Mga Batayang Estadistika

| Nilai Portofolio | $ 310,518,914 |

| Posisi Saat Ini | 144 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

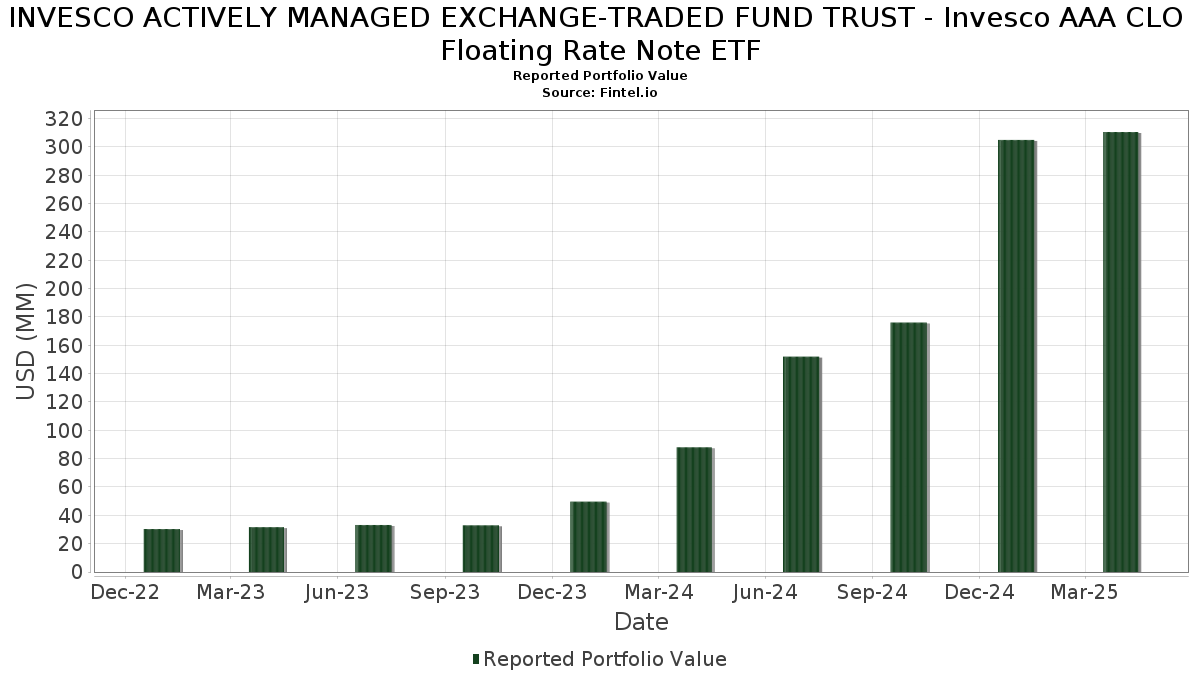

INVESCO ACTIVELY MANAGED EXCHANGE-TRADED FUND TRUST - Invesco AAA CLO Floating Rate Note ETF telah mengungkapkan total kepemilikan 144 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 310,518,914 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama INVESCO ACTIVELY MANAGED EXCHANGE-TRADED FUND TRUST - Invesco AAA CLO Floating Rate Note ETF adalah Invesco Premier U.S. Government Money Portfolio, Institutional Class (US:US00142W8432) , Antares CLO 2020-1 Ltd (KY:US03666LAL62) , Neuberger Berman Loan Advisers CLO 47 Ltd., Series 2022-47A, Class A (KY:US64135DAA37) , Neuberger Berman Loan Advisers Clo 40 Ltd (KY:US64134JAA16) , and Texas Debt Capital CLO 2023-I Ltd (KY:US88238CAA09) . Posisi baru INVESCO ACTIVELY MANAGED EXCHANGE-TRADED FUND TRUST - Invesco AAA CLO Floating Rate Note ETF meliputi: Invesco Premier U.S. Government Money Portfolio, Institutional Class (US:US00142W8432) , Antares CLO 2020-1 Ltd (KY:US03666LAL62) , Neuberger Berman Loan Advisers CLO 47 Ltd., Series 2022-47A, Class A (KY:US64135DAA37) , Neuberger Berman Loan Advisers Clo 40 Ltd (KY:US64134JAA16) , and Texas Debt Capital CLO 2023-I Ltd (KY:US88238CAA09) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 12.31 | 12.31 | 4.0449 | 4.0449 | |

| 4.99 | 1.6388 | 1.6388 | ||

| 4.99 | 1.6383 | 1.6383 | ||

| 3.99 | 1.3113 | 1.3113 | ||

| 3.17 | 1.0411 | 1.0411 | ||

| 2.53 | 0.8314 | 0.8314 | ||

| 2.50 | 0.8225 | 0.8225 | ||

| 2.50 | 0.8200 | 0.8200 | ||

| 2.32 | 0.7636 | 0.7636 | ||

| 2.00 | 0.6562 | 0.6562 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 9.71 | 3.1910 | -0.1382 | ||

| 6.39 | 2.0979 | -0.0956 | ||

| 3.75 | 1.2308 | -0.0951 | ||

| 6.31 | 2.0724 | -0.0924 | ||

| 6.00 | 1.9714 | -0.0904 | ||

| 6.00 | 1.9723 | -0.0838 | ||

| 4.99 | 1.6398 | -0.0749 | ||

| 4.58 | 1.5047 | -0.0748 | ||

| 5.35 | 1.7565 | -0.0742 | ||

| 4.80 | 1.5782 | -0.0710 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-06-30 untuk periode pelaporan 2025-04-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US00142W8432 / Invesco Premier U.S. Government Money Portfolio, Institutional Class | 12.31 | 12.31 | 4.0449 | 4.0449 | |||||

| Signal Peak CLO 11 Ltd., Series 2024-11A, Class A1 / ABS-CBDO (US82666XAA81) | 9.71 | -0.66 | 3.1910 | -0.1382 | |||||

| Park Blue CLO 2022-1 Ltd., Series 2022-1A, Class A1R / ABS-CBDO (US70016WAQ78) | 6.39 | -0.88 | 2.0979 | -0.0956 | |||||

| GoldenTree Loan Management US CLO 9, Ltd., Series 2021-9A, Class AR / ABS-CBDO (US38138JAN37) | 6.31 | -0.80 | 2.0724 | -0.0924 | |||||

| Cedar Funding IX CLO Ltd., Series 2018-9A, Class AR / ABS-CBDO (US15033EAN85) | 6.00 | -0.60 | 1.9723 | -0.0838 | |||||

| Elmwood CLO III Ltd., Series 2019-3A, Class A1RR / ABS-CBDO (US29002HAW97) | 6.00 | -0.91 | 1.9714 | -0.0904 | |||||

| Madison Park Funding XXXVII Ltd., Series 2019-37A, Class AR2 / ABS-CBDO (US55817EAW66) | 5.35 | -0.58 | 1.7565 | -0.0742 | |||||

| CIFC Funding 2023-II Ltd., Series 2023-2A, Class A / ABS-CBDO (US125488AA46) | 5.01 | -0.44 | 1.6461 | -0.0673 | |||||

| TICP CLO VII Ltd., Series 2017-7A, Class ASR2 / ABS-CBDO (US87248TAU97) | 5.00 | -0.14 | 1.6437 | -0.0623 | |||||

| Cedar Funding XIV CLO Ltd., Series 2021-14A, Class AR / ABS-CBDO (US15034AAL98) | 4.99 | -0.89 | 1.6398 | -0.0749 | |||||

| Palmer Square CLO 2023-1 Ltd., Series 2023-1A, Class AR / ABS-CBDO (US69702TAJ16) | 4.99 | 1.6388 | 1.6388 | ||||||

| Empower CLO 2025-1 Ltd., Series 2025-1A, Class A / ABS-CBDO (US29249DAA90) | 4.99 | 1.6383 | 1.6383 | ||||||

| Golub Capital Partners CLO 61(M), Series 2022-61A, Class A1A / ABS-CBDO (US381738AY94) | 4.97 | -0.62 | 1.6337 | -0.0698 | |||||

| Empower CLO 2024-1 Ltd., Series 2024-1A, Class A1 / ABS-CBDO (US29244RAA32) | 4.80 | -0.83 | 1.5782 | -0.0710 | |||||

| Regatta XVII Funding Ltd., Series 2020-1A, Class AR / ABS-CBDO (US75888BAQ77) | 4.58 | -1.27 | 1.5047 | -0.0748 | |||||

| AIMCO CLO Ltd., Series 2020-11A, Class A2R / ABS-CBDO (US00140NBG43) | 4.23 | -0.96 | 1.3891 | -0.0642 | |||||

| US03666LAL62 / Antares CLO 2020-1 Ltd | 4.00 | 0.00 | 1.3156 | -0.0481 | |||||

| AGL CLO 29 Ltd., Series 2024-29A, Class A1 / ABS-CBDO (US00119BAA17) | 4.00 | -0.82 | 1.3139 | -0.0589 | |||||

| US64135DAA37 / Neuberger Berman Loan Advisers CLO 47 Ltd., Series 2022-47A, Class A | 4.00 | -0.27 | 1.3135 | -0.0514 | |||||

| OCP CLO Ltd., Series 2019-17A, Class AR2 / ABS-CBDO (US67113LAW63) | 3.99 | 1.3113 | 1.3113 | ||||||

| Blueberry Park CLO Ltd., Series 2024-1A, Class A / ABS-CBDO (US09609QAA67) | 3.99 | -1.17 | 1.3090 | -0.0638 | |||||

| CIFC Funding 2017-I Ltd., Series 2017-1A, Class ARR / ABS-CBDO (US17181PAC32) | 3.91 | -0.71 | 1.2830 | -0.0564 | |||||

| US64134JAA16 / Neuberger Berman Loan Advisers Clo 40 Ltd | 3.75 | -3.80 | 1.2308 | -0.0951 | |||||

| Empower CLO 2022-1 Ltd., Series 2022-1A, Class A1R / ABS-CBDO (US29246AAL44) | 3.75 | 48.38 | 1.2305 | 0.3712 | |||||

| US88238CAA09 / Texas Debt Capital CLO 2023-I Ltd | 3.55 | -0.25 | 1.1669 | -0.0456 | |||||

| Flatiron CLO 25 Ltd., Series 2024-2A, Class A / ABS-CBDO (US33883XAA81) | 3.49 | -1.25 | 1.1448 | -0.0566 | |||||

| US67091YAY05 / OCP CLO 2015-9 Ltd | 3.47 | -1.03 | 1.1389 | -0.0539 | |||||

| OCP CLO 2024-31 Ltd., Series 2024-31A, Class A1 / ABS-CBDO (US67570AAA43) | 3.26 | -0.61 | 1.0693 | -0.0456 | |||||

| Symphony CLO XXV, Ltd., Series 2021-25A, Class B / ABS-CBDO (US87167WAE57) | 3.17 | 1.0411 | 1.0411 | ||||||

| Magnetite XVII Ltd., Series 2016-17A, Class AR2 / ABS-CBDO (US55954EAY59) | 3.10 | -0.58 | 1.0196 | -0.0434 | |||||

| Neuberger Berman Loan Advisers CLO 39 Ltd., Series 2020-39A, Class A1R / ABS-CBDO (US64134GAL32) | 3.00 | -1.06 | 0.9845 | -0.0469 | |||||

| Regatta XXII Funding Ltd., Series 2022-2A, Class AR / ABS-CBDO (US758968AN14) | 2.99 | 198.21 | 0.9826 | 0.6409 | |||||

| US87232AAN46 / TCI-Flatiron Clo 2018-1 Ltd | 2.62 | -0.04 | 0.8618 | -0.0318 | |||||

| US03766HAA86 / Apidos CLO XXXIX, Series 2022-39A, Class A1 | 2.59 | -0.54 | 0.8523 | -0.0356 | |||||

| US05684UAA34 / Bain Capital Credit CLO 2022-1 Ltd | 2.59 | -0.65 | 0.8515 | -0.0368 | |||||

| Symphony CLO XX Ltd., Series 2018-20A, Class AR2 / ABS-CBDO (US87166VAW81) | 2.53 | 0.8314 | 0.8314 | ||||||

| US55952AAA79 / ASSET BACKED SECURITY | 2.50 | 0.8225 | 0.8225 | ||||||

| Neuberger Berman Loan Advisers Nbla Clo 52, Ltd., Series 2022-52A, Class AR / ABS-CBDO (US64135FAN06) | 2.50 | -0.83 | 0.8217 | -0.0370 | |||||

| US55954PAN42 / MAGNETITE XXI LTD 2019-21A A 3ML+102 04/20/2034 144A | 2.50 | -0.20 | 0.8214 | -0.0316 | |||||

| Magnetite XL Ltd., Series 2024-40A, Class A1 / ABS-CBDO (US55955RAA77) | 2.50 | -1.11 | 0.8208 | -0.0394 | |||||

| US64132DAL29 / Neuberger Berman Loan Advisers CLO 32 Ltd., Series 2019-32A, Class BR | 2.50 | -0.28 | 0.8203 | -0.0321 | |||||

| Carlyle US CLO 2022-3 Ltd., Series 2022-3A, Class AR / ABS-CBDO (US143111AL66) | 2.50 | 0.8200 | 0.8200 | ||||||

| US15032TBE55 / Cedar Funding II CLO Ltd | 2.49 | -0.48 | 0.8195 | -0.0339 | |||||

| Benefit Street Partners CLO XXIX, Ltd., Series 2022-29A, Class AR / ABS-CBDO (US08186EAL20) | 2.49 | 99.28 | 0.8192 | 0.3932 | |||||

| Peebles Park Clo, Ltd., Series 2024-1A, Class A / ABS-CBDO (US70537AAA07) | 2.40 | -0.83 | 0.7887 | -0.0356 | |||||

| US381743AA12 / Golub Capital Partners CLO 54M L.P | 2.40 | -0.08 | 0.7886 | -0.0293 | |||||

| OHA Credit Funding 4 Ltd., Series 2019-4A, Class AR2 / ABS-CBDO (US67098DBC65) | 2.32 | 0.7636 | 0.7636 | ||||||

| RR 5 Ltd., Series 2018-5A, Class A1R / ABS-CBDO (US74979VAM54) | 2.21 | -0.59 | 0.7248 | -0.0306 | |||||

| AGL Core CLO 31 Ltd., Series 2024-31A, Class A / ABS-CBDO (US00852MAA80) | 2.20 | -0.77 | 0.7226 | -0.0319 | |||||

| US27830BBN38 / EATON VANCE CLO 2013-1 LTD / EATON VANCE CLO 2013-1 LLC 3ML+125 01/15/2034 144A | 2.20 | -0.32 | 0.7223 | -0.0284 | |||||

| Benefit Street Partners Clo XXVII, Ltd., Series 2022-27A, Class AR / ABS-CBDO (US08179PAQ54) | 2.19 | -1.44 | 0.7200 | -0.0370 | |||||

| US29004JAL70 / ASSET BACKED SECURITY | 2.10 | -0.19 | 0.6910 | -0.0264 | |||||

| US74980XAC02 / RR15 Ltd | 2.07 | -1.90 | 0.6783 | -0.0385 | |||||

| US55817HAN98 / Madison Park Funding LXII Ltd | 2.05 | -0.48 | 0.6744 | -0.0280 | |||||

| US74923EAC21 / Rad CLO 5 Ltd., Series 2019-5A, Class BR | 2.00 | -0.30 | 0.6575 | -0.0258 | |||||

| Regatta X Funding Ltd., Series 2017-3A, Class AR / ABS-CBDO (US75884BAL27) | 2.00 | -0.65 | 0.6570 | -0.0282 | |||||

| OHA Credit Funding 17, Ltd., Series 2024-17A, Class A / ABS-CBDO (US67109SAA50) | 2.00 | -0.89 | 0.6566 | -0.0303 | |||||

| US14310MAY30 / Carlyle Global Market Strategies CLO 2014-1 Ltd | 2.00 | -0.30 | 0.6562 | -0.0258 | |||||

| CARLYLE US CLO 2021-6 Ltd., Series 2021-6A, Class A1R / ABS-CBDO (US143133AN68) | 2.00 | 0.6562 | 0.6562 | ||||||

| Benefit Street Partners Clo XXXVII Ltd., Series 2024-37A, Class A / ABS-CBDO (US08182TAA79) | 2.00 | 0.6559 | 0.6559 | ||||||

| Signal Peak CLO 14 Ltd., Series 2024-14A, Class A / ABS-CBDO (US82667FAA66) | 2.00 | 0.6556 | 0.6556 | ||||||

| US03767CAB63 / APID_17-28A | 2.00 | -0.40 | 0.6556 | -0.0262 | |||||

| Goldentree Loan Management US CLO 12, Ltd., Series 2022-12A, Class AJR / ABS-CBDO (US38138FAS02) | 1.99 | -0.65 | 0.6553 | -0.0279 | |||||

| Flatiron CLO 21 Ltd., Series 2021-1A, Class A1R / ABS-CBDO (US33883PAQ00) | 1.95 | -0.82 | 0.6394 | -0.0287 | |||||

| US06759JAQ13 / Barings CLO Ltd 2019-I | 1.85 | -0.38 | 0.6079 | -0.0245 | |||||

| Elmwood CLO VIII Ltd., Series 2021-1A, Class AR / ABS-CBDO (US29003EAS46) | 1.80 | -0.83 | 0.5913 | -0.0267 | |||||

| Palmer Square CLO 2015-1 Ltd., Series 2015-1A, Class A1A5 / ABS-CBDO (US69689ABU34) | 1.79 | -0.45 | 0.5871 | -0.0243 | |||||

| Galaxy XXII CLO Ltd., Series 2016-22A, Class ARR / ABS-CBDO (US36320TBD46) | 1.74 | 0.5725 | 0.5725 | ||||||

| Empower CLO 2025-1 Ltd., Series 2025-1A, Class B / ABS-CBDO (US29249DAC56) | 1.74 | 0.5717 | 0.5717 | ||||||

| US11124TAJ34 / BDRVR_20-1A | 1.67 | -0.36 | 0.5479 | -0.0218 | |||||

| US15675AAA79 / CERB 23-1 A CLO 144A FRN (TSFR3M+240) 03-22-35 | 1.55 | -0.32 | 0.5094 | -0.0200 | |||||

| Barings CLO Ltd. 2023-III, Series 2023-3A, Class A / ABS-CBDO (US067932AA18) | 1.50 | -0.53 | 0.4935 | -0.0208 | |||||

| US06762HAA59 / BABSN_23-1A | 1.50 | -0.27 | 0.4934 | -0.0193 | |||||

| RR 29 Ltd., Series 2024-29RA, Class A1R / ABS-CBDO (US74989VAA98) | 1.50 | -0.73 | 0.4929 | -0.0215 | |||||

| Barings CLO Ltd. 2022-III, Series 2022-3A, Class BR / ABS-CBDO (US06762VAJ52) | 1.50 | 0.4929 | 0.4929 | ||||||

| CIFC Funding 2020-III Ltd., Series 2020-3A, Class A2R / ABS-CBDO (US12560EAN67) | 1.50 | -0.27 | 0.4924 | -0.0190 | |||||

| OCP CLO Ltd., Series 2017-13A, Class AR2 / ABS-CBDO (US67097LAV80) | 1.50 | -0.86 | 0.4917 | -0.0223 | |||||

| Symphony CLO 40, Ltd., Series 2023-40A, Class AR / ABS-CBDO (US871989AP42) | 1.50 | -0.93 | 0.4916 | -0.0227 | |||||

| Ballyrock CLO 14 Ltd., Series 2020-14A, Class A1A / ABS-CBDO (US05874XAL38) | 1.49 | -0.99 | 0.4910 | -0.0228 | |||||

| ABPCI DIRECT LENDING FUND CLO V Ltd., Series 2019-5A, Class A1Z / ABS-CBDO (US000807BE65) | 1.49 | -0.67 | 0.4902 | -0.0212 | |||||

| US87165YAC75 / Symphony CLO XIX Ltd | 1.41 | -4.74 | 0.4619 | -0.0408 | |||||

| US38178GAA85 / Golub Capital Partners Clo 49M Ltd | 1.40 | -0.21 | 0.4596 | -0.0178 | |||||

| Antares CLO 2018-3 Ltd., Series 2018-3A, Class A2R / ABS-CBDO (US03665LAN38) | 1.40 | -0.64 | 0.4594 | -0.0197 | |||||

| Regatta XX Funding Ltd., Series 2021-2A, Class AR / ABS-CBDO (US75884YAK47) | 1.34 | 0.4413 | 0.4413 | ||||||

| ABPCI DIRECT LENDING FUND CLO V Ltd., Series 2019-5A, Class A1RR / ABS-CBDO (US000807AW72) | 1.31 | -0.53 | 0.4294 | -0.0180 | |||||

| US289907AN71 / ASSET BACKED SECURITY | 1.30 | -0.46 | 0.4280 | -0.0176 | |||||

| CARLYLE US CLO 2021-4 Ltd., Series 2021-4A, Class A1 / ABS-CBDO (US14316TAA43) | 1.30 | -0.23 | 0.4274 | -0.0165 | |||||

| CIFC Funding Ltd., Series 2014-5A, Class A1R3 / ABS-CBDO (US12550ABD72) | 1.30 | -0.69 | 0.4274 | -0.0187 | |||||

| CIFC Funding 2017-V Ltd., Series 2017-5A, Class AR / ABS-CBDO (US12551MAL37) | 1.30 | -0.76 | 0.4266 | -0.0188 | |||||

| Signal Peak CLO 9 Ltd., Series 2021-9A, Class A1R / ABS-CBDO (US82670QAN97) | 1.30 | -1.14 | 0.4263 | -0.0205 | |||||

| RR 38 Ltd., Series 2025-38A, Class A1A / ABS-CBDO (US74988FAA57) | 1.30 | 0.4257 | 0.4257 | ||||||

| Regatta 30 Funding Ltd., Series 2024-4A, Class A2 / ABS-CBDO (US75903UAC71) | 1.29 | 0.4252 | 0.4252 | ||||||

| Park Blue CLO 2022-II Ltd., Series 2022-2A, Class A1R / ABS-CBDO (US70018CAQ96) | 1.28 | -1.09 | 0.4194 | -0.0199 | |||||

| AGL Core CLO 4 Ltd., Series 2020-4A, Class AR2 / ABS-CBDO (US001199AQ17) | 1.25 | -0.64 | 0.4110 | -0.0178 | |||||

| US00120JAA16 / AGL CLO 13 Ltd | 1.25 | -0.24 | 0.4109 | -0.0161 | |||||

| US55955EAL20 / MAGNE 2020-27A AR 3ML+114 10/20/2034 144A | 1.25 | -0.32 | 0.4109 | -0.0161 | |||||

| Galaxy Xxiv Clo Ltd., Series 2017-24A, Class AR / ABS-CBDO (US36321BAG68) | 1.25 | -0.56 | 0.4108 | -0.0173 | |||||

| AIMCO CLO Ltd., Series 2021-16A, Class AR / ABS-CBDO (US00901FAJ57) | 1.25 | -0.71 | 0.4107 | -0.0179 | |||||

| US81880XAL64 / SHACK 2019-14A A1R | 1.25 | -0.32 | 0.4101 | -0.0162 | |||||

| Pikes Peak Clo 4, Series 2019-4A, Class ARR / ABS-CBDO (US72132WAN92) | 1.24 | -0.64 | 0.4087 | -0.0177 | |||||

| Cedar Funding XII CLO Ltd., Series 2020-12A, Class ARR / ABS-CBDO (US15033TBA25) | 1.24 | 0.4079 | 0.4079 | ||||||

| US03666BAA26 / Antares CLO 2021-1 Ltd | 1.20 | -0.17 | 0.3945 | -0.0150 | |||||

| US46604EAE23 / IVY HILL MIDDLE MARKET CREDIT FUND IX LTD | 1.20 | -0.42 | 0.3931 | -0.0157 | |||||

| US15032TBG04 / Cedar Funding II CLO Ltd | 1.13 | -1.56 | 0.3724 | -0.0197 | |||||

| US38179QAC15 / Golub Capital Partners CLO 68B Ltd | 1.10 | 0.3623 | 0.3623 | ||||||

| Elmwood CLO 26 Ltd., Series 2024-1A, Class B / ABS-CBDO (US29004CAE84) | 1.10 | -0.72 | 0.3622 | -0.0157 | |||||

| Golub Capital Partners Clo 71(M), Series 2024-71A, Class A / ABS-CBDO (US38179NAB01) | 1.00 | -0.60 | 0.3291 | -0.0137 | |||||

| Madison Park Funding XIX Ltd., Series 2015-19A, Class AR3 / ABS-CBDO (US55819QBJ58) | 1.00 | -0.60 | 0.3290 | -0.0139 | |||||

| BCRED BSL CLO 2021-1, Ltd., Series 2025-1A, Class B / ABS-CBDO (US05553MAC55) | 1.00 | 0.00 | 0.3289 | -0.0121 | |||||

| CBAMR 2019-9 Ltd., Series 2019-9A, Class AR / ABS-CBDO (US14987VAN91) | 1.00 | -0.69 | 0.3288 | -0.0145 | |||||

| OCP CLO 2020-20 Ltd., Series 2020-20A, Class A1R / ABS-CBDO (US670859AK32) | 1.00 | -0.70 | 0.3288 | -0.0141 | |||||

| CARLYLE US CLO 2021-4 Ltd., Series 2021-4A, Class B1 / ABS-CBDO (US14316TAE64) | 1.00 | -0.30 | 0.3287 | -0.0128 | |||||

| Elmwood CLO VI Ltd., Series 2020-3A, Class ARR / ABS-CBDO (US29001VAU35) | 1.00 | -0.89 | 0.3286 | -0.0151 | |||||

| Carlyle Global Market Strategies CLO Ltd., Series 2012-3A, Class A1B2 / ABS-CBDO (US14312EAL74) | 1.00 | -0.30 | 0.3283 | -0.0130 | |||||

| US14314LAE56 / CARLYLE GLOBAL MARKET STRATEGIES CLO 2014-2R LTD CGMS 2014-2RA A2 | 1.00 | -0.30 | 0.3280 | -0.0128 | |||||

| OCP CLO 2016-12, Ltd., Series 2016-12A, Class A1R3 / ABS-CBDO (US67092RAY45) | 1.00 | -0.99 | 0.3278 | -0.0153 | |||||

| AGL CLO 14 Ltd., Series 2021-14A, Class AR / ABS-CBDO (US00851WAL37) | 1.00 | 0.3272 | 0.3272 | ||||||

| Elmwood CLO X Ltd., Series 2021-3A, Class BR / ABS-CBDO (US29002VAN82) | 1.00 | -0.70 | 0.3272 | -0.0142 | |||||

| CARLYLE US CLO 2019-3 Ltd., Series 2019-3A, Class A2RR / ABS-CBDO (US14314HBA14) | 0.99 | -1.59 | 0.3265 | -0.0170 | |||||

| US55955EAN85 / Magnetite XXVII Ltd., Series 2020-27A, Class BR | 0.92 | -0.86 | 0.3036 | -0.0138 | |||||

| Cedar Funding XI Clo Ltd., Series 2019-11A, Class A1R2 / ABS-CBDO (US15033LAW28) | 0.92 | -7.00 | 0.3014 | -0.0343 | |||||

| US87165YAE32 / Symphony CLO XIX Ltd., Series 2018-19A, Class B | 0.90 | -0.33 | 0.2953 | -0.0115 | |||||

| RR 24 Ltd., Series 2022-24A, Class A1A2 / ABS-CBDO (US75000HBA14) | 0.90 | -1.10 | 0.2950 | -0.0142 | |||||

| US70470MAE57 / PEACE PARK CLO LTD | 0.80 | -0.25 | 0.2613 | -0.0102 | |||||

| Golub Capital Partners Static 2024-1 Ltd., Series 2024-1A, Class A1 / ABS-CBDO (US381929AA67) | 0.79 | -6.50 | 0.2601 | -0.0282 | |||||

| Symphony CLO XXII Ltd., Series 2020-22A, Class BR / ABS-CBDO (US87167GCM06) | 0.74 | -0.93 | 0.2442 | -0.0114 | |||||

| CIFC Funding Ltd., Series 2014-4RA, Class A1A2 / ABS-CBDO (US12552FBC68) | 0.73 | 0.2408 | 0.2408 | ||||||

| US61774JAE47 / MORGAN STANLEY WATON | 0.63 | -0.79 | 0.2058 | -0.0091 | |||||

| CIFC Funding Ltd., Series 2016-1A, Class AR3 / ABS-CBDO (US17180TBL52) | 0.57 | 0.1869 | 0.1869 | ||||||

| US15674VAA26 / Cerberus Loan Funding XLI LLC | 0.52 | -0.76 | 0.1710 | -0.0076 | |||||

| Elmwood CLO 29 Ltd., Series 2024-5A, Class AR1 / ABS-CBDO (US289913AC92) | 0.52 | -0.95 | 0.1709 | -0.0078 | |||||

| AGL Core CLO 27 Ltd., Series 2023-27A, Class A / ABS-CBDO (US00092DAA81) | 0.50 | -0.79 | 0.1645 | -0.0072 | |||||

| US12549BBA52 / CIFC Funding 2013-II Ltd | 0.50 | -0.20 | 0.1645 | -0.0062 | |||||

| Ivy Hill Middle Market Credit Fund VII Ltd. / ABS-CBDO (US46602ABE10) | 0.50 | 0.1634 | 0.1634 | ||||||

| US87168NAE40 / SYMP 2022-32A A1 TSFR3M+185 04/23/2035 144A | 0.50 | -1.20 | 0.1628 | -0.0077 | |||||

| US33829WAE93 / 522 Funding CLO 2019-5 Ltd | 0.49 | -1.60 | 0.1621 | -0.0085 | |||||

| Carlyle US CLO 2024-1 Ltd., Series 2024-1A, Class A / ABS-CBDO (US142923AA93) | 0.45 | -0.66 | 0.1479 | -0.0066 | |||||

| Elmwood CLO III Ltd., Series 2019-3A, Class A2RR / ABS-CBDO (US29002HAY53) | 0.32 | -0.31 | 0.1066 | -0.0042 | |||||

| AGL Clo 28 Ltd., Series 2023-28A, Class AL2 / ABS-CBDO (US00120WAC82) | 0.30 | -0.66 | 0.0988 | -0.0040 | |||||

| Apidos Loan Fund 2024-1 Ltd., Series 2024-1A, Class A1 / ABS-CBDO (US037986AA40) | 0.30 | -0.33 | 0.0985 | -0.0039 | |||||

| AIMCO CLO Ltd., Series 2019-10A, Class ARR / ABS-CBDO (US00901AAS69) | 0.25 | -0.40 | 0.0823 | -0.0034 | |||||

| AGL CLO 20 Ltd., Series 2022-20A, Class BR / ABS-CBDO (US00119CAS08) | 0.25 | -0.80 | 0.0821 | -0.0036 | |||||

| 522 Funding CLO 2020-6 Ltd., Series 2020-6A, Class A1R2 / ABS-CBDO (US33835AAY55) | 0.13 | -0.77 | 0.0425 | -0.0018 | |||||

| US36320WAL00 / Galaxy XXI CLO Ltd | 0.07 | -49.26 | 0.0229 | -0.0236 |