Mga Batayang Estadistika

| Nilai Portofolio | $ 3,329,695,938 |

| Posisi Saat Ini | 141 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

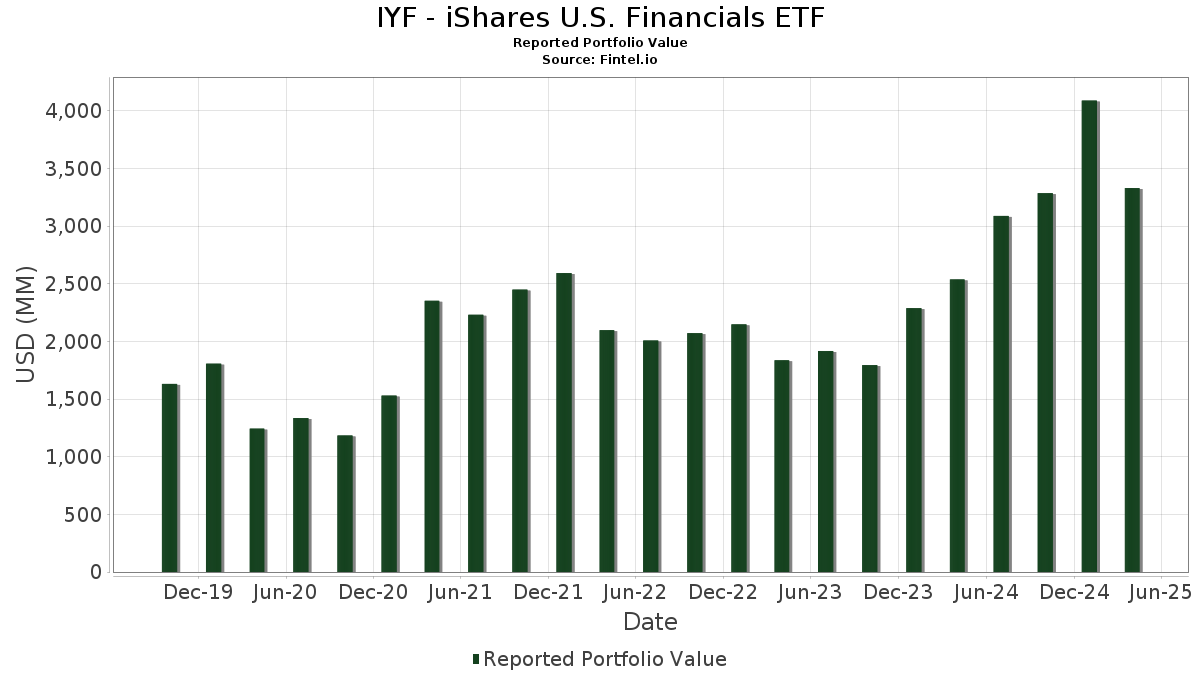

IYF - iShares U.S. Financials ETF telah mengungkapkan total kepemilikan 141 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 3,329,695,938 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama IYF - iShares U.S. Financials ETF adalah Berkshire Hathaway Inc. (US:BRK.B) , JPMorgan Chase & Co. (US:JPM) , Bank of America Corporation (US:BAC) , Wells Fargo & Company (US:WFC) , and The Goldman Sachs Group, Inc. (US:GS) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 0.35 | 98.00 | 2.9494 | 0.6176 | |

| 0.78 | 418.43 | 12.5930 | 0.4211 | |

| 0.99 | 80.25 | 2.4153 | 0.4188 | |

| 0.21 | 59.26 | 1.7836 | 0.4075 | |

| 3.94 | 157.30 | 4.7341 | 0.3527 | |

| 0.24 | 68.88 | 2.0730 | 0.2923 | |

| 0.29 | 66.15 | 1.9908 | 0.2601 | |

| 0.34 | 56.78 | 1.7090 | 0.2391 | |

| 0.15 | 46.90 | 1.4116 | 0.2104 | |

| 0.19 | 93.13 | 2.8029 | 0.1617 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 8.52 | 8.52 | 0.2565 | -2.9762 | |

| 1.26 | 308.30 | 9.2785 | -1.4998 | |

| 0.40 | 45.79 | 1.3780 | -0.4436 | |

| 0.43 | 56.56 | 1.7022 | -0.3662 | |

| 0.68 | 78.77 | 2.3706 | -0.2315 | |

| 0.18 | 98.29 | 2.9580 | -0.2234 | |

| 0.12 | 24.45 | 0.7357 | -0.2194 | |

| 1.13 | 77.01 | 2.3176 | -0.1774 | |

| 0.31 | 42.37 | 1.2751 | -0.1685 | |

| 0.09 | 80.33 | 2.4175 | -0.1525 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-06-23 untuk periode pelaporan 2025-04-30. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| BRK.B / Berkshire Hathaway Inc. | 0.78 | -23.72 | 418.43 | -13.21 | 12.5930 | 0.4211 | |||

| JPM / JPMorgan Chase & Co. | 1.26 | -21.09 | 308.30 | -27.78 | 9.2785 | -1.4998 | |||

| BAC / Bank of America Corporation | 3.94 | 5.23 | 157.30 | -9.36 | 4.7341 | 0.3527 | |||

| WFC / Wells Fargo & Company | 1.96 | -6.25 | 138.98 | -15.52 | 4.1827 | 0.0293 | |||

| GS / The Goldman Sachs Group, Inc. | 0.18 | -8.78 | 98.29 | -22.00 | 2.9580 | -0.2234 | |||

| PGR / The Progressive Corporation | 0.35 | -7.19 | 98.00 | 6.11 | 2.9494 | 0.6176 | |||

| SPGI / S&P Global Inc. | 0.19 | -7.17 | 93.13 | -10.98 | 2.8029 | 0.1617 | |||

| BLK / BlackRock, Inc. | 0.09 | -7.17 | 80.33 | -21.09 | 2.4175 | -0.1525 | |||

| SCHW / The Charles Schwab Corporation | 0.99 | 3.13 | 80.25 | 1.49 | 2.4153 | 0.4188 | |||

| MS / Morgan Stanley | 0.68 | -8.34 | 78.77 | -23.57 | 2.3706 | -0.2315 | |||

| C / Citigroup Inc. | 1.13 | -7.21 | 77.01 | -22.08 | 2.3176 | -0.1774 | |||

| CB / Chubb Limited | 0.24 | -7.19 | 68.88 | -2.34 | 2.0730 | 0.2923 | |||

| MMC / Marsh & McLennan Companies, Inc. | 0.29 | -7.18 | 66.15 | -3.50 | 1.9908 | 0.2601 | |||

| CME / CME Group Inc. | 0.21 | -7.19 | 59.26 | 8.73 | 1.7836 | 0.4075 | |||

| ICE / Intercontinental Exchange, Inc. | 0.34 | -7.19 | 56.78 | -2.46 | 1.7090 | 0.2391 | |||

| BX / Blackstone Inc. | 0.43 | -7.17 | 56.56 | -30.96 | 1.7022 | -0.3662 | |||

| AJG / Arthur J. Gallagher & Co. | 0.15 | -7.22 | 46.90 | -1.42 | 1.4116 | 0.2104 | |||

| KKR / KKR & Co. Inc. | 0.40 | -7.22 | 45.79 | -36.54 | 1.3780 | -0.4436 | |||

| MCO / Moody's Corporation | 0.09 | -7.16 | 42.61 | -15.77 | 1.2825 | 0.0052 | |||

| APO / Apollo Global Management, Inc. | 0.31 | -7.18 | 42.37 | -25.90 | 1.2751 | -0.1685 | |||

| AON / Aon plc | 0.12 | -7.17 | 41.45 | -11.18 | 1.2474 | 0.0692 | |||

| PNC / The PNC Financial Services Group, Inc. | 0.24 | -7.18 | 37.96 | -25.78 | 1.1426 | -0.1488 | |||

| USB / U.S. Bancorp | 0.93 | -7.19 | 37.42 | -21.64 | 1.1262 | -0.0794 | |||

| AFL / Aflac Incorporated | 0.33 | -8.43 | 35.70 | -7.32 | 1.0743 | 0.1019 | |||

| TRV / The Travelers Companies, Inc. | 0.13 | -8.45 | 35.52 | -1.37 | 1.0691 | 0.1598 | |||

| BK / The Bank of New York Mellon Corporation | 0.43 | -9.95 | 34.38 | -15.74 | 1.0347 | 0.0046 | |||

| ALL / The Allstate Corporation | 0.16 | -7.52 | 31.00 | -4.60 | 0.9330 | 0.1126 | |||

| TFC / Truist Financial Corporation | 0.79 | -7.44 | 30.45 | -25.48 | 0.9163 | -0.1152 | |||

| AIG / American International Group, Inc. | 0.37 | -11.26 | 30.24 | -1.79 | 0.9102 | 0.1327 | |||

| DFS / Discover Financial Services | 0.15 | -7.26 | 27.17 | -15.76 | 0.8178 | 0.0034 | |||

| AMP / Ameriprise Financial, Inc. | 0.06 | -8.12 | 26.96 | -20.35 | 0.8114 | -0.0432 | |||

| MET / MetLife, Inc. | 0.34 | -9.04 | 25.95 | -20.76 | 0.7811 | -0.0458 | |||

| MSCI / MSCI Inc. | 0.05 | -7.12 | 24.66 | -15.16 | 0.7423 | 0.0083 | |||

| COIN / Coinbase Global, Inc. | 0.12 | -7.22 | 24.45 | -35.38 | 0.7357 | -0.2194 | |||

| NU / Nu Holdings Ltd. | 1.93 | -5.23 | 23.99 | -11.03 | 0.7220 | 0.0412 | |||

| PRU / Prudential Financial, Inc. | 0.21 | -7.60 | 21.96 | -21.41 | 0.6609 | -0.0445 | |||

| HIG / The Hartford Insurance Group, Inc. | 0.17 | -7.83 | 21.12 | 1.36 | 0.6357 | 0.1096 | |||

| HOOD / Robinhood Markets, Inc. | 0.40 | -7.38 | 19.63 | -12.45 | 0.5907 | 0.0248 | |||

| ACGL / Arch Capital Group Ltd. | 0.21 | -7.03 | 19.46 | -9.42 | 0.5856 | 0.0433 | |||

| NDAQ / Nasdaq, Inc. | 0.24 | -7.19 | 18.67 | -14.10 | 0.5619 | 0.0132 | |||

| WTW / Willis Towers Watson Public Limited Company | 0.06 | -7.45 | 18.43 | -13.57 | 0.5547 | 0.0163 | |||

| BR / Broadridge Financial Solutions, Inc. | 0.07 | -7.19 | 16.88 | -5.57 | 0.5080 | 0.0567 | |||

| ARES / Ares Management Corporation | 0.11 | -7.39 | 16.79 | -28.74 | 0.5052 | -0.0895 | |||

| MTB / M&T Bank Corporation | 0.10 | -7.29 | 16.78 | -21.79 | 0.5051 | -0.0367 | |||

| RJF / Raymond James Financial, Inc. | 0.12 | 2.12 | 16.52 | -16.94 | 0.4970 | -0.0050 | |||

| BRO / Brown & Brown, Inc. | 0.14 | -8.04 | 15.71 | -2.83 | 0.4729 | 0.0647 | |||

| STT / State Street Corporation | 0.17 | -7.36 | 15.34 | -19.68 | 0.4617 | -0.0205 | |||

| LPLA / LPL Financial Holdings Inc. | 0.05 | -1.32 | 15.05 | -13.99 | 0.4530 | 0.0112 | |||

| FITB / Fifth Third Bancorp | 0.40 | -7.59 | 14.44 | -25.04 | 0.4346 | -0.0518 | |||

| CBOE / Cboe Global Markets, Inc. | 0.06 | -7.15 | 13.92 | 0.78 | 0.4190 | 0.0702 | |||

| MKL / Markel Group Inc. | 0.01 | -7.61 | 13.67 | -8.13 | 0.4113 | 0.0358 | |||

| CINF / Cincinnati Financial Corporation | 0.09 | -8.05 | 12.68 | -6.60 | 0.3815 | 0.0388 | |||

| WRB / W. R. Berkley Corporation | 0.17 | -7.19 | 12.53 | 13.10 | 0.3771 | 0.0974 | |||

| HBAN / Huntington Bancshares Incorporated | 0.86 | -7.72 | 12.48 | -22.04 | 0.3755 | -0.0286 | |||

| FCNCA / First Citizens BancShares, Inc. | 0.01 | -10.57 | 12.21 | -27.83 | 0.3675 | -0.0597 | |||

| TROW / T. Rowe Price Group, Inc. | 0.14 | -2.83 | 12.09 | -26.41 | 0.3640 | -0.0509 | |||

| RF / Regions Financial Corporation | 0.54 | -9.12 | 11.03 | -24.72 | 0.3319 | -0.0380 | |||

| NTRS / Northern Trust Corporation | 0.12 | -8.25 | 10.83 | -23.21 | 0.3259 | -0.0301 | |||

| IBKR / Interactive Brokers Group, Inc. | 0.06 | -7.66 | 10.79 | -27.02 | 0.3248 | -0.0486 | |||

| PFG / Principal Financial Group, Inc. | 0.13 | -7.20 | 10.01 | -16.54 | 0.3011 | -0.0016 | |||

| FNF / Fidelity National Financial, Inc. | 0.15 | -8.08 | 9.88 | 1.22 | 0.2975 | 0.0509 | |||

| FDS / FactSet Research Systems Inc. | 0.02 | -7.25 | 9.77 | -15.50 | 0.2940 | 0.0021 | |||

| CFG / Citizens Financial Group, Inc. | 0.26 | -8.77 | 9.76 | -29.25 | 0.2937 | -0.0545 | |||

| TW / Tradeweb Markets Inc. | 0.07 | -5.98 | 9.67 | 2.47 | 0.2911 | 0.0528 | |||

| L / Loews Corporation | 0.11 | -6.52 | 9.37 | -5.00 | 0.2819 | 0.0330 | |||

| EG / Everest Group, Ltd. | 0.03 | -7.25 | 9.18 | -4.23 | 0.2762 | 0.0343 | |||

| US0669225197 / BlackRock Cash Funds: Institutional, SL Agency Shares | 8.52 | -93.34 | 8.52 | -93.34 | 0.2565 | -2.9762 | |||

| UNM / Unum Group | 0.11 | 4.55 | 8.38 | 6.48 | 0.2524 | 0.0536 | |||

| KEY / KeyCorp | 0.56 | -6.83 | 8.29 | -23.10 | 0.2495 | -0.0227 | |||

| SOFI / SoFi Technologies, Inc. | 0.65 | -5.00 | 8.08 | -24.69 | 0.2432 | -0.0277 | |||

| EQH / Equitable Holdings, Inc. | 0.16 | 0.00 | 7.77 | -9.13 | 0.2339 | 0.0180 | |||

| RNR / RenaissanceRe Holdings Ltd. | 0.03 | -5.82 | 7.49 | -2.03 | 0.2254 | 0.0324 | |||

| RGA / Reinsurance Group of America, Incorporated | 0.04 | -7.41 | 7.44 | -23.88 | 0.2239 | -0.0229 | |||

| EWBC / East West Bancorp, Inc. | 0.08 | -5.95 | 7.15 | -21.86 | 0.2153 | -0.0158 | |||

| NLY / Annaly Capital Management, Inc. | 0.34 | -5.49 | 6.65 | -9.24 | 0.2002 | 0.0151 | |||

| US0669224778 / BlackRock Cash Funds: Treasury, SL Agency Shares | 6.32 | -45.78 | 6.32 | -45.77 | 0.1901 | -0.1040 | |||

| GL / Globe Life Inc. | 0.05 | -14.03 | 6.20 | -13.15 | 0.1866 | 0.0064 | |||

| AIZ / Assurant, Inc. | 0.03 | -9.03 | 5.98 | -18.52 | 0.1800 | -0.0053 | |||

| OWL / Blue Owl Capital Inc. | 0.32 | -4.46 | 5.90 | -31.95 | 0.1776 | -0.0413 | |||

| KNSL / Kinsale Capital Group, Inc. | 0.01 | -5.66 | 5.81 | -7.08 | 0.1749 | 0.0170 | |||

| FHN / First Horizon Corporation | 0.32 | -8.74 | 5.72 | -24.62 | 0.1721 | -0.0194 | |||

| AFG / American Financial Group, Inc. | 0.04 | -7.46 | 5.52 | -14.17 | 0.1661 | 0.0038 | |||

| ALLY / Ally Financial Inc. | 0.16 | -7.57 | 5.33 | -22.54 | 0.1604 | -0.0133 | |||

| ORI / Old Republic International Corporation | 0.14 | -9.87 | 5.29 | -7.35 | 0.1593 | 0.0150 | |||

| PRI / Primerica, Inc. | 0.02 | -9.14 | 5.29 | -17.94 | 0.1592 | -0.0035 | |||

| HLI / Houlihan Lokey, Inc. | 0.03 | -3.83 | 5.24 | -14.22 | 0.1576 | 0.0035 | |||

| SF / Stifel Financial Corp. | 0.06 | -5.69 | 5.17 | -30.25 | 0.1556 | -0.0315 | |||

| CG / The Carlyle Group Inc. | 0.13 | -5.91 | 5.15 | -35.26 | 0.1551 | -0.0459 | |||

| MKTX / MarketAxess Holdings Inc. | 0.02 | -4.86 | 4.99 | -4.44 | 0.1502 | 0.0183 | |||

| JEF / Jefferies Financial Group Inc. | 0.11 | -6.74 | 4.97 | -43.32 | 0.1495 | -0.0718 | |||

| WBS / Webster Financial Corporation | 0.10 | -6.81 | 4.93 | -26.83 | 0.1483 | -0.0217 | |||

| AGNC / AGNC Investment Corp. | 0.53 | 1.34 | 4.66 | -10.24 | 0.1404 | 0.0092 | |||

| SEIC / SEI Investments Company | 0.06 | -7.19 | 4.65 | -16.08 | 0.1400 | 0.0001 | |||

| MORN / Morningstar, Inc. | 0.02 | -4.71 | 4.64 | -17.44 | 0.1396 | -0.0023 | |||

| PNFP / Pinnacle Financial Partners, Inc. | 0.05 | -6.54 | 4.64 | -24.91 | 0.1395 | -0.0164 | |||

| CBSH / Commerce Bancshares, Inc. | 0.08 | -4.63 | 4.58 | -13.28 | 0.1378 | 0.0045 | |||

| WAL / Western Alliance Bancorporation | 0.07 | -6.75 | 4.57 | -26.03 | 0.1376 | -0.0184 | |||

| AXS / AXIS Capital Holdings Limited | 0.05 | -8.35 | 4.51 | -3.01 | 0.1357 | 0.0183 | |||

| WTFC / Wintrust Financial Corporation | 0.04 | -5.41 | 4.41 | -19.62 | 0.1328 | -0.0058 | |||

| CMA / Comerica Incorporated | 0.08 | -3.64 | 4.36 | -23.07 | 0.1311 | -0.0118 | |||

| EVR / Evercore Inc. | 0.02 | -9.53 | 4.33 | -36.24 | 0.1303 | -0.0411 | |||

| CFR / Cullen/Frost Bankers, Inc. | 0.04 | -4.41 | 4.20 | -20.13 | 0.1263 | -0.0064 | |||

| RYAN / Ryan Specialty Holdings, Inc. | 0.06 | -8.13 | 4.09 | -9.60 | 0.1231 | 0.0089 | |||

| BPOP / Popular, Inc. | 0.04 | -6.92 | 4.06 | -13.71 | 0.1221 | 0.0034 | |||

| XP / XP Inc. | 0.25 | -7.16 | 4.04 | 9.48 | 0.1217 | 0.0285 | |||

| ZION / Zions Bancorporation, National Association | 0.09 | -8.43 | 3.87 | -28.84 | 0.1164 | -0.0208 | |||

| MTG / MGIC Investment Corporation | 0.15 | -6.47 | 3.84 | -8.77 | 0.1156 | 0.0093 | |||

| SNV / Synovus Financial Corp. | 0.09 | -8.68 | 3.78 | -29.87 | 0.1136 | -0.0223 | |||

| RLI / RLI Corp. | 0.05 | -3.38 | 3.76 | -2.52 | 0.1131 | 0.0158 | |||

| STWD / Starwood Property Trust, Inc. | 0.20 | -3.74 | 3.75 | -4.53 | 0.1129 | 0.0137 | |||

| PB / Prosperity Bancshares, Inc. | 0.05 | -4.35 | 3.73 | -18.81 | 0.1124 | -0.0037 | |||

| THG / The Hanover Insurance Group, Inc. | 0.02 | -5.83 | 3.65 | 2.19 | 0.1097 | 0.0196 | |||

| SLM / SLM Corporation | 0.13 | -8.51 | 3.62 | -5.23 | 0.1091 | 0.0125 | |||

| FAF / First American Financial Corporation | 0.06 | -10.43 | 3.58 | -13.83 | 0.1078 | 0.0028 | |||

| BEN / Franklin Resources, Inc. | 0.19 | 1.93 | 3.58 | -14.02 | 0.1076 | 0.0026 | |||

| RITM / Rithm Capital Corp. | 0.32 | -8.15 | 3.57 | -10.78 | 0.1074 | 0.0064 | |||

| VOYA / Voya Financial, Inc. | 0.06 | -6.23 | 3.50 | -21.82 | 0.1055 | -0.0077 | |||

| OMF / OneMain Holdings, Inc. | 0.07 | -8.01 | 3.28 | -22.04 | 0.0986 | -0.0075 | |||

| AMG / Affiliated Managers Group, Inc. | 0.02 | -2.37 | 3.04 | -13.98 | 0.0915 | 0.0023 | |||

| IVZ / Invesco Ltd. | 0.22 | -10.43 | 3.03 | -35.13 | 0.0912 | -0.0267 | |||

| COLB / Columbia Banking System, Inc. | 0.13 | -4.72 | 2.90 | -23.43 | 0.0873 | -0.0083 | |||

| FNB / F.N.B. Corporation | 0.22 | -6.96 | 2.89 | -22.38 | 0.0871 | -0.0070 | |||

| AGO / Assured Guaranty Ltd. | 0.03 | -8.91 | 2.73 | -15.51 | 0.0823 | 0.0006 | |||

| OZK / Bank OZK | 0.06 | -7.16 | 2.69 | -22.13 | 0.0810 | -0.0063 | |||

| WTM / White Mountains Insurance Group, Ltd. | 0.00 | -6.29 | 2.66 | -14.29 | 0.0800 | 0.0017 | |||

| LAZ / Lazard, Inc. | 0.07 | -6.54 | 2.65 | -33.14 | 0.0799 | -0.0203 | |||

| JHG / Janus Henderson Group plc | 0.08 | -5.75 | 2.64 | -30.34 | 0.0794 | -0.0162 | |||

| LNC / Lincoln National Corporation | 0.08 | 0.00 | 2.47 | -9.38 | 0.0745 | 0.0056 | |||

| TPG / TPG Inc. | 0.05 | -5.91 | 2.47 | -35.00 | 0.0743 | -0.0216 | |||

| KMPR / Kemper Corporation | 0.04 | -6.23 | 2.26 | -17.48 | 0.0681 | -0.0011 | |||

| BHF / Brighthouse Financial, Inc. | 0.04 | -10.43 | 2.20 | -15.53 | 0.0663 | 0.0005 | |||

| VIRT / Virtu Financial, Inc. | 0.05 | -7.10 | 2.00 | -9.19 | 0.0601 | 0.0046 | |||

| CACC / Credit Acceptance Corporation | 0.00 | -2.96 | 1.90 | -6.87 | 0.0572 | 0.0057 | |||

| FHB / First Hawaiian, Inc. | 0.08 | -0.71 | 1.85 | -17.80 | 0.0557 | -0.0012 | |||

| BOKF / BOK Financial Corporation | 0.01 | -1.47 | 1.37 | -16.86 | 0.0413 | -0.0004 | |||

| RKT / Rocket Companies, Inc. | 0.09 | -3.12 | 1.18 | -0.76 | 0.0355 | 0.0055 | |||

| CNA / CNA Financial Corporation | 0.02 | -12.14 | 0.74 | -13.69 | 0.0224 | 0.0006 | |||

| TFSL / TFS Financial Corporation | 0.04 | 21.60 | 0.52 | 14.96 | 0.0155 | 0.0042 | |||

| UWMC / UWM Holdings Corporation | 0.08 | 3.51 | 0.38 | -19.20 | 0.0115 | -0.0005 | |||

| XAF FINANCIAL JUN25 / DE (N/A) | 0.21 | 0.0063 | 0.0063 | ||||||

| S P MID 400 EMINI JUN25 / DE (N/A) | 0.04 | 0.0012 | 0.0012 |