Mga Batayang Estadistika

| Nilai Portofolio | $ 3,640,811,805 |

| Posisi Saat Ini | 80 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

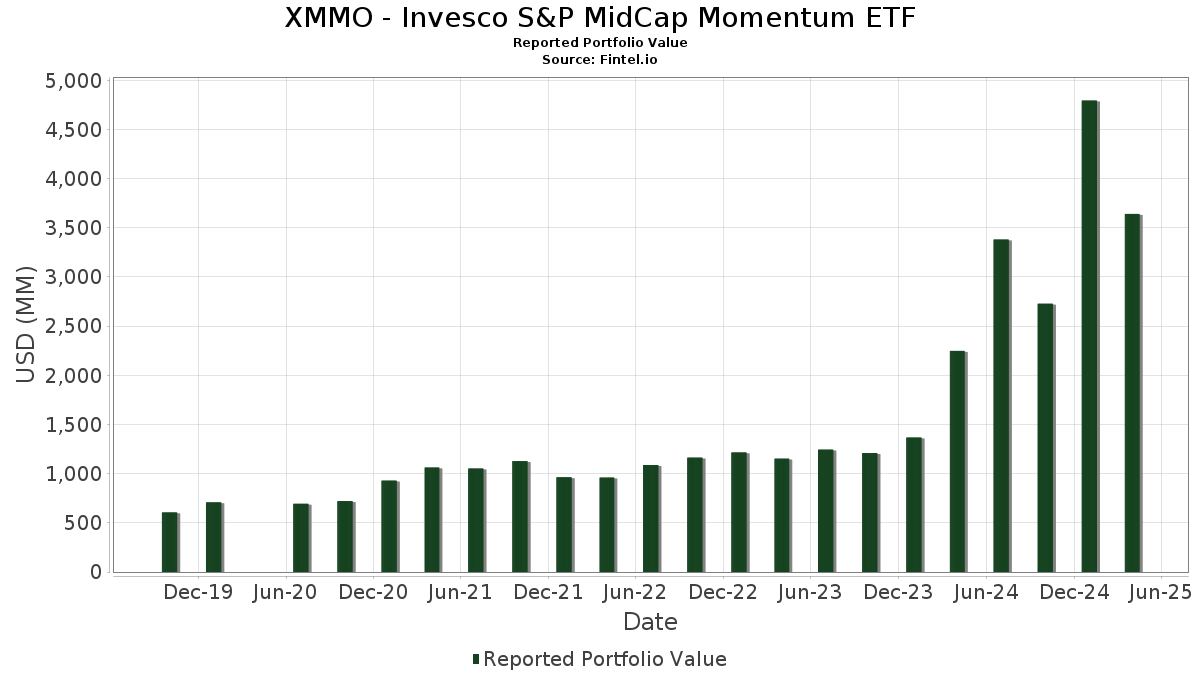

XMMO - Invesco S&P MidCap Momentum ETF telah mengungkapkan total kepemilikan 80 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 3,640,811,805 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama XMMO - Invesco S&P MidCap Momentum ETF adalah Interactive Brokers Group, Inc. (US:IBKR) , Sprouts Farmers Market, Inc. (US:SFM) , EMCOR Group, Inc. (US:EME) , Guidewire Software, Inc. (US:GWRE) , and Equitable Holdings, Inc. (US:EQH) . Posisi baru XMMO - Invesco S&P MidCap Momentum ETF meliputi: Guidewire Software, Inc. (US:GWRE) , Carpenter Technology Corporation (US:CRS) , RB Global, Inc. (US:RBA) , Duolingo, Inc. (US:DUOL) , and Flex Ltd. (US:FLEX) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 159.96 | 159.96 | 4.6782 | 4.6782 | |

| 0.47 | 95.53 | 2.7938 | 2.7938 | |

| 0.40 | 77.58 | 2.2690 | 2.2690 | |

| 0.59 | 69.60 | 2.0354 | 2.0354 | |

| 0.68 | 68.86 | 2.0137 | 2.0137 | |

| 0.17 | 65.55 | 1.9170 | 1.9170 | |

| 0.86 | 148.55 | 4.3445 | 1.8077 | |

| 60.87 | 60.87 | 1.7802 | 1.7802 | |

| 1.71 | 58.75 | 1.7182 | 1.7182 | |

| 0.60 | 43.31 | 1.2666 | 1.2666 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.23 | 43.53 | 1.2731 | -1.7128 | |

| 0.18 | 36.48 | 1.0669 | -1.1371 | |

| 0.00 | 0.00 | -0.9165 | ||

| 0.18 | 61.48 | 1.7981 | -0.6550 | |

| 1.14 | 53.15 | 1.5544 | -0.5677 | |

| 0.28 | 47.18 | 1.3797 | -0.5533 | |

| 0.41 | 58.01 | 1.6966 | -0.5394 | |

| 0.07 | 37.13 | 1.0858 | -0.5139 | |

| 0.11 | 26.56 | 0.7767 | -0.4613 | |

| 0.17 | 27.74 | 0.8111 | -0.4086 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-06-27 untuk periode pelaporan 2025-04-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| Invesco Private Prime Fund / STIV (N/A) | 159.96 | 159.96 | 4.6782 | 4.6782 | |||||

| IBKR / Interactive Brokers Group, Inc. | 0.86 | 60.23 | 148.55 | 26.64 | 4.3445 | 1.8077 | |||

| SFM / Sprouts Farmers Market, Inc. | 0.79 | -19.22 | 135.75 | -12.76 | 3.9701 | 0.6052 | |||

| EME / EMCOR Group, Inc. | 0.26 | -25.21 | 104.45 | -33.11 | 3.0547 | -0.3224 | |||

| GWRE / Guidewire Software, Inc. | 0.47 | 95.53 | 2.7938 | 2.7938 | |||||

| EQH / Equitable Holdings, Inc. | 1.78 | -17.73 | 87.92 | -25.24 | 2.5714 | 0.0280 | |||

| UNM / Unum Group | 1.08 | 164.47 | 84.26 | 324.89 | 2.4642 | 0.8533 | |||

| USFD / US Foods Holding Corp. | 1.21 | 85.08 | 79.71 | 123.44 | 2.3311 | 1.1725 | |||

| DTM / DT Midstream, Inc. | 0.80 | 5.12 | 78.20 | 1.09 | 2.2868 | 0.6140 | |||

| CRS / Carpenter Technology Corporation | 0.40 | 77.58 | 2.2690 | 2.2690 | |||||

| CASY / Casey's General Stores, Inc. | 0.17 | -21.60 | 76.34 | -14.01 | 2.2326 | 0.3127 | |||

| BJ / BJ's Wholesale Club Holdings, Inc. | 0.59 | 69.60 | 2.0354 | 2.0354 | |||||

| RBA / RB Global, Inc. | 0.68 | 68.86 | 2.0137 | 2.0137 | |||||

| UTHR / United Therapeutics Corporation | 0.22 | 152.67 | 67.56 | 215.51 | 1.9758 | 0.1016 | |||

| DUOL / Duolingo, Inc. | 0.17 | 65.55 | 1.9170 | 1.9170 | |||||

| FIX / Comfort Systems USA, Inc. | 0.16 | -31.23 | 62.61 | -37.40 | 1.8311 | -0.3318 | |||

| CW / Curtiss-Wright Corporation | 0.18 | -45.48 | 61.48 | -45.80 | 1.7981 | -0.6550 | |||

| Invesco Private Government Fund / STIV (N/A) | 60.87 | 60.87 | 1.7802 | 1.7802 | |||||

| FLEX / Flex Ltd. | 1.71 | 58.75 | 1.7182 | 1.7182 | |||||

| THC / Tenet Healthcare Corporation | 0.41 | -44.70 | 58.01 | -43.89 | 1.6966 | -0.5394 | |||

| JEF / Jefferies Financial Group Inc. | 1.14 | -10.88 | 53.15 | -45.84 | 1.5544 | -0.5677 | |||

| EHC / Encompass Health Corporation | 0.45 | -27.89 | 53.04 | -15.02 | 1.5513 | 0.2015 | |||

| OHI / Omega Healthcare Investors, Inc. | 1.26 | 328.78 | 49.09 | 417.15 | 1.4357 | 0.0495 | |||

| MTZ / MasTec, Inc. | 0.38 | 229.94 | 48.08 | 539.72 | 1.4062 | 0.7956 | |||

| TXRH / Texas Roadhouse, Inc. | 0.28 | -42.41 | 47.18 | -47.22 | 1.3797 | -0.5533 | |||

| ORI / Old Republic International Corporation | 1.25 | 5.09 | 47.16 | 8.02 | 1.3793 | 0.4351 | |||

| SF / Stifel Financial Corp. | 0.54 | -9.76 | 46.66 | -33.25 | 1.3647 | -0.1471 | |||

| JLL / Jones Lang LaSalle Incorporated | 0.20 | -8.28 | 46.43 | -26.25 | 1.3577 | -0.0035 | |||

| EWBC / East West Bancorp, Inc. | 0.51 | -24.38 | 44.06 | -37.17 | 1.2884 | -0.2280 | |||

| HLI / Houlihan Lokey, Inc. | 0.27 | -29.86 | 44.02 | -37.44 | 1.2873 | -0.2343 | |||

| RGA / Reinsurance Group of America, Incorporated | 0.23 | -61.65 | 43.53 | -68.47 | 1.2731 | -1.7128 | |||

| GMED / Globus Medical, Inc. | 0.60 | 43.31 | 1.2666 | 1.2666 | |||||

| DKS / DICK'S Sporting Goods, Inc. | 0.22 | 85.93 | 42.14 | 134.15 | 1.2323 | -0.2295 | |||

| EXLS / ExlService Holdings, Inc. | 0.86 | 1,032.56 | 41.66 | 289.55 | 1.2183 | 0.2823 | |||

| FT2 / First Horizon Corporation | 2.28 | 41.14 | 1.2032 | 1.2032 | |||||

| EXEL / Exelixis, Inc. | 1.04 | 40.68 | 1.1898 | 1.1898 | |||||

| AR / Antero Resources Corporation | 1.16 | 138.38 | 40.33 | 210.40 | 1.1794 | 0.0422 | |||

| NFG / National Fuel Gas Company | 0.52 | 39.65 | 1.1596 | 1.1596 | |||||

| OGE / OGE Energy Corp. | 0.87 | 39.29 | 1.1489 | 1.1489 | |||||

| CLH / Clean Harbors, Inc. | 0.18 | -33.57 | 37.78 | -39.00 | 1.1050 | -0.2345 | |||

| AIT / Applied Industrial Technologies, Inc. | 0.15 | -36.21 | 37.52 | -40.32 | 1.0972 | -0.2623 | |||

| MUSA / Murphy USA Inc. | 0.07 | -49.37 | 37.13 | -49.81 | 1.0858 | -0.5139 | |||

| MLI / Mueller Industries, Inc. | 0.50 | 37.09 | 1.0848 | 1.0848 | |||||

| EVR / Evercore Inc. | 0.18 | -49.22 | 36.48 | -64.21 | 1.0669 | -1.1371 | |||

| BRBR / BellRing Brands, Inc. | 0.47 | -23.58 | 36.01 | -23.79 | 1.0530 | 0.0313 | |||

| PLNT / Planet Fitness, Inc. | 0.38 | 35.80 | 1.0469 | 1.0469 | |||||

| SEIC / SEI Investments Company | 0.45 | 34.84 | 1.0190 | 1.0190 | |||||

| CART / Maplebear Inc. | 0.87 | 34.68 | 1.0141 | 1.0141 | |||||

| COKE / Coca-Cola Consolidated, Inc. | 0.02 | -41.68 | 33.47 | -42.19 | 0.9790 | -0.2731 | |||

| SNX / TD SYNNEX Corporation | 0.30 | 407.29 | 33.16 | 437.54 | 0.9698 | 0.2379 | |||

| DOCS / Doximity, Inc. | 0.57 | 32.28 | 0.9440 | 0.9440 | |||||

| KD / Kyndryl Holdings, Inc. | 0.99 | -27.02 | 32.26 | -37.67 | 0.9433 | -0.1758 | |||

| RYAN / Ryan Specialty Holdings, Inc. | 0.48 | -12.02 | 31.65 | -13.44 | 0.9256 | 0.1349 | |||

| FLS / Flowserve Corporation | 0.68 | 3.97 | 30.67 | -24.90 | 0.8969 | 0.0138 | |||

| HALO / Halozyme Therapeutics, Inc. | 0.50 | 30.63 | 0.8958 | 0.8958 | |||||

| CBSH / Commerce Bancshares, Inc. | 0.47 | 28.78 | 0.8416 | 0.8416 | |||||

| CHWY / Chewy, Inc. | 0.77 | 28.73 | 0.8402 | 0.8402 | |||||

| CVLT / Commvault Systems, Inc. | 0.17 | -53.14 | 27.74 | -50.83 | 0.8111 | -0.4086 | |||

| LPX / Louisiana-Pacific Corporation | 0.31 | 26.62 | 0.7787 | 0.7787 | |||||

| AYI / Acuity Inc. | 0.11 | -36.70 | 26.56 | -53.61 | 0.7767 | -0.4613 | |||

| JHG / Janus Henderson Group plc | 0.76 | 29.36 | 25.30 | -4.38 | 0.7399 | 0.1677 | |||

| ONB / Old National Bancorp | 1.20 | 24.62 | 0.7199 | 0.7199 | |||||

| ESAB / ESAB Corporation | 0.20 | -30.35 | 24.44 | -32.44 | 0.7147 | -0.0675 | |||

| VNOM / Viper Energy, Inc. | 0.58 | 23.57 | 0.6894 | 0.6894 | |||||

| AM / Antero Midstream Corporation | 1.41 | -12.45 | 23.31 | -9.66 | 0.6817 | 0.1237 | |||

| SNV / Synovus Financial Corp. | 0.53 | 198.70 | 22.87 | 220.45 | 0.6688 | -0.0719 | |||

| AAON / AAON, Inc. | 0.25 | 22.76 | 0.6656 | 0.6656 | |||||

| TXNM / TXNM Energy, Inc. | 0.42 | 385.51 | 22.60 | 511.75 | 0.6611 | 0.1215 | |||

| GTLS / Chart Industries, Inc. | 0.17 | 22.53 | 0.6589 | 0.6589 | |||||

| UMBF / UMB Financial Corporation | 0.24 | 11.88 | 22.51 | -10.26 | 0.6582 | 0.1159 | |||

| VNO / Vornado Realty Trust | 0.61 | 21.66 | 0.6334 | 0.6334 | |||||

| SLM / SLM Corporation | 0.74 | -31.71 | 21.36 | -29.26 | 0.6248 | -0.0283 | |||

| R / Ryder System, Inc. | 0.16 | -24.10 | 21.35 | -34.45 | 0.6242 | -0.0800 | |||

| KNF / Knife River Corporation | 0.22 | -43.91 | 20.81 | -49.43 | 0.6086 | -0.2814 | |||

| CUZ / Cousins Properties Incorporated | 0.62 | 17.02 | 0.4978 | 0.4978 | |||||

| CNO / CNO Financial Group, Inc. | 0.44 | -14.73 | 16.59 | -19.00 | 0.4851 | 0.0422 | |||

| BDC / Belden Inc. | 0.16 | 66.98 | 16.30 | 132.12 | 0.4768 | -0.0938 | |||

| SBRA / Sabra Health Care REIT, Inc. | 0.87 | -25.58 | 15.53 | -20.51 | 0.4542 | 0.0317 | |||

| PPC / Pilgrim's Pride Corporation | 0.22 | -33.96 | 12.19 | -22.55 | 0.3565 | 0.0162 | |||

| US8252528851 / Invesco Government & Agency Portfolio, Institutional Class | 1.49 | 68.81 | 1.49 | 68.94 | 0.0434 | 0.0244 | |||

| EXP / Eagle Materials Inc. | 0.00 | -100.00 | 0.00 | -100.00 | -0.9165 |