Mga Batayang Estadistika

| Nilai Portofolio | $ 21,513,662,182 |

| Posisi Saat Ini | 41 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

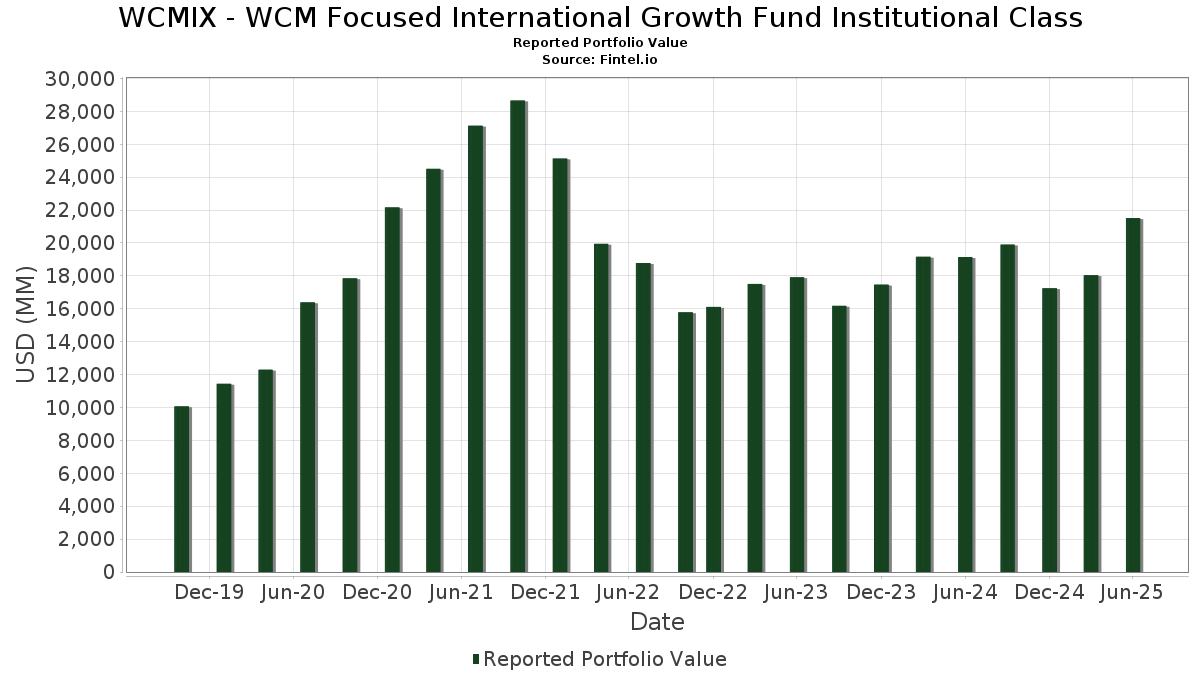

WCMIX - WCM Focused International Growth Fund Institutional Class telah mengungkapkan total kepemilikan 41 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 21,513,662,182 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama WCMIX - WCM Focused International Growth Fund Institutional Class adalah Siemens Energy AG (IT:ENR) , Sea Limited - Depositary Receipt (Common Stock) (US:SE) , Taiwan Semiconductor Manufacturing Company Limited (TW:2330) , Rolls-Royce Holdings plc (GB:RR.) , and Spotify Technology S.A. (US:SPOT) . Posisi baru WCMIX - WCM Focused International Growth Fund Institutional Class meliputi: Philip Morris International Inc. (US:PM) , Deutsche Börse AG (DE:DB1) , Rheinmetall AG (DE:RHM) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 4.63 | 843.41 | 3.9135 | 3.9135 | |

| 10.86 | 1,269.46 | 5.8904 | 2.2853 | |

| 1.18 | 386.90 | 1.7952 | 1.7952 | |

| 0.17 | 358.11 | 1.6616 | 1.6616 | |

| 732.84 | 3.4004 | 1.4726 | ||

| 35.56 | 889.97 | 4.1295 | 0.6879 | |

| 1.26 | 967.81 | 4.4907 | 0.5889 | |

| 5.39 | 517.33 | 2.4004 | 0.3508 | |

| 27.29 | 997.83 | 4.6300 | 0.3212 | |

| 18.58 | 556.72 | 2.5832 | 0.2870 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.81 | 397.38 | 1.8439 | -1.8272 | |

| 2.65 | 368.71 | 1.7108 | -1.7524 | |

| 5.33 | 369.26 | 1.7134 | -1.5139 | |

| 0.82 | 196.19 | 0.9103 | -1.2741 | |

| 25.76 | 414.33 | 1.9225 | -0.9980 | |

| 5.11 | 465.53 | 2.1601 | -0.6109 | |

| 2.12 | 691.59 | 3.2090 | -0.5744 | |

| 0.79 | 282.30 | 1.3099 | -0.4696 | |

| 1.60 | 299.01 | 1.3874 | -0.3739 | |

| 6.01 | 387.46 | 1.7978 | -0.3631 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-08-26 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| ENR / Siemens Energy AG | 10.86 | -1.02 | 1,269.46 | 95.15 | 5.8904 | 2.2853 | |||

| SE / Sea Limited - Depositary Receipt (Common Stock) | 6.33 | -1.65 | 1,012.53 | 20.55 | 4.6982 | 0.0433 | |||

| 2330 / Taiwan Semiconductor Manufacturing Company Limited | 27.29 | -1.16 | 997.83 | 28.34 | 4.6300 | 0.3212 | |||

| RR. / Rolls-Royce Holdings plc | 73.99 | -14.43 | 980.59 | 16.68 | 4.5500 | -0.1075 | |||

| SPOT / Spotify Technology S.A. | 1.26 | -1.47 | 967.81 | 37.46 | 4.4907 | 0.5889 | |||

| BA. / BAE Systems plc | 36.69 | -1.44 | 952.21 | 26.67 | 4.4183 | 0.2524 | |||

| MIH / Mitsubishi Heavy Industries, Ltd. | 35.56 | -1.65 | 889.97 | 43.31 | 4.1295 | 0.6879 | |||

| PM / Philip Morris International Inc. | 4.63 | 843.41 | 3.9135 | 3.9135 | |||||

| SAP / SAP SE | 2.66 | -1.52 | 814.83 | 12.39 | 3.7808 | -0.2372 | |||

| UMB MONEY MARKET II SPECIAL / / STIV (SF8888628) | 732.84 | 110.67 | 3.4004 | 1.4726 | |||||

| SAF / Safran SA | 2.12 | -18.22 | 691.59 | 1.30 | 3.2090 | -0.5744 | |||

| IGQ5 / 3i Group plc | 11.60 | -1.65 | 656.54 | 18.37 | 3.0464 | -0.0275 | |||

| CPNG / Coupang, Inc. | 18.58 | -1.65 | 556.72 | 34.36 | 2.5832 | 0.2870 | |||

| 1N8 / Adyen N.V. | 0.29 | -1.65 | 535.13 | 17.84 | 2.4830 | -0.0336 | |||

| MELI / MercadoLibre, Inc. | 0.20 | -1.65 | 518.10 | 31.76 | 2.4040 | 0.2249 | |||

| 7974 / Nintendo Co., Ltd. | 5.39 | -0.98 | 517.33 | 39.88 | 2.4004 | 0.3508 | |||

| CP / Canadian Pacific Kansas City Limited | 6.51 | -1.65 | 516.43 | 11.04 | 2.3963 | -0.1812 | |||

| ASML / ASML Holding N.V. - Depositary Receipt (Common Stock) | 0.59 | -1.65 | 469.02 | 18.95 | 2.1763 | -0.0090 | |||

| ACGL / Arch Capital Group Ltd. | 5.11 | -1.65 | 465.53 | -6.90 | 2.1601 | -0.6109 | |||

| MNDY / monday.com Ltd. | 1.47 | -1.65 | 463.19 | 27.20 | 2.1492 | 0.1311 | |||

| IBN / ICICI Bank Limited - Depositary Receipt (Common Stock) | 13.31 | -1.65 | 447.76 | 4.97 | 2.0776 | -0.2864 | |||

| 3690 / Meituan | 25.76 | -1.65 | 414.33 | -21.38 | 1.9225 | -0.9980 | |||

| RACE / Ferrari N.V. | 0.81 | -47.71 | 397.38 | -40.01 | 1.8439 | -1.8272 | |||

| 700 / Tencent Holdings Limited | 6.01 | -1.46 | 387.46 | -0.63 | 1.7978 | -0.3631 | |||

| DB1 / Deutsche Börse AG | 1.18 | 386.90 | 1.7952 | 1.7952 | |||||

| NU / Nu Holdings Ltd. | 27.53 | -1.65 | 377.71 | 31.77 | 1.7526 | 0.1641 | |||

| ASM / ASM International NV | 0.59 | -1.65 | 377.03 | 38.45 | 1.7494 | 0.2403 | |||

| UBSG / UBS Group AG | 11.07 | -1.65 | 375.86 | 8.71 | 1.7440 | -0.1721 | |||

| NVO / Novo Nordisk A/S - Depositary Receipt (Common Stock) | 5.33 | -37.43 | 369.26 | -36.59 | 1.7134 | -1.5139 | |||

| AZN / Astrazeneca plc | 2.65 | -37.74 | 368.71 | -41.00 | 1.7108 | -1.7524 | |||

| LIN / Linde plc | 0.78 | -1.65 | 367.10 | -0.90 | 1.7033 | -0.3496 | |||

| CPG / Compass Group PLC | 10.72 | -1.65 | 363.03 | 0.71 | 1.6845 | -0.3132 | |||

| RHM / Rheinmetall AG | 0.17 | 358.11 | 1.6616 | 1.6616 | |||||

| EXPN / Experian plc | 6.54 | -1.65 | 337.10 | 9.45 | 1.5641 | -0.1427 | |||

| WCN / Waste Connections, Inc. | 1.60 | -1.65 | 299.01 | -5.92 | 1.3874 | -0.3739 | |||

| CNQ / Canadian Natural Resources Limited | 9.01 | -1.65 | 283.20 | 0.46 | 1.3141 | -0.2482 | |||

| AON / Aon plc | 0.79 | -1.65 | 282.30 | -12.08 | 1.3099 | -0.4696 | |||

| TEAM / Atlassian Corporation | 1.35 | -1.07 | 274.50 | -5.32 | 1.2737 | -0.3330 | |||

| STE / STERIS plc | 0.82 | -53.04 | 196.19 | -50.23 | 0.9103 | -1.2741 | |||

| JAPANESE YEN / / STIV (999999999) | 5.27 | 0.0245 | 0.0245 | ||||||

| JPY SPOT FORWARD CONTRACT / / STIV (999999999) | -5.60 | -0.0260 | -0.0260 |