Mga Batayang Estadistika

| Nilai Portofolio | $ 4,197,031,201 |

| Posisi Saat Ini | 2,047 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

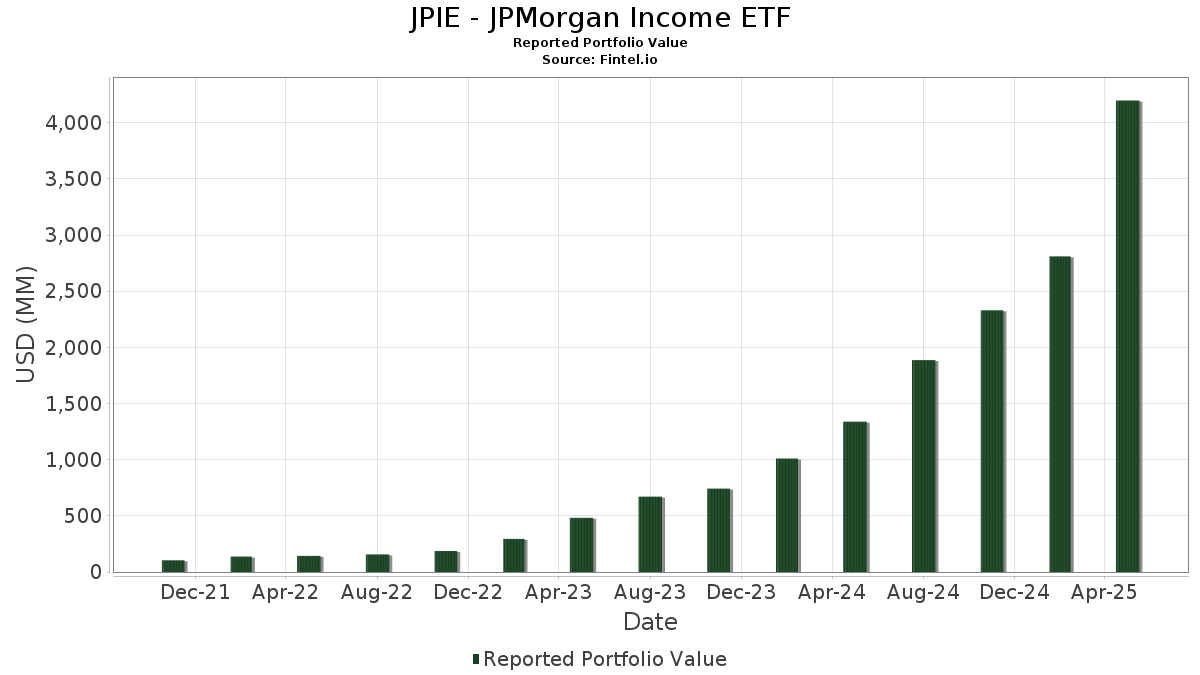

JPIE - JPMorgan Income ETF telah mengungkapkan total kepemilikan 2,047 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 4,197,031,201 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama JPIE - JPMorgan Income ETF adalah Ginnie Mae (US:US21H0526606) , JPMorgan Trust I. - JPMorgan Prime Money Market Fund IM (US:JIMXX) , GINNIE MAE (US:US21H0626695) , Ginnie Mae (US:US21H0526788) , and Multifamily Connecticut Avenue Securities Trust 2020-01 (US:US62548QAD34) . Posisi baru JPIE - JPMorgan Income ETF meliputi: Ginnie Mae (US:US21H0526606) , GINNIE MAE (US:US21H0626695) , Ginnie Mae (US:US21H0526788) , Multifamily Connecticut Avenue Securities Trust 2020-01 (US:US62548QAD34) , and COMMERCIAL MORTGAGE BACKED SECURITIES (US:US62547NAB55) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 289.58 | 7.5238 | 6.1392 | ||

| 266.54 | 266.60 | 6.9268 | 4.5122 | |

| -27.61 | -0.7173 | 2.9334 | ||

| 86.84 | 2.2564 | 2.2564 | ||

| 80.10 | 2.0812 | 2.0812 | ||

| 75.64 | 1.9652 | 1.9652 | ||

| 75.64 | 1.9652 | 1.9652 | ||

| 71.32 | 1.8530 | 1.8530 | ||

| 53.86 | 1.3993 | 1.3993 | ||

| 62.71 | 1.6293 | 1.1671 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| -168.75 | -4.3844 | -4.0222 | ||

| -82.19 | -2.1356 | -2.1356 | ||

| -35.54 | -0.9234 | -0.9234 | ||

| 83.12 | 2.1598 | -0.6748 | ||

| 30.92 | 0.8032 | -0.5485 | ||

| 37.29 | 0.9688 | -0.3012 | ||

| 33.50 | 0.8705 | -0.2959 | ||

| 33.50 | 0.8705 | -0.2959 | ||

| 33.88 | 0.8802 | -0.2856 | ||

| 29.09 | 0.7557 | -0.2586 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2025-07-28 untuk periode pelaporan 2025-05-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| US21H0526606 / Ginnie Mae | 289.58 | 1,454.26 | 7.5238 | 6.1392 | |||||

| JIMXX / JPMorgan Trust I. - JPMorgan Prime Money Market Fund IM | 266.54 | 271.61 | 266.60 | 271.54 | 6.9268 | 4.5122 | |||

| GNMA II, 30 Year / ABS-MBS (US3618N5JE04) | 86.84 | 2.2564 | 2.2564 | ||||||

| GNMA II, 30 Year / ABS-MBS (US3618N5GQ60) | 83.12 | -1.32 | 2.1598 | -0.6748 | |||||

| GNMA II, 30 Year / ABS-MBS (US3618N5MS52) | 80.10 | 2.0812 | 2.0812 | ||||||

| GNMA II, 30 Year / ABS-MBS (US3618N5KX65) | 75.64 | 1.9652 | 1.9652 | ||||||

| GNMA II, 30 Year / ABS-MBS (US3618N5KX65) | 75.64 | 1.9652 | 1.9652 | ||||||

| GNMA II, 30 Year / ABS-MBS (US3618N5KY49) | 71.32 | 1.8530 | 1.8530 | ||||||

| US21H0626695 / GINNIE MAE | 62.71 | 908.33 | 1.6293 | 1.1671 | |||||

| US21H0526788 / Ginnie Mae | 53.86 | 1.3993 | 1.3993 | ||||||

| GNMA II, 30 Year / ABS-MBS (US3618N5EX30) | 37.29 | -1.21 | 0.9688 | -0.3012 | |||||

| GNMA II, 30 Year / ABS-MBS (US3622ADUJ59) | 37.18 | 0.9661 | 0.9661 | ||||||

| GNMA II, 30 Year / ABS-MBS (US3622ADKH04) | 33.88 | -2.22 | 0.8802 | -0.2856 | |||||

| GNMA II, 30 Year / ABS-MBS (US3622ADKG21) | 33.50 | -3.34 | 0.8705 | -0.2959 | |||||

| GNMA II, 30 Year / ABS-MBS (US3622ADKG21) | 33.50 | -3.34 | 0.8705 | -0.2959 | |||||

| CITI Asset Receivables Trust I / ABS-O (US17302EAA64) | 32.98 | 0.8570 | 0.8570 | ||||||

| GNMA II, 30 Year / ABS-MBS (US36179Y2N36) | 30.92 | -23.04 | 0.8032 | -0.5485 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 29.09 | -3.50 | 0.7557 | -0.2586 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 29.09 | -3.50 | 0.7557 | -0.2586 | |||||

| GNMA II, 30 Year / ABS-MBS (US3618N5GR44) | 29.06 | -0.80 | 0.7550 | -0.2307 | |||||

| US62548QAD34 / Multifamily Connecticut Avenue Securities Trust 2020-01 | 27.36 | 17.06 | 0.7108 | -0.0756 | |||||

| US62547NAB55 / COMMERCIAL MORTGAGE BACKED SECURITIES | 22.75 | 134.42 | 0.5912 | 0.2645 | |||||

| ROCK Trust, Series 2024-CNTR, Class E / ABS-MBS (US74970WAJ99) | 21.31 | 72.91 | 0.5537 | 0.1389 | |||||

| GNMA II, 30 Year / ABS-MBS (US36179YYW82) | 19.98 | -4.90 | 0.5191 | -0.1878 | |||||

| GNMA II, 30 Year / ABS-MBS (US3618N5PL72) | 19.09 | 0.4959 | 0.4959 | ||||||

| Citi Asset Receivables Trust I, Series 2025-3, Class CERT / ABS-MBS (US17302FAA30) | 17.74 | 0.4610 | 0.4610 | ||||||

| Octagon Ltd., Series 2022-1A, Class DR / ABS-CBDO (US67579ABE64) | 16.80 | 0.4365 | 0.4365 | ||||||

| US20753BAB80 / Connecticut Avenue Securities Trust 2023-R07 | 16.67 | -0.98 | 0.4332 | -0.1334 | |||||

| GNMA II, 30 Year / ABS-MBS (US3622ADHD37) | 16.55 | -9.18 | 0.4300 | -0.1832 | |||||

| CITI Asset Receivables Trust I, Series 2025-2, Class CERT / ABS-MBS (US17292CAA27) | 15.99 | 0.4155 | 0.4155 | ||||||

| PRET Trust, Series 2025-NPL1, Class A1 / ABS-MBS (US74143VAA26) | 14.93 | -5.78 | 0.3879 | -0.1452 | |||||

| PRET Trust, Series 2025-NPL1, Class A1 / ABS-MBS (US74143VAA26) | 14.93 | -5.78 | 0.3879 | -0.1452 | |||||

| IRV Trust, Series 2025-200P, Class A / ABS-MBS (US45006HAA95) | 14.59 | -1.70 | 0.3791 | -0.1204 | |||||

| GNMA II, 30 Year / ABS-MBS (US3622ADHB70) | 13.79 | -9.87 | 0.3582 | -0.1565 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 12.51 | -4.66 | 0.3250 | -0.1165 | |||||

| GNMA II, 30 Year / ABS-MBS (US3622ADG939) | 11.95 | -6.51 | 0.3105 | -0.1196 | |||||

| GNMA II, 30 Year / ABS-MBS (US3622ADKE72) | 11.61 | -2.96 | 0.3017 | -0.1010 | |||||

| ROCK Trust, Series 2024-CNTR, Class D / ABS-MBS (US74970WAG50) | 11.48 | -1.10 | 0.2983 | -0.0924 | |||||

| GNMA II, 30 Year / ABS-MBS (US3622ADHC53) | 11.38 | -9.12 | 0.2958 | -0.1258 | |||||

| US55361AAU88 / MSWF Commercial Mortgage Trust 2023-2 | 11.37 | -1.64 | 0.2953 | -0.0935 | |||||

| GNMA II, 30 Year / ABS-MBS (US3622ADH689) | 11.24 | -4.37 | 0.2920 | -0.1035 | |||||

| GNMA II, 30 Year / ABS-MBS (US3622ADH689) | 11.24 | -4.37 | 0.2920 | -0.1035 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 11.22 | -3.96 | 0.2915 | -0.1016 | |||||

| FHLMC, Multi-Family Structured Credit Risk, Series 2024-MN9, Class M1 / ABS-MBS (US355917AA32) | 11.00 | 989.21 | 0.2858 | 0.2518 | |||||

| US35564KGS24 / FHLMC Structured Agency Credit Risk Debt Notes, Series 2021-HQA2, Class B2 | 10.61 | 50.24 | 0.2757 | 0.0380 | |||||

| GNMA II, 30 Year / ABS-MBS (US3622ADWC88) | 10.39 | 0.2698 | 0.2698 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 10.18 | -3.62 | 0.2644 | -0.0909 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 10.18 | -3.62 | 0.2644 | -0.0909 | |||||

| GNMA II, 30 Year / ABS-MBS (US3618JSAU82) | 10.12 | -0.70 | 0.2629 | -0.0800 | |||||

| GNMA II, 30 Year / ABS-MBS (US3618JSAV65) | 10.12 | -0.71 | 0.2628 | -0.0800 | |||||

| GNMA II, 30 Year / ABS-MBS (US3618JSAV65) | 10.12 | -0.71 | 0.2628 | -0.0800 | |||||

| US1248EPCD32 / CCO Holdings LLC / CCO Holdings Capital Corp. | 10.10 | 30.12 | 0.2624 | 0.0012 | |||||

| Harvest Commercial Capital Loan Trust, Series 2025-1, Class A / ABS-MBS (US41757CAA09) | 9.95 | 95.90 | 0.2585 | 0.0876 | |||||

| GNMA II, 30 Year / ABS-MBS (US3618JB6K27) | 9.90 | -2.65 | 0.2573 | -0.0850 | |||||

| GNMA II, 30 Year / ABS-MBS (US3622ADH762) | 9.89 | -5.33 | 0.2570 | -0.0946 | |||||

| NRM FNT1 Excess LLC, Series 2024-FNT1, Class A / ABS-O (US62956YAA73) | 9.82 | -5.99 | 0.2552 | -0.0964 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 9.68 | -2.83 | 0.2516 | -0.0837 | |||||

| Subway Funding LLC, Series 2024-1A, Class A23 / ABS-O (US864300AE83) | 9.53 | 166.77 | 0.2476 | 0.1274 | |||||

| Subway Funding LLC, Series 2024-1A, Class A23 / ABS-O (US864300AE83) | 9.53 | 166.77 | 0.2476 | 0.1274 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 9.42 | -4.30 | 0.2447 | -0.0865 | |||||

| US35564KJB61 / FHLMC STACR REMIC Trust, Series 2021-DNA5, Class B2 | 9.38 | 146.09 | 0.2436 | 0.1154 | |||||

| US38381ECK29 / GNMA, Series 2021-195, Class IX | 9.18 | 463.57 | 0.2384 | 0.1836 | |||||

| US12554XAU63 / CIFC Funding 2019-V Ltd | 9.03 | 0.09 | 0.2345 | -0.0689 | |||||

| US35563GAB59 / Freddie Mac Multifamily Structured Credit Risk | 8.97 | 83.61 | 0.2331 | 0.0687 | |||||

| Diversified Gas & Oil Corp. / DBT (NO0013513606) | 8.90 | 0.2312 | 0.2312 | ||||||

| BMO Mortgage Trust, Series 2024-5C4, Class A3 / ABS-MBS (US09660SAU42) | 8.78 | -0.56 | 0.2281 | -0.0690 | |||||

| US46644FAX96 / JPMBB Commercial Mortgage Securities Trust 2015-C28 | 8.68 | 0.39 | 0.2255 | -0.0654 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 8.56 | 0.2223 | 0.2223 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 8.56 | 0.2223 | 0.2223 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 8.44 | -4.53 | 0.2192 | -0.0782 | |||||

| US1248EPCE15 / CCO Holdings LLC / CCO Holdings Capital Corp | 8.37 | 52.40 | 0.2175 | 0.0327 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 8.17 | -4.48 | 0.2122 | -0.0755 | |||||

| Pret LLC, Series 2025-NPL2, Class A1 / ABS-O (US69392JAA79) | 8.16 | 0.2119 | 0.2119 | ||||||

| Madison Park Funding Ltd., Series 2021-49A, Class B1R / ABS-CBDO (US55820VAN38) | 8.03 | -0.27 | 0.2086 | -0.0623 | |||||

| US35564KE476 / STACR_22-HQA3 | 7.97 | -0.57 | 0.2070 | -0.0626 | |||||

| US38380RV499 / GNMA, Series 2021-71 | 7.97 | 316.47 | 0.2070 | 0.1426 | |||||

| IRV Trust, Series 2025-200P, Class B / ABS-MBS (US45006HAC51) | 7.52 | 40.38 | 0.1954 | 0.0151 | |||||

| OBX Trust, Series 2025-NQM2, Class A1 / ABS-MBS (US67120VAA35) | 7.48 | 0.1945 | 0.1945 | ||||||

| US35564KDX46 / Freddie Mac Structured Agency Credit Risk Debt Notes | 7.33 | -2.05 | 0.1903 | -0.0613 | |||||

| NRM FHT1 Excess Owner LLC, Series 2025-FHT1, Class A / ABS-MBS (US64832EAA73) | 7.15 | 0.1857 | 0.1857 | ||||||

| US35564KFH77 / FREDDIE MAC STACR REMIC TRUST 2021-DNA3 SER 2021-DNA3 CL B2 V/R REGD 144A P/P 6.26000000 | 7.08 | -1.65 | 0.1840 | -0.0583 | |||||

| US200474AE49 / COMMERCIAL MORTGAGE BACKED SECURITIES | 7.06 | -1.36 | 0.1834 | -0.0574 | |||||

| Connecticut Avenue Securities Trust, Series 2024-R05, Class 2B1 / ABS-MBS (US20754XAG88) | 7.03 | 0.1826 | 0.1826 | ||||||

| Barings CLO Ltd., Series 2022-1A, Class B / ABS-CBDO (US06760DAC20) | 7.02 | 0.23 | 0.1823 | -0.0533 | |||||

| PRET LLC, Series 2025-NPL3, Class A1 / ABS-O (US74143HAA32) | 6.99 | 0.1817 | 0.1817 | ||||||

| MFA Trust, Series 2024-RTL3, Class A1 / ABS-MBS (US59319PAA49) | 6.86 | 77.27 | 0.1781 | 0.0480 | |||||

| US35564KWA32 / Freddie Mac STACR REMIC Trust, Series 2022-DNA3, Class B1 | 6.69 | 519.44 | 0.1738 | 0.1375 | |||||

| US35564KYW34 / Freddie Mac Structured Agency Credit Risk Debt Notes | 6.63 | -1.35 | 0.1721 | -0.0539 | |||||

| MFA Trust, Series 2024-NPL1, Class A1 / ABS-MBS (US58004YAA73) | 6.61 | -3.83 | 0.1717 | -0.0595 | |||||

| SBA Small Business Investment Cos., Series 2024-10A, Class 1 / ABS-O (US831641FX82) | 6.60 | -1.43 | 0.1715 | -0.0539 | |||||

| US055986AC73 / BMO 2023-5C1 Mortgage Trust | 6.58 | -0.38 | 0.1709 | -0.0513 | |||||

| CIFC Funding Ltd., Series 2022-2A, Class BR / ABS-CBDO (US12567MAS08) | 6.56 | -0.65 | 0.1704 | -0.0517 | |||||

| US35564KCP21 / STACR 2021-HQA1 B2 | 6.47 | 78.74 | 0.1682 | 0.0463 | |||||

| US88033GDB32 / CORP. NOTE | 6.27 | 46.02 | 0.1629 | 0.0184 | |||||

| US35564KWT23 / STACR_22-DNA4 | 6.24 | -0.87 | 0.1620 | -0.0496 | |||||

| LCM Ltd., Series 31A, Class AR / ABS-CBDO (US50201QAL86) | 6.01 | -0.03 | 0.1560 | -0.0461 | |||||

| LCM Ltd., Series 31A, Class AR / ABS-CBDO (US50201QAL86) | 6.01 | -0.03 | 0.1560 | -0.0461 | |||||

| US06644EAG35 / BANK5 2023 5YR1 | 6.00 | -0.51 | 0.1560 | -0.0471 | |||||

| US06211EAA91 / BANK5 2023-5YR3 | 6.00 | -0.30 | 0.1559 | -0.0466 | |||||

| PRET LLC, Series 2025-NPL4, Class A1 / ABS-MBS (US74136UAA34) | 5.91 | 0.1536 | 0.1536 | ||||||

| PRET LLC, Series 2025-NPL5, Class A1 / ABS-MBS (US74143LAA44) | 5.72 | 0.1486 | 0.1486 | ||||||

| New York City Housing Development Corp., Multi-Family Mortgage, 8 Spruce Street Project, Series 2024 CL A / DBT (US64966TGS78) | 5.67 | -0.54 | 0.1472 | -0.0445 | |||||

| FREMF Mortgage Trust, Series 2020-K739, Class D / ABS-MBS (US30289SAS68) | 5.66 | 2.48 | 0.1470 | -0.0387 | |||||

| Affirm Asset Securitization Trust, Series 2024-B, Class A / ABS-O (US00835AAA60) | 5.62 | -0.04 | 0.1460 | -0.0432 | |||||

| US1248EPCB75 / CCO Holdings LLC / CCO Holdings Capital Corp 5.375% 06/01/2029 144A | 5.61 | 45.55 | 0.1458 | 0.0160 | |||||

| US20755CAB46 / Connecticut Avenue Securities Trust 2023-R08 | 5.56 | 0.1445 | 0.1445 | ||||||

| ROCK Trust, Series 2024-CNTR, Class A / ABS-MBS (US74970WAA80) | 5.56 | -0.18 | 0.1443 | -0.0430 | |||||

| US38381JZQ39 / Government National Mortgage Association | 5.48 | -2.34 | 0.1423 | -0.0464 | |||||

| US46643TAL61 / JPMBB Commercial Mortgage Securities Trust, Series 2014-C26, Class D | 5.39 | -2.93 | 0.1402 | -0.0468 | |||||

| US17326CAA27 / CGMS Commercial Mortgage Trust 2017-B1 | 5.39 | -1.84 | 0.1401 | -0.0447 | |||||

| Connecticut Avenue Securities Trust, Series 2023-R07, Class 2B1 / ABS-MBS (US20753BAF94) | 5.36 | -1.58 | 0.1391 | -0.0440 | |||||

| US38380P8J69 / GNMA, Series 2020-147 | 5.30 | 0.1377 | 0.1377 | ||||||

| Jonah Energy ABS II LLC, Series 2025-1A, Class B / ABS-O (US479913AF21) | 5.19 | -2.13 | 0.1348 | -0.0436 | |||||

| FHLMC, Multi-Family Structured Pass-Through Certificates, Series 2024-MN9, Class M2 / ABS-MBS (US355917AB15) | 5.14 | -0.89 | 0.1335 | -0.0409 | |||||

| US29425AAG85 / CITIGROUP COMMERCIAL MORTGAGE TRUST 2015-GC33 SER 2015-GC33 CL B V/R REGD 4.72112200 | 5.12 | 0.83 | 0.1331 | -0.0379 | |||||

| US538034AR08 / Live Nation Entertainment Inc 4.75% 10/15/2027 144A | 5.10 | 31.95 | 0.1326 | 0.0024 | |||||

| US983133AA70 / Wynn Resorts Finance LLC / Wynn Resorts Capital Corp 5.125% 10/01/2029 144A | 5.09 | 45.64 | 0.1323 | 0.0146 | |||||

| US20754KAB70 / Fannie Mae Connecticut Avenue Securities | 5.03 | -0.63 | 0.1306 | -0.0397 | |||||

| Connecticut Avenue Securities Trust, Series 2024-R06, Class 1M2 / ABS-MBS (US20755RAC97) | 5.02 | 0.1303 | 0.1303 | ||||||

| Connecticut Avenue Securities Trust, Series 2024-R06, Class 1M2 / ABS-MBS (US20755RAC97) | 5.02 | 0.1303 | 0.1303 | ||||||

| US71643VAB18 / Petroleos Mexicanos | 5.00 | 418.67 | 0.1299 | 0.0975 | |||||

| ReadyCap Holdings LLC, Series QIB / DBT (US755763AE91) | 4.99 | -0.44 | 0.1298 | -0.0391 | |||||

| ReadyCap Holdings LLC, Series QIB / DBT (US755763AE91) | 4.99 | -0.44 | 0.1298 | -0.0391 | |||||

| Purewest ABS Issuer LLC, Series 2025-1, Class B / ABS-O (US74628AAC80) | 4.97 | 0.1292 | 0.1292 | ||||||

| US35564KDY29 / Freddie Mac Structured Agency Credit Risk Debt Notes | 4.96 | 0.04 | 0.1290 | -0.0380 | |||||

| US03463WAF05 / Angel Oak Mortgage Trust I LLC, Series 2019-2, Class B2 | 4.95 | 0.04 | 0.1287 | -0.0379 | |||||

| US65343HAA95 / Nexstar Escrow, Inc. | 4.88 | 46.48 | 0.1267 | 0.0147 | |||||

| US88033GDH02 / Tenet Healthcare Corp | 4.87 | 47.71 | 0.1266 | 0.0156 | |||||

| Connecticut Avenue Securities Trust, Series 2024-R01, Class 1M1 / ABS-MBS (US20753UAA88) | 4.87 | -9.86 | 0.1265 | -0.0553 | |||||

| Connecticut Avenue Securities Trust, Series 2024-R01, Class 1M1 / ABS-MBS (US20753UAA88) | 4.87 | -9.86 | 0.1265 | -0.0553 | |||||

| US94989KBC62 / Wells Fargo Commercial Mortgage Trust 2015-C29 | 4.87 | 1.82 | 0.1265 | -0.0344 | |||||

| US71654QDD16 / Petroleos Mexicanos | 4.86 | 5.49 | 0.1263 | -0.0288 | |||||

| FREMF Mortgage Trust, Series 2017-K69, Class D / ABS-MBS (US30305KAL89) | 4.83 | 103.71 | 0.1256 | 0.0457 | |||||

| FREMF Mortgage Trust, Series 2017-K69, Class D / ABS-MBS (US30305KAL89) | 4.83 | 103.71 | 0.1256 | 0.0457 | |||||

| PMT Loan Trust, Series 2025-INV5, Class A2 / ABS-MBS (US729907AB13) | 4.82 | 0.1252 | 0.1252 | ||||||

| US853496AD99 / Standard Industries Inc/NJ | 4.81 | 32.18 | 0.1249 | 0.0025 | |||||

| Morgan Stanley Capital I Trust, Series 2016-UBS9, Class B / ABS-MBS (US61766CAK53) | 4.80 | -0.31 | 0.1248 | -0.0373 | |||||

| Multi-Family Connecticut Avenue Securities Trust, Series 2025-01, Class M1 / ABS-MBS (US62549CAA99) | 4.80 | 0.1247 | 0.1247 | ||||||

| US3140LK4P59 / FNMA, Other | 4.75 | -1.17 | 0.1234 | -0.0383 | |||||

| Nautical Solutions / ABS-O (N/A) | 4.73 | 0.1230 | 0.1230 | ||||||

| US05583JAN28 / BPCE SA | 4.71 | -0.40 | 0.1223 | -0.0368 | |||||

| US05549GAA94 / BHMS 2018-ATLS | 4.71 | 0.11 | 0.1223 | -0.0359 | |||||

| WFC / Wells Fargo & Company - Depositary Receipt (Common Stock) | 4.71 | -0.17 | 0.1223 | -0.0364 | |||||

| Neuberger Berman Loan Advisers CLO Ltd., Series 2020-38A, Class BR2 / ABS-CBDO (US64133RAW60) | 4.69 | -0.28 | 0.1218 | -0.0364 | |||||

| US64830RAN26 / New Residential Mortgage Loan Trust 2022-SFR2 | 4.64 | 0.41 | 0.1207 | -0.0350 | |||||

| US45258LAA52 / Imola Merger Corp | 4.63 | 34.49 | 0.1204 | 0.0045 | |||||

| US05352TAA79 / AVANTOR FUNDING INC 4.625% 07/15/2028 144A | 4.61 | 46.42 | 0.1196 | 0.0138 | |||||

| US05493QAB14 / BBCMS Mortgage Trust 2023-5C23 | 4.59 | -0.58 | 0.1193 | -0.0361 | |||||

| FREMF Mortgage Trust, Series 2020-K118, Class D / ABS-MBS (US30316TAS15) | 4.55 | 2.22 | 0.1183 | -0.0316 | |||||

| US25470MAG42 / DISH Network Corp | 4.55 | 26.45 | 0.1182 | -0.0028 | |||||

| BX Mortgage Trust, Series 2025-BIO3, Class D / ABS-MBS (US123911AJ80) | 4.53 | 166.69 | 0.1177 | 0.0606 | |||||

| US38381DMB37 / Government National Mortgage Association | 4.53 | 37.10 | 0.1177 | 0.0065 | |||||

| Madison Park Funding Ltd., Series 2021-52A, Class B / ABS-CBDO (US55822BAE56) | 4.52 | 0.22 | 0.1173 | -0.0343 | |||||

| Madison Park Funding Ltd., Series 2021-52A, Class B / ABS-CBDO (US55822BAE56) | 4.52 | 0.22 | 0.1173 | -0.0343 | |||||

| SDR Commercial Mortgage Trust, Series 2024-DSNY, Class B / ABS-MBS (US811304AE49) | 4.51 | -1.44 | 0.1171 | -0.0368 | |||||

| Ares CLO Ltd., Series 2015-4A, Class A3RR / ABS-CBDO (US04015NAQ79) | 4.49 | -0.07 | 0.1168 | -0.0346 | |||||

| US46590KAK07 / JP MORGAN CHASE COMMERCIAL MORTGAGE SECURITIES TRUS SER 2015-JP1 CL C V/R REGD 4.89360700 | 4.45 | 3.64 | 0.1155 | -0.0289 | |||||

| Benchmark Mortgage Trust, Series 2024-V9, Class A3 / ABS-MBS (US081919AN29) | 4.42 | -0.43 | 0.1148 | -0.0345 | |||||

| Benchmark Mortgage Trust, Series 2024-V9, Class A3 / ABS-MBS (US081919AN29) | 4.42 | -0.43 | 0.1148 | -0.0345 | |||||

| Neuberger Berman Loan Advisers CLO Ltd., Series 2021-42A, Class CR / ABS-CBDO (US64133WAS44) | 4.39 | -0.23 | 0.1141 | -0.0340 | |||||

| US081925AF62 / Benchmark 2023-B39 Mortgage Trust | 4.39 | 0.1140 | 0.1140 | ||||||

| US38381DP879 / Government National Mortgage Association | 4.38 | -1.22 | 0.1137 | -0.0354 | |||||

| GNMA II, 30 Year / ABS-MBS (US3618HEL542) | 4.32 | -3.31 | 0.1122 | -0.0381 | |||||

| Palmer Square CLO Ltd., Series 2021-2A, Class BR / ABS-CBDO (US69701XAN49) | 4.31 | 0.1121 | 0.1121 | ||||||

| OCP Aegis CLO Ltd., Series 2025-41A, Class B1 / ABS-CBDO (US675953AE34) | 4.31 | 0.1121 | 0.1121 | ||||||

| GNMA, Series 2025-21 / ABS-MBS (US38381L5V06) | 4.29 | -0.35 | 0.1114 | -0.0334 | |||||

| DGZ / DB Gold Short ETN | 4.28 | 0.02 | 0.1112 | -0.0328 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 4.28 | -3.71 | 0.1112 | -0.0384 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 4.28 | -3.71 | 0.1112 | -0.0384 | |||||

| US62482BAA08 / Mozart Debt Merger Sub Inc | 4.27 | 46.00 | 0.1109 | 0.0125 | |||||

| US42806MBZ14 / Hertz Vehicle Financing III LLC | 4.26 | -2.34 | 0.1108 | -0.0361 | |||||

| TransDigm, Inc. / DBT (US893647BU00) | 4.22 | 45.58 | 0.1096 | 0.0121 | |||||

| FirstKey Homes Trust, Series 2022-SFR2, Class F1 / ABS-O (US33767PAQ19) | 4.21 | -0.45 | 0.1094 | -0.0329 | |||||

| Benchmark Mortgage Trust, Series 2024-V7, Class A3 / ABS-MBS (US08163YAC57) | 4.20 | -0.55 | 0.1091 | -0.0330 | |||||

| US95000XAF42 / WELLS FARGO COMMERCIAL MORTGAGE TRUST 2017-C39 WFCM 2017-C39 A5 | 4.18 | 0.38 | 0.1086 | -0.0315 | |||||

| US78466CAC01 / SS&C Technologies Holdings Inc. | 4.17 | 46.04 | 0.1082 | 0.0122 | |||||

| US88023UAH41 / Tempur Sealy International Inc | 4.15 | 34.84 | 0.1079 | 0.0042 | |||||

| US629377CE03 / NRG Energy Inc | 4.15 | 18.27 | 0.1078 | -0.0102 | |||||

| US06051GHT94 / Bank of America Corp. | 4.14 | 0.19 | 0.1076 | -0.0315 | |||||

| US81728UAB08 / Sensata Technologies Inc | 4.12 | 46.86 | 0.1069 | 0.0126 | |||||

| US45824TBC80 / INTELSAT JACKSON HOLDINGS S.A. | 4.10 | 47.51 | 0.1064 | 0.0130 | |||||

| US28035QAA04 / Edgewell Personal Care Co | 4.09 | 44.97 | 0.1064 | 0.0114 | |||||

| US20754WAC91 / CORP CMO | 4.09 | 0.1062 | 0.1062 | ||||||

| US382550BN08 / Goodyear Tire & Rubber Co/The | 4.08 | 46.64 | 0.1059 | 0.0123 | |||||

| US749571AF20 / RHP Hotel Properties LP | 4.06 | 19.37 | 0.1055 | -0.0090 | |||||

| FREMF Mortgage Trust, Series 2020-K115, Class D / ABS-MBS (US302673AG32) | 4.06 | 2.14 | 0.1055 | -0.0283 | |||||

| RCO X Mortgage LLC, Series 2025-1, Class A1 / ABS-MBS (US75523XAA54) | 4.05 | -8.95 | 0.1053 | -0.0445 | |||||

| RCO X Mortgage LLC, Series 2025-1, Class A1 / ABS-MBS (US75523XAA54) | 4.05 | -8.95 | 0.1053 | -0.0445 | |||||

| GNMA II, 30 Year / ABS-MBS (US3618J7B746) | 4.04 | -0.69 | 0.1049 | -0.0319 | |||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 4.03 | -0.98 | 0.1048 | -0.0323 | |||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 4.03 | -0.98 | 0.1048 | -0.0323 | |||||

| BMO Mortgage Trust, Series 2024-C10, Class XA / ABS-MBS (US096920AF08) | 4.03 | -2.75 | 0.1048 | -0.0347 | |||||

| US46644UBG22 / JPMBB Commercial Mortgage Securities Trust 2015-C30 | 3.98 | 1.14 | 0.1034 | -0.0290 | |||||

| US61690VAE83 / Morgan Stanley Bank of America Merrill Lynch Trust 2015-C26 | 3.97 | 1.53 | 0.1032 | -0.0285 | |||||

| GNMA, Series 2024-195 / ABS-MBS (US38381LR464) | 3.97 | -2.15 | 0.1030 | -0.0334 | |||||

| GNMA, Series 2024-195 / ABS-MBS (US38381LR464) | 3.97 | -2.15 | 0.1030 | -0.0334 | |||||

| BMO Mortgage Trust, Series 2024-5C6, Class A3 / ABS-MBS (US05593QAC87) | 3.96 | -0.45 | 0.1030 | -0.0310 | |||||

| BMO Mortgage Trust, Series 2024-5C6, Class A3 / ABS-MBS (US05593QAC87) | 3.96 | -0.45 | 0.1030 | -0.0310 | |||||

| US013092AC57 / Albertsons Cos Inc / Safeway Inc / New Albertsons LP / Albertsons LLC | 3.95 | 27.55 | 0.1025 | -0.0016 | |||||

| AMSR Trust, Series 2022-SFR3, Class F / ABS-O (US66981YAG44) | 3.94 | 0.51 | 0.1025 | -0.0296 | |||||

| US30711XJ629 / Fannie Mae Connecticut Avenue Securities | 3.94 | 0.20 | 0.1023 | -0.0299 | |||||

| US3137H8UC35 / Freddie Mac Multifamily Structured Pass Through Certificates | 3.94 | -3.43 | 0.1023 | -0.0349 | |||||

| US06540JBP66 / BANK, Series 2020-BN26, Class AS | 3.93 | 0.10 | 0.1021 | -0.0300 | |||||

| US281020AT41 / Edison International | 3.92 | -2.39 | 0.1018 | -0.0333 | |||||

| GNMA, Series 2025-42 / ABS-MBS (US38381MBQ24) | 3.92 | 0.1017 | 0.1017 | ||||||

| Westlake Automobile Receivables Trust, Series 2024-3A, Class D / ABS-O (US96043CAG50) | 3.90 | -0.41 | 0.1014 | -0.0305 | |||||

| US12634NAZ15 / Csail 2015-C2 Commercial Mortgage Trust | 3.87 | -1.18 | 0.1005 | -0.0312 | |||||

| US345397A860 / Ford Motor Credit Co LLC | 3.86 | 14.12 | 0.1004 | -0.0135 | |||||

| Harvest Commercial Capital Loan Trust, Series 2024-1, Class A / ABS-MBS (US417927AA87) | 3.83 | -0.85 | 0.0995 | -0.0305 | |||||

| FHLMC, Multi-Class Certificates, Series 2023-RR21, Class X / ABS-MBS (US3137HBCL68) | 3.81 | -2.28 | 0.0990 | -0.0322 | |||||

| US66977WAR07 / NOVA Chemicals Corp | 3.81 | 23.72 | 0.0990 | -0.0046 | |||||

| US081926AC15 / BENCHMARK 2023-V4 MTG TR 6.84094% 11/15/2056 | 3.80 | -0.71 | 0.0988 | -0.0301 | |||||

| Homeward Opportunities Fund Trust, Series 2024-RTL1, Class A1 / ABS-MBS (US43789FAA12) | 3.80 | -0.47 | 0.0986 | -0.0297 | |||||

| US42806MAR07 / HERTZ 22-2 D 144A 5.16% 06-26-28/06-25-27 | 3.77 | -1.05 | 0.0979 | -0.0303 | |||||

| FHLMC, Series 2025-MN10, Class M1 / ABS-MBS (US35563UAA60) | 3.76 | -1.13 | 0.0977 | -0.0303 | |||||

| US12429TAD63 / Mauser Packaging Solutions Holding Co | 3.75 | 22.59 | 0.0973 | -0.0055 | |||||

| BMD2 Re-REMIC Trust, Series 2019-FRR1, Class 4D1 / ABS-MBS (US055631BM61) | 3.73 | 2.11 | 0.0969 | -0.0260 | |||||

| US36169GAA31 / GCAT Trust, Series 2023-NQM3, Class A1 | 3.72 | -5.08 | 0.0967 | -0.0352 | |||||

| US46590RAK59 / JP Morgan Chase Commercial Mortgage Securities Trust 2016-JP3 | 3.69 | 0.19 | 0.0959 | -0.0281 | |||||

| US46644UBF49 / JPMBB Commercial Mortgage Securities Trust 2015-C30 | 3.69 | 0.99 | 0.0958 | -0.0271 | |||||

| GNMA II, 30 Year / ABS-MBS (US3618J7CH12) | 3.69 | -14.25 | 0.0958 | -0.0489 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 3.69 | -0.08 | 0.0958 | -0.0284 | |||||

| US35564KCN72 / FREDDIE MAC STACR REMIC TRUST 2021-DNA1 SOFR30A+300 08/25/2033 144A | 3.68 | -2.59 | 0.0957 | -0.0315 | |||||

| Republic Finance Issuance Trust, Series 2024-B, Class A / ABS-O (US76042GAA22) | 3.66 | -0.79 | 0.0952 | -0.0291 | |||||

| US810186AS55 / CORP. NOTE | 3.64 | 46.81 | 0.0946 | 0.0112 | |||||

| US12515GAD97 / CD Mortgage Trust, Series 2017-CD3, Class A4 | 3.64 | 46.93 | 0.0945 | 0.0112 | |||||

| US55760LAA52 / Madison IAQ LLC | 3.62 | 46.52 | 0.0940 | 0.0109 | |||||

| US12596GBF54 / CSAIL 2018-C14 Commercial Mortgage Trust | 3.61 | 0.0939 | 0.0939 | ||||||

| Multi-Family Connecticut Avenue Securities Trust, Series 2025-01, Class M2 / ABS-MBS (US62549CAB72) | 3.60 | 0.0935 | 0.0935 | ||||||

| FMCC / Federal Home Loan Mortgage Corporation | 3.59 | -0.14 | 0.0932 | -0.0276 | |||||

| BX Mortgage Trust, Series 2025-BIO3, Class B / ABS-MBS (US123911AE93) | 3.58 | -3.55 | 0.0931 | -0.0319 | |||||

| Symphony CLO Ltd., Series 2020-23A, Class CR2 / ABS-CBDO (US87167NDQ51) | 3.58 | -0.47 | 0.0931 | -0.0280 | |||||

| FREMF Mortgage Trust, Series 2020-K107, Class D / ABS-MBS (US302982AA18) | 3.58 | 0.90 | 0.0930 | -0.0264 | |||||

| US3140LH3C28 / FNMA, Other | 3.56 | -0.03 | 0.0924 | -0.0273 | |||||

| American Credit Acceptance Receivables Trust, Series 2024-1, Class D / ABS-O (US02531AAG67) | 3.54 | -0.95 | 0.0920 | -0.0283 | |||||

| FREMF Mortgage Trust, Series 2019-K92, Class D / ABS-MBS (US302973AL65) | 3.54 | 2.34 | 0.0920 | -0.0244 | |||||

| US05610QAC78 / BMO 2023-5C2 Mortgage Trust | 3.53 | -0.81 | 0.0918 | -0.0281 | |||||

| Madison Park Funding Ltd., Series 2020-45A, Class BRR / ABS-CBDO (US55820BAU17) | 3.53 | -0.08 | 0.0918 | -0.0272 | |||||

| Jonah Energy ABS LLC, Series 2022-1, Class C / ABS-O (US47987EAE77) | 3.52 | -0.23 | 0.0914 | -0.0272 | |||||

| Jonah Energy ABS LLC, Series 2022-1, Class C / ABS-O (US47987EAE77) | 3.52 | -0.23 | 0.0914 | -0.0272 | |||||

| US05875DAL64 / BALLYROCK CLO 2020-2 LTD | 3.51 | 0.06 | 0.0911 | -0.0268 | |||||

| US95001MAP59 / WELLS FARGO COML MTG TR 2017-C38 D CSTR 07/15/2050 144A | 3.50 | 50.88 | 0.0908 | 0.0128 | |||||

| OneSky Loan Trust / ABS-O (N/A) | 3.49 | 0.0908 | 0.0908 | ||||||

| US737446AQ74 / Post Holdings Inc | 3.46 | 24.02 | 0.0899 | -0.0040 | |||||

| US83545GBD34 / Sonic Automotive Inc | 3.45 | 47.35 | 0.0897 | 0.0109 | |||||

| US05565QDV77 / COMPANY GUAR 12/99 VAR | 3.45 | 4,691.67 | 0.0896 | 0.0872 | |||||

| XS2066744231 / Carnival PLC | 3.45 | 81.14 | 0.0896 | 0.0255 | |||||

| US3137FLYY42 / FHLMC, Multifamily Structured Pass-Through Certificates, Series K092, Class X3 | 3.41 | -5.75 | 0.0885 | -0.0331 | |||||

| BX Mortgage Trust, Series 2025-BIO3, Class C / ABS-MBS (US123911AG42) | 3.41 | -2.74 | 0.0885 | -0.0294 | |||||

| US82967NBJ63 / Sirius XM Radio Inc | 3.40 | 46.59 | 0.0884 | 0.0103 | |||||

| US29103CAA62 / Emerald Debt Merger Sub LLC | 3.39 | 45.68 | 0.0880 | 0.0098 | |||||

| US46590RAL33 / JP Morgan Chase Commercial Mortgage Securities Trust 2016-JP3 | 3.39 | 1.17 | 0.0880 | -0.0246 | |||||

| USP7721BAE13 / Peru LNG Srl | 3.38 | 57.82 | 0.0879 | 0.0158 | |||||

| Bridgecrest Lending Auto Securitization Trust, Series 2024-4, Class D / ABS-O (US10806EAF16) | 3.38 | -1.00 | 0.0878 | -0.0271 | |||||

| Bridgecrest Lending Auto Securitization Trust, Series 2024-4, Class D / ABS-O (US10806EAF16) | 3.38 | -1.00 | 0.0878 | -0.0271 | |||||

| Republic of Cote d'Ivoire / DBT (US221625AU01) | 3.38 | -3.35 | 0.0878 | -0.0299 | |||||

| US35563HAB33 / FHLMC, Multi-family Structured Pass-Through Certificates, Series 2022-MN4, Class M2 | 3.38 | -0.32 | 0.0877 | -0.0263 | |||||

| Republic of Senegal / DBT (XS2838363476) | 3.38 | 93.19 | 0.0877 | 0.0289 | |||||

| US38380RVE79 / GNMA, Series 2021-33 | 3.35 | -0.95 | 0.0870 | -0.0268 | |||||

| US94989MAK53 / Wells Fargo Commercial Mortgage Trust | 3.34 | 0.33 | 0.0868 | -0.0253 | |||||

| US64132YAS19 / Neuberger Berman Loan Advisers CLO 34 Ltd., Series 2019-34A, Class BR | 3.31 | -0.03 | 0.0859 | -0.0254 | |||||

| US1248EPCK74 / CCO Holdings LLC / CCO Holdings Capital Corp | 3.28 | 48.33 | 0.0852 | 0.0108 | |||||

| US3137F9YZ86 / FEDERAL HOME LN MTG MLT CTF GT K124 X1 CSTR 12/25/2030 | 3.26 | -4.15 | 0.0847 | -0.0297 | |||||

| Buckhorn Park CLO Ltd., Series 2019-1A, Class CRR / ABS-CBDO (US118382BE92) | 3.25 | -0.25 | 0.0845 | -0.0252 | |||||

| US205768AT12 / Comstock Resources Inc | 3.25 | 44.48 | 0.0844 | 0.0087 | |||||

| US92840VAF94 / Vistra Operations Co LLC | 3.21 | 19.26 | 0.0834 | -0.0072 | |||||

| US18453HAE62 / Clear Channel Outdoor Holdings Inc | 3.21 | 44.54 | 0.0833 | 0.0087 | |||||

| US05554FAD78 / BBCMS Mortgage Trust 2023-C22 | 3.20 | -2.02 | 0.0832 | -0.0268 | |||||

| IRV Trust, Series 2025-200P, Class C / ABS-MBS (US45006HAE18) | 3.19 | -3.57 | 0.0829 | -0.0284 | |||||

| US31418EXW55 / FNMA, 30 Year | 3.19 | -6.43 | 0.0828 | -0.0318 | |||||

| DT Auto Owner Trust, Series 2022-3A, Class E / ABS-O (US23345RAJ59) | 3.17 | -1.15 | 0.0823 | -0.0256 | |||||

| DT Auto Owner Trust, Series 2022-3A, Class E / ABS-O (US23345RAJ59) | 3.17 | -1.15 | 0.0823 | -0.0256 | |||||

| US92735LAA08 / Vine Energy Holdings, LLC | 3.16 | -0.19 | 0.0820 | -0.0244 | |||||

| FHLMC, Series 2024-MN8, Class B1 / ABS-MBS (US35563RAC97) | 3.15 | -2.83 | 0.0819 | -0.0273 | |||||

| FirstKey Homes Trust, Series 2021-SFR2, Class F2 / ABS-O (US33767TAQ31) | 3.14 | 1.45 | 0.0816 | -0.0226 | |||||

| US23345MAA53 / DT MIDSTREAM INC 4.125% 06/15/2029 144A | 3.12 | 46.23 | 0.0810 | 0.0093 | |||||

| US03690AAF30 / Antero Midstream Corporation | 3.11 | 23.49 | 0.0808 | -0.0039 | |||||

| US82967NBC11 / Sirius XM Radio Inc | 3.08 | 29.11 | 0.0800 | -0.0002 | |||||

| US91911XAV64 / Bausch Health Americas Inc 9.25% 04/01/2026 144A | 3.07 | 189.71 | 0.0797 | 0.0441 | |||||

| GNMA II, 30 Year / ABS-MBS (US3622ADAG31) | 3.07 | -11.18 | 0.0797 | -0.0365 | |||||

| US35563FAB76 / FHLMC Multifamily Structured Pass-Through Certificates, Series 2021-MN1, Class M2 | 3.05 | -2.05 | 0.0794 | -0.0256 | |||||

| TRTX Issuer Ltd., Series 2025-FL6, Class A / ABS-CBDO (US897764AA45) | 3.04 | 0.0791 | 0.0791 | ||||||

| XS1953057061 / Egypt Government International Bond | 3.04 | 30.71 | 0.0790 | 0.0007 | |||||

| US61691JAC80 / Morgan Stanley Capital I Trust 2017-H1 | 3.03 | 3.23 | 0.0788 | -0.0201 | |||||

| US34540TF236 / Ford Motor Credit Co. LLC., 6.800%, 08/20/25 | 3.02 | -1.82 | 0.0784 | -0.0250 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 3.02 | -1.92 | 0.0784 | -0.0251 | |||||

| US71677KAA60 / PetSmart Inc / PetSmart Finance Corp | 3.02 | 48.45 | 0.0784 | 0.0100 | |||||

| US3137FYUL87 / Freddie Mac Multifamily Structured Pass Through Certificates | 3.01 | -4.20 | 0.0783 | -0.0275 | |||||

| US05684NAE13 / Bain Capital Credit CLO 2022-3 Ltd | 3.01 | 0.13 | 0.0782 | -0.0229 | |||||

| Barings CLO Ltd., Series 2022-3A, Class A2R / ABS-CBDO (US06762VAH96) | 3.00 | -0.20 | 0.0780 | -0.0232 | |||||

| D1OM34 / Dominion Energy, Inc. - Depositary Receipt (Common Stock) | 2.98 | -0.03 | 0.0775 | -0.0229 | |||||

| US911365BG81 / United Rentals North America Inc | 2.97 | 46.00 | 0.0773 | 0.0087 | |||||

| Symphony CLO Ltd., Series 2019-21A, Class CR2 / ABS-CBDO (US87166RGJ05) | 2.97 | -1.03 | 0.0772 | -0.0238 | |||||

| XS2384698994 / Nigeria Government International Bond | 2.97 | 58.75 | 0.0771 | 0.0142 | |||||

| US38381EQB73 / GNMA_22-4 | 2.96 | -1.10 | 0.0770 | -0.0238 | |||||

| RFT TRUST, Series 2024-2, Class A2 / ABS-O (US76201AAD63) | 2.95 | 0.00 | 0.0767 | -0.0226 | |||||

| RFT TRUST, Series 2024-2, Class A1 / ABS-O (US76201AAC80) | 2.95 | 0.03 | 0.0767 | -0.0226 | |||||

| Republic of El Salvador / DBT (US283875CG53) | 2.95 | 17.82 | 0.0766 | -0.0076 | |||||

| US12596WAE49 / CSAIL 2019-C16 Commercial Mortgage Trust | 2.94 | -7.28 | 0.0765 | -0.0304 | |||||

| US38380PTL84 / GNMA, Series 2020-89, Class IA | 2.94 | 130.20 | 0.0765 | 0.0334 | |||||

| Subway Funding LLC, Series 2024-1A, Class A2II / ABS-O (US864300AC28) | 2.94 | 0.0764 | 0.0764 | ||||||

| US20754MAL19 / CAS_22-R07 | 2.94 | -1.71 | 0.0764 | -0.0243 | |||||

| US20753WAE66 / Connecticut Avenue Securities Trust, Series 2019-R07, Class 1B1 | 2.93 | -3.39 | 0.0763 | -0.0259 | |||||

| Magnetite Ltd., Series 2024-40A, Class B1 / ABS-CBDO (US55955RAE99) | 2.91 | -0.21 | 0.0756 | -0.0225 | |||||

| Carlyle Global Market Strategies CLO Ltd., Series 2016-1A, Class CR3 / ABS-CBDO (US14312HBL96) | 2.90 | 0.0755 | 0.0755 | ||||||

| US538034AV10 / Live Nation Entertainment Inc | 2.90 | 17.86 | 0.0755 | -0.0075 | |||||

| COMM Mortgage Trust, Series 2024-CBM, Class A1 / ABS-MBS (US12674GAA22) | 2.90 | -0.99 | 0.0753 | -0.0232 | |||||

| GTN / Gray Media, Inc. | 2.89 | 92.86 | 0.0751 | 0.0247 | |||||

| US18064PAC32 / Clarivate Science Holdings Corp | 2.87 | 24.93 | 0.0745 | -0.0027 | |||||

| US45344LAC72 / Crescent Energy Finance LLC | 2.87 | 43.75 | 0.0744 | 0.0073 | |||||

| State of Nevada Department of Business and Industry, Brighline West Passenger Rail Project, Series 2025A / DBT (US641455AB65) | 2.86 | -5.14 | 0.0743 | -0.0272 | |||||

| US35564ACC36 / STACR Trust 2018-HRP2 | 2.84 | 0.0739 | 0.0739 | ||||||

| US20754QAF54 / Fannie Mae Connecticut Avenue Securities | 2.83 | -1.53 | 0.0736 | -0.0232 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 2.83 | 0.0736 | 0.0736 | ||||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 2.83 | -1.74 | 0.0735 | -0.0234 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 2.83 | -1.74 | 0.0735 | -0.0234 | |||||

| US12630DBD57 / Commercial Mortgage Trust, Series 2014-CR14, Class C | 2.81 | 1.26 | 0.0730 | -0.0204 | |||||

| US29450YAA73 / EquipmentShare.com, Inc. | 2.81 | 43.51 | 0.0729 | 0.0071 | |||||

| US20753AAA25 / Connecticut Avenue Securities Trust 2023-R03 | 2.81 | 0.0729 | 0.0729 | ||||||

| US05377RHA59 / Avis Budget Rental Car Funding AESOP LLC | 2.81 | -0.21 | 0.0729 | -0.0217 | |||||

| US17323VAA35 / Citigroup Commercial Mortgage Trust, Series 2015-GC29, Class D | 2.81 | -11.57 | 0.0729 | -0.0339 | |||||

| US12597NAC74 / CSAIL 2020-C19 Commercial Mortgage Trust | 2.80 | 25.63 | 0.0729 | -0.0022 | |||||

| US670001AE60 / Novelis Corp | 2.80 | 30.25 | 0.0728 | 0.0004 | |||||

| RR Ltd., Series 2020-12A, Class A2R3 / ABS-CBDO (US74989HAQ56) | 2.80 | 0.00 | 0.0727 | -0.0215 | |||||

| Buckhorn Park CLO Ltd., Series 2019-1A, Class ARR / ABS-CBDO (US118382BA70) | 2.80 | -0.07 | 0.0727 | -0.0215 | |||||

| Buckhorn Park CLO Ltd., Series 2019-1A, Class ARR / ABS-CBDO (US118382BA70) | 2.80 | -0.07 | 0.0727 | -0.0215 | |||||

| Toorak Mortgage Trust, Series 2024-2, Class A1 / ABS-MBS (US89055KAA07) | 2.79 | -0.43 | 0.0725 | -0.0218 | |||||

| Toorak Mortgage Trust, Series 2024-2, Class A1 / ABS-MBS (US89055KAA07) | 2.79 | -0.43 | 0.0725 | -0.0218 | |||||

| US817565CF96 / Service Corp International/US | 2.77 | 46.35 | 0.0719 | 0.0083 | |||||

| US30166QAG47 / EXETER AUTOMOBILE RECEIVABLES TRUST 2022-2 EART 2022-2A E | 2.77 | -6.33 | 0.0719 | -0.0275 | |||||

| FREMF Mortgage Trust, Series 2020-K116, Class D / ABS-MBS (US30316LAS88) | 2.77 | 2.56 | 0.0718 | -0.0189 | |||||

| FREMF Mortgage Trust, Series 19K-1514, Class C / ABS-MBS (US30315AAB08) | 2.76 | 0.22 | 0.0717 | -0.0209 | |||||

| FREMF Mortgage Trust, Series 2020-K113, Class D / ABS-MBS (US30315KAE29) | 2.76 | 2.45 | 0.0716 | -0.0189 | |||||

| US914906AY80 / Univision Communications, Inc. | 2.75 | 21.24 | 0.0714 | -0.0049 | |||||

| US513272AD65 / Lamb Weston Holdings Inc | 2.74 | 19.45 | 0.0712 | -0.0060 | |||||

| US64831KAN63 / New Residential Mortgage Loan Trust, Series 2022-SFR1, Class F | 2.73 | 0.40 | 0.0710 | -0.0206 | |||||

| US3137FRZC82 / FHLMC Multifamily Structured Pass-Through Certificates, Series K107, Class X1 | 2.73 | -5.61 | 0.0709 | -0.0263 | |||||

| US3137FTZS90 / Freddie Mac Multifamily Structured Pass Through Certificates | 2.72 | -5.62 | 0.0707 | -0.0263 | |||||

| FREMF Mortgage Trust, Series 2022-KF132, Class CS / ABS-MBS (US30325VAE65) | 2.71 | -0.22 | 0.0704 | -0.0210 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 2.70 | 0.0702 | 0.0702 | ||||||

| US61764PAN24 / Morgan Stanley Bank of America Merrill Lynch Trust, Series 2014-C19, Class D | 2.66 | 0.11 | 0.0691 | -0.0203 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 2.64 | -5.20 | 0.0687 | -0.0251 | |||||

| AAL / American Airlines Group Inc. | 2.64 | 228.07 | 0.0686 | 0.0415 | |||||

| Elmwood CLO Ltd., Series 2023-2A, Class CR / ABS-CBDO (US29003YAN13) | 2.62 | 0.0679 | 0.0679 | ||||||

| FHLMC, Series 2024-MN8, Class M2 / ABS-MBS (US35563RAB15) | 2.61 | 0.77 | 0.0679 | -0.0194 | |||||

| FHLMC, Series 2024-MN8, Class M2 / ABS-MBS (US35563RAB15) | 2.61 | 0.77 | 0.0679 | -0.0194 | |||||

| US053773BG13 / Avis Budget Car Rental LLC / Avis Budget Finance Inc | 2.61 | 47.96 | 0.0678 | 0.0084 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 2.61 | -3.16 | 0.0678 | -0.0229 | |||||

| US69346MAD11 / PNMAC GMSR Issuer Trust | 2.61 | -0.04 | 0.0677 | -0.0200 | |||||

| Republic Finance Issuance Trust, Series 2024-A, Class A / ABS-O (US76041RAA95) | 2.59 | -0.38 | 0.0673 | -0.0202 | |||||

| Republic Finance Issuance Trust, Series 2024-A, Class A / ABS-O (US76041RAA95) | 2.59 | -0.38 | 0.0673 | -0.0202 | |||||

| FREMF Mortgage Trust, Series 2018-K84, Class D / ABS-MBS (US30297RAJ86) | 2.58 | 2.58 | 0.0671 | -0.0176 | |||||

| US852234AP86 / CORPORATE BONDS | 2.58 | 47.99 | 0.0669 | 0.0083 | |||||

| US62548NAA63 / MULTIFAMILY CONNECTICUT AVENUE SECURITIES TRUST, Series 2023-01, Class M7 | 2.56 | -0.70 | 0.0666 | -0.0203 | |||||

| Connecticut Avenue Securities Trust, Series 2024-R01, Class 1B1 / ABS-MBS (US20753UAF75) | 2.55 | -0.70 | 0.0662 | -0.0202 | |||||

| Connecticut Avenue Securities Trust, Series 2024-R01, Class 1B1 / ABS-MBS (US20753UAF75) | 2.55 | -0.70 | 0.0662 | -0.0202 | |||||

| FREMF Mortgage Trust, Series 2020-K105, Class D / ABS-MBS (US302975BJ58) | 2.55 | 2.50 | 0.0662 | -0.0174 | |||||

| US902104AC24 / II-VI Inc | 2.53 | 37.20 | 0.0658 | 0.0037 | |||||

| US71654QDP46 / Petroleos Mexicanos | 2.53 | -0.86 | 0.0656 | -0.0201 | |||||

| Quikrete Holdings, Inc. / DBT (US74843PAA84) | 2.52 | 107.83 | 0.0655 | 0.0247 | |||||

| LHOME Mortgage Trust, Series 2024-RTL4, Class A1 / ABS-MBS (US50205PAA03) | 2.52 | -0.67 | 0.0654 | -0.0199 | |||||

| Hertz Vehicle Financing LLC, Series 2024-1A, Class D / ABS-O (US42806MCS61) | 2.52 | 0.0654 | 0.0654 | ||||||

| Octagon Investment Partners Ltd., Series 2019-1A, Class BR / ABS-CBDO (US67573LAN91) | 2.52 | 0.16 | 0.0654 | -0.0192 | |||||

| FREMF Mortgage Trust, Series 2018-K83, Class D / ABS-MBS (US302958AS26) | 2.51 | 2.57 | 0.0653 | -0.0172 | |||||

| US68622TAA97 / Organon Finance 1 LLC | 2.51 | 43.26 | 0.0652 | 0.0063 | |||||

| Republic of Cote d'Ivoire / DBT (XS2752065040) | 2.51 | 155.87 | 0.0651 | 0.0322 | |||||

| Republic of Cote d'Ivoire / DBT (XS2752065040) | 2.51 | 155.87 | 0.0651 | 0.0322 | |||||

| Huntington Bank Auto Credit-Linked Notes, Series 2024-2, Class B1 / ABS-O (US44644NAG43) | 2.50 | -11.89 | 0.0651 | -0.0306 | |||||

| Huntington Bank Auto Credit-Linked Notes, Series 2024-2, Class B1 / ABS-O (US44644NAG43) | 2.50 | -11.89 | 0.0651 | -0.0306 | |||||

| Identity Digital Ltd. / DBT (N/A) | 2.50 | 0.0650 | 0.0650 | ||||||

| Republic of El Salvador / DBT (US283875CE06) | 2.50 | -1.42 | 0.0649 | -0.0204 | |||||

| US92943GAD34 / WR Grace Holdings LLC | 2.49 | 47.05 | 0.0648 | 0.0077 | |||||

| Neuberger Berman Loan Advisers CLO Ltd., Series 2020-38A, Class CR2 / ABS-CBDO (US64133RAY27) | 2.49 | -0.24 | 0.0648 | -0.0193 | |||||

| BMO Mortgage Trust, Series 2024-5C3, Class A3 / ABS-MBS (US09660QAT13) | 2.49 | -0.40 | 0.0647 | -0.0194 | |||||

| US02530CAG33 / American Credit Acceptance Receivables Trust 2023-4 | 2.49 | -0.92 | 0.0647 | -0.0199 | |||||

| FREMF Mortgage Trust, Series 19K-1511, Class C / ABS-MBS (US30309KAN00) | 2.49 | 0.69 | 0.0647 | -0.0185 | |||||

| US013092AB74 / Albertsons Cos LLC / Safeway Inc / New Albertsons LP / Albertson's LLC | 2.48 | 45.23 | 0.0645 | 0.0070 | |||||

| GLS Auto Receivables Issuer Trust, Series 2024-4A, Class D / ABS-O (US36270YAL65) | 2.48 | -0.68 | 0.0645 | -0.0196 | |||||

| US038522AQ17 / Aramark Services Inc | 2.48 | 46.19 | 0.0644 | 0.0073 | |||||

| US36265NAF06 / GLS Auto Receivables Issuer Trust, Series 2022-2A, Class E | 2.48 | -0.52 | 0.0644 | -0.0195 | |||||

| US25470XBE40 / DISH DBS Corp | 2.47 | 20.70 | 0.0643 | -0.0047 | |||||

| US12636FAN33 / COMM 2015-LC23 Mortgage Trust | 2.44 | 0.53 | 0.0635 | -0.0183 | |||||

| US126307AZ02 / CSC Holdings, LLC | 2.44 | 14.23 | 0.0634 | -0.0085 | |||||

| US35563QAB32 / Freddie Mac Multifamily Structured Credit Risk | 2.44 | -4.88 | 0.0634 | -0.0229 | |||||

| US87901JAH86 / TEGNA Inc | 2.43 | 45.86 | 0.0632 | 0.0071 | |||||

| US3137FQK360 / Freddie Mac Multifamily Structured Pass Through Certificates | 2.43 | -3.23 | 0.0631 | -0.0213 | |||||

| FREMF, Series 20K-1517, Class C / ABS-MBS (US30315VAN82) | 2.42 | -0.41 | 0.0630 | -0.0189 | |||||

| FREMF Mortgage Trust, Series 2020-K122, Class D / ABS-MBS (US30318BAE92) | 2.42 | 2.45 | 0.0629 | -0.0166 | |||||

| FREMF Mortgage Trust, Series 2020-K122, Class D / ABS-MBS (US30318BAE92) | 2.42 | 2.45 | 0.0629 | -0.0166 | |||||

| Santander Drive Auto Receivables Trust, Series 2025-2, Class D / ABS-O (US80287NAF24) | 2.41 | 0.0627 | 0.0627 | ||||||

| XS1729875598 / Pakistan Government International Bond | 2.41 | 62.10 | 0.0627 | 0.0126 | |||||

| Bridgecrest Lending Auto Securitization Trust, Series 2024-3, Class D / ABS-O (US10805NAF24) | 2.40 | -0.21 | 0.0623 | -0.0186 | |||||

| US05453GAC96 / AXALTA COATING SYSTEMS LLC 3.375% 02/15/2029 144A | 2.40 | 46.28 | 0.0623 | 0.0071 | |||||

| US23345YAJ01 / DT Auto Owner Trust, Series 2022-1A, Class E | 2.39 | -0.38 | 0.0621 | -0.0186 | |||||

| U.S. Treasury 5 Year Note / DIR (N/A) | 2.39 | 0.0620 | 0.0620 | ||||||

| LHOME Mortgage Trust, Series 2024-RTL3, Class A1 / ABS-MBS (US50205GAA04) | 2.38 | -0.54 | 0.0620 | -0.0187 | |||||

| IHRT / iHeartMedia, Inc. | 2.38 | 18.84 | 0.0620 | -0.0056 | |||||

| IHRT / iHeartMedia, Inc. | 2.38 | 18.84 | 0.0620 | -0.0056 | |||||

| US38380RRQ55 / GNMA, Series 2021-11, Class IX | 2.38 | 17.97 | 0.0618 | -0.0060 | |||||

| GNMA, Series 2024-32 / ABS-MBS (US38381J2J58) | 2.36 | -1.95 | 0.0613 | -0.0197 | |||||

| US46266TAA60 / IQVIA, Inc. | 2.34 | 105.79 | 0.0609 | 0.0226 | |||||

| US74166MAF32 / Prime Security Services Borrower LLC / Prime Finance Inc | 2.34 | 19.37 | 0.0609 | -0.0052 | |||||

| Republic of Cote d'Ivoire / DBT (US221625AV83) | 2.34 | 0.0608 | 0.0608 | ||||||

| Republic of Cote d'Ivoire / DBT (US221625AV83) | 2.34 | 0.0608 | 0.0608 | ||||||

| FirstKey Homes Trust, Series 2022-SFR1, Class F1 / ABS-O (US33768NAN21) | 2.34 | 1.13 | 0.0607 | -0.0171 | |||||

| FirstKey Homes Trust, Series 2022-SFR1, Class F1 / ABS-O (US33768NAN21) | 2.34 | 1.13 | 0.0607 | -0.0171 | |||||

| US95001NAC20 / Wells Fargo Commercial Mortgage Trust 2018-C45 | 2.34 | 1.13 | 0.0607 | -0.0170 | |||||

| US74841CAA99 / Quicken Loans LLC / Quicken Loans Co-Issuer Inc | 2.33 | 45.53 | 0.0606 | 0.0067 | |||||

| Elmwood CLO Ltd., Series 2024-12RA, Class CR / ABS-CBDO (US29004MAE66) | 2.31 | -0.30 | 0.0601 | -0.0180 | |||||

| US92332YAD31 / Venture Global LNG Inc | 2.31 | 15.05 | 0.0600 | -0.0076 | |||||

| Magnetite Ltd., Series 2016-17A, Class AR2 / ABS-CBDO (US55954EAY59) | 2.31 | -0.43 | 0.0599 | -0.0180 | |||||

| Magnetite Ltd., Series 2016-17A, Class AR2 / ABS-CBDO (US55954EAY59) | 2.31 | -0.43 | 0.0599 | -0.0180 | |||||

| FHLMC, Series 2024-MN8, Class M1 / ABS-MBS (US35563RAA32) | 2.30 | -0.48 | 0.0599 | -0.0180 | |||||

| FHLMC, Series 2024-MN8, Class M1 / ABS-MBS (US35563RAA32) | 2.30 | -0.48 | 0.0599 | -0.0180 | |||||

| US30711XGQ16 / CORP CMO | 2.30 | -0.35 | 0.0596 | -0.0179 | |||||

| US95000FAC05 / Wells Fargo Commercial Mortgage Trust 2016-C35 | 2.29 | 1.73 | 0.0596 | -0.0162 | |||||

| Credit Acceptance Auto Loan Trust, Series 2023-5A, Class A / ABS-O (US22535PAA03) | 2.28 | -0.52 | 0.0592 | -0.0179 | |||||

| Neuberger Berman Loan Advisers CLO Ltd., Series 2021-42A, Class BR / ABS-CBDO (US64133WAQ87) | 2.26 | -0.18 | 0.0586 | -0.0174 | |||||

| PRET LLC, Series 2024-NPL7, Class A1 / ABS-MBS (US74136TAA60) | 2.26 | -3.18 | 0.0586 | -0.0198 | |||||

| US12592GAJ22 / COMM 2014-CCRE19 Mortgage Trust | 2.24 | 0.40 | 0.0582 | -0.0169 | |||||

| US92943GAA94 / WR Grace Holdings LLC | 2.24 | 39.70 | 0.0581 | 0.0042 | |||||

| Bridgecrest Lending Auto Securitization Trust, Series 2025-1, Class D / ABS-O (US10806HAF47) | 2.23 | -0.13 | 0.0581 | -0.0172 | |||||

| US3137FTG271 / Freddie Mac Multifamily Structured Pass Through Certificates | 2.23 | -5.50 | 0.0580 | -0.0215 | |||||

| SATS / EchoStar Corporation | 2.23 | 28.61 | 0.0578 | -0.0004 | |||||

| US195325EM30 / Colombia Government International Bond | 2.22 | 68.66 | 0.0578 | 0.0134 | |||||

| LHOME Mortgage Trust, Series 2025-RTL1, Class A1 / ABS-MBS (US50205UAA97) | 2.22 | -0.58 | 0.0577 | -0.0175 | |||||

| Magnetite Ltd., Series 2016-17A, Class BR2 / ABS-CBDO (US55954EBA64) | 2.22 | -0.18 | 0.0577 | -0.0172 | |||||

| Magnetite Ltd., Series 2016-17A, Class BR2 / ABS-CBDO (US55954EBA64) | 2.22 | -0.18 | 0.0577 | -0.0172 | |||||

| 1261229 BC Ltd. / DBT (US68288AAA51) | 2.22 | 0.0576 | 0.0576 | ||||||

| 1261229 BC Ltd. / DBT (US68288AAA51) | 2.22 | 0.0576 | 0.0576 | ||||||

| Santander Drive Auto Receivables Trust, Series 2024-1, Class B / ABS-O (US80288AAD46) | 2.21 | -0.36 | 0.0574 | -0.0172 | |||||

| US08161CAJ09 / BENCHMARK 2018-B2 Mortgage Trust | 2.21 | 0.32 | 0.0574 | -0.0167 | |||||

| US12597NAY94 / CSAIL 2020-C19 C SERIES CLASS | 2.20 | -3.33 | 0.0573 | -0.0195 | |||||

| Drive Auto Receivables Trust, Series 2025-1, Class D / ABS-O (US262102AF30) | 2.20 | 0.0572 | 0.0572 | ||||||

| GNMA II, 30 Year / ABS-MBS (US3618HTT790) | 2.20 | -2.40 | 0.0571 | -0.0187 | |||||

| US3137H9UF49 / Freddie Mac Multifamily Structured Pass Through Certificates | 2.20 | -4.27 | 0.0571 | -0.0201 | |||||

| US161175BU77 / Charter Communications Operating LLC / Charter Communications Operating Capital | 2.20 | 1.34 | 0.0570 | -0.0159 | |||||

| US35566CBE49 / FHLMC STACR REMIC Trust, Series 2020-DNA6, Class B2 | 2.19 | -1.70 | 0.0570 | -0.0181 | |||||

| US92939FAE97 / WFRBS Commercial Mortgage Trust 2014-C21 | 2.19 | -3.91 | 0.0568 | -0.0198 | |||||

| US17291EAA91 / Citigroup Commercial Mortgage Trust 2016-P6 | 2.19 | 2.92 | 0.0568 | -0.0147 | |||||

| US17888HAC79 / Civitas Resources Inc | 2.18 | 52.27 | 0.0566 | 0.0085 | |||||

| USP1400MAB48 / Banco Mercantil del Norte SA/Grand Cayman | 2.18 | 217.03 | 0.0566 | 0.0335 | |||||

| US05359AAA16 / Aventura Mall Trust, Series 2018-AVM, Class A | 2.17 | 0.19 | 0.0563 | -0.0165 | |||||

| Toorak Mortgage Trust, Series 2024-RRTL1, Class A1 / ABS-MBS (US89054YAA10) | 2.16 | 0.0561 | 0.0561 | ||||||

| FirstKey Homes Trust, Series 2022-SFR2, Class G / ABS-O (US33767PAW86) | 2.16 | -0.19 | 0.0561 | -0.0167 | |||||

| US3137FXQX98 / Freddie Mac Multifamily Structured Pass Through Certificates | 2.15 | -3.41 | 0.0559 | -0.0190 | |||||

| US18453HAA41 / Clear Channel Worldwide Holdings Inc 5.125% 08/15/2027 144A | 2.15 | 18.08 | 0.0558 | -0.0054 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 2.14 | -5.56 | 0.0556 | -0.0207 | |||||

| US69346VAA70 / Performance Food Group Inc 5.5% 10/15/2027 144A | 2.14 | 18.60 | 0.0555 | -0.0051 | |||||

| California Infrastructure and Economic Development Bank, Brightline West Passenger Rail Project, Series 2025A / DBT (US13034A6B14) | 2.13 | -4.48 | 0.0554 | -0.0197 | |||||

| US30313BAA26 / FREMF 2019-KF73 B | 2.13 | 0.0553 | 0.0553 | ||||||

| US12592KBH68 / COMM 2014-UBS5 Mortgage Trust | 2.12 | 0.00 | 0.0550 | -0.0162 | |||||

| Lendmark Funding Trust, Series 2025-1A, Class A / ABS-O (US52604QAA13) | 2.11 | 0.0549 | 0.0549 | ||||||

| Lendmark Funding Trust, Series 2025-1A, Class A / ABS-O (US52604QAA13) | 2.11 | 0.0549 | 0.0549 | ||||||

| US38381DXB18 / GNMA, Series 2021-133 | 2.11 | 86.26 | 0.0549 | 0.0167 | |||||

| SDR Commercial Mortgage Trust, Series 2024-DSNY, Class A / ABS-MBS (US811304AA27) | 2.11 | -0.75 | 0.0548 | -0.0167 | |||||

| SDR Commercial Mortgage Trust, Series 2024-DSNY, Class A / ABS-MBS (US811304AA27) | 2.11 | -0.75 | 0.0548 | -0.0167 | |||||

| US38381DT913 / Government National Mortgage Association | 2.11 | 3.08 | 0.0547 | -0.0140 | |||||

| American Credit Acceptance Receivables Trust, Series 2023-4, Class E / ABS-O (US02530CAJ71) | 2.10 | -1.22 | 0.0547 | -0.0170 | |||||

| US05401AAB70 / Avolon Holdings Funding Ltd | 2.10 | -0.24 | 0.0545 | -0.0163 | |||||

| US163851AF58 / Chemours Co/The | 2.10 | -22.23 | 0.0544 | -0.0362 | |||||

| US3137H2N837 / FHLMC CMO IO | 2.09 | -4.66 | 0.0542 | -0.0194 | |||||

| US61690QAS84 / Morgan Stanley Bank of America Merrill Lynch Trust 2015-C23 | 2.08 | -1.88 | 0.0541 | -0.0173 | |||||

| US1248EPCS01 / CCO Holdings LLC / CCO Holdings Capital Corp. | 2.08 | 46.62 | 0.0541 | 0.0063 | |||||

| US49461MAA80 / Kinetik Holdings LP | 2.07 | 68.87 | 0.0539 | 0.0125 | |||||

| Affirm Asset Securitization Trust, Series 2024-B, Class D / ABS-O (US00835AAD00) | 2.06 | -0.91 | 0.0536 | -0.0165 | |||||

| US3137F9ZB00 / Freddie Mac Multifamily Structured Pass Through Certificates | 2.06 | -4.19 | 0.0535 | -0.0188 | |||||

| US82967NBA54 / Sirius XM Radio Inc | 2.05 | 46.12 | 0.0534 | 0.0061 | |||||

| R1CL34 / Royal Caribbean Cruises Ltd. - Depositary Receipt (Common Stock) | 2.05 | 172.11 | 0.0532 | 0.0279 | |||||

| US20754RAF38 / Connecticut Avenue Securities Trust 2021-R01 | 2.05 | -0.34 | 0.0532 | -0.0159 | |||||

| US30298NAJ63 / FREMF Mortgage Trust, Series 2019-KF67, Class C | 2.04 | 0.39 | 0.0530 | -0.0154 | |||||

| FNMA / Federal National Mortgage Association - Depositary Receipt (Common Stock) | 2.04 | -0.44 | 0.0530 | -0.0159 | |||||

| CBAM Ltd., Series 2018-5A, Class B2 / ABS-CBDO (US12481QAG01) | 2.04 | 0.10 | 0.0530 | -0.0156 | |||||

| CBAM Ltd., Series 2018-5A, Class B2 / ABS-CBDO (US12481QAG01) | 2.04 | 0.10 | 0.0530 | -0.0156 | |||||

| US92939FAY51 / WFRBS Commercial Mortgage Trust 2014-C21 | 2.04 | -0.05 | 0.0530 | -0.0157 | |||||

| US12769GAB68 / Caesars Entertainment, Inc. | 2.03 | 44.45 | 0.0528 | 0.0055 | |||||

| USP06518AG23 / Bahamas Government International Bond | 2.03 | 51.72 | 0.0528 | 0.0077 | |||||

| FREMF Mortgage Trust, Series 2018-K155, Class C / ABS-MBS (US30296QAS12) | 2.03 | 1.20 | 0.0527 | -0.0147 | |||||

| US12515BAT52 / CD Mortgage Trust, Series 2019-CD8, Class E | 2.03 | 3.16 | 0.0527 | -0.0135 | |||||

| PRET LLC, Series 2024-NPL9, Class A1 / ABS-MBS (US74143TAA79) | 2.03 | -4.52 | 0.0527 | -0.0188 | |||||

| PRET LLC, Series 2024-NPL9, Class A1 / ABS-MBS (US74143TAA79) | 2.03 | -4.52 | 0.0527 | -0.0188 | |||||

| American Credit Acceptance Receivables Trust, Series 2022-3, Class E / ABS-O (US02528GAJ22) | 2.03 | -1.03 | 0.0526 | -0.0162 | |||||

| US040114HT09 / Argentine Republic Government International Bond | 2.02 | 0.0524 | 0.0524 | ||||||

| XS2214237807 / Ecuador Government International Bond | 2.02 | 79.75 | 0.0524 | 0.0146 | |||||

| US019736AF46 / Allison Transmission, Inc. | 2.01 | 112.34 | 0.0523 | 0.0204 | |||||

| PRPM, Series 2025-3, Class A1 / ABS-MBS (US74449DAA37) | 2.01 | 0.0522 | 0.0522 | ||||||

| US25470XAY13 / DISH DBS CORP 7.75% 07/01/2026 | 2.01 | 22.68 | 0.0522 | -0.0029 | |||||

| AGL CLO Ltd., Series 2020-9A, Class BR / ABS-CBDO (US001207AU37) | 2.01 | -0.55 | 0.0522 | -0.0158 | |||||

| US92918BAS25 / Voya CLO 2019-4 Ltd | 2.01 | 0.15 | 0.0521 | -0.0153 | |||||

| American Credit Acceptance Receivables Trust, Series 2025-2, Class D / ABS-O (US024938AG74) | 2.01 | 0.0521 | 0.0521 | ||||||

| Dryden CLO Ltd., Series 2019-68A, Class ARR / ABS-CBDO (US26252QAS12) | 2.00 | -0.25 | 0.0521 | -0.0155 | |||||

| Dryden CLO Ltd., Series 2019-68A, Class ARR / ABS-CBDO (US26252QAS12) | 2.00 | -0.25 | 0.0521 | -0.0155 | |||||

| Octagon Investment Partners Ltd., Series 2018-1A, Class C / ABS-CBDO (US67591UAJ60) | 2.00 | 0.00 | 0.0521 | -0.0154 | |||||

| Shackleton CLO Ltd., Series 2019-15A, Class BR / ABS-CBDO (US81883MAN39) | 2.00 | 0.00 | 0.0520 | -0.0154 | |||||

| US401494AW96 / Guatemala Government Bond | 2.00 | 0.0520 | 0.0520 | ||||||

| Ballyrock CLO Ltd., Series 2024-27A, Class A2 / ABS-CBDO (US05874UAE55) | 2.00 | 0.05 | 0.0520 | -0.0153 | |||||

| Palmer Square Loan Funding Ltd., Series 2024-3A, Class B / ABS-CBDO (US69690EAE95) | 2.00 | -0.25 | 0.0520 | -0.0155 | |||||

| US46645LAC19 / JPMBB Commercial Mortgage Securities Trust, Series 2016-C1, Class D1 | 2.00 | 0.60 | 0.0520 | -0.0149 | |||||

| KKR CLO Ltd., Series 40A, Class BR / ABS-CBDO (US48254UAG04) | 2.00 | 0.00 | 0.0520 | -0.0153 | |||||

| Mariner Finance issuance Trust, Series 2024-BA, Class A / ABS-O (US56847GAA13) | 2.00 | -0.70 | 0.0520 | -0.0158 | |||||

| Republic of Montenegro / DBT (US857305AA45) | 2.00 | 103.15 | 0.0519 | 0.0188 | |||||

| Republic of Montenegro / DBT (US857305AA45) | 2.00 | 103.15 | 0.0519 | 0.0188 | |||||

| SHR Trust, Series 2024-LXRY, Class B / ABS-MBS (US784234AC03) | 2.00 | -0.79 | 0.0519 | -0.0159 | |||||

| Purewest ABS Issuer LLC, Series 2025-1, Class A2 / ABS-O (US74628AAB08) | 2.00 | 0.0519 | 0.0519 | ||||||

| US29425AAJ25 / Citigroup Commercial Mortgage Trust, Series 2015-GC33, Class D | 2.00 | 1.06 | 0.0519 | -0.0146 | |||||

| TPG Trust, Series 2024-WLSC, Class A / ABS-MBS (US872973AA03) | 1.99 | -0.40 | 0.0518 | -0.0156 | |||||

| PRPM LLC, Series 2024-8, Class A2 / ABS-MBS (US74448KAB61) | 1.99 | -1.19 | 0.0517 | -0.0161 | |||||

| US92332YAA91 / Venture Global LNG, Inc. | 1.99 | 16.20 | 0.0516 | -0.0059 | |||||

| Affirm Asset Securitization Trust, Series 2024-B, Class C / ABS-O (US00835AAC27) | 1.99 | -0.85 | 0.0516 | -0.0158 | |||||

| US3137FYTY28 / Freddie Mac Multifamily Structured Pass Through Certificates | 1.98 | -3.78 | 0.0516 | -0.0178 | |||||

| Lendmark Funding Trust, Series 2024-1A, Class A / ABS-O (US52603DAA19) | 1.97 | -0.65 | 0.0513 | -0.0156 | |||||

| US3137H73R20 / FHLMC Multifamily Structured Pass-Through Certificates, Series K142, Class X1 | 1.97 | -4.27 | 0.0513 | -0.0181 | |||||

| US80286PAE16 / SANTANDER DRIVE AUTO RECEIVABLES TRUST 2023-5 SER 2023-5 CL C REGD 6.43000000 | 1.97 | -0.81 | 0.0512 | -0.0157 | |||||

| Santander Drive Auto Receivables Trust, Series 2024-4, Class D / ABS-O (US802919AF77) | 1.97 | -0.76 | 0.0511 | -0.0156 | |||||

| US29250NBC83 / Enbridge Inc | 1.96 | -0.91 | 0.0510 | -0.0156 | |||||

| FREMF Mortgage Trust, Series 2019-KC07, Class C / ABS-MBS (US302988AN09) | 1.96 | 1.03 | 0.0509 | -0.0144 | |||||

| 30064K105 / Exacttarget, Inc. | 1.96 | -1.41 | 0.0509 | -0.0160 | |||||

| US90276XBA28 / UBS Commercial Mortgage Trust 2018-C11 | 1.96 | 0.82 | 0.0509 | -0.0145 | |||||

| Credit Acceptance Auto Loan Trust, Series 2024-3A, Class A / ABS-O (US22535LAA98) | 1.96 | 0.00 | 0.0508 | -0.0150 | |||||

| US96043JAQ85 / Westlake Automobile Receivables Trust 2021-3 | 1.95 | 1.40 | 0.0507 | -0.0141 | |||||

| US35563QAC15 / FHLMC, Multi-Family Structured Credit Risk, Series 2023-MN7, Class B1 | 1.95 | -4.50 | 0.0507 | -0.0180 | |||||

| US20754AAB98 / Fannie Mae Connecticut Avenue Securities | 1.95 | -0.10 | 0.0507 | -0.0150 | |||||

| Santander Drive Auto Receivables Trust, Series 2024-3, Class D / ABS-O (US80287LAF67) | 1.94 | -1.17 | 0.0504 | -0.0157 | |||||

| US536797AG85 / LITHIA MOTORS INC 3.875% 06/01/2029 144A | 1.94 | 47.71 | 0.0503 | 0.0062 | |||||

| Buttermilk Park CLO Ltd., Series 2018-1A, Class CR / ABS-CBDO (US124166AW91) | 1.93 | 0.26 | 0.0502 | -0.0146 | |||||

| US29365BAA17 / ENTG 4 3/4 04/15/29 | 1.93 | 152.56 | 0.0501 | 0.0244 | |||||

| US42806MBQ15 / HERTZ 22-5 D 144A 6.78% 09-25-28/09-27-27 | 1.93 | -1.78 | 0.0501 | -0.0159 | |||||

| US90290MAD39 / US FOODS INC 4.75% 02/15/2029 144A | 1.93 | 47.06 | 0.0500 | 0.0060 | |||||

| US42704LAA26 / Herc Holdings, Inc. | 1.92 | 45.34 | 0.0499 | 0.0054 | |||||

| US35564KLV97 / Freddie Mac STACR REMIC Trust 2021-DNA6 | 1.92 | 0.0498 | 0.0498 | ||||||

| US62482BAB80 / MOZART DEBT MERGER SUB INC | 1.92 | 46.97 | 0.0498 | 0.0059 | |||||

| US62886EBA55 / NCR Corp | 1.91 | 47.69 | 0.0497 | 0.0061 | |||||

| Palmer Square Loan Funding Ltd., Series 2024-3A, Class A2 / ABS-CBDO (US69690EAC30) | 1.91 | -0.16 | 0.0497 | -0.0148 | |||||

| USP01012BX31 / El Salvador Government International Bond | 1.91 | 35.67 | 0.0497 | 0.0023 | |||||

| Dominican Republic Government Bond / DBT (US25714PFB94) | 1.91 | 54.83 | 0.0495 | 0.0081 | |||||

| Dominican Republic Government Bond / DBT (US25714PFB94) | 1.91 | 54.83 | 0.0495 | 0.0081 | |||||

| US12512JBA16 / CD 2018-CD7 Mortgage Trust | 1.90 | 0.58 | 0.0495 | -0.0142 | |||||

| US87165YAE32 / Symphony CLO XIX Ltd., Series 2018-19A, Class B | 1.90 | 0.00 | 0.0494 | -0.0146 | |||||

| Banc of America Re-REMIC Trust, Series 2024-FRR1, Class C / ABS-MBS (US05942XAE76) | 1.90 | 1.50 | 0.0493 | -0.0136 | |||||

| ELM Trust, Series 2024-ELM, Class C10 / ABS-MBS (US26860XBC48) | 1.89 | -0.79 | 0.0491 | -0.0150 | |||||

| US638962AA84 / NCR Atleos Escrow Corp | 1.89 | 46.13 | 0.0491 | 0.0056 | |||||

| BRTSG8EN8 / Staples, Inc., Term Loan | 1.89 | 16.99 | 0.0490 | -0.0053 | |||||

| USP3579ECE51 / Dominican Republic International Bond | 1.88 | -4.19 | 0.0488 | -0.0171 | |||||

| US836205AY00 / Republic of South Africa Government International Bond | 1.87 | 25.35 | 0.0487 | -0.0016 | |||||

| US16115QAF72 / Chart Industries Inc | 1.87 | 46.05 | 0.0485 | 0.0055 | |||||

| Wells Fargo Commercial Mortgage Trust, Series 2024-5C1, Class A3 / ABS-MBS (US95003VAC28) | 1.87 | -0.53 | 0.0485 | -0.0147 | |||||

| Palmer Square Loan Funding Ltd., Series 2022-3A, Class BR / ABS-CBDO (US69690CAS26) | 1.86 | 0.27 | 0.0485 | -0.0141 | |||||

| XS1619155564 / Senegal Government International Bond | 1.86 | 70.60 | 0.0484 | 0.0117 | |||||

| Charter Communications Operating LLC / DBT (US161175CQ56) | 1.86 | 0.81 | 0.0484 | -0.0138 | |||||

| Charter Communications Operating LLC / DBT (US161175CQ56) | 1.86 | 0.81 | 0.0484 | -0.0138 | |||||

| GNMA, Series 2025-38 / ABS-MBS (US38381L8C97) | 1.86 | 0.0484 | 0.0484 | ||||||

| US36168QAL86 / GFL Environmental Inc | 1.86 | 46.92 | 0.0483 | 0.0057 | |||||

| US35563GAC33 / FHLMC, Multi-Family Structured Pass-Through Certificates, Series 2021-MN3, Class B1 | 1.85 | -0.59 | 0.0482 | -0.0146 | |||||

| XS2288906857 / Oman Government International Bond | 1.85 | 32.76 | 0.0481 | 0.0012 | |||||

| US831641FW00 / 5.688% 10 Sep 2033 | 1.85 | -6.24 | 0.0480 | -0.0183 | |||||

| US35563QAA58 / Freddie Mac Multifamily Structured Credit Risk | 1.84 | 129.91 | 0.0478 | 0.0208 | |||||

| US02530EAG98 / American Credit Acceptance Receivables Trust, Series 2023-3, Class D | 1.84 | -0.92 | 0.0477 | -0.0147 | |||||

| US61766RBE53 / MORGAN STANLEY BANK OF AMERICA MERRILL LYNCH TRUS SER 2016-C31 CL C V/R REGD 4.45782200 | 1.83 | 0.61 | 0.0475 | -0.0136 | |||||

| GNMA, Series 2024-138, Class IA / ABS-MBS (US38381LPR77) | 1.82 | -1.09 | 0.0474 | -0.0146 | |||||

| GNMA, Series 2024-138, Class IA / ABS-MBS (US38381LPR77) | 1.82 | -1.09 | 0.0474 | -0.0146 | |||||

| GNMA, Series 2021-63 / ABS-MBS (US38380R2L34) | 1.82 | 0.0473 | 0.0473 | ||||||

| US428040DB25 / Hertz Corp/The | 1.82 | 16.73 | 0.0473 | -0.0052 | |||||

| US59565JAA97 / MIDAS OPCO HOLDINGS LLC | 1.81 | 40.84 | 0.0471 | 0.0038 | |||||

| N1WG34 / NatWest Group plc - Depositary Receipt (Common Stock) | 1.81 | -0.38 | 0.0471 | -0.0142 | |||||

| AIMCO CLO Ltd., Series 2021-16A, Class BR / ABS-CBDO (US00901FAN69) | 1.81 | 0.00 | 0.0471 | -0.0139 | |||||

| US3137F8ZX47 / COMMERCIAL MORTGAGE BACKED SECURITIES | 1.80 | -4.76 | 0.0468 | -0.0168 | |||||

| XS1819680288 / Angolan Government International Bond | 1.80 | -5.37 | 0.0467 | -0.0172 | |||||

| Saavi Energia Sarl / DBT (US78518PAA30) | 1.79 | 67.51 | 0.0466 | 0.0106 | |||||

| US29365BAB99 / Entegris Escrow Corp | 1.79 | 2.99 | 0.0465 | -0.0120 | |||||

| US436440AP62 / Hologic Inc | 1.79 | 22.01 | 0.0464 | -0.0028 | |||||

| US3137F72R56 / FHMS K120 X1 | 1.78 | -4.34 | 0.0464 | -0.0164 | |||||

| US27034RAC79 / Earthstone Energy Holdings LLC | 1.78 | 7.54 | 0.0463 | -0.0095 | |||||

| Banque Ouest Africaine de Developpement / DBT (US06675QAE35) | 1.78 | 120.27 | 0.0463 | 0.0191 | |||||

| US3137FWHG83 / Freddie Mac Multifamily Structured Pass Through Certificates | 1.78 | -3.47 | 0.0463 | -0.0158 | |||||

| US71376LAE02 / Performance Food Group, Inc. | 1.78 | 26.12 | 0.0462 | -0.0012 | |||||

| PRPM LLC, Series 2024-7, Class A1 / ABS-MBS (US74448LAA61) | 1.78 | -5.23 | 0.0461 | -0.0169 | |||||

| BMO Mortgage Trust, Series 2024-C9, Class A5 / ABS-MBS (US05593MAD56) | 1.77 | -2.15 | 0.0460 | -0.0149 | |||||

| US12592LAN29 / Commercial Mortgage Trust, Series 2014-CR20, Class D | 1.77 | -3.49 | 0.0460 | -0.0157 | |||||

| US699149AH36 / Paraguay Government International Bond | 1.76 | -4.13 | 0.0458 | -0.0161 | |||||

| PRET LLC, Series 2024-NPL8, Class A1 / ABS-MBS (US69392DAA00) | 1.76 | -4.76 | 0.0458 | -0.0165 | |||||

| PRET LLC, Series 2024-NPL8, Class A1 / ABS-MBS (US69392DAA00) | 1.76 | -4.76 | 0.0458 | -0.0165 | |||||

| US432891AK52 / Hilton Worldwide Finance LLC / Hilton Worldwide Finance Corp | 1.76 | 19.01 | 0.0457 | -0.0040 | |||||

| Republic of Kenya / DBT (US491798AN42) | 1.76 | -5.69 | 0.0457 | -0.0170 | |||||

| Carlyle US CLO Ltd., Series 2021-7A, Class CR / ABS-CBDO (US14316WAS89) | 1.76 | 0.0456 | 0.0456 | ||||||

| Carlyle US CLO Ltd., Series 2021-7A, Class CR / ABS-CBDO (US14316WAS89) | 1.76 | 0.0456 | 0.0456 | ||||||

| FirstKey Homes Trust, Series 2022-SFR3, Class F1 / ABS-O (US33768EAQ52) | 1.75 | 1.45 | 0.0455 | -0.0126 | |||||

| FirstKey Homes Trust, Series 2022-SFR3, Class F1 / ABS-O (US33768EAQ52) | 1.75 | 1.45 | 0.0455 | -0.0126 | |||||

| BMO Mortgage Trust, Series 2024-C9, Class XA / ABS-MBS (US05593MAF05) | 1.75 | -2.99 | 0.0455 | -0.0153 | |||||

| GNMA / ABS-MBS (US38381MPY02) | 1.75 | 0.0455 | 0.0455 | ||||||

| US60337JAA43 / Minerva Merger Sub Inc | 1.75 | 44.22 | 0.0454 | 0.0046 | |||||

| US38380RA758 / Government National Mortgage Association | 1.75 | -0.96 | 0.0454 | -0.0140 | |||||

| BX Commercial Mortgage Trust, Series 2024-MF, Class A / ABS-MBS (US05612EAA64) | 1.75 | 0.11 | 0.0454 | -0.0133 | |||||

| US36168QAQ73 / GFL Environmental Inc | 1.75 | 37.62 | 0.0454 | 0.0027 | |||||

| US35564KBE82 / FHLMC STACR REMIC Trust, Series 2021-DNA1, Class B2 | 1.75 | -0.85 | 0.0453 | -0.0139 | |||||

| US26209XAD30 / DRIVEN BRANDS FUNDING LLC | 1.74 | 0.35 | 0.0453 | -0.0132 | |||||

| FirstKey Homes Trust, Series 2022-SFR3, Class F2 / ABS-O (US33768EAS19) | 1.74 | 1.34 | 0.0453 | -0.0126 | |||||

| US69007TAE47 / Outfront Media Capital LLC / Outfront Media Capital Corp | 1.74 | 46.46 | 0.0452 | 0.0052 | |||||

| US203372AX50 / CommScope Inc | 1.74 | 134.10 | 0.0452 | 0.0202 | |||||

| GNMA II, 30 Year / ABS-MBS (US3618HNTT40) | 1.74 | -3.71 | 0.0452 | -0.0156 | |||||

| AAL / American Airlines Group Inc. | 1.74 | -14.01 | 0.0451 | -0.0229 | |||||

| PRPM LLC, Series 2025-RPL2, Class A1 / ABS-MBS (US69392MAA09) | 1.73 | 0.0449 | 0.0449 | ||||||

| US69867DAC20 / Panther BF Aggregator 2 LP / Panther Finance Co Inc | 1.72 | 0.06 | 0.0448 | -0.0132 | |||||

| US651229AW64 / Newell Brands Inc | 1.72 | 0.82 | 0.0447 | -0.0127 | |||||

| Business Jet Securities LLC, Series 2024-1A, Class A / ABS-O (US12327CAA27) | 1.72 | -7.78 | 0.0447 | -0.0181 | |||||

| GNMA II, 30 Year / ABS-MBS (US3618HML727) | 1.71 | -6.19 | 0.0445 | -0.0169 | |||||

| Dryden CLO Ltd., Series 2019-68A, Class BRR / ABS-CBDO (US26252QAU67) | 1.70 | 0.00 | 0.0442 | -0.0130 | |||||

| US055988AD13 / BMO 2023-C5 Mortgage Trust | 1.69 | -2.03 | 0.0440 | -0.0142 | |||||

| US019736AG29 / Allison Transmission Inc | 1.69 | 118.89 | 0.0440 | 0.0180 | |||||

| XS2214239175 / Ecuador Government International Bond | 1.69 | 9.59 | 0.0440 | -0.0080 | |||||

| US20753YAL65 / Connecticut Avenue Securities Trust, Series 2022-R04, Class 1B2 | 1.68 | -1.47 | 0.0435 | -0.0137 | |||||

| US78472UAN81 / SREIT TR 2021-MFP G 1ML+297.38 11/15/2038 144A | 1.67 | -6.80 | 0.0434 | -0.0170 | |||||

| US3137G0RJ09 / Freddie Mac Structured Agency Credit Risk Debt Notes | 1.66 | -1.48 | 0.0431 | -0.0136 | |||||

| XS2322319398 / Pakistan Government International Bond | 1.66 | 91.00 | 0.0430 | 0.0138 | |||||

| Elmwood CLO Ltd., Series 2019-3A, Class BRR / ABS-CBDO (US29002HBA68) | 1.65 | -0.18 | 0.0430 | -0.0128 | |||||

| FREMF Mortgage Trust, Series 2023-K752, Class D / ABS-MBS (US30333RAG02) | 1.65 | 2.41 | 0.0430 | -0.0114 | |||||

| US125039AJ66 / CD 2017-CD6 Mortgage Trust | 1.65 | 0.86 | 0.0429 | -0.0122 | |||||

| US12515DAF15 / CD 2017-CD4 D 3.3% 05/10/2050 144A | 1.65 | -1.61 | 0.0428 | -0.0135 | |||||

| JetBlue Airways Corp. / DBT (US476920AA15) | 1.64 | 40.91 | 0.0427 | 0.0035 | |||||

| JetBlue Airways Corp. / DBT (US476920AA15) | 1.64 | 40.91 | 0.0427 | 0.0035 | |||||

| US12008RAR84 / Builders FirstSource Inc | 1.64 | 44.82 | 0.0425 | 0.0045 | |||||

| Santander Bank Auto Credit-Linked Notes, Series 2023-B, Class E / ABS-O (US80290CCE21) | 1.64 | 0.0425 | 0.0425 | ||||||

| US3137HAMD59 / Freddie Mac Multifamily Structured Pass Through Certificates | 1.63 | -4.11 | 0.0425 | -0.0149 | |||||

| GNMA II, 30 Year / ABS-MBS (US3618HMBM06) | 1.63 | -0.24 | 0.0424 | -0.0126 | |||||

| GNMA II, 30 Year / ABS-MBS (US3618HMBM06) | 1.63 | -0.24 | 0.0424 | -0.0126 | |||||

| Republic of Kenya / DBT (US491798AM68) | 1.63 | 30.69 | 0.0424 | 0.0004 | |||||

| US71677HAL96 / PetSmart, Inc., Term Loan B | 1.63 | -0.43 | 0.0423 | -0.0127 | |||||

| N1IS34 / NiSource Inc. - Depositary Receipt (Common Stock) | 1.63 | 0.12 | 0.0423 | -0.0124 | |||||

| Credit Acceptance Auto Loan Trust, Series 2024-3A, Class B / ABS-O (US22535LAC54) | 1.62 | 0.12 | 0.0422 | -0.0124 | |||||

| US3137FMUR10 / Freddie Mac Multifamily Structured Pass Through Certificates | 1.62 | 7.07 | 0.0421 | -0.0088 | |||||

| LHOME Mortgage Trust, Series 2024-RTL2, Class A1 / ABS-MBS (US50205JAA43) | 1.62 | -0.62 | 0.0420 | -0.0127 | |||||

| US682189AQ81 / ON Semiconductor Corp | 1.61 | 43.47 | 0.0419 | 0.0041 | |||||

| HUB International Ltd., 1st Lien Term Loan / LON (US44332EAZ97) | 1.61 | 44.44 | 0.0419 | 0.0043 | |||||

| US35564KNE54 / Freddie Mac Structured Agency Credit Risk Debt Notes | 1.61 | -1.05 | 0.0418 | -0.0129 | |||||

| Diversified ABS Phase LLC, Series 2024-1A, Class A2 / ABS-O (US255123AB74) | 1.60 | -0.44 | 0.0415 | -0.0125 | |||||

| US3137FXYY89 / Freddie Mac Multifamily Structured Pass Through Certificates | 1.59 | -4.04 | 0.0414 | -0.0145 | |||||

| US05593FAD06 / BMO 2023-C7 Mortgage Trust | 1.59 | -1.73 | 0.0414 | -0.0131 | |||||

| S1TT34 / State Street Corporation - Depositary Receipt (Common Stock) | 1.59 | -0.13 | 0.0412 | -0.0123 | |||||

| PRM5 Trust, Series 2025-PRM5, Class C / ABS-MBS (US693980AE42) | 1.57 | 0.25 | 0.0409 | -0.0119 | |||||

| US3137H9MA44 / Freddie Mac Multifamily Structured Pass Through Certificates | 1.57 | -4.22 | 0.0407 | -0.0144 | |||||

| C / Citigroup Inc. - Depositary Receipt (Common Stock) | 1.56 | -1.14 | 0.0406 | -0.0126 | |||||

| US50205TAA25 / LHOME Mortgage Trust 2023-RTL3 | 1.56 | -0.70 | 0.0406 | -0.0124 | |||||

| US26253WAJ71 / DT Auto Owner Trust, Series 2021-4A, Class E | 1.56 | -0.19 | 0.0405 | -0.0120 | |||||

| GNMA II, 30 Year / ABS-MBS (US3618J1V911) | 1.56 | -15.51 | 0.0405 | -0.0216 | |||||

| VCAT LLC, Series 2025-NPL3, Class A1 / ABS-MBS (US92243QAA40) | 1.56 | -8.48 | 0.0404 | -0.0168 | |||||

| VistaJet Pass Through Trust, Series 2021-1C / ABS-O (US92841QAA04) | 1.55 | -3.24 | 0.0404 | -0.0137 | |||||

| US35906ABE73 / Frontier Communications Corp | 1.55 | 0.32 | 0.0404 | -0.0118 | |||||

| INEOS Finance plc / DBT (US44984WAJ62) | 1.55 | 277.32 | 0.0402 | 0.0264 | |||||

| US38381JMQ75 / GNMA | 1.55 | -5.16 | 0.0402 | -0.0147 | |||||

| Quikrete Holdings, Inc., 1st Lien Term Loan B-3 / LON (US74839XAL38) | 1.54 | 0.0401 | 0.0401 | ||||||

| Quikrete Holdings, Inc., 1st Lien Term Loan B-3 / LON (US74839XAL38) | 1.54 | 0.0401 | 0.0401 | ||||||

| US29261AAA88 / ENCOMPASS HEALTH CORP COMPANY GUAR 02/28 4.5 | 1.54 | 0.85 | 0.0401 | -0.0114 | |||||

| US20754CAF68 / CORP CMO | 1.54 | -0.84 | 0.0400 | -0.0122 | |||||

| Elmwood CLO Ltd., Series 2021-3A, Class BR / ABS-CBDO (US29002VAN82) | 1.54 | 0.00 | 0.0400 | -0.0118 | |||||

| Clydesdale Acquisition Holdings, Inc. / DBT (US18972EAD76) | 1.54 | 0.0400 | 0.0400 | ||||||

| US345397D591 / FORD MOTOR CREDIT CO LLC SR UNSEC 6.798% 11-07-28 | 1.53 | -1.61 | 0.0398 | -0.0126 | |||||

| OneMain Direct Auto Receivables Trust, Series 2025-1A, Class D / ABS-O (US682684AD78) | 1.53 | -3.22 | 0.0398 | -0.0135 | |||||

| US29261AAB61 / ENCOMPASS HEALTH CORP COMPANY GUAR 02/30 4.75 | 1.53 | 46.27 | 0.0398 | 0.0046 | |||||

| US432833AJ07 / HILTON DOMESTIC OPERATING CO INC 3.75% 05/01/2029 144A | 1.53 | 46.41 | 0.0398 | 0.0046 | |||||

| Shift4 Payments LLC / DBT (US82453AAB35) | 1.53 | 55.03 | 0.0397 | 0.0065 | |||||

| US42806MCH07 / HERTZ 23-4 D 144A 9.44% 03-25-30/03-26-29 | 1.52 | -2.50 | 0.0396 | -0.0130 | |||||

| US857691AG41 / STATION CASINOS LLC SR UNSECURED 144A 02/28 4.5 | 1.52 | 45.93 | 0.0396 | 0.0045 | |||||

| FHLMC STACR REMIC Trust, Series 2024-DNA1, Class M2 / ABS-MBS (US35564NBA00) | 1.52 | 0.26 | 0.0395 | -0.0115 | |||||

| FHLMC STACR REMIC Trust, Series 2024-DNA1, Class M2 / ABS-MBS (US35564NBA00) | 1.52 | 0.26 | 0.0395 | -0.0115 | |||||

| US29429CAG06 / COMMERCIAL MORTGAGE BACKED SECURITIES | 1.52 | 0.00 | 0.0394 | -0.0116 | |||||

| US07317QAJ40 / Baytex Energy Corp | 1.52 | 37.82 | 0.0394 | 0.0024 | |||||

| PRM5 Trust, Series 2025-PRM5, Class D / ABS-MBS (US693980AG99) | 1.51 | 0.26 | 0.0393 | -0.0115 | |||||

| American Credit Acceptance Receivables Trust, Series 2024-4, Class D / ABS-O (US024945AG26) | 1.51 | -1.24 | 0.0393 | -0.0122 | |||||

| American Credit Acceptance Receivables Trust, Series 2024-4, Class D / ABS-O (US024945AG26) | 1.51 | -1.24 | 0.0393 | -0.0122 | |||||

| US83162CS790 / SBA SMALL BUSINESS INVESTMENT COS SBIC 2023-10A 1 | 1.51 | -4.85 | 0.0393 | -0.0142 | |||||

| US12592XAG16 / COMM 2015-CCRE22 Mortgage Trust | 1.51 | 300.53 | 0.0392 | 0.0265 | |||||

| XYZ / Block, Inc. - Depositary Receipt (Common Stock) | 1.51 | 0.0392 | 0.0392 | ||||||

| XS1631415400 / Ivory Coast Government International Bond | 1.51 | 320.06 | 0.0392 | 0.0271 | |||||

| Credit Acceptance Auto Loan Trust, Series 2024-2A, Class A / ABS-O (US22536VAA61) | 1.51 | -0.72 | 0.0392 | -0.0119 | |||||

| Credit Acceptance Auto Loan Trust, Series 2024-2A, Class A / ABS-O (US22536VAA61) | 1.51 | -0.72 | 0.0392 | -0.0119 | |||||

| Credit Acceptance Auto Loan Trust, Series 2023-5A, Class B / ABS-O (US22535PAB85) | 1.50 | -0.46 | 0.0391 | -0.0118 | |||||

| Octagon Investment Partners Ltd., Series 2019-1A, Class CR / ABS-CBDO (US67573LAQ23) | 1.50 | 0.20 | 0.0391 | -0.0114 | |||||

| US83001AAC62 / Six Flags Entertainment Corp | 1.50 | 45.59 | 0.0390 | 0.0043 | |||||

| US00109LAA17 / ADT Security Corp. | 1.50 | 46.91 | 0.0389 | 0.0046 | |||||

| Suriname Government International Bond / DBT (USP68788AC53) | 1.49 | -2.74 | 0.0388 | -0.0129 | |||||

| FHLMC, Series 2025-MN10, Class M2 / ABS-MBS (US35563UAB44) | 1.49 | -0.80 | 0.0387 | -0.0118 | |||||

| US29254BAA52 / Encino Acquisition Partners Holdings LLC | 1.49 | 730.73 | 0.0386 | 0.0326 | |||||

| US90932LAG23 / United Airlines Inc | 1.49 | 18.68 | 0.0386 | -0.0036 | |||||

| Varsity Brands, Inc., 1st Lien Term Loan B / LON (US92227QAF37) | 1.48 | 0.0386 | 0.0386 | ||||||

| US92840VAB80 / Vistra Operations Co LLC 5.625% 02/15/2027 144A | 1.48 | 45.49 | 0.0386 | 0.0042 | |||||

| US23918KAT51 / DaVita Inc | 1.48 | 0.95 | 0.0385 | -0.0109 | |||||

| US513075BW03 / Lamar Media Corp | 1.48 | 44.96 | 0.0385 | 0.0041 | |||||

| IHRT / iHeartMedia, Inc. | 1.48 | 60.41 | 0.0384 | 0.0074 | |||||

| US03217JAG67 / AMSR 2020-SFR5 Trust | 1.48 | 0.48 | 0.0384 | -0.0111 | |||||

| US25461LAA08 / DIRECTV Holdings LLC/DIRECTV Financing Co., Inc. | 1.48 | 0.00 | 0.0384 | -0.0113 | |||||

| QSR / Restaurant Brands International Inc. | 1.48 | 0.96 | 0.0384 | -0.0109 | |||||

| US3137H6M368 / FHMS K140 X1 | 1.48 | -4.16 | 0.0383 | -0.0135 | |||||

| Yinson Boronia Production BV / DBT (US98584XAA37) | 1.47 | -2.12 | 0.0383 | -0.0124 | |||||

| MTDR / Matador Resources Company | 1.47 | 50.92 | 0.0382 | 0.0054 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.47 | 0.0382 | 0.0382 | ||||||

| US118230AQ44 / BUCKEYE PARTNERS LP | 1.47 | 0.82 | 0.0381 | -0.0108 | |||||

| FMCC / Federal Home Loan Mortgage Corporation | 1.47 | 0.0381 | 0.0381 | ||||||

| US05946KAM36 / Banco Bilbao Vizcaya Argentaria SA | 1.47 | -0.34 | 0.0381 | -0.0114 | |||||

| GNMA II, 30 Year / ABS-MBS (US3618HKKT91) | 1.46 | -4.75 | 0.0381 | -0.0137 | |||||

| GNMA II, 30 Year / ABS-MBS (US3618HKKT91) | 1.46 | -4.75 | 0.0381 | -0.0137 | |||||

| US682691AC47 / OneMain Finance Corp | 1.46 | 45.18 | 0.0380 | 0.0041 | |||||

| US3137FQ4C42 / FHLMC, Multifamily Structured Pass-Through Certificates, Series K101, Class X3 | 1.45 | -5.09 | 0.0378 | -0.0138 | |||||

| GNMA II, 30 Year / ABS-MBS (US3618HMFD60) | 1.45 | -4.61 | 0.0377 | -0.0135 | |||||

| GLS Auto Receivables Issuer Trust, Series 2024-2A, Class C / ABS-O (US37964VAE74) | 1.44 | -0.89 | 0.0375 | -0.0115 | |||||

| GLS Auto Receivables Issuer Trust, Series 2024-2A, Class C / ABS-O (US37964VAE74) | 1.44 | -0.89 | 0.0375 | -0.0115 | |||||

| CBOM / Credit Bank of Moscow (public joint-stock company) | 1.44 | 0.07 | 0.0375 | -0.0110 | |||||

| US57638P1049 / MasterBrand, Inc. | 1.44 | 49.17 | 0.0375 | 0.0049 | |||||

| BX Commercial Mortgage Trust, Series 2024-AIR2, Class A / ABS-MBS (US05613QAA85) | 1.44 | -4.32 | 0.0374 | -0.0132 | |||||

| BX Commercial Mortgage Trust, Series 2024-AIR2, Class A / ABS-MBS (US05613QAA85) | 1.44 | -4.32 | 0.0374 | -0.0132 | |||||

| BMO Mortgage Trust, Series 2024-5C7, Class A3 / ABS-MBS (US09660WAU53) | 1.44 | -0.48 | 0.0374 | -0.0112 | |||||

| SAN / Banco Santander, S.A. - Depositary Receipt (Common Stock) | 1.43 | 0.28 | 0.0372 | -0.0108 | |||||

| GNMA II, 30 Year / ABS-MBS (US3618J5VJ01) | 1.43 | -3.65 | 0.0371 | -0.0128 | |||||