Mga Batayang Estadistika

| Nilai Portofolio | $ 502,068,986 |

| Posisi Saat Ini | 122 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

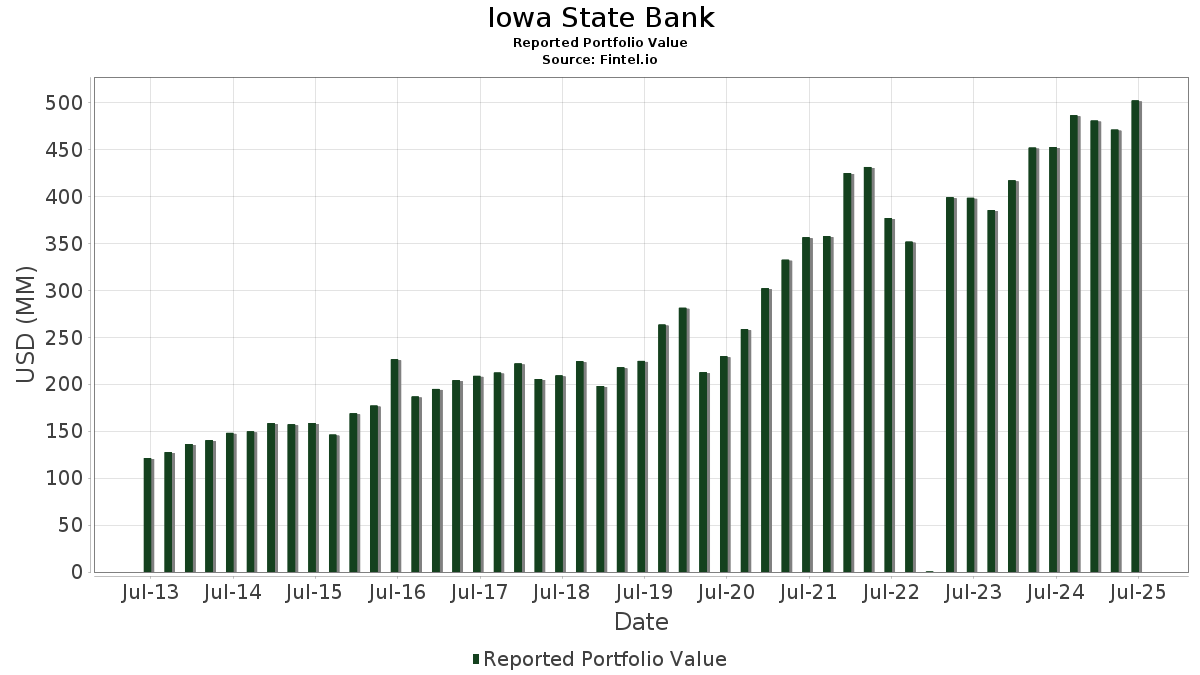

Iowa State Bank telah mengungkapkan total kepemilikan 122 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 502,068,986 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama Iowa State Bank adalah iShares Trust - iShares Core S&P Mid-Cap ETF (US:IJH) , iShares Trust - iShares Core MSCI EAFE ETF (US:IEFA) , Microsoft Corporation (US:MSFT) , iShares Trust - iShares Core S&P Small-Cap ETF (US:IJR) , and JPMorgan Chase & Co. (US:JPM) . Posisi baru Iowa State Bank meliputi: Analog Devices, Inc. (US:ADI) , Royal Bank of Canada (MX:RY N) , Invesco Exchange-Traded Fund Trust - Invesco RAFI US 1000 ETF (US:PRF) , .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.04 | 20.30 | 4.0436 | 0.7810 | |

| 0.09 | 13.86 | 2.6670 | 0.6637 | |

| 0.03 | 7.31 | 1.4569 | 0.4653 | |

| 0.01 | 2.21 | 0.4394 | 0.4394 | |

| 0.02 | 5.04 | 0.9689 | 0.3290 | |

| 0.01 | 10.58 | 2.0357 | 0.3024 | |

| 0.03 | 4.05 | 0.7794 | 0.2483 | |

| 0.01 | 3.11 | 0.5990 | 0.2386 | |

| 0.00 | 1.22 | 0.2343 | 0.2343 | |

| 0.07 | 19.50 | 3.7508 | 0.2207 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.08 | 16.46 | 3.2792 | -0.5108 | |

| 0.00 | 0.53 | 0.1062 | -0.4588 | |

| 0.05 | 9.62 | 1.8507 | -0.4579 | |

| 0.02 | 8.07 | 1.5526 | -0.3781 | |

| 0.05 | 4.91 | 0.9450 | -0.3751 | |

| 0.04 | 6.12 | 1.1773 | -0.3444 | |

| 0.05 | 5.90 | 1.1355 | -0.2633 | |

| 0.04 | 4.70 | 0.9048 | -0.2452 | |

| 0.04 | 6.35 | 1.2217 | -0.2253 | |

| 0.04 | 6.84 | 1.3630 | -0.2246 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-22 untuk periode pelaporan 2025-06-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| IJH / iShares Trust - iShares Core S&P Mid-Cap ETF | 0.37 | -0.47 | 23.23 | 5.79 | 4.4691 | -0.1933 | |||

| IEFA / iShares Trust - iShares Core MSCI EAFE ETF | 0.28 | -2.34 | 23.10 | 7.77 | 4.4434 | -0.1071 | |||

| MSFT / Microsoft Corporation | 0.04 | -0.30 | 20.30 | 32.11 | 4.0436 | 0.7810 | |||

| IJR / iShares Trust - iShares Core S&P Small-Cap ETF | 0.18 | 2.51 | 19.66 | 7.14 | 3.7823 | -0.1139 | |||

| JPM / JPMorgan Chase & Co. | 0.07 | -0.78 | 19.50 | 17.27 | 3.7508 | 0.2207 | |||

| AAPL / Apple Inc. | 0.08 | -0.15 | 16.46 | -7.77 | 3.2792 | -0.5108 | |||

| NVDD / Direxion Shares ETF Trust - Direxion Daily NVDA Bear 1X Shares | 0.09 | 0.80 | 13.86 | 46.94 | 2.6670 | 0.6637 | |||

| IEMG / iShares, Inc. - iShares Core MSCI Emerging Markets ETF | 0.22 | -0.85 | 13.21 | 10.28 | 2.5408 | -0.0020 | |||

| SPHY / SPDR Series Trust - SPDR Portfolio High Yield Bond ETF | 0.55 | 1.54 | 13.03 | 3.18 | 2.5059 | -0.1743 | |||

| AMZN / Amazon.com, Inc. | 0.05 | 0.92 | 10.65 | 16.36 | 2.1210 | 0.1782 | |||

| META / Meta Platforms, Inc. | 0.01 | 1.22 | 10.58 | 29.62 | 2.0357 | 0.3024 | |||

| ABBV / AbbVie Inc. | 0.05 | -0.13 | 9.62 | -11.52 | 1.8507 | -0.4579 | |||

| CSCO / Cisco Systems, Inc. | 0.13 | -0.75 | 9.26 | 11.59 | 1.7814 | 0.0195 | |||

| EMR / Emerson Electric Co. | 0.07 | -5.91 | 9.19 | 14.42 | 1.8296 | 0.1251 | |||

| MS / Morgan Stanley | 0.06 | -2.34 | 8.88 | 17.90 | 1.7686 | 0.1698 | |||

| CAH / Cardinal Health, Inc. | 0.05 | -0.12 | 8.43 | 21.79 | 1.6800 | 0.2097 | |||

| GOOGL / Alphabet Inc. | 0.05 | 0.77 | 8.34 | 14.84 | 1.6614 | 0.1192 | |||

| BRK.B / Berkshire Hathaway Inc. | 0.02 | -2.69 | 8.07 | -11.24 | 1.5526 | -0.3781 | |||

| ETN / Eaton Corporation plc | 0.02 | -13.82 | 7.49 | 13.19 | 1.4409 | 0.0358 | |||

| ORCL / Oracle Corporation | 0.03 | 0.15 | 7.31 | 56.62 | 1.4569 | 0.4653 | |||

| IBM / International Business Machines Corporation | 0.02 | -7.60 | 7.05 | 9.54 | 1.4039 | 0.0378 | |||

| JNJ / Johnson & Johnson | 0.04 | -0.65 | 6.84 | -8.49 | 1.3630 | -0.2246 | |||

| V / Visa Inc. | 0.02 | 0.44 | 6.65 | 1.76 | 1.3255 | -0.0629 | |||

| DIA / SPDR Dow Jones Industrial Average ETF Trust | 0.01 | 0.00 | 6.54 | 4.94 | 1.2579 | -0.0650 | |||

| GJR / Strats Trust For Procter & Gambel Security - Preferred Security | 0.04 | -0.32 | 6.35 | -6.81 | 1.2217 | -0.2253 | |||

| SPY / SPDR S&P 500 ETF | 0.01 | -11.11 | 6.22 | -1.82 | 1.2390 | -0.1061 | |||

| CVX / Chevron Corporation | 0.04 | -0.24 | 6.12 | -14.62 | 1.1773 | -0.3444 | |||

| XOM / Exxon Mobil Corporation | 0.05 | -1.16 | 5.90 | -10.40 | 1.1355 | -0.2633 | |||

| CRM / Salesforce, Inc. | 0.02 | 0.14 | 5.64 | 1.75 | 1.1235 | -0.0535 | |||

| RTX / RTX Corporation | 0.04 | -0.12 | 5.41 | 10.10 | 1.0769 | 0.0344 | |||

| BRK.A / Berkshire Hathaway Inc. | 0.00 | 0.00 | 5.10 | -8.73 | 0.9814 | -0.2052 | |||

| AVGO / Broadcom Inc. | 0.02 | 1.51 | 5.04 | 67.14 | 0.9689 | 0.3290 | |||

| UPS / United Parcel Service, Inc. | 0.05 | -13.91 | 4.91 | -20.99 | 0.9450 | -0.3751 | |||

| PRU / Prudential Financial, Inc. | 0.05 | -0.89 | 4.90 | -4.65 | 0.9768 | -0.1153 | |||

| PEP / PepsiCo, Inc. | 0.04 | -1.40 | 4.70 | -13.16 | 0.9048 | -0.2452 | |||

| ICE / Intercontinental Exchange, Inc. | 0.03 | 0.74 | 4.60 | 7.15 | 0.8856 | -0.0266 | |||

| BAC / Bank of America Corporation | 0.10 | 1.07 | 4.59 | 14.62 | 0.8836 | 0.0327 | |||

| PANW / Palo Alto Networks, Inc. | 0.02 | 0.32 | 4.51 | 20.32 | 0.8977 | 0.1024 | |||

| LLY / Eli Lilly and Company | 0.01 | 0.63 | 4.36 | -5.02 | 0.8675 | -0.1061 | |||

| PLTR / Palantir Technologies Inc. | 0.03 | 0.29 | 4.05 | 61.98 | 0.7794 | 0.2483 | |||

| BLK / BlackRock, Inc. | 0.00 | -1.15 | 3.88 | 9.60 | 0.7468 | -0.0053 | |||

| TFC / Truist Financial Corporation | 0.09 | -2.02 | 3.85 | 2.37 | 0.7407 | -0.0579 | |||

| MET / MetLife, Inc. | 0.05 | -8.06 | 3.84 | -7.91 | 0.7393 | -0.1467 | |||

| CAT / Caterpillar Inc. | 0.01 | -22.62 | 3.67 | -8.93 | 0.7312 | -0.1245 | |||

| AMT / American Tower Corporation | 0.02 | 0.70 | 3.48 | 2.26 | 0.6933 | -0.0292 | |||

| VZ / Verizon Communications Inc. | 0.08 | 0.23 | 3.47 | -4.38 | 0.6908 | -0.0794 | |||

| DIS / The Walt Disney Company | 0.03 | 1.01 | 3.29 | 26.93 | 0.6543 | 0.1048 | |||

| YUM / Yum! Brands, Inc. | 0.02 | 2.54 | 3.14 | -3.44 | 0.6261 | -0.0651 | |||

| HON / Honeywell International Inc. | 0.01 | 66.80 | 3.11 | 83.50 | 0.5990 | 0.2386 | |||

| WM / Waste Management, Inc. | 0.01 | 45.50 | 3.05 | 43.84 | 0.5859 | 0.1362 | |||

| MCD / McDonald's Corporation | 0.01 | -2.54 | 3.03 | -8.84 | 0.6040 | -0.1022 | |||

| LOW / Lowe's Companies, Inc. | 0.01 | -2.03 | 2.97 | -6.81 | 0.5717 | -0.1053 | |||

| EOG / EOG Resources, Inc. | 0.02 | 0.05 | 2.89 | -6.69 | 0.5756 | -0.0819 | |||

| SCHW / The Charles Schwab Corporation | 0.03 | 0.50 | 2.78 | 17.14 | 0.5338 | 0.0308 | |||

| AMGN / Amgen Inc. | 0.01 | -1.90 | 2.75 | -12.08 | 0.5481 | -0.1164 | |||

| FCX / Freeport-McMoRan Inc. | 0.06 | 1.55 | 2.74 | 16.26 | 0.5268 | 0.0267 | |||

| GILD / Gilead Sciences, Inc. | 0.02 | -2.12 | 2.71 | -3.14 | 0.5406 | -0.0544 | |||

| MAS / Masco Corporation | 0.04 | 0.83 | 2.65 | -6.69 | 0.5096 | -0.0931 | |||

| WMT / Walmart Inc. | 0.03 | 0.07 | 2.63 | 11.47 | 0.5066 | 0.0050 | |||

| DUK / Duke Energy Corporation | 0.02 | -2.62 | 2.60 | -5.80 | 0.4999 | -0.0857 | |||

| DLR / Digital Realty Trust, Inc. | 0.01 | -2.14 | 2.56 | 19.05 | 0.4930 | 0.0360 | |||

| LIN / Linde plc | 0.01 | -1.86 | 2.53 | -1.14 | 0.4858 | -0.0564 | |||

| SPYG / SPDR Series Trust - SPDR Portfolio S&P 500 Growth ETF | 0.03 | -8.14 | 2.47 | 8.96 | 0.4748 | -0.0062 | |||

| AGG / iShares Trust - iShares Core U.S. Aggregate Bond ETF | 0.02 | -13.45 | 2.43 | -13.21 | 0.4676 | -0.1270 | |||

| PYPL / PayPal Holdings, Inc. | 0.03 | 1.07 | 2.38 | 15.10 | 0.4737 | 0.0351 | |||

| MDLZ / Mondelez International, Inc. | 0.03 | -1.79 | 2.33 | -2.38 | 0.4649 | -0.0428 | |||

| BMY / Bristol-Myers Squibb Company | 0.05 | -2.52 | 2.28 | -26.02 | 0.4381 | -0.2154 | |||

| PFE / Pfizer Inc. | 0.09 | -1.68 | 2.27 | -5.93 | 0.4367 | -0.0758 | |||

| NKE / NIKE, Inc. | 0.03 | -1.08 | 2.25 | 10.71 | 0.4489 | 0.0166 | |||

| MRK / Merck & Co., Inc. | 0.03 | -2.94 | 2.24 | -14.38 | 0.4458 | -0.1094 | |||

| ADI / Analog Devices, Inc. | 0.01 | 2.21 | 0.4394 | 0.4394 | |||||

| COST / Costco Wholesale Corporation | 0.00 | 1.48 | 2.18 | 6.20 | 0.4334 | -0.0015 | |||

| JCI / Johnson Controls International plc | 0.02 | 2.90 | 2.07 | 35.71 | 0.4125 | 0.0884 | |||

| TJX / The TJX Companies, Inc. | 0.02 | 0.80 | 2.03 | 2.21 | 0.3913 | -0.0313 | |||

| COR / Cencora, Inc. | 0.01 | 1.41 | 2.03 | 9.34 | 0.4036 | 0.0102 | |||

| IVV / iShares Trust - iShares Core S&P 500 ETF | 0.00 | -0.15 | 2.01 | 10.34 | 0.3860 | -0.0001 | |||

| ABT / Abbott Laboratories | 0.01 | 0.76 | 1.99 | 3.32 | 0.3971 | -0.0126 | |||

| COP / ConocoPhillips | 0.02 | 0.50 | 1.99 | -14.14 | 0.3831 | -0.1093 | |||

| DD / DuPont de Nemours, Inc. | 0.03 | 1.11 | 1.76 | -7.14 | 0.3500 | -0.0518 | |||

| CMCSA / Comcast Corporation | 0.05 | -3.28 | 1.71 | -6.46 | 0.3407 | -0.0475 | |||

| MDT / Medtronic plc | 0.02 | 0.89 | 1.58 | -2.16 | 0.3049 | -0.0389 | |||

| VTV / Vanguard Index Funds - Vanguard Value ETF | 0.01 | 0.00 | 1.57 | 2.35 | 0.3023 | -0.0238 | |||

| EXC / Exelon Corporation | 0.03 | -3.13 | 1.45 | -8.77 | 0.2783 | -0.0582 | |||

| CVS / CVS Health Corporation | 0.02 | -1.37 | 1.43 | 0.42 | 0.2759 | -0.0273 | |||

| Community State Bank Capital Stock / Com (00CSBSTK1) | 0.00 | 1.43 | 0.0000 | ||||||

| SYY / Sysco Corporation | 0.02 | -2.34 | 1.40 | -1.48 | 0.2685 | -0.0321 | |||

| OMC / Omnicom Group Inc. | 0.02 | -3.12 | 1.32 | -15.97 | 0.2621 | -0.0703 | |||

| VTI / Vanguard Index Funds - Vanguard Total Stock Market ETF | 0.00 | 0.00 | 1.23 | 10.52 | 0.2366 | 0.0005 | |||

| NSC / Norfolk Southern Corporation | 0.00 | 1.22 | 0.2343 | 0.2343 | |||||

| DOW / Dow Inc. | 0.04 | -0.03 | 0.94 | -24.17 | 0.1805 | -0.0823 | |||

| HD / The Home Depot, Inc. | 0.00 | 0.00 | 0.79 | 0.13 | 0.1522 | -0.0157 | |||

| PGX / Invesco Exchange-Traded Fund Trust II - Invesco Preferred ETF | 0.07 | -35.85 | 0.72 | -36.32 | 0.1393 | -0.1023 | |||

| ING / ING Groep N.V. - Depositary Receipt (Common Stock) | 0.03 | -0.19 | 0.69 | 11.43 | 0.1379 | 0.0060 | |||

| DFIV / Dimensional ETF Trust - Dimensional International Value ETF | 0.02 | 0.00 | 0.68 | 8.84 | 0.1303 | -0.0019 | |||

| IWM / iShares Trust - iShares Russell 2000 ETF | 0.00 | 0.00 | 0.67 | 8.12 | 0.1283 | -0.0026 | |||

| CWI / SPDR Index Shares Funds - SPDR MSCI ACWI ex-US ETF | 0.02 | -11.41 | 0.59 | -2.16 | 0.1131 | -0.0145 | |||

| DFNM / Dimensional ETF Trust - Dimensional National Municipal Bond ETF | 0.01 | 0.00 | 0.53 | -0.37 | 0.1028 | -0.0110 | |||

| QCOM / QUALCOMM Incorporated | 0.00 | -80.68 | 0.53 | -79.97 | 0.1062 | -0.4588 | |||

| VBR / Vanguard Index Funds - Vanguard Small-Cap Value ETF | 0.00 | 0.00 | 0.49 | 4.67 | 0.0949 | -0.0052 | |||

| QQQ / Invesco QQQ Trust, Series 1 | 0.00 | -9.81 | 0.49 | 6.26 | 0.0980 | -0.0005 | |||

| IHF / iShares Trust - iShares U.S. Healthcare Providers ETF | 0.01 | 0.00 | 0.49 | -7.95 | 0.0936 | -0.0185 | |||

| PFG / Principal Financial Group, Inc. | 0.01 | -4.33 | 0.46 | -9.84 | 0.0881 | -0.0199 | |||

| MUB / iShares Trust - iShares National Muni Bond ETF | 0.00 | -2.80 | 0.43 | -3.58 | 0.0829 | -0.0121 | |||

| VEA / Vanguard Tax-Managed Funds - Vanguard FTSE Developed Markets ETF | 0.01 | 0.00 | 0.43 | 12.34 | 0.0824 | 0.0013 | |||

| SPYV / SPDR Series Trust - SPDR Portfolio S&P 500 Value ETF | 0.01 | 0.00 | 0.37 | 2.49 | 0.0715 | -0.0055 | |||

| MEAR / iShares U.S. ETF Trust - iShares Short Maturity Municipal Bond Active ETF | 0.01 | 0.00 | 0.33 | 0.00 | 0.0643 | -0.0066 | |||

| CHE / Chemed Corporation | 0.00 | 0.00 | 0.32 | -20.80 | 0.0609 | -0.0240 | |||

| VGIT / Vanguard Scottsdale Funds - Vanguard Intermediate-Term Treasury ETF | 0.01 | 0.00 | 0.32 | 0.64 | 0.0606 | -0.0058 | |||

| DE / Deere & Company | 0.00 | 26.62 | 0.31 | 37.67 | 0.0612 | 0.0136 | |||

| LGLV / SPDR Series Trust - SPDR SSGA US Large Cap Low Volatility Index ETF | 0.00 | -31.09 | 0.29 | -31.03 | 0.0558 | -0.0333 | |||

| IWB / iShares Trust - iShares Russell 1000 ETF | 0.00 | 0.00 | 0.27 | 10.61 | 0.0523 | 0.0002 | |||

| VNQ / Vanguard Specialized Funds - Vanguard Real Estate ETF | 0.00 | 0.00 | 0.27 | -1.45 | 0.0540 | -0.0045 | |||

| XLV / The Select Sector SPDR Trust - The Health Care Select Sector SPDR Fund | 0.00 | 0.00 | 0.27 | -7.88 | 0.0519 | -0.0101 | |||

| AFL / Aflac Incorporated | 0.00 | 0.00 | 0.27 | -5.00 | 0.0512 | -0.0084 | |||

| HSY / The Hershey Company | 0.00 | -2.78 | 0.26 | -5.80 | 0.0519 | -0.0068 | |||

| VIG / Vanguard Specialized Funds - Vanguard Dividend Appreciation ETF | 0.00 | 0.00 | 0.25 | 5.42 | 0.0488 | -0.0022 | |||

| XLE / The Select Sector SPDR Trust - The Energy Select Sector SPDR Fund | 0.00 | 0.00 | 0.22 | -9.28 | 0.0414 | -0.0090 | |||

| RY N / Royal Bank of Canada | 0.00 | 0.20 | 0.0407 | 0.0407 | |||||

| BA / The Boeing Company | 0.00 | 0.20 | 0.0407 | 0.0407 | |||||

| PRF / Invesco Exchange-Traded Fund Trust - Invesco RAFI US 1000 ETF | 0.00 | 0.20 | 0.0400 | 0.0400 | |||||

| BDJ / BlackRock Enhanced Equity Dividend Trust | 0.02 | 0.00 | 0.15 | 3.45 | 0.0290 | -0.0020 | |||

| CATX / Perspective Therapeutics, Inc. | 0.02 | 0.00 | 0.07 | 62.50 | 0.0126 | 0.0040 | |||

| ED / Consolidated Edison, Inc. | 0.00 | -100.00 | 0.00 | 0.0000 | |||||

| Loymar LTD Stock / Com (002656001) | 0.00 | -100.00 | 0.00 | 0.0000 |