Mga Batayang Estadistika

| Nilai Portofolio | $ 389,595,528 |

| Posisi Saat Ini | 51 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

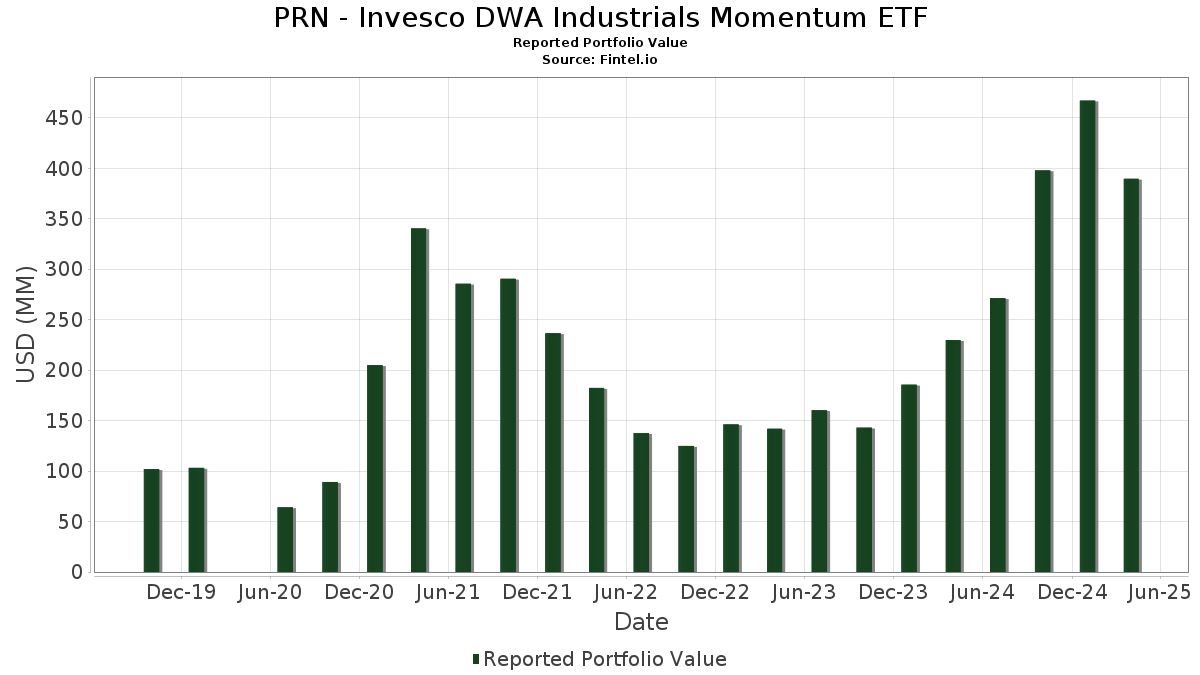

PRN - Invesco DWA Industrials Momentum ETF telah mengungkapkan total kepemilikan 51 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 389,595,528 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama PRN - Invesco DWA Industrials Momentum ETF adalah Trane Technologies plc (US:TT) , W.W. Grainger, Inc. (US:GWW) , HEICO Corporation (US:HEI) , TransDigm Group Incorporated (US:TDG) , and Howmet Aerospace Inc. (US:HWM) . Posisi baru PRN - Invesco DWA Industrials Momentum ETF meliputi: Curtiss-Wright Corporation (US:CW) , Lennox International Inc. (US:LII) , Cummins Inc. (US:CMI) , Aris Water Solutions, Inc. (US:ARIS) , and Pitney Bowes Inc. (US:PBI) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 50.46 | 50.46 | 15.8001 | 15.8001 | |

| 19.44 | 19.44 | 6.0871 | 6.0871 | |

| 0.02 | 7.88 | 2.4668 | 2.4668 | |

| 0.01 | 6.75 | 2.1144 | 2.1144 | |

| 0.36 | 6.65 | 2.0808 | 2.0808 | |

| 0.18 | 6.62 | 2.0716 | 2.0716 | |

| 0.02 | 5.73 | 1.7942 | 1.7942 | |

| 0.22 | 5.41 | 1.6934 | 1.6934 | |

| 0.60 | 5.19 | 1.6240 | 1.6240 | |

| 0.04 | 5.13 | 1.6069 | 1.6069 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.00 | 0.00 | -4.5453 | ||

| 0.00 | 0.00 | -3.3100 | ||

| 0.00 | 0.00 | -2.5735 | ||

| 0.00 | 0.00 | -2.3158 | ||

| 0.00 | 0.00 | -2.2974 | ||

| 0.00 | 0.00 | -1.5163 | ||

| 0.00 | 0.00 | -1.4683 | ||

| 0.00 | 0.00 | -1.4152 | ||

| 0.00 | 0.00 | -1.1758 | ||

| 0.00 | 0.00 | -0.9887 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-06-27 untuk periode pelaporan 2025-04-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| Invesco Private Prime Fund / STIV (N/A) | 50.46 | 50.46 | 15.8001 | 15.8001 | |||||

| Invesco Private Government Fund / STIV (N/A) | 19.44 | 19.44 | 6.0871 | 6.0871 | |||||

| TT / Trane Technologies plc | 0.04 | -4.21 | 13.75 | 1.22 | 4.3037 | 0.8785 | |||

| GWW / W.W. Grainger, Inc. | 0.01 | -9.00 | 13.65 | -12.28 | 4.2730 | 0.3488 | |||

| HEI / HEICO Corporation | 0.05 | -29.53 | 12.96 | -26.05 | 4.0588 | -0.3622 | |||

| TDG / TransDigm Group Incorporated | 0.01 | 11.45 | 12.08 | 16.37 | 3.7825 | 1.1639 | |||

| HWM / Howmet Aerospace Inc. | 0.08 | -17.48 | 11.64 | -9.66 | 3.6450 | 0.3947 | |||

| PH / Parker-Hannifin Corporation | 0.02 | -17.54 | 11.56 | -29.44 | 3.6204 | -0.5127 | |||

| JBL / Jabil Inc. | 0.07 | 14.23 | 10.51 | 3.09 | 3.2921 | 0.7194 | |||

| WSO / Watsco, Inc. | 0.02 | -16.26 | 10.45 | -19.54 | 3.2728 | -0.0039 | |||

| FI / Fiserv, Inc. | 0.06 | 12.62 | 10.31 | -3.78 | 3.2273 | 0.5251 | |||

| PKG / Packaging Corporation of America | 0.05 | 19.06 | 10.10 | 3.92 | 3.1618 | 0.7107 | |||

| RSG / Republic Services, Inc. | 0.04 | 6.52 | 9.86 | 34.90 | 3.0885 | 0.9703 | |||

| GE / General Electric Company | 0.05 | 9.75 | 9.43 | 28.76 | 2.9534 | 0.8313 | |||

| FAST / Fastenal Company | 0.10 | 103.60 | 7.92 | 221.05 | 2.4790 | 0.4463 | |||

| CW / Curtiss-Wright Corporation | 0.02 | 7.88 | 2.4668 | 2.4668 | |||||

| LII / Lennox International Inc. | 0.01 | 6.75 | 2.1144 | 2.1144 | |||||

| BE / Bloom Energy Corporation | 0.36 | 6.65 | 2.0808 | 2.0808 | |||||

| DRS / Leonardo DRS, Inc. | 0.18 | 6.62 | 2.0716 | 2.0716 | |||||

| EXLS / ExlService Holdings, Inc. | 0.14 | 2.44 | 6.60 | -1.18 | 2.0663 | 0.3817 | |||

| AIT / Applied Industrial Technologies, Inc. | 0.03 | 8.27 | 6.35 | 1.29 | 1.9896 | 0.4073 | |||

| VSEC / VSE Corporation | 0.06 | -1.66 | 6.33 | 10.05 | 1.9824 | 0.5311 | |||

| GFF / Griffon Corporation | 0.09 | 6.92 | 6.27 | -3.88 | 1.9626 | 0.3176 | |||

| KTOS / Kratos Defense & Security Solutions, Inc. | 0.17 | 24.21 | 5.80 | 58.13 | 1.8154 | 0.0246 | |||

| CMI / Cummins Inc. | 0.02 | 5.73 | 1.7942 | 1.7942 | |||||

| R / Ryder System, Inc. | 0.04 | 10.59 | 5.73 | -4.50 | 1.7932 | 0.2807 | |||

| ARIS / Aris Water Solutions, Inc. | 0.22 | 5.41 | 1.6934 | 1.6934 | |||||

| BMI / Badger Meter, Inc. | 0.02 | 48.16 | 5.20 | 98.70 | 1.6277 | -0.1034 | |||

| ITT / ITT Inc. | 0.04 | 6.03 | 5.20 | 3.69 | 1.6271 | 0.1753 | |||

| PBI / Pitney Bowes Inc. | 0.60 | 5.19 | 1.6240 | 1.6240 | |||||

| ESAB / ESAB Corporation | 0.04 | 5.13 | 1.6069 | 1.6069 | |||||

| CNM / Core & Main, Inc. | 0.10 | 5.04 | 1.5769 | 1.5769 | |||||

| ALSN / Allison Transmission Holdings, Inc. | 0.05 | 4.97 | 1.5562 | 1.5562 | |||||

| OSIS / OSI Systems, Inc. | 0.02 | 4.96 | 1.5520 | 1.5520 | |||||

| KAI / Kadant Inc. | 0.02 | 2.90 | 4.72 | -8.85 | 1.4764 | -0.0223 | |||

| CR / Crane Company | 0.03 | 4.64 | 1.4523 | 1.4523 | |||||

| SANM / Sanmina Corporation | 0.06 | 4.52 | 1.4167 | 1.4167 | |||||

| MWA / Mueller Water Products, Inc. | 0.17 | 4.52 | 1.4153 | 1.4153 | |||||

| ZWS / Zurn Elkay Water Solutions Corporation | 0.13 | 4.45 | 1.3926 | 1.3926 | |||||

| REVG / REV Group, Inc. | 0.13 | 4.22 | 1.3212 | 1.3212 | |||||

| AYI / Acuity Inc. | 0.02 | 4.15 | 1.2984 | 1.2984 | |||||

| RUSHA / Rush Enterprises, Inc. | 0.08 | -26.32 | 3.90 | -38.16 | 1.2210 | -0.3696 | |||

| TPC / Tutor Perini Corporation | 0.18 | -3.44 | 3.84 | -20.06 | 1.2016 | -0.1890 | |||

| LQDT / Liquidity Services, Inc. | 0.12 | 3.71 | 1.1604 | 1.1604 | |||||

| AZZ / AZZ Inc. | 0.04 | 3.70 | 1.1573 | 1.1573 | |||||

| HURN / Huron Consulting Group Inc. | 0.03 | 3.67 | 1.1481 | 1.1481 | |||||

| ESE / ESCO Technologies Inc. | 0.02 | 3.49 | 1.0935 | 1.0935 | |||||

| EPAC / Enerpac Tool Group Corp. | 0.08 | 3.35 | 1.0476 | 1.0476 | |||||

| NPO / Enpro Inc. | 0.02 | 3.27 | 1.0247 | 1.0247 | |||||

| SXI / Standex International Corporation | 0.02 | 2.97 | 0.9312 | 0.9312 | |||||

| US8252528851 / Invesco Government & Agency Portfolio, Institutional Class | 0.58 | 4.16 | 0.58 | 4.16 | 0.1806 | 0.0409 | |||

| VRT / Vertiv Holdings Co | 0.00 | -100.00 | 0.00 | -100.00 | -3.3100 | ||||

| RKLB / Rocket Lab Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -4.5453 | ||||

| TGLS / Tecnoglass Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -2.3158 | ||||

| XMTR / Xometry, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.9887 | ||||

| ACHR / Archer Aviation Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -2.2974 | ||||

| EME / EMCOR Group, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -2.5735 | ||||

| SOI / Solaris Oilfield Infrastructure, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.1758 | ||||

| PRIM / Primoris Services Corporation | 0.00 | -100.00 | 0.00 | -100.00 | -1.4152 | ||||

| BYRN / Byrna Technologies Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.5163 | ||||

| AGX / Argan, Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -1.4683 |