Mga Batayang Estadistika

| Nilai Portofolio | $ 82,061,130 |

| Posisi Saat Ini | 95 |

Kepemilikan Terbaru, Kinerja, AUM (dari 13F, 13D)

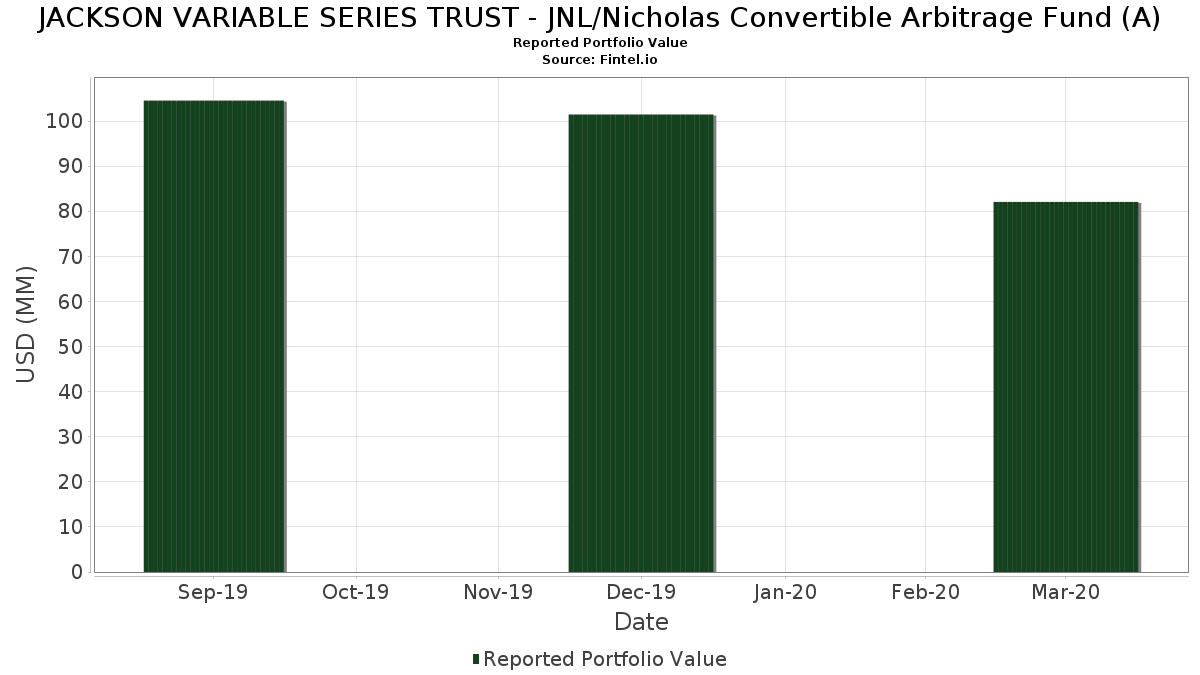

JACKSON VARIABLE SERIES TRUST - JNL/Nicholas Convertible Arbitrage Fund (A) telah mengungkapkan total kepemilikan 95 dalam pengajuan SEC terbaru mereka. Nilai portofolio terbaru dihitung sebesar $ 82,061,130 USD. Aset yang Dikelola (AUM) sebenarnya adalah nilai ini ditambah kas (yang tidak diungkapkan). Aset-aset utama JACKSON VARIABLE SERIES TRUST - JNL/Nicholas Convertible Arbitrage Fund (A) adalah JNL Government Money Market Fund (US:46628D437) , Akamai Technologies, Inc. Bond (US:US00971TAK79) , Illumina, Inc. Bond (US:US452327AH26) , Alteryx Inc (US:US02156BAC72) , and Palo Alto Networks Inc Bond (US:US697435AD78) . Posisi baru JACKSON VARIABLE SERIES TRUST - JNL/Nicholas Convertible Arbitrage Fund (A) meliputi: Akamai Technologies, Inc. Bond (US:US00971TAK79) , Illumina, Inc. Bond (US:US452327AH26) , Alteryx Inc (US:US02156BAC72) , Palo Alto Networks Inc Bond (US:US697435AD78) , and Splunk Inc Bond (US:US848637AC82) .

Peningkatan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| 17.74 | 17.74 | 13.0218 | 6.9607 | |

| 0.00 | 3.86 | 2.8357 | 2.8357 | |

| 5.86 | 4.2977 | 2.6645 | ||

| 2.90 | 2.1292 | 2.1292 | ||

| 2.82 | 2.0728 | 2.0728 | ||

| 2.78 | 2.0395 | 2.0395 | ||

| 2.50 | 1.8365 | 1.8365 | ||

| 2.46 | 1.8032 | 1.8032 | ||

| 6.01 | 4.4138 | 1.7535 | ||

| 2.35 | 1.7282 | 1.7282 |

Penurunan Tertinggi Kuartal Ini

Kami menggunakan perubahan dalam alokasi portofolio karena ini adalah metrik yang paling bermakna. Perubahan dapat disebabkan oleh perdagangan atau perubahan harga saham.

| Keamanan | Saham (MM) |

Nilai (Juta Dolar AS) |

Portfolio % | ΔPorsyento ng Portfolio |

|---|---|---|---|---|

| -0.02 | -3.68 | -2.6988 | -2.6988 | |

| 0.79 | 0.5795 | -2.3585 | ||

| -0.01 | -1.19 | -0.8744 | -2.3178 | |

| 1.39 | 1.0171 | -1.7494 | ||

| 1.11 | 0.8148 | -1.7266 | ||

| 0.00 | 1.04 | 0.7614 | -1.4130 | |

| -0.01 | -3.31 | -2.4313 | -1.3838 | |

| 1.34 | 0.9843 | -1.1919 | ||

| -0.01 | -1.29 | -0.9458 | -0.9458 | |

| 3.02 | 2.2179 | -0.8702 |

Pengajuan 13F dan Dana

Formulir ini diajukan pada 2020-05-28 untuk periode pelaporan 2020-03-31. Klik ikon tautan untuk melihat riwayat transaksi selengkapnya.

Tingkatkan ke versi premium untuk membuka data premium dan ekspor ke Excel. ![]() .

.

| Keamanan | Ketik | Harga Saham Rata-rata | Saham (MM) |

ΔSaham (%) |

ΔSaham (%) |

Nilai ($MM) |

Portpolyo (%) |

ΔPortofolio (%) |

|

|---|---|---|---|---|---|---|---|---|---|

| 46628D437 / JNL Government Money Market Fund | 17.74 | 96.68 | 17.74 | 96.69 | 13.0218 | 6.9607 | |||

| US00971TAK79 / Akamai Technologies, Inc. Bond | 6.01 | 51.91 | 4.4138 | 1.7535 | |||||

| US452327AH26 / Illumina, Inc. Bond | 5.86 | 140.95 | 4.2977 | 2.6645 | |||||

| US02156BAC72 / Alteryx Inc | 4.27 | -5.74 | 3.1310 | 0.0899 | |||||

| US697435AD78 / Palo Alto Networks Inc Bond | 3.97 | -6.46 | 2.9118 | 0.0620 | |||||

| US848637AC82 / Splunk Inc Bond | 3.92 | -12.88 | 2.8740 | -0.1463 | |||||

| DHR / Danaher Corporation | 0.00 | -126.78 | 3.86 | -280.26 | 2.8357 | 2.8357 | |||

| US163092AC35 / Chegg Inc | 3.77 | -6.79 | 2.7704 | 0.0495 | |||||

| US852234AD56 / Square Inc Bond | 3.55 | -16.90 | 2.6057 | -0.2648 | |||||

| US256163AB24 / DOCUSIGN INC DBT | 3.20 | 9.70 | 2.3490 | 0.3886 | |||||

| US531229AJ16 / Liberty Media Corp | 3.06 | 1.23 | 2.2437 | 0.2145 | |||||

| US83304AAA43 / Snap Inc Bond | 3.02 | -34.25 | 2.2179 | -0.8702 | |||||

| US759916AB50 / Repligen Corp Bond | 2.97 | -2.37 | 2.1811 | 0.1362 | |||||

| US76680RAE71 / RingCentral Inc | 2.90 | 2.1292 | 2.1292 | ||||||

| US45784PAJ03 / INSULET CORPORATION | 2.86 | 38.27 | 2.0982 | 0.7090 | |||||

| US09709THH77 / BAC 0 1/8 09/01/22 | 2.82 | 2.0728 | 2.0728 | ||||||

| US679295AC92 / Okta Inc Bond | 2.78 | 19.42 | 2.0405 | 0.4763 | |||||

| US48128DAC11 / JPM 0 1/8 01/01/23 | 2.78 | 2.0395 | 2.0395 | ||||||

| US531229AB89 / Liberty Media Corporation Bond | 2.67 | -27.94 | 1.9628 | -0.5308 | |||||

| US55024UAC36 / Lumentum Holdings Inc | 2.66 | -22.36 | 1.9520 | -0.3491 | |||||

| US25470MAB54 / DISH Network Corp. 3.375% Bond | 2.55 | -32.84 | 1.8731 | -0.6804 | |||||

| US22266LAD82 / COUPA SOFTWARE INC | 2.53 | -3.95 | 1.8559 | 0.0874 | |||||

| US225447AB76 / Cree Inc Bond | 2.52 | -13.01 | 1.8494 | -0.0975 | |||||

| US67020YAK64 / Nuance Communications, Inc. 1.00% Bond Due 12/15/2035 | 2.50 | 1.8365 | 1.8365 | ||||||

| US30063PAC95 / EXACT SCIENCES CORP CONV 0.375% 03/01/2028 | 2.46 | 1.8032 | 1.8032 | ||||||

| US29978AAB08 / Everbridge Inc | 2.44 | 120.31 | 1.7915 | 1.0470 | |||||

| US98954MAC55 / Zillow Group Inc Bond | 2.35 | 1.7282 | 1.7282 | ||||||

| US98986TAA60 / Zynga Inc. DBT | 2.17 | 1.5893 | 1.5893 | ||||||

| US741503AX44 / The Priceline Group Inc. Bond | 2.01 | 1.4752 | 1.4752 | ||||||

| US531229AH59 / Liberty Media Corp | 1.97 | -19.63 | 1.4488 | -0.2014 | |||||

| AVGO / Broadcom Inc. | 0.00 | 0.00 | 1.97 | -20.69 | 1.4434 | -0.2225 | |||

| US87918AAC99 / Teladoc Health Inc Bond | 1.90 | -18.45 | 1.3944 | -0.1713 | |||||

| US23248VAA35 / CyberArk Software Ltd | 1.86 | 1.3662 | 1.3662 | ||||||

| US48123VAD47 / j2 Global Inc | 1.78 | -20.08 | 1.3056 | -0.1905 | |||||

| US803607AB68 / Sarepta Therapeutics, Inc. Bond | 1.48 | -21.98 | 1.0843 | -0.1881 | |||||

| US90184LAF94 / Twitter Inc Bond | 1.39 | -66.59 | 1.0171 | -1.7494 | |||||

| US743424AE31 / PROOFPOINT INC | 1.36 | -9.16 | 0.9971 | -0.0077 | |||||

| US682189AP09 / On Semiconductor Corp Bond | 1.34 | -58.60 | 0.9843 | -1.1919 | |||||

| US852234AE30 / Square Inc | 1.31 | 0.9596 | 0.9596 | ||||||

| US44052TAB70 / Horizon Pharma plc 2.5% Bond due 2022-03-15 | 1.30 | -49.14 | 0.9564 | -0.7655 | |||||

| US41068XAB64 / Hannon Armstrong Sustainable Infrastructure Capital, Inc. Bond 4.125% 9/0 | 1.21 | -22.83 | 0.8860 | -0.1651 | |||||

| US595017AF11 / Microchip Technology Inc Bond | 1.11 | -70.65 | 0.8148 | -1.7266 | |||||

| US22822V3096 / Crown Castle International Corp. | 0.00 | -67.13 | 1.04 | -67.95 | 0.7614 | -1.4130 | |||

| US90138FAB85 / Twilio Inc Bond | 0.93 | 0.6810 | 0.6810 | ||||||

| ELAN / Elanco Animal Health Incorporated | 0.02 | 0.83 | 0.6067 | 0.6067 | |||||

| US57164YAB39 / Marriott Vactins Worldwid Co Bond | 0.79 | -81.95 | 0.5795 | -2.3585 | |||||

| US10806XAA00 / Bridgebio Pharma Inc | 0.70 | 0.5172 | 0.5172 | ||||||

| US29355AAE73 / Enphase Energy Inc | 0.69 | 0.5052 | 0.5052 | ||||||

| ARCC / Ares Capital Corporation | 0.00 | -100.00 | 0.00 | -100.00 | 0.0627 | ||||

| X / United States Steel Corporation | 0.00 | -100.00 | 0.00 | -100.00 | 0.7436 | ||||

| ENPH / Enphase Energy, Inc. | Short | -0.01 | -0.16 | -0.1185 | -0.1185 | ||||

| VAC / Marriott Vacations Worldwide Corporation | Short | -0.00 | -56.12 | -0.17 | -81.10 | -0.1244 | 0.4768 | ||

| BKNG / Booking Holdings Inc. | Short | -0.00 | -0.27 | -0.1975 | -0.1975 | ||||

| BBIO / BridgeBio Pharma, Inc. | Short | -0.01 | -0.28 | -0.2064 | -0.2064 | ||||

| TWTR / Twitter Inc | Short | -0.01 | -61.24 | -0.29 | -76.90 | -0.2145 | 0.6294 | ||

| LBRDA / Liberty Broadband Corporation | Short | -0.00 | -76.82 | -0.38 | -79.19 | -0.2802 | 0.9501 | ||

| ON / ON Semiconductor Corporation | Short | -0.03 | -50.04 | -0.42 | -74.55 | -0.3111 | 0.8060 | ||

| ELAN / Elanco Animal Health Incorporated | Short | -0.02 | -0.43 | -0.3186 | -0.3186 | ||||

| PFPT / Proofpoint Inc | Short | -0.00 | -13.90 | -0.46 | -23.06 | -0.3358 | 0.0637 | ||

| DISH / DISH Network Corporation | Short | -0.02 | -15.28 | -0.49 | -52.30 | -0.3580 | 0.3284 | ||

| JCOM / J2 Global Inc. | Short | -0.01 | -19.89 | -0.53 | -36.04 | -0.3873 | 0.1668 | ||

| HZNP / Horizon Therapeutics Plc | Short | -0.02 | -18.18 | -0.57 | -10.89 | -0.4206 | 0.0091 | ||

| HASI / HA Sustainable Infrastructure Capital, Inc. | Short | -0.03 | 23.85 | -0.58 | -21.50 | -0.4239 | 0.0701 | ||

| ZG / Zillow Group, Inc. | Short | -0.02 | -56.49 | -0.58 | -65.92 | -0.4256 | 0.7164 | ||

| TWLO / Twilio Inc. | Short | -0.01 | -0.60 | -0.4400 | -0.4400 | ||||

| LYV / Live Nation Entertainment, Inc. | Short | -0.01 | -25.03 | -0.64 | -52.35 | -0.4702 | 0.4325 | ||

| RNG / RingCentral, Inc. | Short | -0.00 | -0.67 | -0.4938 | -0.4938 | ||||

| BABA / Alibaba Group Holding Limited - Depositary Receipt (Common Stock) | Short | -0.00 | -0.68 | -0.4995 | -0.4995 | ||||

| MCHP / Microchip Technology Incorporated | Short | -0.01 | -57.19 | -0.72 | -72.28 | -0.5314 | 1.2240 | ||

| CREE / Cree, Inc. | Short | -0.02 | -0.00 | -0.73 | -23.26 | -0.5335 | 0.1021 | ||

| CYBR / CyberArk Software Ltd. | Short | -0.01 | -0.77 | -0.5620 | -0.5620 | ||||

| PODD / Insulet Corporation | Short | -0.00 | -0.00 | -0.79 | -3.32 | -0.5776 | -0.0312 | ||

| NUAN / Nuance Communications Inc | Short | -0.05 | -0.79 | -0.5788 | -0.5788 | ||||

| ZNGA / Zynga Inc - Class A | Short | -0.13 | -0.86 | -0.6329 | -0.6329 | ||||

| OKTA / Okta, Inc. | Short | -0.01 | 22.03 | -0.88 | 29.41 | -0.6460 | -0.1887 | ||

| SNAP / Snap Inc. | Short | -0.08 | -28.84 | -0.90 | -48.22 | -0.6632 | 0.5086 | ||

| EXAS / Exact Sciences Corporation | Short | -0.02 | -11.34 | -0.92 | -44.41 | -0.6755 | 0.4367 | ||

| SRPT / Sarepta Therapeutics, Inc. | Short | -0.01 | -9.45 | -0.97 | -31.36 | -0.7150 | 0.2386 | ||

| CCI / Crown Castle Inc. | Short | -0.01 | -49.64 | -1.02 | -48.84 | -0.7471 | 0.5900 | ||

| PANW / Palo Alto Networks, Inc. | Short | -0.01 | -11.81 | -1.04 | -37.48 | -0.7641 | 0.3546 | ||

| AYX / Alteryx, Inc. | Short | -0.01 | -0.00 | -1.07 | -4.91 | -0.7823 | -0.0292 | ||

| LITE / Lumentum Holdings Inc. | Short | -0.01 | -39.42 | -1.08 | -43.69 | -0.7897 | 0.4943 | ||

| RGEN / Repligen Corporation | Short | -0.01 | 0.04 | -1.18 | 4.41 | -0.8683 | -0.1070 | ||

| AVGO / Broadcom Inc. | Short | -0.01 | -338.72 | -1.19 | -160.58 | -0.8744 | -2.3178 | ||

| EVBG / Everbridge, Inc. | Short | -0.01 | 152.68 | -1.20 | 244.13 | -0.8816 | -0.6472 | ||

| CHGG / Chegg, Inc. | Short | -0.03 | -12.61 | -1.23 | -17.55 | -0.9041 | 0.0994 | ||

| COUP / Coupa Software Inc | Short | -0.01 | 8.83 | -1.26 | 3.97 | -0.9229 | -0.1103 | ||

| SPY / SPDR S&P 500 ETF | Short | -0.01 | -1.29 | -0.9458 | -0.9458 | ||||

| SQ / Block, Inc. | Short | -0.03 | 9.61 | -1.36 | -8.24 | -0.9975 | -0.0025 | ||

| TDOC / Teladoc Health, Inc. | Short | -0.01 | -45.04 | -1.50 | 1.76 | -1.1035 | -0.1107 | ||

| SPLK / Splunk Inc. | Short | -0.01 | 3.55 | -1.65 | -12.76 | -1.2145 | 0.0594 | ||

| DOCU / DocuSign, Inc. | Short | -0.02 | 27.11 | -2.12 | 58.48 | -1.5580 | -0.6580 | ||

| AKAM / Akamai Technologies, Inc. | Short | -0.02 | 44.44 | -2.14 | 52.97 | -1.5712 | -0.6310 | ||

| SIRI / Sirius XM Holdings Inc. | Short | -0.47 | 1.59 | -2.33 | -29.81 | -1.7126 | 0.5211 | ||

| DHR / Danaher Corporation | Short | -0.02 | 49.91 | -2.90 | 35.18 | -2.1265 | -0.6865 | ||

| ILMN / Illumina, Inc. | Short | -0.01 | 158.09 | -3.31 | 112.44 | -2.4313 | -1.3838 | ||

| IWO / iShares Trust - iShares Russell 2000 Growth ETF | Short | -0.02 | -3.68 | -2.6988 | -2.6988 |