US12685JAG04) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.72 | 50.14 | 13.3978 | 13.3978 | |

| 0.71 | 39.62 | 10.5868 | 10.5868 | |

| 0.40 | 27.18 | 7.2630 | 7.2630 | |

| 7.47 | 6.67 | 1.7815 | 1.7815 | |

| 0.00 | 0.43 | 0.1151 | 0.1151 | |

| 0.00 | 0.42 | 0.1122 | 0.1122 | |

| 0.04 | 0.03 | 0.0071 | 0.0071 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 12.11 | 10.35 | 2.7657 | -2.3683 | |

| 14.04 | 13.64 | 3.6459 | -2.1340 | |

| 9.30 | 9.01 | 2.4076 | -1.3648 | |

| 9.01 | 8.80 | 2.3517 | -1.3646 | |

| 8.95 | 8.85 | 2.3637 | -1.2841 | |

| 9.69 | 8.31 | 2.2195 | -1.2293 | |

| 0.10 | 4.92 | 1.3153 | -0.7989 | |

| 0.10 | 4.95 | 1.3234 | -0.7971 | |

| 0.10 | 5.11 | 1.3641 | -0.7893 | |

| 0.05 | 2.06 | 0.5502 | -0.3282 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-17 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| BLV / Vanguard Bond Index Funds - Vanguard Long-Term Bond ETF | 0.72 | 50.14 | 13.3978 | 13.3978 | |||||

| VGLT / Vanguard Scottsdale Funds - Vanguard Long-Term Treasury ETF | 0.71 | 39.62 | 10.5868 | 10.5868 | |||||

| EDV / Vanguard World Fund - Vanguard Extended Duration Treasury ETF | 0.40 | 27.18 | 7.2630 | 7.2630 | |||||

| US30212PBE43 / CONVERTIBLE ZERO | 14.04 | 1.87 | 13.64 | 0.52 | 3.6459 | -2.1340 | |||

| PPL CAP FDG INC / NOTE 2.875% 3/1 (69352PAS2) | 12.15 | 13.12 | 0.0000 | ||||||

| NEW MTN FIN CORP / NOTE 7.500%10/1 (647551AE0) | 12.24 | 12.27 | 0.0000 | ||||||

| VENTAS RLTY LTD PARTNERSHIP / NOTE 3.750% 6/0 (92277GAZ0) | 10.15 | 12.14 | 0.0000 | ||||||

| CMS ENERGY CORP / NOTE 3.375% 5/0 (125896BX7) | 11.37 | 12.09 | 0.0000 | ||||||

| DUKE ENERGY CORP NEW / NOTE 4.125% 4/1 (26441CBY0) | 11.02 | 11.66 | 0.0000 | ||||||

| CENTERPOINT ENERGY INC / NOTE 4.250% 8/1 (15189TBD8) | 10.25 | 11.09 | 0.0000 | ||||||

| US298736AL30 / Euronet Worldwide Inc | 12.11 | 0.00 | 10.35 | -14.16 | 2.7657 | -2.3683 | |||

| AMERICAN WTR CAP CORP / NOTE 3.625% 6/1 (03040WBE4) | 10.27 | 10.31 | 0.0000 | ||||||

| CAPITAL SOUTHWEST CORP / NOTE 5.125%11/1 (140501AE7) | 9.24 | 9.09 | 0.0000 | ||||||

| US00971TAL52 / CONV. NOTE | 9.30 | 2.23 | 9.01 | 1.70 | 2.4076 | -1.3648 | |||

| US345370CZ16 / CONVERTIBLE ZERO | 8.95 | 2.32 | 8.85 | 3.26 | 2.3637 | -1.2841 | |||

| US09709UV704 / BofA Finance LLC | 9.01 | 2.60 | 8.80 | 0.84 | 2.3517 | -1.3646 | |||

| ON SEMICONDUCTOR CORP / NOTE 0.500% 3/0 (682189AU9) | 9.25 | 8.55 | 0.0000 | ||||||

| US29786AAN63 / CONV. NOTE | 9.69 | 1.54 | 8.31 | 2.57 | 2.2195 | -1.2293 | |||

| ENVISTA HOLDINGS CORPORATION / NOTE 1.750% 8/1 (29415FAD6) | 8.69 | 8.06 | 0.0000 | ||||||

| NEXTERA ENERGY CAP HLDGS INC / NOTE 3.000% 3/0 (65339KCY4) | 6.71 | 7.63 | 0.0000 | ||||||

| GLOBAL PMTS INC / NOTE 1.500% 3/0 (37940XAU6) | 8.26 | 7.37 | 0.0000 | ||||||

| MICROCHIP TECHNOLOGY INC. / NOTE 0.750% 6/0 (595017BG8) | 7.41 | 7.28 | 0.0000 | ||||||

| US852234AK99 / CONV. NOTE | 7.47 | 6.67 | 1.7815 | 1.7815 | |||||

| EVERGY INC / NOTE 4.500%12/1 (30034WAD8) | 5.13 | 6.00 | 0.0000 | ||||||

| DEXCOM INC / NOTE 0.375% 5/1 (252131AM9) | 6.23 | 5.84 | 0.0000 | ||||||

| ALLIANT ENERGY CORP / NOTE 3.875% 3/1 (018802AC2) | 5.51 | 5.66 | 0.0000 | ||||||

| UBER TECHNOLOGIES INC / NOTE 0.875%12/0 (90353TAM2) | 3.73 | 5.33 | 0.0000 | ||||||

| MERITAGE HOMES CORP / NOTE 1.750% 5/1 (59001ABF8) | 5.38 | 5.21 | 0.0000 | ||||||

| TAXX / Bondbloxx ETF Trust - BondBloxx IR+M Tax-Aware Short Duration ETF | 0.10 | 0.00 | 5.11 | 0.95 | 1.3641 | -0.7893 | |||

| TXXI / BondBloxx ETF Trust - BondBloxx IR+M Tax-Aware Intermediate Duration ETF | 0.10 | 0.00 | 4.95 | -0.54 | 1.3234 | -0.7971 | |||

| TAXM / BondBloxx ETF Trust - BondBloxx IR+M Tax-Aware ETF for Massachusetts Residents | 0.10 | 0.00 | 4.92 | -0.85 | 1.3153 | -0.7989 | |||

| WEC ENERGY GROUP INC / NOTE 4.375% 6/0 (92939UAR7) | 4.15 | 4.78 | 0.0000 | ||||||

| SOUTHERN CO / NOTE 4.500% 6/1 (842587DZ7) | 4.00 | 4.40 | 0.0000 | ||||||

| HAEMONETICS CORP MASS / NOTE 2.500% 6/0 (405024AD2) | 2.98 | 2.96 | 0.0000 | ||||||

| PINNACLE WEST CAP CORP / NOTE 4.750% 6/1 (723484AK7) | 2.61 | 2.83 | 0.0000 | ||||||

| AGGS / Harbor ETF Trust - Harbor Disciplined Bond ETF | 0.05 | 0.00 | 2.06 | -0.15 | 0.5502 | -0.3282 | |||

| BAC.PRL / Bank of America Corporation - Preferred Stock | 0.00 | 0.43 | 0.1151 | 0.1151 | |||||

| WFC.PRL / Wells Fargo & Company - Preferred Stock | 0.00 | 0.42 | 0.1122 | 0.1122 | |||||

| WEC ENERGY GROUP INC / NOTE 4.375% 6/0 (92939UAP1) | 0.09 | 0.10 | 0.0000 | ||||||

| US12685JAG04 / CONV. NOTE | 0.04 | 0.03 | 0.0071 | 0.0071 | |||||

| US844741BG22 / Southwest Airlines Co | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| US75606DAP69 / Realogy Group LLC/Realogy Co.-Issuer Corp. | 0.00 | -100.00 | 0.00 | 0.0000 |